Detailed chart of accounts. Section III. Production costs

Accounting in an economic entity involves the use of such a tool as accounting accounts used to group information by objects that are monitored. They are of several types. The basis for the numbering of accounts is the Chart of Accounts accounting for 2019 with explanations and postings. It is necessary to distinguish between the chart of accounts of commercial enterprises, as well as those intended for credit and public sector.

Due to the importance of the data that accounting provides, its regulation is carried out at several levels, including by law. One of the regulatory bodies in this area is the Government of the Russian Federation represented by the Ministry of Finance of the Russian Federation.

The latest chart of accounts was put into effect by the Order of the Ministry of Finance in 2000 in order to reform operating system accounting and its convergence with international accounting standards.

This document is intended for use by all enterprises and organizations, with the exception of public sector entities and credit institutions. For the latter, specialized plans have been developed that reflect the specifics of their activities.

Account types

Accounts are a grouping of information about certain accounting objects, which occurs based on the use of the principle double entry(that is, the data is simultaneously recorded on the debit of the first account and the credit of the other).

If the account shows the property of the enterprise, then it is called active. These are accounts for reflecting fixed assets, materials, cash, goods, finished products, expenses, etc.

For this type of accounts, the following is typical: the balance of funds is shown on the debit (asset), the increase occurs on the debit, the decrease on the credit of the account, the final balance is calculated by adding the balance at the beginning and the turnover on the debit of the account and subtracting the credit turnover from their amount.

Passive accounts are required to record information on the sources of creation of enterprise funds. These are accounts of authorized, reserve and additional capital, etc., as well as loans.

These accounts are characterized by the following: the balance is shown on the credit, the increase occurs on the credit, and the decrease on the debit of the account, the final balance is calculated by subtracting the movement on the debit of the account from the amount of the initial balance and the credit turnover.

In addition, active-passive accounts are also used, they can additionally be divided into:

- Accounts where the balance can be both on the credit and on the debit of the account at once. This is usually an account reflecting settlements with suppliers, buyers, personnel, budget, etc.

- Accounts where the balance can only be active or only passive. First of all, they include financial results accounts.

Chart of Accounts 2019 with explanations and postings

Section I. Non-current assets

| Account number and name | Account type | Sub-accounts, analytics | Explanations |

| Active | The account is maintained by the organization | ||

| Passive | Sub-accounts are opened by OS types | The account takes into account the amounts accumulated in the process of using fixed assets | |

| Active | Sub-accounts can be opened by types and objects of value | The account records information about investments in material assets that are provided to others for temporary use for a fee | |

| 04 Intangible assets | The account takes into account investments in intangible assets or R&D work | ||

| 05 Depreciation of intangible assets | Passive | Sub-accounts are opened by types of intangible assets or R&D expenses | The account takes into account the accumulated depreciation during the use of intangible assets |

| 06 | Not applicable | ||

| 07 Equipment for installation | Active | Sub-accounts are opened by type of equipment, its location | The account takes into account the purchased equipment, which should be installed in facilities under construction |

| 08/1. Acquisition land plots 08/2. Acquisition of objects of nature management 08/3. OS facilities construction 08/4. Acquisition of fixed assets 08/5. Acquisition of intangible assets 08/6. Transfer of young animals to the main herd 08/7. Acquisition of adult animals 08/8. R&D performance | The account accumulates costs for objects, which will then be taken into account as fixed assets or intangible assets | ||

| 09 Deferred tax assets | Sub-accounts can be opened by types of assets or liabilities | The account reflects the resulting deferred tax assets | |

