Accounts receivable string in balance. Accounts receivable. The concept, types and general rules of write-off. Doubts or hopelessness

Hello! In this article we will talk about the basics of enterprise receivables.

Today you will learn:

- What is the receivables;

- How to prevent its uncontrollable increase;

- Is it possible to sell receivables.

Essence of receivables

At any enterprise there are payables and receivables. If everything is more or less clear with creditors, then the second option of obligations causes many issues from not only novice entrepreneurs.

Accounts receivable - These are the debts of other parties (buyers, recipients of borrowed funds) before your company. That is, you are considered a lender. For example, you have shipped the goods to your partner, and he has not translated money at the expense yet. It turns out that he is your debtor: he has receivables in front of you.

These obligations can be viewed in two values. On the one hand, the "Account" is the loss of the company, but on the other - the future benefit. It all depends on the right financial policy of the management of the head and the conscientiousness of the recipients of goods, services. A competent approach to existing receivables - a key to success.

Briefly and long-term debt

Receivables in front of the enterprise may have different duration. If your buyers are delayed for up to 12 months, such debt is considered short-term. Its presence is present in 100% of firms.

Most often it does not exceed several months (3 - 6). This is a normal phenomenon, since you can give a counterparty to the delay of payment, or the transfer of money is delayed in connection with the festive days, the features of the bank through which payment passed.

If you shipped the goods, and for the last year I never saw money for it, there are long-term obligations here. They give a reason to doubt the further operability of the buyer. In order not to miss the moment and get your money, you need to immediately choose a reliable business partner.

A long period of return receivables adversely affects the entire enterprise. If you have a large amount of receivables from several buyers, then things are very bad. This means that the means in the turn becomes less and less.

If the case occurs when you urgently need funds, you will have to seek a loan, which will make the position of the company even worse.

Overdue commitment

When you enter into an agreement with future partners, you establish an acceptable payment time at the delivered services. According to the current circumstances, the buyer either translates money on time or does not pay them at all.

The first case is the perfect option when the terms of the agreement are not violated. The buyer receives the goods, and you are money that is using the company's goals.

When payment was not received on time, an overdue receivables arise. Its presence makes your enterprise more vulnerable, you are limited in funds and must support the firm remaining money.

The claims receivable and refund for the supply of supply or the goods themselves are valid for three years after the date specified in the agreement with the partner as the payment period. If for some reason you do not count this, then after 36 months the limitation period of the receivables is debited and the debtor company will write an obligation to their income.

Doubts or hopelessness

If the debtor's enterprise pulls with the payment of obligations, you must understand whether you can recover your money from him or not. There is a notion of dubious debt, which is expressed in the hope of receiving funds from the buyer. This is expressed in the fact that it does not have signs, and for some reason does not want to return the debt you.

The hopeless debt in front of the enterprise is that the company turns its activities in the market and declares itself bankrupt. Then you will not be able to return my goods or money. In practice, such cases are rarely found and only with those leaders who could not implement effective financial policies.

The debit period is three years, if you did not have time to file a lawsuit to the court before the bankruptcy procedure, you can not see your money.

Doubts about paying funds to the debtor appear in the course of long negotiations, according to the results of which he evades payment. In this case, it is not allowed to re-supply the goods on its enterprise to avoid the formation of larger debt.

Before concluding an agreement with a new company, carefully examine its activities in the market. If it has the experience of unpaid obligations, then you should not be supplied. It is better to immediately prevent such cases than to engage in the recovery of receivables.

Objects obligations

Credital obligations are aimed at different objects of enterprises.

Common areas are debts for:

- Supply of products, services or works;

- Bill;

- Budget funds;

- Advances;

- Substatement amounts (for example, issuing money an employee to buy stationery);

- Loans for employees.

Thus, the debt may be not only outside the enterprise, but also inside it. In addition, the form of obligations between branches of one company is distributed.

The ratio of the internal and external debt of the debtors should be such that the firm can function normally. The most admissible form of debt is considered internal. It is much less than the volume of external and most likely will be returned early.

For example, if you as a leader decided to lend its own employees of their company under a low percentage, you may not be doubting the implementation of such payments by employees. Each of them is interested in further work, besides the contract, limiting the possibility of fast dismissal, allows them to keep them until the end of payments. If you trust the amounts of accountable person, you should give yourself an idea of \u200b\u200bpossible consequences.

Why did the receivables arose

Features of the functioning of firms on some of the stages lead to the formation of obligations of debtors.

This existing practice has some common reasons:

- Inaccurate formulations in contracts between the supplier and the debtor;

- Accidentality of partners;

- Payment delay;

- Credit for goods.

The supplier may be to blame for the formation of receivables. The head should not allow phrases in the contract that may be understood. It is necessary to indicate a clear duration of the return of receivables in such a way that the buyer does not have a single question. Compiling agreements are usually dealt with competent and experienced lawyers who know all the subtleties of the right of law.

