Debit 20 credit 96. Accounting for reserves for future expenses. What conclusion can be drawn

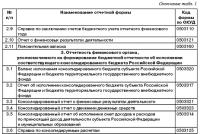

Name of the reserve Purpose Accounts used in accounting For the payment of vacations Funds are allocated for the provision of vacations to employees during the year 70, 69 For the payment of benefits to employees for seniority and others Creation of reserves for lump-sum payments to employees, the allocation of funds for the remuneration of seasonal workers 70, 69 Repair of fixed assets Possible amounts required for routine maintenance (repair) of property and equipment are determined 20,23 Land reclamation Designed for environmental protection measures 20, 23 Warranty repairs and maintenance Reimbursement of costs to buyers for the malfunction of the purchased goods under warranty service 51 Account 96: typical postings In the figure below is the account 96 "Provisions for future expenses" and its typical transactions. To enlarge the picture, click on it.

Postings to account 96 - reserves for future expenses

Description of the transaction Base document 20 96 27 086 The amount of the reserve for the payment of vacation pay is reflected Accounting note Example 2. Creation of a reserve for payment of vacation pay based on average earnings The accounting policy of Zima LLC reflects the creation of a reserve for payment of vacation pay based on average earnings and the number of unused vacation days. The salary of employees for the past 2016 - 2,750,000 rubles.

The balance of vacations for 2016 is 30 days. The average number of days in a month in 2016 is 29.3 days. To calculate the reserve, we use the formula: (average daily earnings + insurance premiums) * the rest of the vacation.

Account 96: reserves for future expenses. example, postings

Postings to create a provision: Dt Kt Amount Description of operation 20.1 96.1 100000 Creates a provision for payment of vacation 20.1 96.1 22000 Creates a provision for insurance premiums in the Pension Fund the total cost of fixed assets and rates of deductions. The reserve for the repair of fixed assets is created on account 20, 23, 26, 44, etc. The annual amount of the reserve should not exceed the arithmetic average of the amount of actual repairs for the previous 3 years.

Having calculated the annual amount, we find the amount of regular deductions to the reserve. If these deductions are made monthly, then the annual amount is divided by 12. If once a quarter, then the annual amount is divided by 4.

Let's say the amount of the reserve for the repair of fixed assets for our organization is defined as 150,000 rubles.

Account 96 in accounting: reserves for future expenses

OU should be closed in the same way as BU, after the close of the month, it turns out that in OU on account 96, no amounts are put. Therefore, the question arose, if the program does not do this, maybe it should not be, and if such a situation is possible, then manually register? Snovy 6 - 11/23/07 - 11:01 am I.e. You are not deploying the asset repair cost analytic.

Then it is easier for you to live. In general, when calculating the plan, you manually write the transactions d25 / 26-k96. When you receive repair services from third-party organizations, you need to make postings d96-k60, when using your materials for repairing d96-k10 (there is a big ambush - if you handed over your materials to the contractor for repair, then you need to use 10.7 with subsequent reflection in the debit 96 of the account , but in 1C they didn't even hear about it).

Account 96 "reserves for future expenses"

Creating a reserve for warranty repairs How reserves for future expenses are formed Reserves for future expenses of the organization consist of:

- Upcoming costs of paying vacation pay to employees;

- Expenses for current repairs of equipment and fixed assets;

- Warranty and repair costs;

- Other costs of the organization.

The company has the right to independently establish the procedure for calculating the reserve for the payment of vacation workers, indicating in the accounting policy, taking into account paragraphs 15 and 16 of PBU 8/2010: When determining the calculation base of the reserve for the repair of fixed assets or equipment, it is necessary to take into account data on the sale of products in the reporting period, the estimated percentage of defects, statistics in the field of warranty repairs, and so on.

Close of the month

After analyzing the sales of the goods, it was revealed:

- 12% of the sold goods are subject to repair;

- 8% of the sold goods are subject to replacement;

- The average cost of repairs per unit of goods is 650 rubles;

- The average cost of replacing a product is RUB 4,500;

- During 2017, it is planned to release 5,000 units of goods.

In this way:

- Calculation of the amount of the reserve for 2017: (5,000 * 12% * 650) + (5,000 * 8% * 4,500) = 2,190,000 rubles.

- The amount of monthly charges to the reserve is: 2,190,000 / 12 = 182,500 rubles.

Transactions on account 96 to create a reserve: Дт Кт Transaction amount, rub.

