Assessment of credit risk and activity of OOO "Kuban credit". Assessment of credit risks of a commercial bank ? modernization of the Bank's IT infrastructure, expansion of software functionality

Like any other bank, LLC "Kuban Credit" is interested in making a profit, the main source of which is currently income from the provision of credit products. The probability of non-repayment of the loan by the borrower to the bank, which in turn, with the massive nature of such phenomena, can lead to its bankruptcy.

Considering the credit policy of the bank as an element of the banking policy, it should be emphasized that the objectives of the credit policy are in organic connection with the general strategic and tactical goals of its banking policy.

Credit risk assessment is a task constantly faced by employees of the credit department of Kuban Credit LLC. The main question is to determine who should be given credit and who should not, while ensuring an acceptable level of credit risk.

Success largely depends on how factors that affect the stability of the borrower's business are taken into account when making a decision to grant a loan. Despite the accumulated experience and knowledge of the Bank's specialists, effective use qualitative characteristics of the borrower in the evaluation and monitoring of its activities is a certain problem. Therefore, it seems necessary to develop measures and mechanisms that will improve existing system creditworthiness assessments, and will also have a positive impact on the competitiveness of the Bank (Table 13).

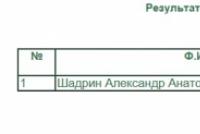

Table 13 - Measures to improve the assessment of credit risk in LLC "Kuban Credit"

MeasuresExpected resultsTo assess credit risk, use the following methods in combination: analytical, Altman's method and statistical.It will allow to achieve more accurate results in assessing credit risk. Creation of a unified electronic database of conclusions on the financial position of the borrower and professional judgments of the risk manager. Centralization of disparate documents will provide access to structured and reliable information on all borrowers. Apply credit risk hedging using credit derivatives, forwards and options Will help mitigate bank credit risk Use proprietary scoring systems to classify customers by reliability. To assess such qualitative indicators as: the level of management organization; the state of the industry in the region, the competitiveness of the enterprise; the nature of the loan transaction; experience of working in a bank with a specific borrower Allows you to accumulate certain statistics to adjust lending methods, formulate more accurate conclusions about the creditworthiness of the borrower enterprise and the features of the loan product, minimize credit risks Revise the ratio of the borrower's income to his monthly payments, if necessary, use on-lending and restructuring loans. Reducing low-quality "long" loans due to the possible insolvency of the borrower. Using foreign forecasting experience financial condition borrower in the coming period Will allow to make more informed decisions on granting loans Use the express method of ranking economic entities (Table 9) based on coefficients financial stability, turnover and liquidity of assets, return on capital. Allows you to formulate more accurate conclusions about the creditworthiness of the borrower and about the features of the loan product

From the analysis carried out in the second part thesis, we can conclude that the volume of loans provided by Kuban Credit LLC to both legal entities and individuals is increasing every year. But it also increases the risk lending activities LLC "Kuban Credit" Therefore, it is necessary to conduct a qualitative assessment credit risks in the bank. Credit risks in the Bank are often underestimated, low-liquid collateral is accepted as collateral or unsecured loans are provided even in cases where negative trends in the borrower's business were already obvious.

The methods for assessing the borrower's creditworthiness offered by Kuban Credit LLC are based primarily on quantitative indicators. But they cannot always fully characterize the creditworthiness of the borrower, since they are able to show his financial condition only at a certain point in time, i.e. give only a retrospective cut.

The strategic goal of the credit policy is to create conditions for the effective placement of attracted funds to ensure stable growth of the bank's profits while observing the limits of liquidity and the acceptable total risk of banking activities. The tactical objectives of credit policy may include, for example, expanding the range of services provided to private clients; improving customer service with high income; cleaning the filing cabinet; decrease in the share of problem loans, etc.

Risk management always characterizes the quality of management, understanding and ability of the bank to resist the inefficient functioning of the loan. It is believed that when lending, as, in fact, when performing other operations, the bank balances between profitability and liquidity, but in practice the management of activities is more multifaceted. In the process of activity, the bank "chooses" not only between profit and liquidity, but also its reliability, competitive position in the market. The elimination of all these problems in Kuban Credit must begin with optimization credit process, and then proceed to improve the risk management system (Figure 7) .

Minimization of credit risksFigure 7 - Minimization of credit risks

Optimization of the lending process involves structuring the transaction based on the needs and capabilities of the borrower. It is necessary to understand for what specific purposes a loan is requested and for what purposes there was a need to attract loan funds(this will help avoid fraudulent transactions on the part of the borrower and neutralize the effect of hidden losses). For each project, the following must be justified: the reasons for the client's need for loan resources; purpose of lending (for current activities, investment purposes, restructuring, etc.); amount, term and other aspects of the transaction (presence / absence of a repayment schedule, tranches, conditions for early termination, etc.).

In order to fully assess the client's ability to properly service the loan, a qualitative analysis of the sources of repayment of the amount disbursed and the actual debt burden of the borrower is needed. The cash flow should be built in such a way that the borrower is able to repay without restructuring loan product, refinancing from third parties and without serious damage to its current activities. For this you need:

predict cash flows on the subject of: sufficiency (is there any profit to repay the loan, taking into account the borrower's loans and borrowings); real income and expenses (whether an unreasonable increase/decrease in revenue and costs is possible; whether payments for a loan requested from the bank are included in the expenses); comparability with cash flows of previous periods; completeness of information (costs and incomes for all types of activities - operating, investment and financial should be taken into account); sensitivity to risks and "margins of safety";

analyze the loan portfolio regarding: sufficiency of net cash flows/ net profit to repay loans in accordance with the established schedule and tranches of existing loans; fulfillment by the borrower of the conditions of existing loan agreements; availability of off-balance sheet liabilities (guarantees, leasing, etc.).

We believe that a more objective assessment of the borrower's creditworthiness can be obtained if, in addition to the existing quantitative and qualitative indicators presented in the second chapter, we add:

level of management organization;

the state of the industry in the region, the competitiveness of the enterprise;

the nature of the credited transaction;

bank experience with a particular borrower.

In our opinion, methods of assessing creditworthiness aimed at optimizing the level of credit risk should be aimed at solving three main tasks. The first is to study the composition and structure of assets and liabilities using coefficients (liquidity, asset utilization efficiency; financial leverage, profitability). The second is to analyze the cash flows and financial stability of the borrower. The third is to give an assessment based on business risk.

Grade loan application allows you to formulate conclusions about the creditworthiness of the borrower and about the features of the loan product. In practice, the assessment is most often based on the application of a complex rating system, it is carried out in accordance with the current methods for determining the credit risk group, i.e. by awarding points according to predetermined criteria.

We believe that the bank can use the following express method for ranking economic entities based on the coefficients of financial stability, asset turnover and liquidity, and return on capital. Compliance with the criteria of each of the analyzed financial ratios gives the corresponding rating value in points (Table 14).

CoefficientsValue in points1. Coefficient financial independence+2.02. Financial leverage +1.53. Overall ratio coverage +2.04. Intermediate coverage ratio +1.05. Coefficient absolute liquidity+1.06. Sales profitability ratio +1.07. Core business profitability ratio +1.0 Share accounts receivable V current assets: Correction score less than 25% - 0.5 From 5 to 50% - 1.0 more than 50% - 1.5

Score in points Investment rating group CommentsFrom 7.5 to 10.01 The highest rating score. Evidence of the financial stability of the enterpriseFrom 5.0 to 7.02 Lending to such an enterprise is possible with an insignificant level of riskFrom 2.5 to 4.53 Making a decision on lending to such an enterprise requires a balanced approach, taking into account the assessment of all risk components and a detailed assessment of its activities Less than 2.04 Negative assessment of activity enterprises. It is recommended to refrain from issuing a loan

The rating of the borrower's financial condition should be downgraded in the presence of negative development trends and high sensitivity of the project to the identified risk factors. It is also rational to reduce the financial condition rating in the presence of additional negative indicators that are not taken into account when the calculation is made. financial position organizations, such as debt/earnings before tax, debt/revenue, and other metrics. However, such a classification cannot take into account all the factors that affect the final assessment of the application.