The fact of the unscrupulousness of the Parties to the Treaty may not get around even the largest and well-known firm. Dishonest leaders who cannot cope with their working responsibilities, there are always a lot of trouble to other firms.

Delay or credit is the normal conditions of relationships between the parties. Receivables in this case are repaid according to the deadlines. Provide such payments only to proven enterprises.

What can affect receivables

There are different factors within the firm and abroad, which may somehow affect the nature of the debt return or the debtor soluperation.

Internal sources include:

- Ineffective finance management policies;

- Inappropriate introduction of prices for goods;

- Improved impact on the debtor.

As an external influence, you can consider:

- Inflation rate;

- Currency rate ratios;

- Crisis state of the economy.

If you in the contract do not provide for measures to influence the malicious defaulter, then the return of debt may not be fulfilled at all. This important feature is submitted by a separate point of agreement.

It is also not worth handing out products in large volumes without money compensation to all debtors. You must try to prevent such moments. You can make a concession to the partner in which you are confident.

Inflation can lead to the rise in the cost of your services. The rise in prices, which is provided for by the Agreement, can lead the other side of the Convention Agreement and Deposlement. The crisis in the economy also has a strong impact on the prisoners of the contract. Depending on the current position of the company's debtor on the market, the payment timing may not be observed.

Manage debts debtors

The efficiency of the company directly depends on the structure of receivables. You need to competently approach this issue to avoid the unpleasant consequences of the enterprise, right up to bankruptcy.

Not only the obligations of the Organization before other suppliers can significantly limit its functioning. The share of receivables here is also great. In the process of managing her, the manager needs to decide for himself, from which this control will consist.

Be sure to include here:

- Creating a special department in an enterprise that will study statistics of indicators;

- Understanding the tasks, functions and results of the debtor's control policies;

- Ensuring the liquidity of obligations of debtors;

- Application maximum attention to the coefficient of wrapping of obligations of debtors.

A detailed and careful analysis of receivables should be carried out on a regular basis. This will help avoid unexpected failures in the development of the enterprise.

Who monitors cash flows of debtors

Any organization is interested in fruitful and efficient cooperation with its counterparties. In order for this process to flow at the proper level, several offices are created within the firm that control the process of activity of the debtor.

Previously, this feature belonged only to a financial manager. However, enterprises grow, conclude an increasing number of contracts, control each of which is becoming harder.

The internal composition of the firm that affects receivables indirectly or directly:

- The highest link is the head;

- Commercial department (individuals concluding contracts with partners);

- Sales Managers;

- Financial Sector (Head of Finance and its subordinate);

- Lawyers;

- Security Service.

The main direction of work for all departments is asked by the head. Commerce representatives are looking for the most profitable partners who do not have significant debts. Lawyers competently compile contracts or study agreements proposed by opponents.

Security service is available only in large companies. Its tasks are to protect the interests of the company from unscrupulous individuals and fraudsters by a thorough study of the client base.

Management tasks

Before the start of any activity with counterparties, the company needs to set the tasks to be solved in the course of cooperation.

These tasks in the management of obligations of debtors include:

- Studying the process of functioning of the future debtor (it should have a good reputation and absent debts);

- Concern for the upcoming compilation of the contract by a competent lawyer;

- Search for funds for financing arising obligations;

- Controlling the dynamics of receivables indicators;

- Making debt routes;

- Work with debtors in the form of claims;

- The ability to establish yourself at the state level to obtain gratuitous support.

Those employees who are engaged in accounting and distribution of debtors must be able to:

- Use for the benefit of the organization's goal;

- Ensure the completion of the tasks of 100%;

- Develop motivating offers for debtors;

- Monitor the current situation;

- Analyze the state of the company and transfer the report to the manager;

- Plan the activities of the organization (define a mission, strategy, decision-making);

- Appoint subordinate workers, each of which will be engaged in certain directions of receivables;

- Compare the readings of the current state of the company with the planned.

The instigator of any new action should be the leader. Appointing competent specialists, weighing in the intricacies of debt of debt of debtors, it increases the chances of the instant development of the company. Each skill and skill will be useful for positive interaction experience with buyers.

Each function of receivables management is necessary for daily execution, if you want prosperity to your enterprise. Management policy determines the further prospects for the development of the company at a high level.

What decisions are accepted for management purposes

Managing the flow of capital from debtors, the enterprise must make effective decisions aimed at different aspects of debt development.

Decisions are made on issues:

- Taking into account the testimony of obligations for each specific date;

- Analysis of all actions preceding the emergence of overdue receivables;

- Taking note of the latest developments in the management of the "Accounts" (every year there are new strategies developed by the Guru of the market and aimed at increasing the turnover ratio);

- Regulation and control of the state of debt debt traveled to the current date.

