Pay your property tax

If you haven't done this for a long time.

Ekaterina Miroshkina

economist

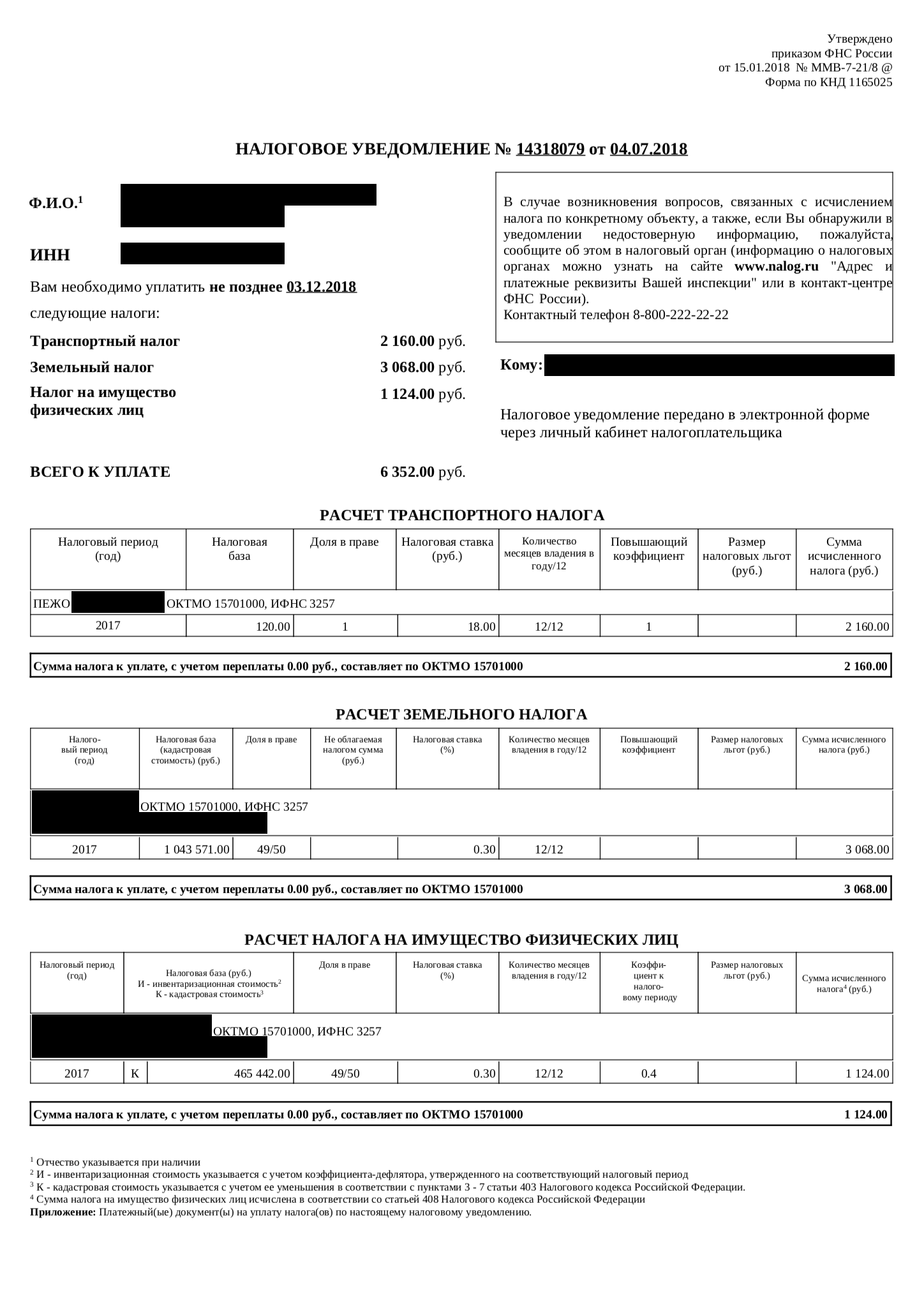

A tax notice may be waiting for you there. December 3rd is the last day you must pay property tax for 2017. Let's figure out what kind of tax it is, how to pay it and what will happen if this is not done.

What is this tax and who should pay it?

The tax on the property of individuals is paid by the owners - that is, those people who are indicated in the documents for real estate. Employers, family members and guests do not have to pay this tax.

If you own an apartment, you are likely to pay property tax. If you rent an apartment, there is no such obligation and no one will send a notice to your name.

