Buying an apartment in a mortgage step-by-step instruction. How to take a mortgage in Sberbank: Step-by-step instructions. How is the transaction on a mortgage using a bank cell

Buying an apartment is serious. Many Parties participate in the process, although the mainstream is the buyer with the seller and the lender, which finances this transaction. Also necessary to collect a lot of documents and, perhaps, to spend a lot of time to harmonize the terms of the loan. However, it only seems that the mortgage design is something impossible.

Preview

The preliminary stage can also be divided into 3 parts. The first will be in finding a suitable loan offer. It is assumed that before going to the bank, you at least familiarize yourself with the overall situation in the mortgage market, the average rates and conditions that you can offer. This can be done on thematic sites, resources of banks themselves, mortgage brokers or forums.The second part is the search for real estate that you will buy on credit. At this stage, you will have to solve you will look for a suitable apartment yourself or contact the realtors. If on the services of the intermediaries you will save, then again, it is necessary to find out what the requirements for the future pledge of banks are imposed.

The third part is intelligence. It's time to visit the selected bank, talk preliminarily with the credit consultant, clarify the conditions and take a list of documents that will be required to design a loan.

Preliminary statement

This stage is also allocated separately. It implies the process of collecting documents and providing them with a bank for consideration. Documents will be a lot:- certifying personality, marital status, etc.;

- indicating income;

- on purchased housing.

The bank, having considered the evidence of your creditworthiness and trustworthiness attempting by you, reading your choice of housing, will lead a preliminary verdict. This is not the conclusion of a loan agreement, but a big step towards him.

Choosing a creditor

And here it is impossible not to say that even having a preliminary approval, you do not need to stop at this bank. You can submit the same package of documents (photocopies) in 2-3 financial structures. This will allow in case of refusal of one of them to save time, because each bank may consider the mortgage documents for several weeks. And if approval you get from all creditors, get the opportunity to choose the most favorable conditions for you.Immediately decor

Decor mortgage loan - This is not just the signing of a loan agreement, which in itself could be reached by a separate stage. The registration includes assessment and insurance of the purchased real estate, coordination of the points of the contract, signing it, registration of the transaction in the relevant instances.At the same time, you are not required to look for the insurer and appraiser, banks offer those professionals with whom they themselves worked. But in the text of the contract it is necessary to look in person personally - and do it until the day of signing, asking the form of a typical mortgage contract in the bank. Do not rely on the words of the consultant - he can forget about something or silent.

Trusting mortgage mortgages and technologies

If the process seems too difficult to you, you can always seek help. As already mentioned, when choosing a property, you can refer to the realtors. Most of these specialists are familiar with the requirements that are putting off banks to mortgage housing, and this is an additional time saving.Questions related to credit documents, choices credit Program And the creditor's approval can be entrusted with a mortgage broker. Of course, such specialists can be found so far only in large cities, but their services are increasingly represented at a good level.

I want to mention another innovation. In an effort to save time - its borrowers, and at the same time and their expenses, many lenders allow you to leave

Mortgage is currently one of the available ways to acquire housing to many Russian families. According to analytical agencies from 11 to 50% of families can afford it in different regions. Linders the possibility of KHMAO. How is the transaction on the mortgage, and what steps should be taken when it is design, is told in this article.

The main differences of mortgages from other types of lending is:

- her goal is to acquire real estate

- very long time (from 10 to 20, and sometimes up to 30 years)

- a large amount of loan (usually several million)

- attracting family members as co-coaches

- prost property is used as collateral

- insurance of pledge on risks of damage and spending rights

- life insurance, health, borrower performance

In order to support certain categories of citizens, Special programs have been developed mortgage lending. If the borrower does not apply to any of the social groups, he has the right to use standard offers.

