Accounting cash on a calculated account. The procedure for documenting and carrying out operations on the settlement account organization Cash accounting for current accounts

Accounting for cash accounts

The current account is an invoice opened in a bank and intended for the storage of ruble tools for the organization and conduct non-cash settlements with other legal entities and individuals. Cash stored on the current accounts, take into account the active synthetic account 51 "Calculated Accounts".

Payments from buyers and customers can receive payments from buyers and customers on the expense of payment of goods supplied by him, products (performed services provided), the amounts to repayment of receivables, bank loans and loans from other organizations are made, cash from the organization's office and others.

Since its current account, an organization can make payments for facilities of fixed assets, raw materials and materials, facilities for renting premises and utilities, payments on various taxes and fees, to receive cash on check for payroll to employees of the organization, for travel expenses, operational and economic costs, etc.

The procedure for documenting and carrying out operations on a settlement account

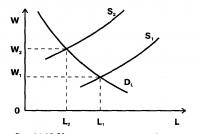

The Bank stores funds for organizations on their accounts, credits the amount entering these accounts, performs the orders of organizations about their transfer and issuance from accounts and on the conduct of other banking operations provided for by banking rules and the contract. The funds from the account can be written off only at the appropriate order of the Client. Without an order of the Customer, the write-off of cash in the account is allowed by the court decision, as well as in cases established by law or provided for by the Agreement between the Bank and the Client. If there are funds in the account, their write-offs from the account is carried out in order of receipt of the Client orders. In case of insufficiency, their write-offs from the current account is made in the following sequence:

The first turn is a write-off on executive documents (compensation for harm caused to life and health, as well as requirements for the recovery of alimony).

The second line is to write-off on executive documents (calculations for the payment of weekend benefits and remuneration with employment faces, including under the contract, on the payment of author's remuneration).

The third queue is the write-off on payment documents (payments for labor with persons working on an employment contract (contract), as well as on deductions to the Pension Fund).

The fourth turn is to write-off on payment documents (in the budget and extrabudgetary funds).

The fifth stage is a write-off on executive documents providing for the satisfaction of other monetary requirements.

The sixth line is a write-off on other payment documents in the calendar order.

The cash flow at the current account is made up with calculated documents, the form of which is approved by the Bank.

The settlement document is the disposal of the payer (client or bank) on the write-off of funds from its account and transferring them to the recipient's recipient or the disposal of the recipient of funds (recoverer) to write off funds from the payer's account to the account specified by the recipient (definer). Estimated documents are made on paper in accordance with the established requirements.

When filling out the calculated documents, the output of textual and digital values \u200b\u200bof details beyond the limits of fields reserved for their station. Values \u200b\u200bof details must be read without difficulty. Signatures, printing and stamps should be affixed in the fields of payment documents intended for them.

Corrections, blots and cleansing, as well as the use of corrective fluid in the settlement documents are not allowed.

The settlement documents are valid for presentation to the servicing bank within 10 calendar days, not counting the day of their discharge.

Estimated documents are presented to the Bank in the number of copies required for all participants in the calculations. All instances of the settlement document must be identical.

Estimated documents are accepted by banks to execute if there are two signatures (first and second) persons with the right to sign the settlement documents on the first instance (except for checks). Estimated documents are accepted by banks to execute regardless of their amount. Write off the cash bank from the account is made on the basis of the first instance of the settlement document. Banks carry out cash flow operations on the current account on the basis of the following settlement documents:

in non-cash calculations, a payment order is drawn up, a payment request, a collection order, a letter of credit check;

in cash, the announcement is drawn up for a cash fee, cash check.

The payment order is the order of the account holder (payer) to the serving bank to translate the specified amount at the expense of the recipient of funds in this or another bank.

Payment order is used to transfer funds:

suppliers for commodity and material values, work, services, including as a prepayment; to the budget and extrabudgetary funds; Bank when returning loans, loans and interest on them; To transfer wages to employee accounts in the bank. Payment orders are accepted by the Bank regardless of the availability of funds on the payer's account. Payment orders are issued on a special form and are submitted to the bank within 10 days from the date of statement, not counting the day of discharge.

Payment request is a settlement document that contains the requirement (creditor, beneficiary of funds) to the payer (debtor) on the payment of a certain amount of money through the bank. Payment requirements are represented by the recipient of the funds (definition) to the payer's account through the recipient bank (deferrator). The Issuer Bank, who adopted payment requirements assumes the obligation to deliver them to their intended purpose (according to the bank account agreement). Payment requirements are applied when calculating goods, work, services, and in other cases provided for by the Treaty. The payment requirement is drawn up on the form in the form 0401061. The collection order is a settlement document, on the basis of which funds are made from payer accounts in indisputable manner.

Incassive orders apply:

in cases where the undisputed procedure for collecting funds has been established by law, including to recover funds by bodies performing control functions; for recovery on executive documents; In cases stipulated by the parties under the main contract, subject to the provision of a bank serving the payer, the rights to write off funds from the payer's account without his order. When collecting funds from accounts in an indisputable order in cases established by law, a link to the relevant law should be made in the collection order (indicating its number, the date of adoption). When making money on the basis of executive documents, the collection order must contain a reference to the date and number of the executive document, as well as the name of the body that has made a decision to be forced. Incassive instructions on the recovery of funds from the accounts exhibited on the basis of executive documents are made by the Bank of the Declaring with the application of the original executive document or its duplicate.

Letterred - from Lat. Assgditivus - trust; English Letter of Credit is a literal "credit letter". The letter of credit is a conditional monetary obligation taken by the Bank (by the Issuer Bank) on behalf of the payer, to make payments in favor of the recipient of funds upon presentation of the latter documents corresponding to the conditions of the letter of credit, or provide the authority to another bank (executing bank) to make such payments. The letter of credit is made in non-cash by transferring the amount of the letter of credit to the recipient's account. The letter of credit is designed for calculations with one recipient of funds.

The check is calculated - this is a security containing anything that is uncomplicated by the Bank of the Bank to make the payment of the amount specified in it by the Chek holder. The credit is the person (legal or physical), which has funds in the bank, which he has the right to dispose by issuing checks, a chek holder - a person (legal or physical), in whose favor of which a check was issued, a payer - a bank in which the monetary cash funds are issued. Organizations receive calculated checks in the form of a limited checkbook. An application and payment order for the deposit of a certain amount are submitted to receive a checkbook to the bank.

The shape of the check and the order of its completion are determined by the law and established in accordance with the banking rules. Checks from limited books are signed by the head of the organization and the chief accountant.

The check from the limited book is issued to the supplier simultaneously with the release of goods or the provision of services. In the check, it is necessarily indicated which organization and to pay on what account or another replacement document should be listed on the check. The absence in the document of any of these details deprives him of the force of the check.

Presentation of a check in the bank serving a check holder, to obtain a payment is considered a check of a check for payment. The checkbook is not entitled to withdraw the check before the expiration of the deadline for its presentation to the payment. Checks are valid for 10 days, not counting the day of their discharge.

