Among the obligations required on the bill. C notes need to be alert. Lettering on bill

Bill - This is a document compiled in compliance with certain conditions that give the right to one person (bill holder) to demand from another person (billboard) obligated on the bill, to pay the amount specified in the bill at a certain time and in a certain place.

In accordance with, the bill is a valuable paper, the rights to which belong to the person named in it, which can transfer them to another person or independently.

The bill simultaneously acts as a settlement, security and debt obligations and allows us to receive income into invested capital.

Vexsel holder - The owner of the bill who has the right to receive the amount of money specified in it. Vexsel holder, marked as a recipient in a promissory bill, is called the first sweepager ( remittom).

Repertent (from Lat. . Remittens -sexing) - a person in favor of which the transfer bill is discharged, the first instext.

The alienation of the rights on the bill is carried out by drawing up the inscription of the bill holder ( indusantom) at the most broad-handed letter indusation(from Lat. . in - on the , Dorsum - spin) with the simultaneous transfer of bill to the acquirer ( endosseat). The transfer inscription usually has the following form: "pay the order" or "instead of me / we pay (pay)." If there is not enough space at the more at the more, then an additional sheet is attached to it - allong. When issuing an outlet of the bill to the first notes, the compilation of the indexment is not required. Through the endorsement, all rights on the bill in aggregate are alienated, including the right to receive a bill on the bill in full. Each endorseant who put the signature on the bill is responsible for acceptance and payment on the bill. Joint responsibility - This is the complete responsibility of each person obligated on the legal bill in front of a legal exchange. Warehouse holder, in the case of non-payment and properly protested bill of exchange in the default, has the right to present a lawsuit to all or some obligations to the bill of employers, without observing the order of the indors. This right of the bill holder is called the right of regression. The exception is the case when the indorsement contains the words "without turnover on me" (unoblant endorsement).

Binding requisites A bills are:

The name of the document "Bill", included directly into the text of the document and expressed in the language on which the bill is drawn up;

Specifying the term of payment;

Specifying the place in which the payment on the bill must be produced;

The name (name) of the person who or by order of which the payment on the bill must be produced;

Specifying the date of drawing up the bill and place its compilation;

Name (name) and the signature of the credentials.

A combination of properly decorated props of bill of exchange is the form of a bill of exchange, and the absence or incorrect design of at least one of them can lead to a defect form of a bill. Defect form bills - This is a term that determines the inconsistency of the document presented as a bill to the formal requirements of bill rights. The defect shape of the bill leads to the loss of a bill of exchange strength, the unconditions of the text described in the document (abstractness of bill of interest), the solidarity of the responsibility of persons on the bill.

The subject of a bill liability can only be money. Bills bill (nominal value of the bill) is the amount money, indicated in the text of the bill and payable to the payer of the bill holder. A bill of exchange is to be directed exactly monetary unitswho are a legitimate payment facility in the territory of the Russian Federation or in other currency.

The person who is obliged to the timely and complete fulfillment of the obligations on the bill in favor of the subject to the random holder is the person named in the text of the bill as a payer and accepting bill - acceptor. The acceptance is expressed by the word "acceptance" or another equivalent word; He subscribes to the payer. The payer through acceptance assumes the obligation to pay bills on time. In the case of a non-payment of the bill holder, even if he is a notes, has the right to initiate a lawsuit against the acceptance.

Note in bill lifetime payment By it can be carried out by:

Definitions of the exact calendar date of payment on the bill;

Definitions that this bill is payable after a certain period of time from the date of its preparation;

Definitions that this bill must be paid upon presentation;

Definitions that this transfer bill is payable after a certain period of time has expired since its presentation of the payer for acceptance;

Definitions that this simple bill is payable after a certain period of time from the moment of its presentation of the tolerator to simply address the presentation of the presentation.

The reliability of the bill can be increased in the presence of guarantee on it. This guarantee is called aval. By virtue of his bill guarantee provided by him ( avalist) It takes a solidarity with other obligations on the bill of interest to the proper holder of the bill for its timely payment.

Aval can be drawn up in the form of an inscription with the "count for Aval" included in its text or another equivalent reservation on the front or back of the bill either on the added sheet added to the bill. allong). Aval is signed by those who give Aval. Paying bill, the Avalist acquires the rights arising from the bill, against which he gave a guarantee, and against those who are required to be the latter.

Operations with promissory notes can be carried out through intermediaries. Vexselger, an endorsant or acilist can indicate any person for acceptance or paying a bill. A bill can be accepted or paid on the established conditions by a person acting as an intermediary for any of the debtors owed in order regress(i.e. the reverse claim for the amount of the amount paid). The mediator may be a third party, even a payer, or any person who is already obliged by the bill, with the exception of the acceptant.

The acceptance of the mediation is noted on the bill and subscribe to the mediator. It indicates at whose expense it is committed. Payment in mediation should cover the entire amount to be paid for whom the payment is made.

A person who has made a payment in order of mediation acquires the rights arising from the bill, against whom he paid, and against those who are obliged before this on the latter. However, he cannot again endorse bill. Indresants following the person who put their signature on the bill and for which the payment was made are exempt from liability.

Thus, the main properties of bills are the following:

Solidarity liability for payments, regardless of the commission of obligations on them;

Establishing an accurate debt date, i.e. urgency of payment without its right to extend;

Abstract: Once upon an occurrence based on a specific deal, in the future the bill is isolated and exists as a separate contract (payment).

| Previous |

The general basis for the onset of bill of interest is non-payment of the bill on the main obligated person. This moment also noted Professor G.F. Shershevich: "The non-payment is a very important circumstance in the bill: they are determined by the responsibility of persons participating in the bill of interest" * (350).

Initially, who can affect the bill, i.e. It has active * (351). By general rule civil legislation, participants of civil legal relations: citizens (individuals), legal entities and state-legal and administrative-territorial entities are possessed: citizens (individuals) Russian Federation, its subjects and municipal members. Citizens and legal entities have a total bill of exchange and, accordingly, the legal capacity arising for citizens from the moment of birth, and for legal entities - from state registration and terminating death (for legal entities - an exception from the state registry after the completion of the liquidation process). The benefits of these persons are limited by the general rules for limiting civil rights: for citizens - in the form of legal limit; For legal entities - in the form of limitation of legal capacity, for example, in the presence of a ban: Judicial as measures to ensure a claim, legislative as a response to a special position of a legal entity - for state-owned enterprises and institutions (Art. 296, 297 of the Civil Code of the Russian Federation), eligible to dispose of property and, accordingly, to oblige on the bill, only with the consent of the owner; For the organization for which bankruptcy procedures are introduced, etc.

The passive benefit of the Russian Federation, its subjects and municipalities is limited initially: in accordance with Art. 2 of the Federal Law "On Transferred and Simple Week", these participants in civil relations are entitled to oblige a transferred and simple bill only in cases specifically provided for by federal law. This restriction applies to the issuance of bills, and to perform an endorsement, and Aval.

Thus, persons responsible for the bill may be a) citizens, regardless of citizenship with full capacity; b) legal entities possessing at the time of the obligations on the bill, full legal capacity; c) the Russian Federation, its subjects, municipalities - in the presence of such a right, specifically provided by the Federal Law (we note that such laws The State Duma Not accepted, and in fact, these participants in civil legal relations are not currently under the subjects of passive investment).