Section II. Productive reserves

| Account number and name | Account type | Sub-accounts, analytics | Explanations |

| Active | 10/1. Raw materials 10/2. Purchased semi-finished products and components, structures and parts 10/3. Fuel 10/4. Containers and packaging materials 10/5. Spare parts 10/6. Other materials 10/7. Materials transferred for processing to the side 10/8. Construction Materials 10/9. Inventory and household supplies 10/10. Special equipment and special clothing in stock 10/11. Special equipment and special clothing in operation | On the account and its sub-accounts, various types of raw materials and materials intended for production activities are accounted for | |

| 11 Raised and fattened animals | Sub-accounts can be opened by places where animals are kept, species, age, etc. | The account takes into account the presence and movement of young animals, birds, etc. | |

| 12, 13 | Not applicable | ||

| 14 Provisions for impairment material assets | Passive | The account takes into account the reserves created in case of deviation of the book value of the available raw materials and materials from the market | |

| 15 Procurement and acquisition of material assets | Active | The invoice takes into account the cost of materials and stocks in transit | |

| 16 Deviation in the value of material assets | Active-passive | Sub-accounts can be opened by stock groups | The account takes into account the difference between the actual and accounting prices purchase of materials and supplies |

| 17, 18 | Not applicable | ||

| Active | 19/1. VAT on OS acquisition 19/2. VAT on acquired intangible assets 19/3. VAT on purchased inventories | The invoice contains information on the amounts of VAT paid to suppliers | |

Section III. Production costs

| Account number and name | Account type | Sub-accounts, analytics | Explanations |

| Active | Sub-accounts can be opened by types of costs or types of products | This account takes into account the costs of producing products, works or services for which the enterprise was organized | |

| 21 Semi-finished products own production | Sub-accounts can be opened by storage locations or names | The account records semi-finished products of own production | |

| 22 | Not applicable | ||

| 23 Ancillary industries | Active | Sub-accounts can be opened by type of production | The account records the costs of production, which are considered auxiliary to the main |

| 24 | Not applicable | ||

| Active | Sub-accounts are opened by departments or expense items | The account records expenses for servicing the main and auxiliary production | |

| 26 General running costs | Sub-accounts are opened by expense item, place of origin, etc. | The account records expenses for management needs that are not directly related to production | |

| 27 | Not applicable | ||

| Active | Sub-accounts can be opened by divisions, types of products, perpetrators, etc. | The account takes into account losses from the release of defects in production | |

| 29 Service industries and households | Sub-accounts can be opened by types of production, according to their cost accounts | The account takes into account the costs of manufacturing products produced by service industries and farms | |

| 30-39 | Not applicable | ||

Section IV. Finished products and goods

| Account number and name | Account type | Sub-accounts, analytics | Explanations |

| 40 Output of products (works, services) | Active-passive | The account is used to account for information about manufactured products, as well as to determine the deviation of the standard cost from the actual one. The account must be closed every month. | |

| 41 Items | Active | 41/1. Goods in warehouses 41/2. Goods in retail 41/3. Containers under the goods and empty 41/4. Purchased items | The account records the valuables that were purchased for the purpose of resale. |

| 42 Trade margin | Passive | Trade margins are recorded on the account if goods for sale are recorded at sales prices | |

| 43 Finished products | Active | Sub-accounts can be opened by storage locations, product groups or units | The account records the finished products that were produced at the enterprise |

| 44 Selling expenses | Sub-accounts can be opened by items and types of expenses | The account records the expenses that were incurred for the purpose of selling goods, works, services | |

| 45 Goods shipped | Sub-accounts can be opened at the location of products or their types | The account records goods sold, the proceeds from which for some time cannot be recognized in accounting | |

| 46 Completed milestones for work in progress | Sub-accounts can be opened by type of work | The account records the completed stages of work, which are of independent importance. | |

| 47, 48, 49 | Not applicable | ||

Section V. Funds

| Account number and name | Account type | Sub-accounts, analytics | Explanations |

| 50 Checkout | Active | 50/1. Cash desk of the organization 50/2. Operating cash desk 50/3. Cash documents | The account records the cash flow of the enterprise |

| 51 Settlement accounts | Sub-accounts can be opened for all settlement accounts | The account records the movement of funds on bank accounts enterprises | |

