Coursework: Accounting for intangible assets. Synthetic and analytical accounting of intangible assets Synthetic accounting of results of intangible assets

Topic 3. ACCOUNTING OF INTANGIBLE ASSETS

2. Synthetic accounting of intangible assets

Intangible assets are accounted for by their types and individual objects on the basis of documents similar to fixed assets (act of acceptance of intangible assets, act of transfer, etc.), the basis for drawing up an act of acceptance are documents such as patents, sales contracts, certificates, etc. .d.

Synthetic accounting of intangible assets is kept on an active account 04 "Intangible assets" at the original cost. The initial cost of intangible assets is the cost of acquisition and creation, including all costs incurred by the organization prior to the transfer of the facility into operation.

All intangible assets are accepted for accounting at their actual (initial) cost, determined as of the date of acceptance for accounting. However, the procedure for determining this value depends on the way the intangible asset is received by the organization.

The initial cost of intangible assets purchased for a fee is determined as the sum of all actual acquisition costs (excluding VAT and other recoverable taxes). The initial cost of intangible assets created by the organization itself is determined as the sum of all actual costs of their creation or manufacture (excluding VAT and other reimbursable taxes).

The initial cost of intangible assets contributed to the account of a contribution to the authorized capital of the organization is determined based on their monetary value agreed by the founders, unless otherwise provided by the legislation of the Russian Federation. The initial cost of intangible assets that are received free of charge is determined based on their market value as of the date of acceptance for accounting.

Intangible assets can be received in the form:

1) contribution to the authorized capital according to the agreed assessment of the founders (D 08 K 75, D 04 K 08);

2) free receipt (D 08 K 98, D 04 K 08, D 98 K 91 as depreciation is charged), for tax purposes are included in taxable profit, are accepted at market value, but not lower than from the transferring party;

To summarize information on the presence and movement of the organization's intangible assets, account 04 "Intangible assets" is intended - the account is active in relation to the balance sheet.

The balance in the debit of the account reflects the presence and value of intangible assets at the beginning of the period. Intangible assets are accepted for accounting on account 04 "Intangible assets" at their original cost.

Acceptance of intangible assets for accounting is reflected in the debit of account 04 "Intangible assets" in correspondence with account 08 subaccount 5 "Investments in non-current assets".

When objects of intangible assets are retired (sale, write-off, transfer free of charge, etc.), their value recorded on account 04 "Intangible assets" is reduced by the amount of amortization accrued during the use (from the debit of account 05 "Amortization of intangible assets"). The residual value of disposed objects is written off from account 04 "Intangible assets" to account 91 "Other income and expenses".

For the objects of intangible assets for which depreciation is taken into account without using account 05 "Depreciation of intangible assets", the accrued amounts of depreciation deductions are written off directly to the credit of account 04 "Intangible assets".

Analytical accounting for account 04 "Intangible assets" is carried out for individual objects of intangible assets. At the same time, the construction of analytical accounting provides the ability to obtain data on the presence and movement of intangible assets necessary for the preparation of financial statements (by type, etc.).

The systematization of accounting data involves the movement of transactions in the accounting accounts by means of double entry. Correspondence of invoices is formed on the basis of primary documents in the program according to typical correspondence. Below are the accounting entries for the movement of intangible assets in Vyatzhilservice LLC.

Table 11 - Accounting entries for the accounting of the accounting program in LLC "Vyatzhilservice" for 2011

The organization acquired the software product on the basis of a copyright agreement for the transfer of non-exclusive rights (in other words, this agreement is often called a license agreement). In this case, the transfer of exclusive rights to the program does not occur (Article 30 of the Federal Law of July 9, 1993 No. 5351-1). The organization only receives for a fee the right to use the program on the same terms as other users. Therefore, the cost of acquiring the program cannot be included in intangible assets.

Expenses for the acquisition of a program, a license, should be recognized as deferred expenses to be written off to current expenses based on the period during which it is planned to use the specified program (Clause 65 of the Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34 "On Approving Regulations on accounting and financial reporting in the Russian Federation ").

Thus, the accounting of the accounting program is not correct.

To obtain summary and detailed information on accounting calculations in the 1C program, standard reports of analytical and synthetic accounting are generated.

The report "Account analysis by subconto" (Appendix H) contains the total amount of correspondences of this account with other accounts for the specified period, as well as account balances at the beginning and end of the period in the context of analytical accounting objects. This report can be generated only for accounts for which analytical accounting is kept.

The register of synthetic accounting is a journal-order (Appendix I). The report contains balances, turnovers on debit and credit in general and in the context of corresponding accounts with various options for summarizing accounting information.

All of the above types of reports are operational. The totals include the turnover sheet, the general ledger.

For accounts for which analytical accounting is maintained, you can get a breakdown of balances and turnovers for specific objects of analytical accounting (subconto). The corresponding report is called the "Account balance sheet" (Appendix K).

The turnover sheet is a report containing all the data necessary to draw up the balance sheet. The turnover sheet shows the balances at the beginning and end of the reporting period, the turnover on debit and credit of each account for the reporting period. General ledger - a report that displays the movement of accounts for the year, grouping this movement by month. The report data contains: opening and closing balance of the account, turnover on debit and credit in general and in the context of offsetting accounts. Actually, the general ledger looks exactly like a journal-order with detailing by month (Appendix L). All information flow using 1C accounting software is given in Appendix M.

Part I. Coursework on the topic "Accounting for intangible assets."

Introduction ………………………………………………………………………… ..3

1. Concept, classification and assessment of intangible assets ..................... 4

2. Documenting the movement of intangible assets ……… .10

3. Synthetic and analytical accounting of the inflow and outflow of intangible assets ………………………………………………………… ..12

4. Accounting for amortization of intangible assets ……………………………… ..17

5. The procedure for accounting for business transactions when granting the right to use intangible assets from organizations - rightholders and rights users …………………………………………………………………………………………………………………………………………………… 27

6. Features of business reputation accounting …………………………………… ... 29

7. Use of intangible assets in the work of Super-Leader LLC ... 31

Conclusion ……………………………………………………………………… 35

Part II. The solution of the problem

Annex 1

Literature ……………………………………………………………………… .36

Introduction.

Before the transition to a market economy, an accounting system was used that met the requirements of the planned economy; its conditions did not provide for the use of intangible assets in practice. Changes in the system of public relations, the need to bring the domestic accounting system in accordance with International Financial Reporting Standards (IFRS) necessitated a corresponding transformation of the accounting system in Russia.

The reform of accounting in Russia is carried out on the basis of the Program for the reform of accounting in accordance with IFRS, approved by the decree of the Government of the Russian Federation of 03/06/1998. No. 283. Currently, Russia has developed and introduced into accounting practice 20 provisions on accounting. "Accounting for intangible assets" - PBU 14/2000. Approved by the order of the Ministry of Finance of the Russian Federation dated 10.16.2000 No. 91n. This provision reflects the main features of the domestic accounting system. There are differences from IAS 38 "Intangible Assets", according to international standards, the concept of intangible assets is more extended than the interpretation in PBU 14.

Many authors, among them both academic economists Polenova S.N., Zakharyin V.R., and practical economists Makarieva V.I., Fomicheva L.P., addressed the issue of accounting for intangible assets after the adoption of PBU 14. comment on the provisions on accounting for intangible assets and provide practical advice.