Now consider who among the persons participating in the bill obligation actually answers the bill. A bill of interest, in accordance with Art. 815 of the Civil Code of the Russian Federation and Art. 1 provisions on the transferable and simple bill, which is an uncommon (unconditional) obligation of the debtor to pay the amount specified in the bill to the holder of the bill of exchange, is undoubtedly a monetary obligation. The essence of the monetary obligation, in accordance with Art. 307 of the Civil Code of the Russian Federation, is the responsibility of the debtor to pay the money to the creditor. The creditor in the bill liability is always a bill holder. The question of who is the main debtor on a bill liability requires a more detailed presentation.

In accordance with Art. 1 provisions The transfer bill must contain the name of the one who should pay (payer) and the signature of the one who issues a bill (a drawer). With regard to a simple bill of exchange, the provision (Art. 75) does not push such a requirement, since the payer is the paid for himself. Thus, at first glance, the main obligations to pay on the bill of exchange by persons are: by the transfer - the payer, according to a simple - a notch. This statement is quite true in relation to a simple bill, but when it comes to a promotional bill, it is true.

With regard to the legal nature of this proposal in the literature on the bill of exchange, several theories were developed. Part of the specialists believes that the obligation of the traissance (the billboard for a transfer bill) is adopted with a deposit: the tracer undertakes to pay the bill if the payment will not be fulfilled by the payer specified by them * (353). E.A. Crashinnikov believes that this is an obligation with a subsequent condition: the traceant undertakes on the bill, but his duty stops if the bill holder will receive satisfaction from the payer * (354). Some authors proposal to pay identified with the order * (355), others - with the instruction * (356). V.A. Belov The content of the transfer bill sees in the offer (offer) of the payer's credentials to conclude a contract for payment in favor of a third party * (357).

At the same time, V.A. Belov notes that "about the obligation ... a drawer to pay the bill drawn in the document in the document", in connection with which it is concluded that "until the acceptance of the acceptance payer, he does not embody the obligation of any person ( Including a credential) about paying a certain amount or other execution. " Such reasoning somewhat diverges with generally accepted, including the law enshrined in the form of the norms, in accordance with which the bill, due to the fact of its design and issuing, initially contains monetary obligation. In this regard, there is a look at the content of the obligation at a transfer bill as an obligation to pay a bill at the expense of the payer to pay a payment (conditional obligation, with a depositing condition). Such a conclusion is confirmed by the norm of law: in accordance with Art. 9 Provisions, the receipt is responsible for payment, i.e. It is a person who is obligated on the bill, despite the direct indication of this in the bill.

An analysis of legal relations from the issuance of a transferable bill allows one position to offer another position, in some way explaining the legal essence of the Tratta. In my opinion, the legal purpose of issuing a transferable bill is attempting to make a drawer to translate its duty, arising from the fact of issuing bills to another person - payer. Let's see if this conclusion matches the content of the bill (by transfer bills) obligations. The person issuing a transfer bill is initially a commitment: it follows from general provisions Civil law on securities and liabilities. In accordance with Art. 142 of the Civil Code of the Russian Federation, security certifies the property rights of its owner. The bill, by definition, certifies the right of its owner will certainly get the amount specified in it. Since the bill of exchange as a document expresses a monetary obligation, respectively, the right of the owner by virtue of Art. 307 of the Civil Code of the Russian Federation corresponds to someone's obligation to pay. The issuance of a transferable bill does not generate the payer of the obligation to pay on it, since he did not give such an obligation (it indicated, perhaps without his will, the tracer), besides, it should be borne in mind that the payer becomes an acceptant, i.e. The debtor on the bill, only for the acceptance of acceptance, but the bill may not be charged to the acceptance, since this is the right, and not the responsibility of the bill holder * (359). Thus, since the obligation cannot be missing a debtor (otherwise it is not an obligation), such at the time of issuing an exchange is a bill of exchange (tracean). Initially, taking an obligation (being a debtor), the tracer tries to translate his duty by specifying this in the text of the bill on the appropriate payer's proposal (it is possible to call this proposal and a kind of offer). In case of disagreement of the payer to make a payment, this duty lies on the trace of course.

The mechanism of occurrence of the waiting officer of the transferable bill of charge to pay the following: because his obligation is conditional, he becomes the debtor, provided that the attempt has failed to translate debt, i.e. The payer refused to accept (give consent to the payment) bill or bill of acceptance was not presented. The fact is that bill legislation refers to the presentation of bills to the acceptance not to the obligation, but to the right of the bill holder (Article 21 of the provisions) in such a situation (when the payer refused to accept the acceptance or accepts a bill of exchange) The payer is not responsible to the random holder * ( 360), which automatically turns the trassian in the main debtor. In the case of the acceptance of the payer of the bill of exchange, he takes upon himself by virtue of Art. 28 The provisions of the obligation to pay a transfer bill on time, even if the receivers itself is the notch itself.

Thus, the main debtors on the bill of exchange are: according to simple - in all cases, the receiving agent, by the transfer - the receiving agent, with the refusal of the payer to make an acceptance or incorporated with an acceptance of the bill of exchange for acceptance, acceptance - when making an acceptance, but when refused to make a payment. The specified persons are exempt from responsibility on the bill only in the following cases:

1) the bill is recognized as invalid by defect form, i.e. Due to non-compliance with formal requirements for the content of bills established by Art. 1 positions;

2) The bill is signed on behalf of the credential or acceptance on behalf of the Acceptance by an unauthorized person. In this case, the rules established by Art. 183 GK - in the absence of approval of the transaction submitted, the person who is obliged to the bill, is the signed person of his or acceptance * (361);

3) The holder of the bill is unfair. In the bill legislation, the presumption of good faith ownership of the bill of exchange by his holder. Therefore, the burden of proof of the opposite lies on stakeholders, including the billiardder and an acceptance as the main debtors. "The person who is obliged on the bill will be exempt from the payment, if he proves that the creditor who submitted the claims knew or was to know at the time of acquiring a bill of invalidity or the absence of an obligation underlying the issuance (transfer) of the bill, or received a bill as a result of cheating or Theft, or participated in deception in relation to this bill or its stealing, or knew or had to know about these circumstances before or at the time of the acquisition of the bill. " It should be noted that in practice, the provocation of these facts is quite difficult. First, the establishment of facts such as theft, deception, abuse is due to proof in criminal proceedings, i.e. The evidence will be a judgment of the court or order of the investigator; Secondly, it is also possible to prove that the bill holder knew about the invalidity of the obligation underlying the issuance (transmission) of the bill, it is possible almost only when the person who is obliged on the bill, and the willsites associate the so-called "personal" relationship. As an example of the unscrupulousness of the rashlagel holder, it is possible to bring the case when the funds of the criminal process will be proved that the random holder, whose requirements are based on the blank index, stole a bill of the legitimate previous holder. An example of a presence in the relationship between the Waiter holder and the credentials of the personal factor confirming the knowledge of the bill of interest to the absence of an obligation underlying the issuance of the bill of exchange is given in paragraph 9 of the review of the practice of consideration of disputes related to the use of bill in the economic turnover: "The bill was issued by the buyer under the supply contract As a preliminary payment for the goods, the Supplier's obligations provider did not fulfill, but on the period specified in the bill, presented it to payment, and then - a lawsuit, motivating its demands by the abstract nature of the bill obligation. In the claim to the bill holder - the supplier was denied the provider, since He and the notes were aware of the essence of the transaction underway at the base of the bill. Such relationships found a variety of personal, and since the lack of grounds for issuing a bill of exchange and the existence of the benefit of his right on the bill of exchange consciously to the detriment of the debtor was proven, the court refused to satisfy the claim ";

4) The promssel holder appealed to the expiration of the deadlines established by Art. 70 positions. It should be borne in mind that the deadlines established by the title of the provision are in their legal nature befall, i.e. Terminating right. Therefore, in the case of the circulation of the bill holder with a suit with a passage of a three-year term to the acquisition of a transferable bill (or to the receiving agent in the absence of an acceptance) or to the receiving agent for a simple bill, the Court applies these deadlines regardless of the statement of the party and refuses to the lawsuit * (363).

