The procedure for the distribution of profits between the participants of LLC. Using the net profit of the organization How Net Profit is distributed

It is always aimed at obtaining stable income by his founders. In all limited liability societies, the main way of distributing the profit received is the payment of dividends, which is regulated by a number of laws, as well as internal documents of the LLC itself. Therefore, owners may have many questions associated with this complex process.

Types of dividend

Dividends are understood as an absolutely legitimate option of profit from investment in the enterprise. On the part of accounting and financial accounting, dividends in is a certain part of the obtained net profit. It is almost always distributed among the owners and participants, according to the subsequent share in the authorized capital.

In economic practice, there are many classifications of this concept.

They are divided into such types:

By type of shares to which accrual is made:

- On ordinary shares;

- On privileged paper.

In the frequency of payments:

- Monthly (found extremely rarely);

- Quarterly;

- Semi-annual;

- Following the year.

In the form of payments:

- In monetary equivalent;

- In property or natural form.

By the size of payments:

- Partial;

- Full.

By expected:

- Main on the basis of the work of the enterprise;

- Additional (special or extraordinary).

All these options for payment of dividends LLC must be enshrined in statutory documents, regulating the subtleties of the distribution and payments procedure.

Source for calculating dividends

The calculation and accrual of dividends are always made only with the amount of net profit, which remains in complete disposal of the enterprise after the retention and payment of mandatory fees and taxes. However, LLC legislation practically does not contain the concept of net profit. Therefore, the accounting data at the enterprise is taken as the basis, which are documented by the applications to it.

These documents have a string in which retained earnings are derived or uncovered loss from activity in a certain period. The concept of "retained earnings" reflects the economic result from all types of activities for a minus of mandatory costs and taxes, including penalties (P.79 provisions for accounting and reporting in the Russian Federation).

There is a need to determine the amount for dividend payments not only at the time of the meeting, but also immediately before the distribution of the amount. This is due to a possible change in net profit due to accounting adjustment or making additional changes to the balance sheet.

The amount specified in the balance sheet is the basis for calculating dividends. The decision on which part of the payment is made by the founders. If in the authorized capital of such a society there is a communal or state share of funds, it must necessarily pay at least 30% of the amount of net annual profit.

How to make a decision on the payment of dividends of LLC

Called and pay dividends to all founders or participating in Ltd. is the right, and not the obligation that is enshrined in the statutory document. According to the generally accepted rule, the distribution of dividend Ltd. is proportional to the shares invested in its authorized fund (paragraph 2 of Article 28 of the Law on OOO).

All answers to questions regarding the distribution of the amount of net total profits of the Company are contained in the documents:

- The provisions of the Charter;

- Corporate agreement between all participants;

- Regulations on the distribution of profits (internal).

The law is not prohibited to make changes to the documents and pay dividends to the disproportionately invested capital of participants. In practice, there are a lot of situations when there is a revision of such a corporate agreement and new persons who are entitled to receive a part of the final profit are made. The main condition is to carry out a general meeting on making appropriate additions to the agreement with the unanimous approval of all participants in the LLC. In this case, it can be limited to a change in the corporate contract without revising the Charter (Civil Code of the Russian Federation Article 66.1 and Article.67.2).

It has been established that all potential participants must be necessarily notified of the meeting 30 days before it. Payment will be made to all those specified in the registra, regardless of their presence at the meeting.

All questions that concern the amount and terms of dividend payments are solved only at the general meeting with the participation of the Founders of the Company (law on LLC PP.7 paragraph 2 of Article 33). This important function cannot be a different organization (as well as put pressure on the management of the company during income distribution).

For discussion and decisions about the possibility of dividend payment:

- The general meeting is gathering, which consists of financial documentation and accounting reporting;

- The share of income received to pay dividends to LLC participants is determined, as well as a decision on the procedure for the distribution of this amount;

- A collective decision on the timing and form of payments on the basis of the mathematical majority of those present by the participants of the Company is being taken.

After the meeting, on the basis of the signed protocol, the management of LLC should issue an appropriate order.

When the decision cannot be accepted

Given that the payment of dividends on the basis of the work is only the right of Ltd., it may not make decisions and send all income to the development or modernization of production facilities, other urgent needs.

But there are situations in which the decision is not accepted or may be considered illegal:

- Until the redemption of all issued shares at the request of the founders or shareholders;

- If the management of the Company does not comply with the requirements for the required amount of net assets;

- Until complete payment of contributions to the authorized fund of LLC;

- With the slightest signs.

If you make a decision to bypass such situations, it may be challenged by any participant in a lawsuit.

Deadline for dividends in OOO

In a limited liability company, the frequency and period of payment of accrued dividends should be regulated by the charter and internal provisions. In most cases, the decision to pay dividends LLC is taken after summing up the results of the work for the reporting period, but may be quarterly and even monthly (law on LLC clause 3 of Article 28). Dividends that are charged once a quarter or half a year are called intermediate.

Often, the period of payment is made to the charter at the stage of creating an enterprise. In any case, the maximum allowable time after making a solution should not exceed 60 days. In individual cases, the founders provide for the possibility of deferred to payments up to 3 years. In such a situation, any participant in Ltd. has its legal right to appeal to court instances and receiving its share from the amount of retained earnings (the resolution of the FAS of the North-Western District dated January 21, 2013 No. F07-7846 / 12).

Dividend payment form

In most cases, dividends shareholders are paid in cash. But in the charter, payment may be provided in the form of other property. Almost always these are their own shares or securities of subsidiaries. Such economic practice is more known as "reinvesting" or "revenue capitalization". It is increasingly used in the domestic economy and contributes to the development of enterprises, their expansion and modernization.

How to get dividends

The right to receive income and the accrual of dividends LLC have all participants who were listed in a special registry at the time of the decision to pay. The question is also solved with the founders, but there can be many nuances in the statutory documents.

The situation in the distribution of payments between the holders of various shares is more complex. The latter must be made to a special register decorated by a list for a certain number.

The latest changes in the legislation have an important nuance: when selling shares after the day of the register for dividend payments, their former owner retains the right to receive this type of income for the last period.

The order completely depends on the type of shares: on ordinary and preferred shares interest from net profit paid separately.

After the planned general meeting and solving all organizational issues, management should accruise dividends, according to the adopted protocol and the published order. If the calculation of dividends of LLC was provided for by the equity and proportional made in the amount, then it is possible to apply the formula:

Net profit× Participant share (in%)

This is a simplified formula explaining how to calculate dividends in LLC in most situations. It is valid and, if necessary, distribute dividends of LLC at. In other cases, the percentage percentage or share will be regulated by the Protocol of the General Assembly.

