Life cycle of real estate objects. The life cycle of real estate as an economic object by creating a property complex is characterized by a phase

The life cycle is a complete sequence of real estate processes from commissioning (from creation) to termination. In theory and practice there are four types of cycles: business, life cycle of goods, type of business and enterprises as a property complex. The duration of the cycle is influenced by periods of production, physical and moral wear, the capital's capital, operating conditions, market conditions and other factors. For real estate assessment, consideration of 2 life cycles of real estate is of interest:

1. Lifecycle of real estate (product) as a physical object.

2. The real estate life cycle as a property object.

The life cycle of real estate (goods) as a physical object consists of 11 stages:

1. Pre-investment stage (analysis of opportunities, justification).

2. Creation, formation (design, construction).

3. Commissioning.

4. Hold and use.

5. Functional, economic obsolescence.

6. Physical wear.

7. Overhaul or reconstruction.

8. The deterioration of consumer properties.

9. Changing the functional purpose.

10. END OF ECONOMIC LIFE.

11. Termination of existence (natural destruction, demolition).

On the 3rd and 11 stages of the real estate life cycle, the procedure of state registration of rights is necessary.

The life cycle of real estate as an object of ownership can be decomposed on 10 stages:

1. Acquisition (purchase, construction, inheritance).

2. Ownership and use in a certain period.

3. Management object.

4. Extraction of profits, customer satisfaction.

5. Decree of property and real rights to the object.

6. Multiple change of owners, owners, users.

7. Changing the functional purpose of the object.

8. Termination of ownership (sale, nationalization, requisition).

9. END OF ECONOMIC LIFE OF THE OBJECT.

10. Repeat the former cycle or the construction of a new, modified.

On 1, 6 and 8 stages of the real estate life cycle requires the procedure for state registration of rights.

Real estate objects in the process of their existence are subject to physical, legal and economic changes. As a result, each property (except Earth) passes the following enlarged stages of life cycle:

Formation - construction, creation of a new enterprise, acquisition (purchase, allocation, etc.) of the land plot;

Operation - operation and development (expansion, reconstruction, change of activity, reorganization, etc.)

Shift (possibly repeated) owner, owner or user;

Termination of existence - demolition, liquidation, natural destruction.

The first, third and fourth stages provide for the state registration of the fact of creating or eliminating the object, as well as the change of ownership.

The life cycle of real estate is subject to certain patterns and includes the economic, physical, chronological and remaining period of economic life.

Economic life life - This is the period of profitable use of the facility when the improvements made contribute to the value of the property. Good repair, re-equipment and optimization of conditions increase, and poor care reduces the term of the economic life of the object. It ends when improvements no longer contribute to the value of the object due to its overall obsolescence.

Physical life - This is the period of the real existence of an object in a functionally suitable state before its demolition (destruction). It may be regulatory, actual, calculated (projected) and increase by modernizing and improving conditions.

Effective age Based on the evaluation of the appearance and technical condition of the structure. This is an age corresponding to the actual preservation of the object, its state at the time of the transaction, evaluation. Effective age may be greater than or less chronological age.

Chronological age - This is the period from the day of entering the object into operation before the date of the transaction or evaluation.

The remaining term of economic life The buildings are calculated from the date of evaluation (analysis) until the end of economic life. Repair and re-equipment prolong this period.

The physical and economic terms of life of buildings have an objective nature that can be adjusted, but cannot be canceled. All stages of the life cycle and lifetime are interconnected between themselves, and when one of them changes, respectively, otherwise change.

Property Lifecycle (Yanioge)

Some scientists economists believe that real estate as a product is a kind of "living organism", developing, as you know, in the following order: the idea is the birth - maturity - aging and death. By analogy, the following stages of the real estate life cycle are distinguished: pre-investment (initial) stage of the project (concept, planning, design, etc.), the project implementation stage (construction, equipment installation), the stage of operation of the object (the phase of removal to the market, growth, maturity, saturation) and phase of liquidation (decline). With the help of the life cycle theory, it is possible to partially predict the situation, but not in the case of the preparation of the forecast model, since in this case the enterprise can lose marketing support.

Real Estate Market Life Cycle

Rule: "buy cheaper, sell more expensive" refers to real estate as to any other type of investment.

Various market segments behave differently at the same time. For example, construction in one part of the city can grow rapidly in price, while at the same time it is stagnant in its other part. However, the ability to identify these cycles can provide additional investment opportunities to the customer.

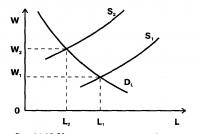

A. Discardial cycle. It is observed when the market is oversaturated, and the number of unoccupied buildings begins to increase. The content of unrealized buildings adversely affects the financial state of the project. This market is the buyer's market. The property owner is required to attach intensive marketing efforts and search for financial support. A small number of new objects appear on the market. Lenders practically suspend their operations to a new lift, and real estate prices are reduced.

B. Absorption cycle. Due to the lack of new construction, which is the result of the decline cycle, the demand and supply in the real estate market begins to gain power. The market goes into a new cycle - the absorption cycle of the created object. After the investment surplus is absorbed, rental rates will begin to grow. In accordance with the increase in demand and a decrease in the proposal, preinvestment research on the creation of new real estate facilities are being carried out.