Cash payment announcement is used when making cash to the organization's current account. Organizations can make cash only on their calculated (current) account. Cash payment announcement is a set of documents consisting of a warrant and receipt. In the declaration of cash contribution, the date of their actual submission to the bank should be specified. They must be completed simultaneously manually or on a computer while maintaining all the components of the form. The name of the account holder, the account number and the name of the credit organization in the ads may be denoted by stamps. When receiving cash from legal entities, the bank's operating worker checks the correctness of the ads of the cash fee, draws up and transfers the announcement to the cash contribution to the cash desk. Cash worker, having received an ad for a cash fee, checks the presence and identity of the signature of the operating officer, the existing pattern, merges the amount of the amount and in words and accepts banknotes from it pols. After receiving money, the cash worker checks the amount specified in the declaration of cash contribution, with the amount actually turned out when recalculating. According to the amount of the Cash Worker, signs an announcement, receipt and order, puts the seal on the receipt and gives it to the Money Brief. The receipt is then applied to the expenditure order and is an exclusive monetary document.

The organizations can take cash, packed in collector bags, special bags, cases, other means for packaging money, ensuring their safety when delivering and not allowing their autopsy without visible traces of an intention. The credit institution contains a list of organizations paying cash in bags, indicating the names of organizations, quantities and numbers of bags of bags. The organization's cashier forms the accompanying documents to be supplied with cash. At the same time, the first copy of the transmitted statement is invested in the bag; The second and third copies - respectively, the overhead and receipt to the bag.

The cash check is the order of the enterprise to the Bank on issuing the amount of cash indicated in it from the current account of the enterprise. Check money is used to receive cash in cash on payroll, deposited wages, accountable amounts. The organization receives checks in the serving bank in the form of a checkbook. This book is obtained in a bank on the basis of an application. A check may be discharged in the amount not exceeding the cash balance at the current account. Checks are filled from hand in ink or ballpoint handles in accordance with the rules set forth on checkbook covers. All check details must be filled. No amendments and blots in checks are not allowed. Cleaned checks from checkbook are not deleted. The name of the account holder, the account number and the name of the credit organization in the checks may be denoted by stamps. Simultaneously with the filling of the check, its details are transferred to the root remaining from the enterprise in the checkbook and being an acquittal document. Checks are discharged in the name of specific recipients of funds. The signing of the check before filling out all its details is strictly prohibited. On the circulation of cash checks indicates the appointment of the amounts of payment. Information on the appointment of payment on the turnover of cash checks is assigned by signatures of the check.

Checks are accepted by the Bank within 10 days from the date of their discharge, not counting the day of discharge, without correcting the date marked on the document. The roots of paid and spoiled checks, as well as spoiled checks, the checklist must keep at least three years. The owner of the account is obliged when closing the account, return the institutions of the Bank checkbooks with the remaining unused roots and checks under the application, indicating the numbers of checks. On cash checks, on the basis of which money and other values \u200b\u200bare issued, marks should be made about the presentation of a passport or replacing his recipient's document. For each amount received in the bank, an accountant discharges a receipt of a cash order in the name of the recipient with an indication of the check number, while the receipt is applied to the bank's disciposition.

Cash organizations used for non-cash payments with other legal entities must necessarily be stored in banks. Bank offers organizations settlement, current, currency and other accounts. Settlement accounts can be opened to any legal entity regardless of the forms of ownership. Current accounts are opened in credit institutions open on the basis of documents, the list of which is established by applicable law. It:

Statement of the established form to open an account;

Copies of the company's charter and the constituent contract, certified notarized;

A copy of the registration certificate of the enterprise, certified notarized;

Evidence of the tax authority on the registration of an enterprise as a taxpayer;

A copy of the registration document as a payer to the Pension Fund of the Russian Federation;

Copy of the certificate of assignment of statistical codes;

The card with sample signatures of the head, Deputy Head and the Chief Accountant of the Enterprise and Print Printing Enterprise in the established form, certified notarized.

The current account is a copy of the personal account opened by the Bank for a specific legal entity. Information about opening an account within five days is transmitted by the Bank to the Tax Inspectorate in which this organization is registered. The Bank's service in the Bank is carried out according to the bank account agreement, which determines the duties of the Bank and the Client, the procedure for calculating the Bank with the Client, the responsibility of the parties to ensure the secrets on the operations of the settlement and other accounts, and also indicate the details of the parties. A bank account agreement may be provided for remuneration for the use of funds that remain on the settlement accounts of the organization.

The procedures for opening the current account, its renewal and closure are governed by the Banking Law. Currently, organizations are allowed to open accounts in the quantity necessary for the implementation of settlement operations. Information on the current accounts opened in various credit institutions is reported to the Tax Inspectorate of both serving banks and the organizing itself.

Operations on settlement accounts are issued in accordance with the Regulation of the Central Bank of the Russian Federation "On non-cash settlements in the Russian Federation" of October 03, 2002 No. 2-p.

Money on the current account is credited according to the banking rules on the basis of standard monetary and settlement documents. For example, cash is removed from the current account on the basis of money check, and enroll - an ad for a cash contribution.

Managers of money on current accounts are the head and ch. accountant. They sign all the documents according to which the money is being written off from the accounts. If there are funds on the account, the amount of which is sufficient to meet all payments, the debiting of funds occurs in the order of receipt of the order of the Client. In case of insufficiency of funds at the current account, they are written off in order of the established article 855 of part 2 of the Civil Code.

In an indisputable order from the organization's accounts, payments are chosen by those unnecessary on time to the state budget, social funds, payments on executive and equivalent documents.

The receipt and consumption of funds at the current account are issued by primary documentation, the form of which depends on the form of calculations. With cash, the calculations use:

Cash fee announcement - cash fee for current account. For the declaration of cash fee provided for a typical form. The form consists of three tear-off parts: the ad will actually contribute to cash, receipts and orders. The announcement of the cash fee is filled in one instance. Simultaneously with the ad, the expendable cash order must be issued, since cash is dropped out of the organization's office.

The bank worker must sign the receipt, put print on it and return the cashier. This receipt is fed to the consumable cash order, which made out the disposal of money from the cash register. A completed order with its marks, the Bank reports the organization along with the banking discharge;

Checkbook (cash check) - Getting from the current account.

To remove cash from the current account, the Organization receives a book with monetary checks in the bank on the basis of an established sample (checkbook). The money check consists of two parts: the tearless sheet and the root of the check. On the tear-off sheet indicate the purpose of obtaining funds, the amount that is removed from the current account, as well as the passport details of the person receiving money. Cash obtained on a check must only be spent on those goals that are specified in it. The tearless sheet of the money check is transferred to the bank employee, which gives cash. The root remains in the checkbook and should be kept in the organization for 5 years. Check is valid for 10 days. If this period has expired, the bank check does not accept. Cash received on a check must be recruited at the office of the organization. Cartrol order should be issued.

When cashlessly, the calculations use: payment orders; Payment requirements, calculated checks, collection orders.

In a contract with the buyer (customer) of goods (works, services), an organization may foresee that their debt will be paid on the payment requirements. Based on the payment request, the buyer's bank (customer) will write money from its payer's current account and enroll the money recipient account.

For payment requires a typical form. As a rule, payment request is drawn up in 4 copies: the first copy of the bank returns organizations; The second instance remains in the bank in which the organization's current account is open; The third and fourth copies are sent to the bank, in which the payer's account is opened (that is, the buyer or customer).

The Bank writes off money from the current account by order of the organization. Such an order is issued with a payment order (for example, pay for goods (work, services), transfer taxes to the budget or carry out another payment). As a rule, the payment order is drawn up in 4 copies: - The first copy of the bank returns the Organization; - the second copy remains in a bank in which the settlement account of the organization is open; - The third and fourth copies are sent to the bank, in which the recipient's account is open. If the monetary funds of the organization are listed, which has a current account in the same bank, it suffices to issue 3 copies of the payment order.