We provide liquidity of receivables

In order for the company to develop correctly and quickly, it is necessary to use all available assets in revolutions. This condition also applies to receivables.

The very presence of the obligations of debtors in a competent approach allows the company to increase its own resources and perform their activities more effectively. This means that having received funds from the next debtor, you must put them again in turnover. That debt, which is for a long time in the hands of the debtor, will not affect your organization.

In order not to suffer the liquidity of receivables, it is best to prevent its delay or a long return. The faster the money will come to the organization from the debtor, the higher the turnover of assets and income of the firm.

The endless flow to debtors and backwards guarantee the successful existence of the company. The head at the head of the Financial Department needs to competently affect buyers and motivate them to pay for a speedy payment.

Turnover coefficient and its characteristics

Accounts receivable is estimated by the turnover coefficient. It displays the size of the revenue per 1 expended ruble. The higher its value, the less time the company leaves for the return of debts from buyers.

To calculate the indicator, it is necessary to find average annual receivables: (obligations at the beginning of the period + debts at the end of the period) / 2. The coefficient of receivables is equal to the attitude of the enterprise's revenue to the average annual sum of obligations.

The effectiveness of the management policy of accounts payable is to increase the ratio of the coefficient.

For these purposes, you can:

- Increase revenue;

- Reduce payables.

Using the balance lines, it can be expressed by the formula for calculating the coefficient in this way: row 2110 / ((1230 at the beginning of the report + 1230 at the end of the report) / 2).

for example , receivables at the beginning of the period amounted to 3,000,000 rubles, at the end - 3,200,000 rubles. The average is equal to: (3,000,000 + 3,200,000) / 2 \u003d 3 100 000 rubles. Revenue at the beginning of the period is equal to 2,300,000 rubles, at the end - 1,800,000 rubles. The turnover coefficient will be in the first case: 2300000/3100000 \u003d 0.74%, in the second: 0.58%.

In the example, the coefficient decreased by 16%. This suggests that the affairs of the company are not developed in the best way. The coefficient decreased due to a decrease in revenue, moreover, receivables increased by the end of the year. The company needs to analyze its activities and change the indicators for the better.

To calculate the coefficient of receivability of receivables in days, it is necessary to divide the total number of days in the period to the coefficient itself. For example, we take the resulting indicators 0.74% and 0.58%. Turnover in the days: 365 / 0.74 \u003d 493 days and 365 / 0.58 \u003d 629 days. As expected, by the end of the year, the return of debts by the company began to take a longer time.

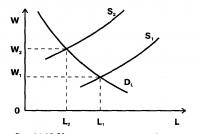

Rising receivables and decline in the enterprise

The dynamics of the indicators of the movement of receitors to the enterprise and back plays an important role in the reporting of the company. Balance between payables and receivables has its subtleties and varies for each enterprise.

If the debt growth occurs, relying from the firm, then this phenomenon is necessary at two stages. The first is to appear new partners, the exit of the enterprise to a new level and active turnover. A small increase in the indicator in different periods is allowed and signals only about high-quality capital management policies.

If the increase in receivables comes to an uncontrolled level from the period in the period, then we are talking about an illiterate approach in cooperation with partners. This process leads to a significant outflow of funds from turnover.

It can suspend the functioning of the enterprise or limit it in capital. Further failure of proper measures leads to a significant reduction in company assets and either bankruptcy.

The rapid increase in the number of debtors can lead to the fact that the development of the launched business becomes simply unprofitable. Such a company will bring a loss to the owner and jeopardize its further existence. Therefore, regular control is needed, management of receivables.

Sale of receivables

Often, in the process of its activities, the company can act simultaneously with the lender and the debtor. For example, you provided services for the transportation of a cargo by one company, which has not yet paid for your work. You, in turn, received a certain item from the supplier, but do not have funds for payment. That is, we are waiting for your debtor will return the money you and give your creditor.

Such a situation is often found, and therefore, at the legislative level, the right of debt assignment was invented, which greatly simplifies the process of returning funds. This concession is called Cessia. It turns out that you gave your debt to your own creditor. In other words, your debtor now has to pay with the lender.

In this transaction, you are considered a cedent, and a new lender is a cessionary. There is an agreement between you, which contains all the debt return nuances. Such an action leads to stabilization of the state of the enterprise and avoids unpleasant consequences for overdue debts.

We produce accounts receivable

Typically, the sale of receivables are produced at a lower price. For example, if the buyer must you 23,000 rubles, you can make a cessia in the amount of 20,000 rubles.

