Change in OSAO since October. Changes to the Law on CTP and individual legislative acts of the Russian Federation - Russian newspaper. Exception from mandatory insurance

Why Polis Osago became the most discussed topic among motorists, as the insurance system changes and why motorists are still dissatisfied

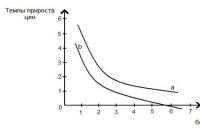

The Ministry of Finance of Russia has prepared another package of amendments to the CCAMAG law. The main one is the change in tariff accrual system. According to the "Kommersant", the department offers to allow insurers to independently install coefficients to the policies. At the same time, at the time of the transition period, they will be allowed only to reduce tariffs. In turn, drivers will be offered three options of policies with limits of payments up to 2 million rubles. And the opportunity to conclude a contract for more than a year.

Lowering coefficients are proposed to establish depending on the manner of driving a motorist, quantity and nature of violations. For this, the car is offered to equip telematics devices. In turn, for insurers, it is proposed to introduce a penalty for the delay in the direction of the client a motivated refusal. Its size will be up to 200 rubles. per day, but not more than 10 thousand rubles. in sum.

If the document is approved, it will become another global change in the CTP system over the past four years. AUTONEWS.RU correspondent remembered where it all started.

August 2, 2014. Law on the simplified registration of an accident

Two years ago, the Europrotokol began to operate in Russia - the system in which the accident participants may arrange a small accident without a call to traffic police officers. Since then, the number of motorists who enjoy this opportunity is growing every year. Only from January to May 2017, in Russia, an accident for Europrotokol was issued 208 thousand motorists - 32% of the total number of drivers in the accident. This year, the number of motorists who wished to arrange an accident without the participation of traffic police inspectors increased by 40%.

It is possible to issue europrotokol if the victims are missing in an accident. Both participants in the accident must have the active policies and not arguing about the circumstances of the accident.

At the moment, the maximum payment on the CTP with independent decoration of the accident is 50 thousand rubles, and if Europrotokol is used in Moscow, St. Petersburg, Moscow or Leningrad regions - 400 thousand rubles.

However, in the near future, the limit of damage to the damage in the accident in Europrotokol may increase twice. At the moment, the relevant bill has already received support to the Government of the Russian Federation and was sent for consideration in the State Duma.

December 1, 2014. Unified Methodology for Calculating CTP

The calculation of the cost of repair in the framework of the OSAGO according to unified reference books is made from December 1, 2014. This document was created two years ago by the Russian Union of Motor Shovers and the Central Bank. The new technique includes reference books at the cost of spare parts, materials and norms. The document includes 80 million positions on the most common brands and models of vehicles in context of 12 economic regions.

From October 17, 2014, the use of this technique made mandatory for insurers. Such measures were taken to eliminate the situation when the cost of repair calculated by various experts on the same damage under one insured event may vary several times. Such situations were usually led to numerous disputes about the amount of payments between insurers and car owners.

The directory of the average cost of spare parts, materials and norms of work used in the CTP are regularly adjusted and updated. So, according to the Russian Union of motorways, since August 1 of this year, the average cost of spare parts decreased by about 8%

October 1, 2015. Electronic Policy Persons

The launch of the sales of electronic policies started in 2015 - first from July 1 in the form of prolongation for individuals, then from October 1, it became possible to execute the policy not only at his insurer, but also any other offering this service. From July 1, 2016, the norms of legislation entered into force, which allowed insurance companies to discover the possibility of buying electronic policies of the OSAGO for legal entities.

Place an electronic policy driver can on the site of any insurance company. You can pay the policy using a bank card. At the same time, the cost of the OSAGO policy does not depend on the method of its design. The service is prohibited to use only beginners behind the wheel - they will have to go to the office of the insurance company.

Since the beginning of this year, the sale of E-Osago has become mandatory for all insurance companies. This affected the growth of sales of such policies: only from the beginning of 2017. Russian car owners have entered into 2.7 million CPU agreements in electronic form.