Attention

Snovy 2 - 11/23/07 - 10:12 am 96 standard account is not serviced at all. This is the first thing. The second - that you have 96 - there is a lot of everything, and each one is all closed in different ways colnishko 3 - 11/23/07 - 10:16 am I have a reserve for 96 repairs. Snovy 4 - 11/23/07 - 10:29 am I don't envy. not only is the analytics sprawling (according to a good plan and fact it is necessary to take into account each OS), so also the second year is butting “there are temporary differences in rem.

Fund or not? " many experts (including myself) argue that the temporary differences in rem. fund is not and cannot be, others believe that since the planned charges differ from the fact, then this is the basis for the formation of time. raznits.And another question - you have rem. fund only in BU? Does NU also have it or not? colnishko 5 - 11/23/07 - 10:39 am in NU, too.

Also, the costs of auxiliary production need to be written off from credit 23 to debit 96 well, and a bunch of operations for debit 96. You do not need to close the month, because the 96 account is closed only once at the end of the year - if there is no rolling over to the next. year of reserve, then the balance of account 96 needs to be reset to zero - the credit must be removed, the debit account must be added to the debit 25-26 of the account (it’s strange why you don’t have 20 and 23). the annual amount of the reserve. Then PR and VR arise there. Similarly to BU 96, the NU account is also closed only at the end of the year. colnishko 7 - 11.23.07 - 11:07 thanks, it's nice to listen to such an intelligent person. I have a chief accountant with an economist now talked and came to the conclusion that this is such a mura 96 account. so they are still deciding what and how they will do, and for now I will wait for their decision.

Provision creation transactions: Monthly write-off to the reserve: Dt Kt Amount Description of the operation 23 96 12500 Creation of the operation of the quarterly deduction to the asset repair reserve Write-off of reserves Write off the vacation reserve (example) In our example, a vacation reserve was created in the amount of 124,900 rubles (100,000+ 22000 + 2900). During the first month, the amount of expenses on vacations of employees of the production unit was 60,000. The amount of contributions to pension insurance for these vacations is 13,200, insurance contributions to the Social Insurance Fund - 1,740.

Postings to write off the vacation reserve Dt Kt Amount Description of the operation 96.1 70 60000 Leave to employees was accrued 96.1 69.2 13200 Contributions to the Pension Fund of the Russian Federation were assessed 96.1 69.1 1740 Contributions to the FSS were accrued Postings to write off the provision for the repair of fixed assets Fixed assets were repaired in the amount of 56,000 rubles.

Dt Kt Amount Description of operation 96.2 10.1 31600 Written off at the expense of the reserve cost of used materials 96.2 70 20000 Written off at the expense of the reserve salary costs 96.2 69.2 4400 Written off at the expense of the reserve of the PFR Closing account 96 You need to understand that the amount of reserves cannot be calculated with absolute accuracy. The wage reserve, for example, can change for reasons such as:

- dismissal of employees;

- change in wages;

- changes in the actual vacation schedule, etc.

If the reserve is exceeded, the amount "on top" is written off at the expense of operating costs. If the reserve is not fully used up, then it is carried over to the next year, or canceled. For a reserve for fixed assets repair, the unspent balance can be closed to account 99.1 at the end of the year, if the repair is not completed in the current year.

Creation of a reserve for vacation pay based on labor remuneration The accounting policy of Vesna LLC reflects the creation of a reserve for vacation pay based on labor remuneration. In this case, the reserve is charged at the end of each month. To calculate the reserve, we use the formula: (OT + insurance premiums) / 28 * 2.33, where

- 28 - the number of vacation days per year for each employee, according to the collective agreement;

- 2.33 is the number of vacation days for 1 month worked.

Hence:

- Insurance premiums - 30.2%;

- Labor remuneration in January - 250,000 rubles;

- January reserve: (250,000 + 75,500) / 28 * 2.33;

- OOO Vesna has formed a reserve for vacation payments in January in the amount of RUB 27,086.

Transactions to create a reserve in OOO Vesna for deferred leave on account 96: Дт Кт Transaction amount, rub.