Receivables in the case of sale will be reflected using the following posting:

| Dr. | K-T. | Amount, rub. | Record |

| 62 | 90 | 230 000 | Revenue |

| 90 | 68 | 41 400 | |

| 62 | 91 | 200 000 | Amount of selling receivables |

| 91 | 62 | 230 000 | Crafting of obligations |

| 51 | 62 | 200 000 | Received from the new lender |

| 99 | 91 | 30 000 | Lesion |

Also, a new lender has the right to resell the obligations to a new person with a surcharge. In this case, receivables are translated at the expense of another cessionary.

This will affect the wiring as follows:

| Dr. | K-T. | Amount, rub. | Record |

| 62 | 91 | 220 000 | Amount of sale of obligations |

| 91 | 58 | 220 000 | Debuting receivables |

| 91 | 68 | 305 | VAT |

| 51 | 62 | 22 000 | Translation from new lender |

| 91 | 99 | 1 390 | Profit |

The right to resemble the available receivables has only the first transaction lender. All subsequent resale will refer to transactions with the implementation of financial investments.

In the first case, the difference between the price of the initial purchase of the obligation and its sales will be used for profit tax purposes. In subsequent transactions, the entire amount of funds received will be taken into account.

The debtors are debtors who can act as physical and legal entities or entities of the economy, which have debt. Activities of any enterprise is not necessary without interaction with debtors and creditors. Debt arising behind the debtors is called receivables.

Types of debtors

Depending on the type of debt, distinguishes the debtors by:

- promissory bills obtained;

- contributions to their own capital;

- extensions issued;

- pay for wages, taxes and payments to other creditors.

Each person in his life was in the role of the debtor: loans from banks or other individuals, debts for utilities - all this leads to arrears.

Considering the status of the debtor in a market economy, it is safe to say that the main debtors of the enterprise are buyers. Some amount of debt accounts for employees. Turning the situation on the other hand, we find that the organization itself becomes a debtor in the presence of debts in front of the state, individuals and legal entities.

What is the difference between debtors from creditors?

With the characterization of receivables or the concept of debtors, the question of the essence of creditors will certainly arise. These are two firmly interconnected phenomena, having opposite values. If the debtor is a debtor, then the creditor is the party that requires the execution of a debt obligation. For example, when shipping unpaid goods, the buyer acts as a debtor, and the manager is the lender.

Debitors and lenders are connected by one whole amount of debt obligation. One party provides funds under certain conditions (or at all without a contract), and the second undertakes to execute them. In this case, the debt for the debtor will be creditor, and for the creditor - receivables. It turns out that debtors are debtors, and the debt, the amount of which is due to the creditor - receivables.

Normal and overdue debt debtors

If commitments arose to a legal entity (for example, a trade enterprise), the fact of receivables are registered. It can have a short-term (less than one year) and long-term (more than one year) repayment period. Normal receivables include the obligations, the term of the execution of which has not yet come. For example, the buyer has shipped goods, payment for which according to the contract will arrive after partial implementation.

When the debtors are a commitment violate, that is, they do not fit into the period established for repayment, overdue arrears arise. There are two types of overdue obligations of the debtor - dubious and hopeless.

Dubious and hopeless debt debt

In cases where receivables for the goods delivered was not repaid on time and does not have sure, pledge or other guarantee of debt payment, it is considered doubtful. Overdue obligations can be performed using a delay or paying through bills, stocks or equivalent barter.

If you appeal to the court no longer seem possible, dubious debt becomes hopeless. This means that this debt is already impossible to compensate. The situation occurs in cases:

- liquidation of a legal entity;

- bankruptcy of the debtor;

- the deadline for filing the claim, if the debt was not confirmed.

The amount of debt, unreal to get, is written off into the financial result.

Accounts receivable in financial management system

The amount of debt of debtors is characterized as a component of the revolving assets of the enterprise. Work related to the debt control of debtors, an important point in the organization of the enterprise management system.

- Planning the total amount of the maximum possible debt of debtors.

- Set credit limit for buyers.

- Control the formation of receivables.

- Attract for the active participation of employees in the development of new scenarios and solving problems related to receivables.

Regardless of which control policy will be developed and adopted at the enterprise, it is necessary to carefully follow the results of financial analysis of debt debt.

Dake turnover indicator. Debt

To analyze the amount of debt of debtors, the turnover coefficient is used, which is calculated by the formula: to about \u003d in ÷ dz cp, where:

In - revenue from the implementation process;

DZ Wed - the average debt value of the debt for the period under review.

The average value is defined as the amount of debt at the beginning and end of the period divided by 2. To calculate the rate of turnover of debt of debtors, the formula: T OBR. D.Z. \u003d T P ÷ K about, where:

T P - considered period in days.

The value of the debt rate of debt of debtors characterizes the average deferment time of payments that the company provides them.

The obtained data on receivables can be distorted due to the fact that its composition also includes obligations under issued advances and debt of owners on contributions to share capital.