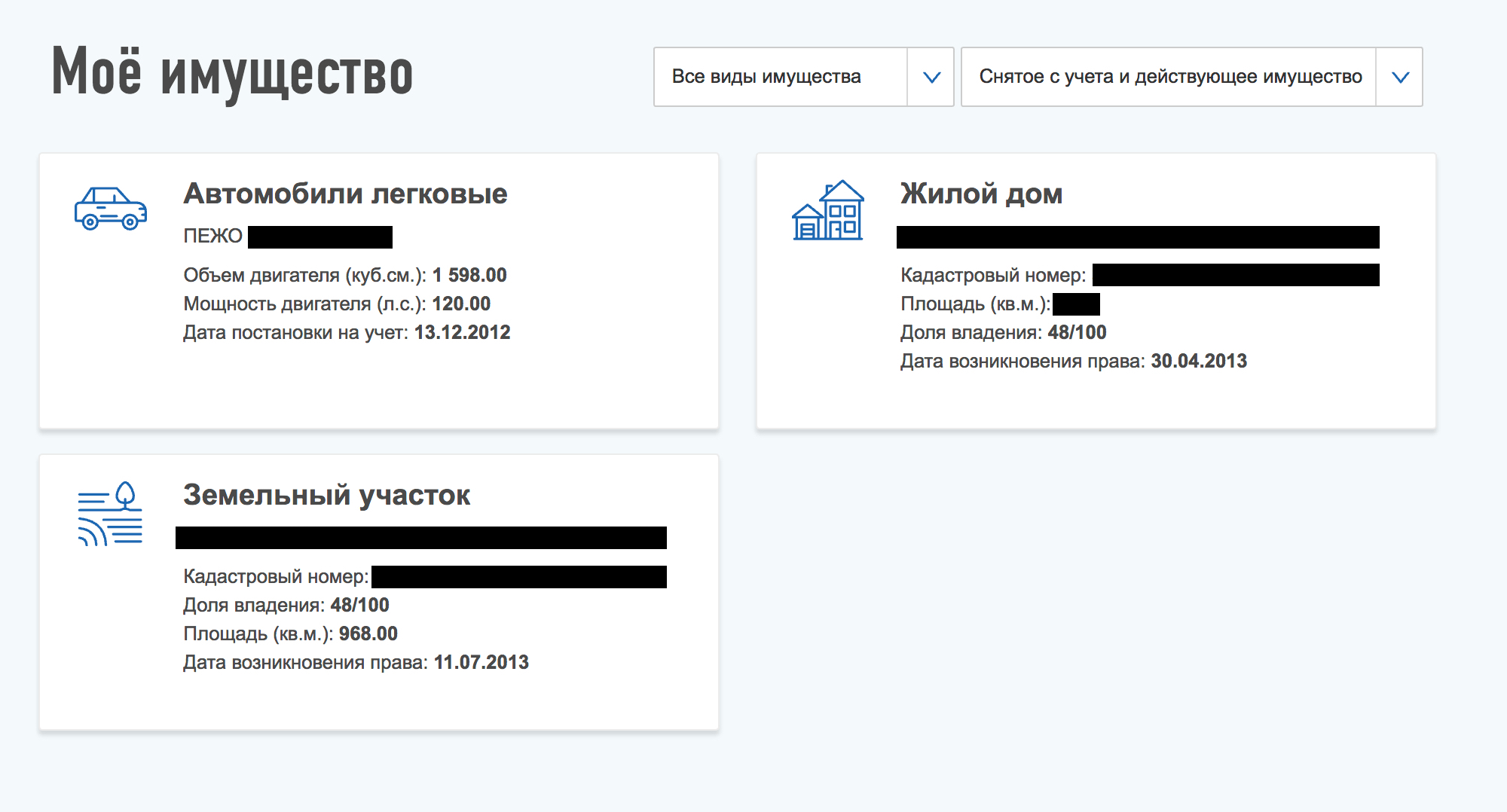

Personal property tax does not apply to cars or land. Other taxes are paid for such objects: transport and land.

You must pay tax if you are the owner, that is, if the property is registered in your name. You may not use the apartment, you may not be an adult and a citizen of Russia, you may have several apartments and not have a job - you will still have to pay property tax. The only condition: the property must be located on Russian territory. By the way, if the apartment is mortgaged, the owner must pay property taxes, not the bank.

How to calculate property tax

There is no need to calculate property taxes yourself. This is done by the tax office. She receives data from Rosreestr about the owners and their property, knows what you own, how many square meters there are in the apartment, for how much and when you bought it.

When the next calendar year ends, the tax office collects all the data, takes into account applications for benefits and informs each owner how much property tax he needs to pay to the budget. The amount is indicated in notifications and sent by mail or via the Internet.