Standard

The standard mortgage is the most common form of lending to those conditions that offer banks for secondary housing, apartments in new buildings, residential buildings with land. The borrower uses only own means to calculate with the bank. The size initial contribution From 10 to 20% of the cost of the apartment, the rate is from 9.1 to 13.75% for secondary housing, up to 14.25% for apartments in new buildings. The loan amount is not more than 70-80% of the price of the deposit of housing. The required age of the borrower is different in various banks ranging from 18 to 75 years. The upper limit of age is defined on the date full repayment Mortgage. Rates are lower for salary customers, borrowers who have accounts in a bank, positive credit history, and with personal insurance.

Social

Social is called a mortgage with state support for the poor who need to improve living conditions, which have no sufficient amount of own funds for calculation. A third party in the contract is the state. Such programs are implemented at the regional level, so they may be different in different regions. More detailed information will be given in the local authorities and the regional branch of AHML.

State support can be in the amount of 10-50% of the cost of housing in the form:

- reducing rates due to budget co-financing

- subsidies of part of the cost of purchased housing

- issuing subsidies to buy in installments of housing from social Fund at a price of 1.5-2.5 times lower than the market

Social mortgage distinguishes:

- Minimum bet (not more than 7.55%)

- Minimum contributions (10-20%)

- Longer loan period

- State subsidies for payment of the first contribution, percentage of mortgage, early repayment of debt

- Postponement of payments or restructuring up to 1.5-3 years. For example, Sberbank to young families with children will issue a mortgage at a rate of 6% for 3-5 years and 9.25% further.

- Reducing the size of monthly payments during refinancing

- One-time subsidies (for example, maternal capital)

The state helps doctors, teachers, scientists, large families acquiring new buildings at a rate of up to 12%. Restrictions on the area of \u200b\u200bapartments are established: no more than 32 sq.m. per, 48 on two, then 18 sq.m. For each family member. The terms of the help of this social group is not older than 35 years old (Doctor of Sciences up to 40 years), the availability of the need. They are available mortgage under 8.5% and payment up to 30%, subject to its own funds, no less than 10% of the cost of housing. Young families with children in separate regions support will be provided in the amount of up to 40% of the price of new buildings. There are regional programs with a payment of 100% of the cost, the borrower extends only interest.

Mortgage in Alpha Bank

Credit limit:

from 60,000 to 50,000,000 rubles.

30 years

from 8.49%

from 21 to 70 years

Consideration:

Mortgage in the bank Opening

Credit limit:

from 500,000 to 30,000,000 rubles.

30 years

from 7.95%

from 21 to 68 years

Consideration:

Credit on great amount in Sovcombank

Credit limit:

from 150,000 to 30,000,000 rubles.

10 years

from 11.9%

from 20 to 85 years

Consideration:

Cash loan in the Loco-Bank

Credit limit:

from 100,000 to 5,000,000 rubles.

7 years

from 10.4%%

from 21 to 68 years

Consideration:

For young family

A young is considered a family in which the age of spouses is no more than 35 years old. If the family needs housing and stands in line in the local administration to improve living conditions, it has the right to receive a subsidy:

- 35% of the cost of housing in the absence of children

- 40% if available

Money is allocated to the first contribution of the mortgage or as a supplement to its own means when buying an apartment. At the same time, the family must confirm its financial consistency with 2-NDFL references or from the bank status bank.

Military

The servicemen under contract and police officers after three and 10 years, respectively, are entitled to use funds accumulated on their personal accounts. Provided by subsidies only those who need improvement housing conditions. Banks are issued by a military mortgage with the conditions of its repayment to age of 45.

5 basic conditions for obtaining

Mortgage design is based on federal laws, and the requirements for borrowers can be determined independently. There are conditions common to all:

- Citizenship of the Russian Federation

- Registration Permanent in the Bank's Presence Region

- The age of the borrower is 21-70 years old. Some banks expanded the age limits from 18 to 75 years.

- Work experience is not less than a year and the last place from 6 months.

- Total income should be such to ensure not only mortgage payments, but also the normal existence of a borrower and his family

How to issue

The process of issuing a mortgage consists of several stages requiring an analysis and an assessment of the consequences on each of them.

