Pension tax for IP per year. Fixed (insurance) IP contributions. Tax accounting of contributions for themselves

Until 2013, an individual entrepreneur opened his activity in one person, he was self-employed and paid taxes on himself and handed over the Declaration on UNVD. Since 2013, IP plans to use hired employees for labor contracts for trade. Need to report B. tax inspection About hiring staff? How to pay charges for yourself, if there are employees with salary? How to reflect PI accounting for hired employees?

The information presented in the response file allows the following conclusion.

Tax legislation of the Russian Federation does not contain duties for employers in providing additional information about hiring employees.

However, the legislation of extrabudgetary funds not only obliges, but also requires employers - entrepreneurs to undergo mandatory registration in PF and FSS.

Despite the fact that the entrepreneur hires employees legislation does not relieve it from the payment of insurance premiums for itself, based on the value of the rank year. The entrepreneur must pay until the end of 2013:

- in Pension Fund - 32 479.2 rubles. (5205 rubles. 2? 26%? 12);

In FFOMS - 3185,46 rub. (5205 rubles. 5.1%? 12).

Total in two funds - 35 664.66 rubles.

For employees, the entrepreneur will pay for the generally installed rules and donate reporting to the relevant funds (see the answer file information).

The rationale for this position is given in the articles of the magazine "Simplified" and "Wenna", which you can find in the "Magazines" tab

1. Article:In 2013, entrepreneurs must use new CBC

News on the topic:

KBK

Who concerns:

individual entrepreneurs

C new year has changed codes budget classificationthat use individual entrepreneurs. The adjustments were affected by pension contributions for insurance of those who do not have employees. And at the same time, the CBC for patent activities, which came to replace UPN based on a patent. *

So, entrepreneurs must list contributions to the Pension Fund of the Russian Federation for its insurance in 2013 on codes 392 1 02 02140 06 1000 160 (on the insurance part of the pension) and 392 1 02 02150 06 1000 160 (on the accumulative part of the pension). During the periods, expired before January 1, 2013, pay contributions for themselves on the CBC 392 1 02 02100 06 1000 160 (insurance part) and 392 1 02 02110 06 1000 160 (cumulative part).

The tax, which is paid in connection with the use of a new patent taxation system, introduced two CBC. The tax on the code 182 1 05 04010 02 1000 110 is credited to the budgets of urban districts, and in code 182 1 05 04020 02 1000 110 - to the budgets of municipal districts.

2. Article:How to pay "in the charger" insurance contributions in 2013

Every year legislation on insurance contributions to state extrabudgetary funds Certain changes. And this year is no exception. In the article, we will tell, what innovations in relation to the payment of insurance premiums are waiting for "intensers" in 2013

President of Russia V.V. Putin on December 3, 2012 signed Federal Law No. 243PH (hereinafter referred to as Law No. 243-FZ), which makes changes to some legislative acts RF on issues of compulsory pension insurance. These innovations come into force on January 1, 2013 and relate mainly by individual entrepreneurs who have no employees. But first things first.*

Who should pay insurance premiums

First of all, we recall that the procedure for calculating and paying insurance premiums for compulsory pension insurance, Mandatory social insurance in case of temporary disability and due to motherhood, compulsory medical insurance is governed by Federal Law of July 24, 2009 No. 212-FZ (hereinafter - Law No. 212-FZ), and insurance premiums against industrial accidents and professional diseases - Federal Law of 24.07.98 No. 125-FZ (hereinafter referred to as Law No. 125-FZ).

According to the provisions of these laws in 2013, the payers of insurance premiums will be, in particular, the following categories of insurers: *

- organizations, individual entrepreneurs, as well as individuals who are not recognized by the PI, which produce payments and other remuneration in favor of employees;

- individual entrepreneurs, lawyers, notaries engaged in private practice, and other persons engaged in private practice in the procedure established by the legislation of the Russian Federation, not producing payments in favor of individuals.

Moreover, the taxation system of the role is not played by the Insured. It means that organizations and individual entrepreneurs applying "shift", along with all the others, are also recognized by payers of insurance premiums.

The procedure for payment of insurance premiums by employers

As before, the object of taxing by insurance premiums will be payments and other remunerations accrued in favor of individuals within the framework of labor relations and civil law agreements, the subject of which is the performance of work, the provision of services, under the author's order contracts and licensed agreements (paragraph 1 Art. 7 of Law No. 212-ФЗ).

The former remains a list of payments not subject to insurance premiums. It is enshrined in Law No. 212-FZ and Law No. 125-FZ.

As for the tariffs on insurance premiums, the total rate remained at the level of 2012 - 30%, including:

- 22% - to the Pension Fund of the Russian Federation;

- 2.9% - in the FSS of the Russian Federation;

- 5.1% - in FFOMS.

Moreover, such tariffs will be applied until the accrued resulting from the beginning of the year payments in favor of employees will not exceed 568,000 rubles. All that over the specified value will be addressed only by pension contributions at 10% tariff.

