Transport tax for legal entities. Transport tax for individuals: rate, calculation, payment, payment time. Who pays for what

Transport tax must pay all machine owners, both individuals and a legal entity. This article discusses the organizations. You will be able to learn how the transport tax of JUR is paid. Persons how it expects and is charged, in which time is paid and much more.

Transport tax in 2016-2017 for legal entities

First of all, it is necessary to consider the features of transport tax for Yurlitz:

- Available reporting periods. They recognize the first, second and third quarters. At the end of each reporting period, the organization should pay advance payments. For each reporting period, tax reports are not necessary. You only need to do this at the end of the year.

In some regions, the legislation does not establish the reporting periods at all, and, it means that the obligation to pay advances.

- The procedure for calculating the amount of the tax. Companies should calculate the total amount of tax and advances completely independently, while employees do tax Service. The formula for calculating the transport tax in 2016 can be found in.

- Payment procedure. Transport tax For organizations involves paying one of two ways:

- By making a prepayment;

- One-time payment without advances.

If advance payments are established by law, they need to pay for each quarter. Their size is one fourth part of the annual amount. Payment takes place in terms established by the legislation of the region.

When the tax period ends, the companies that paid advances should supplement the remaining amount. If advance payment legislation does not provide, the total amount is submitted at the end of the tax period.

Read more about the payment of advance payments on transport tax, read.

- Reporting on the calculation of transport tax. Legal entities, unlike physical, should take tax reporting. When the tax period expires (but not later on February 1 next year), companies must pass in tax inspection Declaration.

- Privileges. Obviously, for physical and for legal entities Various types of benefits are provided. For Jurlitz, such benefits may be provided for budgetary or state organizations.

How the transport tax for legal entities is calculated

As mentioned above, the Jurlitz should calculate the tax on transport independently. They should do it according to the following formula:

TN \u003d CH * NB * NP.

- CH - tax rate, established depending on the power of transport;

- NB - tax base, determined by power or other transport characteristics;

- NP - tax period.

However, regional power can establish increase or lower coefficients that will change the final amount of tax. Raising coefficients may depend on the price of the car, its age, the category of user TC. Lowing coefficients can be installed for preferential categories of auto owners.

Accounting tax tax

All organizations must keep records paid to taxes. All operations with transport tax are reflected in the account "Calculations for Taxes and Recruits" (68). The corresponding account will be directly dependent on the method of using transport. Wiring in accounting may be as follows:

- D20, 23, 25, 91.2 - K68 - tax calculation;

- D68 - K51 - payment of tax.

The amounts of tax should be included in the cost of the company's main activity.

In order to tax revenue taxes, transport taxes are attributed to the quarter in which they were either accrued or paid. You must not forget that for goals tax accounting All transport tax costs must be documented. The certificate of an accountant, advance payment, the tax accounting register and others can be confirming documents. Consider tax only by this transport that was used to extract commercial benefits.

Organizations of simplities can take into account transport taxes as expenses only when finding "income-expenses" facility. If the company is located on UNVD, take into account the amount of taxes on transport is not necessary.

Transport Tax Reporting

Despite the fact that Juralice should produce advance payments three times in the year, they should only take reports once a year. Date of delivery tax Declaration - The first February of the year, which follows the tax period.

Despite the fact that Juralice should produce advance payments three times in the year, they should only take reports once a year. Date of delivery tax Declaration - The first February of the year, which follows the tax period.

Entrepreneurs and ordinary citizens to donate tax reporting is not necessary, since all calculations produce tax inspectorates for them.

About the deadlines for the delivery of the Transport Tax Declaration can be found in more detail.

Payment of tax

Organizations must list prepayments to the budget within thirty days after the end of the next reporting period. The date of crediting tax to the budget will be recognized the day when the necessary payment documents were transferred to the credit institution.

Dates of payment of the total tax amount establishes regional legislation. In most cases, this February and March of that year followed by the reporting.

Responsibility for non-payment

If the organization does not pay taxes, it will have to incur the following penalties:

- Extraordinary verification of the tax inspection.

- Accrual of penalties on an unpaid amount (in the amount of 1/300 from the refinancing rate for each overdue day).