Of particular importance is the assessment of the bank's experience with the client: the duration and strength of relationships, credit history, etc.

For each loan requested by an economic entity, it is necessary to study the external environment, regional and industry factors affecting the credit relationship of the enterprise with the bank, and only after that proceed with the analysis financial reporting. The information contained in the financial statements should be supplemented by data on the breakdowns of the timing of receivables and accounts payable and business plan calculations, as well as a feasibility study for obtaining a loan. If there is not enough information for analysis, especially for clients who first applied to the bank for a loan, the bank may be assisted in some cases by credit bureaus(this is a common practice abroad).

Detailed comprehensive the financial analysis borrower (movement Money, liquidity, solvency, ratio of own and borrowed money) and the object of lending is made on the basis of the documentation available to the bank. In this case, the bank must use documents provided both by the borrower itself and obtained from other sources, as well as documents already available in the bank and previously provided by the borrower (for previous loans and when receiving other services). It should be noted that each bank, as a rule, applies its own system for assessing the risk group of a loan product, but tries to make it as close as possible to international standards.

We believe that in order to provide access to reliable information on all borrowers, the Bank needs to develop a single electronic database of opinions on the financial position of the borrower and the professional judgments of the risk manager.

The following assessment methods can be used to assess credit risk: analytical, expert and statistical.

The analytical method for assessing the risk of default on a loan is based on the application established by the Bank Russian order of calculation. Loans are divided into 4 risk groups depending on the terms of delay in payment of the principal debt or its re-registration and the nature of the security. For each group, a risk coefficient was established. Since the risk assessment criteria are formalized, the risk value is calculated without much difficulty. But the result obtained does not give a complete picture of the possible losses. The method is used to determine the required reserve for possible losses on loans and include it in the bank's costs.

The statistical method of assessing credit risk is associated with the study of statistics of losses that have occurred in past decisions. Their value is established, a probabilistic analysis is carried out, and a forecast is made. The amount of risk is determined as an average indicator based on credit history bank as the ratio of the amount of outstanding loans and non-fulfillment of other obligations by customers to the total amount of loans issued. The total amount of losses from lending operations is estimated as the total amount of obligations of the borrower (or group) to the bank, multiplied by the probability of losses in the course of lending operations. As an estimate of the probability of losses from lending operations, the average share of loan defaults and non-fulfillment of other obligations by customers (or their groups) with similar characteristics and creditworthiness indicators over the previous history of the bank's development is used.

The expert method is associated with the processing of the opinions of experienced specialists. It is applied for risk factors that cannot be quantified. As a rule, the method involves conducting a questionnaire and scoring.

We believe that it would be appropriate to combine these methods in order to achieve more accurate results in assessing credit risk. That is, in addition to the credit risk assessment methods used in Kuban Credit, it is necessary to develop a scoring system, develop a new methodology related to assessing key financial indicators of borrowers based on a credit scoring system. The main purpose of using the methodology is to adapt the international experience accumulated in this area and the recommendations of the Basel Committee to the Russian banking practice. In addition, for a reasonable assessment of creditworthiness, in addition to information in numerical values, expert review qualified analysts.

It is also advisable to use foreign experience in predicting the financial condition of the borrower in the coming period in order to make an informed decision on granting loans.

Optimization of the credit process implies the development of a methodology for calculating the credit limit (risk) for one borrower or for a group of related borrowers.

In order to improve the credit risk management system, first of all, it is necessary to develop and approve the procedure for analyzing credit risk and ways to reduce it. For this it is necessary to carry out a number of activities:

motivation by the bank of specialists to develop and test new methods of credit risk analysis;

identification of errors in the activities of not only the credit department, but also risk management departments, elimination of identified shortcomings;

determination of the degree of risk as a percentage of the loan amount;

tightening control over the level of credit risk, in particular:

- a) when monitoring actual activity it is expedient for the borrower to develop new reporting forms.

- b) when monitoring the condition of the collateral, check the adequacy of the current market value, carry out timely departure of bank representatives to the place of storage of the subject of pledge;

- c) when monitoring the fulfillment by the borrower of the terms of the loan agreement, identify the reasons for non-fulfillment of obligations and propose ways to level risks, if any;

- d) constantly monitor the implementation of decisions and measures approved by the credit committee of the bank, including those proposed by the risk manager.

Particular attention should be paid to the advanced training of risk managers. To this end, it is necessary on an ongoing basis:

conduct certification of risk managers for knowledge and correct application of the provisions regulatory framework bank and relevant legislation;

to motivate risk managers to develop new methods for risk analysis, as well as to improve their skills.

The choice of the type of credit policy is based on the strategy of the bank, focused on the growth of its capital, increasing income, maintaining liquidity, reducing the risks of banking activities or a mixed strategy. Credit policy how the basis of the credit management process determines priorities in the development process credit relations and functioning of the credit process. Credit policy as the basis of the credit management process determines the priorities in the development of credit relations and the functioning of the credit process.

By defining a strategy, banks develop individual approaches to lending to relevant borrowers, including individuals. For example, a bank may recommend issuing personal loans secured by a house, but refrain from expanding the issuance of loans for long-term investments, loans to persons with a dubious reputation, loans secured by shares of private companies, etc. A bank's lending policy may determine the geographic regions where a bank's credit expansion is desired. For example, a bank may limit the scope of its lending policy to the city where it is located or to a rural area. And a large bank can focus in its activities not only on the development of credit relations with private clients at the national, but also at the international level. Thus, in order to develop an optimal credit policy, it is necessary to determine priority areas the work of the bank, taking into account the state of the market for banking operations and services, the level of competition, the capabilities of the bank itself.

Credit policy is necessary for banks primarily because it allows you to regulate, manage, rationally organize the relationship between the bank and its customers to attract resources on a repayable basis and invest them in lending to bank customers. It is also important to emphasize that the credit policy is the basis of risk management in the bank's activities.

Thus, the study of all quantitative and qualitative characteristics of the borrower should enable the lender to make a decision on the credibility of the potential borrower, which should be reasoned without taking into account the nature of the security, since the security should only serve to reduce credit risk.

The increase in the volume of transactions and the emergence of new forms of credit relations against the backdrop of changing regulatory norms require banks to improve the quality of credit management and revise the approaches underlying the formation of credit monitoring, which, being one of the most important components of credit policy, should adapt the new economic conditions and the needs of the subjects economic life to the overall development strategy of the bank and develop adequate standards for managing the credit process and credit risk. Credit monitoring in a commercial tank can be effective only if it is scientifically substantiated and is formed in accordance with the laws of economics and the laws of bank management.

Thus, the complex development of theoretical and practical issues, revealing all aspects of the formation and implementation of credit monitoring in a commercial bank, is an important and urgent problem of the modern banking system of Russia.

The entire international banking community is concerned about the problem of repayment of loans, and its importance has now increased. For Russia, it is associated with the presence of problem loans, the volume of which increased with the activation of the credit policy of banks. Figure 1 shows the dynamics of overdue debt on loans, deposits and other placed funds.