To calculate the tax, the cadastral or inventory value is taken, and not the one specified in the purchase and sale agreement. The tax office itself knows and does all this. Property tax will be charged from the date on which the property is registered. If you bought an apartment in the middle of the year, then you need to pay not for 12 months, but in proportion to the period of ownership.

If there are several owners, then the tax will be calculated for each separately. But the tax office will also take this into account, calculate and distribute it itself. You only need to check the data in the notification: errors may occur.

What are the tax rates?

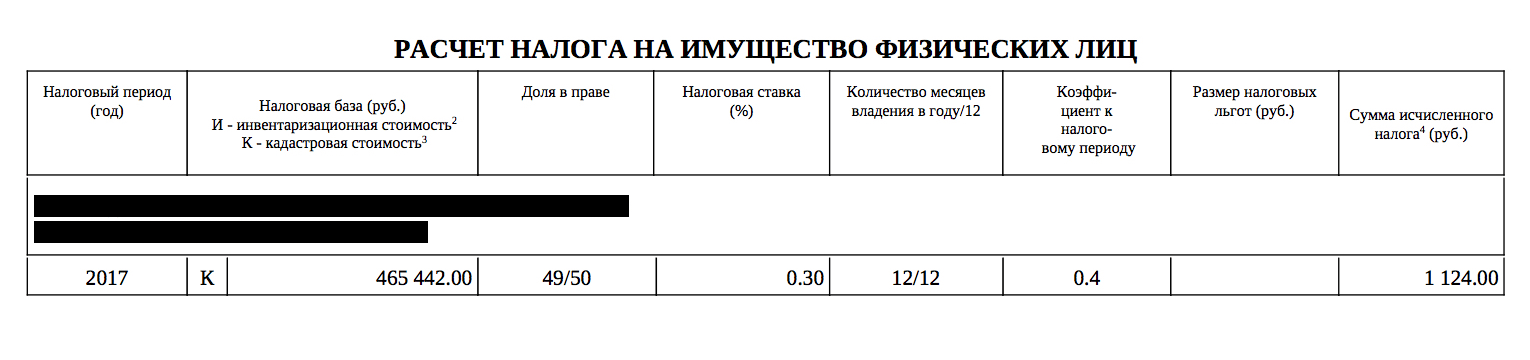

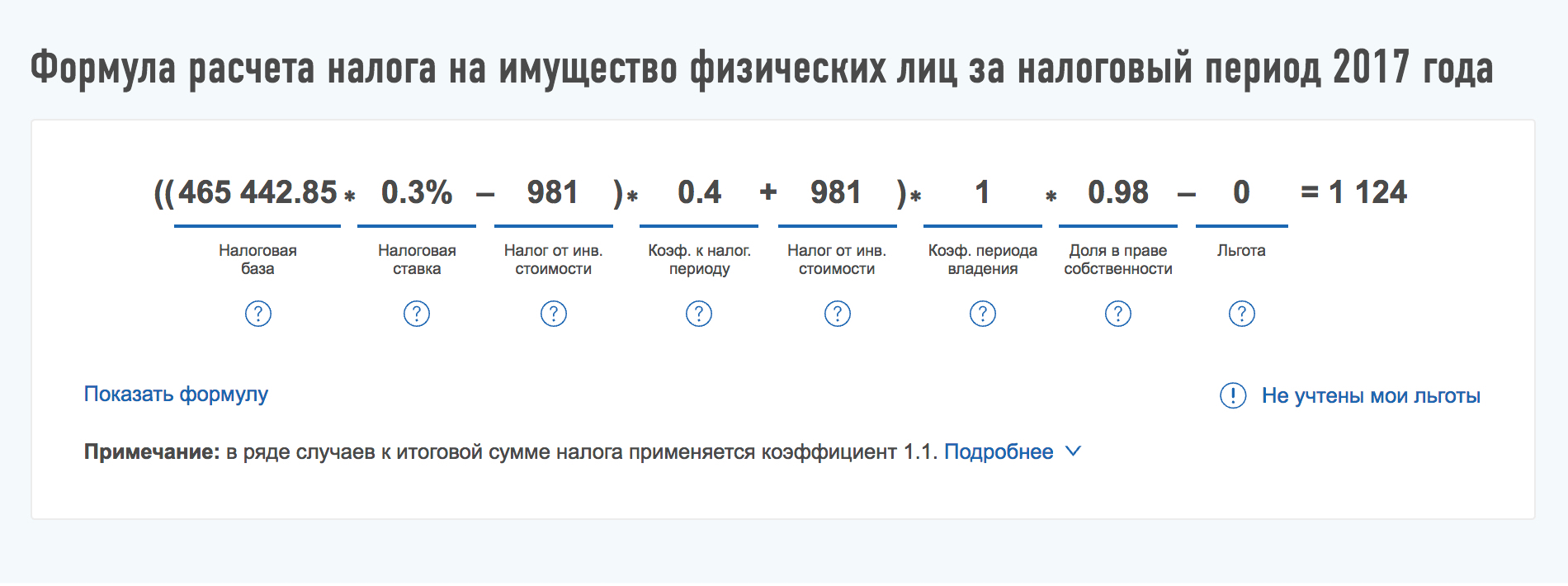

Property tax rates depend on what value is used for calculation: cadastral or inventory. The tax is not yet calculated based on cadastral value in all regions - the transition is gradual. The tax notice will show what became the tax base in your calculation. Information on cadastral value can be obtained on the Rosreestr website.

The tax notice indicates only the part that became the tax base. And the full amount is given separately in your personal account.

In any case, the final rate is at the discretion of the municipalities. The Tax Code sets basic tax rates.

Basic rate for cadastral value

Residential houses, apartments, rooms, cottages, garages, parking spaces, outbuildings and unfinished houses

Expensive real estate with a cadastral value of more than 300 million rubles, excluding garages and parking spaces in these properties

Other property: bathhouses, warehouses, gazebos