- Penalties for non-payment of taxes.

- Transfer of business to the court for compulsory debt write-off.

- Holding debt from tax payer income forced.

- The imposition of arrest to the ownership of the tax of taxes.

If the organization specifically provides inaccurate information in reporting, or will shy away from taxes authorized by employees, such as the management company and the Chief Accountant, will have to incur administrative, or even criminal punishment.

The time limit for transport is three years. In this regard, if the Tax Inspectorate filed an application for debt collection, the limitations of which is more than three years, it is necessary to go to court.

Transport tax 2016. Determined by Chapter 28 "Transport Tax" of the Tax Code of the Russian Federation. Paying a transport tax in 2016 needed and do it should every person who registered a car (as well as a motorcycle, aircraft, ship). All vehicles that are subject to state registration are taxed. For example, cars must be registered in the traffic police, and, for example, no scooters do not need to register, it means that it is also no need to pay for it.

We need to pay the transport tax to each person who registered the vehicle is written in Art. 375 "taxpayers" of the Tax Code of the Russian Federation. Quote: "Taxpayers of the tax recognize persons on which, in accordance with the legislation of the Russian Federation, vehicles recognized by the object of taxation are registered ...". At the same time, it is not necessary to be the owner of the car. When selling / donating / loss of a car, if it is still registered on you, you still need to pay the transport tax while you do not remove it from accounting.

Physicians must separate transport tax in 2016Based on the tax notice that they are sent from the Tax Authority. This message indicates information on which the cost of transport tax was conducted in each particular case.

How will the magnitude of the transport tax in 2016 be calculated?

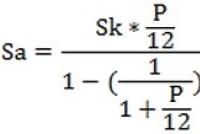

Calculation of transport tax will be made according to the following formula:

Tax Size \u003d Tax Bet * The tax base * (Number of ten months of ownership / 12) * Enhancement coefficient.

Tax rate.

Value tax rate can independently adjust local bodies Control, but cannot be different more than 10 times from the rate adopted in the Tax Code of the Russian Federation. For example, the 2012 transport tax rates in Moscow were, for example, by passenger cars With engine power less than 100 horsepower 7 rubles / l. from. (more basic 2.8 times), 100 - 125 horsepower - 20 rubles / l. from. (more basic 5.4 times) and so on.

It should be noted that the value of the tax rate, which is accrued, depending on the year of the car, will be determined by the number of years after the release of the car, as of January 1 current year. The countdown begins in the year, which follows the year of release vehicle.

Pay transport tax 2016. It is necessary at the installed rates of the regions of the person's registration region, which is registered a car. And it does not matter where the car is registered and used. There used to be the opposite.

If the transport tax rate is not established in the subject of the Russian Federation, then the imposition of transport tax is occurring at the rates designated in paragraph 1 of Article 361 Tax Code RF.

Increased transport tax on expensive cars.

1.01.2014 The coefficients increasing the amount of tax to pay to the budget for expensive passenger cars were introduced. To calculate the amount of transport tax of such cars, it is necessary to calculate the calculation by the usual formula to multiply to the corresponding coefficient.

The coefficients of transport tax on luxury.

|

The average cost of a passenger car |

The size of the raising coefficient of transport tax |

|

|

|

|

|

|

|

|

|

|

|

The procedure for calculating the average cost of passenger cars is determined by the Ministry of Industry and Trade of the Russian Federation. List of passenger cars average cost Which more than 3 million p can be viewed on the site of the Ministry of Industry of Russia http://www.minpromtorg.gov.ru/ (information is updated until March 1 of each year).

The procedure and timing of transport tax pay 2016.

Transport tax 2016 is paid According to a special tax notice (from the tax station) and the receipt of form No. PD-4. Transport tax for 2016 should be paid until December 1, 2017.

Notice is sent in the form of a registered letter no later than thirty working days from the date of the time of payment of transport tax. In this case, it is assumed that the notification you received after six working days from the date of sending a registered letter. In this case, it does not matter whether you received a letter in fact.

Quite often, tax inspectors send notifications later than it is required and you have time to accrue penalties as they declare. But this is contrary to the law. Penalty is charged from 7 working days after sending notifications (however, no earlier than the date of the onset of the tax). The date of departure of the notification can be found on the envelope, or rather on the mail stamp of the post office, through which the letter with the notification was sent.