In my coursework, I wanted to comprehensively consider what intangible assets are, in the modern sense, on the basis of existing legislation, and also study their classification. Analyze various business transactions associated with the use of intangible assets, such as the receipt, disposal, granting of the right to use, as well as the valuation and amortization of intangible assets. I would especially like to touch upon the issue of accounting for business reputation, a relatively new concept in modern economic life.

In the practical part of my work, I will consider accounting for intangible assets, namely a trademark, using the example of the work of Super-Leader LLC: acceptance for accounting, assessment, depreciation, conclusion of a license agreement and disposal of a trademark through its sale.

Concept, classification and assessment of intangible assets.

In accordance with clause 3 of PBU 14/2000 (6, p. 158), intangible assets include property that simultaneously meets the following conditions:

a) does not have a material-material (physical) structure;

b) can be identified (separated, separated) from other property;

c) is intended for use in the manufacture of products, in the performance of work or the provision of services, or for the management needs of the organization;

d) is used for a long time (over 12 months or during a normal operating cycle if it exceeds 12 months);

e) the subsequent resale of this property is not expected;

f) is able to bring economic benefits to the organization;

g) there are duly executed documents confirming the existence of the asset itself and the exclusive rights of the organization to the results of intellectual activity (patents, certificates, etc.).

In accordance with the listed conditions, the following objects of intangible property are classified as intangible assets:

* the exclusive right of the patent holder to an invention, industrial design, utility model;

* the exclusive right of the owner to a trademark and service mark, appellation of origin of goods;

* the exclusive right of the patent holder to selection achievements.

The structure of intangible assets also includes the goodwill of the organization and organizational expenses.

When classifying, the following types of intangible assets can be distinguished:

· Objects of intellectual property;

· Deferred costs;

· Business reputation of the organization.

Intellectual property objects can be divided into two types: regulated by patent law and regulated by copyright.

Patent law protects the content of a work. To protect an invention, utility models, industrial designs, trade names, trademarks, service marks, their registration according to the established procedure in the relevant authorities is required.

Subjects regulated by patent law (industrial property objects). Legal regulation of industrial property objects is carried out by the Patent Law of the Russian Federation, the Law of the Russian Federation "On Trademarks, Service Marks and Appellations of Origin of Goods", as well as by-laws governing the procedure for registration and registration of objects, the amount of duties and other issues (9, p. 181 ).

Invention subject to legal protection if it is new, has an inventive step and is industrially applicable (device, method, substance, strain, microorganism, plant and animal cell cultures) or is a known device or method, but has a new application. A patent for an invention is issued for a period of up to 20 years and certifies the priority of the invention, authorship, as well as the exclusive right to use it.

Industrial model - artistic and design solution of the product, which determines its appearance. Distinctive features of the patentability of an industrial design are its novelty, originality and industrial applicability. A patent for an industrial design is issued for a period of up to 10 years and can be extended for another period of up to 5 years.

Utility model represents the constructive implementation of the component parts. The distinctive features of a utility model are novelty and industrial applicability. Legal protection of a utility model is carried out in the presence of a certificate issued by the Patent Department for a period of up to 10 years and is extended at the request of the patent holder for an additional period of up to 3 years.

The main forms of use of objects protected by patent law are the transfer of rights under a license agreement and the introduction of the object as a contribution to the authorized capital of the organization. A license agreement differs significantly from a purchase and sale and lease agreement, since the patent owner transfers under the license agreement not the invention itself, but only the exclusive right to use it; the patent owner can transfer the right to use the invention to a wide range of third parties and use the invention himself. The cost of objects protected by patents consists of the costs of acquiring them, legal, consulting and other costs.

Trademark and service mark- designations that make it possible to distinguish, respectively, homogeneous goods and services of legal entities or individuals.

Legal protection of a trademark and service mark is carried out on the basis of a certificate from the Patent Office certifying the priority of the trademark, the exclusive right of the owner to the trademark in relation to the goods specified in the certificate. The certificate is issued for a period of 10 years and can be renewed each time for the same period.

Name of the place of origin of goods- the name of a country, settlement or other geographical feature used to designate a product, the special properties of which are exclusively or mainly determined by characteristic or human factors, or both at the same time. Legal protection of an appellation of origin is carried out on the basis of a certificate issued by the Patent Office, issued for a period of 10 years and renewed each time for the same period.

Computer program- an objective form of representation of a set of data and commands intended for the operation of computers and other computer devices. It also includes preparatory materials obtained during the development of the program and audiovisual displays.

Database- an objective form of presentation and organization of a set of data (articles, calculations, etc.), systematized in order to find and process this data.

Integrated Circuits Topology- the spatial-geometric arrangement of the set of elements of the integrated microcircuit and the connections between them fixed on the material carrier.

Agreements on the transfer of property rights to a computer program, database, topology of integrated microcircuits can be registered with the Russian Agency for the Legal Protection of the indicated objects by agreement of the parties. An agreement on the full assignment of all property rights to registered objects is subject to mandatory registration with the Agency.

Deferred costs Are organizational costs.

Organizational expenses consist of the costs of paying for the services of consultants, advertising, preparation of documentation, registration fees and other expenses of the organization during the period of its creation until the moment of registration. The organizational costs included in intangible assets include the costs associated with the formation of a legal entity and recognized in accordance with the constituent documents as the contribution of the participants (founders) to the authorized capital.

The expenses of the organization associated with the need to re-register the constituent and other documents (expansion of the organization, change of activities, submission of samples of signatures of officials, etc.), production of new stamps, seals, etc., are included in the general business expenses of the organization and are reflected in debit account 26 "General expenses". Organizations that change the organizational and legal form, these expenses are made at the expense of the profit remaining at their disposal.

Business reputation of the organization- this is the difference between the purchase price of the organization (as the acquired property complex as a whole) and the book value of its property. When acquiring privatization objects at an auction or through a tender, the business reputation of an organization is determined as the difference between the purchase price paid by the buyer and the estimated (initial) cost of the sold organization.

An item of intangible assets is goodwill, which is considered a premium to the price paid by the buyer in anticipation of future economic benefits.

Negative goodwill is treated as a rebate to the customer and is treated as deferred income.

Valuation of intangible assets. In accounting and reporting, intangible assets are reflected at historical cost. Show separately amortization of intangible assets.

The initial cost is determined for objects:

· Contributions made to the account in the authorized capital (fund), - by agreement of the parties (agreed value);

· Acquired for a fee from other organizations and persons - at the actual costs incurred for the acquisition of objects and bringing them to a state suitable for use;

· Received free of charge from other organizations and persons - at market value as of the date of posting.

The costs of acquiring intangible assets include amounts paid to the seller of the property, intermediaries, for information and consulting services, registration fees and duties, customs expenses and other costs associated with the acquisition of items.

The costs of creating intangible assets and bringing them to a condition suitable for use are made up of the wages accrued to the relevant employees, social deductions, material costs and general production and general business costs.

Intangible assets that enter the organization in exchange for any property are assessed based on the value of the property being exchanged.

The valuation of intangible assets, the cost of which upon acquisition is determined in foreign currency, is carried out in rubles at the exchange rate of the Central Bank of the Russian Federation in effect on the date of acquisition of the object.

The cost of intangible assets, at which they are taken into account, is not subject to change.

Documenting the movement of intangible assets.

The main operations for the receipt of intangible assets in the organization are:

Purchase for a fee;

Creation within the organization itself;

Receipt as a contribution to the authorized (pooled) capital of the organization;

Receipt is free of charge (under a donation agreement), etc.