June 1, 2016. Refusal of imposed insurance

Since the summer of last year, Russians have received the opportunity within five working days to abandon imposed insurance. The relevant document was prepared by the Bank of Russia back in 2015, but an additional time was allocated to insurers in order to rebuild their activities on new principles of work,

Russians were allowed to abandon life insurance, insurance against accidents and diseases, health insurance, hull insurance and financial risk insurance. The client will be able to terminate the contract within five working days from the date of conclusion, regardless of the date of payment of the insurance premium, but only if during this period, an insured event occurred. In this case, the car owner's car owner must return in full.

Such an innovation was made due to the frequent cases when the car owners could buy the policy of the CTP, only acquiring additional insurance in the burden. At the same time, prove that the insurance imposed the client was rather difficult.

The transition to new forms did not affect the cost of OSAGO for motorists - the main costs fell on insurance companies. The cost of making a form of a new sample policy has grown slightly - less than 1 ruble.

July 2016. Polis Osago became Pink

Last year, for the first time since the invention, the color of the document has changed - with green on pink. The background of the form has become more complex - it appeared graphic figures and color stretch between yellow, pink and lilac flowers. According to representatives of the state dawn, the degree of protection of the policy was also increased - to make a fake, fraudsters will need at least two years.

September 1, 2016. Ban on raising tariffs

A year ago, the State Duma, after a long dispute, approved the law prohibiting raising tariffs on the OSAGO more than once a year. The document was prepared by the deputies of the LDPR and was discussed throughout the year.

The reason for the initiative was the rise in prices for the policy of the OSAGO from April 12, 2015. Then the basic auto insurance rates rose by 40% at once. In addition, the tariff corridor has been expanded from 5% to 20%. Such a decision was made by the Board of Directors of the Bank of Russia, which explained this to the lossless business. It came to the point that the insurers simply went out of a number of regions, and the car owners had nowhere to buy polis.

This decision caused a sharp discontent with most car owners. In return, they received an increased limit of payments for harm caused to life and health, as well as a transparent calculation method.

March 2017. Natural reimbursement of damage instead of cash payments

At the beginning of the spring of this year, the head of state made global changes to the rules of mandatory auto insurance. This is a natural reimbursement of damage instead of cash payments. According to the document, the owner of the damaged car must be applied to repair the maintenance station, which the insurance companies themselves are engaged in the list. This rule works only for passenger cars that belong to individuals. The repair period of the car should not exceed 30 days. At the same time, the service must be located within no further than 50 km from the place of residence of the car owner or the location of the accident.

The law also does not exclude the possibility of obtaining funds from insurance companies. However, now it is possible only if the machine is not subject to repairs, the driver was harmful to the moderate or heavy, in the event of the driver's death or if the repair costs 400 thousand rubles. In addition, the monetary compensation of the owner of a broken car may require if it is dissatisfied with the quality of repair.

According to the Government's plan, new amendments should simultaneously take into account the interests of motorists and insurance companies. So, for car owners, the innovation is beneficial to what actually excludes disputes with the insurance company regarding the amount of payments and allows you to get a renovated car without any surcharge. In turn, insurers can control the quality and scope of work at stations themselves. In addition, they also reduce the risks of court proceedings and related spending.

July 2017. Creating a Commission to resolve disputes between insurers

Russian President Vladimir Putin signed a document on the establishment of a special commission in the country of the Russian Union of Autogues. Its main goal is to resolve disputes between insurers who relate to mutual settlements on direct reimbursement of SCJO losses.

The commission of a conflict situation is given 20 days. In case of disagreement of the insurer with their decision, the dispute will be considered by the Arbitration Court. Such an innovation in the government was explained by the desire to reduce the burden on the courts and at the same time reduce the abuse of the right of fraudsters.

From October 1, 2014, the next number of amendments to the Law on CTP, established by the Federal Law of July 21, 2014 No. 223-FZ "On Amendments to the Federal Law" On Compulsory Civil Liability of Vehicle Owners "and individual legislative acts of the Russian Federation. "

The main changes - an increase in the sum insured of the damage caused by property as a result of the accident and reducing the limit value of the wear of parts in determining the insurance payment.

The insured amount of the OSAGO for harm caused by property will be 400 thousand rubles for each vehicle affected by an accident. But is it so joyful for the drivers this news?