Questions of calculation and payment tax pay for organizations concern almost all taxpayers, since certain vehicles are registered on most companies. Organizations should take into account changes in transport tax legislation used since 2016 when filling tax reporting For 2016, with which you can find in this article.

Transport tax payers in 2016

Considering the issues of calculation and payment of transport tax by organizations, it should be remembered that the specified tax is regional and the subject of the Russian Federation in the person of the legislative bodies belongs to the right to establish its individual elements within the code. Consequently, organizations should be treated not only to the provisions of the Code, but also to the legislation of the region, where the vehicle is registered. It is also important to remember that the legislation is not static and can often change quite often, respectively, when calculating the transport tax, it is necessary to clarify whether there is a "fresh" editorial board on transport tax, where, for example, a bet has been changed.

Before proceeding to the calculation of the transport tax for legal entities and filling the declaration, it is necessary to decide whether your organization is a payer of the transport tax. According to the norms of the Code, the taxpayers are faces for which vehicles recognized by the object of taxation are registered. Before directly proceeding with the completion of the tax return, the organization needs to conduct a revision of vehicles that have been nosed for it during the entire 2016, even already implemented.

The tax declaration should be compiled only if the organization registered the vehicles specified in the list established by the Code of the Code. The object of taxation on transport tax may be not only terrestrial, but also water and air vehicles. At the same time, these vehicles must be registered under the legislation of the Russian Federation. In some cases, directly specified in the Code, for example, in relation to the wanted vehicles, to submit to the tax authority, the declaration is not necessary to calculate and pay the tax. At the same time, the specified exemption will be applicable if the fact of theft, hijacking it is possible to confirm the documents of the relevant law enforcement agencies.

The tax calculation and the filling of the Transport Tax Declaration for organizations, as a rule, does not cause difficulties. It is necessary to correctly fill out all the lines of the tax return form (we note that since 2016 will be applied new form) At the same time, you can be guided by the approved procedure for completing it and applications to it. It is more expedient to start filling the declaration from section 2, which makes data that allows you to identify the vehicle, as well as calculate the tax on it, taking into account various types of benefits. The required data required to specify in relation to each vehicle organization. Section 1 of the Declaration reflects information on the amounts paid amounts of advance payments and the total tax number for the year is displayed.

Changes in legislation used since 2016

Transport tax of organizations has not changed significantly since 2016. At the same time, with a number of changes in legislation, organizations should be found. Consider the most important of them.

- Federal Law of 03.07.2016 N 249-FZ made changes to the Code for the payment of transport tax issues. Now it is necessary to take into account the appearance of new benefits on the transport tax, which, at the same time, concerns not all taxpayers. We are talking about organizations, which registered vehicles with a permitted maximum mass of over 12 tons, contributed to a special registry. Since 2016, such organizations will be provided the new kind tax breaks, namely the amount of the calculated tax on the basis of the tax period can be reduced by the amount paid for this vehicle in this tax period. If after the work of calculations of the amount of tax to pay to the budget it will be negative, then the resulting difference is not compensated from the budget, the amount of tax will be declared equal to zero.

Tax authorities will be annually to receive information from the registry until February 15. The procedure for providing such information is planned separately.

At the same time, contributing changes to taxpayers are allowed not to pay quarterly advance payments on transport tax on such vehicles.

- Also amendments to the Code of December 29, 2015 N 396-FZ were amended, which came into force on January 1, 2016. These changes specify how transport tax is calculated for legal entities for the month in which the transition of ownership from one subject to another occurred. According to the new rules, the question becomes a settler who, in this case, will be a shipping tax payer - a seller or buyer.

If the registration of the vehicle occurred up to the 15th day of the month inclusive or the removal of the vehicle from registration was carried out after the 15th day of the month, this month is recognized as complete for calculating and paying transport tax. On the contrary, a symmetrical manner, in the case of registration by the organization of a vehicle after the 15th day of a month or the removal of the vehicle from registration to the 15th day of the month inclusive, the specified month should not be taken into account in the formula for calculating the tax (when determining the coefficient).