Content

- 1 Create a reserve

- 1.1 Creating a provision for future vacations

- 1.2 Provisioning transactions:

- 1.3 Creation of a provision for the repair of fixed assets

- 1.4 Provisioning transactions:

- 2 Write-off of reserves

- 2.1 Writing off the vacation reserve (example)

- 2.2 Postings to write off the vacation reserve

- 2.3 Transactions to write off the provision for the repair of fixed assets

- 3 Closing 96 accounts

Creating a reserve Creating a reserve for future vacations A reserve for paying vacations is created as follows:

- the amount of the vacation reserve is calculated;

- based on the amount of the vacation reserve, the amount of insurance premium reserves is calculated;

- the vacation reserve is created quarterly or monthly.

There are several ways to form a reserve.

Designed to summarize information about the status and dynamics of the amounts planned for the subsequent even write-off of expenses for various production needs. Let's figure out how the reserves for future expenses are accounted for, what costs are accumulated on it and what records are used to write them off .

Reserves for liabilities: account 96

The creation of reserves (fact and criteria) are fixed in the accounting policy of the organization. Reservation of amounts, documented by appropriate calculations and accounting forms, is reflected in the account. 96, corresponding with invoices for the production and sale of products: D / t 20, 23, 51, 69, 70, 76, 91, 97, 99 - K / t 96.

So, the amounts of reserves, divided by items of planned costs in the future, are fixed on this account. Most often, companies practice creating reserves for:

- Payment of vacations (+ insurance contributions to funds) in the coming periods;

- Payment of annual seniority remuneration;

- Expenses for works of a seasonal nature;

- Expenses for the repair of the OS, land reclamation, environmental protection measures;

- Expenses for warranty repairs and maintenance of facilities, etc.

The actually incurred expenses included in the previously formed reserve are reflected in the d-that account. 96 and are written off to production costs in correspondence with cost accounts.

Analytical accounting by account 96 is carried out separately for each created reserve. The correctness of the formation and use of reserve amounts is periodically checked in accordance with calculations, estimates and other accounting documents. If necessary, their sizes are adjusted. At the end of the year, an inventory is required for reserve operations.

Provisions for future expenses in the balance sheet: line and its name

The reserves for future expenses formed by the company in the balance sheet are recorded in the lines of estimated liabilities:

- In the 4th section "Long-term liabilities" - p. 1430;

- In the 5th section "Short-term liabilities" - page 1540.

The created reserves are reflected in the specified lines within long-term or short-term liabilities based on the period of their circulation. For example, the accrued provision for employee vacations of the current year will be fully used in the reporting period and, therefore, is considered as a short-term estimated liability, reflected in line 1540. Long-term liabilities include operations on restructuring of production facilities, ie. those that are planned to be carried out in a period exceeding 12 months.

Provisions for future expenses: transactions

Accounting for reserves for future expenses and payments begins with the creation of a reserve:

|

Operation |

Correspondence of invoices |

Base |

|

|

Accrual of a reserve for future expenses on the main production (production output, payment of vacations in future periods, deductions to funds) |

Production plans, staff leave schedule, accounting reference-calculation of the amount of costs |

||

|

Provision for expenses on auxiliary production |

Estimate and technical documentation Help-calculation |

||

|

Creation of a repair fund |

|||

|

Monthly payments for service industries (29), for example, forthcoming expenses for the repair of leased property, expenses for selling in trade (44) |

|||

|

Formation of a material incentive fund within the company |

Mark in UP, help - calculation |

||

|

Transfer of the amounts of contributions for overhaul to the reserve |

Plans for the formation of earmarked contributions |

||

|

Creation of a reserve from other income receipts |

Economic justification, calculations |

||

|

Accrual from prepaid expenses |

|||

At the end of the reporting period, on the basis of documented transactions, the accountant writes off item-by-item to production costs, ensuring their uniformity and based on the calculation methodology adopted by the company. The basic accounting records are as follows:

|

Operation |

Correspondence of invoices |

Base |

|

|

Write-off of expenses for completed current repairs (stages) |

Acts of completed work |

||

|

Write-off of costs for auxiliary and service industries |

|||

|

Coverage of depreciation costs of fixed assets |

|||

|

Accrual of vacation pay to personnel from reserve funds |

Vacation schedules, HR orders, personal accounts |

||

|

Insurance premiums were calculated for this amount of vacation pay |

Calculation of deductions |

||

Provisions for future expenses: account closure

In the process of production, the size of the created reserves may change, therefore, by the end of the year, the overrun of the reserve funds or the excess of the actually incurred expenses over the reserve is possible. The excess of the reserve can be written off at the expense of operating expenses (if justified). If at the end of the year there is a balance of reserve funds, then it is canceled, or carried over to the next financial year. It is important to consolidate the operations for maintaining and closing the 96th account in the accounting policy of the organization.