We will remind, earlier, the legislation on insurance contributions provided for such tariffs only in 2012-2013. And since 2014 it was assumed that the policyholders would accrue contributions from the total tariff of 34%, which acted in 2011. After the entry into force of Law No. 243-FZ, the validity of the aggregate tariff in the amount of 30% extended until 2015 is inclusive. *

The consolidated table of the main tariffs of insurance premiums for 2013 on the relevant budgets is presented in Table. one .

In addition to the main tariff of insurance premiums, reduced will be valid in 2013. However, not all organizations and individual entrepreneurs who apply "shift" will be able to take advantage of benefits. Such right is provided only to pharmacy organizations paying single tax On the imputed income, as well as individual entrepreneurs using "shift" and having a license for pharmaceutical activities. * They will pay only pension contributions on the tariff of 20% with payments in favor of employees. This is stated in the law No. 212-FZ.

Please note: payment of insurance premiums in the FSS of the Russian Federation and the FFOMS, as well as an additional contribution of 10% with the amount of payments exceeding limit value Bases, such insurers are not provided by law.

The summary table of reduced insurance premium tariffs for 2013 on the relevant budgets is presented in Table. 2. *

As can be seen, for the payers of a single tax on imputed income, having employees, practically nothing has changed. They, as before, are obliged to pay insurance premiums with payments and remuneration to their employees. Tariffs for 2013 also remained at the level of last year.

The procedure for payment of insurance premiums by merchants who do not have employees

In 2012 and earlier the amount of insurance premiums, individual entrepreneurs were determined on the basis of the cost insurance year.

The procedure for determining the fixed size that does not produce payments in favor of employees is established by parts 1.1 and 1.2 of clause 1 of this article No. 212-ФЗ.

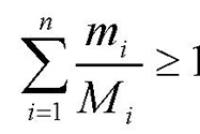

Thus, the fixed amount of the insurance premium for compulsory pension insurance is determined by individual entrepreneurs according to the following formula: *

FRV \u003d (2? Mrot? T)? 12,

where the FRV is a fixed amount of the insurance premium for compulsory pension insurance;

Mrots - the minimum wage at the beginning of the fiscal year, for which insurance premiums are paid;

T - the fare of insurance premiums in the FIU.

Based on this formula, it can be seen that the pension rate of insurance premiums of self-employed SP increased twice.

The fixed size of the insurance premium on mandatory health insurance is calculated by individual entrepreneurs for the following formula:

FRMV \u003d (Mrot? T)? 12,

where FRMV is a fixed amount of insurance premium for compulsory floating.

As for the tariffs of insurance premiums for individual entrepreneurs who do not have hired employees, they remained the same: 26% - in the FFOM, 5.1% - in the FFOMS.

Individual entrepreneur A.V. Komarov provides services for the carriage of goods and applies the tax system in the form of UNVD. Hired employees do not have a merchant. Compare the magnitude of insurance premiums paid by the MP for themselves in the FIU and the FOMS in 2012 and 2013. *

In 2012, Mrometa is 4611 rubles. (Federal Law of 19.06.2000 No. 82PH).

Consequently, in 2012, an individual entrepreneur must pay:

- to the Pension Fund of the Russian Federation - 14,386,32 rubles. (4611 rubles. 26%? 12);

- in FFOMS - 2821.93 rubles. (4611 rubles. 5.1%? 12).

Total in 2012, the merchant will list the insurance premiums in the amount of 17,208.25 rubles. (14 386,32 rub. + 2821.93 rubles.).

In 2013, the entrepreneur must pay insurance premiums in the following sizes:

- to the Pension Fund of the Russian Federation - 32 479.2 rubles. (2? 5205 rub. 26%? 12);

- in FFOMS - 3185,46 rub. (5205 rubles. 5.1%? 12).

Total in 2013, the merchant must transfer insurance premiums to the budget in the amount of 35,664.66 rubles. (32 479.2 rubles. + 3185,46 rub.).

As can be seen from the example, the amount of insurance premiums of self-employed IP increased more than twice.

Such an increase in the tax burden may adversely affect the activities of many merchants.

Terms of payment of insurance premiums and reporting procedure

Refusal or failure to set time documents (copies of their) necessary to control the correctness of the calculation, completeness and timeliness of payment (transfer) will now become a fine of 200 rubles. For each unforeseen document.

For non-payment or incomplete payment of insurance premiums, controlling authorities can accrue a fine of 20% of the unpaid amount ().

expert magazine "Wmenenka"

Yours faithfully,

expert "Glavbuch system" Yermachenko Alexander

The answer is approved: lead expert Hot line "Glavbuch system" Rodionov Alexander

_____________________________

The answer to your question is given in accordance with the rules of the "hotline" "Glavbuch system", which you can find at:

Probably, it is hardly about whom the fact that fixed payments of IP in 2013 will increase more than 2 times.