To calculate the amount that accounted for the share, it is necessary to use the dividend profitability coefficient:

DD \u003d (amount of dividends per year / Market value)× 100%

All calculations must be made by the time the registry is closed. After that, the amount is necessarily deducted by the NDFL for dividends. Currently, it is 13%.

How to pay dividends to the founder of LLC

According to the laws and the Charter of the Company, the accrual of the amount of dividends founders can occur without taking into account interest on its share in the authorized capital. However, such an opportunity should be taken into account in the statutory documents and properly framed. Otherwise, unpleasant controversial situations often arise when submitting to the tax inspection.

This feature is associated with the interpretation of Article 43 of the Tax Code, which determines the dividends as the financial income of the Company's participant, which should be paid in the amount, strictly proportional to the invested proportion. If the amount of interest received by the founder exceeds the specified and not recorded by documentary documents, tax deductions will be carried out in an increased amount. The tax service has the full right to equate such dividends to the other type of income.

The legislation provides that society can be created by one person. In this case, the resolution in which the payment of dividends is indicated by the only founder of LLC is accepted alone. At the moment, there are no clear explanations in the form of the meeting protocol in this case, but all controlling and inspection authorities insist on its presence.

Dividends on preferred shares

Preferred shares can give their holders certain advantages when paying dividends. In most situations, the percentage of payments in the distribution of profits is enshrined in the Company's Charter, but may depend on the nominal value of the action.

The main advantages over ordinary shares are:

- Have a clearly fixed mechanism for calculating dividends;

- Certain frequency of accruals;

- Advanced list of sources for paying;

- Advantage in queue for interest.

Some LLC during stable and profitable work create special funds in which they reserve part of the profits. In the event of a lack of financial resources, funds from such "stocks" are spent on payment of dividends only on issued by privileged shares (law on JSC of Article 42 of claim 2).

At the same time, if a special rate is not installed on privileged shares, their owners will receive dividends in the amount equal to ordinary shares. If the Company's Management Board decides not to pay payments on the results of the unfavorable reporting period, the owners of preferred shares also have no right to get their share.

Dividends for participants Ltd. are often paid in cash.

The amount can be transmitted by two main ways:

- To an open account in any bank (cashless);

- Through the cashier of the enterprise in cash.

If the date of the last day of payments coincides with the festive or weekend, it should be transferred to the next working day. The amount of dividends is translated into accounts already without taking into account taxes.

Responsibility for non-payment of dividends

If society violates the rights of shareholders and participants to pay dividends, the latter may apply to the court for their forced recovery. In the claim, interest may also be indicated for the entire delay. In some situations, such a violation of payments becomes an administrative offense (CACAP Article 15-20).

Any limited liability company in fact is a business entity, therefore court sessions are held only in the arbitration court (even when the claim is submitted by an individual).

If the participant of the LLC did not receive dividends on an objective reason (did not provide reliable data on the place of residence, current account or other clarifications), it may require them in society within 3 years after the date of the end of payments. If a pre-trial check reveals that the cause of non-payment was the lack of a decision on dividend distribution, will be denied in the lawsuit.

Yu.A. Inoshetseva, Accounting and Taxation Expert

How to "spend" net profit correctly

As you know, the company's net profit (PE) distribute owners. But whatever their decision, the accountant should reflect it in accounting and reporting. The snag is that in regulatory acts on accounting, it is said only about how to calculate the arrival paragraph 83 of the situation, approved. Order of the Ministry of Finance from 29.07.98 No. 34N. During the year, it accumulates on credit account 99 "Profits and losses", and in the preparation of annual accounting reporting, the amount of net profit is written off from account 99 on credit of account 84 "Retained earnings". Credit balance on account 84 is your retained profit (NRP). But about how to "spend" profits, in regulatory acts on accounting practically nothing is said, there is only a mention in terms of accounts.

The procedure for the distribution of emergency was established by laws on AO and LLC sub. 11 p. 1 Art. 48 of the law of 26.12.95 No. 208-FZ (hereinafter - the Law on JSC); sub. 7 p. 2 art. 33 of the Law of 08.02.98 No. 14-FZ (hereinafter - the Law on OOO). At the same time, joint-stock companies are obliged part of the PE to send to the reserve fund, and LLC can do this at wish pP. 1, 2 tbsp. 35 of the Law on JSC; p. 1 Art. 30 of the Law on OOO. The remaining profit shareholders (participants) can be distributed at their own discretion. So, when complying with certain conditions, they can send profits to the payment of dividendo in articles 42, 43 of the Law on JSC; p. 1 Art. 28, Art. 29, paragraph 1 of Art. 30 of the Law on OOO. And sometimes the owners make a decision to send PE to acquiring new OS or the payment of premiums to employees. But laws on JSC and LLC do not talk about how in these cases reflect the distribution of the NPS in accounting.

To understand this issue, first let's talk about what the NPP is from the point of view of reporting.

What is capital and profit

Retained earnings are part of the capital of the organization, it is reflected in section III "Capital and Reserves" of the balance.

The standards establishes the rules only to recognize assets and liabilities, and capital is an arithmetic difference between them. Regulations of capital accounting does not exist in the RAS, nor in IFRS.

In turn, profit is the difference between income and expenses and clause 7 of IFRS (IAS) 1 "Representation of Financial Reporting".

As well as in the case of capital, standards installed only the rules for accounting income and expenses, and the profit is derived.

Accounting is regulated by the Special Standard of PBU 9/99, and expenses - PBU 10/99. Moreover, the concepts of "income" and "expenses" are also determined by categories of "assets" and "obligations".

Thus, the income of the organization is an increase in its economic benefits as a result of the receipt of assets or repayment of obligations, with the exception of the contributions of the participating in p. 2 PBU 9/99. As can be seen from the formula for calculating capital, as a result of the receipt of assets or repayment of obligations, capital increases.

The organization's expenses are, on the contrary, reducing its economic benefits as a result of the disposal of assets and (or) the emergence of obligations, except for reducing contributions by decision of the participants (property owners) p. 2 PBU 10/99. As a result of the disposal of assets or the occurrence of obligations, the capital's capital decreases.

Of course, these are only general definitions of income and expenses, for their recognition, it is necessary to comply with certain conditions established in PBU 9/99 and 10/99, but we will not consider them in this article.

Note that an increase or decrease in the economic benefits of the Organization, which occurred as a result of operations with its owners (for example, the payment of dividends), is not recognized in income or expenses. True, right about it only in IFRS, but in fact this rule is valid in the RAS p. 109 IAS (IAS) 1 "Representation of Financial Reporting".