| 52 Currency accounts | Sub-accounts can be opened for all accounts in foreign currency | The account records the movement of funds on the company's bank accounts opened in foreign currencies | |

| 53, 54 | Not applicable | ||

| 55 Special bank accounts | Active | 55/1. Letters of credit 55/2. Checkbooks 55/3. Deposit accounts | The account is accounted for monetary obligations in rubles and foreign currency in letters of credit, promissory notes and other monetary documents |

| 56 | Not applicable | ||

| 57 Transfers on the way | Active | The account records the amounts of money in rubles and foreign currency that have been sent, but have not yet been credited to the destination | |

| 58 Financial investments | 58/1. Units and shares 58/2. Debt securities 58/3. Loans granted 58/4. Contributions under a simple partnership agreement | The account takes into account the company's investments in bonds, stocks, other securities, etc. | |

| 59 Provision for impairment financial investments | Passive | Sub-accounts can be opened for each reserve | The account records the funds set aside as a reserve in case of depreciation of financial investments. |

Section VI. Calculations

| Account number and name | Account type | Sub-accounts, analytics | Explanations |

| Active-passive | The account records settlements with suppliers and contractors of the business entity | ||

| 61 | Not applicable | ||

| Active-passive | Sub-accounts can be opened under contracts, counterparties, etc. | The account records settlements with buyers and customers | |

| 63 Provisions for doubtful debts | Passive | The account takes into account sums of money formed reserves for doubtful debts | |

| 64, 65 | Not applicable | ||

| 66 Settlements on short-term credits and loans | Passive | The account takes into account information on short-term (up to 12 months) loans and borrowings received by the company | |

| 67 Accounts for long-term loans and loans | Sub-accounts can be opened by types of loans and loans, organizations that issued them, etc. | The account takes into account information on long-term (more than 12 months) loans and borrowings received by the company | |

| Active-passive | Sub-accounts are opened by types of taxes and fees | The account records the subject's settlements of taxes and fees | |

| 69/1. Calculations for social insurance 69/2. Calculations for pension provision 69/3. Calculations for compulsory health insurance | The account takes into account settlements on deductions to social funds | ||

| Sub-accounts are opened for employees of the organization | The account records settlements with employees of the company for wages, payment of income on shares, etc. | ||

| Sub-accounts can be opened by accountable persons | The account records the amounts that were issued under the report for the implementation of production or administrative expenses | ||

| 72 | Not applicable | ||

| 73 Settlements with personnel for other transactions | Active-passive | 73/1. Loan settlements 73/2. Compensation calculations material damage | The account takes into account settlements with the company's personnel for all types of settlements, except for salaries and accountability |

| 74 | Not applicable | ||

| 75 Settlements with founders | Active-passive | 75/1. Settlements on contributions to the authorized (share) capital 75/2. Calculations for the payment of income | The account takes into account settlements between the company and the founders |

| 76/1. Settlements for property and personal insurance 76/2. Claim settlements 76/3. Calculations on due dividends and other income 76/4. Settlements on deposited amounts | The account records settlements with debtors and creditors that cannot be assigned to accounts from 60 to 75 | ||

| 77 Deferred tax liabilities | Passive | Sub-accounts are opened by types of assets or liabilities for which there was a tax difference | The sub-account is used to record the resulting tax liabilities |

| 78 | Not applicable | ||

| 79 On-farm settlements | Active-passive | 79/1. Settlements for allocated property 79/2. Calculations for current operations 79/3. Settlements under a property trust management agreement | The account is used to record settlements between branches, separate divisions, branches, etc. |