Accounting account receivable

Accounts receivable - the property right of the organization, therefore its amount is included in the assets. To account for such sums, several accounting accounts are used, the main of which are:

- 62 - to reflect customer receivables;

- 70, 71, 73 - to account for employee debt on accountable amounts and other operations;

- 75 - to reflect the arrears of the founders;

- 76 - reflects the calculations with the debtors for other operations;

- 60 - in case of issuance of advances in the account of the supplied products;

- 68, 69 - In case of overpayment of the amount of payments to the budget.

The amount specified in the debate of the listed accounts indicates the obligations of the debtor. As soon as the debt is repaid, the accountant carries out wiring with an indication of the amount made in the loan accounting accounts for debt accounts.

If payments on the obligations of debtors are overdue and cannot be claimed with them, the amount is attributed to the debit of account 91.2. In cases where the debtor after the trial paid all the imposed sanctions, the result refers to other income of the enterprise (sch. 91.1).

Creating a reserve of dubious debts

Accounting of receivables, which moved into a discharge questionable or hopeless, provides for the creation of a reserve of dubious debts. It is worth remembering that the commission of this action primarily regulates accounting policies. Only buyers receivables can be written off to the reserve. The operation reflects the wiring: D 63 CT 62.

The amount includes operating costs, thereby reducing the profit of the enterprise. At the same time, the debt itself does not disappear, but is listed on the off-balance account 007 for 5 years. The company leaves a chance to demand debt in case the financial situation of the debtor changes.

When the debtor is paying off debt, the amount will be written from the account of the reserve to the income of the enterprise: DT 91.1 Kt 63 (Dt 91.1 Kt 007).

Debitors are some of the counterparties in the system of market relations of buyers and customers. Paying due attention to the credit policy of the enterprise, it is possible to avoid the formation of hopeless debts, which inhibits the economic development of the company.

Accounting accounting of receivables calls the total debt, which is due to the enterprise from individuals and legal entities. However, this definition for many still remains a mystery that accounts are receivable. Therefore, in this article I will try to give a wide vision of this category of accounting.

The concept and determination of receivables

Nowadays, almost no enterprise is functioning without receivables, because its education is happening:

- the debtor is due to the ability to use free additional fundamentals;

- the lender is due to an increase in the market for the sales of services and goods.

The funds that form this allege to the organization are removed from the activities of the economic turnover, which does not advantaged the plus in terms of the financial consistency of the enterprise. An increase in receivables can bring the subject to financial collapse, bankruptcy (see also :). In this regard, accounting should ensure the timely recovery of the funds that make up the debtor of the debt.

Categories receivables

The excess of the debtor-oh debt over the creditor is one of the conditions for the financial stability of the enterprise.

So, the flow rate of one enterprise to the physical or legal entity acting in the role of his debtors is caused by debt-ko. Thus, the Deb-Rustic Justice is part of the revolving capital of the enterprise.

Debtor. Led is conditionally divided into overdue and normal debt.

- Normal debtor-th debt is called the debts of agents on shipped goods, works and services, which has not yet come for payment, but passed the transfer of ownership to the new owner; If suppliers, performers or contractors were listed for the delivery of the advantage of the advance.

- Overdue Deb-Raspann-Tyu is called debts on work or services, goods that have not been paid in the agreed period.

Overdue Deb-Rusty debt is divided into dubious and hopeless.

- Doubtful debt is every zoop, arising from the taxpayer, which arises due to the implementation of the goods, the fulfillment of work, when this zadar is not repaid within the period established in the contract, and is not secured by a pledge, bank guarantee or guarantion.

- After the end of the lawsuit period, the dubious debt will grow into a hopeless debit-kuyu, which is unrealistic to recovery. Such an unpleasant situation may form as a result of the fact that the debtor was liquidated or became bankrupt if the limitation period of expired and debt was not confirmed, if there are funds on "problem accounts" in banks, and also if it is impossible to recover using judicial The bailiff according to the court decision in the amount of debt amount (if an enterprise, its property is located at the disposal of operational management).

According to the duration of the maturity of receivables, it is divided into groups:

- short-term (when the debt repayment occurs throughout the year after the date of the reporting date);

- long-term (when the repayment will happen not earlier than the year after the reporting date)

Debuting receivables

To prevent the distortion of accounting information, as well as to ensure the sustainability of the enterprise in the financial plan, it is necessary to carry out the sealing of the Deb-Languy. First, the claims of the desired amount occurs in the order of claim, after the recovery of commercial debts is carried out using the court.

Each enterprise should monitor and conduct an analysis of receivables, to record it, after that - to check the intercession. When the amount of partnership debts is revealed, it is presented to the debtor before its demand. When in the continuation of the limitation period, he will not be recovered or the debtor is eliminated, then the enterprise has been written off this lighter.