When the reserved agent and the acuptant are called the main debtors, mean the fact that they are those responsible for the payment. Their duty arose from the most notes (including the duty of the Accessant, with its consent of the host of the offer, i.e. the proposal to pay) * (364). Accordingly, with a non-payment of the bill, the receipt manager and the acceptant are those responsible for the bill, including carriers and bills in a narrow sense, in the form of sanctions.

But besides the main debtors, obliged in the case of non-payment on the bill, the responsibility are also responsible: an endorsant and acilist. In general, bill legislation is inherent in the principle of responsibility of all persons who have been obliged by staging of certain inscriptions on the bill. Let us consider more material conditions for the onset of the bill of interest of the Indresant and Avalist during non-payment.

Endorser. The bill refers to the category of order securities, the rights for which are transmitted by performing a transfer inscription on it - an endorsement. Thus, the main legal purpose of the bill of exchange endorsement is the transfer of the right to the bill, i.e. The rights to receive the payment, in fact we are talking about the assignment of law. However, if with a classic concession, the so-called cession, the initial lender is only responsible for the invalidation of the requirements transferred to the new creditor, not responsible for the failure to fulfill this requirement by the debtor (Art. 390 of the Civil Code of the Russian Federation), then, with a concession of the requirements through the endorsement, the endorsant responds to an endossee (person to which Requirements are transmitted), and for reality (existence) of the transmitted law, and for the implementation of this right * (365). This property of the indors (not only to transfer the right, but also to create the responsibility of the broadcasting bill) is related to both the history of the bill of exchange, and with its legal nature (unconditional and abstraction), and such a property as lightweight turnover conditions.

Let's try to compare the conditions under which there is a cessism and an endors. With the assignment of the requirements through an ordinary cession, a new lender has the ability to verify the reality and reality of the transmitted right, he sees documents confirming the right of claim, and is able to give them a legal assessment. When transferring the rights to the Endoshosat bill, it cannot establish a reality nor the reality of the transmitted law, since the bill of exchange is not to accept or the payment, as a rule, has not yet been presented. Taking a bill, the new holder is able to estimate only the authenticity of the signature of the previous holder of the bill, thereby performing the action, according to the degree of risk, differing from the cessia * (366). In order to maintain the stability of billphaning that has a considerable effect on stability monetary turnover (Bill in many cases, in many cases, a substitute for money), the legislator, and provided for the principle of responsibility of all previous indictors to the holder of the bill of exchange for execution of a bill of exchange.

This principle is implemented in the norms of Art. 15 provisions, according to which an endorsant, since it is not agreed by the opposite, responsible for acceptance and payment, as well as Art. 47, by virtue of which all the indices bills are solidarly obliged before the random holder. The technically the responsibility of the indorsants occurs in the case of non-payment of the bill (by the random or acceptant) by attracting it as a defendant in the case (both the only and along with other obligations) or the debtor in the forensic work, if in relation to him Notarized protest in default.

However, the endorsant is a person responsible for the bill, not always. In particular, he does not respond on the bill, in case of non-payment, the main debtor, in the following cases:

a) if the endressing is not an order, but a blank, i.e. Not containing instructions in whose favor it is made, and consists of one signature of the index. For example, the first willssel holder - OJSC Alfa "- industed bills through the Blank Indusation of Betta CJSC, issuing a transfer of the purchase and sale of bills. In turn, CJSC "Betta" indexed the bill of Ltd. Gamma is also by making a blank endorsement on the basis of the exchange agreement. Thus, CJSC "Betta" with a non-payment of the bill of exchange for the bill will not respond to the bill holder for the fulfillment of the obligation, because there is no bill as one of its previous holders. The specified person can, in this case, to respond only for the reality of the requirement contained in the bill, or the most notes, if the bill will be subsequently declared invalid or bill will be a substrate or fake (paragraph 2 of Art. 147 of the Civil Code of the Russian Federation);

b) If the billboard has banned the transfer of the bill through an endorsement. The reserve has the right to reveal the transfer of rights on the bill and notes itself by the Index. In accordance with Art. 11 provisions, such a reversion is certified by the words "not orders" or any equivalent expression * (367). In the presence of such a revenue, the bill is considered as nominal paper, the assignment of the rights to which can only be carried out in the procedure of the cessia (paragraph 2 of Article 146 of the Civil Code of the Russian Federation). The concession transaction of the right claim must be drawn up on a bill either on an additional sheet or a separate document compiled in accordance with the requirements of paragraph 1 of Art. 160 Civil Code. If the bill contains a ban on the bill of interest to transfer to it by means of an endorsement, the transaction of the concession in the form of a separate document was not issued, from the content of the record produced on the back of the bill of exchange or on an additional sheet, it follows that it is committed according to the rules of the endorsement, and not concessions of the right, Such indors are invalid and, accordingly, persons who have committed them, are not responsible before the random holder;

c) If the index is crossed out. In accordance with Art. 16 positions, crossed out the indexes are unlocked, respectively, the person specified in it does not respond to the bill;

d) The indors is partial. Article 12 of the situation prohibits a partial endorsement on the bill, recognizing it invalid. Thus, the endorsant who committed such an invalid indorsement will not, by virtue of paragraph 1 of Art. 167 of the Civil Code of the Russian Federation, to respond as a bill debtor, his responsibility will be associated with the invalidity of the transaction on the transfer of rights on the bill;

d) One of the indorsants was revealed by a new endorsement. This ban is called the Endorsim Rektar, it is usually expressed by the same words as a similar reversion of the drawer: "Pay only such a thing", "pay such something, but not his order", "such something without the right indissation" etc. The legal meaning of the Entrosant Rektorsa also concludes the transformation of bills in nominal paper, the rights to which are only transmitted in the order of ordinary cession and, accordingly, the endorsant is responsible only before its indors (those in whose favor he made an endorsement), but not before other persons , in whose advantage of the bill was subsequently improvated by the finesant counterparty;

e) a continuous series of endorses is broken. In accordance with Art. 16 Provisions, a person who owns a bill, is considered as a legal holder, if it is based on a continuous series of indors. The continuity of the endors means that their row should be consistent, i.e. Each previous Endosseat is the subsequent indorseine * (368). For example, a number of indors will be considered interrupted if the first indexment was performed by Ivanov A.P. In favor of the State Unitary Enterprise "Star", and the bill is in the hands of Fedorova G.A. Thus, neither Ivanov A.P., nor GUP "Star" will not answer Fedorov G.A. A number of endors will be considered interrupted, and if one of them is not signed * (369);