Accordingly, the situation is currently excluded when the tax has been paid in the same month and the buyer and the vehicle seller at the same time. In order to avoid cases of excessive tax paying for an or acquired vehicle to the budget, organizations should take into account the considered changes in legislation and apply them in practice when calculating the amount of tax to pay.

- Continuing to talk about the changes in the Code for regulating issues related to transport tax for organizations in 2016, it is possible to note the specificization of the provisions of the Code in terms of increasing coefficients for calculating the tax on the so-called "costly" cars (cost from 3 million rubles). Now a list of such cars should be posted on the website of the Ministry of Industry and Commission of Russia in the period established by the Codex (no later than March 1), and this list will be applied only with respect to the tax period in which it is published (not in the previous and not in the following tax periods).

The procedure and timing of the payment of transport tax in Moscow

The tax for each vehicle is paid in full rubles (50 kopecks and are more rounded to a whole ruble, and less than 50 kopecks are not taken into account) to the budget of the city of Moscow.

Taxpayers-organization Pay tax no later than February 05 of the year following the expired tax period. During the tax period, the payment of advance payments for taxpayers - organizations are not produced.

Thus, organizations need to pay for the transport tax for 2018 - until February 5, 2019, for 2019 - until February 5, 2020. More than O.tax payment procedures Read the article on the link.

Transport tax period for 2019 for legal entities in Moscow - February 5, 2020

Citizens Pay transport tax on a tax notice sent by the tax authority. The amount of tax on the car is determined by the tax authorities on the basis of information that are submitted to tax authorities Authorities exercising state registration vehicles in the Russian Federation. In general, the transport tax should be paid in general on time no later than December 1 of the year, following the expired tax period, that is, in 2019 the tax is paid for 2018, respectively, at the rates established for 2018, and the automotive tax for 2019 - until December 1, 2020.

Payment period for citizens: Since 2016, the period of payment tax on the car has changed individuals - Now the tax must be paid until December 1 (previously the payment period was established until October 1).

Transport tax is payable within a period no later than December 1 of the year following the expired tax period. That is, a car tax for 2018 must be paid until December 1, 2019, for 2019 - until December 1, 2020, and in 2020 - until December 1, 2021. If December 1 is a non-working day, the period of payment is transferred to the nearest business day.

The time of payment of transport tax on the car in Moscow in 2020 - until December 1, 2020 (tax is paid for 2019)

Transport tax rates in Moscow

Auto tax rates in Moscow are established accordingly depending on the power of the engine, the thrust of the reactive motor or gross capacity of vehicles per honest power of the engine motor vehicle, one kilogram of the reactive motor force, one register ton of vehicle or a vehicle unit in the following sizes:

| Name of the object of taxation |

Tax rate (in rubles) for 2017-2019, 2020 |

|

Cars passenger |

|

|

over 100 hp up to 125 hp (Over 73.55 kW to 91.94 kW) inclusive |

|

|

over 125 hp up to 150 hp (Over 91.94 kW to 110.33 kW) inclusive |

|

|

over 150 hp up to 175 hp (Over 110.33 kW to 128.7 kW) inclusive |

|

|

over 175 hp up to 200 hp (Over 128.7 kW to 147.1 kW) inclusive |

|

|

over 200 hp up to 225 hp (Over 147.1 kW to 165.5 kW) inclusive |

|

|

over 225 hp up to 250 hp (Over 165.5 kW to 183.9 kW) inclusive |

|

|

Motorcycles and scooters with engine power (from each horsepower) |

|

|

up to 20 hp (up to 14.7 kW) inclusive |

|

|

over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive |

|

|

over 35 hp (Over 25.74 kW) |

|

|

Engine power buses (from each horsepower): |

|

|

up to 110 hp (up to 80.9 kW) inclusive |

|

|

over 110 hp up to 200 hp (over 80.9 kW to 147.1 kW) inclusive |

|

|

over 200 hp (Over 147.1 kW) |

|

|

Trucks With engine power (from each horsepower): |

|

|

up to 100 hp (up to 73.55 kW) inclusive |

|

|

over 100 hp up to 150 hp (Over 73.55 kW to 110.33 kW) inclusive |

|

|

over 150 hp up to 200 hp (Over 110.33 kW to 147.1 kW) inclusive |

|

|

over 200 hp up to 250 hp (Over 147.1 kW to 183.9 kW) inclusive |

|

|

over 250 hp (Over 183.9 kW) |

|

|

Other self-propelled vehicles, machines and mechanisms on a pneumatic and caterpillar (from each horsepower) |