Information about the cash flow on the current account is contained in the discharge account, which is a copy of the personal account of a particular organization. It is daily (if the number of operations is insignificant, it may be less frequent) is submitted to the client. The bank's statement reflects: Date, document number, operation code, money amounts on the debit and loan, as well as balances at the beginning and end of the day. When processing a document, it is necessary to remember that the write-off or issuance of money from the current account is reflected in the debit, and the receipt and remnants are on the loan, that is, this account is passive for the bank. Together with the discharge, the primary documentation comes from the record, based on the record, which they have written off or crediting money.

Accounting for cash on current accounts is carried out at an active account 51 "Current accounts", the debit of accounts reflects the balance of money on accounts, admission, and on the loan - write-off. At the enterprise to the account can open subaccounts on the name of the bank with which the calculation is calculated.

The debit of the account reflects the amounts received from:

1. Dt 51 CT 62 - from buyers, procurement organizations.

2. DT 51 CT 76/9 - from other debtors

3. Dt 51 CT 66, 67 - short-term or long-term bank loans and loans

The credit account 51 reflects the amounts received from the bank or listed on other accounts or other organizations

1. Dt 60 Kt 51 - suppliers and contractors

2. Dt 68 CT 51 - Debt Financial Body for Payments

3. DT 69 CT 51 - Debt Soc. Insurance and security

4. Dt 66, 67 Kt 51 - debt on repayment of loans and loans

5. DT 76 CT 51 - debt creditors.

Accounting register, which reflects operations on a settlement account with a magazine accounting form, is a 2-APC order magazine.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Abstract on the topic: "Accounting for cash accounts"

Introduction

Basic fundraising principles

Accounting for current account operations

Opening accounting account

Introduction

In the process of carrying out its activities, the enterprise enters business relations with different enterprises, organizations and persons. A constantly committed circuit of economic funds causes a continuous resumption of diverse calculations.

The correct organization of settlement operations ensures the stability of the organization's turnover, strengthening contractual and settlement discipline and improve its financial condition.

Calculations are carried out in cash. Cash is the financial resources of the organization, the highest liquid assets possible to ensure the fulfillment of obligations of any level and species. From their presence, the timeliness of the repayment of the accounts of the enterprise depends. Between organizations, most calculations are made non-cash. Cashless payments are conducted by transferring funds from the payer's account to the recipient's account with the help of various banking operations that replace cash in circulation. Therefore, the accounting of funds and control over their treatment on settlement and foreign currency accounts is of great importance.

Cash, as a rule, internal calculations are underway. Cash movement is performed by cash transactions. In the conditions of a market economy, it should be processed from the principle that the skillful use of funds can bring an additional income to the enterprise, and therefore, it is necessary to constantly think about the rational investment of temporarily free funds for additional profit. Therefore, accounting accounting of money is important for the right organization of money circulation, the organization of settlements and lending.

In this course work, issues of cash flow on settlement, currency and special accounts in banks will be considered.

Basic fundraising principles

Money represents a special product, spontaneously allocated from the commodity world and has become a universal equivalent. With the emergence of money, they began to perform several functions:

cost measures where they act as perfect, countable money to measure the value of the finished products acquired, the cost of living and extractive labor, etc.;

tools Where they are presented with full-fledged money (gold and silver coins) and their substitutes (defective coins and paper money) for the implementation of trade exchange. The functioning of money as a means of treatment is a continuous chain of the transformation of goods (T) in money (D) and money in goods (T - D - T);

payment tools, Where they act as full-fledged money and their substitutes, including "credit money" (bill). In this function, money is used in non-cash payments with suppliers, contractors, buyers, etc., as well as in cash settlements with employees for labor pay, pay benefits, pensions, winnings on bonds, etc.;

accumulation means Where they can accumulate in the accounts of legal entities, at the deposits of individuals, but, unfortunately, the state does not fully guarantee their preservation, since this accumulation is made in defective money.

If this accumulation will be made with full-fledged money, they will perform a function hidden treasures;

world (world) money Where they perform in the form of gold ingots, and if necessary, they produce their sale in exchange for foreign currency, followed by using it as a means of payment.

All functions of money are an object of accounting.

For the organization of any core business (production, intermediary, commercial, etc.), funds are required. The funds of the Organization are formed when selling finished products, goods, from providing service and other services, as well as in the form of revenues from operations with securities, etc.

Organizations spend cash on the development of the main activity, the acquisition of material values, the remuneration of workers; Investments in non-current assets (construction of industrial and cultural and household facilities, the purchase of cars, tractors and other facilities of fixed assets, the costs of laying and growing perennial plantations, etc.).

In connection with the foregoing former State Bank of the USSR, the procedure for the formation, storage and use of funds, in which changes were made by the Central Bank of Russia in accordance with Decree of the President of the Russian Federatione.r.c.aI "On additional measures to limit the non-license cash circulation" of 14.06.92 № 622 and other regulatory acts:

Letter of the Central Bank RF from 04.10.93 No. 18 (as amended from 26.02.96 No. 247) "On approval" of the procedure for conducting cash transactions in the Russian Federation "with applications;

Letter of the Central Bank of the Russian Federation from 09.07.92 No. 14 (as amended from 26.12.97 No. 105-y) "On the introduction of the Regulation on non-cash settlements in the Russian Federation";

RF law from 19.10.92 No. 3615-1 "On currency regulation and currency control", etc.

These and other regulatory acts, in particular, have been established that enterprises, organizations and institutions (including trade organizations) regardless of their organizational and legal form:

are obliged to keep their money in bank institutions;

must be calculated on their obligations with other enterprises in non-cash through banks institutions;

may have cash in their cashier within the limits established by the institutions of banks in coordination with the heads of organizations;

must be submitted to the bank all cash in excess of the limits of cash balance in the checkout in the manner and deadlines agreed with the Bank's institution;

they have the right to keep cash in its cash desks above the established limits only for wages, payments for social insurance, scholarships, pensions and only for a period not over three working days, including the day of receiving money in the Bank's institution.

Enterprises, organizations and institutions (including trade organizations) having a permanent monetary revenue and expending it for wages and for other purposes (payment of pensions, procurement of agricultural products, buying containers and things in the population), do not have the right to delay cash in their cash desks Money to the onset of payments.

All responsibility for ensuring the safety and proper use of funds is assigned to the head and chief accountant of the organization. They must strictly follow the rules for cash and banking operations, correctly document the cash flow.

For accounting for cash in terms of accounting accounts, the following main (synthetic) accounts are provided:

50 "Cassa";

51 "Settlement accounts";

52 "Currency Accounts";

55 "Special accounts in banks";

57 "Translations on the way."

All these accounts in relation to the balance are active and posted in the second section of the balance of the balance on the relevant articles.

Memorial-order Synthetic accounting is carried out in the main book in generalized form, i.e. Without subaccounting units, and analytical accounting is in the contract book, the record in which is made during the year.

Under rational form Synthetic and analytical accounting is combined in relevant orders and statements, recordings in which are manufactured within a month. At the end of the month, debit and loan revs are transferred to the main book.