g) if the endressing is a pavement. In accordance with Art. 18 Provisions, when transferring bills, an endorsant can make a reservation "Currency to receive", "on collection", "as trusted" and other, denoting instructions. The legal purpose of such reservations is the instructions to another person to carry out the rights on the bill (make a payment to pay, to make a payment, perform a protest in case of non-payment), while remaining a carrier of rights, although not being an instertainer. Thus, in the presence of the designing indorsement of the indussant and the bill holder, the contractual relationships of the assignment and, accordingly, the bill holder cannot require the creditor of the payment;

h) The endorsant excluded himself from among the persons responsible for the bill. Norms Art. The 15 provisions providing for the exposal responsibility for acceptance and payment are dispositive: "Since the opposite is not agreed." Accordingly, the disposition of the specified norm gives the indictor the opportunity to exclude itself from among those responsible for the bill of persons by inclusion in the text of the endorsement of the reservation "without turnover on me" or any other reservation meaning the release of the indorse station from responsibility for payment * (370). In this case, the endorsant is not responsible for both the person in favor of which the bill has been improving. The presence of this reservation significantly reduces the value of the bill, as it indicates the concerns of the indussant that the main debtor will refuse the main debtor on the bill, as a result of which the responsibility will be entrusted with the industors;

and) if the indexment is a mortgage. Pledge, in accordance with Art. 334 of the Civil Code of the Russian Federation, is one of the ways to ensure the fulfillment of the obligation. The subject of the collateral is the property of the debtor, which is drawn to the recovery in the event of non-fulfillment by the debtor, and from the value of which the lender receives satisfaction. A bill can also be a pledge. The owner of the bill of exchange, which is a debtor on any civil obligation, transfers it to a deposit (more correctly - in the mortgage) to its creditor by means of an endorsement with the reservation "currency in provision", "currency in pledge." Since the purpose of the transfer of bills in pledge is its alienation, i.e. The transfer of ownership of the bill of exchange as a thing, the endorsant does not become obliged by the bill person. He remains a debtor on the secret key of the bill of exchange by a civil obligation and, if not fulfilling its non-fulfillment, is responsible for the loan as property (the bill is either implemented by the holder in accordance with Art. 349-350 of the Civil Code of the Russian Federation, or is made to the payment of persons who are obligated on the bill, except for the pledger);

th) the indorsement performed after protest in the default. According to the rule established by Art. 20 Provisions, an endorsamment, perfect after the protest of the bill of exchange in the default or after the expiration set for protest, has the consequences of only an ordinary cessia. Since, in accordance with Art. 390 Civil Code of the Russian Federation, the initial lender that gave way to the requirement is responsible for the new lender only for the invalidity of the requirement, but is not responsible for its non-fulfillment, respectively, the endorsant in the case under consideration is not a person obligated on the bill;

k) The procedural timing of the presentation of the bill is missing. For bill legislation, the presence of sufficiently rigid deadlines is characterized, in many cases that are a biased, the violation of which entails negative consequences For holder bill. In accordance with Art. 34 provisions, the bill holder should present to the bill of exchange for a period of presentation within one year from the date of its preparation, bill with a period of payment for a certain day or in so many time from the preparation or presentation must be brought to payment either per day when it should To be paid, either in one of the two working days (Art. 38 of the provisions). Also, the timelines are set to protest the bill in Neakcept and in the default (Article 24, 44 of the provisions). In case of passing the listed deadlines, the bill holder loses its rights against all the persons owe, including the indorsants, with the exception of the Acceptance at the transfer bill and the billboard for the simple bill (Art. 53 and 78 of the provisions). A bill may contain the reservations of the "turnover without costs", "without protest" and other, meaning the release of the Wexsel holder on the duties of protesting the bill in Neakcept or default. In this case, the holder of the bill must present it to payment and in case of refusal of the main debtor to make a payment, to inform his industors (and according to the transfer bill and the drawer, if the payment was not performed by the acceptant) within four working days following the day of presentation (Art. 45-46 positions);

l) If not performed the protest of the bill in the default. Waiting relationships are generated by two types of liabilities: the obligations of the main (or main) debtors: the bill ofes and the acquisition at the transfer bill and the billboard for a simple bill, and the obligations of the debtors in the order of regression: the indorsants and the Avalists carrying - will not be a mistake to say - subsidiary and solidarity Vexsel holder (with default). The assignment of these debtors to regressive means that their responsibility on the bill comes only with the presence of a protest of the bill in the non-payment or in Neakcept. Without such a protest, the indors are not required for the bill * (371), except in the cases of the waiting for the reservation "turnover without expenses" or another, meaning the release of the Waxelker from the protest, or the ads of the payer (a drawer) insolvent (paragraph 6 of Art. 44 of the provisions) or an insurmountable force that impede the presentation of bills to accept, payment or protesting, the action of which lasts more than thirty days (paragraph 4 of Art. 54 of the situation);

m) The same cases of liberation from liability, which are listed above in relation to the main debtors: the unscrupulousness of the holder of the bill, invalidity of the bill and indors, signing the indorsement by an unauthorized person, skipping the timing of the claim.

Paying bills (voluntarily or in lawsuits), the Endosant acquires the right to demand the amounts paid to them from all the persons in front of him (paragraph 3 of Art. 47 of the Regulation). For example, if the random holder received a bill and other payments from its indussant, such an endorsant is entitled to demand payment from the indressants facing him, their acilists, a drawer and an acceptant * (372).

Regarding the passage of the timing of the claim, it is necessary to keep in mind that Art. 70 Provisions establishes for regressive bill requirements other than for the requirements for the main debtors:

The claims of the bill holder against the indors and against the bill of exchange will be redeemed by the expiration of one year from the protest committed in fixed time, or from the date of payment, in the case of a reservation on the turnover without costs;

The claims of the indictors to each other and to the receiving agent of the transferable bill are redeemed by the expiration of six months, counting from the day, in which the endorsant paid bills, or from the date of the presentation to him.

Avalist. Aval is the only one bill of charge to ensure the execution of a bill of interest, representing a guarantee. In accordance with Art. 361 of the Civil Code of the Russian Federation The guarantor affects the creditor of another person for the execution of its obligations in whole or in part, therefore, Aval is an obligation to pay a bill of interest in one of the obligations on the bill of interest in the event of non-payment. Aval, like the acceptance, can be given completely or in a part of the bill.

Aval may be given for all persons required on the bill: a drawer, an acceptant and an endorsant. Avalists of the Breakfather in Simple Wrecker and Accessant in Translated arbitrage practice Refers to direct debtors, Avalist's indorsand to regressive * (373). However, the reservation should be done here. To direct debtors on a bill liability include those in respect of which the presentation of the payment requirement is possible without protesting the promissory bill in the default. Thus, this division is quite private, according to the procedural criterion. From a material point of view, the Avalist of the Recreation and the Accessant does not apply to the main debtors, although it is responsible in the same way as they, since his responsibility comes only after the failure of these persons to make a payment, i.e. Wears an additional (accessor) character * (374). It is from this point of view that all the Avalists are attributed to persons (along with the indussant), carrying additional responsibility to the creditor - a bill holder.