One of the ways to minimize the credit risk of banks is to create an effective system of banking control. Integral part This problem is the timely identification and organization of work with problem loans.

Credit monitoring is a complex information and analytical system that includes control over the quality of loans granted, its assessment and forecasting of future development in order to organize timely and adequate management decisions that reduce credit risk at all stages of working with a loan.

There are two main features of credit monitoring objects, the first of which is their dynamism, and the second is the presence or possibility of danger arising in the process of the monitoring object functioning. Therefore, credit monitoring should be identified primarily as a multifactorial process aimed at reducing the riskiness of credit transactions and preventing negative transactions associated with the emergence of difficulties in the process of repaying a loan.

The main difference between a monitoring system and a control system is in predicting the future development of objects.

The information and analytical base for credit monitoring in commercial banks is formed from information coming from various sources:

Information provided by the borrower. These include an application for a loan, a borrower's questionnaire, juristic documents, financial documents, information about the object of lending, information about the security of the loan.

Intra-bank information that exists under the conditions of the operation of a single information field of the bank (credit history in this bank, data on the movement of funds on the borrower's accounts, the quality of debt service, information received by a loan officer when visiting the office or production of the borrower).

Information received from third parties, including:

Regulatory and Supervisory Bodies ( tax office, registration chambers and licensing authorities);

credit institutions serving this borrower;

judiciary;

Mass media, Internet;

credit bureaus.

It is very important that this information is constantly updated, otherwise the upcoming signs of a loan problem may go unnoticed.

An adequate system for determining, assessing, monitoring and controlling credit risks is an integral element of credit policy. Credit risk is understood as the probability of loss of liquidity and/or financial losses due to untimely performance or non-performance by the borrower of its obligations as a result of various internal and external factors. The specifics of the organization system for monitoring credit risks is that poor state control and weak corporate governance are the reasons for limited financial transparency, which makes it difficult to properly assess risks.

The credit risk to which commercial Bank, depends on a number of factors that characterize the loan portfolio and credit policy of the bank. Chief among these factors are the following:

degree of diversification loan portfolio by borrowers, regions, industries (the higher the diversification, the lower the risk, the higher the concentration of the loan portfolio, the higher the risk);

share of overdue loans in the portfolio (including implicit and restructured overdue debt);

loans to non-traditional business areas (which contributes to increased credit risk due to the inability to predict how the business will develop in the future);

the share of new borrowers in the loan portfolio that do not have a credit history (also contributes to a potential increase in the risk of loan default due to the fact that the borrower may be dishonest);

pledge of illiquid and low-liquid assets (the risk of difficulties arises if it is necessary to sell the pledge);

organization of lending in the bank as a technological process.

Main scope practical application monitoring is management, or rather, information service of management in various fields of activity. Monitoring is a rather complex and ambiguous phenomenon. It is used in various fields and with different purposes, but at the same time it has common characteristics and properties.

Analysis and assessment of the quality of the loan portfolio of corporate clients commercial bank

Bank loan portfolio management is one of the elements of the credit risk management system...

Risk analysis in banks of the Republic of Kazakhstan

The formation and development of banking risk management is of great practical importance from the point of view of bank employees...

Analysis of credit risk management and ways to improve on the example of OJSC "Sberbank of Russia"

IN general view banking risks are divided into four categories: financial, operational, business and extraordinary risks. Financial risks, in turn, include two types of risks: pure and speculative. Net risks, including credit risk...

Business plan for launching a new banking service at CJSC JSCB "Express-Volga"

The inevitability of the occurrence of risk situations and the manifestation of their consequences require the development and adoption in practice of appropriate methods of preventing and responding to them in order to eliminate or reduce damage ...

Credit risk

Credit risk is defined primarily as an economic risk associated with the management of financial resources. However, its specific feature, which distinguishes it from other types of economic risks, is that ...

The risk assessment of the bank's loan portfolio provides for: * a qualitative analysis of the total credit risk of the bank, the essence of which is to identify risk factors (identifying its sources) and requires in-depth knowledge ...

Bank credit risk assessment

The problem of minimizing credit risk requires the creation of an adequate methodology for assessing its risk, which can only be unified by a certain measure, because each bank has its own clientele, its own market segment, industry specifics...

All banking risks can be divided into two large groups - "financial" and "non-financial". Traditionally, financial risks include: a) credit risk; b) market risk (currency, stock, interest); c) liquidity risk...

Assessment of credit risks of a commercial bank

Assessment of the borrower's creditworthiness in order to minimize credit risk

Assessment of the potential level of losses of a particular bank for its loan portfolio

The credit risk models discussed above make it possible to single out at least four types of variables that determine the quality of bank loans. Among them, the share of overdue debt in the loan portfolio...

Development of the insurance business in the Republic of Kazakhstan

Risk is not constant. He is changeable. These changes are largely due to changes in the economy, as well as a number of other factors...

Improving risk management in a commercial bank

The quality of the loan portfolio is real score compiled for loans already granted to borrowers. Knowing the structure of the loan portfolio by categories of loan quality and determining average percentage problematic...

Management of problem loans in second-tier banks: Kazakhstani and international experience

Banks in Kazakhstan do not currently have a robust credit risk management process in place. Moreover, unreliable financial information, the legal structure leads to poor analysis of the lending industry...

Establishment credit limits as a mechanism for minimizing credit risk

By credit risk, we mean the probability of potential losses that the bank may incur due to the inability or unwillingness of the counterparty to fulfill financial obligations on loans...

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Kuban Credit Bank is a member of the main professional banking and business communities: the bank is a member of the Association of Russian Banks (ARB), a member of the Association of Regional Banks "Russia", a member of the Krasnodar Chamber of Commerce and Industry.

Bank "Kuban Credit", actively developing, constantly introduces new computer technologies. The information site of the bank and other online products have been created and are actively working. Currently, Kuban Credit Bank provides a wide range of services to legal entities and individuals.

CB LLC "Kuban Credit" joins the Code of Ethical Principles of Banking, developed by the Association of Russian Banks, as an act of self-regulation of the banking community Russian Federation based on business ethics and financial law. CB LLC "Kuban Credit" voluntarily agrees to be guided in its practice by the specified Code, based on long-term interests banking sector Russian economy and requirements of civilized market relations.

The Bank's long-term strategy is based on the client business development model. The principles of customer focus and the desire to achieve excellent knowledge of customers give bank managers the opportunity to effectively manage risks and create conditions for long-term mutually beneficial partnerships.

LLC "Kuban Credit" is a universal bank actively developing both work with retail clients and services for the corporate sector.

Kuban Credit Bank has created a significant organizational, intellectual, technical and financial potential. The bank has a stable position in the Kuban financial market, high liquidity of assets, dynamic growth of key indicators, and a stable client base. Kuban Credit Bank is a member of the main professional banking and business communities: the bank is a member of the Association of Russian Banks (ARB), a member of the Association of Regional Banks "Russia", a member of the Krasnodar Chamber of Commerce and Industry.

CB "Kuban Credit" LLC received certificate No. 269 dated December 09, 2004 on its entry into the register of banks participating in the system compulsory insurance deposits State Corporation Deposit Insurance Agency.

CB "Kuban Credit" LLC joins the Code of Ethical Principles of Banking, developed by the Association of Russian Banks, as an act of self-regulation of the activities of the banking community of the Russian Federation on the basis of business ethics and financial law. CB "Kuban Credit" LLC voluntarily agrees to be guided in its practice by this Code, based on the long-term interests of the banking sector of the Russian economy and the requirements of civilized market relations.