With mechanized processing of economic information apply table-automated form Accounting or automate accounting based on personal computer using AWP (automated workplace) accountant. With this account form, the primary documents are equipped with packs in bundles, indicating the necessary information on the accompanying label. From the machine-counting station or from PEVM is obtained as an accounting register Mobile Movie "Consideration of Accounting Considers and Calculations".

In the automation of accounting on the basis of PEVM using ART accountant, data from the primary documents are directly introduced into a computer with the formation of a working information base for each account. Note that it is this form of accounting that is most common.

Accounting for current account operations

cashless cash bill

All free funds of the organization are stored in serving institutions of banks on specially discovered settlement accounts. Each current account is assigned a number to be specified on all documents when writing or entering money. Currently, the customer account number is twenty-digit and signs in the personal account number are located from the first discharge, on the left:

the first sign (one digit) means the partition number section of the accounts;

the following two characters (two digits) mean the first order account number;

the fourth and fifth signs (two digits) mean a second order account number;

the following three characters (three digits) mean currency or precious metal code;

the ninth sign (one digit) is a protective key;

the following four characters (four digits) mean the branch number (separation, structural unit);

the last seven characters (seven digits) mean the sequence number of the client's personal account (organization, enterprises, firms, etc.).

Checking account It is an inconspicuous contribution of the organization, i.e. The balance remaining at the end of the year passes the next year.

The storage of cash in bank accounts is important, since:

reliably ensure their preservation of stresses;

the use of intended purpose is controlled;

eliminates and accelerate calculations between legal entities by applying non-cash forms of calculations.

A certain benefit has organizations: the bank credits the contribution interest on their settlement accounts in a certain amount from the average annual cash balance on the account.

In accordance with the Decree of the President of the Russian Federation of 21.03.95 No. 291, the organization has the right to have an unlimited number of settlement, current and other accounts.

The Bank opens up the estimated (current) accounts by taxpayers only upon presentation of a document confirming registration in the tax authority and in the social insurance and security funds bodies (or upon presentation of a document certifying the tax authority's notification of the taxpayer's intention to open the corresponding account in the bank).

In the case of identifying the GST bodies of the Russian Federation, the discovery banks (current, currency, loan, deposit, etc.) accounts without notifying the tax authority on the heads of organizations, as well as on individual entrepreneurs, is imposed an administrative penalty in the amount of hundred and minimum monthly payments established by The legislation of the Russian Federation.

Opening accounting account

To open the current account, the organization independently chooses the most convenient and profitable bank, where the following documents must be presented:

1. Application for opening an account for a special form.

2. Card with sample signatures of the head and chief accountant of the organization with print print (in two copies). The peasant (farmer) economy, the tenant on an individual rental represent a single signature card, certified notarized.

3. The decision of the city (district) administration on the creation of the organization.

4. A copy of the approved charter, lease agreement, a document for the right to use land or other documents confirming the legality of the organization's functioning.

5. certificates of registration in:

tax inspectorate at the place of registration;

social Insurance Fund;

pension Fund;

mandatory Medical Insurance Fund.

Having considered the submitted documents, the Bank decides to open the organization of the current account and notifies its client about it.

Managing funds in the current accounts are the head of the Organization and the chief accountant who sign all the documents on the basis of which money is made.

In this regard, when changing one of two managers of funds (head of the Organization or Chief Accountant), a new card with samples and printing of the organization should be presented to the Bank's institution.

Cash stored in current accounts are intended for both core activities and investments in non-current assets.

By virtue of this, the current accounts are credited with funds received as a result of the main activity of the organization: revenue from the sale of finished products and goods, from the provision of services, from the work performed on the side of work. In addition, revenue from the implementation of fixed assets, rent for leased funds, as well as revenue from the sale of other assets (materials, raw materials, semi-finished products, securities, intangible assets, etc.), Dividends shares, bonds, etc.

Cash funds are consumed from settlement accounts as on the main activity (the acquisition of raw materials, materials, goods, wage of workers, etc.) and by investing in non-current assets (for the acquisition of fixed assets, the acquisition of intangible assets, etc.), and Also on financial investments (acquisition of shares, bonds and other securities, providing loans, etc.).

The receipt and write-off of cash with current accounts can be carried out in two ways:

* Cash;

* Non-cash.

With cash contribution to the current account, issued calculation fee, The establishment of the Bank gives the receipt of the established sample.

This document consists of three parts: ads to the fee of cash, drawn up by the Client and the remaining bank for accounting of received money; receipts discharged by the bank for issuing a client; orders Announced to the discharge of the bank issued to the client.

Cash issuance from the current account is made by checks Which will be discarded in a checkbook. Check for cash receipt consists directly from the check and the root. Simultaneously with the filling of the check, the root is filled. Checks are protected by watermarks, so no cleansing, as well as agreed corrections in them are not allowed.

Checks are nominal and presenters. In the name check, after the word "pay", the name, name, patronymic of the recipient, is indicated, and to obtain money it is necessary to present a passport. In the bearer check, the name, name, the patronymic of the recipient is not indicated (they are currently almost not applied).

On the front side of the check, besides the date of its discharge, the sum of figures and in words are indicated, the prints of the printage and the signature of the head and the chief accountant of the organization are put.

On the reverse side of the check, it is indicated for what goals the checklist receives money (for pay for labor, travel expenses, etc.), which is also confirmed by the signatures of the head and the chief accountant of the organization.

The procedure for filling and using cash checks is the following:

1. The check and the spine check are filled with only ink by hand or ballpoint.

2. In the details of the "sum of the numbers" there should be free spaces and after the amount of rubles must be burned with two lines.

3. After the word "pay" fit into ink:

a) on the bearer check: the word "bearer";

b) on the name check: the surname, the name, patronymic of the person, whose name is discharged.

4. The amount of the words should begin with a capital letter at the very beginning of the line. The word "rubles" should be indicated after the sum in the words without leaving the free space.

5. Check is signed by the Chekodata necessarily ink.

6. Signing a check before filling out all its details is strictly prohibited.

7. No amendments in the text check are not allowed.

8. When submitting a special certificate account by the owner that the organization is not allowed to have a seal, the check is taken without fastening its print print.

9. Signature on the reverse side of the check in receipt of money is selected by the bank only on the name check.

10. The roots of paid and spoiled checks, as well as spoiled checks, the checkbook must keep at least three years.

11. Simultaneously with the preparation of the check, all the details of the Check root must be filled.

12. When closing the account, its owner is obliged to submit to the bank a statement and attach checkbooks with the remaining unused checks and the roots, which indicate the numbers of checks.

The money obtained on a check from the current account must be recruited at the box office by extracting the receipt cash order.

Most of the current account operations are made non-cash, i.e. It is carried out without the participation of cash, by transferring funds from the payer's account (in a savings or other bank) and enroll them to the recipient's account.

Cashless payments are divided into homogeneous (local) and non-resident.

Singlegory (Local) Calculations - These are calculations between organizations serviced by one or different institutions of the bank located in one settlement.

Nonresident calculations - These are calculations between organizations serviced by the Bank's institutions located in different locations.

In contrast to payments in cash, when money is directly transmitted to the recipient payer, non-cash payments are made in strict accordance with the Regulations on non-cash settlements in the Russian Federation, approved by the Central Bank of the Russian Federation of 9.07.92 No. 14, followed by the Central Bank of the Russian Federation dated December 24, 1997 No. 95- U, from 26.12.97 No. 105-y, etc.