In general, everything as usual, in the new year, legislators again launch hands in small business pockets. Last year, "pleased" new order of reference cash operationsBy which the IP should keep a cash book, set the cash limit and hand over an over-limit revenue to the current account. Only we survived it as you! - New defeats. It seems that officials protect only oligarchs and from entrepreneurs squeeze the last juices. Well, let's not lose heart. It is unpleasant, but not deadly.

So, about everything in order.

From January 1, 2013, in Part 1 of Article 14 of the Federal Law No. 212-FZ dated July 24, 2009, changes were made to the fixed payments of the IP in 2013 to be calculated from the twofold dimension of the minimum wage.

However, now a fixed payment of IP will be established on the basis of Mrometa, in force at the beginning of the year And it will not change throughout the year. That is, a fixed payment of IP finally became fixed! (Sorry for the tautology, but with our legislation, you can not say otherwise!)

At the same time, fixed payments to the pension fund in 2013 will be calculated on the basis of the double size of the minimum wage. To calculate the fixed payment in the FIU per year, the minimum wage is multiplied by two, then at the corresponding tariff for 12 months. The rate of distribution of contributions to the insurance and cumulative part remained at the same level: in relation to persons of 1966. And over the entire amount of contributions is transferred to financing the insurance part of the labor pension, and for persons born in 1967 and younger - is distributed by 20% on financing the insurance part and 6% on financing the accumulative part of the labor pension. From January 1, 2014, this ratio will change: in relation to persons of 1967 p. And under the financing of the insurance part it will be necessary to list 24 percent, and the accumulative part - 2 percent.

Calculate fixed payments in the pension fund

- For persons. Born in 1966 and older

On the insurance part of the pension 5205x2x26% x12 \u003d 32479, 2 rubles.

- For persons 1967 and younger

On the insurance part of pensions of 5205 x 2 x 20% x 12 \u003d 24984 rubles.

On the accumulative part of the pension 5205 x2 x6% x 12 \u003d 7495.2 rubles.

However, a fixed payment in FFOMs will still count on a single minimum wage (well, even though it pleases)

The size fixed payment in the FOMS in 2013 will be

5205x5.1% x12 \u003d 3185,46 rub.

Total common the tax burden For IP will be 32479,2 + 3185,46 \u003d 35664.66 rubles.

For comparison Fixed payment of IP in 2012 Massed only 17208.25 rubles. And what will happen next?

Fixed insured premiums in 2013 for self-employed taxpayers

In accordance with the new edition of Article 14 of the Law No. 212-ФЗ, the fixed dimensions of insurance premiums are determined:

1. PFR - 26% of the twofold size of the minimum wagon, increased by 12 times.

2. FFOMS - 5.1% of the minimum wage, increased by 12 times.

From 01/01/2013 Set a new level minimum size wages (minimum wage) in the amount of 5,205 rubles per month.

Accordingly, the cost of the insurance year in 2013. will be:

1. PFR \u003d 5205 * 2 * 0.26 * 12 \u003d 32 479.20rub. (if the contribution payer is 1967 born and younger, then contributions to PF will compile: the insurance part 24984.00 rubles, for the accumulative part 7495.20 rubles. If the payer is 1966 of birth and older, then the whole amount is paid to the insurance part)

2. FFOMS \u003d 5205 * 0.051 * 12 \u003d 3 185.46 rub.

The total amount of insurance premiums for such payers will be 35 664.66 rub.

At the same time, taxpayers have the right not to calculate and not pay insurance contributions to the FFR and FFOMS for the periods ( Specified in paragraphs.1-18 of paragraph 1 of Article 27 of the Federal Law of December 17, 2001. №173-ФЗ "On labor pensions in the Russian Federation"), if inthe flow of these periods has not been carried out:

- Passage of military service upon call.

- Care of one of the parents for each child before reaching the age of 1.5 years, but not more than 3 years in total.

- The care of disabled students, a child-disabled child or an age of 80 years old.

- Residence of spouses of military personnel, held by military service under the contract, together with spouses in areas where they could not work due to the lack of employment opportunities, but not more than 5 years a total.

- Accommodation abroad for workers' spouses aimed at diplomatic missions and consular agencies of the Russian Federation, the permanent representative offices of the Russian Federation under international organizations, trade offices of the Russian Federation in foreign countries, representation of federal executive authorities, government agencies with federal executive bodies or as representatives of these bodies abroad, as well as representative offices public institutions RF (state bodies and government agencies of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than 5 years a total.

Note: Not to accrue and not pay contributions, taxpayers can onlypresentations of documents confirming the lack of activity in the specified periods.

Payers of insurance premiums that pay insurance premiums in a fixed amount for compulsory pension insurance

|

Name of the KBK. |

|

|

392 1 02 02140 06 1000 160 |

insurance contributions For compulsory pension insurance in a fixed size, credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension |

|

392 1 02 02150 06 1000 160 |

insurance contributions For compulsory pension insurance in a fixed size, credited to the budget Pension Fund of the Russian Federation to pay the accumulative part of the labor pension |

The article is updated as of 2017.

