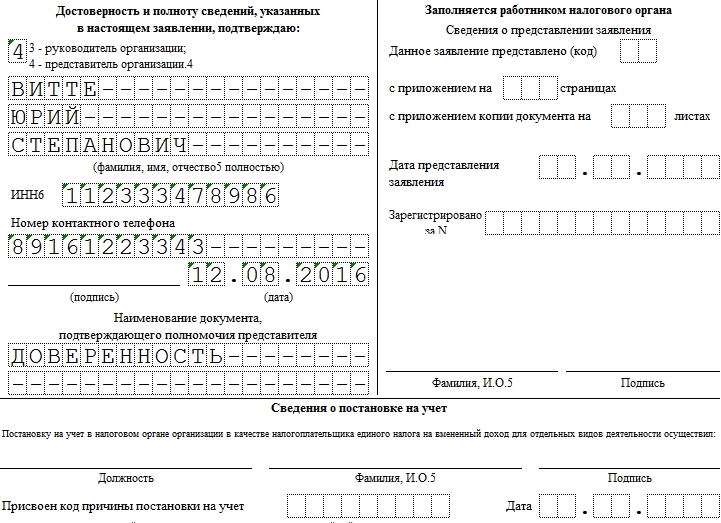

ENVD-1. Application for registration of an organization as a UTII payer

The UTII-1 application is used to register an enterprise as an imputed income tax payer. At the moment, the form from 2014 is considered valid.

Sample filling and blank form UTII-1

FILES

Form use

The UTII-1 form should be filled out when the organization plans to register with the Federal Tax Service. The choice of the tax authority depends on the location of the activity ( not to be confused with the place of business registration).

Fill Features

UTII-1 can be filled both manually and electronically. In the first case, the data should be entered in legible printed characters, one per cell. The rules allow you to fill out an application with a black and blue pen.

If you put a blot or made a mistake, take another form. Do not make any corrections! This form will not be accepted by the IRS.

Electronic UTII-1 is filled in Courier New font size 18, one character per cell.

In both cases, if the last letter of the word is in the last cell, indent on a new line.

Filling the header

Please note that unlike many accounting forms, gaps in UTII-1 must be filled with dashes. In our example, the company carries out 2 types of activities - accordingly, the third block will be completely crossed out. An empty cell can only remain in 2 cases:

- a space is required (as in the title from the example),

- the fields are filled in by tax officials.

Filling in personal data

If the representative of the company does not have a patronymic, the third line is filled with dashes. Non-resident enterprises that do not have PSRN leave the column crossed out.

Those who submit UTII-1 through a representative (code 4) should indicate the number of pages of copies of the document authorizing the person: in our case, one, because. the power of attorney is completed on 1 page. According to the order of the Federal Tax Service, in the line “Document name” only the type (i.e. power of attorney) is indicated, and not specific data.

Wrong: Power of Attorney No. 1 dated 1.08.2016

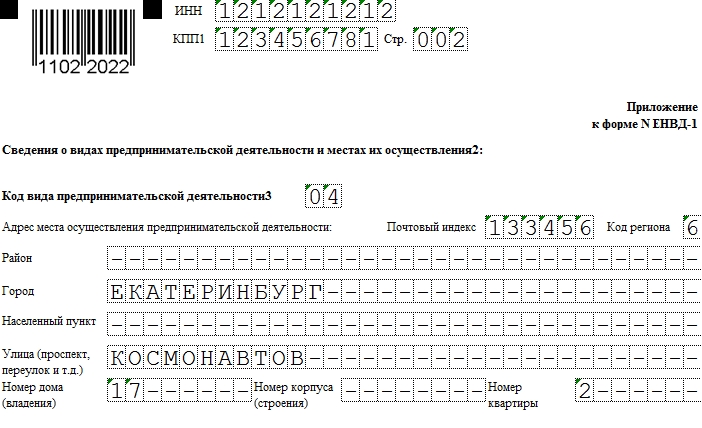

Filling in information about the place of business

In the column "Settlement" we enter the name of the point, if it is not a city. For example, Svetlaya, if we are talking about the village of Svetlaya, or Orlovo, if we are talking about the village of Orlovo.

Terms and features of submission

The UTII-1 form is submitted no later than 5 business days after the start of an activity that qualifies as generating imputed income. It is convenient that the application can be submitted both in person (if someone other than the head submits, then a power of attorney is needed), and by mail or in the form of an electronic report.

When the UTII-1 form is not needed

In fairly common cases:

- if the taxpayer is an individual entrepreneur, for registration you need to submit,

- When should you waive UTII?

- when ENTI activities are carried out on a one-time basis.