With the diversity of ownership forms, the activities of organizations in the context of the development of market relations The provision on non-cash settlements is based on the principle of freedom of selection of bank clients of the forms of non-cash settlements, which are indicated by them in contracts.

Currently, different forms of non-cash settlements are used, under which various bank settlement documents are applied:

money orders;

payment requirements;

payment requirements - instructions;

letters of credit;

estimated checks, etc.

The provision provides for the abolition of calculations using payment requirements. However, given the traditionally established relationship between suppliers and buyers through the acceptance-collection form of settlements, banks are not entitled to refuse to customers in the reception of payment requirements. All settlement documents are accepted by the bank for execution regardless of their amount.

Payment orders, payment requirements, payment requests, instructions, statements on the letter of credit, collection orders (orders) used in non-cash settlements in the Russian Federation, starting from January 1, 1998, should be issued on the form of the All-Russian Management Documentation Classifier.

Consider the mains forms of non-cash settlements.

Payment order (Form No. 0401060) is a written order of the account holder to write off the money from his account and enroll them to the recipient's account. It is used mainly on non-unique operations, to list the taxes to the budget, held from the remuneration of workers to pay for accounts of communications organizations for services for settlements with the bodies of property, social and health insurance and other cases.

Calculations using payment orders are carried out by agreement of the parties and on commercial operations that may be urgent, early and delayed.

Expirable payment is performed in the following options:

a) advance payment, i.e. Before shipment of goods or the provision (provision) of services;

b) after the shipment of the goods or the provision of services, i.e., by direct acceptance of goods or performed services (works);

c) Partial payments for large transactions.

Armchair and delayed payments may occur within the framework of contractual relations without prejudice to the financial situation of the Parties.

With uniform and constant deliveries, calculations between suppliers and buyers can be carried out in order planned payments On the basis of contracts (agreements) using payment orders, as well as other settlement banking documents.

In this form, the calculations are carried out not for each individual shipment, the leave of goods or the provision of services, but by periodic transfer of funds on time and in size in advance agreed by the parties. Planned payments are used both at single-ground and in non-resident calculations and can be made by payment orders, payment requirements, translations and / or calculated checks. The sums of each scheduled payment are set by the parties for the coming month (quarter) based on the frequency of payments and the volume of purchases (supplies) of products, goods or services. Recalculations are made in the manner due to the Agreement (Agreement).

Payment orders are valid for 10 days from the date of discharge, not counting the day of the document statement, and are accepted by banks to execute without limiting the amount only in the presence of funds on the payer's account.

Payment orders are discharged using technical means for the bank and all parties involved in the calculations. The first instance should be signed by the head and chief accountant of the organization and have print print. Packs and clearing in payment orders are not allowed.

In the supplementary period, the largest proportion in the structure of non-cash settlements occupied access-collection form (acceptance or collection). With this form of calculations, the bank settlement document is payment request (f. No. 0401061).

Incasso is the type of banking operation consisting in the receipt by the Bank of Money on various documents (bills, checks, etc.) on behalf of and at the expense of its customers.

In order to take advantage of an acceptance-collection form of calculations, the supplier is the vacation documents to the buyer (invoice, invoices, etc.) and from the transport organization (when sending goods) should receive transport documents (railway and other receipts). Based on the prepared and received documents, the supplier issues payment request which transfers to the bank to collection.

The acceptance form of calculations "starts from the supplier", which sends goods to the buyer or provides services. The necessary documents (rendered services, work performed) are drawn up with the necessary documents, on the basis of which a payment request is discharged.

The received payment requirements Bank serving the supplier forwards to the bank serving the payer, or leaves if the supplier and payer accounts are in one bank.

The acceptance of the payment requirement was set 3 business days, not counting the day of receipt of documents to the bank, but in some cases, at the request of the client, it can be extended to 7 days. In terms of acceptance, payment requirements are placed in a card number 1 (urgent file). If during the period set for acceptance, the payer did not declare his refusal to pay a payment request, it is considered acceptanced and payable. Currently, the greatest distribution has a negative acceptance ("silent acceptance"). The essence of the negative acceptance is that if in the prescribed period a written refusal to pay to the bank did not receive, then the payment request is considered acceptanced ("silence is a sign of consent") and payable.

If there is money at the payer's current account, payment request is paid and with a payment of payment is sent to the supplier's bank.

The acceptance form of calculations is applied only if it is provided for by the contract or agreement concluded between the supplier and the buyer.

During the period set for acceptance, the payer can declare full or partial disclaimer.

Full failure From acceptance may be claimed:

upon receipt of the inappropriate goods;

upon receipt of previously paid goods;

in cases provided for by the Treaty.

Partial refusal From payment, i.e., the refusal of paying the amount of the amount specified in the payment request may be declared when:

admission along with the ordered unprotected goods;

admission of previously partially paid goods;

overestimation of price or quantity, non-compliance with the range and in other cases provided for by the Treaty.

The acceptance-collection form of calculations is most beneficial to the buyer, as it can use the received goods before their payment, and it is less profitable to the supplier, because, sending goods to the buyer, it is not guaranteed in their timely payment. For this reason, with the introduction in July 1992 pre-payment and the forms of the settlement document payment request The use of an acceptance-collection form of calculations is limited and its application must be provided in the contract.

Payment Requirement (F.P. No. 0401064) is a written demand for the supplier to pay the buyer on the basis of the costs sent to the servicing bank of the payer of the settlement and transport and shipping documents, the cost of the products made under the contract "of completed works or services rendered.

Supplier, wringing a payment request-order along with transport and shipping documents (three copies), directs them to the buyer's bank. The buyer's bank, having received documents, transmits payer payment requests, instructions, leaving transport and shipping documents in the payer No. 1.

The payer is obliged to return to the servicing bank payment request-order within three days from the date of receipt of it to the payer's bank.

With the consent, the head and chief accountant of the payer's organization is fully or partially paid and put print prints on all instances of the payment request and transfer them to the servicing bank.

The transfer of the payment request-order by the supplier directly to the buyer (payer) is allowed. The payer (head and chief accountant) signs all copies of the payment request-order, puts print prints and transmits a bank to the branch to pay, indicating the amount in words

If you need to telegraph payment advice, the supplier on all instances of the order requirement is affixed by the "Payment Translate Telegraph" inscription. On the refusal to fully or partially pay the payment request-order, the payer notifies the serving bank within three days after receiving documents. Paid payment request-order The payer's bank sends to the bank serving the supplier.

The latest copies of the settlement documents (with a bank marker) The chief accountant of the organization should be stored in a separate folder before receiving an extract from the current account in the bank.

Daily Bank is for its customers an extract from the current account which is an accurate copy of the records on the account.

Various institutions of banks make discharge of their customers on various shapes. However, any form of discharge must contain mandatory details: date, document number, perfect operation code with an indication of the debit amount (write-off or issuance of money from the current account) and the loan (admission or cash payment for the current account), as well as incoming and outgoing balance Cash at the current account, certified by signatures of the Contractor and the Bank's controller with the pencils of the bank stamp.

Having received an extract of the bank, the chief accountant selects the payment documents to it, on the basis of which the money was written off or enrolled in the current account, writing the name of the organization or the content of the operation opposite each amount. Processing the bank's statement from the current account, it must be borne in mind that the records of the debit will indicate the write-off of money, and the credit records are the receipt of money to the account. This is explained by the fact that the current accounts of organizations and other clients in the accounting bank are passive accounts on which the funds raised are taken into account.