An enterprise can be created by the reserve of dubious debts, while the rehabilitation of the borrower's solvency is expecting. When it is written off at a loss of an enterprise due to the insolvency of the debtor, then she does not cancel. This debt should hang in the balance sheet in the continuation of another five years from the date of its write-off to observe the probability of recovery of it in case the position of the economic debtor will change.

Debit-Ya debt must be inventory. As a result of the inventory, the identification of dubious receivables and debt, which is unrealistic to recovery, as well as an overdue debtor-th debt and the limitation period according to each obligation.

Initially, in order to determine the position of the Deb-th thorough, it is necessary to estimate the level and composition of the enterprise receivables, plus to this - the effectiveness of financial resources invested in it.

It is necessary to evaluate the degree of Deb district debt, as well as the dynamics of its change in the previous period. This assessment will allow the coefficient of distraction of fixed assets towards the d-Torsky axes with the help of the formula:

To deb. back \u003d Receivables / fixed assets

The formula means that the financial stability of the enterprise will be the higher, the lower this coefficient will be.

When evaluated, the following indicators are used: the coefficient of the overdue debt zador:

Overdue Support Coefficient \u003d Debit-Kaya Overdue / Deb. Ledg-T.

For visitors to our site there is a special offer - you can completely get advice with a professional lawyer, just leaving your question in the form below.

This coefficient serves to characterize the quality of the Debskie zero, and the value of it shows the reduction of the liquidity of the enterprise, as well as raising risks.

Accounts receivable are financial and commercial assets of the company working on a counterparty as a result of a transaction, contract, etc. In the role of a counterparty, buyers, contractors and other accountable persons can act. Accounts receivable refers to the property of the company (its assets) and is subject to inventory regardless of the maturity date.

Similar words, the concept of the Company's receivables is the amount of debt that the borrower has not yet returned for certain services or goods.

We give an example of receivables:

The enterprise "MAX" specializes in the manufacture of building mixtures. He has several debtors (debtors), these are firms that do not have the financial opportunity to make payment for the goods immediately. The two parties conclude an agreement with the date of repayment of debt and all the nuances in case of its non-fulfillment. Thus, the company "MAX" without refusing a loan, in the future will receive economic profits.

2. What is the difference between receivables and payables?

With receivables, your company has debtors, and in the case of accounts payable, debtors are you. On the one hand, the lack of receivables testifies to the caution of the company, since not all debtors eventually have the opportunity to return debt. But at the same time, the company deprives itself potential income from conscientious counterparties.

Regarding accounts payable, the same story, its high level indicates the problems of the company, and the absence demonstrates the success and payback of business by its own. But since KZ is third-party capital, it would be foolish not to take advantage of the opportunity to develop at the expense of other people's investments. It follows from this that the value is not the presence, but the volume and relationship of receivables and accounts.

3. Types of receivables

There are many criteria for which you can classify the types of receivables, but we turn to the main one.

Depending on the maturity date:

Depending on the receipt of payment:

In order to avoid serious consequences of non-payment of debt, firms create reserves for doubtful debts. The volumes of reserves are approved individually, it all depends on the financial position of the debtor and the probability of repayment of obligations. A reserve is established for doubtful debts after inventory.

4. Management of enterprise receivables

Often there are situations when an enterprise, seeking to increase profits, begins to overload itself by debtors, which ultimately can lead to a large number of unpaid debt and even to the bankruptcy of the enterprise. Reasonable managers pay great attention to the amount of debts and are strict accounting of receivables using various tools, such as Excel.

Receivables Management Methods:

- Strengthening work with receivables - debt collection without resorting to the assistance of judicial authorities.

- Balance control and accounts for payables and receivables.

- Motivation of the Sales Department (regarding the adoption of measures, in order to maximize the rapid return of funds from the debtor)

- Counting the real value of DZ, given the possibility of its sale.

- Creating a system of implementation at which payments regularly and guaranteed will occur, for example, a discount system for punctual clients.

- Calculation of the limit level of receivables.

- Audit of losses from DZ (what profit could receive a company in the case of instant payment and use of this money).

With competent control and management of receivables, the company can maximally protect itself from the risks associated with the non-missing debts, a decrease in solvency and disadvantage of working capital.

5. Inventory receivables

Inventory receivables are reconciliation of documents with counterparties, confirmation of the availability of debt and its size. Conduct an inventory before the annual report, change of the chief accountant, in the liquidation or reorganization of the enterprise and in case of emergencies, such as a fire.

Inventory is carried out on a specific date, the company sends data on debt to its borrowers, and they should confirm or refute the availability and amount of debt. This is ideal, but in fact not everything is so smooth, firstly, the inventory can take a large amount of time, in some firms reaching the month. Secondly, not all debtors respond to requests, especially those whose debt has long been waiting for it to be repaired.

