Codes of the new USN declaration: values

Putting down the correct codes in the tax return is of great importance, because otherwise all the work of the accountant with this form may go down the drain. Therefore, let us consider in more detail the code indicators of the declaration under the simplified tax system.

Why do we need

Keep in mind that when filling out some details of the declaration on the simplified tax system for 2016, you need to enter not specific amount information, but put down certain codes.

As a general rule, any USN tax return code serves to simplify. To:

- do not overload the completed form;

- special programs could analyze this report more quickly.

Starting from the report for 2016, all simplified users must apply the form adopted by the order of the tax service of Russia dated February 26, 2016 No. ММВ-7-3/99. Let's figure out exactly what codes you need to put down in it.

Values

As mentioned, putting down the correct codes when filling out the declaration on the simplified tax system for 2016 is very important. Actually, most of them are present immediately on the first sheet:

As for the code of the tax authority (the first two digits are the code of your region, and the second two are the number of the tax authority), it is taken from the certificate of state registration of the company (IP). This question can be clarified using the services of the official website of the tax service of Russia - www.nalog.ru.

Deal with what tax return code put down in one case or another, the following tables will help you.

Taxable period

In addition, we note that on the basis of Art. 346.23 of the Tax Code of the Russian Federation, a declaration on the simplified tax system is submitted only at the end of the tax period. It is a calendar year (clause 1 of article 346.19 of the Tax Code of the Russian Federation). And for the reporting periods, you do not need to do anything. Therefore, in the overwhelming majority of cases, the simplisticists put down in USN declaration tax period code – 34.

Place of submission

As you can see, for simplistic companies, filling out is quite simple. Just write in USN declaration code at the location– 210. He is – USN declaration code at the location and accounting.

Based on the place of residence of the individual entrepreneur, the location of the company, the USN also indicates the area code - OKTMO. More will be said about it later.

Business restructuring

As seen, liquidation code in the USN declaration has a value of 0.

Submission procedure

| Feed method code | Decryption |

| 01 | On paper (by mail) |

| 02 | On paper (in person) |

| 03 | Paper + removable media (in person) |

| 04 | By TCS with electronic signature |

| 05 | Other |

| 08 | On paper + on removable media (by mail) |

| 09 | On paper with a barcode (in person) |

| 10 | On paper with a barcode (by mail) |

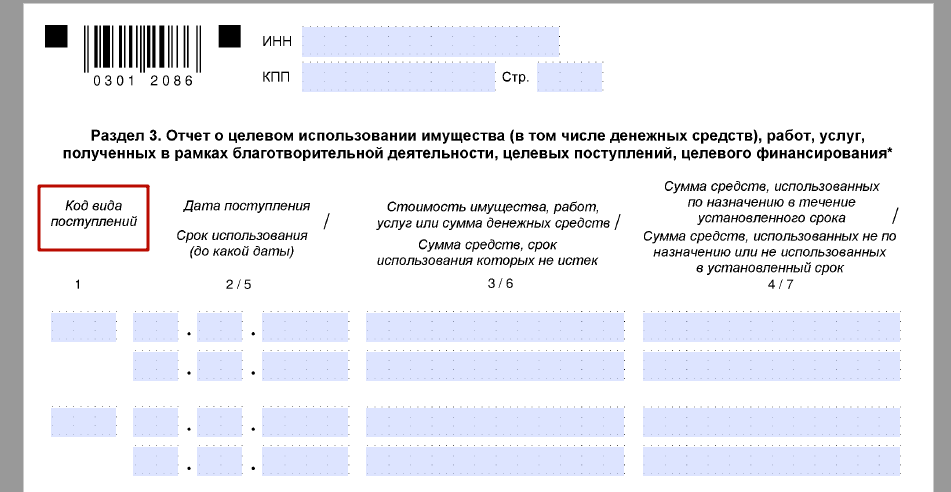

Charity, targeted funds

There are also a number of specific codes. They will tell the tax authorities that the simplistic person received property, money, work, services as part of:

- charitable activities;

- targeted income;

- targeted funding.

These codes are needed by a narrow circle of simplistic people and not in all cases. Mostly non-profit organizations. Moreover: simplistic people show receipts to their address through charity or as part of the intended purpose only in the last 3rd section of the declaration on the simplified tax system:

If desired, the full composition of these codes can be found in the 5th Appendix to the order of the tax service of Russia dated February 26, 2016 No. ММВ-7-3/99.

The OKTMO code in the new declaration on the simplified tax system for 2016 must be affixed on the basis of “OK 033-2013. All-Russian classifier of territories of municipalities. It was adopted by order of Rosstandart dated June 14, 2013 No. 159-st.

The code for the type of activity according to OKVED is based on OK 029-2014 (NACE Rev. 2). All-Russian classifier of types of economic activity” (approved by order of Rosstandart dated January 31, 2014 No. 14-st).