After the processing of the bank's discharge, the chief accountant is a developing statement with an indication of the names of organizations from which funds are received or are transferred from the current account.

Accounting Cash at the current account is carried out on the main account of 51 "current accounts", which in relation to the balance sheet is active and is posted in the II section of the balance sheet of the article "Settlement accounts (51)". The debit of the account takes into account the balance and receipt of funds for settlement accounts, and on the loan - their write-off (spending). Synthetic accounting is carried out in the main book, and analytical accounting in the memorial and warrant form of accounting is in the contract book, and with a magazine-orchers in the journal-order No. 2, the form of which is similar to the order-order № 1.

On the front side of the order warrant records are made on credit account 51 "Settlement accounts" (when transferring and issuing money from the current account) in correspondence with the debit of other accounts.

On the reverse side of the order warrant records, the debt debit of 51 "Settlement accounts" (upon receipt of money for the settlement account) in correspondence with the loan of other accounts. This part of the order magazine is customary to be called statement. In the Order No. 2 records are made within a month. Journal-order number 2 with statement open separately for each current account.

The statement indicates the balance on the first number and records are made upon receipt of funds for the current account (by the debit of account 51 "Credential accounts" from a loan of various accounts):

Debit account 51 "Settlement accounts"

Credit accounts 50 "Cashier" - with cash contribution to the current account (deposited wages, revenue from the sale of products, works, services, etc.);

55 "Special accounts in banks" - enrollment on the settlement accounts of unused cash balances on letters of credit and checkbooks;

62 "Calculations with buyers and customers" - the receipt of revenue for the products sold from the procurement organizations and other buyers and customers;

66 "Calculations on short-term loans and loans" - when enrolling for current accounts of short-term loans and loans received by the organization for a period of no more than 12 months;

76-1 "Calculations on property and personal insurance" - transfer insurance companies for insurance indices for those who died as a result of natural disasters of crops and other insured property;

76-2 "Calculations on claims" - the receipt of funds to the current account from organizations in the order of satisfaction of claims and others.

In the order, the order is made for issuing and transferring funds from the current account (on credit account 51 "Settlement accounts" into the debit of other accounts):

Debit accounts 50 "Cashier" - issuance from the current cash account;

55 "Special accounts in banks" - exhibiting from the settlement account of letters of credit, acquisition by clients of checkbooks;

60 "Calculations with suppliers and contractors" - payment of invoices for suppliers for delivered commodity values, contracting organizations - for the work performed on the main activity and investments in non-current assets;

66 "Calculations on short-term loans and loans" - when repaying from the current account of short-term loans and loans received by the organization for up to 12 months.;

68 "Calculations on taxes and fees" - when transferring payments from the current account to the budget (tax incomes of individuals, deductions from profit, etc.) and fees;

69 "Calculations for social insurance and provision" - when transferring from the current account of payments to the Social Insurance Fund. Pension Fund and Compulsory Medical Insurance Funds;

70 "Calculations with personnel of wages" - transfer of due remuneration of workers to their personal accounts in banks and other accounts;

Account credit 51 "Settlement accounts".

Currently, the client may make complaints about the bank.

So, for the late (later the next day of receiving the relevant document) or the incorrect write-off of funds from the account of the payer's client, as well as for late or incorrectly enrollment by the Bank of the amounts due to the recipient client, the owner has the right to demand a penalty of 0.5% from the bank From non-timely enrolled (written off) amounts for each day of delay (delay) of payments, reflecting in taking into account the presented complaint with wiring:

Debit of subaccount 76-2 "Calculations for claims"

Credit subaccount 91-1 "Other" revenues ".

Monthly, these account registers are closed by counting the results of the receipt and spending of funds for settlement accounts. The statement shows the balance for the first number of the next month. To do this, the voltage at the beginning of the month add turnover by statement and deduct the turnover by magazine.

Bibliography

1. Erofeeva V.A., Klushhanseva G.V. Accounting (financial) reporting. - M.: Yurait-Edition, 2005.

2. Sokolova E.S., Egorova L.I. "BFO", educational and practical manual;

3. Magazine "Actual Accounting" N 3/2009, I.G. Kostyukova, expert magazine;

4. Federal Law "On Accounting" of 21.11.1996 N 129-FZ;

5. Order of the Ministry of Finance of Russia "On Forms of Accounting Reporting" of July 22, 2003 N 67n;

Posted on Allbest.ru.

Similar documents

The concept of cash funds of the enterprise. Forms of non-cash payments. Tasks of accounting and auditing of cash funds. Accounting of cash transactions, accounting of operations on a settlement account, accounting for transfers and procedure for collecting money.

thesis, added 19.07.2011

The economic maintenance of funds and their role in the process of circulation of the organization's funds. The procedure for opening an account in the bank. Accounting at the current account. Accounting for cash flow operations at the current account.

course work, added 27.05.2012

Economic and financial characteristics of OJSC Polotsk Agroservis. The economic maintenance of funds and their role in the process of circulation of the organization's funds. The procedure for opening an account in the bank. Accounting for cash flow operations at the current account.

coursework, added 03/26/2016

Accounting at the current account. Synthetic and analytical accounting of operations on a settlement account. The procedure for entering and writing off funds. Analysis of the structure of the balance of the enterprise, the liquidity of working capital and financial sustainability.

course work, added 19.03.2014

The main theoretical provisions of accounting. Audit and control of the availability and use of funds, their receipts and expenditure at the checkout and a settlement account, analytical and synthetic accounting. Ways to optimize the monetary calculation system.

thesis, added 04.12.2009

The essence of the basic principles of accounting. Accounting for money on settlement and special accounts in the bank. Features of conducting operations on a settlement account and reflection in accounting. The concept of bank payment documents, their types.

examination, added 01/13/2012

Accounting for cash on the current account and other accounts in the bank, cash operations and monetary documents. The concept of receivables and payables. Accounting for settlements with buyers and customers, suppliers and contractors, on wages.

course work, added 01/31/2009

Cashless money and its organization. Accounting operations at the current account. Accounting and analysis of cash flow at the current account on the example of LLC Zagotromtorg. Audit verification of operations on a settlement account of the enterprise.

thesis, added 15.04.2014

Definition, essence of the current account. Correspondence of accounts for cash accounting operations at the current account. Types of calculations. Receiving and issuing cash. Cashless calculations. Basic documentation. Opening procedure, closing the current account.

coursework, added 14.07.2008

Nature, economic essence of cash. Accounting prospects. Accounting for the availability of funds in LLC "Social Pharmacy-98". Features of accounting for cash at the box office, at the current account. Accounting policy of funds and documents.

In practical activity, each business entity faces the need to make calculations in non-cash form. Calculations of the enterprise with suppliers for acquired materials (services); with buyers for realized products; with loan credit institutions; Calculations on mandatory payments to the budget, payments to extrabudgetary funds and others are most often carried out through the current account.

Conceptory certificate!

Checking account - This is an expense, an open enterprise in a bank in the ruble currency and intended for the storage of funds to organize and implement settlements in non-cash form.