Further, the problem is to resolve data inconsistencies, in this case you have to check all the operations carried out with this company, it creates a special difficulty if the enterprise is in another city or, even better, in another country. When sending a certificate of receivables, it is necessary to take into account the fact that the company may be both a debtor and lender at the same time. Even if by estimates you turned out to be a debtor, the statement is necessary to send, while specifying the amount and receivables and accounts.

After the verification, the company must compile an inventory act, some establish their own form template, or use standard, for example: sample 1 (download).

6. Deprecation of receivables

The turnover of receivables shows how quickly the firm receives the payment of DN for sold goods and services.

The coefficient of receivability of receivables shows how effective measures is taking an organization to minimize DZ. This indicator quantitatively measures how many times the company received a payment for the period in the amount of the average residue of unpaid debt from its buyers.

* Medium balance of receivables it is calculated as the amount of buyers receivables according to the accounting balance on the beginning and the end of the analyzed period divided by 2.

Formula turnover Receivables:

The period of depreciation of receivables in the days of formula:

*OTZ in daysshows the number of days during which debt remains unpaid.

As such a norm of turnover coefficient does not exist, it will be different for each industry. But in any case, the higher the OTZ, the better for the organization, this means that buyers quickly repay the debt.

7. Recovery of receivables

Any enterprise is found with the problem of improperness of receivables. Of course, the buyer can have various good reasons, but who cares? The company wants to recover his money for the provided goods.

The return of receivables can be carried out by different methods, for example, hire the mafia, but if legally, it is better to make a claim or contact the judicial authorities. If you decide to settle a conflict lovely, you should send a claim to the debtor to clearly explain your position and find out what kind of sound objections.

In the appeal of recovery of receivables, you must specify the following items:

- Call

- Detailed calculation of the amount of the debt

- Calculation of interest interest

- Debt repayment period

- Court handling warning

In addition, under the claim there should be a signature of an authorized person, you should also attach copies of all documents related to debt. If the debtor received your letter (should be evidence) and did not respond on time, then with a calm conscience you can contact the court with the requirement of return receivables.

8. Disability of receivables

According to the law, the debt is considered an overdue, if the term of the limitation of the debt (3 years) and hopeless debt has expired, if the firm does not have the opportunity to pay duty. On these grounds, the company has the right to write off the debt. The write-off of hopeless overdue receivables is allowed to carry out the period in which the limitation period was held.

The write-off of receivables with an expired limitation period can be carried out by two methods. The first is to use for this purpose a reserve of dubious debts, if the reserve has not been provided for this debt, it is written off to financial results. Posting the write-off of receivables should be carried out exclusively for each obligation separately. The reason for this can be the results of inventory, written confirmations or order of the head of the enterprise.

A sample of the order for debiting receivables: Sample 2 (download).

Cancellation of hopeless DZ is not the actual cancellation of debt, therefore, for five years after the write-off, receivables are reflected in the balance sheet. And throughout the period, you need to follow the financial condition of the debtor, if he did not have the opportunity to pay off debt.

9. Receivables Report

For the manager, it is important to have an idea of \u200b\u200bwhat the amount of funds it can use when the following revenues will be and on the basis of the report to think over its actions on finance. Also, according to the report, it is possible to evaluate the receivables of each client, who responsibly makes payments, and who does not even understand the importance of timely debt payment.

Sample decoding receivables and payables Sample: Sample 3 (download).

10. Sale and purchase of receivables

If you do not have the slightest desire to deal with the debtors, but you wish to return funds, you can sell receivables, if there are faces, what it will be interesting. Often these are the people who themselves have debt before the debtor. The company has the opportunity to buy receivables at a lower price, so to speak with a discount, and then present documents to the debtor and demand the return of debt at full cost. For the sale of debt, the consent of the debtor is not needed, it will be enough to notify it about the sale of debt.

Optimization of the enterprise sales system and minimalization of risks in working with receivables and payables

Accounts receivable- This is one of the most liquid assets of the enterprise. However, the amount of receivables is something that can cause a lack of financing, especially without correlation with payables and without effective management of these types of debts. This article will talk about the concepts of receivables and payables, on risks associated with the availability of debt assets and liabilities, as well as some methods for reducing these risks.

The concept of receivables - is this we should or should we?

Accounts receivable is the debt of external counterparties and employees of the enterprise before the organization.

Buyers receivables arises in the case of providing a deferment of payment (in this case, they talk about a commercial loan), as well as with the buyer's failure to fulfill their obligations under the payment of the goods, works, services, services. Prepayment suppliers of goods, works, services is also included in receivables. Examples of such debutors can serve as rental deposits or amounts paid for the annual subscription of printed publications.

As part of receivables, an overpayment of taxes, fees and contributions to extrabudgetary funds, as well as various debt of employees before the organization, for example:

- the amounts received by employees under the report;

- wage overpayment;

- debt on loans received from the enterprise;

- duty to compensation for shortage and material damage.