Fixed contributions are insured premiums for compulsory pension insurance and compulsory medical insurance paid by individual entrepreneurs, lawyers, notaries and other individuals involved in private practice. Until 2014, fixed contributions were really fixed (installed per year) and the same for all those paying them. Then came into force amendments to legislation that change the procedure for calculating contributions and essentially contributions were ceased to be fixed.

Until 2017, mandatory insurance premiums were transferred to pension, medical and social insurance of workers and individual entrepreneurs in extrabudgetary funds: Pension (FFR), social insurance (FSS) and compulsory medical insurance (FOMS). Since 2017, control over the calculation and payment of contributions is again transferred to the federal tax ServiceThat until 2010 has already been collecting such payments called the ESN (single social tax).

IN tax code A new chapter has been made, which regulates the calculation and payment of contributions to:

- mandatory pension insurance;

- mandatory medical insurance;

- social insurance in case of temporary disability and motherhood.

Contributions are paid not to extra-budgetary funds, but in their tax inspectorate, according to a new one. Contributions to injuries for employees remained in the introduction of the Social Insurance Fund, nothing has changed against them.

You will always vkurse the latest changes in the legislation for IP and LLC and will be able to receive and fill out on-line tax and accounting statements in accordance with the latest changes in legislation. Calculations of taxes and contributions will be prepared automatically.

Who should pay insurance premiums?

Contributions in a fixed size are required to pay all individual entrepreneurs, regardless of the system, keeping economic activity and income. In particular, if the IP works somewhere in the employment contract, and insurance premiums are paid for it, this is not the basis for exemption from paying contributions calculated in a fixed amount.

As for the payment of insurance premiums by an individual entrepreneur, regardless of the maintenance of economic activity and the availability of income, the final point set you the Russian Federation in its definition of 09.12.13 No. 17276/13, indicating that the obligation to pay insurance premiums arises from the IP since the acquisition They are not associated with such status and is not related to the actual implementation and receipt of income.

Please note that since 2010, contributions are also paid to those IPs, which in previous years enjoyed benefits: military pensioners pay contributions on a par with all other entrepreneurs. Since 2013, you can not pay fixed contributions over the next periods:

- service service in the army;

- the period of care of one of the parents for each child until they reach the age of one and a half years, but not more than three years in total;

- the period of care carried out by a working person for disabled I group, a child-disabled child or the person who has reached the age of 80;

- the period of residence of spouses of military personnel undergoing military service under the contract, along with spouses in areas where they could not work due to the lack of employment opportunities, but not more than five years in total;

- the period of accommodation abroad of workers' spouses aimed at diplomatic missions and consular agencies of the Russian Federation, the permanent representations of the Russian Federation under international organizations, trade missions of the Russian Federation in foreign countries, representation of federal executive bodies, government agencies with federal executive bodies or as representatives These bodies abroad, as well as in the representation of government agencies of the Russian Federation (state bodies and government agencies of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years a total.

If the IP has the right to benefit, but continues to receive income from business activities, I must pay insurance premiums on the general reasons (claim 7 of Article 430 of the Tax Code of the Russian Federation).

If a annual revenue A businessman is more than a threshold of 300 thousand rubles, he must transfer an additional insurance premium, calculated as 1% of the amount of exceeding.

In 2017, an individual entrepreneur must list payments only for compulsory pension and medical insurance. Transfer of social insurance premiums for hospital and decal payments IP produces voluntary.

The procedure for calculating the size of insurance premiums

The calculation of the amount of insurance premiums IP in 2017 depends on the size of the minimum wage (minimum wage size), which is 7,500 rubles.

Mroth for calculating contributions is taken on January 1 of the current year. If during the year, the minimum wage changes, contributions to this year Do not recalculate. New Mrot To calculate contributions will be applied only for the next year!

Since 2014, the size of fixed contributions depends on the annual income of the IP, since it is exceeded during the year of income of 300 thousand rubles. It is necessary to accrue another 1% contribution from the income amount exceeding 300 thousand rubles.

The income is considered as follows:

- In case of income taken into account in accordance with Article 210 of the Tax Code of the Russian Federation, i.e. Those incomes that are subject to NDFL (concerns only income received from entrepreneurial activity). In determining these revenues, expenses are taken into account (site Clerk.ru Resolution of the Constitutional Court of November 30, 2016 No. 27-P);

- When wept with the object of taxation "Revenues" - revenues taken into account in accordance with Article 346.15 of the Tax Code of the Russian Federation. Those. Those incomes that are subject to tax on the USN (such income are indicated in column 4 of the books of income and expenses and are indicated in line 113 tax Declaration on USN);