The current account is the main account of the organization through which cash transactions are carried out. At the same time, the organization independently determines the required number of current accounts. An open account is assigned a 20-digit number, indicating this in the company's charter. In the future, this number is indicated in all documents related to the flow of funds on a computational account. Bank settlement and cash service is carried out on the basis of a concluded agreement between the organization and the bank. Operations on a settlement account are carried out in chronological order at the appropriate order of the account holder (organization), as well as without order of the owner in cases defined by law. When making a disadvantage of funds, the invoice is carried out in the following order:

Compliance with this queue is regulated by Art. 855 Civil Code of the Russian Federation.

The current account opens in credit institutions (banks), which companies choose for themselves.

The bank manager to the opening application sets the "permissive" signature and an economic entity that opens account is assigned a billing number consisting of 20 characters. Through the settlement account, all non-cash settlements of the enterprise (only with the help of documents) are carried out.

From May 1, 2014, the Organization and IP, which are payers of insurance premiums, are exempt from the obligation to report to the FSS and PFD information about opening and closing bank accounts. These changes are made by federal law of 04/02/2014. № 59-FZ.

From May 2, 2014, the obligation of organizations and the PI report to the tax inspectorate of information on the opening and closing of accounts, according to the Federal Law of 04/02/2014. № 52-ФЗ.

Opening accounting account

To open a current account in the Bank, a legal entity is obliged to provide the following documents to the Bank:

- Application for opening an account in rubles, signed by the head and chief accountant of the organization;

- Bank account agreement (two copies) in rubles, signed on each sheet;

- Certificate of state registration of a legal entity;

- A copy of the discharge from the Unified State Register of Legal Entities certified by a notarial or body that issued a document with the date of issue not exceeding 1st month before submitting documents;

- A copy of the properly approved statute (provisions) with changes and additions is certified by a notarial or body that registered a document;

- A copy of the constituent agreement certified by a notarial or higher authority;

- Protocol of the meeting of founders;

- A copy of the employment contract with the head of the organization;

- A copy of the order of joining the position of head and appointment of the chief accountant, certified by the print by print and signature the head of the organization;

- Card with sample signatures and a selection of the head of the enterprise and the chief accountant, certified notarized;

- Photocopy of passports of persons declared in the signature sample card;

- The original certificate of registration with the tax authority and its notarized copy;

- A copy of the information letter from the territorial body of state statistics with assigned codes and confirming registration in the state territorial statistical body, certified by the prints of the press and signatures of the organization's officials (not necessarily);

- Copies of licenses for the activities of which require licenses.

The list of necessary documents is enshrined by the instruction of the Bank of Russia from 30.05.2014 N 153-and (ed. Dated December 24, 2014) "On the opening and closing of bank accounts, accounts for deposits (deposits), deposit accounts" (registered in the Ministry of Justice of Russia 06/19/2014 N 32813).

Synthetic and analytical accounting of operations on a settlement account

In terms of accounts, information on cash flow on the bank accounts in the Bank is taken into account in an active account 51 "Current accounts". The debit of the account reflects the receipt of funds for the settlement account, on the loan of their write-off. The balance in the account can only be debit or zero.

Analytical accounting of money movement is carried out in the "bank statements". The Bank is and provides an extract for the organization according to the bank's document management. Execution is compiled from the position of the bank, while it is provided with the application of all primary documents. The frequency of the provision of discharge is determined by the turnover of cash flow at the current account, but usually daily.

Paying bank

Bank statement is the basis for making correspondence on account accounts 51 "Current accounts".

It is important to draw attention to the fact that as already mentioned earlier, the extract is drawn up from the position of the bank. And this in turn means that the amounts reflected in the loan statement in accounting should be reflected in the debit of account 51 and on the contrary, those amounts that in the discharge are the debit costs 51 and the enterprise should reflect them in the loan turnover . Based on this, the balance in the discharge can only be credit, because Negative balance in the account can not.

If the company has several settlement accounts, analytical accounting on account 51 "Current accounts" must be conducted in the context of each account.

Synthetic accounting of cash flow at the current account with a magazine accounting form of accounting is carried out in a journal-order No. 2, Vedomost No. 2 and, accordingly, in the main book. In the automated account form as registers systematizing the data of the primary accounting, they are: awning, an account analysis, account card, invoice.

Regulatory framework for accounting on account 51 "Current accounts", documentary registration of settlements

In addition, as mentioned earlier, as a regulatory framework is:

- Instructions of the Bank of Russia from 30.05.2014 N 153-and (ed. Dated December 24, 2018) "On the opening and closing of bank accounts, accounts for deposits (deposits), deposit accounts";

- Position of the Bank of Russia dated 19.06.2012 N 383-P (ed. From 11.10.2018) "On the rules for the translation of funds";

- and etc.

The primary instructions for accounting for cash flow at the current account are:

- Payment order;

- Collection payment order;

- Payment request;

- Calculation fee announcement;

- Cash check.

Conceptory certificate!

Payment order - This is a document, which is an order of the Bank to transfer funds from the account of the owner to the recipient's account.

Collect payment order -the requirement to write down in the indisputable procedure of funds in cases determined by the legislation. When writing off funds on the basis of executive documents in the collection order, it is necessary to indicate a reference to the date, the executive document and the authority of its issued (for example, the write-off of the penis and non-payment of taxes in the IFTS).

Payment request -this is a document that is the requirement of the supplier to the buyer and the order of the buyer to its bank on the payment of delivered goods, works and services. At the same time, the supplier sends a payment request directly to the buyer's bank.

Cash Contribution announcement -it is drawn up when cash with cash on the current account. The bank as a document confirming the receipt of money issues a receipt.

Cash check -a document acting as an order to the Bank on the issuance of cash in the specified amount. Checking books are issued by the Bank based on a special statement and are strict reporting documents. Spoiled checks are not removed, they are subject to storage at the check agent for at least three years. When closing the account, the checkbook is obliged to return to the bank the remaining unused checking roots.

Typical wiring on account 51 "Settlement accounts"

Economic operations for the debit of account 51 "Settlement accounts"

| № | Source documents | Corresponding accounts | ||

| Debit | Credit | |||

| 1 | 2 | 3 | 4 | 5 |

| 1 | Cash received from the cashier on the R / s | Bank statements, cash fee announcement, bank receipt for cash reception | 51 | 50 |

| 2 | Received cash with currency accounts | Execution of the bank for a currency account, | 51 | 52 |

| 3 | An unused amount of letters of credit, checks, bank cards, deposits was returned to the current account. | Execution of the Bank for Calculation Account, Exchange Bank for Special Accounts | 51 | 55 |

| 4 | Received cash, listed on the road (money transfers, revenue collection) | Execution of the Bank for Calculation Account | 51 | 57 |

| 5 | In order of return of the long-term and short-term loans provided, another organization received funds for the settlement account. | Execution of the Bank for Calculation Account | 51 | 58 |

| 6 | Arrival from suppliers and contractors (repayment of prepayment, advance payment, overpayment amounts) | Execution of the Bank for a Calculation Account and Payment Order | 51 | 60 |

| 7 | Revenue reflected from buyers and customers for supplied finished products, performed work provided services | Execution of the Bank for Calculation Account, Payment Order, Payment Requirement | 51 | 62 |

| 8 | Received funds at the expense of bank loans and other loans: A) short-term B) long-term |