Since 2012, a partner of SME Bank OJSC, Commercial Bank Kuban Credit, a limited liability company, has been lending to small and medium-sized businesses, including through targeted resources of an open joint-stock company "Russian Bank support for small and medium businesses.

A stable financial position and the presence of a high credit rating"A-", forecast "stable" (according to the agency "Rus-Rating") allowed CB "Kuban Credit" to receive state support in the form of unsecured loans from the Bank of Russia. The achievements of the Bank are recognized and highly appreciated by the banking community of the country: CB "Kuban Credit" ? Winner of awards at three Russian banking festivals.

Magazine "Expert Yug" No. 18?19 (107?108) dated May 10, 2010 published information about the awarding of the Chairman of the Supervisory Board of CB LLC "Kuban Credit" V.K. Budarin with the title of "The Best Banker of Russia" in 2009, Viktor Konstantinovich became the only representative of the banking community of southern Russia among the laureates, while he received a high award for the second time. For the first time the title of "The Best Banker of Russia" was awarded to Viktor Konstantinovich in 2007.

The basis of Kuban Credit's business is lending to the real sector of the economy, which accounts for over 60% of the bank's assets. At the same time, three quarters of the loan portfolio are loans provided to small and medium-sized businesses, as well as "retail" loans. The Bank takes part in the implementation national project"Affordable and comfortable housing for the citizens of Russia", thereby helping to solve the most important social problem? formation of an affordable housing market in the Kuban.

Among the reliable partners of the bank "Kuban Credit" are more than 30 construction industry enterprises, such as the plant CJSC "OBD", LLC "KrasnodarInvestStroy", LLC "KrasnodarStroySnab", LLC "OBD-Invest", LLC ISK "Budmar", JSC APSK "Gulkevichsky ", OJSC "Silikat", CJSC "Kuban Marka", etc.

The mission of the Bank is to meet the needs of each client in banking services high quality and reliability, saving the funds of clients and investors, their investments in the real sector of the region's economy.

Strategic goals of the Bank:

? development and constant updating of the range of banking products in accordance with the needs of customers;

? improving the manufacturability of doing business to ensure high quality services at optimal costs;

? development of a comprehensive service system in order to increase customer loyalty;

? maintaining confidence on the part of customers and counterparties, including by increasing the openness and transparency of the Bank's activities.

The main directions of the bank's prospective work are set out in the Development Strategy of CB Kuban Credit LLC for 2014? 2018 and are as follows:

? further expansion of business geography through the development of a regional network;

? build-up of the capital base, allowing to expand the Bank's investments in the economy of the Krasnodar Territory and the capital of Kuban;

? increase in the client base;

? preservation of lending to corporate clients as the prevailing direction of the Bank's activity;

? improvement of the risk management system in conjunction with the overall development of the Bank's asset and liability management systems;

? implementation of a system of quality standards for managing operational and liquidity risks. Development of quality standards for managing credit, interest, market risks;

? modernization of the Bank's IT infrastructure, expansion of functionality software.

As part of the improvement of the Bank's corporate governance system, functions have been formalized and clearly distributed among management bodies, rules and procedures have been defined to ensure compliance with the principles of professional ethics. The Bank has optimized the risk management system, established effective control over the activities of divisions in order to protect the rights and legitimate interests of the Bank's owners and customers. Timely disclosure of complete and reliable information about the Bank to interested parties was ensured.

CB LLC "Kuban Credit" has a four-level structure of management bodies (Figure 4), which includes: General meeting, the Supervisory Board, the Management Board of the Bank and the sole executive body. The following collegial bodies have been formed under the Chairman of the Management Board of the Bank: Credit commission, Asset and Liability Management Committee, Operational Risk Management Committee, Sub-Offices Committee.

Figure 4? The structure of the management bodies of CB LLC "Kuban Credit"

As a result, the general characteristics of the organization, its features, specification of activities and services provided are considered. The organizational structure of management of CB "Kuban Credit" LLC has been studied and graphically displayed.

2.2 Analysis of the financial activities of a commercial bank

Accounting and reporting in the Bank is carried out in accordance with the instructions established Central Bank RF. The bank is required to provide financial statements according to the forms and within the time limits established by law. The basis of the bank's analytical work is the analysis of balance sheet and income statement data (assessment of the dynamics of volume indicators: assets, deposits, equity, loans, profits). The results of the analysis of the state of the bank's assets are the basis for the development of the credit and investment policy of the bank. The ultimate goal of the analysis is to identify the bank's problems at the earliest possible stages of their formation. The results of the analysis should be used in determining the supervisory regime, including deciding on the advisability of conducting inspections of banks and determining their scope, as well as the nature of the supervisory response measures applied to banks .

Next, we will analyze the Bank's activities for 2011–2014. using information from balance sheet and income statement. The received data will be summarized in separate tables, and their changes will be considered in dynamics for the specified period.

An analysis of the financial condition of a bank should begin with a study of the effectiveness of the structure of its liabilities, since capital is formed on their basis.

Table 2. The structure of liabilities of LLC "Kuban Credit" for 2011-2014, thousand rubles

|

Article title |

Abs. change |

Udel. weight, % |

||||||||

|

1 Loans received from the CBRF |

||||||||||

|

2 Due to credit institutions |

||||||||||

|

3 Customer funds: |

||||||||||

|

3.1 including deposits of individuals |

||||||||||

|

4 Released debentures |

||||||||||

|

5 Other liabilities |

||||||||||

|

6 Total liabilities |

||||||||||

|

Sources of own funds |

||||||||||

|

7. Authorized capital(funds of shareholders - participants) |

||||||||||

|

8. Share premium |

||||||||||

|

9. OS re-evaluation |

||||||||||

|

10. Reserve fund |

||||||||||

|

11. Profit (loss) for the reporting period |

||||||||||

|

12. Retained earnings |

||||||||||

|

13. Total sources of own funds |

In accordance with Table 2, CB Kuban Credit LLC has an insignificant share in the structure of its liabilities of loans received from the Central Bank, and their volume tends to increase in 2014 compared to 2011, when there were no loans received from the Central Bank of the Russian Federation at all.

A steady growth trend is observed in terms of attracted customer funds. In 2012, the indicator increased by 4,466,961 thousand rubles. compared to 2011, and in 2014 customer funds increased by another 12,500,714 thousand rubles. The share of customer funds in the total amount of liabilities in 2014 was 96%. Funds of credit institutions increased and in 2014 amounted to 464,263, which may indicate an increased confidence of other credit institutions in the Bank, which may have a positive effect on its image, as well as increase the amount of available funds. Individuals' deposits also show a growth trend. So the increase in this indicator in 2012 amounted to 1876571 thousand rubles, and in 2014 - 5126173 thousand rubles. The share of deposits of individuals in the total amount of deposits in 2014 is 39% (29462609 thousand rubles), which indicates confidence in the Bank on the part of the retail client.

Issued debt obligations (bonds, certificates of deposit and savings, bills, etc.) appear in 2013 and 2014. The presence of this indicator indicates the insufficiency of capital at that time, attracted in another way.

Other liabilities of the Bank tend to increase. They include: settlements with foreign exchange and stock exchanges, settlements for the purchase / sale of foreign currency and commemorative coins, for futures transactions, for securities, for letters of credit, settlements with suppliers and contractors, etc.