- When weaned with the object of taxation "revenues reduced on the amount of expenses" - revenues taken into account in accordance with Article 346.15 of the Tax Code of the Russian Federation. Those. Those incomes that are taxed on the USN tax (such income are indicated in column 4 of the books of income and expenses and are indicated in the line 213 of the tax return on USN). Costs in determining income to calculate contributions are not taken into account;

- With the ESCN - revenues taken into account in accordance with paragraph 1 of Article 346.5 of the Tax Code of the Russian Federation. Those. Those incomes that are subject to tax on the ESCH (such income are indicated in column 4 of the books of income and expenses and are indicated in the line 010 of the tax return on the ESHN). Costs in determining income to calculate contributions are not taken into account;

- Under UNVD - the imputed income of the taxpayer of UTII, calculated according to the rules of Article 346.26 of the Tax Code of the Russian Federation. The imputed income is indicated in the line 100 of Section 2 of the Declaration on UTII. If there are several sections, then the income is summed according to all sections. When determining the annual income, imputed revenues for declarations for 1-4 quarter declare.

- At PSN - a potentially possible income, calculated according to the rules of Article 346.47 of the Tax Code of the Russian Federation and Article 346.51 of the Tax Code of the Russian Federation. Those. That income from which the cost of a patent is considered.

- If IP applies several tax systems at the same time, then revenues are addressed

Until January 1, 2014, payers of born in 1967 and under the insurance premiums were shared on the insurance and cumulative part. Since 2014, such a division is provided only for those persons who have written an application for the transfer of the funded part in NPF or a statement of choosing an investment portfolio management company, an expanded investment portfolio of the state management company or the investment portfolio of state valuable papers State Management Company. The so-called "melts", which did not write any statements, the cumulative part of the pension is deprived, all contributions they go to the insurance part.

At the same time, regardless of whether the payer of fixed insurance premiums has a cumulative part or not, pension insurance contributions are paid by a single settlement document (payment, receipt). Divides the insurance and cumulative part of the PF itself, depending on its information.

Thus, all IP in 2014-2017 pay contributions to pension insurance with one payment (receipt)

IN 2017 The rates of calculating the amount of payment of insurance premiums IP "For yourself" are as follows:

Calculation of insurance premiums at an income of 300 tr. and less

Mrots in 2107 is 7,500 rubles. Mroth for calculating contributions is taken on January 1 of the current year. If during the year the minimum wagon changes, the contributions for the current year are not recalculated. The new minimum end to calculate contributions will be applied only for the next year!

- Contributions for compulsory pension insurance (OPS) are partially differentiated, and they are calculated using the formula: 1MROT * 12 * 26% (with annual income that do not exceed 300 thousand rubles), which will be 23 400 rubles.

- Contributions to Mandatory Medical Insurance (OMS) are calculated by the formula: 1MROT * 12 * 5.1%, which will be 4,590 rubles in year.

Total: 27990 rubles.

Forecast of insurance premiums for 2018: If the minimum wage will be 9489 rubles.

- Contributions to the FIU: (9489 * 26% * 12) \u003d 29605.68 rubles.

- Contributions to FFOMS: (9489 * 5.1% * 12) \u003d 5807.27 rubles.

Total insurance fee for IP in 2018 will be: 35 412.95 rubles.

If the minimum wage will be 7,800 rubles.- Contributions to the FIU: (7800 * 26% * 12) \u003d 24336 rubles.

- Contributions to FFOMS: (7800 * 5.1% * 12) \u003d 4773.6 rubles.

Total insurance fee for IP in 2018 will be: 29 109.6 rubles.

In case the income of the payer of insurance premiums for estimated period exceeds 300,000 rubles, in addition to fixed pension contributions (23400 rubles) paid contributions in the amount of 1% of the income exceeding 300,000 rubles. Then the formula will be viewed: 1 Mrot * 12 * 26% plus 1% of the income amount exceeding 300 thousand rubles.

Note! Contributions for health insurance from income above 300 thousand rubles are not paid! Those. The amount of contributions to the FFOMS fixed for all IP, regardless of the amount of annual income.

The upper limitation of the amount of contributions to the FIU is also introduced - in 2017, this amount cannot exceed the figure calculated by the formula - 8 minimum wage * 12 * 26%, i.e. 187 200 rubles.

Example:IP received in 2017 the income in the amount of 1,200,000 rubles. Calculate the amount of insurance premiums IP to pay:

pension insurance contributions will be calculated in this way: (7 500 * 12 * 26%) + ((1,200,000 - 300,000) * 1%) \u003d (23 400 + 9 000) rub. \u003d 32 400 rubles. contributions for medical insurance will be 4,590 rubles. (7 500 * 12 * 5.1%) at any level of income. Total: the total amount of insurance premiums for itself in this example is equal to 36,990 rubles.

IP, notaries and lawyers pay contributions in a fixed size only for themselves. With payout individuals In labor and civil law contracts are paid insurance premiums on compulsory insurancewhich are calculated on the basis of accrued payments in favor of these individuals.