Section VII. Capital

| Account number and name | Account type | Sub-accounts, analytics | Explanations |

| 80 Authorized capital | Passive | Can be opened for each participant | The account collects information on the creation and movement of the authorized capital |

| 81 Treasury shares (shares) | Active | The account takes into account the movement of shares that were redeemed joint stock company from holders for further sale or cancellation | |

| 82 Reserve capital | Passive | The account reflects the formation and change of reserve capital | |

| 83 Additional capital | Sub-accounts can be opened in the areas of creation and use | The account reflects the formation and change of additional capital | |

| 84 Retained earnings (uncovered loss) | Active-passive | Sub-accounts can be opened according to the directions of use of funds | The account reflects the movement of funds of retained earnings or uncovered loss of the subject |

| 85 | Not applicable | ||

| 86 Targeted funding | Active-passive | Accounts can be opened according to the purpose of funds and sources of financing | The account records the funds received for the implementation of special-purpose activities |

| 87, 88, 89 | Not applicable | ||

Section VIII. Financial results

| Account number and name | Account type | Sub-accounts, analytics | Explanations |

| Active-Passive | 90/1. Revenue 90/2. Cost of sales 90/3. value added tax 90/4. excises 90/5. Profit/loss on sales | The account collects information on current activities to determine financial result. All information is grouped by sub-accounts, after which it is debited to account 90/9 | |

| 91 Other income and expenses | 91/1. Other income 91/2. other expenses 91/9. Balance of other income and expenses | This account reflects information about other income and expenses that are not related to the main activity. At the end of the period, all sub-accounts are closed to account 91/9 | |

| 92, 93 | Not applicable | ||

| 94 Shortfalls and losses from damage to valuables | Active | The account takes into account various shortages and losses, regardless of the identification of the perpetrators for them. | |

| 95 | Not applicable | ||

| 96 Reserves upcoming expenses | Passive | Sub-accounts are opened by types of reserves | The account records reserve funds, which should be evenly allocated to production or sales costs. |

| 97 Deferred expenses | Active | Sub-accounts are opened by types of expenses | The account includes expenses incurred in given period, but actually refer to the future. |

| 98 Deferred income | Passive | 98/1. Deferred income 98/2. Donations 98/3. Future receipts of debts for shortfalls identified in previous years 98/4. The difference between the amount to be recovered from the perpetrators and book value for missing values | The account records the income that the entity received in this period, but in fact they relate to future periods. |

| 99 Gains and Losses | Active-Passive | Required to obtain the final financial result for current period. When making annual report the account is closed on account 84. | |

Off-balance sheet accounts

| Account number and name | Account type | Sub-accounts, analytics | Explanations |

| 001 Leased fixed assets | Off-balance sheet | Sub-accounts can be opened for lessors or fixed assets | The account records fixed assets that are leased from the company |

| 002 Inventory items accepted for safekeeping | Sub-accounts can be opened by types of valuables, owners, storage locations, etc. | The account records the valuables accepted by the company for safekeeping | |

| 003 Materials accepted for recycling | Sub-accounts can be opened by customers, types of raw materials, their locations, etc. | The account records the received raw materials and materials, which are subject to processing into finished products | |

| 004 Goods accepted for commission | Sub-accounts can be opened by the owners of the goods and the name of the goods | The account records goods that are accepted by the organization under a commission agreement | |

| 005 Equipment accepted for installation | Sub-accounts are opened by objects or pieces of equipment | Usually used by contractors, the account takes into account the equipment of the customer, which will be installed on site | |

| 006 Forms of strict accountability | Sub-accounts can be opened by types of forms and their locations | The subaccount is used to account for the movement of strict reporting forms - books of receipts, diplomas, certificates, etc. | |

| 007 Written-off debt of insolvent debtors | Sub-accounts are opened for each debtor whose debt has been written off | The account is used to record debts that were written off at the end of the statute of limitations. By law, they are on the balance sheet for another 5 years. | |

| 008 Security for obligations and payments received | Sub-accounts can be opened for each collateral received | The account is used to record collateral received against obligations or goods | |

| 009 Security for obligations and payments issued | Sub-accounts can be opened for each issued collateral | The account is used to record collateral issued by the firm against its obligations. | |

| 010 Depreciation of fixed assets | Sub-accounts can be opened for each object | The account is used to accumulate information about the depreciation of the housing stock, landscaping, etc. | |

| 011 Leased fixed assets | Sub-accounts can be opened for tenants or fixed assets | The account is designed to account for fixed assets that were leased out, if under the agreement they must be accounted for on the lessee's balance sheet |

