Taxes

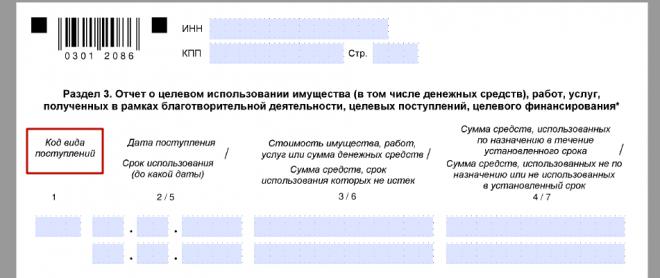

Putting the correct codes in the declaration under the simplified tax system is of great importance, since otherwise all the accountant’s work with this form may go down the drain. Therefore, let us consider in more detail the code indicators of the declaration under the simplified tax system.

They never cease to amaze the population. Today, using the Internet, you can make purchases, communicate and send documents. It is even offered to get into some organizations using the Internet. Is it possible to sign up for...

Paragraph 1 of Article 13.3 of the Federal Law (hereinafter referred to as Federal Law No. 115, which entered into force on July 25, 2002) stipulates that in order to carry out labor activities, foreigners must obtain a special permit. For...

Making insurance contributions to the Pension Fund for employees is the responsibility of all employers, regardless of the type of business activity. The amount of contributions is regulated by current legislation and...

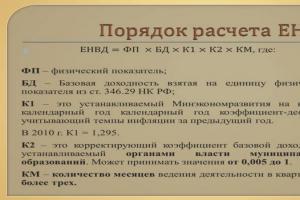

A special tax regime in the form of a single tax on imputed income is used to reduce the financial burden on business. Its application is relevant for small organizations involved in legislative...

The forestry industry has always been considered a profitable sector. Extraction, sale and processing of wood can bring in very serious money. However, for beginners, entering this market promises many problems. Sad statistics...

The UTII-1 application serves to register the enterprise as a payer of tax on imputed income. At the moment, the 2014 form is considered valid. Sample filling and blank form...

After the new year, the documents that legal entities and individuals used to offset and refund overpaid taxes changed. The Federal Tax Service has supplemented the previously existing forms with sections that will be needed for...

Every quarter, organizations and enterprises that operate in our country submit a report to the tax service. In it they reflect the amount of profit that the company received for the period in question...