Fixed contributions are also paid by the heads of the CFC for themselves and for members of the CFC. At the same time, the size of fixed contributions does not depend on the magnitude of the income of the economy (paragraph 2 of Article 430 of the Tax Code)

If IP is registered after the beginning of the next estimated period, or closed during the calculating period, the amount of insurance premiums payable for this estimated period is determined in proportion to the number of calendar months of activity. For an incomplete month of activity, the size of insurance premiums is determined in proportion to the number of calendar days of this month.

The first day of registration of the IP should not be taken into account (Part 2 of Article 4 No. 212-ФЗ). Those. According to the law, if registration, for example, the 10th number, then consider the insurance premiums of the PI, starting from the 11th. But at the fact of the FIU almost always believes from the first day of the month. Therefore, it is better to pay for a full month than to spend time on disputes with the FIU. Contributions for IP Better to pay with kopecks, because In 125-ФЗ, there is not a word about rounding.

Terms of payment of insurance premiums Procedure for deduction from tax on income IP

Insurance premiums for the estimated period are paid by PI no later than December 31 of the current calendar year, with the exception of contributions in the amount of 1% of income exceeding 300 thousand rubles.

The insurance premiums calculated from the amount of the income of the payer of insurance premiums exceeding 300,000 rubles for the estimated period are paid by the payer of insurance premiums no later than April 1 of the year following the expired settlement period.

The amount of paid insurance premiums can be reduced by the amount of income tax. Therefore, the payment of insurance premiums is more profitable to distribute during the year, depending on the income received.

For example, if you do not assume income in the first and (or) second quarter, it makes no sense to rush to the payment of contributions. Perhaps you will be more profitable to pay 3 \\ 4 or even the one annual sum in the third or fourth quarter, when significant income is expected. And vice versa - if the main income is expected only at the beginning or mid-year, then the bulk of contributions must be paid in the same quarter.

The essence of the ability to reduce the accrued single tax in the quarter, which is expected to be significant advance payment By tax, you were able to consider the amount of insurance premiums made in the same quarter. At the same time, contributions must be listed before you expect the amount of a single tax to pay.

As for ENVD, there is no concept for him zero declarations By imputed tax. If you are a payer of this tax, then the lack of income will not be the basis for its non-payment. Pay an imputed tax, calculated on a special formula, will still have to the quarter on the basis of the quarterly declaration. For UNVD, it will be reasonable to pay insurance premiums every quarter equal shamesIf the quarterly sums of imputed income change.

An additional amount equal to 1% of annual income exceeding 300 thousand rubles must be transferred until April 1, 2018, but if the limit exceeded at the beginning or middle of the year, then these additional contributions can be made before, because They can also be taken into account when calculating taxes. There is the same rule here - the tax reduction due to the contributions paid in the same quarter before the payment will be calculated.

Table of application of deduction of insurance premiums from income tax.

| Tax regime | Entrepreneurs working without hired personnel | Entrepreneurs working with hired personnel | Base |

|---|---|---|---|

| USN (Object of taxation "Revenues") | Reduce a single tax is not more than 50 percent. Contributions paid by the entrepreneur for employees and their own insurance | sub. 1 p. 3.1 Art. 346.21 of the Tax Code of the Russian Federation | |

| USN (object of taxation "Revenues minus costs") | Reduce income can be all the amount of paid insurance premiums. | p. 4 art. 346.21 and sub. 7 p. 1 Art. 346.16 of the Tax Code of the Russian Federation | |

| ENVD | Reduce a single tax on the full amount of paid insurance premiums in fixed size | You can reduce UTIIs by no more than 50 percent. Contributions paid by the entrepreneur for employees, benefits and their own insurance (from 13 to 17 years to their contributions, it was impossible to reduce | sub. 1 p. 2 art. 346.32 of the Tax Code of the Russian Federation |

| Patent | The cost of a patent does not decrease | Art. 346.48 and 346.50 NK RF | |

| Open | IP on the basis of the right to include fixes. Payment in the NDFL expenses | NK Art. 221. | |

Responsibility for non-payment of insurance premiums

If the entrepreneur missed the payment, then it can accrue the penalty, the size of which is the 1/300 acting refinancing rate. Penios are considered for every overdue payment day. Currently, the refinancing rate of the Central Bank of the Russian Federation is 11%.

Thus, you can get about 13% per annum. If IP made no full payment or did not pay contributions at all, then the imposition of a fine size of 20% is possible. At the same time, if the intent was detected in not paying taxes, the penalty could reach 40% of the sum of arrears.

Contribution reports

KFH once a year, no later than January 30, is submitted to the IFSN (calculation of insurance premiums of KND-115111). Since 2012, individual entrepreneurs, notaries, lawyers who do not produce payments and other remuneration to individuals, no statements in PF do not pass!