The change in the total volume of liabilities has to increase. In 2012, this indicator increased by 4522343 thousand rubles, and in 2014 by 13007920 thousand rubles. and amounted to 50269383 thousand rubles.

Authorized capital for 2011 - 2014 remains unchanged. In addition, in 2012 the Bank increased the profit left at its disposal by 404,732 thousand rubles, and in 2014 both profit and the reserve fund increased.

The indicators of the volume of own funds and the total volume of liabilities from 2011 to 2014 have a positive trend. Basically, this increase was due to the growth of customer funds, namely private customers, issued debt obligations and other factors.

At the next stage of assessing the financial and economic position of the bank, we will analyze its assets. Analysis and evaluation active operations bank shows how efficiently the bank uses its resource base. Consider the assets of CB LLC "Kuban Credit", their dynamics and calculate the growth rate (table 3).

The volume of funds and accounts of the Central Bank of the Russian Federation increased by 40.68% in 2014 compared to 2013, which indicates an increase in the Bank's operations through the Central Bank of the Russian Federation, compared to 2012, when this indicator decreased to - 15%.

For the study period, the volume required reserves increased from 160083 and amounted to 403212 thousand rubles. At the beginning of 2014, there was an increase in the funds invested by the Bank in other credit institutions.

With regard to net investment in trading securities, i.e. investments less provisions for impairment, the situation is ambiguous. Here we can talk about the cautious policy of the Bank, associated with a sharp drop in interest in investing in financial instruments, which can give a large income compared to investing in loans.

In terms of net loan debt to the Bank, an increase in 2012 by 24% is observed.

In 2012 fixed assets, intangible assets and inventories increased by 108% and maintained the trend until 2014. Such an increase is due to the expansion of the bank's activities, the opening of additional offices and branches.

Table 3. Structure and dynamics of the assets of Kuban Credit LLC, thousand rubles

|

Name of articles |

Absolute value |

Specific weight, % |

Growth rate, % |

||||||||||

|

1. Cash and accounts with the CBR |

|||||||||||||

|

2. Required reserves |

|||||||||||||

|

3. Funds in credit institutions |

|||||||||||||

|

4. Net investments in securities at fair value through profit or loss |

|||||||||||||

|

5. Net debt |

|||||||||||||

|

6. Net investments in securities and other available-for-sale financial assets |

|||||||||||||

|

7. Net investment in securities held to maturity |

|||||||||||||

|

8. Fixed assets, intangible assets and inventories |

|||||||||||||

|

9. Other assets |

|||||||||||||

|

10. Total assets |

Other assets of the Bank play an important role in its activities. These include transactions with precious metals and stones, for factoring and forfaiting transactions, with currency and stock exchanges, settlements for the purchase / sale of foreign currency, letters of credit, disposal and sale of property, settlements with branches, with employees, etc. As of January 1, 2012, this indicator increased by 209%, and in 2014 it decreased by 7%, which is a sign that its assets are not diversified.

Thus, we can say that the change in the total amount of assets in the analyzed period has positive trends. So, by January 1, 2012, assets increased by 118%, and in 2014 by 134% and amounted to 53476328 thousand rubles. For clarity, we present the structure of assets of MDM Bank OJSC for 2014 in the form of a diagram (Figure 5).

Figure 5 - The structure of the assets of Kuban Credit LLC as of 1.01.15

In general, the increase in assets for the analyzed period is a positive trend in the development of Kuban Credit LLC. At the same time, it is important that there was a significant increase in net loan debt, as this indicates an active policy pursued by the bank.

INcomplianceWithinstructionCBRFfrom16 .01.20 04 G. №110 ?AND " Aboutmandatoryregulationsjar" Allcreditorganizationsmustobserverowmandatoryrequirementscharacterizingpayment methodbnessjarAndlevelcreditrisk (table4 ).

Table 4? Information about the mandatory standards of LLC "Kuban Credit"

|

Name of indicator |

Standard value |

Absolute change |

|||||

|

2013 to 2012 |

2014 to 2013 |

||||||

|

1. Sufficiency of the bank's own funds (N1) |

|||||||

|

2. Instant liquidity indicator of the bank (H2) |

|||||||

|

3. Indicator of current liquidity (H3) |

|||||||

|

4. Long-term liquidity ratio (N4) |

|||||||

|

5. Indicator maximum size risk per 1 borrower or group of related borrowers (H6) |

|||||||

|

6. Indicator of the maximum size of large credit risks (H7) |

|||||||

|

7 The indicator of the maximum amount of loans, bank guarantees and guarantees provided by the bank to its participants (N9.1) |

|||||||

|

8 Indicator total value risk by bank insiders (H10.1) |

|||||||

|

9 Indicator of using the bank's own funds to acquire shares of other legal entities (N12) |

As we can see, the Bank carried out in 2011-2014. its activities within the limits established by the Central Bank of the Russian Federation, while liquidity indicators are quite high and have a positive trend.

The equity capital adequacy ratio, by 2014, decreased to 13.4%, but it is 3.4% more than the minimum level, which is 10%. This decrease is due to the reduction in equity capital. Thus, as of January 1, 2015, 13.4% of risk-weighted assets are backed by equity.

Instant liquidity ratio (minimum 15%) tends to decrease. If at the beginning of 2012 this figure was 90.1%, by 2014 it had dropped to 73.8%. Thus, it can be said that due to its highly liquid assets (cash on hand, funds in the settlement center, etc.), CB Kuban Credit LLC is able to business day pay off 73.8% of its obligations, which in this case indicates sufficient instant liquidity.

An upward trend is observed in terms of the current liquidity ratio (minimum 50%), which increased by 17.2% by 2014. Thus, the Bank can cover 95.6% of its current liabilities from liquid assets, i.e. financial assets which can be mobilized by the Bank within 30 calendar days. As you can see, the value of the standard does not go beyond the minimum, however, current liabilities cannot be fully repaid at the expense of liquid assets.

The long-term liquidity ratio (the maximum limit of which is 120%) determines the maximum allowable ratio of bank credit claims with a remaining maturity of more than 365 or 366 calendar days to the bank's own funds (capital) and obligations (liabilities) with a remaining maturity of over 365 or 366 calendar days. This standard decreased by 12.6% at the beginning of 2013 to 83.2%, thus remaining within the established limits.

The maximum risk ratio per one borrower or a group of related borrowers (N6) regulates (limits) the bank's credit risk in relation to one borrower or a group of related borrowers and determines the maximum ratio of the total amount of the bank's credit claims to the borrower or a group of related borrowers to its own funds (capital) jar. The value of this indicator decreased by 2% in 2014 compared to 2013.

In 2013, there is an increase in terms of the maximum size of large credit risks: at the beginning of 2012 - 50.4%, and by 2014 it decreased by 24.1%. The norm of the maximum size of large credit risks (N7) regulates (limits) the total amount of large credit risks of the bank and determines the maximum ratio of the total amount of large credit risks and the amount of the bank's own funds (capital).

The indicator of the maximum amount of loans, bank guarantees and guarantees provided by the bank to its participants (shareholders) (N9.1) in 2008 is decreasing in dynamics.

The indicator of the total amount of risk for the bank's insiders (N10.1) increased from 2.6% in 2012 to 2.7% in 2012 and is within the limits set by the Central Bank of the Russian Federation.