The mechanism for obtaining a bill on the bill is consisted of bill of charge to pay the main debtor: the payer or the receiving agent for the transfer bill, the tolerator for a simple bill. If Aval is performed for the indicated persons, the payment requirement can be simultaneously presented to the Avalist. When making a payment, the main debtor Aval stops * (375).

The responsibility of the Avalist comes in the event that the main debtor on the bill has not paid a bill of exchange (although the Avalist has the opportunity and will voluntarily pay on the bill of exchange, for example, in advance of the insolvency of the main debtor) and the claim declares the person for which the Avalist guarantees. Paying bills, Avalist, as well as an endorsant, acquires the right of regressing requirements for obligations to which are related to, in accordance with Art. 32 provisions, a person for which the Avalist gave guarantee, and all the participants of the bill of exchange relations before this face. For example, if Aval is given for the billboard for a simple bill, the Avalist has the right of regression only against the drawer, since no one must before the latter. If Aval is granted to the IndoSanta, the Avalist acquires regress not only to him, but to all who would be obliged to in front of this indussant if he had paid bills: to the previously standing indorsemers, their Avalists, a drawer and an acceptant.

Consider, as before, cases where the Avalist is exempt from bill liability:

a) the invalidity of a bill obligation due to the defect form. As a general rule of civil legislation (clause 3 of Art. 329 of the Civil Code of the Russian Federation), the invalidity of the main obligation shall entail the invalidity of providing its obligation. The bill legislation perceived this principle of partially (Art. 32 of the provisions): The obligation of the Avalist is invalid, unless the bill of interest is recognized as invalid on the defect form. If the bill of interest is recognized as invalid on any other basis, for example, due to the issuance of bills under the influence of deception (Art. 179 of the Civil Code of the Russian Federation, Art. 17 of the Regulation), in which the first weekly holder participated, the Avalist of the Recreation or Indusant will be responsible for the payment;

b) not performed the protest of the bill in the non-payment or non-acceptance. On this basis, only the analyst of the indussant can be released from responsibility, i.e. Persons who respond to the bill only in the presence of protest * (376);

c) disrupted the timing of the bill of exchange for payment, to the acceptance (Article 53 of the situation). However, if Aval is given for the billboard for a simple bill or acceptance at the transfer bill, which are responsible for the payment and when passing the timing of billing to the payment or acceptance, the Avalist from the fulfillment of the obligation is not exempt;

d) the timing of the limitation of the claim (Article 70 of the situation) is missing;

e) Aval is signed by an unauthorized person.

- Owned:

- State (treasury) - debt obligations issued on behalf of the state to cover the budget deficit.

- Municipal, or regional, - debt obligations issued on behalf local organs Authority and management when agreeing with the government.

- Private debt obligations manufactured by corporations, financial and industrial groups, commercial banks, individuals.

- By the nature of the transaction:

- Commercial, based on a specific commercial sale of sales (supplies) of goods (products). Essence - delaying payment, providing a commercial loan.

- Financial, based on the loan issued. Essence - a guarantee of the return of the loan received.

- Fictive, based on which there is neither the movement of goods or the movement of money.

- Banking (corporate). Release only in Russia. The essence is the involvement of "cheap" temporarily free money, reflects the ratio of the loan of money with the billseller at the Vselasel holder for a certain remuneration.

- By the number of participants:

- Simple (solo). The payer and the drawer is one person. The essence is the debtor's earlier, creditor bills.

- Translation (Tratta). Payer and bills - various faces. It is necessary for the consent of the payer to be payers - the main debtor on the bill. The debtor payer of the billboard, the earliest - the debtor of the first sweepager.

- By date of payment:

- Definitely urgent. You can install a specific date (day) of payment.

- Uncertainly urgent. The day of payment is not defined in advance and depends mainly from the bill holder.

- By availability of pledge:

- Secured. The bill is guaranteed by the deposit, which remains at the disposal of Credit to full debt payment.

- Unsecured. A bill of exchange is not guaranteed by keyword.

- If possible, transfer to another person:

- Indorsemed. According to the indorsement, I can transfer to another person, I turn freely.

- Unhindinsy. Named, the transmission to another person is impossible, a reservation is "not ordered".

- At the place of payment:

- Domicyl. The place of payment does not coincide with the location of the payer, the first holder or with the place of promissory bill. It is indicated in the notch addition.

- Uncompleted. The place of payment is the location of the track (translated bill), a drawer (simple bill), Remitector (first recipient) or a place of promissory bill.

Character of bill transactions

- commercial

- financial

- fictive

- banking

Based on commercial bill Lies a specific commodity deal. Commercial bill is a document that arises in the sale of goods selling goods, providing services and fulfillment of custom works in credit. He is accompanied additional documentsconfirming its merchant nature.

For financial bill It is characteristic that it is an additional guarantee of the return of the loan issued, that is, it is based on the movement of money. Financial bills - issued by the Ministry of Finance and banks to attract additional money.

Bill Fictive bill - There is no movement of the goods, no money movement. The fictitious notes include: bronze, friendly, counter.

Bronze bill It does not have a coating (real support), and does not participate in real transactions. He has no financial obligationAnd in his appeal necessarily a fictional face or knowingly insoluble.

Friendship bill - A bill that gives one platforming person to another unprofitable as a means of payment or finding money by accounting bills in the bank. This is the security paper that two people write down on each other in order to cash money in the bank without the movement of goods.

Fig. 1.Shem a bill transaction using a friendly bill.

Counter bill - Two faces exhibit bills to each other, after which they take into account them in different banks. With the occurrence of the payment period, they again exchange bills and take them into account in other banks.

Fig. 2. Scheme of a bill transaction using the oncoming bill.

Bank bill - One-sided, no obligation of the bank's obligation - the issuer of bills to pay the bill to the amount specified in the bill within the prescribed period.

Fig. 3. Scheme of a bill transaction using a bank bill.

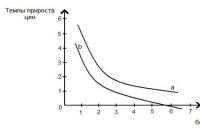

Banks produce bills interest and discount. Interests are sold at par, and when the bill of exchange is paid to the repayment of the bill holder, a denomination is paid, as well as interest on it. The percentage amount depends on the established interest rate, the conditions for its payment and time, during which the bill was at the bill holder. Such bills should be undefined urgent: paid by the bank upon presentation or in so many time from presentation. The bank in such bills may indicate that the term of their presentation is not earlier than this time from the compilation (sale).

Discount promissory notes are sold below the denomination (with discount discount). Such bills are definitely urgent, that is, when selling, the bank stipulates the maturity of such a bill. For the issuer's bank, such bills of exchange serve as a means of attracting temporarily free money from legal entities and individuals. The benefit of the bank is that the release of bills does not require registration: no need to disclose information about yourself, how this requires the release of other securities, you do not need to pay the emission tax and carry out other costs.

For the buyer, the acquisition of bank bills is beneficial because:

- they are liquid

- you can get on credit for promissory provision

- bank notes are sold and bought on secondary market valuable papers

- they can be used as a payment

Bank bills have a deposit form, and is used in various financial transactions. It is easy to get in the bank, for which it is necessary to make a bill in the cash register, and the bank will write a bill of 1 to 270 days.

Number of participants of the drawing bill

Translated bill - This is a document containing an order to create a payment to another person who must fulfill the acceptance.