|

|

Snowmobiles Motor with engine power (from each horsepower) |

|

|

up to 50 hp (up to 36.77 kW) inclusive |

|

|

over 50 hp (Over 36.77 kW) |

|

|

Boats, motorboats and other water vehicles with engine power (from each horsepower) |

|

|

up to 100 hp (up to 73.55 kW) inclusive |

|

|

Yachts and other sailing and motor vesselswith engine power (from each horsepower): |

|

|

up to 100 hp (up to 73.55 kW) inclusive |

|

|

over 100 hp (Over 73.55 kW) |

|

|

Hydrocycles S.engine capacity (from each horsepower): |

|

|

up to 100 hp (up to 73.55 kW) inclusive |

|

|

over 100 hp (Over 73.55 kW) |

|

|

Non-suitable (towed) courts, For which the gross capacity is determined (with each register ton of gross capacity or units of gross capacity in the event that the gross capacity is defined without specifying dimension) |

|

|

Airplanes, helicopters and other aircraft having engines (from each horsepower) |

|

|

Airplanes having jet engines (from each kilogram of thrust) |

|

|

Other aquatic and air vehicles that do not have engines (from a vehicle unit) |

Note, When charging the tax on the car apply Increased coefficients of transport tax on expensive cars worth more than three million rubles.

Attention: Due to the fact that the final amount of tax depends on the category and brand of the car, its power, we do not recommend using online calculators. The most faithful calculation is achieved by a simple multiplication of the car's capacity at the tax rate (taking into account the raising coefficients for expensive cars).

Benefits on the payment of transport tax in Moscow

The Law of Moscow "On Transport Tax" was completely released from tax payment:

- organizations providing services for the transport of passengers with urban passenger transport of general use - on vehicles transporting passengers (except taxis);

- residents of the special economic zones of the technical and introduction type created on the territory of the city of Moscow (hereinafter referred to as special economic zones) are in relation to vehicles registered on these residents, from the moment of inclusion in the register of residents of a special economic zone. Benefits are granted for a period of 10 years, starting from the month of registration of the vehicle. The right to benefit is confirmed by the discharge from the register of residents of a special economic zone issued by the management body of a special economic zone;

- 2.1. Organizations recognized by the management companies of special economic zones and operating in order to implement agreements on the management of special economic zones - in relation to vehicles registered on these organizations, from the moment of conclusion with the authorized Government of the Russian Federation by the federal executive authority of agreements on the management of special economic zones . Benefits are granted for a period of 10 years, starting from the month of registration of the vehicle - the benefit has been introduced since 2018;

- 2.2. Governors of the International Medical Cluster and the project participants who concluded agreements on the implementation of the project with managing Company International Medical Cluster and carrying out in the territory of the International Medical Cluster Activities for the implementation of the project - in relation to vehicles registered with the management companies of the International Medical Cluster and project participants. The participants of the project of benefits are granted from the moment the agreement on the implementation of the project with the Management Company of the International Medical Cluster - Benefit has been applied from 2018 to 2028;

- Heroes of the Soviet Union, Heroes of the Russian Federation, citizens awarded the Order of Fame of Three degrees,

- veterans of the Great Patriotic Wardisabled people of the Great Patriotic War - for one vehicle registered on citizens of the specified categories;

- competition veterans,disabled hostilities - for one vehicle registered on citizens of the specified categories;

- disabled I and II Groups - for one vehicle registered on citizens of the specified categories;

- former juvenile prisoners of concentration camps, ghetto, other places of compulsory content created by the fascists and their allies during the Second World War - for one vehicle registered on citizens of these categories;

- one of the parents (adoptive parents), guardian, a child's career, a disabled child - for one vehicle registered on citizens of the specified categories;