In the opinion of financiers, from this year on, enterprises are required to create reserves for the payment of vacations for accounting purposes. Let's consider the rules for using such reserves.

Everything is unchanged in tax accounting

As before, in tax accounting for the payment of vacation pay, a reserve can be created at the discretion of the company.

If no provision is made, vacation pay is recognized as a labor expense for income tax purposes.

Moreover (with the accrual method) in proportion to the vacation days falling on the corresponding months.

Therefore, for example, if in August the employee is paid vacation pay for the period from August 15 to September 11, it is impossible to take into account the entire amount of payment in August. This month, expenses should include only that part of the vacation pay that falls on the days of rest provided in August.

And the rest of the vacation pay must be recognized in September. This is stated, in particular, in the letter of the Ministry of Finance of Russia dated June 14, 2011 No. 07-02-06 / 107.

But in accounting, vacation pay now needs to be calculated taking into account PBU 8/2010 "Estimated Liabilities, Contingent Liabilities and Contingent Assets" (approved by order of the Ministry of Finance of Russia dated December 13, 2010 No. 167n). Thus, the obligations of the organization in connection with the emergence of employees' right to paid leave are estimated (letter of the Ministry of Finance of Russia dated June 14, 2011 No. 07-02-06 / 107).

In other words, if earlier enterprises could decide for themselves whether to form them or not, now only small enterprises can not do this (then they will take into account vacation pay in labor costs of the month when they are accrued).

However, a specific methodology for the formation of estimated reserves, unfortunately, has not been established, so the company needs to develop it independently and consolidate it in the accounting policy.

The ideal option would be to form a reserve at the end of each month for each employee based on the number of days of rest he earned for this month and his average earnings, determined in the prescribed manner.

But this is very time consuming, and the only benefit is to correctly form the reporting indicators. Therefore, the organization has the right to provide for other methods of forming the estimated liability. The main thing is to substantiate and consolidate a specific procedure in accounting policy.

Example 1.

The accounting policy of Krasnoderevshchik LLC contains the following methodology for the formation of estimated liabilities in relation to the payment of vacations.

Since all employees are entitled to vacation pay for 28 calendar days, the estimated liability is formed evenly throughout the year based on the annual wages fund as follows:

- the expected annual vacation pay is calculated (by dividing the annual wages fund by 12 months and by 29.4 and multiplying the result by 28);

- the monthly amount of the increase in the estimated reserve is determined (the calculated expected annual amount of vacation pay is divided by 12).

Suppose that the annual wages fund of workers of OOO Krasnodrevshchik for 2011 is 2,600,000 rubles.

Then the expected annual amount of vacation pay for this category of workers is equal to:

RUB 2,600,000 : 12 months : 29.4 × 28 days = 206 349.21 rubles.

And the monthly amount of the estimated reserve being created will be:

RUB 206,349.21 : 12 months = 17 195.77 rubles.

Please note: experts differ as to whether it is necessary to reserve also the amount of insurance premiums from vacation pay.

Some propose to form an estimated liability for the entire amount, including both vacation pay and insurance premiums from them. But there is also another point of view.

The fact is that the obligation to pay vacation pay really arises for the enterprise as a result of past events - for each month worked, employees earn the right to a certain number of vacation days (in case of dismissal - to compensation or leave with subsequent dismissal).

But the obligation to pay insurance premiums arises only when payments are actually accrued in favor of employees. That is, while vacation pay is not accrued, the company does not need to pay insurance premiums from them.

Therefore, it is necessary to form an estimated liability only for the amount of vacation pay themselves, and insurance premiums are not reserved in accounting, they are recognized as expenses at a time as they are actually accrued.

The estimated liabilities should be taken into account on the "Provisions for future expenses" account.

When creating estimated liabilities for the payment of vacation pay, their value is charged to expenses for ordinary activities (in the debit of accounts,, ...).

Example 2.

Let's continue with example 1.

On a monthly basis during 2011, the accountant forms (increases) an estimated reserve in relation to forthcoming expenses for paying vacation pay to staff by recording:

DEBIT 20 CREDIT 96

- 17 195.77 rubles. - the estimated reserve for the payment of vacation pay to workers has been increased.

Suppose that in August two employees were given leave and they were given vacation pay in the amount of 43,000 rubles.