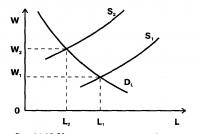

The transfer bill (Tratta) is a written document containing the unconditional order of the payer's waxesseller to pay a certain amount of money within the prescribed period and in a particular place of the bill holder or his order. Thus, the transfer bill (Tratta) is a document that regulates the bill of interest to the three sides: a drawer (trafficking), the debtor (highway) and a bill holder - the recipient of the payment (Remitent). At the same time, the tracer - the debtor in front of Repertent, the track - the debtor in front of the trassant. The route becomes the main payer after agreement (acceptance) to accept the payment on the bill. The law establishes that the billboard (tracer audience) is responsible for the acceptance, and for the payment on the bill.

Fig. 4. Scheme of a bill transaction using a transfer bill.

Simple (solo) bill - This is the obligation of the creditor about payment, specified amount money to another person.

A simple bill is a written document containing a simple and no obligation of the obligation of the credentials (debtor) to pay a certain amount of money within the prescribed period and in a particular place of a bill holder or his order.

The structure of bills of interest on the simple bill is somewhat simpler than the transferred. In a simple bill of exchange, the Vexsel is a direct debtor, and it is obliged by a simple bill, as well as the acceptance of the transferable, therefore, the simple bill accept noise.

Fig. 5. Scheme of a bill transaction using a simple bill.

Application of simple bills

Solo-bills are actively used in the following directions:

- Attracting temporarily free money. Banks are actively using simple bills to attract funds, since the bill has undeniable advantages both before the deposit and before the savings certificate.

- First, unlike deposits, incomes for which are taxed by a total rate for income tax, taxation of revenues for promissory notes is usually lower. This difference in taxation, of course, makes a bill as a tool to attract funds more attractive for both banks and depositors.

- Secondly, although the rates of taxation of income on bills and savings certificates are the same, the bill is still preferably savings certificates due to greater liquidity. This means that the bill holder has the opportunity to pay off with its creditors not only with money, but also a bill for the services provided and rendered services or early to take into account the bill.

- Bill lending. The essence of this type of lending is that the borrower receives a loan not money, but bills. As a rule, such notes are liquid, as the borrower uses them as settlement In their financial and economic operations. This species Lending is beneficial to both the bank and the borrower, because the bank, the loaning of the borrower, does not use its assets, which reduces the cost of the credit operation. Accordingly, the credit percentage for the borrower is less.

- Bill of exchange as a means of payment. A bill of exchange is special securities. This feature is that the bill can be used as a means of payment. It is now very popular among banks, financial and credit and industrial enterprises, operations with the so-called "settlement" promissory notes are enjoyed. "The estimated" bill is a bill that is purchased with a discount for coating accounts payable Before the credentials in the amount of the bill. The essence of such an operation is that the difference between the purchase price of the bill and the bill of interest is income. Usually, such operations are used by the bills of reliable banks or transportation enterprises (primarily railways), energy, metallurgical and other industries, products or services of which are liquid. The notes of the above industrial enterprises are purchased with a view to early repayment Credit debts before the credentials, therefore, warranty letters are usually attached with the obligation of a bill of exchange. Early pay off bills in the account of the payable debt of the bill holder before the credentials for produced by the latest goods and services rendered.

- equal price cutting - above cut-off prices

"Dirty" price of the bond - market price Bonds taking into account accumulated coupon income

2Same junior securities from the listed are: ordinary shares, preferred shares

Aval is - guarantee on the bill; Guarantee on a check

Acceptance bill can be decorated - only on the front side of the bill

Acceptance is necessary for - Translated bill

Joint-stock company during the first year of its existence of the bond issue - maybe subject to certain conditions

Joint-stock company can produce shares nominal defuncts

Joint-stock company can produce bonds nominal defuncts

Joint-stock company places the release of serial bills with a total volume of 100,000 minimum wages. In this case, registration of emission prospectus not required

Joint-Stock investment fund in the Russian Federation its shares from shareholders redeems only in cases provided by law

Joint-Stock investment fund in the Russian Federation is open joint stock company, closed investment fund, institute of Collective Investment

Joint-Stock investment fund is investor, emitty

Action A has a beta coefficient equal to 1, 4, and the share in 1.5. With a general increase in the price of the stock market, the price will rise more - Shares B.

The underwriter can place securities of the issuer of the new release on stock and over-the-counter market

Arbitration transactions are the purchase and simultaneous sale of the same asset in different markets, if there are different prices for them, whose participants seek to profit without risk

Payer Bank is obliged to pay off check- first-demand

Payer Bank for a check is responsible for the non-payment of the check- just before the check

Exchange order, which takes priority to all other orders, is an order - Market

Exchange order, which takes priority to all other orders, is an order Market

The forms of the Blank Explanation reports the Endorsant on the bill - All rights

A non-acceptable check is presented to the payer payer. Bank such a check pay - must

In the bill without specifying the date of payment made a percentage reservation. It means that- bill does not lose weight; percentage reservation

In a bill of charge, a percentage reservation is made to a certain date. It means that - bill does not lose weight; The percentage of the reservation is considered untidized

Only persons who licensed the professional participant in the securities market and received the status of a dealer in the state securities market, state and municipal securities in Russia can be redeemed in kind can speak in Russia

In the world and Russian practice, active management of the securities portfolio compared to passive management is used Much more often

In several copies may be discharged - notes; Covenant?

In bonds can be converted in accordance with the terms of the issue - Ordinary shares, preferred shares, issuer options

As part of the technical analysis, analyze - Volumes of securities transactions, prices of financial instruments

As part of the fundamental analysis, it is determined at what stage of the life cycle is National Economics. Painted enterprise. Product produced on this enterprise

In Russia, in the bill appeal the existence of bills in non-documentary form - forbidden

In Russia, discharge bills on bearer - can not

There are two main types of bills.

Simple bill (solo bill) - Securities certifying any unilateral abstract obligation of the bill of charge to pay monetary amounts provided for by the exchange rates. There may be several bills of bills of the same bill.

Transferable bill (Tratta) is a security paper on which the billboard (tracer audience) offers to make a payment of the bill to the acquirer (Remitent) to a third party (RUSSATU). The route does not bear any responsibility on the bill before adopting (acceptance). After that, the acceptant becomes the main debtor, and the warranty function remains behind the traxant.

According to the transferable bill, the ladder can have a corresponding coating or agreement with it. Tracing can be produced by a drawer directly on himself. "In this case, the trace and the track is the same face. Despite the fact that, in fact, such a bill (it is referred to as the ne-simple) is simple, formally it refers to the category Translated with all arising legal consequences.

There are examples when Tratta is issued to itself (the trace and remittor coincide in one person) - a bill of one's own order, or all three participants of Tratta are combined in one person.

Recently, in practice, Tratta has largely lost its practical significance compared to a simple bill. The difference between them is manifested only at the time of occurrence, then it becomes purely formal.

In addition to signs arising from the law, the bill can be classified based on the nature of the base transaction.

Allocate financial promissory bills arising from a loan, commodity (or commercial), resulting from a real deal (supply of products or services).

Bank bills issued by the Bank (i.e., the bank is a letter of interest). Bank bill can have a financial nature (if the bank has released it as a deposit tool, in order to attract funds), or commodity (in the case of a random loan).

A bill as a security must have significant (mandatory) and may have insignificant (optional) details.

To the number mandatory requisites Propsychies include:

1. Specifying the place of drawing up a bill (in the absence of a special indication, the bill is considered to be drawn up in a place marked next to the name of the drawer).