Table 5? Analysis of income and expenses of the bank LLC "Kuban Credit", thousand rubles.

|

Name of articles |

Absolute value |

Absolute change |

Growth rate, % |

|||||||||

|

1. Operating income |

||||||||||||

|

2. Operating expenses |

||||||||||||

|

3. Total net operating income |

||||||||||||

|

4. Non-operating income |

||||||||||||

|

5. Non-operating expenses |

||||||||||||

|

6. Total net non-operating profit (loss) |

||||||||||||

|

7. Total income |

||||||||||||

|

8. Total cost |

||||||||||||

|

9. Gross profit |

From the above data, it can be seen that the growth of gross profit is more influenced by the increase in operating profit, this is a positive trend, since the bank's operating activities must occupy a predominant share for the successful functioning of the bank.

However, the Bank has a higher growth rate of expenses than the growth rate of income, this is a negative trend, and may indicate either that the Bank attracts more long-term resources during the analyzed period and places them in long-term assets, or that the Bank is buying financial resources at a high price, and places them at a lower price. Both situations are negative.

For greater clarity, we illustrate the data on income and expenses in the form of a diagram (Figure 6).

Figure 6? Dynamics of income and expenses of LLC "Kuban Credit"

Although profit is one of the most important performance indicators, it does not always provide sufficiently objective information about the level of efficiency of the bank. It is also necessary to consider profitability indicators, the analysis of which is given in Table 6.

Table 6 - Key performance indicators of the financial and economic results of the bank LLC "Kuban Credit"

As can be seen from the table, the overall profitability has minor fluctuations over the period under review.

The profitability of all assets by 2011 decreased and amounted to 0.02%. That is, 0.02 rubles of profit per 1 ruble of assets.

Return on equity (ROE - Return on Equity) by 2014 increased by 0.05% and amounted to 0.16, i.e. 1 ruble of equity accounts for 0.16 rubles of current profit. The factor that influenced the increase in return on equity is the increase in current profit. This coefficient is of interest to founders, shareholders or shareholders, because shows the effectiveness of their investment.

The indicator of NP to income tends to decrease in 2014, it decreased and amounted to 0.05 kopecks. profit on 1 rub. bank income. The decline in the indicator negatively characterizes the bank's management.

Summing up, we can say that, in general, the activities of Kuban Credit LLC are efficient and stable. Complied with all the standards in accordance with the Instruction of the Bank of Russia dated December 3, 2012 No. 139? And "On the mandatory ratios of banks." The dynamics of the structure of assets and liabilities has a positive trend, although there are negative fluctuations. The dynamics of profitability indicators in most cases tends to increase, which coincides with changes in income and expenses.

2.3 Methods for assessing credit risk in Kuban Credit LLC

The main, active work of the bank is the provision of loans; its viability depends on the state of the credit business in the bank. The lending process begins with the consideration of a loan application. Therefore, it is very important to be able to identify and assess credit risk at this stage. When considering a loan application, an analysis of the creditworthiness of a potential borrower is carried out. Depending on various factors, the bank makes either a positive or a negative decision on the borrower. Thus, "bad" applications that do not meet the bank's requirements for borrowers and have an increased level of risk are not allowed to the bank.

The main divisions of the Bank that make up the organizational structure of the risk management system are: Credit Commission, Asset and Liability Management Committee, Operational Risk Management Committee, Strategic Planning and Risk Management Department, Department internal control, Security Service.

Credit risk management in CB LLC "Kuban Credit" is carried out through:

? regular analysis of the borrower's ability to timely repay interest and principal obligations;

? setting limits on one or a group of related borrowers;

? obtaining sufficient collateral for the loans provided

Its viability depends on the state of the credit business in the bank. Most banks are characterized by the amount of loans issued from 50% to 70% of the total assets of the bank. It is the level of credit risk that determines general state financial risk of the bank. Therefore, there is a stricter control by the CBR of the credit strategy and tactics of the bank and its loan portfolio.

Prompt and accurate assessment of credit risk is the most urgent task for a commercial bank; increasing the profitability of banking activity largely depends on its efficiency and accuracy. Credit risk assessment is the first step in the risk management system. Their minimization is based on risk assessment. In the process of assessing credit risk, the bank divides customers according to the degree of risk, on the basis of which it makes a decision on lending, and also sets a lending limit. In addition to the above, the amount of interest on the loan also depends on the amount of credit risk.

The decision to grant a loan or to issue an obligation to Kuban Credit is made on the basis of a comprehensive analysis of the following main factors of the borrower's activity:

? legal legal capacity reference business, receiving kr e dita And implementation credited deals ;

? financial And credit story borrower ;

? current financial state ;

?character carried out activities, strength positions on market ;

? economic efficiency potentially credited etc O ekta ;

? assets, employees providing loan .

Appreciation all these factors And issuance conclusions relative b But creditworthiness And financial states borrower on ending A body solution credit committee is engaged control loans A nia .

Complex analysis financial states borrower held on basis data financial ( accounting ) reporting . Having considered A are such documentation How : accounting balance, report O profits And losses report about changes capital, report O movement monetary funds And others .

Analysis these financial reports borrower allows reveal his creditworthiness . These documentation define sources coatings loans : profit the borrower monetary availability V box office And on accounts V banks, assets V quality ensure credit, existing other liquid assets, various guarantees And insurance . At consideration balance sheets potential borrowers minimum How behind three recent P e rioda, necessary etc O track dynamics development key indicators, determining V horse h nom account, their creditworthiness .

Practice shows What period retrospective analysis fina n owl development borrower must exceed V 3 times credit period . For example, borrower wishes get credit on one year, That period retro O spe To active analysis must compose three of the year, But With special attention analysis indicators before credit period . For this Can And With use special methods by weight coefficients . Weighted koe f agents must be maximum For indicators directly n But before credit P e Riodom . Further should use special methods forecasting indicators creditworthiness on end kr e dietary period, When zae m box must return credit And accrued interest . Retrospective analysis starts With definitions quantities purely th negotiable capital companies, which determined How rel O schenie general size negotiable assets To short-term obligations T to you

Zero or positive meaning clean negotiable capital is satisfactory . positive meaning indicator O h starts, What company works effectively . However zero meaning P O indicator means What company Not It has " buffer" on happening arose O venia contingency And day demand on resources . Management enterprises Also interested V availability positive negotiable capital, allowing use released facilities For further e th development companies .

Further should calculation major financial indicators :

Table 6 - O main e financial e indicators

|

Coefficient name |

Calculation method |

Explanation |

|

|

1. Current liquidity ratio |

Current assets / Current liabilities |

Indicates how much of the current liabilities for loans and settlements can be repaid by mobilizing all the |

|

|

2. Quick liquidity ratio |

(Working capital - Inventory - exp. bud. per-s) / Short-term liabilities |

||

|

3. Quick liquidity ratio |

(DS + short-term financial investments+ Short-term DZ) / Short-term short-circuit |

||

|

4. Absolute liquidity ratio |

Highly liquid assets / Short-term liabilities |

It characterizes the ability of an economic entity to mobilize funds to cover short-term debt; the higher this ratio, the more reliable the borrower |

|

|

5. Financial independence ratio |

Equity / Balance currency |

The normal limit of this coefficient is estimated at 0.5, i.e. K, > 0.5. The ratio shows the share of own funds in total volume enterprise resources. |

|

|

6. Ratio of own and borrowed funds |

Equity / Total Liabilities |

The coefficient shows what part of the enterprise's activities is financed by borrowed funds. Normal Coefficient Limit, > 1 |

|

|

7. Return on assets |

NP / Average value of total assets for the period |

||

|

8. Profit Ratio |

Operating profit before taxes, dividends and interest / Sales proceeds |

It characterizes the profitability of the product itself, i.e. the efficiency of the enterprise's operational activities |

|

|

9. Profitability ratio (for trade organizations) |

PE after interest and taxes / Sales proceeds. |

||

|

10. Profitability ratio (for industrial enterprises) |

PE after interest and taxes / s / s products. |

Consider peculiarities work jar OOO " Kuban Credit " By formation reserves on possible losses By loans And his approaches To both With baking lending .