At the time of buying square meters citizens applying for property tax deduction, it is important to pay attention to the status of the property: whether it is residential or not. The explanations of the Ministry of Finance were published by the Federal tax service(FNS). Due to direct instructions Labor Code labor relations are of a reimbursable nature. Receive timely and in full wages is one of the key rights of the employee, and its timely and full payment is the main obligation of the employer. At the same time, in the event that an employee performs work, no external factors - extraordinary circumstances, disasters or threats of disaster (fires, floods, famine, earthquakes, epidemics or epizootics) and other cases that endanger the life or normal living conditions of the entire population or part of it, should interfere with the exercise of this right and duty. Although there are still some reservations about this in the Labor Code of the Russian Federation. According to the law, the period for conducting both documentary and field check cannot exceed 20 business days. In the case when a legal entity operates on the territory of several regions, the duration of any of these inspections is determined separately for each of its branches, representative offices or separate structural subdivisions. At the same time, as established general term verification can not be more than 60 working days. The views of the courts on what period is meant here: all checks in relation to legal entity and its subsidiaries and divisions, or the examinations of each of them, diverge, and this clearly illustrates one of the Supreme Court Russian Federation affairs.

As a social security medical workers compensation for work in countryside. On what conditions such payments are made and whether they are subject to personal income tax, we will tell in the article. On March 11, the State Duma adopted in the third, final, reading the Law of the Russian Federation on an amendment to the Constitution of the Russian Federation "On improving the regulation of certain issues of the organization and functioning of public authorities." Recall that the law provides for the introduction of targeted adjustments to certain articles of chapters 3-8 of the Basic Law of the State concerning the establishment of additional social guarantees, the expansion of the powers of public authorities, the clarification of the procedure for forming the Government of the Russian Federation, etc.

Applying a Chart of Accounts

- Inseparable improvements. Accounting and tax accounting for the lessor

N 91n, Instructions for the use of the Chart of Accounts for Financial Accounting economic activity organizations, approved by Order of the Ministry of Finance of Russia dated ... N 91n, Instructions for the application of the Chart of Accounts for the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated ...

- Fixed asset for sale as an object of property taxation

... /01). According to the Instructions for the Application of the Chart of Accounts for Accounting Financial and Economic Activities of Organizations (hereinafter referred to as the Instruction) for accounting ...

- Inseparable improvements. Accounting and tax accounting for the tenant

6/01, Instructions for the application of the Chart of Accounts for the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated ...

- The employee purchased the tool at his own expense and brought the check to the accounting department - how to make a purchase

Consider the following. In accordance with the Chart of Accounts for accounting of financial and economic activities of organizations and the Instructions for its application ...

- Acquisition of software under a sublicense agreement: how to take into account

Use under sublicensing agreements" (Chart of Accounts for Accounting for the Financial and Economic Activities of Organizations and Instructions for its Application...

- Accounting for the costs of services for providing access to the electronic trading platform

Types of expenses in accordance with the Chart of Accounts for accounting of financial and economic activities of organizations and instructions for its use ...

- Accounting for the purchase of real estate under an agreement on the assignment of rights to claims of equity participation in construction

actual receipt. Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated ...

- Separate accounting of expenses and revenues for the supply of products as part of the execution of the state defense order

Zapasov", Instructions for the application of the Chart of Accounts for the accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated ...