OUTPUT

Capital, including the NDP, is not the property of the organization, but abstract financial categories, which are an arithmetic difference between assets and obligations (income and expenses).

We distribute profits

The question arises: if the profit is not money, but an abstract financial statement indicator, then how can I distribute it or something to "spend"? It can be said conditionally that the profit is "spent" when its value is reduced in the balance sheet. This happens when dividends and creating a reserve fund. Consider these and other options for the distribution of profits, as well as their influence on reporting indicators.

Dividends

The most common way to distribute profits is the payment of dividends. As we said, the outflow of assets in connection with the payment of dividends is not recognized by the expense of the organization. Therefore, the accrual of dividends participants relates directly to the decrease in the NRP and capital of the Organization, reflected by the wiring: Debit of account 84 "Retained earnings (uncovered loss)" - credit account 75 "Calculations with founders".

About how to calculate and pay dividends to participants in Ltd., read:Dividends can be paid money or property, but in any case the payment of dividends will lead to a decrease in the assets of the Organization and p. 1 Art. 42 law on JSC. When paying money, the wiring will be like this: the debit of account 75 "Calculations with the founders" is a credit of account 51 "Settlement accounts". And the payment of dividends property (for example, goods) is reflected as the implementation of wiring:

- debit account 76 "Calculations with different debtors and creditors" - a loan of account 90-1 "Revenue" - Received from the sale of goods transmitted to the payment of dividends;

- debit account 90-2 "Cost of sales" - account credit 41 "Goods" - the cost of goods is written off;

- the debit of accounts 75 "Calculations with the founders" - a credit of account 76 "Calculations with different debtors and creditors" - the debt to the participant on the payment of dividends will be credited.

OUTPUT

The distribution of profits on dividends leads to a decrease in capital (including the lines of 1370 NRP) and assets.

Reserve Fund

As we have said, JSC is obliged to create a reserve fund. Its size should be at least 5% of the authorized capital of the Company, and the statute of AO can be determined and larger size background yes p. 1 Art. 35 law on JSC. If ooo creates a reserve fund, its size is determined exclusively established by p. 1 Art. 30 of the Law on OOO.

The reserve fund is created by wiring: Debit account 84 "Retained earnings (uncovered loss)" - credit of account 82 "Reserve capital". And it is reflected in the balance sheet of 1360 in section III "Capital and Reserves".

Thus, from the point of view of financial statements, the creation of a reserve fund leads to the redistribution of amounts within section III of the balance sheet (part of the NPP, as it were, "shifts" to another capital article). As a result of such a redistribution, the structure of the organization's balance is improved. After all, on dividends, it is possible to distribute only the NPP, and the reserve fund will remain in capital theoretically forever. Since despite the fact that it is written in the laws on JSC and LLC, it is impossible to spend the reserve capital. And in the assets of the balance, the reserve fund corresponds to resources (property, money), secured by the organization's own funds, which is definitely good.

With financial (but not from a legal) point of view, the reserve fund can be compared with the authorized capital. It is not by chance that the law on JSC, when it comes to the requirements for the structure of the balance sheet (for example, when making a decision on the payment of dividends), the reserve fund is mentioned along with the authorized capital. For example, on the day of making a decision on the payment of dividends, net assets should not be less than the amount of authorized and reserve capital A p. 1 Art. 43 law on JSC.

The reserve fund can be used to cover damages if the owners have taken such a decision. At the date of his adoption, wiring is made: Debit account 82 "Reserve capital" - credit of account 84 "Retained earnings (uncovered loss)". The adoption by the owners of the decision on repayment of losses due to reserve capital should be disclosed in explanations for the reporting note and p. 10 PBU 7/98. As you understand, as a result of the use of the reserve fund, as well as when it is created, the organization's capital will not change. Covering losses due to the reserve fund is rather a psychological effect - the "breakless" balance looks more attractive for investors.

In addition, according to the Law on Joint-Stock Companies, the funds of the reserve fund can be sent to the repayment of bonds and redemption of shares. However, in our opinion, this statement does not make sense. After all, the bonds (or buy out shares) means to pay money to their holder. Consequently, only assets can be sent to repayment and redemption of securities, and not an article of capital.

The release of bonds is reflected in the same way as the attraction of a loan, wiring to the debit of account 51 "Settlement accounts" and a credit of account 66 "Calculations for short-term loans and loans" p. 1 PBU 15/2008.

Accordingly, the repayment of bonds is reflected by the wiring: the debit of account 66 "Calculations on short-term loans and loans" is a credit of account 51 "Current accounts". As a result, at the same time decreases assets and liabilities in the balance sheet. Capital Articles This operation does not affect. True, in the commentary of 82 instructions for the application of the account plan, it is said that the repayment of bonds at the expense of the reserve fund is reflected by the wiring: the debit of accounts 82 "Reserve Capital" is a credit of account 66 "Calculations for short-term loans and loans". However, it is impossible to agree with this. After all, as we have said, the loan of account 66 reflects the issue of bonds, and not their repayment.

OUTPUT

Creating a reserve fund due to PE and the use of it for repayment of losses leads to the redistribution of amounts within capital articles. Use the backup fund for other purposes (for example, to repay bonds) is impossible.

Accumulation and consumption funds

Sometimes the owners want to send the NRP to the purchase of new OS, on the payment of premiums to workers or for charity. Usually in such cases they decide on the creation of so-called accumulation and consumption funds.

Accountant need to reflect the decision of the owners in accounting. But how to do this, because such funds are not mentioned in the laws on AO and Ltd., nor in existing regulatory acts on accounting. Immediately, let's say that no funds in account can be created.

We tell the participants

Clean profit can only spend on dividends. It is not necessary to create funds consumption and accumulate funds from net profit, since "live" money is still spent on the acquisition of assets, and not profit.

The very concept of funds due to profits came to us from the Soviet accounting. For example, Soviet enterprises have created funds development funds, the funds of which were sent to the purchase of new equipment. In the instructions for the 1985 account plan says that the funds of such a fund, intended for the purchase of equipment, should be kept in a bank on a special account

General. In accordance with the corporate right, dividends exist only in JSC. In the legislation on OOO the word "Dividend" is not used, it is said only about the distribution between the participants of the net profit.

Tax legislation uses the concept of "dividends" and for JSC, and for LLC. For simplicity, we will further use the tax approach and the distribution of net profit between the participants in JSC and LLC (as well as between the partnership participants, members of the production cooperative) to be called dividends.

In the Civil Code of the Russian Federation, the Tax Code of the Russian Federation, the Federal State Unitary Enterprise of JSC and OO and other regulatory documents are given different definitions of the dividend. Let us dwell on the following: dividends recognized the income of the ELOD participant on the shares belonging to him (shares) in the Criminal Code received from the HL with the distribution of net profit in proportion to shares (shares) of the participant in the authorized capital of these Yul.