Regardless of the direction of receipt of intangible assets, the primary documents that formalize the operations of their receipt are:

2) primary documents developed in the organization itself in accordance with the norms of Art. 9 "Primary accounting documents" of the Federal Law "On Accounting" (1, p. 8) and approved by the order of the head on accounting policy:

Acceptance (posting) act of intangible assets;

Certificate of acceptance and transfer of intangible assets, etc.

In these documents, the mandatory details characterizing the object of intangible assets must be its initial cost, the amount of accrued amortization, useful life, inventory number, data of the title of protection (patent, certificate, agreement on the alienation of the exclusive right to the object of intellectual property, etc.).

When intangible assets are disposed of and written off from the balance sheet, the following primary documents are drawn up:

1) the act of acceptance and transfer of the object of fixed assets (except for buildings, structures) form N OS-1;

2) an act on the write-off of an object of fixed assets (except for vehicles) of standard form N OS-4;

3) primary documents developed in the organization itself and approved by the order of the head on accounting policy - the act of disposal (write-off) of an intangible asset.

In addition to the mandatory details stipulated by the Federal Law "On Accounting", these documents must contain data for calculating the financial result from the disposal of the object of intangible assets, with the exception of disposal as a contribution to the authorized (pooled) capital.

The unit of accounting for intangible assets is an inventory item. It is considered a set of rights arising from one patent, certificate, an exclusive right alienation agreement, etc. ...

For each object of intangible assets, the accounting department maintains a Card for accounting for intangible assets of form N IA-1, approved by the Resolution of the State Statistics Committee of Russia dated 10.30.1997 N 71a (17).

A feature of some intangible assets as accounting objects is the need to take measures to protect them. To this end, it is advisable to develop special internal rules for the protection of such objects, providing in them a list of persons entitled to familiarize themselves with them, the obligations of these persons not to disclose relevant information and other necessary information.

Synthetic and analytical accounting of the inflow and outflow of intangible assets.

Synthetic accounting for intangible assets carried out on accounts 04 "Intangible assets", 05 "Depreciation of intangible assets", 19 "Value added tax on acquired values", subaccount 2 "VAT on acquired intangible assets", and account 91 "Other income and expenses".

Account 04 is active, designed to receive information on the presence and movement of intangible assets owned by the organization on the basis of ownership. Accounting for intangible assets on account 04 is carried out in the initial assessment. For some types of intangible assets from account 04, the accrued depreciation on these assets is written off to the expense accounts.

If the organization has several types of intangible assets of significant value, it is advisable to open sub-accounts for each type of assets in accordance with the classification of intangible assets adopted by the organization, for example:

04-1 "Objects of intellectual property";

04-2 "Deferred Costs";

04-3 "Business reputation";

04-4 "Expenses of the organization for research, development and technological work";

04-5 "Other objects".

Account 05 "Depreciation of intangible assets" reflects the accrual and write-off (upon disposal) of amortization for those types of intangible assets for which the repayment of their value is made using account 05.

Expenses for the acquisition and creation of intangible assets relate to long-term investments and are reflected in debit 08 "Investments in non-current assets" from the credit of settlement, material and other accounts. After registering the acquired or created intangible assets, they are reflected in the debit of account 04 "Intangible assets" from the credit of account 08.

The receipt of intangible assets in exchange is also initially reflected on account 08 from the credit of account 60 "Settlements with suppliers and contractors" or 76 "Settlements with various debtors and creditors" with subsequent posting on the debit of account 04 from credit of account 08. Objects transferred in exchange property is written off from the credit of the corresponding accounts (01, 10, 12, 40, etc.) to the debit of sales accounts (90, 91).

Intangible assets contributed by the founders or participants on account of their contributions to the authorized capital of the organization (at the agreed cost) are reflected on account 08. At the same time, the debts of the founders for contributions to the authorized capital are reflected in the debit of account 75 "Settlements with founders" and the credit of account 80 " Authorized capital".

For the value of intangible assets received in the account of a contribution to the authorized capital, accounting entries are made:

Debit 08 Credit 75

Debit 04 Credit 08.

Intangible assets received free of charge are credited to the debit of account 08 "Investments in non-current assets" from the credit of account 98 "Deferred income", subaccount 98-2 "Gratuitous receipts". From account 08 the initial cost of intangible assets is written off to account 04 "Intangible assets". The cost of intangible assets received free of charge, accounted for on subaccount 98-2, is subsequently written off monthly in the amount of accrued depreciation deductions for the object on the credit of account 91 "Other income and expenses".

When buying an organization, investments in the acquired non-current assets are reflected in the debit of account 08 "Investments in non-current assets" and the credit of account 76 "Settlements with various debtors and creditors". A positive goodwill is recorded in the debit of account 04 "Intangible assets" from the credit of account 08. A negative goodwill is reflected in the credit of account 98 "Deferred income".

Organizations pay VAT on acquired intangible assets at established rates. The procedure for further reflection of VAT transactions depends on the purpose of intangible assets, the type of organization.

In accordance with the Tax Code of the Russian Federation, VAT on acquired intangible assets is accounted for in accordance with the generally established procedure according to the debit of account 19 (9, page 187), subaccount "VAT on acquired intangible assets", in correspondence with the credit of accounts 60 and 76. Monthly after registration intangible assets the amount of VAT is debited from the credit of account 19 to the debit of account 68 "Calculations of taxes and fees".

For non-refundable intangible assets received, taxable profit is increased by the value of the assets received, but not lower than their residual value held by the transferring organization.

The main types of disposal of intangible assets are their sale, write-off due to unsuitability, gratuitous transfer, transfer of intangible assets as a contribution to the authorized capital of other organizations. When intangible assets are disposed of as a result of their sale, write-off, or gratuitous transfer, the entire amount of accumulated amortization is debited from the credit of account 04 "Intangible assets". The residual value of intangible assets is written off from account 04 to the debit of account 91 "Other income and expenses". The debit of account 91 also writes off all costs associated with the disposal of intangible assets, and the amount of VAT on sold and donated intangible assets. The credit of account 91 reflects the amount of proceeds from the sale or other income from the disposal of intangible assets.

The financial result from the disposal of intangible assets is formed on account 91 and then debited from account 91 to account 99 “Profits and losses”. In this case, if the amount of proceeds from the sale of intangible assets exceeds their residual value and the costs associated with disposal, then the difference is written off to the debit of account 91 and the credit of account 99. If the residual value of the disposed intangible assets is not reimbursed by proceeds from their sale, then the difference between them are written off from the credit of account 91 to the debit of account 99.

In case of gratuitous transfer of intangible assets, the payer of VAT is the transferring party (the receiving party pays income tax). Taxable turnover is determined based on the average selling price (excluding VAT), but not less than the residual value of intangible assets.

When intangible assets are transferred as a contribution to the authorized capital of other organizations, the residual value is written off from the credit of account 04 to the debit of account 58 "Financial investments". The amortization amount for the transferred intangible assets is debited to account 05 from the credit of account 04.

The excess of the agreed value over the residual value for the transferred intangible assets is reflected in the debit of account 58 and credit of account 91 "Other income and expenses". The inverse difference is accounted for on the debit of account 91 and credit of account 58.

A friend who has contributed intangible assets as a contribution under a joint venture agreement also reflects them as part of financial investments. However, measures intangible assets at residual value and not at agreed value.