- On the obligation to keep records on the off-balance account 002

The off-balance account is directly named in the Chart of Accounts for the financial and economic activities of organizations. In addition, the maintenance of this off-balance sheet ... follows from the Instructions for the Application of the Chart of Accounts for Accounting for the Financial and Economic Activities of Organizations (approved by Order of the Ministry of Finance of the Russian Federation dated ... 002). 3. Instructions for the application of the chart of accounts for financial and economic activities of organizations (approved by Order of the Ministry of Finance of the Russian Federation dated ...

- How to fix last year's mistake with the simplified tax system "income minus expenses"

Correspondence with account 91 (see the Chart of Accounts for the financial and economic activities of organizations and the Instructions for its use ...

- How to reflect marriage in the accounting in the absence of fault of employees

- Rules for paying sick leave, the period of which affects 2 months

The following posting scheme is used (see the Chart of Accounts for accounting for the financial and economic activities of organizations and the Instructions for its use ...

- Write-off of damaged goods in accounting and tax accounting when the guilty person is not identified

- Is it possible to transfer fixed assets with a residual value of less than 40 thousand rubles. in the MPZ?

The other follows from the analysis of the Chart of Accounts for accounting of the financial and economic activities of organizations and the Instructions for its application ...

- Security expenses. Accounting and tax accounting

Accounts" (Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated ... N 33n, Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated ...

See what accounting accounts organizations use in 2017, what is the difference between active, passive and active-passive accounts, how to determine the account balance at the end of the reporting period. For your convenience, we have compiled a table of accounting accounts for 2017.

Types of accounting accounts in 2017

In 2017, the chart of accounts is in effect, approved. by order of the Ministry of Finance dated October 31, 2000 No. 94n. Instructions for use approved by the same order.

All accounts in the chart of accounts are divided into 3 types:

- Active

- Passive

- Active-passive

The difference lies in where the addition of assets is reflected, and where the departure is on the debit or credit of the account.

Active ones are reflected in the composition of the asset balance, passive ones make up its passive part. Below we have compiled a table of accounting accounts in 2017 by their types.

Active accounting accounts

Active accounting accounts contain information about the assets of the organization, i.e. about property owned by the company. For example, fixed assets, intangible assets, cash etc.

These accounts form an asset balance sheet.

The balance of active accounts is formed according to the following formula:

Important! Active accounts can only have a debit balance. If you get a debit balance - look for an error in accounting.

See below the active accounting accounts in 2017 in the table.

Table. Active accounting accounts in 2017

Passive accounting accounts

Passive accounting accounts contain information about the sources of financing of the company's activities. For example, information about company loans and borrowings, information about settlements with personnel, etc.

The balance of passive accounts is reflected in the liability of the organization's balance sheet and is formed according to the following formula:

Important! The balance of passive accounts can only be credit. If you get a credit balance - look for an error in accounting.

See below the passive accounting accounts in 2017 in the table.

Table. Passive accounting accounts in 2017

Active-passive accounts in 2017

Active-passive accounts contain information both about the property of the organization and about the sources of its formation. They are of 2 types:

- The account at the end of the period has only one balance (either debit or credit). For example, account 99 "Profit and loss";

- The account at the end of the period has both a debit and a credit balance. For example, 76 "Settlements with other debtors and creditors".

The principle of determining the balance on active-passive accounts is the same as for simply active or passive accounts, which we indicated above.

At the same time, a debit entry means either an increase in funds or a decrease in the source of financing, and a credit entry means either an increase in the source or a decrease in funds.

Attention! When maintaining an active-passive account, it is important to correctly build account analytics in order to avoid confusion when reflecting debit and credit transactions in the account.

See below the active-passive accounting accounts in 2017 in the table.

Table. Active-passive accounting accounts in 2017

All information on coronavirus for an accountant

Everybody is here latest news, which will help you understand the issue and protect the company. The feed is constantly updated.

If a firm keeps records using the double entry method, it must use this chart of accounts, regardless of the legal form and form of ownership. The exception is state-owned enterprises and credit institutions.