If in a region property taxes are calculated based on inventory value, the rates are different. They also use a deflator coefficient - the inventory cost is multiplied by it, and then by the rate.

Property tax rates vary. For example, for a cost of up to 10 million rubles, the tax rate may be 0.1%, and if more than 30 million, then 0.3%.

Is it possible to reduce the tax

The tax reduction can occur automatically or at the request of the taxpayer. It depends on what it is being reduced by. Sometimes you won't have to pay tax at all.

Tax deduction. When calculating tax based on cadastral value, a tax deduction is provided for owners. This is not the deduction that is given when buying or selling an apartment, but a special one for property tax. You cannot return money from the budget with its help, but you can save money.

The tax deduction works like this: when calculating the tax base, the area of the property is reduced by a predetermined number of square meters. To do this, you don’t need to do anything; the deduction is due to everyone and for every object.

Property tax deductions

House

Apartment or part of a house

Room or part of an apartment

Reducing factors. During the first years of application of the cadastral value, reduction factors are taken into account. For the first year - 0.2, for the second - 0.4, for the third - 0.6. In 2018, this coefficient was supposed to be 0.8, but it was canceled. And when calculating the tax for 2017, different rules apply: it is calculated so that from the fourth year it does not grow by more than 10% per year. But it is not necessary to understand this entire system: everything is taken into account automatically.