KBK

Contributions From January 1, 2017, it is necessary to pay for the requisites of the FTS, and not the Pension Fund! CBK of ordinary FIU and for exceeding 300 tr. Coincide since 2017.List of CBC on insurance premiums IP for yourself:

| Payment type | For 2016 in 2017 | For 2017 in 2017 |

|---|---|---|

| In the FIU in a fixed size (based on the Mrot) | 182 1 02 02140 06 1100 160 | 182 1 02 02140 06 1110 160 |

| In the FIU from income exceeding 300,000 rubles. | 182 1 02 02140 06 1200 160 | 182 1 02 02140 06 1110 160 |

| In FFOMs fixed size (based on the minimum wage) | 182 1 02 02103 08 1011 160 | 182 1 02 02103 08 1013 160 |

Fixed-size contributions are required to pay all individual entrepreneursRegardless of its taxation system, maintaining (or lack) commercial activities and income. If the entrepreneur has employed employment on employment contract, and the employer's insurance premiums are paid for it, then this cannot be the basis for the release of IP from paying contributions in a fixed size.

1 stage (for all IP)

In 2020, tariffs for payment of IP "For themselves" at the income of 300 thousand rubles and less are:

32 448 rub.

8 426 rub.

In just 2020, the size of minimum fixed contributions for IP is: 40,874 rubles. Listed the amount of fixed contributions is necessary on time until December 31, 2020 inclusive.

In 2020, tariffs for payments by IP "For themselves" at income more than 300 thousand rubles are:

v to the Pension Fund (insurance part) - at a rate of 1% from the received income of the IP Over 300,000 rubles. per year. At the same time, the sum of all payments of the PP for itself is limited by the amount of 268 010 rubles.

List the amount of pension contributions from income over 300 thousand rubles for 2020 is necessary on July 1, 2021 inclusive.

1 stage (for all IP)

In 2019, tariffs for payments by IP "For themselves" at the income of 300 thousand rubles and less components:

v to the pension fund (insurance part) - 29 354 rub.

v B. Federal Fund compulsory health insurance - 6 884 rub.

In total, in 2019, the size of minimum fixed contributions for IP is 36,238 rubles.

Stage 2 (for IP only, annual income which exceeded 300,000 rubles)

In 2019, tariffs for payment of IP "For themselves" at income more than 300 thousand rubles are:

v to the Pension Fund (insurance part) - at a rate of 1% from the received income of the IP Over 300,000 rubles. per year. At the same time, the sum of all payments of the MP for itself is limited by the amount of 234,832 rubles.

1 stage (for all IP)

In 2018, tariffs for payments by IP "For themselves" at the income of 300 thousand rubles and less compile:

v to the pension fund (insurance part) - 26 545 rub.

v to the Federal Fund for Mandatory Medical Insurance - 5 840 rub.

In total, in 2018, the size of minimum fixed contributions for IP is 32,385 rubles.

Stage 2 (only for IP, the annual income of which exceeded 300,000 rubles)

In 2018, tariffs for payment of IP "For themselves" at income more than 300 thousand rubles are:

v to the Pension Fund (insurance part) - at a rate of 1% from the received income of the IP Over 300,000 rubles. per year. In this case, the sum of all payments of the PP for itself is limited by the amount of 212 360 rubles.

From January 1, 2017, not to the Pension Fund, but to the territorial tax inspection at the place of registration of the entrepreneur. This also applies to debts on contributions over the past years.

1 stage (for all IP)

In 2017, tariffs for payments by IP "For themselves" at the income of 300 thousand rubles and less components:

v to the pension fund (insurance part) - 23 400 rub.

v to the Federal Fund for Mandatory Medical Insurance - 4 590 rub.

In total, in 2017 the size of minimum fixed contributions for IP is: 27 990 rubles.

Stage 2 (only for IP, the annual income of which exceeded 300,000 rubles)

In 2017, tariffs for payment of IP "For themselves" at income more than 300 thousand rubles are:

v to the Pension Fund (insurance part) - at a rate of 1% from the received income of the IP Over 300,000 rubles. per year. At the same time, the sum of all payments of the MP for itself is limited by the amount of 187,200 rubles.

From January 1, 2017, not to the Pension Fund, but to the territorial tax inspection at the place of registration of the entrepreneur. This also applies to debts on contributions over the past years.

1 stage (for all IP)

In 2016, tariffs for payment of IP "For themselves" with income of 300 thousand rubles and less are:

v to the pension fund (insurance part) - 19 356 rub. 48 kopeck

v to the Federal Fund for Mandatory Medical Insurance - 3 796 rub. 85 kopeck

In total, in 2016, the size of minimum fixed contributions for IP is: 23 153 rubles. 33 kopecks

Stage 2 (only for IP, the annual income of which exceeded 300,000 rubles)

In 2016, tariffs for payment of IP "For themselves" with income more than 300 thousand rubles are:

v to the Pension Fund (insurance part) - at a rate of 1% from the received income of the IP Over 300,000 rubles. per year. At the same time, the sum of all payments of the MP for itself is limited by the amount of 154,851 rubles. 84 kopeki