The main task of the PS is to harmonize the accounting indicators and the indicators of the current current reporting. In order to use the accounts correctly, comments are given for each of them in the instructions of the Ministry of Finance.

What does the chart of accounts look like in 2019?

This is a scheme for registering and grouping indicators of the economic activity of an enterprise. These include assets, various liabilities, financial operations And so on. In the PS, the accounts of the first order (synthetic) and the second order (sub-accounts) are indicated. Based on the PS, companies create and approve a working chart of accounts with complete list all accounts. Accounting accounts are divided into:

- active;

- passive;

- active-passive.

Active Accounts

The closing and opening balances must be recorded in the debit of the account. Record the increase in the debit of the account, and the decrease in the credit.

List: 01, 03, 04, 08, 09 - 10, 19 - 20, 23, 25, 26, 29 - 41, 43, 44 - 58, 60.2, 60.7, 62.1, 62.3 - 62.6, 62.11, 62.22, 62.44, 73, 75.1, 76.2, 76.22, 81, 90.2 - 90.8, 91.2, 94, 97.

Passive Accounts

The closing and opening balances must be recorded on the credit of the account. Record the increase on the credit of the account, and the decrease on the debit.

List: 02, 05, 42, 59, 60.1, 60.3, 60.6, 60.11, 60.22, 62.7. 77, 80, 82 - 83, 90.1, 91.1, 96, 98, 99.2.1, 99.2.3.

Active-passive accounts

Such accounts are either unilateral or bilateral. In the first case, the balance is either debit or credit, and in the second - both debit and credit. List: 11 - 16, 40, 60, 62, 68 - 69, 71, 75, 76.1, 76.3, 76.5 - 76.11, 76.55, 76.AB, 79, 84 - 90, 90.9, 91, 91.9, 99 - 99.2, 99.2.2.

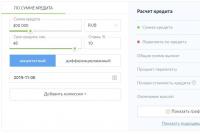

Working Chart of Accounts 2019

It is not necessary to use all plan accounts. Each company has the right to have its own chart of accounts. We advise small companies to use the chart of accounts in the service.