On account 04 "Intangible assets" the expenses of the organization for R&D are separately taken into account, the results of which are used for the production or management needs of the organization.

The indicated expenses are accepted for accounting on account 04 in the amount of actual costs, while account 04 is debited in the correspondence of account 08 "Investments in non-current assets".

From account 04 "Intangible assets" R&D expenses are written off to the debit of accounts 20 "Main production", 26 "General business expenses" or other accounts for accounting for production costs.

R&D expenses are written off in one of the following ways:

· Linear;

· In proportion to the volume of products (works, services), which is supposed to be obtained for the entire period of application of the R&D results.

The period for writing off R&D expenses is determined by the organization independently, based on the expected period of use of R&D. The deadline for writing off these expenses is set at five years and cannot exceed the period of the organization's activity. In tax accounting, R&D expenses must be written off within three years.

R&D expenses are written off from the 1st day of the month following the month in which the application of the R&D results was started. Write-off of expenses for these works is carried out evenly in the amount of 1/12 of the annual amount, regardless of the chosen method of writing off expenses.

In case of termination of the use of R&D results, the remaining part of expenses is written off from account 04 for non-operating expenses (account 91 "Other expenses and income").

Analytical accounting on account 04 "Intangible assets" is kept on separate objects of intangible assets, as well as by types of R&D expenses. At the same time, analytical accounting should provide the ability to obtain data on the presence and movement of intangible assets, as well as the amount of expenses for research, development and technological work.

Analytical accounting of intangible assets is carried out in the card for accounting for intangible assets. The card is used to record all types of intangible assets. It opens for each object separately.

The front side of the card indicates the full name and purpose of the object, the initial cost, useful life, the rate and amount of accrued depreciation, the date of registration, method of acquisition, registration document and basic information on the disposal of the object (number and date of the document, reason for disposal, the amount of proceeds from sales). The back side of the card contains the characteristics of the object of intangible assets.

Accounting for amortization of intangible assets.

The rules and methods for calculating amortization for intangible assets are established by the Regulations for Accounting and Financial Reporting in the Russian Federation and PBU 14/2000 "Accounting for Intangible Assets".

The purpose of depreciation is to pay off their cost over a specified useful life.

The cost of patents and certificates, exclusive rights by means of depreciation is not redeemed:

1) if the objects of intellectual property belong to non-profit organizations (clause 56 of the Regulations for the maintenance of accounting and financial reporting in the Russian Federation) (3, p. 33);

2) if exclusive rights to intellectual property objects belong to other organizations, but are used by the organization as a result of the granting by the rightholder of non-exclusive rights under license agreements, commercial concession agreements, etc. and are recorded on off-balance sheet accounts.

In accordance with regulatory documents, the main rules for calculating amortization of intangible assets are as follows.

1. Depreciation deductions are calculated and presented in the accounting regardless of the results of the organization's activities.

2. Depreciation deductions are reflected in the accounting of the reporting period (month, quarter, year) to which they relate.

3. Accrual of depreciation is carried out during the entire useful life of the object, without stopping, except in cases of conservation of the organization.

4. Depreciation begins to accrue from the first day of the month following the month of accepting the object for accounting, until the cost of intangible assets is fully paid off or discarded.

5. Depreciation on intangible assets ceases to be calculated and shown in accounting from the first day of the month following the month when their value is fully repaid or retired.

6. During the reporting period, depreciation deductions for such objects are charged monthly in the amount of 1/12 of the annual amount, except for cases when depreciation is calculated by writing off the cost in proportion to the volume of production.

7. In seasonal industries, the annual amount of depreciation deductions is calculated evenly during the period of the organization's work in the reporting year.

8. Amortization of the organization's business reputation is charged over twenty years (but not more than the period of the organization's activity).

9. Depreciation deductions for organizational expenses are reflected in the accounting by an even decrease in the initial cost over twenty years (but not more than the term of the organization).

In accounting, the accrued depreciation is included in the cost of goods, works, services and distribution costs for the sale of goods.

The amount of amortization deductions upon redemption of the value of patents and certificates is determined by their useful life. The useful life of exclusive rights to the results of intellectual activity is the expected life of the object, during which the organization can receive economic benefits (income) (clause 17 of PBU 14/2000 "Accounting for intangible assets") (6, p. 162). It is determined by the organization independently on the date of putting the facility into operation.

The application for the calculation of depreciation of an intellectual property object of its expected life, established by clause 17 of PBU 14/2000 "Accounting for intangible assets", will include the useful life of such an asset, stipulated by the relevant contracts.

According to the norms of clause 15 of PBU 14/2000 "Accounting for intangible assets" (6, p. 161), an organization has the right to apply one of the following methods of depreciation for groups of homogeneous objects of intangible assets, fixing them in the order of the head of the organization on accounting policy for accounting purposes :

* linear method;

* method of decreasing balance;

* method of writing off the cost in proportion to the volume of products (works, services).

To calculate the annual amount of depreciation charges in the linear method, data on the initial cost of the object and the useful life are used.

To calculate the annual amount of depreciation in the diminishing balance method, information on the residual value of the object and its useful life is used.

The method of writing off the cost in proportion to the volume of products (works, services) is based on calculations made on the basis of data on the initial cost of the object and the estimated (planned) volume of products (works, services) for the entire period of useful use of the object.

The initial cost of an object of intangible assets, when amortization is calculated by the write-off method in proportion to the volume of products (works, services), can be included in the organization's expenses or distribution costs only during the useful life established on the basis of data on the total planned production volume during the operation of intangible assets and volume production per month. Therefore, if during the useful life of the object a smaller volume of products (works, services) is produced than it was planned before the start date of depreciation, then part of its cost will remain unamortized, which will affect the financial results of the organization. The under-depreciated cost of objects will be paid off at the expense of profit and shown in accounting as other expenses on the debit of account 91 "Other income and expenses", subaccount 2 "Other expenses".

In the production of products (works, services) in volumes exceeding the planned, after the write-off of the entire value of the objects, the depreciation should be stopped.

For each item of intangible assets, the organization should apply only one of the methods of depreciation. It is determined at the time the object is registered and does not change during the entire period of its useful life or until the object is disposed of.

With the straight-line method and the method of diminishing balance, for the calculation of depreciation, it is necessary to take into account the useful lives of the objects. In accordance with the norms of clause 17 of PBU 14/2000 "Accounting for intangible assets", this period is determined at the time the object is accepted for accounting on the basis of:

The validity period of the patent, certificate and other restrictions on the useful life in accordance with the legislation of the Russian Federation;

The expected life of the facility, during which the organization can receive economic benefits (income).

In addition, for certain types of intangible assets, the useful life is determined based on the quantity of products or other natural indicator of the volume of work, services expected to be received as a result of their use.

In practical work, the useful life can be determined:

Expert way;

Based on documents confirming the transfer of exclusive rights to the results of intellectual activity.

If it is impossible to determine the useful life of the object, the rate of depreciation is set for 20 years, but not more than the period of the organization's activity (clause 17 of PBU 14/2000 "Accounting for intangible assets", clause 56 of the Regulations on accounting and financial reporting In Russian federation).

The depreciation rate is a percentage of the initial cost of an object of intangible assets that is to be attributed to the cost of production or distribution costs, i.e. inclusion in the structure of expenses for the ordinary activities of the organization (clause 8 of PBU 10/99 "Expenses of the organization", approved by Order of the Ministry of Finance of Russia dated 06.05.1999 N 33n (as amended on 27.11.2006 N 156n)) (5, p. 131) ...