2. Specifying the drawing date of the bill.

3. Name of the payer (for a transfer notes).

4. Bill label.

5. No circumstances (for transferred) or promise from its own behalf (for a simple bill) to pay.

7. The name of the one who or the order of whom should be made.

8. Specifying the place of payment (in the absence of a special indication, a simple bill is considered to be paid at the placement (SiC), and the translation - in the place marked next to the title of the payer.

9. Signature of the credentials.

To the number additional requisites Propsychies include:

1. Payment period (in its absence, bill is payable upon presentation).

2. Restrictions in the timing of presentation to the payment in uncertain-term bills.

3. The reservation on the presentation of the spectat within a certain period of acceptance.

4. An indication of the person who has an accepted copy of the spending.

5. Specifying a special point at the place of payment other than the place of residence of the payer, to receive payment.

6. Specifying a special place of payment that does not coincide with the place of finding a track or a place for compiling a simple bill, the so-called domicile. Such bills are also called domicillary.

7. Indication of the person, in addition to a payer who should receive a payment - Domiciliat.

8. Specifying an intermediary in an acceptance or payment.

9. Effective payment reservation.

10. Percentage reservation.

11. The reservation of the ladder "Not Order".

12. The reservation of the imperfection of protest.

The place of drawing up with the consent of the parties may not coincide with valid. Strict definition, which category administrative-territorial unit should be indicated, no, it is left at the discretion of the parties. In the absence of a special indication of the place of payment in a simple bill of exchange, they are based on.

The designation of the drawing date of the bill is made according to the generally accepted calendar calculation (number, month, year). It is necessary to correctly calculate the period of payment, to determine the ones of the parties to this date, to determine the limitations of limitations on bills of promise.

A bill label should be included in the bill text and is designed to explicitly denote the document of the bill. Strict wording of the proposal (promises on your own behalf, if it is a simple bill) to pay the law not established. It is said that it should be simple, i.e. Do not cause any doubt in its true sense, prevent interpretation.

The promise (proposal) must be unconditional, i.e. Not to be addicted to any reasons or conditions, because the strength of the bill is only in it itself. The only permissible reservation is not an orders, i.e. Prohibition transfer bills on the endorse. The most responsibility is not responsible for those whom the bill has crossed against the reservation. It can only be responsible for the new owners - those who received it as a result of the assignment of rights (cession) in the general order.

Included in the text of the bills other conditions do not deprive its strength and are simply ignored. It should be noted that on the basis of issuing bills, it is possible to establish conditions outside of it, regulated by other law.

The designation of the initiation of the bill of exchange, referred to in the case of the transfer - Remitent, is its full name in accordance with its statutory documents. For entrepreneurs - individuals, along with the name of the surname, name, patronymic and passport data, you should specify the patent data so that it does not arise to doubt the commercial origin of the bill. An incomplete name may require the provision of evidence of the identity of the bill holder with the face named in it. Even the complete inconsistency of the designation of the first acquirer of his present name implies the invalidity of the bill of exchange only with respect to its itself, but not for subsequent acquirers. If the bill reached them in a number of externally correct transmission inscriptions, all kinds of conscientious willssel holder is considered a legal bearer of the bill. Especially it should be stated that the payment can be made by the order of the Wexsel projector to another person and without a special reservation "... or his order."

The bill must be accurately indicated, as is customary in monetary documents, numbers, and with a capital letter, in words. According to the same rules to it can be added interest rate. However, it should be borne in mind that the latter will be valid only in a wait for a period of presentation or at a time of presentation, otherwise it will not have the strength. When dispersion, preference is given propycy.

The amount of the bill can also be in the currency. Collisional issues of issuance and appeal of bills nominated in foreign currencyare mainly allowed. To write a bill in foreign currency can anyone both legal and individual. This position is fully set out in the decision of the Presidium of the Court of the Russian Federation of October 28, 1997 No. 4518/97. It is indicated that the legitimacy of the issuance of the currency bill is justified by P.P. 41, 77 provisions on the transfer and simple bills and art. 317 of the Civil Code of the Russian Federation. A bill that is discharged in a currency that does not have conceived at the place of payment can be paid in the local currency at the rate set on the day of payment, unless the payment is not due to the currency specified in the bill in the bill. Consequently, the issuance of bills without a special permission of the Bank of Russia is allowed to indicate the amount in foreign currency, provided that it will not be due to the exchange that the payment must be made in the currency specified in the bill. That is, the obligation can be executed in the currency of the place of payment Bulletin of the Russian Federation. - 1998. - № 2. - S. 17 ..

When considering cases related to the appeal of bills in foreign currency, the courts need to be borne in mind that such securities refer to the category of limited commodity objects (Article 129 of the Civil Code of the Russian Federation). For the issuance of currency bill with an unconditional currency of payment requires a special permission of the Bank of Russia. Only banks that have a license for carrying out operations in foreign currency can be issued by the issuer of foreign currency bills.

The amount of bills indicated by numbers is also made in the document header. Under the term of exchange is meant the date of payment on it. It must be accurately indicated.

The method of appointing the period of payment on the bill under the threat of invalidity of the latter should strictly correspond to the established, namely, it must be one of the following:

On the day of presentation;

In such a time from the date of presentation;

In such a time from the day of compilation;

On a certain day.

In the first case, if the credentials did not indicate a different period, the bill must be charged for payment during the year from the date of compilation. Subsequent notes can leave or shorten these times when transferring bills. A billiardler may also indicate a day earlier bill can not be brought to payment, then the time for presentation flow from this day. In general, the term of any actions on the bill, if he falls on the day off, refers to the first working day after him.

The name of the billboard should satisfy the same requirements as in the case of the first acquirer, it should be fully and accurately identifying this face under the threat of insignificant bills. The signature of the official must be exclusted personally. This person must have all the powers to sign the document. Otherwise, the person who signed his will be obligated on the bill.

Thus, when considering the case in the supervisory instance, it was found that the bill was signed by the Deputy Director for Finance and the Economics, which is not a power of attorney for issuing bills. In the resolution of the Presidium of the Higher Arbitration Court 06/23/2006 No. 1112/06 It was stated that in accordance with paragraph 1 of Article 53 of the Civil Code of the Russian Federation entity Acquires civil rights and assumes civil duties through its bodies operating in accordance with the law, other legal acts, constituent documents. According to the Charter of the Company, the specified official was not authorized to commit such actions, this is assigned to the competence of the General Assembly. Consequently, the Company's obligation to pay bills did not appear the Vestnik of the Russian Federation. - 2006. - № 11. - P. 23 ..

The same applies to the name of the payer at the transfer bill. Although in the case of its incorrect name, all other obliged persons remain those.

The same requirements are subject to the designation of the place of payment as to the placement of the bill. At the place of payment, the bill must be brought to pay for the payer. If the place of payment is different than the location of the payer, then the bill is the name of the domicile, and it is assumed that the payer will be in the place of payment (which in this case is called domicile). At the place of payment, a special point can be appointed, different from the place of residence of the payer, for receipt of payment. Usually, the bank is as such. In domicile, it is possible to identify a special payelectric-domiciliata. Usually they are assigned a bank. In this case, the bill of payment in the city number through (the name of the bank, address, details) is marked on the bill of charge. In order to pay a bill, the bank must have a sufficient coating from the payer. With his lack, he refuses the payment without any consequences for himself, the debtor is responsible for the payment.