1 stage (for all IP)

In 2015, tariffs for payment of IP "For themselves" at the income of 300 thousand rubles and less comprising:

v to the pension fund (insurance part) - 18 610 rub. 80 kopeck

v to the Federal Fund for Mandatory Medical Insurance - 3 650 rub. 58 kopeck

In total, in 2015, the size of minimum fixed contributions for IP is: 22 261 rubles. 38 kopecks

Stage 2 (only for IP, the annual income of which exceeded 300,000 rubles)

In 2015, tariffs for payment of IP "For themselves" at income more than 300 thousand rubles are:

v to the Pension Fund (insurance part) - at a rate of 1% from the received income of the IP Over 300,000 rubles. per year. At the same time, the sum of all payments of the MP for itself is limited by the amount of 148,886 rubles. 40 kopecks

1 stage (for all IP)

In 2014, tariffs for payment of IP "For themselves" at the income of 300 thousand rubles and less are:

v to the pension fund (insurance part) - 17 328 rub. 48 kopeck

v to the Federal Fund for Mandatory Medical Insurance - 3 399 rub. 05 kopeck

In total, in 2014, the size of minimum fixed contributions for IP is: 20 727 rubles. 53 kopecks

Stage 2 (only for IP, the annual income of which exceeded 300,000 rubles)

In 2014, tariffs for payment of IP "For themselves" with income more than 300 thousand rubles are:

v to the Pension Fund (insurance part) - at a rate of 1% from the received income of the IP Over 300,000 rubles. per year. In this case, the sum of all payments of the MP for itself is limited by the amount of 138,628 rubles.

In 2013, tariffs for payment of IP "for themselves" are:

1966 year of birth and older

v to the pension fund (insurance part) - 32 479 rub. 20 kopeck

1967 year of birth and younger

v to the pension fund (insurance part) - 24 984 rub. 00 kopeck

7 495 rub. 20 kopeck

Regardless of year of birth

v to the Federal Fund for Mandatory Medical Insurance - 3 185 rub. 46 kopeck

In total, in 2013, the size of minimum fixed contributions for IP is 35 664 rubles. 66 kopecks

In 2012, tariffs for payment of IP "For themselves" are:

1966 year of birth and older

v to the pension fund (insurance part) - 14 386 rub. 32 kopeck

1967 year of birth and younger

v to the pension fund (insurance part) -11 066 rub. 40 kopeck

v to the pension fund (cumulative part) - 3 319 rub. 92 kopeck

Regardless of year of birth

v to the Federal Fund for Mandatory Medical Insurance -2 821 rub. 93 kopeck

In total, in 2012, the size of minimum fixed contributions for IP is: 17 208 rubles. 25 kopecks

In 2011, tariffs for payment of IP "for themselves" are:

1966 year of birth and older

V to the pension fund (insurance part) - 13 509 rub. 00 kopeck

1967 year of birth and younger

V to the pension fund (insurance part) - 10 392 rub. 00 kopeck

v to the pension fund (cumulative part) - 3 117 rub. 60 kopeck

Regardless of year of birth

V to the Federal Fund for Mandatory Medical Insurance - 1 610 rub. 76 kopeck

1 039 rub. 20 kopeck

In total in 2011, the size of minimum fixed contributions for IP is: 16 158 rubles. 96 kopecks

In 2010, tariffs for payments by IP "for themselves" are:

1966 year of birth and older

V to the pension fund (insurance part) - 10 392 rub. 00 kopeck

1967 year of birth and younger

V to the pension fund (insurance part) - 7 274 rub. 40 kopeck

v to the pension fund (cumulative part) - 3 117 rub. 60 kopeck

Regardless of year of birth

V to the Federal Fund for Mandatory Medical Insurance - 571 rub. 56 kopeck

v B. Territorial Foundation compulsory health insurance - 1 039 rub. 20 kopeck

In total for 2010, the size of minimum fixed contributions for IP is: 12,002 rubles. 76 kopecks

In 2009, tariffs for payment of IP "for themselves" are:

V to the pension fund (insurance part) - 4 849 rub. 60 kopeck

v to the pension fund (cumulative part) - 2 424 rub. 8 0 kopeck

In total in 2009, the size of minimum fixed contributions for IP is: 7,274 rubles. 40 kopecks

In 2008, tariffs for payment of IP "for themselves" are:

V to the pension fund (insurance part) - 2 576 rub. 00 kopeck

v to the pension fund (cumulative part) - 1 288 rub. 0 0 kopeck

In total in 2008, the size of minimum fixed contributions for IP is: 3,864 rubles. 00 kopecks

You need help in preparing payment documents on the payment of pension contributions of the IP, the preparation of tax and accounting reporting, Calculation of tax payments, registration, change in EGR IP or Elimination of IP? Specialists of the companywebsite We are glad to offer your help. We work with all regions of the Russian Federation. We offer the services of a remote accountant and a lawyer.