The straight-line method and the diminishing balance method are characterized by straight-line depreciation during the reporting year. In seasonal production, the amount of depreciation by objects for the year is first calculated, and then it is evenly distributed over the period of operation of the organization in the reporting year.

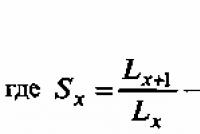

With the method of calculating depreciation in proportion to the volume of products (works, services), depreciation is calculated based on the natural indicator of the volume of products (works, services) in the reporting period and the ratio of the initial value of the object of intangible assets and the estimated volume of products (works, services) for the entire useful life of this object. Thus, the amount of depreciation for any period can be calculated using the formula:

where A is the amount of depreciation for the reporting period;

N is the rate of depreciation deductions (17).

In turn, the rate of depreciation is calculated using the formula:

where S is the initial cost of the intellectual property object;

V is the estimated volume of products (works, services) for the entire useful life of the object (17).

Depreciation charges of intangible assets can be reflected in accounting in two ways (clause 21 PBU 14/2000 "Accounting for intangible assets") (6, p. 163):

By accumulating the corresponding amounts in a separate account;

By reducing the initial cost of intellectual property.

To account for depreciation in the first way (accumulation of depreciation amounts), synthetic account 05 "Depreciation of intangible assets" is used. Analytical accounting of depreciation is organized for each object.

Accounting for depreciation in the second way by reducing the initial cost is kept on the synthetic account 04 "Intangible assets" for individual objects.

The chosen option for accounting for depreciation should be fixed in the accounting policy of the organization.

In the first method, the monthly accrued depreciation amounts are reflected in the accounting entry:

If, for some reason, depreciation on objects has not been accrued, if an error is found in the records, correction is made in the period when they were identified:

Credit account 05 "Amortization of intangible assets".

The amounts of the correction referred to account 91 "Other income and expenses" are included in the structure of other expenses of the organization.

Write-off of the amount of accrued depreciation on retired objects of intangible assets (as a result of sale, gratuitous transfer under a gift agreement, under an exchange agreement, write-off, transfer to the authorized (pooled) capital, etc.) is recorded on the accounts by correspondence:

Debit of account 05 "Amortization of intangible assets"

Credit account 04 "Intangible assets", subaccount "Disposal of intellectual property".

In the second method, when, according to the accounting policy, for the purposes of accounting for the depreciation of objects, account 05 "Depreciation of intangible assets" is not used, its accrual reduces their initial value by an entry on the debit of the accounts of production costs and selling expenses and credit of account 04 "Intangible assets":

The debit of account 20 "Main production", 25 "General production costs", 26 "General business expenses", 44 "Selling expenses", 08 "Investments in non-current assets", 29 "Service industries and farms", 79 "On-farm settlements", 97 "Deferred expenses", etc.

In this case, the amount of accrued depreciation reduces the initial cost of objects.

When depreciation is calculated by reducing the original cost of intangible assets, then after its full repayment, the objects continue to be listed in the accounting records. A similar situation arises:

1) if the useful life of intangible assets in the organization is less than the legal term of the right to a patent, certificate;

2) if the organization, in accordance with the legislation, extends the term of the patent.

In practice, a situation is possible when the legal term of the exclusive right to an object of intangible assets is longer than its useful life established in the accounting policy for accounting purposes (for example, when the object is used to perform specific services, works, manufacture of certain products), and the method of depreciation used is by decreasing the original cost. Then from the moment of full repayment of the initial cost of the object in the organization until the end of its useful life, it will also be included in the contingent valuation.

At the end of the legal term of the patent or certificate, the amount of the conditional valuation of the intellectual property object is written off to the financial results:

Debit of account 91 "Other income and expenses", subaccount 2 "Other expenses"

Credit account 04 "Intangible assets".

To calculate depreciation for intellectual property objects, a monthly statement of depreciation of intangible assets is used.

Accounting for the disposal of intangible assets in all areas, except for the contribution to the authorized (pooled) capital of a third-party organization, is made to account 04 "Intangible assets", subaccount "Disposal of intangible assets". The result of the reflection of these transactions is the identification of the financial result for them.

When, in the accounting policy of the transferring party, the accounting for the amortization of intangible assets is kept on account 05 "Amortization of intangible assets", the financial result from their transfer is revealed as follows.

4. The initial cost of the retired object is written off:

Debit of account 04 "Intangible assets", subaccount "Disposal of intangible assets"

Credit account 04 "Intangible assets".

2. The amount of accrued depreciation is written off:

Debit of account 05 "Amortization of intangible assets"

3. The amount of the residual value of the object is reflected in the structure of other expenses of the organization:

Debit of account 91 "Other income and expenses", subaccount 2 "Other expenses"

Credit account 04 "Intangible assets", subaccount "Disposal of intangible assets".

4. Value added tax on the value of the retiring object:

Debit of account 91 "Other income and expenses", subaccount 2 "Other expenses"

Credit account 68 "Calculations for taxes and fees", subaccount "Calculations for VAT".

When intangible assets are disposed of under an exclusive right alienation agreement (as a result of its sale), the accounting under it is made as follows:

Revenue amount:

Account debit 62 "Settlements with buyers and customers"

Credit account 91 "Other income and expenses", sub-account 1 "Other income";

Financial result (profit):

Debit of account 91 "Other income and expenses", subaccount 9 "Balance of other income and expenses"

Credit account 99 "Profits and losses".

Disposal of intangible assets free of charge under a gift agreement leads to a loss:

Debit account 99 "Profit and loss"

Credit to account 91 "Other income and expenses", sub-account 9 "Balance of other income and expenses".

The disposal of objects on account of contributions to the authorized (pooled) capital is considered in the accounting as long-term financial investments in account 58 "Financial investments", subaccount 1 "Shares and shares".

The following record is made on the amount of depreciation accrued on the objects transferred to the account of deposits:

Debit of account 05 "Amortization of intangible assets"

Credit account 04 "Intangible assets".

The residual value of intangible assets is written off:

Debit of account 58 "Financial investments", subaccount 1 "Shares and shares"

Credit account 04 "Intangible assets".

When, in the accounting policy of the transferring party, the accounting for the amortization of intangible assets is kept on account 04 "Intangible assets", when calculating the financial result from the transfer of objects, only the residual value of the transferred objects of intangible assets is reflected in the accounting.

The procedure for accounting for business transactions when granting the right to use intangible assets from organizations - rightholders and rights users.

Exclusive rights to intellectual property objects are confirmed by documents of title (patents, certificates, etc.) issued by the Russian Agency for Patents and Trademarks (Rospatent). Owning these rights, the rightholder has unlimited possibilities to dispose of them: to use them in his activities, to transfer exclusive rights to a new owner, to transfer non-exclusive rights to use objects of intangible assets to other legal entities or individuals.

The transfer to a new owner of exclusive rights to an intellectual property object is formalized by an agreement on the assignment of rights, according to which the party accepting the exclusive rights becomes the rightholder.

An entity assigning its exclusive rights reflects the disposal of the corresponding intangible asset for its sale. The residual value of the object is debited from the credit of account 04 to the debit of account 91, the amount of depreciation on the transferred object - to the debit of account 05 from the credit of account 04, the amount of VAT on the object - to the debit of account 91 and credit of account 68 "Calculations of taxes and fees".