For those who acquired the policy earlier, the limits remain the same and in such contracts the maximum payment of the victim will be carried out in the same way as until October 1, 2014 (120 thousand rubles for harm caused by one car, 160 thousand rubles for harm caused by several vehicles).

As explained in Rs, The car owner with a contract concluded before October 1, 2014, maybe if desired, terminating the old contract and losing 23% of its cost, issue an OSAO with new limits,if your responsibility to third parties will be protected more reliable.

But will your own car be protected more reliable if you do not have CASCO policy, but only the OSAGO?

After all, new loans for the "Iron" payments are valid only in relation to the CTP treaties issued by car owners from today. L.the imit of insurance payments on the OSAGO is determined on the basis of the conditions of the CTP agreement concluded with the culprit of an accident.

Thus, if your contract is issued with new limits, and the agreement of the accident of an accident - with old, for its affected car you can get paid only within the limits used until October 1, 2014.

Different limits will act during the transition period for approximately a year. It was assumed that from October 1, the policy of the OSAO with old limits and new property limits will be in parallel and with new property limits.

The form of new policies should be approved by the Bank of Russia, taking into account the new edition of the OSAGO Rules

Since the new limits blanks have not yet printed, the insurers of the CTP received permission to use old forms with corrected limits before the exhaustion of their stocks. When making a policycarefully see whether these corrections made to your form

What other changes occurred and what is postponed?

From October 1, 2014, under the OSAGO contracts, the limiting importance of the details taken into account in determining the insurance payment is reduced to 50% (under contracts concluded before October 1, 2014, the limit value of the details wear is 80%). Payment for the details that significantly affect the safety of the vehicle is made without wear.

The planned experiment on unlimited Europrotokol in Osago from October 1 will not begin, as the government has not yet been approved by a special decree on the requirements for fixing the circumstances of the accident. The increase in tariffs will most likely happen in mid-October, after approval of the package of draft laws represented by the Central Bank.

The last few weeks have passed for car owners and insurance companies in a strong excitement: everyone was waiting for October 1, when the amendment should be taken into force of the ARGO law. New rules will affect the cost of insurance, the system of coefficients and the size of payments. Also, drivers will have official right in some cases draw up an accident with the help of expanded Europrotokol.

However, so far insurance companies have become paused. As it became known, at the time on October 1, the Central Bank did not prepare (or prepared, but did not show the insurers) a number of important documents necessary in order to start working under the new rules: talking about the new tariffs themselves, the OSAGO form and the form of the application. Obviously, car owners will have to wait a few days to arrange insurance for new tariffs.

Earlier it was reported that in October, the OSAO will rise in price by 18-24%, and the maximum payment limit will grow to 400,000 rubles.

Insurance should rise in price - representatives of the government, State Duma and Central Bank came to such a joint decision. Already in October, the CTP will grow by 18-24%, and for April 2015 the second stage of the rise of the price is scheduled, but how much it will be large - until it is specified.

Representatives of the Central Bank have not yet given official comments, but, speaking in the Duma, Elvira Nabiullina (Chairman of the Central Bank) stated: problems in the OSAGO system were copied for years, for example, the base rate did not change over 11 years. Therefore, the amendments to the law are under consideration, but representatives of the State Duma are already expressing confidence that they will be accepted. Thus, it can be assumed that there are already major changes in the near future of car owners.

The maximum limit of property payments will increase from 120,000 to 400,000 rubles, and the base tariff of the OSAGO - by 18-24%. April 1, 2015 will increase the limit of payments for the life and health of victims in an accident - up to 500,000 rubles.

Insurance companies will be able to pay monetary compensation or organize the repair of a damaged car at their discretion. Also, in case of repair, they will be able to use a used spare part.

At the same time it is possible that the cost of the CTP will depend on the age of the driver.

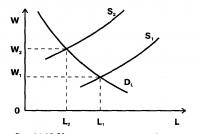

The Russian Union of Motor Shovers (RSA) presented to familiarizing a new system of coefficients on the OSAGO. It provides 4 age-related categories of drivers and five categories defining driving experience. As a result of their imposition, 20 different groups are obtained, and each of them will have its own coefficient when calculating the cost of insurance of OSAGO. What is interesting, this coefficient can be both boosting and downward.