Analysis And planning credit risks produced Not only By ruble loans, But And By loans, granted V foreign currency, precious metals, By issued guarantees . Analysis, cla With sif And cation, grade quality And planning credit portfolio jar product O ditsya By next stages :

? Definition criteria And indicators analysis And planning credit portfolio jar .

? Retrospective analysis credit portfolio jar behind past similar periods .

? Classification loans And their quantitative-qualitative oce n ka By degrees their security ( secured, not enough provide e chennye And unsecured ) And By level credit risk ( standard or practical e ski risk-free loans, non-standard loans With moderate risk nevo h gate, dubious loans With high With high level no return And hopeless loans, representing F To tic losses jar ).

? Analysis positive And negative factors conditions, def e dividing quality credit portfolio .

? Development activities By liquidation, A at impossibility maximum decrease actions negative And maximum P O elevation positive factors conditions By improvement merits Yu drawing, basic credit portfolio .

? Development new, more efficient, multivariate credit T nyh portfolios on new planned period With calculation additional income jar By to each from options improved portfolio .

? Comparative analysis, choice, agreement, statement And And With use most efficient credit portfolio jar .

? Continuous control, collection information O credit operations, systematic summing up results, comparative analysis actual data O loans With data planned credit portfolio And Adoption timely managerial decisions By decrease risk And P O elevation profitability credit operations .

Similar Documents

Regulatory aspects of assessing creditworthiness in the Russian Federation. Comparative evaluation methods for assessing the creditworthiness of bank borrowers. Organization of work on credit risk management. Credit rating legal entity. Risk reduction methods.

thesis, added 06/25/2013

Comprehensive assessment bank loan portfolio risk, credit risk forecasting model. Approbation of the forecasting model for the total credit risk of the bank and its assessment, recommendations for improving the quality of the loan portfolio of JSCB Svyaz-bank.

thesis, added 11/10/2010

Problems of the credit risk rating system. Methodology for the formation of financial ratings. Russian system ratings, its role, development problems and prospects for using it to assess the credit risk and creditworthiness of a borrower in Russia.

term paper, added 11/17/2015

The main methods for assessing the creditworthiness of large and medium-sized enterprises adopted in the Russian Federation. Analysis of the loan portfolio of the bank "SKB-BANK", its credit policy. Measures to improve the assessment of the borrower's credit risk in a commercial bank.

thesis, added 03/20/2013

Analysis of theories of credit risks, comparative characteristics of methods for assessing the creditworthiness of borrowers, such as Sberbank, American and French. Methods for improving methods and prospects for banking management in risk management.

term paper, added 01/05/2011

Analysis of credit risks in banking system Russia. Determination of the borrower's credit rating. Evaluation of the bank's credit risk using the VaR model and simulation procedures on the example of the loan portfolio of Sberbank of Russia.

thesis, added 01/18/2015

Organizational approaches to risk management. Characteristics of the degree of protection of the bank against credit risk. Advantages and disadvantages of exchange and over-the-counter hedging instruments. Combined methods for assessing country risk. Credit risk factors.

thesis, added 01/09/2011

Essential characteristics of credit risk, assessment methods. The main groups of credit risks: internal (regulated) and external (non-regulated). Analysis of existing approaches to credit risk. Features of credit risk management in JSC VTB Bank.

term paper, added 10/07/2011

Concept, essence, types bank loan. Essence and content of credit risk. Methodological approaches to the analysis of the borrower's creditworthiness, its main stages and directions, proposals for improving this process using a specific example.

thesis, added 02/18/2012

Management of the quality of the loan portfolio of the bank's corporate clients as an element of the credit risk control system. Analysis and evaluation of the loan portfolio of the commercial bank JSC "Krayinvestbank". Optimization of the formation and management of the loan portfolio.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

PRIVATE INSTITUTION

PROFESSIONAL EDUCATIONAL ORGANIZATION

“KUBAN COLLEGE OF CULTURE, ECONOMICS AND LAW”

COURSE WORK

GOS SPO 38.02.07 3B-13-9

ORGANIZATION OF CREDIT MONITORING IN THE BANK

Vozisova Anastasia Sergeevna

Head E.V. Kasakova

Krasnodar 2016

Introduction

Chapter 1. Economics of credit monitoring

Chapter 1.1 Organization of credit monitoring in commercial banks

Chapter 1.2 Credit monitoring as a credit risk management system

Chapter 2. Analysis of lending conditions on the example of the bank "Kuban Credit"

Chapter 2.1 Organizational and economic characteristics of the bank

Chapter 2.2 Analysis of the credit policy of the bank

Chapter 2.3 Analysis of the creditworthiness of the borrower on the example of physical. faces

Chapter 3. Improving the mechanism of credit monitoring

Chapter 3.1 Problems of organization of credit monitoring in banks

Chapter 3.2 Ways to Improve Credit Monitoring to Reduce Credit Risks

Introduction

Conclusion

credit bank monitoring

Introduction

Credit monitoring is the bank's control over the use and repayment of loans. The Bank regularly monitors the intended use of the loan, the fulfillment of other conditions of the loan agreement. To do this, the bank checks the current state of the financial and economic activity borrower, if necessary audit checks at the borrower's facility.

By investing in securities, the bank pursues two goals: generating income and providing liquidity. In order to minimize risks on securities, banks make investments in various types of reliability, urgency, profitability, issuer valuable papers, i.e. diversify the portfolio of securities (stock portfolio).

Relevance of the research topic. Current state The banking system of Russia is characterized by the consolidation and development of a trend towards the restoration of banking activities. In the field of lending, the structure and quality of assets of credit institutions improved, which was reflected in the growth of loans real sector economy, reduction of overdue debts, overall improvement in the quality of the loan portfolio. Despite the apparent improvement in the situation, the banking system is poorly protected from numerous risks, including credit ones. Among the main reasons hindering the creation of an effective system for protecting the banking system from credit risk, one can single out the reasons associated with the organization of work in the Bank of Russia in the implementation of credit monitoring of commercial banks and with the conduct of credit monitoring in commercial banks themselves. These reasons are largely due to the lack of development of the problems of both banking monitoring in general and credit monitoring.

The purpose of this study is to clarify the essence of credit monitoring, assess the state of credit monitoring in banking and determine ways to improve it.

Research objectives. To achieve this goal, it was necessary to solve the following tasks and find out its structure:

Research theoretical basis credit monitoring, revealing its essence and place in the banking monitoring system;

To assess the organization of credit monitoring of commercial banks;

Determine the directions for conducting credit monitoring in a commercial bank and in the Bank of Russia;

Conduct an analysis of banking practice in organizing and conducting

credit monitoring;

Identify some ways to improve credit monitoring in banking.

The subject of the study is the current practice of organizing and conducting credit monitoring.

The object of the study is the Bank "Kuban Credit" and Russian commercial banks.