Income received from the assignment of exclusive rights to objects of intangible assets are recognized as operating income, the profit received is reflected in the debit of account 91 and credit of account 99 “Profits and losses”.

When transferring the right to use objects of intangible assets to other legal entities or individuals, non-exclusive rights are transferred; exclusive rights remain with the owner of intangible assets. The transfer of these rights is formalized by a license agreement, according to which one party (the licensor) allows the other party (the licensee) to use the object of intangible assets on the terms specified in the agreement.

When the right to use objects of intangible assets is transferred, they remain on the balance sheet of the owner. The transfer of rights to objects is reflected by entries on the corresponding sub-accounts or analytical accounts on account 04.

For the granted right to use intangible assets, the licensee either pays the licensor a one-time fee (“lump-sum payment”), or makes periodic payments (“royalties”) during the entire period of use of the relevant object.

The procedure for accounting for income from a licensor depends on the areas of its activities. If the licensor has the granting of rights to use objects of intangible assets as the main activity, then the accrual of a one-time remuneration or periodic payments is drawn up with an accounting entry:

Debit of account 76 "Settlements with different debtors and creditors"

Credit account 90 "Sales", subaccount 1 "Revenue"

In the event that the granting of these rights is not the subject of the licensor's activities, the accrued remuneration or periodic payments are reflected in the debit of account 76 and credit of account 91 "Other income and expenses".

The amount of accrued depreciation on the corresponding objects of intangible assets in the first case is charged to the accounts for accounting for the costs of core activities, and in the second case - to the debit of account 91.

The licensee's intangible assets received for use are accounted for off the balance sheet in the assessment specified in the license agreement.

The accrual of a one-time remuneration for the granted right to use the objects of intangible assets is reflected in the debit of account 97 "Prepaid expenses" and the credit of account 76. During the term of the license agreement from account 97, expenses are written off evenly to accounts for accounting for production costs. Periodic payments under the license agreement are monthly written off to the accounts of production costs from the credit of account 76.

Features of accounting for business reputation.

Business reputation organization is the difference between the purchase price of the organization (as the acquired property complex as a whole) and the cost of all its assets and liabilities according to the balance sheet. Wherein positive the entity's reputation should be viewed as a premium to the price paid by the customer in anticipation of future economic benefits and should be accounted for as a separate inventory item.

It is sometimes believed that the business reputation of an organization is due to beneficial business contacts, favorable relationships between its employees and a high reputation among clients, which, in turn, is determined by the favorable location of the organization, monopoly privileges, highly qualified administration and other factors.

The amount of the excess of the price for which the operating organization can be sold over the total value of all assets is the payment for these intangible values of the organization, which were created by its previous owners. This approach assumes that this amount can be accounted for as a separate asset of the organization.

For accounting purposes, the value of the acquired goodwill of the organization is taken as the difference between the amount paid to the seller for the organization and the sum of all assets and liabilities on the balance sheet of the organization as of the date of its purchase (acquisition). When acquiring privatization objects at an auction or through a tender, the business reputation of an organization is the difference between the purchase price paid by the buyer and the estimated (initial) value of the sold organization.

Negative the business reputation of the organization should be considered as a discount on the price provided to the buyer due to the lack of factors of stable customers, reputation for quality, marketing and sales skills, business relationships, management experience, staff qualifications, etc., and accounted for as deferred income ...

In the Letter of the Ministry of Finance of Russia dated December 23, 1992 N 117 "On the reflection in accounting and reporting of operations related to the privatization of enterprises" (13), a procedure was established for reflecting the difference in the acquisition of an enterprise as a whole at a price different from the estimated (initial) value of its property ...

Based on subsection 3 "Procedure for accounting for property sold at auction or competition" of this Letter, the following conclusions can be drawn.

When selling objects of privatization at an auction (when buyers are not required to fulfill any conditions in relation to the object of privatization) or through a tender (when buyers are required to fulfill certain conditions or implement investment programs in relation to the object of privatization), ownership of them passes to to the highest bidder.

If an enterprise is acquired at a price different from the estimated (initial) value of its property, the difference is reflected in the following order.

In the event that the purchase price exceeds the estimated (initial) value, the property is credited at the estimated (initial) value on the debit of their respective accounts from the cash accounting credit in the amount of redemption costs. The amount of the excess is reflected as intangible assets on the debit of account 04 "Intangible assets" (subaccount "The difference between the purchase price and the assessed value" or "Business reputation of the organization." ) value with reflection on the debit of their accounting accounts and credit of cash accounts (in the amount of redemption costs) and account 98 "Deferred income" (subaccount "The difference between the purchase price and the assessed value of the property" or "Business reputation of the organization") in the amount of excess of the estimated (initial) cost over the purchase price.

It is forbidden to include in the composition of intangible assets the intellectual and business qualities of the organization's personnel, their qualifications and ability to work, since they cannot be separated from their carriers and cannot be used without them, while intangible assets can be separated, separated from another property.

Use of intangible assets in the work of Super-Leader LLC.

Super-Leader LLC supermarket chain ordered the development of the design of its Bag logo design bureau. The cost of services is 23,600 rubles, including VAT - 3,600 rubles. It was decided to register the logo as a trademark. The services of a patent attorney for registering a trademark with Rospatent cost 1,770 rubles, including VAT - 270 rubles. The fees for the registration of the trademark amounted to 18,500 rubles.

The accountant of Super-Leader LLC made the following entries:

Debit 08 subaccount "Acquisition of intangible assets" Credit 60

RUB 21,500 ((23 600 - 3600) + (1770 - 270)) - the cost of services of a design bureau and a patent attorney is reflected;

Debit 19 Credit 60

RUB 3870 (3600 + 270) - input VAT on services of a design bureau and patent attorney is taken into account;

Debit 08 subaccount "Acquisition of intangible assets" Credit 76

RUB 18,500 - fees for registration of a trademark are taken into account;

Debit 60 Credit 51

RUB 25,370 (23 600 + 1770) - paid for services for the development and registration of a trademark;

Debit 76 Credit 51

RUB 18,500 - the duties have been paid to Rospatent;

Debit 04 Credit 08 subaccount "Acquisition of intangible assets"

RUB 40,000 (21,500 + 18,500) - the registered trademark is included in intangible assets.

VAT paid for services for the manufacture and registration of a trademark can be deducted by the store after registering an intangible asset:

Debit 68 subaccount "Calculations for VAT" Credit 19

RUB 3870 - the amount of input VAT is accepted for deduction.

Super-Leader LLC entered into a two-year license agreement in October 2004 for the use of its trademark by another store. Under this agreement, OOO Super-Leader receives 118,000 rubles. (including VAT - 18,000 rubles) in equal monthly installments over two years.

The residual value of the trademark is 36,666.7 rubles. The monthly amortization of the trademark is RUB 333.33. Depreciation is charged on a linear basis. The order on accounting policy established that the accrual of depreciation on intangible assets is carried out on account 05.

An entity determines income and expenses on an accrual basis.

The following entries were made in the accounting records of the licensor.

In October 2004:

Debit 04 subaccount "Trademark granted for use" Credit 04 subaccount "Trademark"

RUB 36,666.7 - the trademark was transferred for use.

Debit 51 Credit 62

RUB 4916.67 (118,000 rubles: 24 months) - royalty received from the licensee for the use of the right to a trademark;

RUB 4916.67 - the received monetary funds are reflected in the structure of other income;

750 RUB (4916.67 rubles: 118% х 18%) - VAT charged on royalties;

Debit 91 subaccount "Other expenses" Credit 05 subaccount "Amortization of the trademark transferred for use"

RUB 333.33 - depreciation was charged on the trademark transferred under the license agreement.