The need to make changes to the existing system of increasing coefficients, representatives of the RC explain the fact that young and inexperienced drivers often fall into the accident, and pay for insurance on average not much more than those whose driving experience is measured by decades.

At the moment, there are rules according to which drivers are under 22 years old and those whose experience is less than 3 years old, pay insurance based on the increasing coefficient of 1.8. But 23-year-old drivers who manage the car 4 years are already under the action of the raising coefficients do not fall.

In the new system, a detailed classification of different groups of drivers will be used, the raising coefficient can maximize 2.52 and reduced coefficients. For example, if the driver's age is over 45 years old, and driving experience is 7 years or longer, then its coefficient will be less than one, (down).

The basic tariff of the OSAO before October 1 was equal to 1980 rubles. However, the cost of insurance depends also on several coefficients, which are determined by the characteristics of the car, driver's experience, the history of accidents and the territory of use.

Azat. 07.10.2014 23:08From October 11, 2014, basic tariff rates will be raised within the tariff corridor: minimum values \u200b\u200bwill increase by 23.2%, maximum values \u200b\u200bby 30%. For example, if for passenger cars who are in possession of individuals, the base tariff was 1980 rubles, now it will be at least 2440 rubles and a maximum of 25,74 rubles. The correction coefficients (place of residence, age, driver's experience, etc.) remained unchanged.

In the future, from April 1, 2015, insurance amounts will be increased by damage to the life and health of victims in an accident and the basic tariffs of the CTP will be revised again. Of course, in the most side ...

Ilya

04.10.2014 21:56

Everything is fine. You just want to stand in line and wait 2-4 weeks, and you want or need the need for time, then pay and for the speed on the same day for life - here you and the polister from under the floors, and the prize whipping for another man.

Petjuna

06.07.2014 19:35

For riding without insurance, a fine of 800 rubles. If the average price of the OSAGO (that is, there was 5,000 rubles per year, we pretend: the guits for checking documents on average stop 2-3 times and only on posts . Who rides mainly in the city, respectively and do not stop if it is not particularly violated. Next, take into account that corruption in our transcendental altitudes and the question is solved for 300-500 rubles, then the question is brewing, and why I need an OSAGO))).

Basil

07.06.2014 12:59

Yemanzhelinsk, Chelyabinsk region bought a car, for registration needed insurance, from insurance companies only works as a newsstone, for insurance on the car 3700 (135 hp) plus necessarily life insurance and housing in the amount of 4000, with even documents even documents Neither the main thing is to give money, and my life is insured for five years, this is also not interested in anyone. And now I have a car, but I think nor cheap me on a taxi. And where it is "we began to live better." Dust .

laughter for the sake of the sake, in line with me, Dedok Matatsycie in 5000Thesthashawned. Insurance price, 6015 rub

Maria

31.05.2014 12:33

Zlatoust. Chelyabinsk region She arrived to insure Chevrolet Lacetti. Forms, naturally, there is no anywhere. They insure only Rosgosstrak, but with a prerequisite for life insurance, I had to insure there, gave 7950. (Insured Father, and I was insured). And there are no no worthwhile, my insurance company Alpha Insurance closed for another six months ago in our city, naturally, we are not hearing about it. Neither spirit, insurance ends 06.06.14, and in other companies, you need to come at 6 am, take a ticket for a certain day, And this must be waiting for about 10 days to insure, and it is not a fact that they are insured. In short, complete chaos.

leonid

27.05.2014 11:33

Astrakhan. He arrived to insure Toyota Corolla 109l.s. Last year, the Polis Stall 1820r. Where was the same for many years sent - in the queue, sign up for 6 ion. And where in the garage? A firm came to another - in line! In the third - no blanks! etc. Insured in 6 firma for 2900 + 600 rubles. for a life. And the discount was 5%, as explained that my company where I was always insured, I did not bring me to the database !!! When will this chaos end ??? Someone will answer for it? Or are we so and will they scream how much will they say ???

21.05.2014 19:13

why in the policy is not written for use in the rental and taxis