V. cycle of new construction. The cycle of new construction corresponds to increased demand in the market of construction objects along with a reduction in proposals for free land. Rental rates increase with real estate price. During this period, the level of inflation increases, and the cost of construction increases, which increases the sales price of the real estate object.

G. Market Saturation Cycle. Real estate sales growth occurs at a slow pace and, in the end, is reduced. There is surplus of finished construction products and capacities. Employment level begins to decrease, and construction activities are gradually stopped. The best time to increase property objects is the stage of the absorption cycle or a period of new construction.

To assess the effectiveness of the real estate market, it is necessary to consider the life cycle of the object in more detail and establish the main critical points in time, the combinations of which will affect the duration of the cycle and the dynamics of cost changes, results.

Life cycle of real estate object

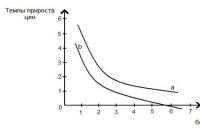

Evaluation of the effectiveness of the functioning of any real estate object (erected or updated) implies consideration of it throughout the life cycle. The life cycle of the object from the moment of technical and economic justification until the moment of physical or moral aging can be divided into three periods:

1 Construction (preinvestment and investment phases);

2 operation until full payback (entrepreneurial phase of the project);

3 exploitation upon subsequent developing results for invested investments (innovation, closing of the object).

To a large extent determining the effectiveness of the functioning of the object is the first period. This stage is especially complex, it consists of numerous components, namely: analysis of the conditions for the embodiment of the initial design, development of the concept of the project, the assessment of its viability, the choice and coordination of the place of placement of the facility, the environmental justification, expertise, the development of a feasibility study, the development of the construction permit, the creation temporary construction infrastructure, creating or updating an object, commissioning it. The second period includes the development of capacity, operating an object with stable parameters of its design capacity. Considering the nature of the curve reflecting the change in the time of the cost characteristics of the construction and operation of the object. Determining the ratio of various phases, it is possible to obtain the comparative effectiveness of the periods of the life cycle of the object of real estate, carry out an analysis of the costs and results of the contractor and the customer's activities.

At the third stage of the life cycle of the object, the period of subsequent developments on investment investment occurs. Theoretically, the third period can continue for quite a long time. The limitation of the feasibility of operating the object is the additional cost of eliminating physical and moral wear.

Duration of the phases of the life cycle of real estate objects (public / private sectors):

Residential buildings - (conceptual phase1-4 / 0.5-2) (contract phase and working design 1-3 / 0.5 - 4) (construction 1-4 / 0.5-1.5)

Industrial facilities - (conceptual phase 1-4 / 0.5-6) \u200b\u200b(contract phase and working design 1-3 / 0.5-2.5) (construction1,5-2.5 / 0.5-2)

Commercial buildings - (conceptual phase 0.5-3 / 1-10)) (contract phase and working design 0.5-2 / 1-4) (construction 0.5-1.5 / 0.5-2)

The duration of the project as a whole depends on the type of construction; Considerable attention is paid to the conceptual phase of the project in order to obtain in the future maximum efficiency of invested funds.

Factors of the dynamics of the consumer value of real estate

All without exception, material objects exist in time and in space. Therefore, it is necessary to adequately characterize any object with only those spatially temporal parameters in which it is located, and those influences that have it. It is also necessary to take into account that although the time and space are mandatory conditions for the existence of real estate, but it is impossible to consider their categories equivalent: the space (if it is not considered on the abstract logical level, but in the specifics of natural-real characteristics with the final quantitative measurement) itself changes in time. This is a direct consequence of human activity, as a result of which the natural space is sequentially transformed with increasing intensity. One of the characteristic features inherent in time existence (equally relating to the proceeds, and to material objects) is cyclical, that is, periodic renewability in time. At the same time, many different cycles in their content coexist, in certain ways related to each other, coinled each other. The original are natural cycles that have a direct or indirect influence on all others, they themselves are not exposed to this influence: a person may actively act on nature in a wide variety of forms, but not in its power to cancel or change the change of seasons or day and night .

Therefore, it is natural that human activity (incl. Economic), which is always carried out in natural conditions, is influenced by these cycles, and sometimes obeys them. It is most clearly manifested in agriculture and partially in construction, where the entire production process is "adjusted" under the fluctuations in the natural and climatic conditions, and the results of labor to a significant extent depends on these conditions.

At the same time, economic cycles are defining for the predominant number of specific activities. The very existence, the content and dynamics of such cycles is determined by the internal laws of the development of the economic system (natural cycles have only corrective influence in the form of seasonal oscillations of the conjuncture). Under economic cycles are the periodic fluctuations in the intensity of the reproduction of economic benefits (including the production, exchange, distribution and consumption). The source characteristic of the economic cycle is the rate of economic growth.