LLC "Super-Leader" after two years of granting a non-exclusive right to use a trademark to another store decided to sell him the exclusive right to it. The initial cost of the right to a trademark was 40,000 rubles. Depreciation was charged using account 05. The total amount of accrued depreciation was:

(40,000 rubles - 36,666.7 rubles) + 333.33 rubles. x 24 months = 11 333.22 rubles.

Under the agreement, the buyer paid 35,400 rubles for the exclusive right to the trademark. (including VAT - 5400 rubles).

The following entries were made in the accounting records of Super-Leader LLC:

Debit 04 subaccount "Disposal of intangible assets" Credit 04 subaccount "Trademark"

RUB 40,000 - the initial cost of the exclusive right to a trademark has been written off;

Debit 05 subaccount "Trademark amortization" Credit 04 subaccount "Disposal of intangible assets"

RUB 11,333.22 - the amount of accrued depreciation has been written off;

Debit 62 Credit 91 subaccount "Other income"

35 400 rub. - reflects the proceeds from the sale of the exclusive right to a trademark;

Debit 91 subaccount "VAT" Credit 68 subaccount "Calculations for VAT"

RUB 5400 - VAT was charged on the exercise of the exclusive right to a trademark;

Debit 91 subaccount "Other expenses" Credit 04 subaccount "Disposal of intangible assets"

RUB 28,666.78 (40,000 - 11,333.22) - the residual value of the exclusive right to a trademark was written off;

Debit 91 subaccount "Balance of other income and expenses" Credit 99

RUB 1333.22 (35 400 - 5400 - 28 666.78) - the profit from the operation is reflected.

Conclusion.

In my work "Accounting for intangible assets" was considered a fairly new topic for our modern economic life. It is now, with the development of the market economy, the great importance of information in our life, have acquired the intangible assets of organizations. A trademark and business reputation of a company can sometimes be worth much more than the property of the company. A lot of firms are currently operating not in material form, but in the information sphere, in the field of scientific and technical developments. For them, intangible assets play a major role in organizing the conduct of business.

On the basis of the current legislation, I considered various ways of accepting and disposing of intangible assets, the documents with which synthetic and analytical accounting of the movement of intangible assets is carried out, and various methods of calculating amortization on intangible assets.

On the example of the Super-Leader LLC supermarket chain, the registration and valuation of the store's trademark were considered, the method was chosen and depreciation was calculated for this type of intangible assets, the granting of the right to use the trademark under a license agreement was shown, as well as the disposal of the intangible asset in connection with its sale.

Modern PBU "Accounting for Intangible Assets" 14/2000 contradict individual regulatory legal acts, namely, the Regulation on accounting and financial reporting in the Russian Federation. Also, in connection with the entry into force of part four of the Civil Code of the Russian Federation from January 2008, the norms of which will finally settle the issues of legal support for the use of intellectual property results in the conduct of business by business entities, the Ministry of Finance of the Russian Federation will have to amend certain provisions of the existing PBU.

LITERATURE.

1. Civil Code of the Russian Federation. Parts I and II. - M .: Prospect, 1998.

2. Federal Law “On Accounting” dated November 21, 1996, No. 129-FZ (as amended on November 3, 2006). // 22 provisions on accounting. - M .: Eksmo, 2007.

3. Regulations on accounting and financial reporting in the Russian Federation. Approved by order of the Ministry of Finance of the Russian Federation of July 29, 1998 N 34n (as amended on March 26, 2007). // 22 provisions on accounting. - M .: Eksmo, 2007.

4. Chart of accounts for accounting of financial and economic activities of the organization and Instructions for its use. Approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000. No. 94n. // Comments on the new Chart of Accounts. - M .: Information Agency "IPB-BINFA", 2001.

5. Regulation on accounting "Expenses of the organization" PBU 10/99. Approved by order of the Ministry of Finance of the Russian Federation of 05/06/1999 N 33n (as amended on 11/27/2006). // 22 provisions on accounting. - M .: Eksmo, 2007.

6. Regulation on accounting "Accounting for intangible assets" PBU 14/2000. Approved by order of the Ministry of Finance of the Russian Federation of October 16, 2000 N 91n (as amended on November 27, 2006). // 22 provisions on accounting. - M .: Eksmo, 2007.

7. Accounting: Textbook / A.S. Bakaev, P.S. Bezrukikh, N. D. Vrublevsky and others / Ed. P.S. Handless. - 4th ed., Rev. and add. - M .: Accounting, 2002 .-- 625 p.

8. Financial accounting: a textbook for universities / Ed. prof. Yu.A. Babaeva. - M .: University textbook, 2003 .-- 525 p.

9. Kondrakov N.P. Accounting: Textbook. allowance. - 5th ed., Rev. and add. - M .: INFRA-M, 2007. - 717 p.

10. Bazarova A.S. Intangible assets. // "Tax Bulletin", 2005, N 7.

11. Zakharyin V.R. Features of accounting for objects of intangible assets in 2007.// "Financial and accounting consultations", 2007, N 6.

12. Lyublinskaya Ya.E. Trademark. // "Chief accountant". Application "Accounting in trade", 2004, N 4.

13. Makarieva V.I. Intangible assets. // "Tax Bulletin", 2001, N4.

14. Musina A. Costs of obtaining a trademark. // "Financial newspaper. Regional issue", 2005, N 17.

15. Orlova E.V. Corporate identity of the organization: accounting and tax accounting. // "Tax Bulletin", 2003, N 9, 10.

16. Polenova S.N. Accounting for the acquisition and granting of rights to use objects of intellectual property. // "Accounting", 2003, N 18.

17. Polenova S.N. Intangible assets: recognition and accounting. // "Everything for an accountant", 2007, N 10.

18. Semenova M.V. Trademarks: accounting and taxation. // "Russian tax courier", 2005, N 22.

19. Fomicheva L.P. Trademarks: receipt, accounting and use. // "Consultant", 2004, N 12.

20. Sharonova E. Commentary on the Accounting Regulations "Accounting for Intangible Assets" PBU 14/2000. // "AKDI" Economics and Life ", 2001, N1.

Definition 1

Under intangible assets(Intangible assets) understand objects of long-term use that do not have material content, but have a value estimate and generate income for the organization.

According to RAS and financial statements of the Russian Federation, intangible assets include rights arising from:

- from copyright and other agreements on works of science, literature, art and objects of related rights;

- from patents for inventions, industrial designs, selection research;

- from the rights to know-how;

- from model certificates, trademarks and service marks or licensed agreements for their use;

- from the rights to purchase brokerage places, or the right to use brokerage places;

- rights to use natural resources, land.

Remark 1

Accounting for intangible assets is carried out in the context of types and individual objects, based on the documents: the act of acceptance of intangible assets, the act of transfer and others. The basis for drawing up acts of acceptance are patents, sales contracts, certificates and other documents of title.

Synthetic accounting for intangible assets maintained on an active account $ 04 $ "Intangible Assets" at the original cost of the asset. The initial cost of intangible assets consists of the cost of acquisition and creation, including all costs incurred by the organization prior to the transfer of the facility into operation.

Picture 1.

Intangible assets are accepted for accounting at their actual initial cost. The cost is determined as of the date of acceptance for accounting. The way in which the value is determined depends on the way in which the intangible asset entered the company.