Let's also assume that:

- standard deductions for these employees are no longer provided;

- insurance premiums (including contributions for injuries) are paid at a rate of 34.2 percent in total.

The accountant reflected the accrual and payment of vacation pay as follows:

DEBIT 96 CREDIT 70

- 43,000 rubles. - vacation pay has been accrued (part of the estimated liability has been written off against the recognition of payables for the payment of vacation pay);

DEBIT 20 CREDIT 69

- 14 706 rubles. (43,000 rubles × 34.2%) - insurance premiums were calculated for the amount of vacation workers;

DEBIT 70 CREDIT 68

- 5590 rubles. (43,000 rubles. × 13%) - personal income tax withheld from the amount of vacation pay;

DEBIT 70 CREDIT 50

- 37 410 rubles. (43,000 - 5590) - paid vacation pay.

But the main difference between the new estimated liabilities from the old reserves for the payment of vacation pay is that if the funds of the estimated liability are not enough, the company's expenses for vacation pay are reflected in the accounting in a general manner. In other words, there can be no debit balance on the account.

That is, if the amount of vacation pay accrued in the current month exceeds the amount of the estimated liability created by this time, the debit of the account is made only for the amount that is on this account, and the difference (excess) is credited directly to the debit of the company's cost accounting accounts.

Accordingly, in the future, the amount of the estimated liability created in the following months should be adjusted.

After all, if vacation pay has already been paid to someone, the obligation for them in the current year is no longer formed.

Example 3.

Let's continue with the previous examples.

Suppose that in September vacation pay was accrued to employees in the amount of 115,000 rubles.

Prior to that, for the period from January to August inclusive, the estimated liability (turnover on the account credit) was formed in the amount of:

RUB 17 195.77 × 8 months = RUB 137,566.16

Thus, in August a provision has already been used in the amount of 43,000 rubles.

This means that the balance of unused estimated liabilities (account balance as of September 1, before calculating vacation pay in September) is:

RUB 137,566.16 - 43,000 rubles. = 94 566.16 rubles.

And the amount of vacation pay accrued in September is 115,000 rubles. As you can see, it exceeds the value of the formed estimated liability. This means that the accountant needs to calculate vacation pay in September as follows:

DEBIT 96 CREDIT 70

- 94 556.16 rubles. - vacation pay was accrued within the amount of the previously formed estimated liability (the estimated liability was written off against the recognition of accounts payable on payment of vacation pay);

DEBIT 20 CREDIT 70

- 20 433.84 rubles. (115,000 - 94,556.16) - vacation pay was charged in excess of the amount of the previously formed estimated liability;

DEBIT 20 CREDIT 69

- 39 330 rubles. (115,000 rubles. × 34.2%) - insurance premiums were accrued in the amount of vacation pay;

DEBIT 70 CREDIT 68

- RUB 14,950 (RUB 115,000 × 13%) - tax withheld from the amount of vacation pay;

DEBIT 70 CREDIT 50

- RUB 100,050 (115,000 - 14,950) - vacation pay was paid.

In addition, in the future, it is necessary to take into account the fact that some employees have already received vacation pay in excess of the amount of the previously formed estimated liability. That is, the deductions should be reduced.

The reasonableness of recognition and the amount of the estimated liability are reviewed at the end of the year, as well as when new events occur in connection with this liability. As a result, it can be:

- increased in accordance with the procedure established for the recognition of the estimated liability;

- reduced in accordance with the procedure established for writing off the estimated liability;

- remain unchanged;

- completely written off.

Surplus amounts are charged to other income of the entity.

It is important to remember

By creating a reserve for the payment of vacations to employees, it is more profitable for an enterprise to choose for the purposes of accounting the same procedure for its formation as in tax accounting. True, if the reserve funds are not enough, then the amount of excess vacation pay in accounting can be written off to expenses immediately, and for profit tax purposes - only at the end of the year based on the results of the inventory.

Vacation reserve at the enterprise: under what conditions it is necessary to close account 96 for the vacation payment reserve, accounting entries - read the article.

Question: How account 96 (vacation reserve) is closed at the end of the year. And do I need to close it?

Answer: In the event that the organization carries over the balance of the reserve to the next year, and when the reserve is not created in the next year, make a reversal entry in production and distribution costs in the accounting for the amount of the underutilized reserve for the payment of vacations.