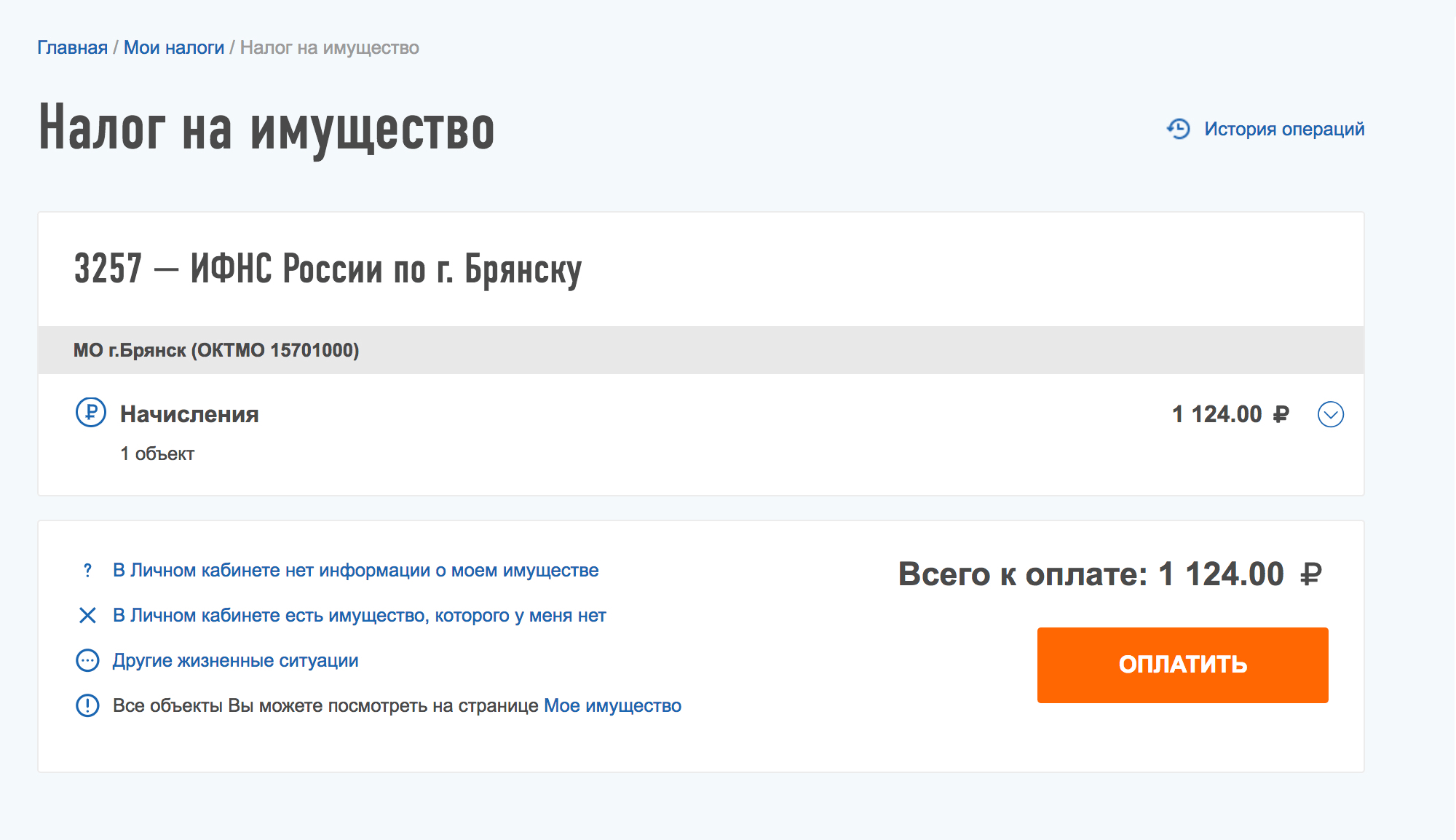

For example, in the Bryansk region in 2017, the cadastral value was used for the calculation of the cadastral value for the second year. Therefore, the tax notice now indicates a coefficient of 0.4. This is so that owners are not shocked by a sharp increase in taxes. Next year the coefficient will be 0.6 - the tax for the same object will be higher. And then it will grow by 10% per year. Unless, of course, something changes again.

Privileges. In addition to tax deductions, the law provides for federal benefits for veterans, disabled people and pensioners. They are exempt from paying property tax on one property from each category. Local authorities can set their own benefits. Information about them is on the tax website. To receive the benefit,

If you are entitled to a benefit, but it was not given, there is still time to recalculate everything. Use and help parents and grandmothers deal with charges. Maybe they retired, but the tax office doesn’t know about it yet and is expecting a tax that shouldn’t happen. This service does not require registration: just describe the error and submit an application for the benefit - the tax will be recalculated or completely reset to zero.

When does a tax notice arrive?

The tax office sends the owner a tax notice one month before the deadline for paying the tax. Typically, notifications begin to be sent out in the summer. By the end of November they had already been sent to everyone. As long as there is no notification, there is no obligation to pay tax.

Notifications are sent in two ways:

- By registered mail.

- To the taxpayer’s personal account on the website nalog.ru.

If you have a personal account, then the tax notification will go there by default. And they won’t send it by mail without a separate request. That is, if the postman did not give you an envelope, this does not mean that you do not owe anything - check your personal account.

If you need a notification on paper, you will have to go to the tax office and write a statement. Now the notification indicates three taxes at once: property tax, land tax and transport tax. They may also indicate personal income tax - don’t be alarmed.

Why the tax notice may not arrive

Sometimes tax notices never arrive at all. Here's why it might happen:

- No tax due. For example, you have a benefit or simply have no property.

- The tax is less than 100 rubles. Then it will be sent next year.

- The documents were lost.

If you own property but have not received any tax notices, report it to your tax office. Especially if you do not have access to the mail to which letters arrive. Or don't follow them. Even if you do not pick up the notice, you are considered to have received it.

And for the future, create a personal account on the website nalog.ru. There you can check everything and pay immediately. If you have an account with government services, then you have access to your personal account.

If you don’t have time to go somewhere or don’t want to, in December you can check your tax debt through the Tinkoff Bank app or through government services. The arrears will be reflected there and you can pay them immediately - however, already taking into account penalties.