The initial cost of intangible assets acquired by an organization for a fee is added up as the sum of all acquisition costs incurred, net of VAT and other recoverable taxes.

The initial cost of intangible assets created by the organization is equal to the sum of all actual costs of their creation or manufacture minus VAT and other recoverable taxes.

The initial cost of intangible assets that were contributed to the account of a contribution to the authorized capital of the company is determined based on their monetary value approved by the founders, unless otherwise provided by the legislation of the Russian Federation. The initial cost of intangible assets received free of charge is equal to their market value as of the date of their acceptance for accounting. The receipt of intangible assets can be carried out:

in the form of a contribution to the authorized capital according to the approved assessment of the founders and reflected by entries:

- Credit $ 75 $ "Settlements with founders"

in the form of a gratuitous receipt and is reflected by postings:

- Debit $ 08 $ "Investments in non-current assets"

- Credit $ 98 $ "Deferred income"

- Debit $ 04 $ "Intangible assets"

- Credit $ 08 $ "Investments in non-current assets"

- Debit $ 98 "Deferred income"

- Credit $ 91 $ "Other income and expenses".

as an acquisition and is reflected in the accounting by posting:

- Debit $ 08 $ "Investments in non-current assets"

- Credit $ 60 $ "Settlements with suppliers and contractors"

- Debit $ 19 $ "VAT on purchased values"

- Credit $ 60 $ "Settlements with suppliers and contractors."

in the form of development on its own and is reflected in the accounting entry:

- Debit $ 08 $ "Investments in non-current assets"

- Credit $ 10 $, $ 70 $, $ 69 $, $ 76 $ ...

- Debit $ 04 $ "Intangible assets"

- Credit $ 08 $ "Investments in non-current assets".

in the form of bringing intangible assets to the requirements of operation is reflected by postings:

- Debit $ 08 $ "Investments in non-current assets"

- Credit $ 70 $, $ 69 $, $ 76 $ ...

- Debit $ 04 $ "Intangible assets"

- Credit $ 08 $ "Investments in non-current assets".

Analytical accounting of intangible assets kept in the intangible assets accounting card. A card is opened for each object separately. The front side of the card reflects the full name and purpose of the object, the initial cost of the asset, useful life, the rate and amount of accrued depreciation, the date of intangible assets registration, the method of acquiring the object, the number and date of the document-basis for registration, the reason for disposal, the amount proceeds from the sale of an asset. On the reverse side of the card, the characteristics of the intangible asset are described.

Intangible assets are used in economic activities for a long time and monthly their value is transferred to manufactured products, work performed and services rendered.

The mechanism of the gradual transfer of the value of intangible assets to the finished product and the accumulation of a cash fund to replace intangible assets is called amortization.

The amortization charge is calculated at the rates established based on the initial cost and useful life of the asset. If it is not possible to establish the term, then the depreciation rates are calculated based on the ten-year service life of intangible assets, but no more than the end of the actual use of intangible assets, depreciation is not charged on them.

It is logical to start the accrual of depreciation from the first day of the month that follows the month the intangible assets were put into operation and stop from the first day following the month of the asset retirement.

Remark 2

To summarize information on the accumulated depreciation charges for intangible assets for which the cost is repaid, a passive account $ 05 $ "Depreciation of intangible assets" is intended.

The monthly amount of depreciation accrued on intangible assets according to the norms, the organization includes in production costs and is reflected in the debit of accounts of $ 20, $ 25, $ 26, $ 97, $ 44 and credit of the account $ 05.

- the exclusive right of the patent holder to an invention, industrial design, utility model;

- exclusive copyright for computer programs, databases;

- property right of the author or other rightholder to the topology of integrated circuits;

- the exclusive right of the owner to a trademark and service mark, appellation of origin of goods;

- the exclusive right of the patentee to selection achievements.

The structure of intangible assets also includes the goodwill of the organization and organizational expenses.

Organizational expenses consist of the costs of paying for the services of consultants, advertising, preparation of documentation, registration fees and other expenses of the organization during the period of its creation until the moment of registration.

It should be noted that the organizational costs included in intangible assets include costs associated with the formation of a legal entity and recognized in accordance with the constituent documents as the contribution of participants (founders) to the authorized capital.

The expenses of the organization associated with the need to re-register the constituent and other documents (expanding the organization, changing the types of activities, submitting samples of signatures of officials, etc.) for the manufacture of new stamps, seals, etc., are included in the general business expenses of organizations and are reflected in the debit of the account 26 "General expenses". Organizations that change the organizational and legal form, these expenses are made at the expense of profits.

The goodwill of an organization is the difference between the purchase price of the organization (as an acquired property complex as a whole) and the book value of its property. When acquiring privatization objects at an auction or through a tender, the business reputation of an organization is determined as the difference between the purchase price paid by the buyer and the estimated (initial) cost of the sold organization.

An item of intangible assets is a good business reputation, which is considered as a premium to the price paid by the buyer in anticipation of future economic benefits.

Negative goodwill is treated as a rebate to the customer and is treated as deferred income.

Valuation of intangible assets. In accounting and reporting, intangible assets are reflected at their initial and residual values. Show separately amortization of intangible assets.

The initial cost is determined for objects:

- contributions made to the authorized capital (fund) - by agreement of the parties (agreed value);

- purchased for a fee from other organizations and persons - at the actual costs incurred for the acquisition of objects and bringing them to a state suitable for use;

- received free of charge from other organizations and persons - at market value as of the date of posting.

The costs of acquiring intangible assets include amounts paid to the seller of the property, intermediaries, for information and consulting services, registration fees and duties, customs expenses and other costs associated with the acquisition of items.

The costs of creating intangible assets and bringing them to a condition suitable for use are made up of the wages charged to the relevant employees, social deductions, material costs and general production and general business costs.

Intangible assets that enter the organization in exchange for any property are assessed based on the value of the property being exchanged.

The valuation of intangible assets, the cost of which upon acquisition is determined in foreign currency, is made in rubles by translating foreign currency at the exchange rate of the Central Bank of the Russian Federation in effect at the date of acquisition of the object.

The cost of intangible assets, at which they are taken into account, is not subject to change, except for the cases established by the legislation of the Russian Federation.

Documenting the movement of intangible assets

Currently, there are no recommendations for documenting the movement of intangible assets. Therefore, organizations must themselves develop the forms of the relevant documents based on the Regulations on Documents and Workflow in Accounting and the Law on Accounting, which have determined the list of mandatory details in the documents, and the characteristics of the objects taken into account.

In accordance with the peculiarities of intangible assets, the documents on their receipt and disposal should contain their characteristics, indicate the procedure and period of use, initial cost, amortization rate, date of commissioning and decommissioning and some other details. Particular attention should be paid to the correctness of the transfer of ownership of intangible assets. For example, the acquisition of rights to objects protected by patent law (inventions, utility models, etc.) must be confirmed by appropriate licensing agreements registered with the Patent Department. The acquired rights must be formalized by agreements with legal entities or individuals.

A feature of some intangible assets as accounting objects is the need to take measures to protect them. To this end, it is advisable to develop special internal rules for the protection of such objects, providing in them a list of persons entitled to familiarize themselves with them, the obligations of these persons not to disclose the relevant information and their job descriptions, as well as other necessary information.

Synthetic and analytical accounting of the receipt and creation of intangible assets

Disclosure of information about intangible assets in financial statements