If the organization rolls over the reserve balance to the next year, reverse only the excess of the reserve balance over the reserve amount for unused vacation. If the organization does not plan to create a reserve for the payment of vacations next year, then reverse the balance of the reserve at the end of the year in full. This accounting procedure is established in clause 3.51 of the Methodological Instructions approved by order of the Ministry of Finance of Russia dated June 13, 1995 No. 49.

Taking into account these transactions, the amount of the reserve reflected on loan 96 will be buried by the end of the year.

Justification

How to use the vacation allowance

Reflect the accrual of vacation pay in accounting by postings:

Debit 96 subaccount "Reserve for the payment of vacations" Credit 70

- accrued vacation pay at the expense of the reserve;

Debit 96 subaccount "Reserve for the payment of vacations" Credit 69 subaccount "Settlements with the Pension Fund of the Russian Federation on the insurance part of the labor pension"

- accrued at the expense of the reserve pension contributions to finance the insurance part of the labor pension from vacation pay;

Debit 96 subaccount "Reserve for the payment of vacations" Credit 69 subaccount "Settlements with the Pension Fund of the Russian Federation on the funded part of the labor pension"

- accrued at the expense of the reserve pension contributions to finance the funded part of the labor pension from vacation pay;

Debit 96 subaccount "Reserve for the payment of vacations" Credit 69 subaccount "Settlements with the FSS for social insurance contributions"

- accrued from the reserve social insurance contributions from vacation pay;

Debit 96 subaccount "Reserve for the payment of vacations" Credit 69 subaccount "Settlements with FFOMS"

- accrued at the expense of the reserve for medical insurance contributions to the FFOMS from vacation pay;

Debit 96 subaccount "Reserve for the payment of vacations" Credit 69 subaccount "Settlements with the FSS for contributions to insurance against accidents and occupational diseases"

- accrued from the reserve contributions for insurance against accidents and occupational diseases from vacation pay.

If the amount of the reserve was not enough to pay vacation pay, then reflect its additional accrual by posting:

- written off to expenses the amount of vacation pay exceeding the amount of the created reserve.

If, as of the reporting date, the amount of the reserve turned out to be excessive, then it must be reversed:

Debit 20 (23, 25, 26, 29, 44 ...) Credit 96

The amount of the allowance for the payment of redundant difference leave has been reversed.

This procedure follows from clause 23 of PBU 8/2010 and the Instructions to the chart of accounts.

Reserve inventory

As of December 31, make an inventory of the reserve created in accounting and tax accounting for the payment of vacations. This is the requirement of clause 3.50 of the Methodological Instructions approved by order of the Ministry of Finance of Russia dated June 13, 1995 No. 49, and clause 3 of Article 324.1 of the Tax Code of the Russian Federation.

In the course of the inventory, compare the actual amount of vacation expenses incurred in the current year with the actual amount of deductions to the reserve.

If it turns out that the amount of the accrued reserve is less than the amount of the actual expenses for the payment of vacations, include the difference in the composition of the current expenses for the payment of vacations. Such a rule is established in paragraph 3 of clause 3 of article 324.1 of the Tax Code of the Russian Federation.

In accounting, make the posting:

- additionally accrued a reserve for the amount of excess of actual expenses on vacation pay over the amount of the reserve.

An example of additional accrual of a provision before actual expenses for vacation pay

In 2012, OOO "Trading Firm" Hermes "" in accounting and tax accounting created a reserve for the payment of vacations. In accounting, the organization formed a reserve according to the rules of tax accounting.

At the end of the year, the accountant carried out an inventory, as a result of which it was revealed that in 2012:

Actual deductions to the reserve were made in the amount of RUB 490,584;

the accrued amount of vacation pay, taking into account contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases, amounted to 510,000 rubles.

The amount of the reserve is less than the amount of actual expenses for paying vacation pay (including insurance premiums) by 19,416 rubles. (490,584 rubles - 510,000 rubles).

At the end of the year, the organization's accountant added a reserve to the actual expenses for paying for vacations in 2012. In accounting, he made the entries:

- 19 416 rubles. - additionally accrued a reserve for the amount of excess of actual expenses on vacation pay (including insurance premiums) over the amount of the reserve.

When calculating income tax, the accountant took into account 19,416 rubles in expenses.

If it turns out that the amount of the accrued provision is greater than the amount of actual expenses for the payment of vacations, the procedure for accounting for the difference depends on whether the organization will create a provision for the payment of vacations next year or not.