Ticket 44 construction restrictions in the process of development of urban space. ??????? (Baranova)

45.Procession of reproduction in the field of real estate (Trojina)

Reproduction is a continuous process of resuming fixed assets and preventing its premature wear. In real estate - It is a construction. The concept of real estate management is reduced to obtain the greatest effect from managing the actions of people, project executors. WITH economical points of view, construction - The industry of logistics in which the main funds of industrial and non-productive purposes are being created: ready-to-use buildings, structures and their complexes. Under construction implies the process of the construction or creation of infrastructure facilities. The main stages of this process are land separation, design, coordination of the project in the authorities, actually the process of building a building or structure, commissioning. As a rule, work is carried out by a group of specialists from a construction or engineering company under the leadership of the project manager (Eng. Project Manager) and is controlled by technical supervision and development engineers (designer engineer or project architect).

Specialists who participate in the development and implementation of construction projects should create effective mechanisms for planning, budgeting, document management, timely supply of building materials, logistics, workplace safety, etc. In addition, they need to take into account the environmental consequences of their work and create a minimum temporary inconveniences for the public at the end stage of the facility.

Ticket 46. Phases of the investment project in the field of real estate. (Yanoglo)

The investment cycle is the time period between the beginning of the investment and the moment of the delivery of the property into operation.

Analysis of the project's viability is carried out before the project submission to investors to determine whether the project is worth further than the cost of time and cash, as well as there are sources of coverage of all costs and obtaining normal profits.

There are 3 phases of the life cycle of the investment project, which themselves consist of stages and stages:

1. Faise preinment(Technical and Economic Research):

1.1 Preinvestment Research and Prior Planning Project

· List of potential investors;

· Project information - goals, analysis of conditions, etc.;

1.2. Possibility of the market: analysis of the market, price dynamics, demand and suggestions, etc.

1.3. Material and labor resources:

· Material forms of production (quality, availability of resources);

· Determining the need for labor resources;

1.4. Selection and coordination of the placement of the facility (analysis of the location, the environment, the final choice of the site system);

1.5.Financial analysis and investment assessment (risk analysis, costs, financial plan development);

1.6. Development of the market -Excinic project plan (control over the implementation of the loan agreement).

2.Fase investment:

2.1. Studia of general planning, development of design and estimate documentation (development, coordination and approval of the TEO, obtaining a construction permit);

2.2. Bidding and concluding contracts (preparation of a contract for a contract, contract agreement);

2.3. Studia implementation and completion of the project (construction):

· Quality planning and management structure;

· Implementation and delivery of the facility.

3. Entrepreneurship infase:

3.1. The work of the Developer Developer Developer (ordering and placement of equipment, furniture);

3.2. The work of property management owner:

· Real estate management procedure;

· Real estate service;

3.4. Real estate from the user (control over the use of the premises, organizational and technical support, etc.).

The implementation of investment objectives involves the formation of investment projects that provide investors and other project participants with the necessary information to make an investment decision.

The concept of the investment project is interpreted by two:

1. As an activity (event), involving the implementation of a complex of any actions that ensure the achievement of certain purposes;

2. As a system that includes a certain set of organizational and legal and calculation and financial documents necessary to implement any actions or describing these actions.

There are various classifications of investment projects. Depending on the basis for the basis of the classification, the following types of investment projects can be distinguished.

By relation to each other:

· independent allowing simultaneous and separate exercise, and the characteristics of their implementation do not affect each other;

· mutually exclusive those. Do not allow simultaneous implementation. In practice, such projects often perform the same function. From the aggregate of alternative projects can only be implemented;

· complete The implementation of which can occur only together.

In terms of implementation (creation and operation):

· Short-term (up to 3 years);

· Medium-term (3-5 years);

· Long-term (over 5 years).

By scales (Most often, the scale of the project is determined by the size of the investment):

· small projects, the action of which is limited to the framework of one small firm that implements the project. Basically, they are plans to expand production and increasing the range of products. They are distinguished by relatively small implementation periods;

· medium projects- These are most often projects for the reconstruction and technical re-equipment of the existing production of products. They are implemented in stages, in some industries, in strict accordance with previously developed schedules for the receipt of all types of resources;

· large projects - Projects of large enterprises, which are based on a progressively "new idea" of the production of products necessary to meet the demand in the domestic and foreign markets;

· megaprojects- These are targeted investment programs containing many interrelated end projects. Such programs can be international, state and regional.

By basic directional:

· commercial projects, the main purpose of which is profit;

· social projects, oriented, for example, to solve unemployment problems in the region, a decrease in the criminal level, etc.;

· environmental projects, the basis of which is an improvement in habitat;

· others

Depending on the degree of influence of the results of the investment project on domestic or foreign markets of financial, material products and services, labor, as well as on environmental and social environment:

· global projects, the implementation of which significantly affects the economic, social or environmental situation on Earth;

· people's projects, the implementation of which significantly affects the economic, social or environmental situation in the country, and with their assessment it is possible to be limited to the consideration of only this influence;

· large-scale projects, the implementation of which significantly affects the economic, social or environmental situation in a separate country;

· local projectsThe implementation of which does not have a significant impact on the economic, social or environmental situation in certain regions and (or) cities, the level and structure of prices in commodity markets.

A feature of the investment process is its conjugacy with uncertainty, the degree of which can vary significantly, so depending on the size of the risk, investment projects are divided into this way:

· reliable projectscharacterized by a high probability of obtaining guaranteed results (for example, projects performed under state order);

· risk projectsFor which a high degree of uncertainty both costs and results (for example, projects related to the creation of new industries and technologies).

