Transport tax: a receipt does not arrive - what to do and how to pay off the debt without a document for payment?

When the time comes to pay the transport tax, each obligated citizen receives a “chain letter” from the tax office - a notification that states what needs to be paid for to the state and within what time frame.

But sometimes it happens that such a paper does not reach the addressee, but no one relieves the citizen of the responsibility to pay the tax.

A completely logical question arises: how to pay transport tax without a receipt? The answer to it can be easily found out from this article.

Fortunately, in the age of the high popularity of the Internet, you can easily check your transport tax debt and pay the required amount without leaving your computer.

Fortunately, in the age of the high popularity of the Internet, you can easily check your transport tax debt and pay the required amount without leaving your computer.

Or, using some online resources, you can simply generate a receipt for payment of transport tax and print it out so that you can make a payment with it at the bank office.

All a citizen needs is to know some data (TIN, passport, SNILS, etc.), which will be discussed in more detail later in the article.

How to pay transport tax if there is no receipt?

There are several options for obtaining a receipt for payment of transport tax:

There are several options for obtaining a receipt for payment of transport tax:

- personally;

- by registered mail;

- through the Personal Account.

To receive the notification in person, you need to come to the Federal Tax Service at your place of residence and pick it up against a signature.

A large amount of information and documents pass through tax offices every day. And inspectors do not always cope with all the responsibilities assigned to them.

This includes sending notifications to taxpayers. Some citizens may simply forget to notify, so cases arise that a transport tax receipt has not been received from the relevant Federal Tax Service.

Or, tax authorities still send a notification of payment of transport tax by registered mail, using the services of the Russian Post. Such a letter is considered received if 6 days have passed since it was sent.

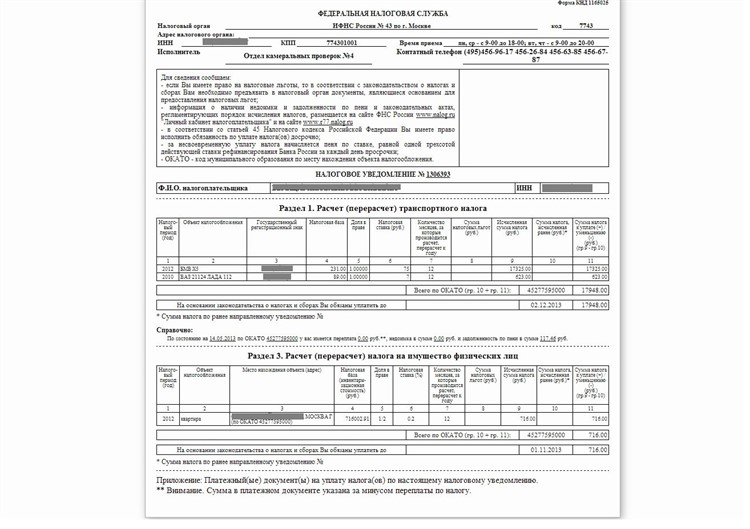

What does a transport tax receipt look like?

A citizen can view an electronic receipt for the transport tax of individuals and print it out only if he has a personal account registered on the website of the Federal Tax Service of Russia.

As a general rule, it is believed that if there is no receipt for payment of transport tax, the taxpayer risks that he will be in debt, and penalties may also be charged. Perhaps he will even face administrative liability.

But under no circumstances should you panic! You should personally contact your inspectorate with documents and request a receipt for payment of transport tax. Or simply clarify the information on the tax debt for the car and as soon as possible

You can also take the opportunity to get advice on registering a taxpayer’s Personal Account, and then receive a login and password from the Federal Tax Service.

Information for verification and payment

In the question of how to pay transport tax without a receipt, you will need the following information:- Taxpayer INN;

- passport data;

- SNILS;

- information about the vehicle.

Citizen's TIN

TIN is a taxpayer identification number, which consists of 12 digits.

The combination of these numbers is unique for each citizen. On the assignment of a TIN, the inspectorates of the Federal Tax Service of Russia issue certificates of registration with the tax authority, which indicates the date of registration.

Certificate form

A receipt for payment of transport tax using a TIN has its own nuances. Without providing a TIN, a citizen will not be able to pay transport tax, because both when making a payment at a bank branch and when making a non-cash payment in your personal account, you will need to enter this number.