- persons having cars passenger with engine capacity up to 70 horsepower (up to 51.49 kW) inclusive - for one vehicle of the specified category registered on these persons;

- one of the parents (adoptive parents) in a large family - for one vehicle registered on citizens of the specified categories;

- chernobyls - for one vehicle;

- individuals who took part in the special risk divisions directly participate in the tests of nuclear and thermonuclear weapons, the elimination of accidents of nuclear facilities on the means of weapons and military facilities - for one vehicle registered on citizens of the specified categories;

- individuals who received or suffered radiation disease or disabled as a result of testing, exercises and other works related to any kind of nuclear facilities, including nuclear weapons and space techniques, for one vehicle registered on citizens of these categories;

- one of the guardians of the disabled person from childhood recognized by the court is incapable - for one vehicle registered on citizens of the specified category;

- persons having vehicles equipped with exclusively by electric motors - in relation to these vehicles registered on these individuals (benefits applied from 2020 to 2025).

Pensioners in old age benefits on the payment of transport tax in Moscow do not have.

Important. The benefits listed in subparagraphs 3-8, 11-14 do not apply to passenger cars with a motor capacity Over 200 hp (Over 147.1 kW).

Individuals benefits are provided according to a statement on the basis of a document confirming the right to benefit. If the taxpayer has the right to receive benefits on several repairs, the benefits are provided on one basis for the choice of the taxpayer.

Privileges do not apply to water, air vehicles, snowmobiles and motorcycles.

In case of (loss), the rights to benefits during the tax period calculus the amount of tax is made taking into account the coefficient determined as the ratio of the number of full months preceding the month (following month) of the emergence (loss) of the rights to benefits, to the number of calendar months in the tax period. In this case, the coefficient is calculated up to three marks after the comma.

Prepared "Personal Rights"

Companies that have registered cars, motorcycles, buses, helicopters, yachts, boats, etc., must in 2016 pay transport tax over the past - 2015.

If you or your company are the owner of a vehicle, according to the laws in force in the Russian Federation, must pay transport tax. As a rule, the payment of transport tax does not cause serious difficulties from individuals. Since the calculation of the tax, the control over the payment is assigned to the tax inspectorate. And they, in turn, are unlikely to forget timely notify you about the need to pay.

As for enterprises, they need to independently expect, pay tax and hand over the declaration. This we will look at in detail in the article.

In 2016, it is necessary to pay a transport tax for 2015. For 2016, pay the tax and report on it in 2017. Companies that pay advance payments on transport tax obliged in I, II, III quarters of 2016 to pay 1/4 from the amount of the tax.

Who pays transport tax in 2016

Transport, as a rule, is registered on the owner, which can be both a private person and an enterprise. All vehicle owners are obliged to pay a transport tax in accordance with CO (hereinafter referred to as the Tax Code of the Russian Federation).

What vehicles are taxed listed in. Here is this list:

- cars;

- motorcycles;

- motor collers;

- buses;

- aircraft;

- helicopters;

- boats;

- yachts;

- boats;

- motorboats;

- hydrocycles, etc.

Not subject to transport tax in accordance with paragraph 2 of Article 358 of the Tax Code of the Russian Federation:

- rude boats;

- engine boats with power up to 5 liters. from.;

- passenger cars for disabled;

- fishing marine and river ships;

- tractors, self-propelled combines, specialists (milkoses, scrolls, etc.), if such machines are used to produce agricultural products;

- passenger and cargo marine, river and aircraft, if the main activity of the company owner of the vehicle is the transportation of passengers and goods.

Transport tax for legal entities in 2016

All private owners of vehicles are already accustomed to the fact that they receive annually from tax Notice We need to pay transport tax and a sample receipt for payment. Citizens of the Russian Federation do not count the transport tax in 2016 on their own. This is governed by paragraph 3 of Article 363 of the Tax Code of the Russian Federation.

But on the enterprises is entrusted with the obligation to independently calculate the transport tax. In accounting, the company is considered correct if the calculation is decorated by an accounting certificate.

In some regions, it has been established that the transport tax is paid at the end of the year. For example, in Moscow, in accordance with the law of Moscow dated 09.07.2008 No. 33.