What is the creditor of the company's debt with simple words

Payables are the debt of the enterprise before external counterparties, budget and extrabudgetary funds, as well as employees of the enterprise.

Payable arrears arises if the company received goods, work or services, she overturned them in accounting, but did not fulfill the obligations to pay. Debt to creditors is current and overdue depending on the right to delay the payment and the date of the occurrence of debt.

For example, wages are charged in accounting on the last day of the month, and is paid at the beginning of the next month. At the end of the month of accrual, payables in front of employees of the company's payroll will be current. In case of non-payment of wages within the prescribed period, such debt will be considered overdue.

Consider how debating and creditors are reflected in the accounting statements of the enterprise.

Account and creditor for the year in f. 1 balance and other forms of annual reporting

Depending on the repayment period, the creditor is divided into long-term (more than a year) and short-term (less than a year) and, in accordance with this classification, are shown in the balance sheet. Payable debt in the balance sheet is either a long-term obligation, which is reflected in section IV, or a short-term commitment, which is reflected in line 1520 of section V.

Accounts receivable is reflected in line 1230 in section II of the accounting balance.

Accounts receivables and payables are important indicators of the accounting reporting of an enterprise that are subject to decoding in explanations for reporting (clause 27 PBU 4/99 "Accounting Reporting of the Organization", approved by the order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43N). Deciphering receipts and creditors are interested in reporting users first of all, since these assets and liabilities may be risk sources.

What does the ratio of receivables and payables mean?

The ratio of receivables and payables is an important item to analyze the financial condition of the enterprise. However, it cannot be viewed separately from other reporting articles.

If the creditor exceeds the receipt - this may mean that the company is experiencing a shortage of working capital, but it may also mean that the enterprise has a sufficient number of other resources, such as cash.

Unambiguously, it can be said that the postponement of payments provided to customers should be less or equal to the deferment of payments to the enterprise suppliers. Otherwise, the company will experience an acute shortage of the funds necessary for settlements with creditors, with the additional costs of the payment of penalties and fines with additional expenditures.

It is necessary to understand that the terms "receivables" and "payables" are needed correctly. If you write the buyer as a claim as follows: "Please pay account receivables under the supply contract", your counterparty will not understand the essence of the request, since the debt before your company is listed as a creditor.

Important ! When issuing legally significant documents, do not refer arrears as payables or receivables, use the concepts defined in the contract.

Accounts and payables are a source of risks

You can allocate the following risks associated with debitor and creditors:

- credit risk (risk of failure to fulfill obligations by debtors);

- the risk of loss of liquidity (the risk of failure to fulfill obligations to creditors);

- operational risk (risk of loss and losses due to shortcomings in control and management systems).

What measures should the enterprise be taking to reduce the influence of risks on current activities?

Work on the prevention of the occurrence of overdue and impossible to recover debts of buyers (credit risk) begins with assessing client reliability before the conclusion of the contract. For such an assessment, to analyze the accounting statements of the client. It is important to have information about the participation of the future buyer in legal processes, tax disputes, check the powers of officials signing legal documents, as well as to conduct other necessary checks.

Of course, the most reliable way to prevent debt collection from buyers is the work on the basis of prepayment, but in market conditions you have to find compromise payment options, including the provision of delaying payment.

Work on the prediction of cash flows, depending on the payment obtained and the delay, can significantly reduce the risk of liquidity loss.

Reducing operational risks is achieved by building a clear management system receivables and payables. One of the elements of the management of receivables is insurance of debaters.

Insurance of receivables

How does receivables insurance work? The company concludes an agreement with an insurance company, where the main conditions of the insurance contract are determined, including the list of insurance claims, the procedure for assessing the financial position of debtors and others. For example, in the insurance contract it may be determined that the insured event recognizes the failure to fulfill the obligations of the buyer during a certain term insurance contract.

The insurance company and the policyholder determine the list and the amount of receivables subject to insurance.

Note! The insurance company does not insure receivables as a whole, and carefully suits the risks of non-payment in the context of each insurer client.

What happens as a result of the occurrence of the insured event? The insurance company pays the enterprise to the insurer the amount of insured receivables with a certain discount, that is, part of the amount of the debt is charged to the expenses of the enterprise. After that, the right demands of debt proceeds to the insurance company.

Despite the fact that insurance of receivables is a fairly reliable tool in reducing credit risks, the company should compare the upcoming costs and the estimated benefits of this type of insurance.

RESULTS

In order to provide competitive commercial conditions for their customers , in particular, to give them a deferment of payment, the company must find a source of financing its own expenses for the period of deferment. The accounts payable is one of such sources of financing the current activities of the enterprise. Competent and effective management of receivables and payables are the key to success of any commercial activity.