Dividends also include any income derived from sources outside the Russian Federation related to dividends in accordance with the legislation of foreign countries.

Not recognized by dividends (paragraph 4 of Art. 43 of the Tax Code of the Russian Federation):

1) payments to VER participants in its liquidation in cash or in general, not exceeding the contribution of the participant in the authorized capital of the Company;

2) payments to the Company's shareholders in the form of the transfer of shares of the same society to the property;

3) payments to a non-profit organization for the implementation of its main statutory activities (not related to entrepreneurial activities), produced by economic societies, whose share capital consists entirely of contributions from this non-commercial organization.

Using the net profit of Yul. The payment of dividends is one of the areas of use of the net profit of Yul. Other areas of use of net profit: in the production development of Yul (construction, acquisition of fixed assets, etc.); The formation of reserve and other Funds of HL is in the manner and sizes provided for by the Charter of HR; coverage of losses of past years; an increase in UK Yul; Payments to employees from net profit (on vouchers, material assistance, recreation, cultural and sports events, etc.); remuneration of members of the Board of Directors; Charitable goals, etc.

There is an eternal problem: how to find an optimum between part of the net profit of Yul, directed to the development of production, and part directed to the payment of dividends. In world practice, more than 50% of the net profit of joint-stock companies is sent to the payment of dividends. In the Russian Federation, only 1/3 of all OJSC declare dividends.

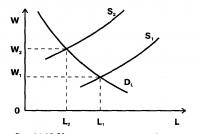

The classification of the dividend paid yul is presented in Fig. 18.1.

Fig. 18.1. Classification Dividend

Sources of payment of dividends. The source of dividend payment is the profit of the reporting year after taxation (net profit). The retained earnings of past years is also taken into account. Net profit of AO is determined according to the financial statements of the Company.

Therefore, Yul, using a USN (simplified taxation system) and dividend paying, should be accounting.

Dividends on preferred shares of certain types can also be paid in AO at the expense of special funds of society previously formed for these purposes.

Decision and payment of dividends. The decision to pay dividends on the basis of activities of AO is made by the General Meeting of Shareholders (this is its exceptional competence).

And this is the right, not the responsibility of the General Assembly. This means that shareholders are not entitled to demand dividend payments if the decision on the distribution of net profit was not accepted.

The decision can be made by a simple majority of votes at the next (annual) General Meeting of Shareholders (in the event of dividends for the financial year dividends) or on an extraordinary (when paying dividends for the first quarter, half of the year and nine months of the fiscal year). In both cases, the timing of the adoption of such a decision should be established in the Charter of the Company.

The law establishes the following restrictions on the deadlines for the decision on the payment of dividends (distribution of net profit):

1. According to the final (annual) dividends, the decision must be made in AO not earlier than March 1 and no later than June 30, following the financial year (in Ltd. - not earlier than March 1 and no later than April 30, following the financial year).

2. By intermediate dividends, the decision must be taken within three months after the end of the relevant period (first quarter, half of the year, nine months).

In solving the payment of dividends for each category (type) of shares, the amount of dividends, the form and timing of their payment are determined.

The size of the dividend is defined as the amount of net profit in rubles and kopecks per share of a certain category and type, excluding the taxable tax.

The size of the dividend on an ordinary share must be no more than the size recommended by the Board of Directors of JSC.

The size of the dividend on a privileged action is established in the Charter of the JSC. If this size is not defined, it is determined in the same order as on ordinary shares.

Information about the announced dividends, their size, form and terms of payment is posted on the website of AO on the Internet.

Net profit in LLC is generally distributed (in whole or in part) between its participants in proportion to their shares in the authorized capital. However, the charter of the LLC may be provided for a disproportionate distribution of profits. The provisions relating to this issue may be made to the Charter only when they adopted by all participants in the LLC unanimously.

The profits and losses of the full partnership are distributed between comrades in proportion to their shares in the share capital, unless otherwise provided by the constituent contract or other agreement with the comrades (for example, equally). The same documents determine the timing of the decision on the distribution of net profit between comrades (quarterly, once every six months, or after the end of the transaction).

The contributor to the partnership in faith has the right to receive a part of the net profit due to its share in the share capital, in the manner prescribed by the Constituent Treaty.

The net profit of the manufacturing cooperative (PC) is distributed between its members in accordance with their personal labor and (or) other participation, the size of a shared contribution, and between members of the PC, which do not host personal labor participation in the activities of the cooperative, respectively, the size of their mutual contribution. By decision of the general meeting of PC members, part of the net profit of the PC can be distributed between its employees.

Part of the net profit, distributed among PC members in proportion to the size of their mutual contributions, should not exceed 50 percent of the PC profits to be distributed among the members of the cooperative.

Dividends are paid money, and only in cases provided for by the Charter of the Company - other property. For example, dividends can be paid to products, basic means, shares (including the shares of subsidiaries) and others. At the same time, the types of property that can be transferred to the dividend account must be specified in the CHO Charter. The assessment of property can be made by agreement of the parties and may be lower than the carrying value of the property.

Regarding LLC law does not say anything about the form of distribution of net profit. By default, the distribution of net profit in the form of property is legitimate, but this method is also preferably recorded in the Charter.

The term and procedure for payment of dividends is determined by the Charter of the Ho or decision of the general meeting of participants about the payment of dividends. It should not exceed 60 days from the date of the decision to pay dividends.

If the decision to pay dividends is made, their payment becomes the duty of the joint-stock company. If dividends were not paid on time, then the statute of limitations for obtaining dividends - three years from the date when 60 days from the date of decision-making will be expired on the payment of dividends. In the Charter, Yul may be provided for a longer period of claims, but not more than five years. The statute of limitations is canceled for cases when the participant could not get his dividends under the influence of the threat or violence. In other cases, the missed time is not restored.

With the entry into force of the Federal Law of December 31, 2010, N 409-FZ are the same as in JSC, the terms of the timing and procedure for dividend payments to LLC.

If the participant Ho did not pay dividends in a timely manner in a timely manner, it may also require interest from society in the amount of the refinancing rate of the Central Bank of the Russian Federation.

The Company is not entitled to provide an advantage in the terms of dividend payments to certain owners of shares of one category (type). The payment of announced dividends on the shares of each category (type) should be carried out simultaneously to all shares of this category (type).

If dividends were not received by the participants of the Company, after the expiration of the limit of the limitation of unclaimed dividends are restored as part of the unallocated profits of the Company.

The adjustment of the tax base in terms of the recovery of dividends is made from the date they were taken into account in the income for income tax purposes due to the expiration of limitations for obtaining dividends.

If dividends are accrued, but there is no possibility to pay them in society, then non-confined dividends, the statute of limitations on which has expired, the participant of the Company cannot take into account the composition of its tax expenses as losses (a letter of the Ministry of Finance of Russia dated March 20, 2012 No. 03-03 06-1 / 133).

The AO cannot decide to reduce the Criminal Code until the full payment of announced, but not paid dividends, as well as until the end of the period established for the shareholders of the requirements for the payment of declared dividends.

The ban on the reduction of the Criminal Code if the company has an unpaid part of the distributed profit is not provided.

Recipients and severity of dividend payments. The right to receive dividends shareholders who owned shares on the "Registry closing" date (the date of the list of persons entitled to participate in the shareholders meeting).

This date is determined by the Board of Directors annually, usually 1-2 months before the General Meeting of Shareholders. In the case of the shareholder of the shareholder owned by him to the date of "Registry Closure", the right to receive dividends proceeds to the new owner of the shares. If the shares were purchased after the date of the "Registry closing", the right to dividends remains behind their former owner, since it will be listed in the list of shareholders.

The list of persons entitled to receive dividends is drawn up by the registry holder (by society or registrar). To compile it, the nominal shares holder presents data on persons in the interests of which he owns shares.

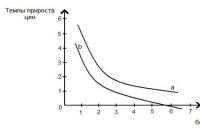

Dividends in AO are installed and paid separately on preferred and ordinary shares. The owner of preferred shares has an advantage in obtaining dividends to the owner of ordinary shares. In turn, the owners of various types of preferred shares may have a different order in their receipt (see Fig. 18.2). The decision to pay dividends on the more low-order shares cannot be accepted until dividends are announced on higher-order shares.

Fig. 18.2. Severity of dividend payments in JSC

Restrictions on the payment of dividends.Dividends are accrued and paid only by fully paid shares. According to the following groups of shares, dividends are not charged:

Not placed (not issued in appeal);

Acquired (bought) and on the balance sheet of JSC by decision of the Board of Directors (General Meeting of Shareholders);

Received AO due to non-fulfillment by the Buyer's obligations to acquire them.

AO is not entitled to make a decision on the payment (declaration of dividends) for shares:

Until full payment of the UK AO;

Before the repurchase of shares, which the AO should buy out when the shareholders had the right to demand the ransom of the society by the company;

If AO meets signs of bankruptcy or becomes answered as a result of dividend payments;

If the requirement is not followed by the amount of net assets of JSC: the cost of net assets of the AO on the day of the decision on the payment of dividends is less than its Criminal Code, the Reserve Fund and the magnitude of the elimination value of placed preferred shares above their nominal value, or will become less as a result of the adoption of such a decision;

If the cost of net assets LLC is less than its Criminal Code and Reserve Fund or will become less than their size as a result of the adoption of this decision.

The society is not entitled to pay dividends to its participants, the decision to pay which was made if at the time of payment of dividends:

Society meets the signs of bankruptcy or will be answered as a result of payment;

The cost of net assets of society is less than its Criminal Code and the Reserve Fund or will become less as a result of payment.

As the specified circumstances are stopped, the Company is obliged to pay profit participants, the decision on the distribution of which is accepted between the participants of the Company.

In the case of an unreasonable refusal of the Company from the payment of distributed profits, participants have the right to apply to the Arbitration Court to recover from society by the part of the profits.

In the case when the decision of the General Meeting on the payment of dividends was taken in the presence of the circumstances limited to the possibility of such a decision, or after its adoption, circumstances arose, excluding the possibility of dividend payments, the court is not entitled to meet the participant's claims.

With the termination of these circumstances, dividend payments must be resumed.

Taxation dividends. Yul When paying dividends should perform the obligation of the tax agent in terms of calculation, retention and transfer to the budget of the following taxes:

1) income tax (if dividends are paid by the participant - legal entity);

2) NDFL (if dividends are paid by the participant - a physical person).

The duty on calculating, holding and transfer of the dividend tax arises at the Yul - source of payment of dividends (tax agent), regardless of what tax regime (USN, UNVD or ECHN) uses Yul.

If the recipient of dividends is not a fee for income tax, then the tax agent does not arise the duties to transfer dividends tax. This is, for example, when paying dividends on shares (shares in the Criminal Code), which are in state or municipal property; When paying dividends with mutual investment funds, which are in the trust management of management companies; For shares that belong to the Bank of Development and Foreign Economic Activities - Vnesheconombank.

With the amount of dividends that are paid by Yul, using a USN, a tax agent (Yul, who pays dividends) must keep income tax. This is due to the fact that in relation to the dividends received, such villages are not exempt from payment of income tax. Yul - Dividend recipient will be listed by dividends minus income tax.

If Yul - the recipient of dividends is not translated into UTII, then with the amount of dividends due to him, the tax agent must keep the income tax. Yulia, located on ENVD, is exempt from the payment of income tax only with respect to the profit received from the activities translated on UNVD, the dividends to such income do not belong.

The tax rate differs depending on the recipient of dividends (see Table 18.1).

Calculation of the amount of tax held in the payment of dividends is made for each recipient of dividends separately and depends on whether the dividend itself has received a paying Yul or not.

If the Yul, distributing profits, did not receive the dividend itself, then the amount of the tax detected from dividends paid to Russian participants will be calculated by the formula

where N I. - the amount of the holding tax i.- a shareholder (participant), rub.; DV I. - the amount due to the payment of dividends i.- Shareholder (participant), rub.; Art - tax rate from dividends,%.

In the event that Yul, distributing profits, was the recipient of dividends, the amount of tax paid by Russian participants of dividends is calculated by the formula

where Dv. - total amount due to payment dividends, rub.; Dp. - The total amount of dividends received by the company itself in the current and previous periods (with the exception of dividends taxing at a rate of 0%).

Table 18.1.

Income and NDFL tax rate when paying dividends

If the amount of taxes from dividends will be a negative value, the obligation to pay the tax does not arise and the reimbursement from the budget is not produced.

If the Russian Yul is paying dividends to a foreign physical person or Yul, the tax base is determined for each such payment and tax is calculated in the same way as by the formula (18.1).

If dividends are paid to the heir, the NDFL is held with them, although incomes passing in the order of inheritance are not subject to personal income tax. But this norm applies if the income is obtained from an individual, and here revenues are not received from an individual, but from Yul.

Both income tax and NDFL, held in the payment of dividends, are transferred to the budget of the tax agent that made the payment, no later than the day following the day of payment (paragraph 4 of Art. 287, and paragraph 6 of Art. 226 of the Tax Code of the Russian Federation).

NDFL from dividends that Yul pays to participants to individuals, Yul pays to the IFNS, where it is worthwhile, even if the participants are registered in another region of the Russian Federation (paragraph 7 of Art. 226 of the Russian Federation). The IFNS, where he is registered by Yul, transmits data on dividends paid and retained by NDFLs in the IFTS in the Mass of Residence of each participant, when Yul reports at the end of the year, in form 2-NDFL (clause 2 of Art. 230 Tax Code of the Russian Federation).

According to the Ministry of Finance of Russia (the letter of the Ministry of Finance of Russia dated 24.06.2008 N 03-03-06 / 1/366) Part of the net profit of Yul, distributed between its participants disproportionately to their shares in the UK Yul (which could be in LLC and economic partnerships in According to their constituent documents) is not recognized for tax purposes by dividends, but is considered as a payment due to net profit. For the purpose of taxation, paid payments in terms of exceeding the amount of dividends (net profit of Yul, distributed among the participants of Yuli in proportion to their shares in UK Yul, are subject to a total tax rate (13% for individuals - residents of the Russian Federation and 15% - non-residents; 20% for Yul - residents and 30% - for non-residents).

Yul can pay dividends not only by the end of the year, but also intermediate dividends (according to the results of the quarter, half of the year, nine months). The total amount of intermediate dividends may turn out to be more pure earlings at the end of the year. The resulting difference is included in the income of the participants and is subject to generally (at a rate of 13% for NDFL and at a rate of 20% for income tax).

When paying dividends in the monetary form of an inclination of VAT does not arise.

The payment of dividends property (if provided for by the Charter of HL) is considered to be a realization in connection with the change of the owner and is subject to VAT. The assessment of property can be made by agreement of the parties.

Dividends are not subject to insurance premiums (they are only subject to payments on labor and civil law agreements, the subject of which is the performance of work, the provision of services).

S. Nikitin

Consulting group Rune

According to the accounting accounting accounts of the financial and economic activities of organizations and instructions for its application, approved by the Order of the Ministry of Finance of Russia from 10/31/2000 No. 94n, the indicators "Net profit" and "retained earnings" are formed in different accounting accounts.

The indicator of net profit is formed on the balance sheet account 99 "Profit and losses" by the end of the reporting year and is the final financial result of the organization's activities during the reporting period.

The ability to write off any costs at the expense of net profit, except those that are defined by regulatory acts on accounting, is not provided. Thus, in addition to profit and loss from ordinary activities and other income and expenses for the debit of account 99, only expenses incurred by the organization due to emergency circumstances (natural disaster, fire, accident, flood, etc.) accrued Payments for tax profit organizations, as well as the amount of tax sanctions due.

The amount of net profit of the reporting year is written off by the final turnover of December with the record:

Debit 99 "Profits and losses", Credit 84 "Retained earnings (uncovered loss)".

Balance account 84 is intended to summarize information about the presence and movement of the amount of retained earnings (uncovered loss).

In accordance with the letter of the Ministry of Finance of Russia dated February 23, 2002 No. 04-02-06 / 3/60, the retained earlier profits of past years is the balance of the profit remaining at the disposal of the organization's results for the last reporting year and decisions taken to use it (direction In reserves, formed in accordance with legislation or constituent documents, to cover losses on the payment of dividends, etc.). Based on this, net income is formed on the organization's balance sheet only by the end of the current (reporting) year, i.e. We are talking about the reflection of the organization's operations in accounting accounts for the current period.

Analytical accounting on account 84 should be organized in such a way as to ensure the formation of information on the use of funds.

According to the current legislation, the net profit of the organization may be aimed at deducting in reserve capital, to pay dividends, the capitalization of the organization, as well as on other payments to the decision of the shareholders (founders) of the organization.

Calculations to Reserve Capital

Reserve capital can be created both in joint-stock societies and in limited liability companies. In accordance with Art. 35 of the Federal Law of December 26, 1995 No. 208-FZ (as amended by 24.05.99) "On Joint-Stock Companies" (hereinafter - Law No. 208-ФЗ) Reserve Fund of the Company is intended to cover its losses; repayment of bonds of society; Repurchase of the Company's shares in the absence of other means. The reserve fund cannot be used for other purposes.

Joint stock companies form a reserve capital in the amount provided by the Company's charter, but not less than 5% of the authorized capital.

The reserve capital of the Company is formed through the obligatory annual deductions until it achieves the size established by the Company's charter. The amount of annual deductions is provided for by the Company's charter, but there can be no less than 5% of net profit until the size established by the Company's Charter is achieved.

Article 30 of the Federal Law of 8.02.98 No. 14-FZ "On Limited Liability Societies" (hereinafter - Law No. 14-FZ) Limited Liability Company is granted the right to create a reserve fund and other funds in the manner and sizes provided for by the Company's Charter . The procedure for the use of reserve fund funds is determined by the highest management body of the Company.

In limited liability companies, the creation of a reserve fund, as opposed to joint-stock companies, is voluntary. Thus, when approving the Charter, the founders express their consent to the direction of the profits on the formation of reserve capital. Additional decision on this matter is not required. Therefore, it can be concluded that the direction of profit on the formation of a reserve fund is a mandatory procedure that does not require the decision of the owners.

According to the accounting accounts plan to the reserve capital of profits are reflected on the loan of account 82 "Reserve Capital" in correspondence with the debit of account 84.

Payment of dividends

In accordance with paragraph 1 of Art. 43 of the Tax Code of the Russian Federation Dividend recognizes any income received by the shareholder (participant) from the organization during the distribution of profits remaining after taxation (including in the form of interest on privileged shares), according to the shareholder (participants), proportion to shareholders (participants) In the authorized (folding) capital of this organization.

According to pp 11 p. 1 Art. 48 of Law No. 208-FZ (as amended from 10/31/02 No. 134-ФЗ) The distribution of profits (including the payment (announcement) of dividends) refers to the competence of the General Meeting of Shareholders, and in accordance with paragraph 1 of Art. 47 of this Law, issues provided for by the specified subparagraph should be solved at the annual meeting of shareholders, which is carried out within the time limits established by the Company's Charter, but not earlier than two months and no later than six months after the end of the fiscal year.

The joint stock company has the right to make decisions not only about the payment of dividends on the basis of the fiscal year, but also on the payment of interim dividends based on the results of the first quarter, half of the year, nine months of the fiscal year (paragraph 1 of Article 42 of Law No. 208-FZ). This decision can be made within three months after the end of the corresponding period.

Based on Art. 33 of Law No. 14-FZ Approval of annual reports and annual balance sheets, as well as the decision on the distribution of the Company's net profit between the Company's participants, refers to the competence of the General Meeting of the Company's participants. According to Art. 28 of Law No. 14-FZ The Company is entitled quarterly, once every six months or a year to decide on the distribution of its net profit between the participants of the Company. The decision to determine the part of the profits distributed among the participants of the Company is made by their general meeting, which should be conducted no earlier than two months and no later than four months after the end of the fiscal year (Article 34 of Law No. 14-FZ).

Thus, the legislation establishes a harsh duration of the distribution of net profit, including the accrual of dividends. The use of unallocated profits on the payment of dividends is legitimate if the appropriate decision is made by the General Meeting of Shareholders (participants) in the time established by law.

The retained earnings of past years cannot be directed to the payment of dividends.

Considering that the source of dividend payment is the Company's profit after taxation (net profit), which is determined according to the financial statements, dividends in the joint-stock company can be accrued and paid only at the expense of the net profit of the joint-stock company's reporting year. This point of view is reflected in the letter of the Ministry of Finance of Russia dated February 23, 2002 No. 04-02-06 / 3/60.

Such an order of distribution of amounts of net profit on the payment of dividends is confirmed by arbitration practice. In paragraph 15 of the section "Disputes associated with the payment of dividends" of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation of November 18, 2003, No. 19 "On some issues of applying the Federal Law" On Joint-Stock Companies "it explains that the decision to pay (declard) dividends , including the amount of dividend and the form of his payment, is made by the General Meeting of Shareholders for Shares of Each category (type), including on privileged, in accordance with the recommendations of the Board of Directors (Supervisory Board) of the Company. In the absence of a decision on the announcement of dividends, the Company is not entitled to pay, and shareholders require their payments.

Dividends, the decision to pay (by the announcement) of which adopted by the General Meeting of Shareholders, are subject to payment on time defined by the Company's Charter or decision of the General Meeting of Shareholders. If the charter is not determined by the charter, it should not exceed 60 days, including when it is established by the decision of the General Assembly (paragraph 16 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of November 18, 2003 No. 19).

The direction of the profits of the reporting year on the payment of revenues to the founders (participants) of the joint stock company on the basis of approval of annual accounting reporting is reflected in the debit of account 84 and the credit of account 70 "Calculations with wage personnel" or 75 "Calculations with the founders".

Despite the fact that according to accounting accounts plan, in the payment of interim dividends, an account was also provided for the debit of account 84 and the loan of accounts 75 and 70, in our opinion, such a record is incorrect and in the current year should not be applied.

According to the Tax Code of the Russian Federation, Dividend recognizes the amounts of the distributed profits regardless of whether profits are distributed at the end of the year or before it is completed. The only requirement is to be net profit, i.e. Profit remaining after taxation.

However, as already mentioned, after making a decision by the General Meeting of Shareholders (founders) on the approval of annual reporting and the distribution of profits and until the end of this year, the organization does not affect the organization, and retained earnings, i.e. That that is not subject to distribution. And in accordance with paragraph 2 of Art. 42 of Law No. 208-ФЗ The source of dividend payment is the profit of the Company after taxation (Net profit of the Company). Dividends on preferred shares of certain types can also be paid at the expense of special funds for these purposes. The Company's net profit was determined according to the Company's financial statements and until the end of the fiscal year, accountability is reflected by comparing credit and debit revolutions on account 99.

In our opinion, the accrual of intermediate dividends during the year it is advisable to reflect the record: Debit 99, Credit 75. In the income statement, accrued intermediate dividends should be reflected with the minus sign (in parentheses) after the "Current Income Tax" line.

Taking into account the requirements of diligence in accounting, i.e. Great readiness for recognition in accounting accounting and obligations than possible income and assets, not allowing the creation of hidden reserves (paragraph 7 of the accounting policy "Accounting Policy of the Organization" (PBU 1/98), approved by the Order of the Ministry of Finance of Russia from 9.12.98 № 60N), making decisions on the payment of dividends with greater periodicity than once a year, can lead to negative tax consequences. For example, a situation in which an organization that paid dividends based on the results of the first quarter of 2004 from the profits formed during this period may receive a loss following the results of this year.

Thus, only those organizations that have a sustainable financial position can also be allowed to make a decision on the distribution of profits in the form of intermediate dividends and are confident in increasing profits by the end of the year.

It should be borne in mind that from January 1, 2005, the incomes of taxpayers - individuals and legal entities from equity participation in the activities of organizations obtained in the form of dividends are taxed at a rate of 9%, and not 6%, as before. This amendment is made in paragraph 4 of Art. 224 and p.p. 1 p. 3 Art. 284 of the Tax Code of the Russian Federation by federal law of 29.07.04. No. 95-FZ. Thus, when paying dividends in 2005 in 2004, such income will be taxed at a rate of 9%.

Other payments due to profits

For accounting purposes, the funds listed in connection with the implementation of charitable activities, sports events, recreation, cultural and educational activities and other similar activities in accordance with paragraph 12 of the Regulations on accounting "Organization 'Expenses" (PBU 10/99) approved by the Order of the Ministry of Finance Russia dated July 6, 199.99 No. 33N, are non-dealerization costs and are reflected in the debit of account 91 "Other income and expenses". However, such payments can be carried out and at the expense of retained earnings, as the decision on the use of retained earnings in a joint-stock company or a limited liability company is within the competence of the General Meeting of Shareholders (participants). Therefore, if the protocol of the General Meeting of Shareholders (Participants) is determined that some expenses should be carried out by profits, in accounting, this expense should be reflected in the debit of account 84.

Thus, when closing the (Reformation) of the balance after the adoption of an appropriate solution to the shareholders (participants) of the Company should be reflected in the direction of profit in reserve capital, the needs of consumption and the payment of dividends to the founders. The distribution of profits in the consumption and accumulation funds is reflected in the internal records in account 84, and the unused portion of net profit is allocated in analytical records.

Example. According to the results of 2003, the joint stock company received profits in the amount of 1,200,000 rubles. The general meeting of shareholders on March 25, 2004 approved the results of the Company's activities for 2003, decided to pay dividends in the amount of 1,000,000 rubles. and about the direction of 200,000 rubles. On the organization of summer holidays of children. In accounting, these operations were reflected as follows:final records of December 2003:

Debit 99, Credit 84, subaccount "Retained earnings of this year" - 1,200,000 rubles. - reflected retained earnings;

Debit 84, subaccount "Retained earnings", Credit 75, subaccount "Calculations for income payment" - 1,000,000 rubles. - Dividends are accrued;

Debit 84, subaccount "Retained earnings", Credit 84, subaccount "Profit to use according to the approved estimate" - 200,000 rubles. - reserved the amount of profit 2003 for use in 2004 according to the approved estimate for the organization of summer holidays.

During 2004, the debit of account 84, the subaccount "Profit to use according to the approved estimate" in correspondence with accounting accounts (other accounts, such as consideration of materials) reflected the spending of reserved amounts of profit for years of children. Thus, with its actual use of the balance on account 84, the subaccount "Profit to use according to the approved estimate" will not.

Similarly reflects the use of profit for the payment of prizes to employees of the organization, providing material assistance, for the payment of cultural and sports events, etc. The underlying condition - should be decided by the organization's owners about the use of net profit for these purposes.

Retained earnings (uncovered loss) characterizes the net profit accumulated during the existence of the organization remaining at its disposal (after payment of dividends, creating a reserve fund, etc.). This part of the profit is no longer consumed, and records for the debit of account 84 are not produced. Therefore, this part of the profit is a source of funding tools for capital investments of industrial and non-productive purposes.

In analytical accounting, the funds of retained earnings used as financial support for the development of the organization and other similar activities for the acquisition (creation) of the new property, as well as not yet used, can be divided.

In order to monitor the status and use of funds to finance capital investments for analytical accounting on account 84, it is recommended to open two subaccounts: "Retained earded earnings", "retained earnings used". At the subaccount "Retained earded earnings" is sent by retained earnings of the organization and recorded:

Debit 99-9, Credit 84, subaccount "Retained earnings formed".

As the fixed assets and the implementation of other capital investments are purchased simultaneously with the account on the debit of account 01 and the credit of the account 08, an internal entry is applied:

Debit 84, subaccount "Retained earnings formed", Credit 84, subaccount "Retained earnings used".

If the balance of the subaccount "Retained earnings formed" will become debit, this suggests that the organization allows to immobilize its own and attracted funds, i.e. Uses the current resources for the acquisition of fixed assets.

Thus, if the decision on the distribution of profits was adopted at the annual general meeting of shareholders (participants), which was conducted in the period established by law, in accounting, it is possible to reflect the appropriate use of profit on the debit of account 84.

The procedure for submitting accounting reporting

The approval of annual financial statements is competing the annual General Meeting of Shareholders (the next general meeting of participants). Following the approval of annual financial statements, the organization should reflect the records of December, including the income payments to the founders (participants) on the debit of account 84 in correspondence with a score of 75 or 70. Thus, in the annual accounting balance in the section "Capital and Reserves" "Retained earnings (uncovered loss)" will not correspond to the amount of net profit received during the reporting year.

In paragraph 2 of Art. 15 of the Federal Law of 21.11.96. No. 129-FZ "On Accounting" (with subsequent changes and additions) established that annual financial statements should be submitted to authorized bodies within 90 days at the end of the year. Thus, it turns out that the reporting should be approved by the General Meeting no later than 90 days at the end of the year.

However, in accordance with paragraph 1 of Art. 47 of the Law No. 208-FZ Annual General Meeting of Shareholders is carried out within the deadlines established by the Company's Charter, but not earlier than two months and no later than six months after the end of the fiscal year; The next general meeting of participants of the LLC is carried out under Art. 34 of Law No. 14-FZ no earlier than two months and no later than four months after the end of the fiscal year. Therefore, a situation is possible, in which the accounting statements are approved in compliance with the deadlines established by these laws, and the representation of statements - with a violation of the term provided for by paragraph 2 of Art. 15 of the Law "On Accounting". At the same time, according to paragraph 2 of Art. 15 of this law, the submitted annual accounting reporting should be approved in the manner established by the constituent documents of the Organization.

Of course, the general meeting would be optimal before the expiration of 90 days at the end of the year. However, if the organization has not yet been able to approve the reporting during this period, it has the right to pass it out and without taking into account the consideration of the results of activities for the reporting year. It is this position that the Ministry of Finance of Russia adheres to the order of which dated December 31, 2004 No. 135n "On Amendments to the indication of the procedure for the preparation and submission of accounting reporting (an order of February 22, 2003 No. 67N)" from the instructions, paragraph 14 was excluded, Where it was said about the submission of reporting, taking into account the mandatory consideration of the organization's activities for the reporting year.

The participants of the Limited Liability Company are eligible to share in such an organization. Unless otherwise provided by the Charter Ltd., the Company's profit is distributed among the participants in proportion to their shares in the authorized capital (paragraph 2 of Art. 28 of the Federal Law of 08.02.1998 No. 14-FZ).

Ltd. may decide on the distribution of net profit quarterly, 1 time in six months or 1 time per year. Questions about the distribution of net profit and payment of dividends are related to the competence of the general meeting of participants in the LLC. This means that it is the general meeting of participants that makes a decision to determine the part of the profit of Ltd., which will be distributed between them (paragraph 1 of Art. 28 of the Federal Law of 08.02.1998 No. 14-FZ). Despite the fact that the concept of "dividends" is characteristic of joint-stock companies, in our consultation we will also be used for convenience to use this term, implying a part of the profit of Ltd., which is distributed between its participants.

About how to make a decide on the distribution of profits on dividends, we were told in a separate and made a sample of such a decision.

However, before making a decision on the payment of dividends, it is necessary to determine the amount of profit, which can be distributed among the participants. This magnitude brings to the information of the participants, the head of LLC. After all, it is the leader of the Organization (for example, its general director) is responsible for the current management of the organization, and, therefore, it is he who can offer the norm of the distribution of profits on dividends, which at this stage would be optimal and did not contradict the requirements of the current legislation. After all, the profit of Ltd. on dividends can not always be distributed.

Ban on the distribution of profits and payment of dividends

Ltd. does not have the right to distribute between participants and pay dividends, in particular (paragraph 1 of Art. 29 of the Federal Law of 08.02.1998 No. 14-FZ):

- until full payment of all authorized capital;

- before paying the actual value of the share or part of the share of the participant LLC;

- if at the time of the decision (payment) of LLC meets the signs of insolvency (bankruptcy) or if the specified signs appear in the Company as a result of the adoption of such a decision (payments);

- if at the time of decision-making (payments) the cost of net assets LLC is less than its authorized capital and the reserve fund or will be less than their size as a result of the adoption of such a decision (payment).

Information about the magnitude of the profit of Ltd., which can be distributed among the participants, the head of the organization can get from the service note prepared for him, as a rule, by the chief accountant of the organization.

It is in the official note on the name of the head of the LLC, all conditions that prevent decision making and subsequent payment to participants should be taken into account.

Let us give an example of a service note on the distribution of profits and the payment of dividends.