In practice, this classification is not exhaustive and allows for further detail.

However, the development of any investment project - from the initial idea to operation - can be represented as a cycle consisting of three phases: before investment, investment and operational (or production). The total duration of the three phases is the life cycle (lifespan) of the investment project.

4. Life cycle of real estate objects

Since the objects of real estate during the time of their existence are subjected to economic, physical, legal change, then any immovable thing (with the exception of the Earth) passes the following stages of life cycle:

1) formation -this is the construction, i.e. the creation of a new enterprise, purchase or allocation of the land plot;

2) exploitation -includes functioning and development, i.e. expansion, reorganization or reconstruction

3) termination of existence -this is demolition, natural destruction or liquidation.

The life cycle of real estate acquired for commercial purposes, from the point of view of the owner of this property can be repeated with the new owner of the same real estate up to the end of the life of the object. The life cycle is constantly subject to certain patterns, in Harrison - this is a period of physical, economic, chronological and remaining economic life.

By the date of the physical life of the object refers to the time when you can live or work in an existing building or building. This indicator may be regulatory, calculated, actual and increased by improving the conditions or by modernization. If the object of real estate is demolished, the term of physical life ends.

By the period of economic life include the period during which the object can be used to give - at the same time, these improvements contribute to the cost of the object. If the improvements made do not contribute a certain contribution to the value of the property in view of what it is outdated, then the term of its economic life is ends.

Under chronological age understands the period that has passed since the entry of the property of the property into operation before the date of its assessment.

The evaluation of the appearance of the object of real estate, its technical condition, economic factors that affect the total cost of the object, is based on an effective age.

Effective age -this is an age corresponding to a certain physical condition of the object and takes into account the possibility of its implementation.

A typical service life is called the normative service life.

Regulatory service life -this is the service life of buildings or structures, which is defined in regulatory acts.

Under term of the remaining economic lifebuildings understand the period from the date of its assessment until the end of the economic life. This period uses an appraiser expert in order to assess future income. The term of the remaining economic life of the object increases its upgrades or repairs.

All the stages of the life cycle and the life of real estate objects are related to each other. The owner of real estate for the implementation of adequate measures, which will ensure an increase in property profitability and its preservation, the foundation of real estate in a certain (any) stage of the life cycle should be taken into account.

This text is a familiarization fragment. From the book a man and his soul. Life in the physical body and the astral world author Ivanov u m From the book Big Soviet Encyclopedia (LS) author BSE From the book travelers Author Major NikolayA difficult life route The attitude of our domestic scientists to Sven Giedin has undergone significant changes. Causes are lurking both in the character of the Giedin itself and in the political situations of his time. From youth knowing Russian and experiencing sympathy for Russia and her

From book Real Estate Economics Author Burkhanova Natalia50. Basic principles of taxation of real estate The basic principles of taxation are considered in the Tax Code of the Russian Federation (Article 3 and Art. 5). The main principles of taxation include: 1) Each person should pay legally established

From Book Finance: Cheat Sheet Author author unknown47. Impact of finance for the standard of living of the population The socio-economic essence of financial relations is to study the issue, at the expense of whom the state receives financial resources and in whose interests these funds are used.

Organizational behavior: Crib Author author unknown50. The life cycle of the organization is widespread the concept of the life cycle of the organization is its change with a certain consistency of states when interacting with the environment. There are certain stages through which organizations are held, and

From Book Marketing: Crib Author author unknown45. The life cycle of goods The product life cycle is a change in sales and profits throughout its life time. The goods have a stage of origin, growth, maturity and the end - "death", care.1. Stage "Development and conclusion to the market." This is the investment period in marketing

From the book Civil Code of the Russian Federation Author Garant. From the book Biology [full guide to prepare for the exam] Author Lerner Georgy Isaakovich From the book how and where to write a complaint correctly to defend your rights Author Nerman Vera From the book a brief reference book of the necessary knowledge Author Chernyavsky Andrey Vladimirovich2.7. The cell is a genetic unit of living. Chromosome, their structure (shape and size) and functions. The number of chromosomes and their species constant. Features of somatic and sex cells. Life cycle of cells: interfac and mitosis. Mitoz - division of somatic cells. Meiosis. Phase

From the book the newest philosophical dictionary Author Gitsovanov Alexander Alekseevich4.5.1. Life cycle of algae The green algae department includes unicellular colonial and multicellular plants. Total about 13 thousand species. Unicellular include Chlammedonad, Chlorella. Colonies are formed by Volvox and Pandorina cells. To multicellular

From the book I will know the world. Viruses and diseases The author of Chirkov S. N. From the book of the authorLife cycle of stars The usual star highlights energy due to the conversion of hydrogen in helium in a nuclear oven located in its core. After the star spends the hydrogen in the center, it begins to break the stars in the shell, which increases in size,

From the book of the author"Life World" (Lebenswelt) is one of the central concepts of the late phenomenology of Husserl, formulated by him as a result of overcoming the narrow horizon of a strictly phenomenological method due to the appeal to the problems of world ties of consciousness. Such an inclusion "World"

From the book of the authorThe life cycle of the virus each virus penetrates its cell, only in its characteristic way. Penetrating, he must first of all withdraw the upper clothes to expose, at least partially, its nucleic acid and start copying it. The development of the virus is well organized.

Any real estate object is a material asset that exists in time, so you can specify its life cycle. The life cycle of the real estate object (physical) is a period of time during which the real estate exists as a physical object. The life cycle of real estate object consists of the following stages (phases):

1. Formation of project plan and choosing the option of using free land. During this period, the choice of the best and most efficient use of the land plot is carried out - taking into account the characteristics of its characteristics and all properties of the environment. Based on the analysis, the maximum productive version of the use of legally permitted, physically implemented, economically expedient and financially feasible are selected. The choice of use options is completed by developing a technical task to design improvements.

2. Design improvements. At this stage, on the basis of a technical task for design - is carried out (by a specialized organization) Development of a project with the manufacture of documentation necessary to obtain permissions and the implementation of the preparation of the land plot (with fixation of the form and size, with the removal of unnecessary natural and artificial vegetation, with draining reservoirs) , as well as laying of communications, building buildings (structures) and planting new plantations. An acceptance of the project from the project organization is advisable to implement with the participation of the management company who participated in the development of a technical task for design.

3. Manufacturing (construction, construction) improvements. During the implementation of the project, contractual organizations almost completely change all the physical characteristics of the object, with the consolidation of these changes in inventory and cadastral documents. During the construction of improvements and as a result of fixing the new status of the object, the environmental characteristics relating to the created object are also changing.

4. Appeal (purchase and sale, donation, rental, etc.) with the transfer of property law or with the advent of encumbrance to this right. At this stage, operations are carried out with the object and the state is registered by the state a change in the legal fate of the latter. When buying and selling an object, a subject of ownership is changing. When renting the Earth or (and) for rent or in hiring the owner (or - on behalf of the owner - the management company), the rights of use (and, perhaps) are transferred to another subject with the emergence of encumbrance of ownership.

5. Use (use) of an object of purpose with technical and maintenance. At this stage of the life cycle, the managing (or professional management company) organizes rational spending by users of the consumer potential of the object. Over time, the characteristics of the object undergo change, because Improvements are physically wearing and are functionally obedient, which is exacerbated by changes in the situation in the economy and in an external physical environment, leading to an additional, so-called external obsolescence.

In the process of operation, the episodically, a technical examination and the current repair of individual elements of improvements without stopping the use of the object as a whole are carried out.

6. Modernization: overhaul, reconstruction, restoration of improvements with possible refilling (change in functional purpose) of the object. This stage begins at the moment when the object in the current state cannot more satisfy the modern needs of users or (and) if its operation becomes economically ineffective. At this stage, at least a major overhaul is made without changing the planning solution and functional purposes, but with the elimination of disposable physical wear and functional obsolescence.

If the analysis of the best and most efficient use of land and improvements, performed at this point, will show the feasibility of partial change in the functionality of improvements, the latter are reconstructed with a change in the planning of the room. Naturally, the functions of major repairs of elements of improvements that preserve the initial functional purpose are also provided.

If an analysis of the use of an object in an existing condition shows the need to fully replace its functional purpose, then the reconstruction may be accompanied not only by a radical change in layout, but also an extension or superstructure of existing buildings and build a free part of the land.

7. Recycling, demolition of improvements, disposal or secondary use of materials. The life cycle is completed by the demolition of improvements at the end of their economic life. The management company prepares proposals for the appointment of the timing and economically appropriate method of demolition of buildings, given the possibility of selling elements of structures and materials of liquidated buildings and communications (minimizes the volume of liquidation costs).

Some stages during the life cycle of the property can be repeated. For example, the plan of the project creation of a new object may occur both at the stage when the land plot is completely free and at the stage of the need for reconstruction, partial demolition or completion of buildings. The circulation phase can be realized in the process of the object of the object repeatedly, and the time of treatment determine the time boundaries of the periods that make up the basis of the so-called investment cycles.

The object of real estate, being a material asset, can be used as an economic good, product or source of income. If the real estate object brings income to its owner and satisfies its needs, it is operated by the user in order to increase income, profits. As soon as the assessment object does not generate income, it for the owner loses its utility and is subject to sale and can be sold as a product as a whole or in parts at any stage of the life cycle.

The main stages of the life cycle of the object of real estate, as the product:

1. Acquisition of real estate (purchase, building, inheritance).

2. Ownership and use in a certain period

3. Management of real estate

4. Extraction of profits, meeting the needs of the owners

5. Decree property

6. Change of owners, owners, users

7. Regulation of real rights to the object

8. Changing a functional purpose

9. Termination of ownership

Cash flows in the stages of the investment cycle in real estate are distinguished by opposite orientation and unevenness. At the initial stage, negative cash flows have (during construction or purchase). During its use (rental), negative cash flows are transformed into positive and the owner receives stable revenues, although costs are also possible (for repair and maintenance of the building)

Unlike other goods, real estate, revenues, requires professional assets management, starting with the search for choosing the best and most effective use and its practical implementation.

State Educational Institution of Higher Professional Education

St. Petersburg Trade and Economic Institute

Under the discipline "Real estate economics"

"Features and life cycle of real estate object"

Performed: Andreyanova E.V.

C. 1410, Faculty of TEF, 4 course

scientific adviser

Pirogova O.E.

St. Petersburg, 2010

Introduction

Chapter 1. The concept of real estate and its object

1 Defining the concept of real estate

2 Real Estate Object

Chapter 2. Features and life cycle of real estate

1 Features of the property

2 Life cycle of real estate as a physical object

3 Property Life Cycle as an Economic Object

4 Life cycle of real estate enterprise as a property complex

Conclusion

Bibliography

Applications

Introduction

Real estate objects occupy a special place in the system of social relations, since economic activity and priority relations of people in all spheres of their activities are directly related to them directly or indirectly.

Today, real estate objects are presented by the central link of the country's market economy. And this is understandable - the object of real estate is not only a special product, but at the same time capital, bringing income, and the basis for the provision of services in order to conduct effective entrepreneurial activities.

The real estate economy is a system of relations arising in the process of real estate operations.

Knowledge of discipline is necessary in the preparation of modern specialists, as any professional is currently facing practical activities with the processes occurring in the real estate market.

The main purpose of methodical indications is to master knowledge of knowledge about the essence of real estate objects, the legal aspects of the real estate economy, the main operations and approaches to the assessment of real estate objects, the features of the real estate market and the types of entrepreneurial activity on it.

1. The concept of real estate and its object

1 Defining the concept of real estate

The concept of "real estate" is not separated from another concept - "Property".

Property is a set of property, i.e. subject to money assessment, legal relations in which this person is located (physical or legal).

The property belonging to a physical or legal person is divided by:

· Asset: a set of things belonging to the person on the right of ownership or by virtue of other things; A combination of rights on other people's actions (for example, debt property);

· Passive: a set of things belonging to other persons, but temporarily owned by this person; A combination of obligations lying on this person.

Historically, since the time of Roman law, property is customary to divide on movable and immovable.

According to Art. 130 Civil Code of the Russian Federation (Next of the Civil Code of the Russian Federation) "To real estate (real estate, real estate) includes land plots, sections of subsoil, It is impossible, including forests, perennial plantings, buildings, structures.

Real-statements are also subject to state registration of air and sea vessels, internal navigation vessels, space objects. The law to real estate can be attributed to other property. "

Modern Russian legal practice set a number of signs in which the physical object can be attributed to real estate:

· Durable connection with a certain land plot (the impossibility of moving an object without disproportionate damage to its purpose);

· Finished in terms of use on intended purpose;

· A certified (officially registered) belonging to a specific owner - the state, the subject of the federation, the municipality, private person or the group of individuals;

· The possibility of physical separation of the object of real estate and real estate (i.e., the presence of clearly established physical boundaries of the object of real estate);

· Functional independence of the real estate object (it is possible to use this object of real estate separately from other objects, or its functional purpose involves the partial use of other real estate objects);

· The presence (or absence) of servitude and other restrictions on the rights of use.

Things not related to real estate, including money and securities, are recognized by movable property. Registration of rights to movable property is not required, except the cases indicated in the law.

2 Real Estate Object

"Object of Real Estate" contains two bases - physical and legal. The physical basis of this concept relies on the real estate component, namely: buildings, structures, land plots, subsoil, etc. All that "is an object that is associated with the Earth so that its movement is impossible without disproportionate damage to its purpose."

The legal part runs in the field of realization of rights arising from real estate operations and its use.

Thanks to the wear, real estate object loses its liquidity - "The possibility of implementing any method of transforming real estate in money" is a legal component of the concept.

Each property object has its own cadastral number, the process is applied to it called "Inventory of Real Estate Object". It is characterized by an "inventory business" - the history of the emergence and changes in the object of real estate. All of the above refers to the legal part of the definition of real estate.

Civil rights facilities include things, including money and securities, other property, including property rights; work and services; information; the results of intellectual activity, including exclusive rights to them (intellectual property); Intangible benefits.

2. Features and life cycle of real estate

1 Features of the property

Having a land plot as an integral part, all artificial buildings (real estate objects) have generic signs that allow them to distinguish them from movable objects. It:

Stationarity, immobility. The sign is characterized by a solid physical connection of the real estate object with the earth's surface and the impossibility of its movement in space without physical destruction and damage, which makes it unsuitable for further use.

Materiality. It should be noted the fact that real estate always functions in natural-material value of the cost form. The physical characteristics of the real estate object include, for example, data on its size and form, inconvenience and hazards, environmentally, on access roads, utilities, surfaces and a subspeted layer, landscape, etc. The set of these characteristics determines the usefulness of the object, which and Makes the basis of real estate value. However, by itself it does not define the cost. Any object has a cost, having in one way or another characteristics as the suitability and limited nature of the proposal. Limitations should be present to create a significant cost. Social ideals and standards, economic activity and trends, laws, governmental solutions and actions, natural forces affect the behavior of people, and all this, interacting with each other, creates, preserves, changes or reduces the cost of real estate. It should also be noted that real estate is one of the few products whose cost is not only almost always stable, but also tends to gradually increase over time.

The durability of real estate is almost higher than the durability of all other goods, except for certain types of precious stones and products from rare metals.

For example, according to the construction standards and rules operating in Russia, residential tasks depending on the material of the main structures (foundations, walls, overlaps) are divided into 6 groups with regulatory periods of service from 15 to 150 years.

The duration of the earth's circuit with its proper use of infinite, and the violation of its correct operation will lead to irreplaceable losses.

In addition to the main generic signs of real estate, private features can be distinguished, which are determined by specific indicators depending on the type of real estate objects.

It is almost impossible to talk about two identical apartments, about two identical sites, about two identical buildings, since they will necessarily have differences in the location in relation to other real estate objects, infrastructure and even to the parties to light, which shows heterogeneity, uniqueness and Uniqueness of each property object.

Real estate has an increased economic value. This is due to the fact that it is intended for long-term use and is not consumed during use. As a rule, it has a constructive complexity that requires large costs of maintaining in proper condition.

In addition, the property of real estate always has its functional purpose. It can be production and non-manufacturing. In terms of industrial purposes, the property object directly or indirectly participates in the creation of products, the performance of work, the provision of services. With non-manufacturing - provides conditions for residence and maintenance of people.

Real estate always acts as an object of long-term investment. Most often, this is due to the fact that the acquisition of the real estate object is not possible, since its real estate is required to invest in the property in the property. In addition, if we talk about the income side of the case, cash investments in real estate objects are costs with a rather high payback period.

It should be noted that some types of real estate can go to movable property. So, for example, forests and perennial plantings by definition relate to real estate, and the harvested forest is already movable property.

It should be noted that the equipment placed in buildings and structures (heating, water supply, sewage, electrical equipment, elevators, lattices, second metal doors, etc.) refers to movable property. But since it became an integral part of the real estate object, then in the case of a transaction on this object, the entire movable property should be described in detail, including the real estate (this applies to the property to be seized when making a transaction).

Often, when performing real estate transactions, a set of rights and interests that are not part of real estate may be transmitted. These may be rental rights, predominant acquisition or other interests (servitudes).

So, the real estate includes the most valuable and non-governmental facilities of fixed assets, and such real estate facilities such as land and subsoil have a greater not only economic, but also strategic significance for any state at all times.

For example, in the test period, the Earth was the only significant source of wealth as every person individually and the state and society as a whole.

Real estate in any public device is an object of economic and government interests, and therefore for this category of property introduced the obligation of state registration of rights to it, which allows you to identify the object and the subject of law, for the connection between the real estate object and the subject is invisible to it, and the transfer of real estate through Physical movement is impossible.

2 Life cycle of real estate as a physical object

Speaking as a physical object, real estate is a commodity, property object, business and takes various stages and processes in each of their hypostasis.

The life cycle of the real estate object (physical) is a period of time during which the real estate exists as a physical object. The life cycle of real estate object consists of the following stages (phases):

Formation of project plan and choosing the use of free land. During this period, the choice of the best and most efficient use of the land plot is carried out - taking into account the characteristics of its characteristics and all properties of the environment. Based on the analysis, the maximum productive version of the use of legally permitted, physically implemented, economically expedient and financially feasible are selected. The choice of use options is completed by developing a technical task to design improvements.

Design improvements. At this stage, on the basis of a technical task for design - is carried out (by a specialized organization) Development of a project with the manufacture of documentation necessary to obtain permissions and the implementation of the preparation of the land plot (with fixation of the form and size, with the removal of unnecessary natural and artificial vegetation, with draining reservoirs) , as well as laying of communications, building buildings (structures) and planting new plantations. An acceptance of the project from the project organization is advisable to implement with the participation of the management company who participated in the development of a technical task for design.

Manufacturing (construction, construction) improvements. During the implementation of the project, contractual organizations almost completely change all the physical characteristics of the object, with the consolidation of these changes in inventory and cadastral documents. During the construction of improvements and as a result of fixing the new status of the object, the environmental characteristics relating to the created object are also changing.

Appeal (purchase and sale, donation, leasing, etc.) with the transfer of property rights or with the appearance of encumbrance to this right. At this stage, operations are carried out with the object and the state is registered by the state a change in the legal fate of the latter. When buying and selling an object, a subject of ownership is changing. When renting the Earth or (and) for rent or in hiring the owner (or - on behalf of the owner - the management company), the rights of use (and, perhaps) are transferred to another subject with the emergence of encumbrance of ownership.

Use (use) of an object of purpose with technical and operational services. At this stage of the life cycle, the managing (or professional management company) organizes rational spending by users of the consumer potential of the object. Over time, the characteristics of the object undergo change, because Improvements are physically wearing and are functionally obedient, which is exacerbated by changes in the situation in the economy and in an external physical environment, leading to an additional, so-called external obsolescence.

In the process of operation, the episodically, a technical examination and the current repair of individual elements of improvements without stopping the use of the object as a whole are carried out.

Modernization: overhaul, reconstruction, restoration of improvements with possible reproofing (change in functional purpose) of the object. This stage begins at the moment when the object in the current state cannot more satisfy the modern needs of users or (and) if its operation becomes economically ineffective. At this stage, at least a major overhaul is made without changing the planning solution and functional purposes, but with the elimination of disposable physical wear and functional obsolescence.

If the analysis of the best and most efficient use of land and improvements, performed at this point, will show the feasibility of partial change in the functionality of improvements, the latter are reconstructed with a change in the planning of the room. Naturally, the functions of major repairs of elements of improvements that preserve the initial functional purpose are also provided.

If an analysis of the use of an object in an existing condition shows the need to fully replace its functional purpose, then the reconstruction may be accompanied not only by a radical change in layout, but also an extension or superstructure of existing buildings and build a free part of the land.

Disposal, demolition of improvements, disposal or secondary use of materials. The life cycle is completed by the demolition of improvements at the end of their economic life. The management company prepares proposals for the appointment of the timing and economically appropriate method of demolition of buildings, given the possibility of selling elements of structures and materials of liquidated buildings and communications (minimizes the volume of liquidation costs).

Obviously, some phases are repeated at different stages of the life cycle. For example, the plan of the project creation of a new object may occur both at the stage when the land plot is completely free and at the stage of the need for reconstruction, partial demolition or completion of buildings. The circulation phase can be realized in the process of the object of the object repeatedly, and the time of treatment determine the time boundaries of the periods that make up the basis of the so-called investment cycles.

3 Property Life Cycle as an Economic Object

object Real Estate Property Economic

The life cycle of the object of real estate is subject to certain patterns and includes the term of economic and physical life.

The term of economic life, which determines the period of time during which the object can be used as a source of profit. The term of economic life ends when the improvements produced cease to contribute to the cost of the object.

A typical length of physical life is a period of real estate object in a functionally suitable state before its demolition. Determined by regulatory documents. The physical and economic terms of life of real estate objects have an objective nature that can be adjusted, but cannot be canceled.

Lifetime - time segment when the object exists and you can live or work in it.

From the point of view of the life of the real estate object, allocate such dates as:

ü Effective age, reflecting the age of the object, depending on the appearance, the technical condition.

ü chronological (actual) age, the corresponding period of the object stay in operation since its input.

ü The remaining amount of economic life used to estimate the object by an appraiser as an expert and the amount of the estimation date before the end of the economic life of the object.

The life cycle of real estate as an economic object is as follows:

Creature

State registration of real estate - in the Russian Federation - legal act of recognition and confirmation by the state, restrictions (encumbrances), transition or termination of rights to real estate in accordance with the Civil Code of the Russian Federation.

Possession and use; Changing owners. Possession - in civil law - the empowerment of the owner; The actual possession of a thing that creates for the owner the possibility of direct impact on the thing.

Development

Deterioration of consumer properties of real estate

End of economic life

4 Life cycle of real estate enterprise as a property complex

The enterprise as an object of rights is recognized as a property complex used to carry out entrepreneurial activities.

The company as a whole as the property complex is recognized as real estate.

The company as a whole or part of it can be the object of purchase and sale, collateral, lease and other transactions related to the establishment, change and termination of real rights.

The company as a property complex includes all types of property intended for its activities, including land, buildings, structures, equipment, equipment, raw materials, products, rights, demand, debts, and the rights to designations, individualizing enterprise, its products, work and services (corporate name, trademarks, service signs), and other exceptional rights, unless otherwise provided by law or contract.

Life cycle of the company as a property complex:

Creation or privatization of the enterprise

State registration of property rights (state, municipal, private, share ownership). State registration of rights to the enterprise and transactions with it should be carried out in a special procedure due to the legal specifics of this object. The main feature of the enterprise is the possibility of incorporating land plots and other real estate objects in various territories, as well as the possibility of excluding real estate from the enterprise.

Formation or access to design power

Optimal functioning

Change of owners, private and complete

Reorganization, reform, reconstruction, merger, absorption

Bankruptcy (optional stage)

Liquidation (optional stage). The liquidation of the property complex is trading and other mechanisms for selling property (including immovable bankrupt organizations in accordance with the regulatory legal provisions of competitive production.

Termination Functioning: Natural non-altitude termination, physical destruction, conscious demolition.

Conclusion

With any public device, a special place in the system of social relations is occupied by real estate, with the functioning of which is one way or another, the life and activities of people in all areas of business, management and organization are associated. It is real estate forms the central link of the entire system of market relations. Real estate facilities are not only the most important product that satisfies the various needs of people, but at the same time and capital in a real form bringing income.

Real estate - the basis of the national wealth of a country, having a massive nature in the number of owners. Therefore, the knowledge of the real estate economy is necessary for successful entrepreneurial activities in various types of business, as well as in the lives of any family and separate citizens, since property for real estate is the primary basis for freedom, independence and decent existence of all people.

Bibliography

1. "Real Estate Economics." Textbook. Goremichkin V. A., Moscow, 2008.

. "Real estate economics." Tutorial. Asaul A. N. Karasev AV, Moscow, 2009.

Ozers E. S. Economics and real estate management. SPb: The GSS Response, 2006 - 422 p. - ISBN 5-901-810-04

Ignatov L. L. Real Estate Economics. Educational and methodical manual. - M.: Publishing MSTU them. N. E. Bauman, 2008. - 168 p. - ISBN 5-7038-2174-6