The degree of elaboration of the topic in literature. Assessing the degree of elaboration of the topic, it should be noted that by now there are practically no works devoted to a comprehensive study of the essence of credit monitoring, goals, objectives and organization of its implementation. At the same time, the importance of its implementation is emphasized by many scientists - economists. The bulk of the research covers only certain aspects of the control and management of credit risks. Separate studies of credit monitoring issues are found in the works of the following authors: Batrakova L.G., Vasilishen E.N., Marshavina L.Ya., Olynanogo A.I., Platonov V., Higgins M. and some others. Since in the process of studying the issues of credit monitoring, the general theoretical aspects of banking monitoring, monitoring of credit risk, monitoring of the loan portfolio, monitoring of credit policy are affected, the scientific works of Antipov O.N., Babicheva Yu.A., Beloglazova G. N., Belyaeva M.K., Buzueva A.V.,

Bora M.Z., Zhukova E.F., Ivanova V.V., Korobova G.G., Krasavina L.N., Lavrushina O.I., Lobanova A., Nesterenko E.A., Panovoy G.S. , Rose Peter S., Sokolinskaya N.E., Filin S., Chugunov A., Shor K., Shulkova N.N., Yampolsky M. and others.

1. Economic bases of credit monitoring

1.1 Organization of credit monitoring in the bank

Monitoring credit institution is a system of external control over the credit operations of banks, carried out as part of the supervisory activities of the Bank of Russia.

It includes:

· analysis of the bank's loan portfolio, identification of violations and development of recommendations for its adjustment;

analysis of compliance with standards, limits, requirements for the formation of reserves;

Checking the implementation of control over the execution of loan agreements;

organization of work with overdue debts;

· Evaluation of the work of the credit department of the bank and the Credit Committee;

Checking the correctness of the reflection of credit transactions on accounts accounting.

In the process of lending, when implementing banking monitoring, the bank should pay special attention to the following aspects:

Compliance with the principles of bank lending;

Monitoring the fulfillment of the terms of the loan agreement;

Control over the intended use of credit funds;

Monitoring of credit collateral and verification and storage of pledged property;

Loan repayment analysis;

Identification of problem loans and development of measures to eliminate such debts;

Analysis of the quality and structure of the bank's loan portfolio as a whole;

Monitoring of credit risk and development of measures to minimize it

To ensure successful and uninterrupted credit activities, each bank must have its own system of intra-bank monitoring of credit operations and clearly identified the most qualified and experienced bank employees, exercise credit control at all stages of the lending process.

In banking practice, various methods of credit monitoring are used, which are based on several basic principles:

1) periodic inspection of all types of loans (every 30-60.90 days all large loans and selectively small loans are checked);

2) careful development of stages credit control to ensure that all critical terms and conditions of each lending transaction are verified, including:

Compliance of actual payments on the loan with the calculated data;

The quality and condition of the loan collateral;

Completeness of relevant documentation;

Assessment of changes in the financial condition and forecasts regarding the increase or decrease in the borrower's needs for a bank loan;

Assessment of the compliance of the provided credit funds with the credit policy of the bank and the standards developed by the regulatory authorities for its loan portfolio;

Credit monitoring can be classified according to certain criteria:

1) by area of implementation:

Internal monitoring, in which control is carried out mainly on documents that correspond to a particular stage of the lending process, and the degree of credit risk is assessed;

External monitoring, which includes meetings and negotiations with borrowers who are in arrears; telephone calls, correspondence; counter checks of the movement of goods purchased at the expense of credit funds, on-site inspections, negotiations with guarantors, etc.

2) by the nature of the conduct:

Preliminary monitoring, which involves checking the compliance of lending activities with legal requirements, the availability of appropriate permits, limits, etc. to the provision of credit funds includes the analysis of loan documentation, assessment of the financial condition of the borrower and analysis of the loan project, assessment of the subject of collateral for the loan, etc. The main idea of preliminary credit monitoring with the definition real risk for bank and acceptance effective solution to provide a loan to a borrower;

Current monitoring consists in exercising control by the bank over the fulfillment of the terms of the loan agreement by the borrower after the decision is made to grant a loan and issue credit resources. The main idea of current monitoring is to determine the risk of losses for a banking institution due to the inability of the borrower to repay the debt and pay interest on it. repayment by the borrower of credit debt, changes in its financial condition and economic activity are determined, the client’s fulfillment of the terms of the loan agreement for the intended use of credit funds is analyzed, the quality of the property provided as security is assessed, etc.;

The next (further) monitoring of the credit activity of the bank is to ensure a systematic check of the state of the organization of the credit activity of the bank, the correctness of registration, the proper execution of the performed credit operations.

3) Depending on the ox implementation methods:

Remote monitoring;

Inspection monitoring;

4) depending on the scope of supervision:

Local;

Regional;

National;

Global;

5) depending on the coverage area:

At the level of the loan portfolio as a whole - the main goal (timely identification of signs, facts, changes or their trends characterizing the state of the loan portfolio as such, which may lead or has already increased risks and adversely affect the results of the bank's activities, as well as the development of proposals for improvement of the state of banking credit activity;

At the level of an individual loan agreement - the goal is to timely identify deviations in the process of lending to a particular borrower at all its stages; clarification of the reasons for these deviations and the development of proposals for correcting the mistakes made.

6) depending on the groups of borrowers, monitoring of loans granted is distinguished:

Borrowers - legal entities;

Borrowers - individuals;

Borrowers - banks;

Borrowers - non-banking financial institutions;

Groups related persons jar;

Borrowers - government bodies

The main directions of credit monitoring of the bank can be distinguished:

1. Control over the fulfillment by the borrower of the terms of the loan agreement, collateral agreements and other obligations that he assumed in connection with the conclusion of the loan agreement

2. Control over the targeted use of credit funds by the borrower

3. Monitoring changes in the financial condition of the borrower and identifying changes in its business activities, periodic evaluation of the borrower's guarantors

4. Control over the quality of the accepted loan collateral and verification of the storage of the pledged property

5. Analysis of the quality and structure of the bank's loan portfolio as a whole to identify problem loans and develop measures to eliminate debt.

1.2 Credit monitoring as a credit risk management system

The increase in the volume of transactions and the emergence of new forms of credit relations against the backdrop of changing regulatory norms require banks to improve the quality of credit management and revise the approaches underlying the formation of credit monitoring, which, being one of the most important components of credit policy, should adapt the new economic conditions and the needs of subjects of economic life to the overall development strategy of the bank and to develop adequate standards for managing the credit process and credit risk. Credit monitoring in a commercial tank can be effective only if it is scientifically substantiated and is formed in accordance with the laws of economics and the laws of bank management.

Thus, the comprehensive development of theoretical and practical issues that reveal all aspects of the formation and implementation of credit monitoring in a commercial bank is an important and urgent problem of the modern Russian banking system.

The entire international banking community is concerned about the problem of repayment of loans, and its importance has now increased. For Russia, it is associated with the presence of problem loans, the volume of which increased with the activation of the credit policy of banks. Figure 1 shows the dynamics of overdue debt on loans, deposits and other placed funds.

One of the ways to minimize the credit risk of banks is to create an effective system of banking control. An integral part of this problem is the timely identification and organization of work with problem loans.

Credit monitoring is a complex information and analytical system that includes control over the quality of loans granted, its assessment and forecasting of future development in order to organize timely and adequate management decisions that reduce credit risk at all stages of working with a loan.

There are two main features of credit monitoring objects, the first of which is their dynamism, and the second is the presence or possibility of danger arising in the process of the monitoring object functioning. Therefore, credit monitoring should be identified primarily as a multifactorial process aimed at reducing the riskiness of credit transactions and preventing negative transactions associated with the emergence of difficulties in the process of repaying a loan.

The main difference between a monitoring system and a control system is in predicting the future development of objects.

The information and analytical base for credit monitoring in commercial banks is formed from information coming from various sources: