OSN

Form SZV-4-1 “Individual information on the insurance period and accrued insurance contributions for compulsory pension insurance of the insured person” was generated in the following situations: if the insured person had no

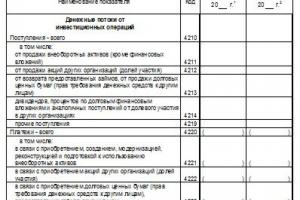

The procedure for filling out Form 4 “Cash Flow Statement” in the BukhSoft: Enterprise program The programs contain all primary accounting forms, all accounting and tax reporting (including the form...

07/05/2017. Topic of the article: An example of filling out the 6-NDFL form for the half-year of 2017. No later than July 31, 2017, you must submit a 6-NDFL report for the half-year. Filling out this calculation is more difficult than for 1 quarter. Because...

The Dominican Republic is a very popular winter tourist destination among Russian tourists. A visa is not required for a short stay in this country. Just fill it out and present it to...

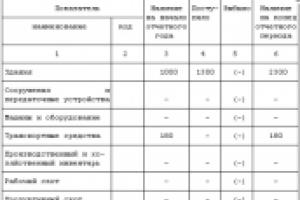

Tax consultant Form No. 5 "Appendix to the Balance Sheet" contains indicators that decipher the data of Form No. 1 "Balance Sheet". It consists of 10 sections. According to clause 3 of the Instructions on...

Balance sheet form 3 is one of the financial reporting applications that contains all information about the organization’s capital and its changes over several years. Let's consider the form of the indicated...

The UIN code in the payment slip, or the unique accrual identifier, is a specific cipher in which errors are not allowed. The UIN code must be included in the payment order. We'll tell you where to get this code...

Clause 2 of Article 80 of the Tax Code of the Russian Federation gives the right to submit a single simplified declaration if two conditions are met: there are no objects of taxation for taxes in respect of which the EUD is filed; in the reporting period not...

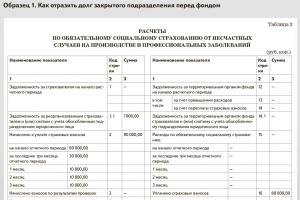

The Social Insurance Fund has updated the form for calculating contributions for injuries. New lines have been added to the 4-FSS calculation for 9 months of 2017. For the first time, you need to report on the new form for 9 months on October 20th or 25th, depending...