In the Moscow region, in accordance with paragraph 1 of Article 2 of the Law of the Moscow Region of November 16, 2002 No. 129/2002, the company is obliged to pay advance payments on transport tax on each quarter. The procedure is registered in paragraph 2 of Article 360, paragraph 2.1 of Article 362, paragraphs 1 and 2 of Article 363 of the Tax Code of the Russian Federation.

The size of the advance payment on the transport tax is equal to the annual amount of the tax, in accordance with paragraph 2.1 of Article 362 of the Tax Code of the Russian Federation.

Since 2014, improving coefficients have been introduced to calculate the transport tax for cars worth over 3 million rubles.

Calculation of transport tax in 2016

Transport tax full year Calculate the formula:

Transport tax In 2016, for an incomplete year, calculate with the factor of using the vehicle according to the following formula:

Tax base for calculating transport tax

What is a tax base for calculating the transport tax is defined in. It:

- engine power B. horsepower - for vehicles with engines;

- gross capacity in register tons - for water uncomplicable (tow) vehicles;

- the unit of vehicle is for other aquatic and air vehicles.

Rates for calculating transport tax

Basic transport rates are established by paragraph 1 of Article 361 of the Tax Code of the Russian Federation. On their basis, the authorities establish specific tariffs in accordance with paragraph 2 of Article 356 of the Tax Code of the Russian Federation. Therefore, in the regions of the Russian Federation rates are different.

Basic transport tax rates

Tax object | Tax rate |

Motor passenger cars up to 100 hp | 2.5 rubles. For 1 hp |

Passenger cars with engine power from 100 to 150 hp | 3.5 rubles. For 1 hp |

Motor passenger cars from 150 to 200 hp | 5 rubles. For 1 hp |

Passenger cars with engine power from 200 to 250 hp | 7.5 rubles. For 1 hp |

Motor cars with engine capacity Over 250 hp | 15 rubles. For 1l.s. |

Motorcycles and motor scooters with engine power up to 20 hp | 1 rub. For 1 hp |

Motorcycles and motor scooters with engine power from 20 to 35 hp | 2 rub. For 1 hp |

Motorcycles and motor scooters with engine capacity Over 35 hp | 5 rubles. For 1 hp |

Buses with engine capacity up to 200 hp | 5 rubles. For 1 hp |

Buses with engine capacity Over 200 hp | 10 rubles. For 1 hp |

Trucks with engine power up to 100 hp | 2.5 rubles. For 1 hp |

Trucks with engine power from 100 to 150 hp | 4 rubles. For 1 hp |

Trucks with engine capacity from 150 to 200 hp | 5 rubles. For 1 hp |

Trucks with engine power from 200 to 250 hp | 6.5 rubles. For 1 hp |

Trucks with engine capacity Over 250 hp | 8.5 rubles. For 1 hp |

Other self-propelled vehicles, machines and mechanisms on a pneumatic and caterpillar go | 2.5 rubles. For 1 hp |

Snowmobiles and motor engines with engine capacity up to 50 hp | 2.5 rubles. For 1 hp |

Snowmobiles and motor engines with engine capacity Over 50 hp | 5 rubles. For 1 hp |

Boats, motorboats and other water vehicles with engine power up to 100 hp | 10 rubles. For 1 hp |

Boats, motorboats and other water vehicles with engine capacity Over 100 hp | 20 rubles. For 1 hp |

Yachts and other sailing and motor vessels with engine power up to 100 hp | 20 rubles. For 1 hp |

Yachts and other sailing and motor vessels with engine capacity Over 100 hp | 40 rubles. For 1 hp |

Hydrocycles with engine power up to 100 hp | 25 rubles. For 1 hp |

Hydrocycles with engine power Over 100 hp | 50 rubles. For 1 hp |

Noncommose (tow) vessels for which gross capacity is determined | 20 rubles. For 1 reg. T. |

Airplanes, helicopters and other aircraft having engines | 25 rubles. For 1 hp |

Airplanes having jet engines | 20 rubles. For 1 kgf |

Other water and air vehicles that do not have engines | 200 rubles. For 1 TS |

How to calculate advances on transport tax

In some regions, quarterly reporting periods are established on transport tax. If this order is introduced in your region, you must count advances, the final sum of transport tax to pay for reporting year. The formula will be like this:

If the tax amount turned out to be penny, round it according to the arithmetic rules. That is, less than 50 kopecks are discarded, and the values \u200b\u200bof 50 kopecks are more rounded to the full ruble. This allows you to make paragraph 6 of Article 52 of the Tax Code of the Russian Federation.

