What is the basic return at UTII

A special tax regime in the form of a single tax on imputed income is used to reduce the financial burden on businesses. Its use is relevant for small organizations engaged in legally established activities.

Who can carry out activities under the special taxation regime

UTII can be successfully applied by business structures operating in the areas, the list of which is determined by regional acts.

Types of activities that can use UTII

Business entities cannot use the special tax regime:

- whose activities are carried out in the service sector related to the organization of public catering in public institutions;

- having more than a hundred employees;

- carrying out their activities with the involvement of third-party organizations on the basis of equity participation;

- belonging to the category of large taxpayers;

- profiting from the lease of gas station facilities.

Change in the taxation system

In order to change the taxation regime, appropriate grounds are needed, which can be:

- termination of activities subject to a single tax;

- violations of legislative norms regarding the timely filing of reports and transfers of mandatory payments;

- cancellation of the taxation system by authorized bodies directly for the type of activity that is core for the organization.

How to calculate UTII

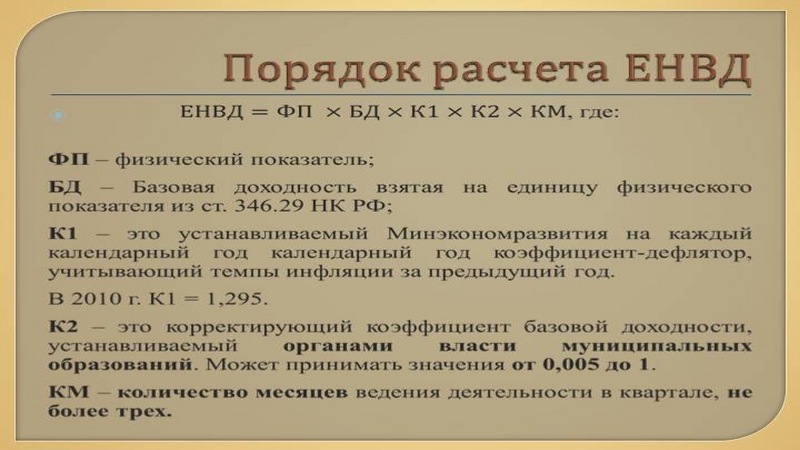

The calculation of the basic yield for UTII is carried out according to the formula represented by the product of the values:

- basic return;

- physical indicator;

- coefficients;

- the statutory fifteen percent rate.

The formula for calculating the amount of tax

From the components of the calculation, one can see the main advantage of the tax regime, which lies in the constancy of the size of the tax, the amount of which is not affected by the income received by the business entity.

If a business entity carries out activities in several areas that meet the requirements of the tax regime, then the tax is calculated and paid separately for each type of activity.