The organization may not make changes to the accounting policy and continue to create a reserve for the payment of vacations (using the same methodology). In this case, part of the underutilized reserve in the current year can be carried over to the next year.

For this:

Determine which employees did not use vacation (part of it) for the current year;

Determine the exact number of vacation days unused by such employees in the current year;

calculate the average daily earnings of such employees.

Then, for each employee, calculate how much of the reserve can be carried over to the next year. To do this, determine the estimated amount of vacation pay not used by the employee in the current year:

Estimated amount of vacation pay not used by the employee in the current year = Actual number of vacation days not used by the employee in the current year * Average daily earnings of the employee + Amount of contributions for mandatory pension (social, health) insurance and insurance against accidents and occupational diseases related to calculated vacation pay

Summarize the results obtained for each employee. You will receive the total amount of the reserve that can be carried over to the next year. If a decision is made to transfer the reserve, add it to the reserve for paying for vacations for the coming year.

Compare the estimated amount of vacation pay for unused employees in the current year with the balance of the reserve. If this amount exceeds the actual balance of the reserve at the end of the year, include the excess amount in labor costs. If the amount of the calculated reserve in terms of unused vacation is less than the actual balance of the reserve at the end of the year, then include the negative difference in non-operating income.

This procedure is established by paragraph 4 of Article 324.1 of the Tax Code of the Russian Federation.

When forming the accounting policy for the next year, the organization has the right to refuse to create a reserve. In this case, include the entire amount of the underutilized reserve as of December 31 of the current year in the non-operating income of the current year. This rule is established by paragraph 5 of Article 324.1 of the Tax Code of the Russian Federation.

And in the case when the organization transfers the balance of the reserve to the next year, and when the reserve is not created in the next year, in accounting, make a reversal entry in the costs of production and circulation in the amount of the underutilized reserve for the payment of vacations:

Debit 20 (23, 25, 26, 29, 44) Credit 96 subaccount "Reserve for the payment of vacations"

The excess accrued amount of the provision for the payment of vacations has been canceled.

If the organization rolls over the reserve balance to the next year, reverse only the excess of the reserve balance over the reserve amount for unused vacation. If the organization does not plan to create a reserve for the payment of vacations next year, then reverse the balance of the reserve at the end of the year in full.

This accounting procedure is established in clause 3.51 of the Methodological Instructions approved by order of the Ministry of Finance of Russia dated June 13, 1995 No. 49.

An example of transferring a part of the provision for the payment of vacations to the next year

In 2012, OOO "Trading Firm" Hermes "" in accounting and tax accounting created a reserve for the payment of vacations. In the accounting policy for accounting purposes, the same procedure for the formation of a reserve is fixed as in the accounting policy for tax purposes. The organization does not change the methodology for forming the reserve in 2012.

According to inventory data in 2012:

Actual deductions to the reserve were made in the amount of 520,128 rubles;

the accrued amount of vacation pay, taking into account compulsory insurance premiums, amounted to 500,000 rubles.

Thus, the amount of the accrued reserve is more than the amount of actual expenses for paying vacation pay by 20,128 rubles. (520,128 rubles - 500,000 rubles).

In 2012, only the manager A.S. Kondratyev. The accountant calculated the amount of the provision related to unused vacation as follows.

For January-December 2012, Kondratyev was paid a salary in the amount of 176,400 rubles. There were no other payments to the employee during this period. The calculation period has been fully worked out.

The average daily earnings of Kondratyev is 500 rubles per day. (176 400 rubles: 12 months: 29.4 days / month). Accordingly, the amount of vacation pay as of December 31, 2012 is:

RUB 500 / day * 28 days = RUB 14,000

Contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases:

RUB 14,000 * (22% + 2.9% + 5.1% + 0.2%) = 4228 rubles.

The amount of the provision for unused vacation is equal to:

RUB 14,000 + 4228 RUB = RUB 18,228

The difference between the amount of the unused reserve for 2012 and the amount of the reserve calculated based on the days of unused vacation is:

RUB 20,128 - 18,228 rubles. = 1900 RUB

When calculating income tax, the accountant included 1900 rubles. in the structure of non-operating income in 2012. In accounting, he made the posting:

Debit 44 Credit 96 subaccount "Reserve for the payment of vacations"

1900 RUB - the amount of the reserve for the payment of vacations, which was overcharged in 2012, was reversed.

Provision for payment of vacations in the amount of 18,228 rubles. the accountant moved to 2013.