Period for calculating transport tax

You need to pay transport tax from a month of setting up to a month of removal of transport from accounting.

The transport period is the number of months when you owned a vehicle, that is, when it was registered on you. This is important when calculating the transport tax, if you were the owner of less than 1 year.

A month in which the vehicle was registered, and the month in which it was removed from the register, they are considered as full months. If you put and removed from the account of the vehicle for one month, use 1 (one) month in the calculation.

If you do not use your transport, your car suffered in an accident, is not subject to recovery, written off from the balance - remove it from accounting in the traffic police. Otherwise, pay transport tax.

If your transport in the hijacking, you definitely need to take a certificate from the police and provide it with IFTS. During the search for transport, the tax does not have to pay you. Such actions are regulated by the letter of the Ministry of Finance of Russia dated 04.23.2015 No. 03-05-06-04 / 23454 and the letter of the FTS of January 15, 2015 No. BS-3-11 / 70 @, the letter of the Ministry of Finance of Russia dated 09.08.2013 No. 03-05-04 -44/32382.

LLC "Akt" has owned a car Mazda 3 MPS (registration sign - x657en177, VIN GAIZZZ6AEL077567). Machine power - 250 liters. from. It is registered with the company in May 2015. Consequently, in the tax period, the company owned the machine eight full months (from May to December).

The share of the firm in the right to the vehicle is 1/1.

A special coefficient on this machine will be 0.6667 (8 months: 12 months).

In the region where the "asset" works, the transport tax rate for such a power is 25 rubles / l. from. Mazda 3MPS tax for 2015 amounted to:

250 l. from. x 25 rubles / l. from. x 1 x 0,6667 \u003d 4167 rub.

Advance payments on tax will be:

In the first quarter - 0 rubles. (250 hp x 25 rubles / l. With. X 0.0000 x 1/4);

- in the second quarter 1042 rubles. (250 hp x 25 rubles / l. S. X 0,6667 x 1/4);

- in the third quarter 1563 rubles. (250 hp x 25 rubles / l. With. X 1,0000 x 1/4).

When paying a transport tax in 2016

Regional authorities independently establish the procedure and timelines for the payment of transport tax and advance payments. However, the period of payment of transport tax is no earlier than February 1 at the outcome of the reporting year.

Accordingly, in 2016, we pay transport tax for 2015 and its payment - no earlier than February 1, 2016.

Transport tax Declaration in 2016

Only enterprises that are owners of vehicles are reported on the transport tax. This duty does not apply to individuals - transport owners. The Declaration must be submitted to the Tax Inspectorate at the location of the vehicle or at the place of registration. the largest taxpayer. The reporting procedure is established in Article 363.1 of the Tax Code of the Russian Federation.

No later than February 1, 2016, enterprises must submit to the Tax Inspectorate for the Transport Tax Declaration for 2015.

The 2016 Transport Tax Declaration is obliged to submit to the Tax Inspectorate no later than February 1, 2017.

The form of the Transport Tax Declaration and the procedure for its completion were approved by order of the Federal Tax Service of Russia of 20.02.2012 No. MMB-7-11 / 99 @.

If a average number Workers last year exceeded 100 people, it is necessary to donate statements in electronic form.

Accounting for transport tax in 2016

Transport tax calculations need to be reflected on credit account 68 "Calculations for taxes and fees". Discover the 68 separate subaccount. For example, "Calculations on Transport Tax".

Make such wiring when charging and paying the transport tax or advance:

Debit 20 (23, 25, 26, 44 ...) Credit 68 subaccount "Calculations for Transport Tax"

- accrued transport tax / advance payment on transport tax;

Debit 68 subaccount "Calculations on Transport Tax" Credit 51

- Transport tax / advance payment on transport tax paid.