If a bank is specified as a payer, the bank's relationship with the receipt can be built: 1) on the basis loan agreement; 2) by opening cumulative account; 3) by using a documentary letter of credit.

The text can be placed in the text that the payment must be made only by the first acquirer, but not his order. "I undertake to pay (pay) on this bill to this, but not his orders." The reason for this reservation may be the fact that the creditor does not want to miss those objections that could be opposed to the bill holder (including the possibility of completing the credit or in reluctance to increase the regressive amount). In the case of the premises of this reservation, the bill can only be transferred in the procedure of cessia. Such a bill is called the name - Rektka-Veksel Chuvakov VB Legal nature of rectaging paper // Russian laws: experience, analysis, practice. - 2006. - № 7. S. 17 ..

Vexselger, an endorsant or acilist may indicate the so-called mediator, i.e. The person to which you can seek accepting an acceptance or, after protest, payment, but which is not required by the bill. With regard to the relationship between the intermediary and the person appointed it, they are regulated by civil law.

The reserve can put a reservation in the text of the protest imperfect. "Turnover without costs" or "without protest". This means that a rashsel holder, having received a waiver after the bill of exchange or payment, not making a protest, may apply for this to any obligated person, otherwise the costs of protest will lie on it. This reservation is also intended to protect the reputation and reliability of the bill.

In the case of a translated bill of exchange, its presentation may be due to a certain period of acceptance. If the latter is not done with a noter holder, he will lose his rights arising from non-acceptance or non-payment.

For an exchange for a period of presentation or in so many time from presentation, a period of which should be submitted during which it must be submitted to accept or payment. If this condition fails to comply with this condition loses its rights to all obliged persons, with the exception of the payer (the acceptant, in the case of a translated bill).

Since the translated bill can be issued in several copies, the instance number may be provided in its text, otherwise each copy will be considered as an independent bill. This usually takes place in the wording of the promise to pay. "Pay on this prima-bill (second or first, second copy, etc.) ...", as well as in the header of the bill. Prima, Secunda, Tertia - respectively, the first, second and third instances. According to the provision on the transfer and simple bill of charge, all that paid one copy is free from paying the rest, but only if there are no acceptanced among them. Otherwise, all such is the same responsibility.

Often while one copy of the transferable bill is started in turnover, the other is sent for acceptance. Then on the instance of the instance, the text includes a margin about the person who has an acceptable instance.

All props of bills must be associated, clips in a single bill text, which is a signature of the bill. In the text, you should not allow skips and ambiguities, since they may entail the invalidity of the bill. The lack of bill details, although it can deprive a document of the bill of exchange, does not mean that the document has no power. If he satisfies the conditions for civil legislation to debt obligations, in accordance with them, it can be recognized as such. Then the relationship arising between the parties will be considered in the general order.

As already noted, the bill as a valuable paper is characterized by the property of increased processability. According to paragraph 3 of Art. 146 of the Civil Code The Endosant is responsible not only for the existence of the right, but also for its implementation. If we consider the debt legal relationship between the participants of the transaction on the transmission of the bill, it creates the obligations of the bill of exchange for the bill or other persons (indors, the track - in the transfer of the bill). It should be borne in mind that the right to fulfill the obligation from civil-law transaction is only among the counterparty on the transaction. Other persons who do not participate in it, including the willssel holder, have no rights to the Civil Law Accessant Requirements. Their relationships are already in the plane of the bill legislation of the bitters B.V. Bill debt obligation // Taxes (newspaper). - 2006. - No. 44. - S. 11 ..

The attention was drawn to this and in the decision of the Presidium of the Supreme Arbitration Court of August 31, 2006 in case No. 4849/06, where it was indicated that the receiving agent could object to the first random holder, referring to the binding of their transaction. The second and subsequent acquirers who are not participants in this transaction can only be based on the text of the Bulletin of the Russian Federation. - 2007. - № 1. - P. 24 ..

Inconsiders can be made on the bill (VNEVELY, having the general importance) details provided for by the Regulations on the Transfer and Simple Week. Among them are most common:

1) Marking of a notification letter (avizo) payer: "According to our advice" or "without our advice." This letter concerns the on-noise relations of the parties.

2) Marking on obtaining currency. This note is important as evidence of the debtor monetary sum when loan.

3) the designation of the person from which the track is obtained: "... and put it (amount) at our account number."

4) Marking about the target for which the bill is issued. For example, that this is a depot bill (security), which is issued as collateral, but not for sale or pay. Such a bill can be transferred, the relationship of the maxillaholder and the first acquirer will be considered in this case in general procedure.

The endorsement is a transfer inscription, for the owner's own signature of the bill holder, on the turnover of the bill, through which a bill may be repeatedly transferred to other persons (for example, "pay the order of such").

The reservation about the order is not obligatory, the possibility of transmitting bills is implied, notarial certificate is not required. The first endorsement is affixed on the left above, notarization is not required. The indorsement should be simple and uncomplicated, any conditions are considered simply not written. The endressant may prohibit further transmission, if the obligation or in the proposal to pay instead of the word "order" will place the phrase "not orders".

The reasons for the ban may be the same as when drawing up a bill. The difference is that further bill can still be transferred according to the indors, but the endorsant who has placed the prohibition will not be responsible before those who will take place still. Thus, this endorsant will be responsible only before its indorseist.

In its legal nature, the endorsement has the same one-sided act, generating the same abstract obligation. When the endorsement is the same meaning as when issuing, it has good acquisitions.

Two types of gear stations are distinguished:

Actually, the transfer inscription (nominal and blank), in which the document becomes owned;

And a substantive, replacing a power of attorney for certain actions related to paying.

Personal transfer inscription contains the name of the new acquisitioner of the bill, made according to the same rules as in compiling, and with the same consequences. The blank inscription of the name does not contain and consists of one inscription of the indussant.

With a blank inscription, the appeal of the bill is simplified, the transition from hand to hand takes place according to the principles of real law, like any movable property. Persons who visited the owners of bills with blank, i.e. Not imprinted on it, they do not carry any responsibility on the bill of exchange, the responsibility may arise only on the general foundations. The bill acquires the character of the paper on the bearer. So, A.F. Fedorov in his book "Bill Light" writes "With a blank inscription ... The actual transition of bills from one person to another is performed on the beginning of civil law, and the bill holder will at the moment will be the one who owns a bill on the principles of the real law as any movement »Fedorov A.F. A bill right. M., Statute 2005. - P. 349 .. Yu.N. Bucheeva notes "Thus, the blank inscription, allowing the transfer of the bill without further formalities, in the subsequent appeal, despite the prohibition of bills on the bearer, gives a bill of paper on the bearer to the bill, although not quite. The difference consists, firstly, the billproof bureaucrats are not yet rebeling to transmit it in the future and on the transfer inscriptions (forms and nominal), even with the prohibition of transmission, meanwhile, as it can not have seats with bearer papers; And secondly, - in the fact that the holder of the bill of exchange with a blank inscription is able to be considered a legitimized notebook only in the case when other indors are available on the bill of exchange, there are between themselves in an inseparable connection "Bakseva Yu.N. Legal nature of a blank bill // lawyer. - 2007. - № 4. - P. 17 ..