Execution of the Bank for Calculation Account, Documents for Short-term and long-term loans and loans | A) 51. | A) 66. |

| 9 | Returned from the budget of overpayments for taxes and fees based on the results of recalculation | 51 | 68 | |

| 10 | Reimbursion of the organization by the Foundation of Social Insurance Expenditures on the payment of various benefits | Execution of the Bank for Calculation Account, Payment Order | 51 | 69/1 |

| 11 | Returned from extrabudgetary funds The amount of overpayments based on the results of recalculation | Execution of the Bank for Calculation Account, Payment Order | 51 | 69 |

| 12 | Enrolled on the R / s listed by accountable persons revenue for sold products and goods | 51 | 71 | |

| 13 | The amounts received from employees of the organization, repayment of the loan, compensation for material damage | Employment of the Bank for Settlement Accounts, Postal Translation Receipts | 51 | 73 |

| 14 | Cash at the expense of the contribution to the authorized capital entered the current account | 51 | 75 | |

| 15 | Received cash from different organizations and individuals in the account of the repayment of receivables; Called the amounts of satisfied claims, dividends on securities, interest on debt obligations of other organizations, revenues from participation in the authorized capital of other organizations, distributed profits from joint activities, funds from subsidiaries | Execution of the Bank for Calculation Accounts, payment orders | 51 | 76 |

| 16 | Credited the amounts of insurance compensation received by the organization from insurance companies | Execution of the Bank for Calculation Accounts, payment orders | 51 | 76 |

| 17 | Received cash at the expense of targeted financing | Execution of the Bank for Calculation Accounts, payment orders | 51 | 86 |

| 18 | Cash at the expense of emergency income as a result of an emergency | Execution of the Bank for Calculation Account | 51 | 99/4 |

| 19 | On the R / from the head organization received funds from the structural unit, taken into account on a separate balance | Execution of the Bank for Calculation Account | 51 | 79 |

| 20 | Received cash in the account of the income of future periods | Execution of the Bank for Calculation Account | 51 | 98/1 |

Economic Operations on Account Loan 51 "Current Accounts".

| № | Content of economic operations | Source documents | Corresponding accounts | |

| Debit | Credit | |||

| 1 | 2 | 3 | 4 | 5 |

| 1 | Transfer funds to the cash desk from the current account | Execution of the Bank for Calculation Account, PKO | 50 | 51 |

| 2 | Funds are listed from one current account for open accounting accounts in other banks | Execution of the Bank for Calculation Accounts, payment orders | 51 | 51 |

| 3 | Reflected write-off on the R / s for the purchase of currency funds | Execution of the Bank for Calculation Account, Currency Account, Payment Orders | 52 | 51 |

| 4 | Credited cash in letters of credit | Extrusion of the bank on a settlement account, special accounts, payment orders, an application for a letter of credit | 55/1 | 51 |

| 5 | Declaring checkbook | Execution of the Bank for Calculation Account, Special Accounts, Payment Orders, Application for Checking Book | 55/2 | 51 |

| 6 | Deposit accounts are open | 55/3 | 51 | |

| 7 | Other special accounts are open (special account for bank cards, specials. Account for financing Cap. Investments) | Execution of the Bank for Settlement, Special Accounts, Payment Orders | 55 | 51 |

| 8 | Loans are granted, bonds and other financial investments from the current account are paid. | Execution of the Bank for Calculation Account | 58 | 51 |

| 9 | Calculated with P / C with suppliers and contractors (including advances) | Execution of the Bank for Calculation Accounts, payment orders | 60 | 51 |

| 10 | The unused advance payment was returned to buyers and customers previously received from them. | Execution of the Bank for Calculation Accounts, payment orders | 62 | 51 |

| 11 | Paid debt on short-term loans | Execution of the Bank for Calculation Accounts, payment orders | 66 | 51 |

| 12 | Payable long-term loans | Execution of the Bank for Calculation Accounts, payment orders | 67 | 51 |

| 13 | Listed budget for taxes and fees | Execution of the Bank for Calculation Accounts, payment orders | 68 | 51 |

| 14 | Calculated with the R / C with social insurance and security funds | Execution of the Bank for Calculation Accounts, payment orders | 69 | 51 |

| 15 | With personnel on wages, benefits and dividends (in accounts of credit institutions and postal translations) were calculated with the R / s | Execution of the Bank for Calculation Accounts, payment orders | 70 | 51 |

| 16 | The advances are listed by accountable persons outside the organization | Execution of the Bank for Calculation Accounts, payment orders | 71 | 51 |

| 17 | Refilled on compensation accounts for the use of personal cars for office travel, loans by an employee of an organization for individual needs | Execution of the Bank for Calculation Accounts, payment orders | 73 | 51 |

| 18 | Associated income amounts to founders, legal entities from participation in the activities of the organization (dividends for shares, pairs, land shares) | Execution of the Bank for Calculation Accounts, payment orders | 75 | 51 |

| 19 | Listed by insurance companies in terms of property and personal insurance | Execution of the Bank for Calculation Accounts, payment orders | 76/1 | 51 |

| 20 | Calculated with the R / s with depositors | Execution of the Bank for Calculation Accounts, payment orders | 76/4 | 51 |

| 21 | Calculated with the P / C with the population for the accepted cattle and C / x products | Execution of the Bank for Calculation Accounts, payment orders | 76/7 | 51 |

| 22 | Calculated with R / s with alimony recipients | Execution of the Bank for Calculation Accounts, payment orders | 76/9 | 51 |

| 23 | The cost of targeted costs funded by target sources listed funds | Execution of the Bank for Calculation Accounts, payment orders | 86 | 51 |

| 24 | Credited cash lost due to natural disasters and other extraordinary circumstances | Execution of the Bank for Calculation Accounts, payment orders | 99 | 51 |

All temporary free cash in the enterprise, with the exception of cash at the checkout, should be stored at the current account discovering in the bank's separation.

A revenue for realized products from buyers, customers and other receipts is credited to the enterprise account. Cash for enrollment to the current account, the Bank accepts from the representative of the account holder.

The Bank performs the instructions of the enterprise on the transfer or issuance of appropriate amounts to pay for acquired commodity values, on the repayment of a bank loan and loans, obligations to budget, extrabudgetary funds, suppliers, other creditors, for settlements with members of the labor collective for labor payments, for travel, Economic and representative spending, the acquisition of fuel and lubricants, and other targets within the balance of funds on the invoice and compliance with the priority provided for by law.

The write-off of funds from the current account is made according to the requirements relating to one priority, it is carried out in the order of the calendar order of receipt of documents.

The bank controls the operations performed on a calculated account. In particular, checks whether the enterprise does not conduct the owner of the operation of the operation that do not meet the nature of its activities provided for by the Charter, which violates the established procedure for the use of funds or rules of calculations.

With not sufficient or lack of funds on the settlement account of the enterprise, the Bank placed on payment documents placed in a card 2.

Documents placed in the Card - Bank pays as funds are received on the current account of the enterprise, following the conditions of the sequence.

The procedure for opening a current account for opening a current account The company submits to the bank:

Statement of the established form to open an account;

Copies of the company's charter and the constituent contract, certified notarized;

A copy of the registration certificate of the enterprise, certified notarized;

Certificate of the tax authority on registration of an enterprise as a taxpayer;

A copy of the registration document as a payer to the Pension Fund of the Russian Federation;

A copy of the registration document in the territorial fund of compulsory health insurance as a payer;

The card with sample signatures of the head, Deputy Head and the Chief Accountant of the Enterprise and Print Printing Enterprise in the established form, certified notarized.