| account number | Account name |

|---|---|

| 01 | fixed assets |

| 02 | Depreciation of fixed assets |

| 02.01 | Depreciation of fixed assets |

| 02.02 | Amortization of profitable investments in material assets |

| 03 | Profitable investments in material values |

| 04 | Intangible assets |

| 04.01 | Intangible assets of the organization |

| 04.02 | R&D results |

| 05 | Amortization of intangible assets |

| 08 | Investments in non-current assets |

| 08.01 | Fixed assets– acquisition of land plots |

| 08.04 | Non-current assets - acquisition of fixed assets |

| 08.05 | Non-current assets - acquisition of intangible assets |

| 10 | materials |

| 19 | VAT on purchased assets |

| 19.ag | VAT on operations of a tax agent |

| 20 | Primary production |

| 23 | Auxiliary production |

| 25 | overhead costs |

| 26 | General (administrative) expenses |

| 29 | Service industries and farms |

| 41 | Goods |

| 42 | Trade margin |

| 43 | Finished products |

| 44 | Selling expenses (sales expenses) |

| 45 | Goods shipped |

| 50 | Cash register |

| 51 | Settlement accounts |

| 52 | Currency accounts |

| 55 | Special bank accounts |

| 55.01 | Special bank accounts |

| 55.02 | Checkbooks |

| 55.03 | Deposits |

| 55.04 | Electronic money |

| 57 | Transfers on the way |

| 58 | Financial investments |

| 60 | Settlements with suppliers and contractors |

| 62 | Settlements with buyers and customers |

| 63 | Allowance for doubtful debts |

| 66 | Settlements on short-term loans and borrowings |

| 66.02 | Calculations on amounts of credits and loans |

| 66.03 | Interest on short-term loans and borrowings |

| 67 | |

| 67.01 | Settlements on long-term credits and loans |

| 67.02 | Interest on long-term loans and borrowings |

| 68 | Calculations for taxes and fees |

| 68.ag | VAT in the performance of duties of a tax agent |

| 68.acc | excises |

| 68.vm | Single tax on imputed income |

| 68.dr | Other taxes and fees |

| 68.zem | Land tax |

| 68.im | Property tax |

| 68.vat | |

| 68.ne | Penalties on taxes |

| 68.pr | income tax |

| 68.tr | Transport tax |

| 68.trg | Trading fee |

| 68.zem | Land tax |

| 68.usn | Single tax when applying the simplified tax system |

| 68.fl | Personal Income Tax |

| 68.shtf | Tax Penalties |

| 69 | Settlements for social insurance and security |

| 69.dp1 | Voluntary pension contributions on the funded part at the expense of the employer |

| 69.dp2 | Voluntary pension contributions for the funded part from the income of employees |

| 69.oms | Settlements with the PFR on contributions to the mandatory health insurance in FFOMS |

| 69.pf1 | Settlements with the PFR for the insurance part of pension contributions |

| 69.pf2 | Settlements with the PFR on the funded part of pension contributions |

| 69.ss1 | Settlements with the FSS for contributions for temporary disability and maternity |

| 69.ss2 | Settlements with the Social Insurance Fund for contributions for accidents and occupational diseases |

| 69.ss3 | Settlements with the FSS on voluntary contributions for accident insurance |

| 69.shtf | Penalties on insurance premiums |

| 69.ne | Interest on insurance premiums |

| 70 | Settlements with personnel for payroll |

| 71 | Calculations with accountable persons |

| 73 | Settlements with personnel for other operations |

| 73.01 | Loan settlements |

| 73.02 | Calculations for material damage |

| 73.03 | Settlements for other transactions |

| 75 | Settlements with founders |

| 75.01 | Settlements on contributions to the authorized (share) capital |

| 75.02 | Income calculations |

| 76 | |

| 76.01 | Settlements for property and personal insurance |

| 76.02 | Claim settlements |

| 76.03 | Calculations on due dividends and other income |

| 76.04 | Settlements on deposited amounts |

| 76.dr | Settlements with different debtors and creditors |

| 76.al | Alimony payments |

| 76.vp | VAT on advances and prepayments received |

| 76.abv | VAT on advances and prepayments issued |

| 76.pcl | Settlements with principals |

| 80 | Authorized capital |

| 81 | Own shares (shares) |

| 83 | Extra capital |

| 83.01 | Increase in the value of non-current assets |

| 83.02 | Other sources of additional capital |

| 84 | Retained earnings (uncovered loss) |

| 86 | Special-purpose financing |

| 90 | Sales |

| 90.01 | Revenue |

| 90.02 | Cost of sales |

| 90.03 | value added tax |

| 90.04 | excises |

| 90.09 | Profit/loss on sales |

| 91 | Other income and expenses |

| 91.01 | Other income |

| 91.02 | other expenses |

| 91.09 | Balance of other income and expenses |

| 94 | Shortfalls and losses from damage to valuables |

| 96 | Reserves for future expenses |

| 97 | Future spending |

| 98 | revenue of the future periods |

| 98.01 | revenue of the future periods |

| 98.02 | Donations |

| 99 | Profit and loss |

| 001 | Leased fixed assets |

| 002 | Inventory assets accepted for safekeeping |

| 003 | Materials accepted for recycling |

| 004 | Goods accepted for commission |

| 007 | Written-off debt of insolvent debtors |

| 012 | Low value fixed assets |

On the Kontur.Accounting website, you can download the working chart of accounts of the balance sheet for 2019 for free.

Have you registered an organization no more than 3 months ago? Or just planning to open an LLC? Then we give you 3 months of work in Kontur.Accounting - a friendly online service for calculating salaries, paying taxes and submitting reports via the Internet.