How to quickly pay property taxes

Here are the tax payment methods:

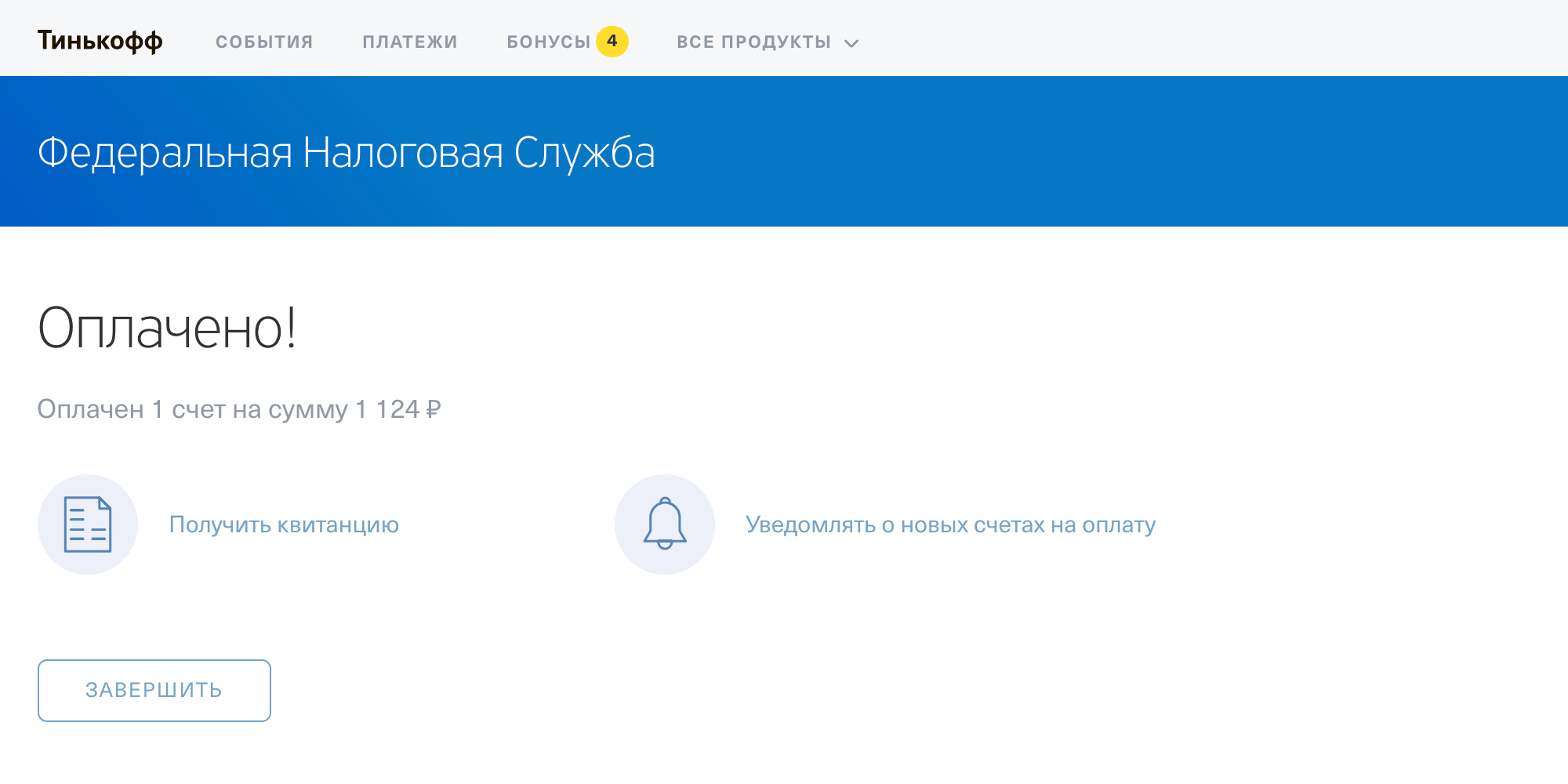

- Through your personal account on nalog.ru. Payment in a couple of clicks - you can pay the entire amount at once or pay in installments.