Passport details

In the absence of this document, the taxpayer will not only be denied a personal consultation with the Federal Tax Service, but also will not accept an application for re-issuance of a notice or receipt for paying tax on a car.

SNILS of a citizen

SNILS stands for “Individual number from the certificate of compulsory pension insurance” and is a green card with a unique code written on it. It is thanks to this set of numbers that the tax office will be able to “break through” a citizen’s tax debt.

Also, SNILS data will be needed when viewing information about tax debts on the website of the Federal Tax Service of Russia and the State Services portal.

Information about the vehicle

Information about the vehicle is

- state number of the car (that is, the one indicated on each car);

- VIN code, which consists of 17 digits that allow you to identify the car. It can be viewed on the vehicle title, insurance policy or registration certificate.

Payment

A taxpayer has several ways to pay transport tax if there is no receipt. He can choose the most convenient option for himself. Below is a detailed description of each of them.

Through Sberbank

To pay the annual car tax, you need to use the “” service. To access it, you must have an open account and a bank card from Sberbank of Russia.

Also, this card must have a personal account registered on the official website of Sberbank. Also, this method is suitable for those drivers who nevertheless requested a second receipt to pay the tax.

Sberbank Online

Step-by-step instructions for payment are as follows:

- To register such an account, a citizen should contact any branch of Sberbank, where he will be given a login and password;

- go to the Sberbank website, go to the “Sberbank online” section and enter your username and password, and then log in using the SMS code;

- after loading your personal account, click on the “Transfers and Payments” section, then select “Federal Tax Service”;

- go to “Search and pay taxes to the Federal Tax Service”;

- Next, the payment card will open, where you need to enter the document index - a special code consisting of 15 or 20 characters. It is located at the top of the receipt and this code is unique;

- payment of tax.

In addition, citizens have the opportunity to use any Sberbank terminal and, using a receipt, pay the tax amount through it. Or contact any branch of this bank.

Through the website of the Federal Tax Service

The website of the Federal Tax Service of Russia offers 2 ways to pay transport tax:

The website of the Federal Tax Service of Russia offers 2 ways to pay transport tax:

- through the service “Payment of taxes for individuals”;

- through your personal account.

To pay through a special service, you need to go to the website of the Federal Tax Service of Russia and go to the specified section.

You can see the tax amount on your receipt or calculate it yourself. The overpaid amount will be credited to the taxpayer’s account and can be spent on paying other taxes.

Then the site will ask you to choose cash or non-cash payment. If a citizen plans to pay in cash, the service will generate a payment document for him, with which he can go to the bank.

Have you sold your car and the tax is still due? It describes in detail what to do in such situations.

Have you sold your car and the tax is still due? It describes in detail what to do in such situations.

According to general rules, pensioners are required to pay transport tax on the same basis as everyone else. But in some regions there are benefits for them. Where and what conditions must be met for this, read.

When choosing a non-cash form of payment, it is worth looking at the list of banks through which payment is made. As a rule, the most popular type of payment is through a Kiwi wallet.

But, if the taxpayer has a card of any of the partner banks indicated on the website, then when specifying its details, the tax will be paid from there. All that remains is to click “Pay” and the payment can be considered completed.

To use the second payment method, you must be registered on the website https://www.nalog.ru, with a personal login and password.To obtain a login and password, the taxpayer must contact his regional Federal Tax Service.

To check the tax, in your personal account you should go to the “Objects of Taxation” section and then select the car on which the tax may have been charged.

If the driver is sure that the tax has already arrived, you need to open the “Accrued” tab and then “Pay accruals”. In the window that appears, select the amount of tax for transport and click on it.

Then you can choose either to generate a payment order or to pay by bank transfer, again, if the payer has a card from a partner bank or an electronic wallet.

Through the tax office

Unfortunately, there is no way to directly pay the transport tax to the Federal Tax Service for the relevant region.

Unfortunately, there is no way to directly pay the transport tax to the Federal Tax Service for the relevant region.

The only thing you can do is contact the inspectorate with your passport and write an application for re-issuance of the receipt, and also find out whether the transport tax has been charged.

You can only pay using the methods described in this article.

It is important to remember that, despite the absence of a receipt for repaying the tax, the taxpayer must take the initiative and find out whether the obligation to pay it again has arisen, and also take prompt action to pay.