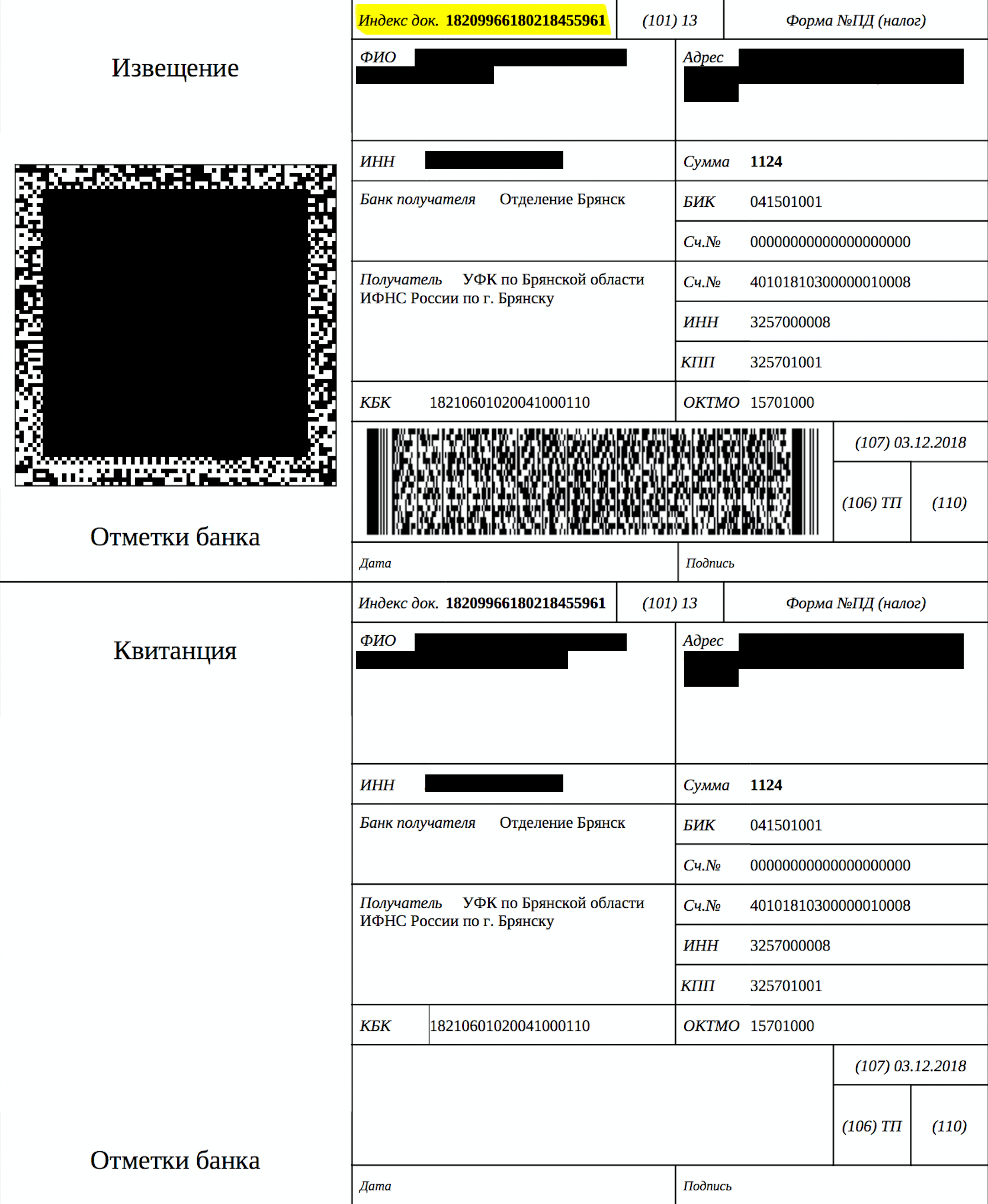

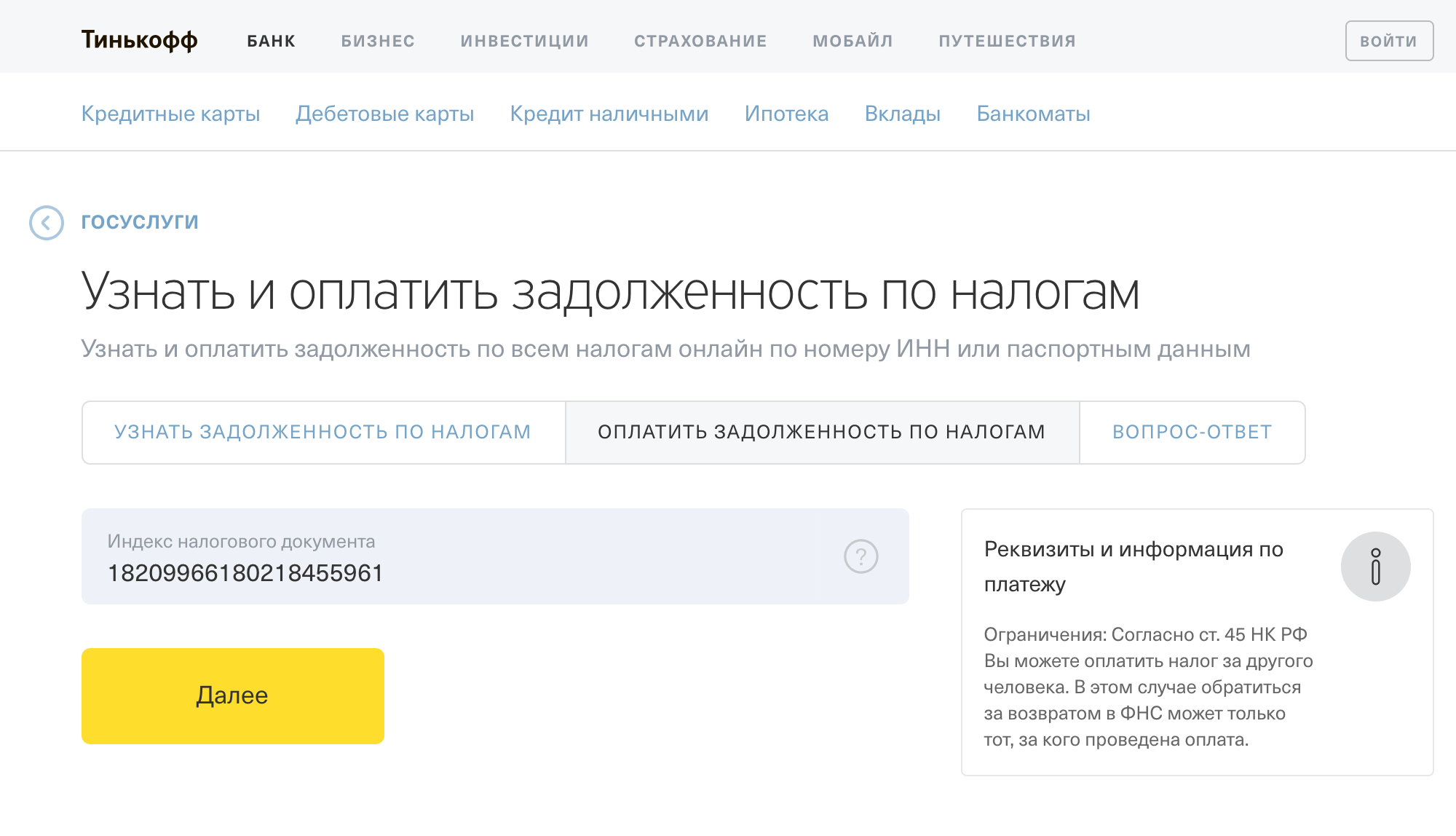

- In the Tinkoff Bank service. You will need the document index. It’s convenient to pay not only for yourself.

- On the government services portal. There is also a service for paying taxes by receipt number and even for third parties.

- On the tax website without a personal account. You can use the receipt number or without it. But then you will have to fill out the taxpayer’s information and know the amount.

- At the bank using a paper receipt. Printed receipts will be sent by mail with the notification. Just take them to the bank and pay the old fashioned way - for yourself and others.

Can anyone pay tax for me?

Since 2017, taxes can be paid for third parties. Even if you pay for your parents with your card, the money will go where it should. Previously, this was not possible: only parents were allowed to pay for their children.

But in order to pay property tax for someone else, you need to either fill out the payment slip correctly, or have access to your personal account, or know the document index - these are many numbers that are indicated on the receipt. According to the document index, you can pay for anyone.

When to pay property tax

In general, a fine can still be charged for non-payment of taxes - 20 and 40% of the debt. But for the property tax specified in the notice, such a fine is not assessed. That is, if you receive a notification and you need to pay 3,000 rubles in property tax, but you haven’t paid, they will only charge you a penalty. There will be no fine of this amount, because inaction is not a violation for which a 20% fine is imposed.But if you have an apartment, and the tax office doesn’t know about it, then there will still be a risk of getting a fine. Because then you kind of have to talk about your property yourself. And if they didn’t do this, then they deliberately underestimated the tax base. This is no longer inaction, but precisely the violation for which you are fined under Article 122 of the Tax Code of the Russian Federation.

You can check your objects in your personal account on the website nalog.ru.

Forced collection. If you do not pay the tax yourself, it will be collected by force. They can report you to work or write off money from your card based on a court order.

Criminal liability. Only those who own a lot of expensive properties, have not paid for them for a long time and owe millions to the budget should be afraid of criminal liability for property tax. That is, formally there is such a responsibility, but in order for it to be applied, one must accumulate a huge debt over several years.

Remember

- Property taxes must be paid by December 3, 2018. This applies to all owners of apartments, houses and garages.

- The tax office itself calculates the amounts due and indicates them in the notification. Check your email or personal account.

- There are benefits and deductions for property taxes. You only need to apply for the benefit once, and the deduction is given automatically.

- You can pay tax via the Internet and not only for yourself.

- If you do not pay, they will charge a penalty and will collect forcibly.