Selection of the program

Analyzing the proposals of many banks, having expedted a previously, which amount can be obtained, and the size of monthly payments, the borrower compares them with their capabilities. If there is grounds for getting preferential mortgage With state support, it is always recommended to use them. It should be borne in mind that the state programs act on new buildings, the loan amount does not exceed 70% of the value of the collateral on the evaluation report, and the first installment bank will ask to place on the account. Monthly contribution should not be above 30% total income families.

List of documents

By selecting a mortgage program and a bank, it is necessary to proceed with the preparation of documents for the borrower, purchased housing for the preferential program. Documents are prepared in accordance with the requirements of the authorities and credit organization.

You will need:

- originals and photocopies of documents on all family members

- on mortgage property

- certificate of Salary 2-NDFL

- certified copy of the employment record

- employment confirmation

- certificate for state support (if available)

Request

A loan application can be issued online in the selected bank or personally visit the department of a credit organization with a passport and documents and, following its recommendations, issue an application form in the bank.

Select an object for mortgage loan

The object of the mortgage can be secondary housing, new building, residential building on the plot. Choosing an object, the borrower must proceed from financial opportunities families. Banks offer preferential conditions Mortgage, if the borrower buys accommodation from developers partners. Using state subsidies, choose an object, which is recommended by the authorities. Documents on the selected object impose a bank to coordinate.

Registration of collateral

By choosing housing and coordinating it with all parties (the Bank, the authorities, the FIU), proceed to the design of the lending contract. For collateral you need to order an estimate of the cost of housing in the company agreed with the bank and acceptability in the form of a pledge. The evaluation report also transmits the Bank. Examined documents credit Committee. Notifies the borrower on the form of pledge.

Conduct sale

The transaction includes several stages:

- The contract for the sale of housing with the property owner is concluded.

- A loan agreement is concluded with a bank, in which the term is necessarily indicated and the amount of the loan, the rate, termination conditions, early repaymentSanctions for late payments.

- The contract indicates that it is a deposit, its cost, insurance requirement.

- It should be very carefully reading all the points of the contract. This bank gives a borrower at least five days.

We register a mortgage and property rights

Mortgage agreement is registered in Rosreestre in accordance with Art. 20 №102-ФЗ. Application for registration fill the borrower and bank. A contract for the purchase and sale of real estate and a collateral contract (if it is compiled with a bank separately) or mortgaged. Mortgage registration is also possible on the application of the notary, a certified transaction. If the mortgage is decorated, the mortgage registration is carried out on it.

We decorate insurance

At the request of the Bank and in order to reduce the mortgage rate, the borrower insures the property transferred to the deposit, from damage and loss of rights. Insurance amount Not less than the cost of the loan, taking into account all percent. Most banks demand to insure the life and working capacity of the borrower. Personal insurance And in the interests of the borrower, so that the mortgage obligations in case of accident or death have not crossed his heirs. The end of the process is the transfer of money to the seller specified in the contract of sale in the way.

How is the transaction using a bank cell

Transferring money through a leased banking cell is one of the safe and reliable methods for calculating real estate.

The procedure is as follows:

- The buyer rents a cell (minisaph) for a certain period.

- The representative of the bank, the buyer and the seller recalculate money and put them into a cell to store the bank.

- The bank checks the authenticity of the bill and blocks funds for a coherent period.

- Typically, the registration of the transaction takes up to 7 days, at this time it is drawn up a cell lease agreement.

- The seller, fulfilling the terms of the contract of sale, confirms these bank documents and gets access to the cell. Most often, the condition is the fact of registration of the ownership of the buyer for the acquired real estate.

The cost of the lease service cells, authentication of bills will be up to 5 thousand rubles.

How long is made in Sberbank and other banks

The time that makes the mortgage decoration in Sberbank and in other banks depends not only from banks, but also from the borrower itself. Usually, the mortgage is derived from one to two months. Consider time gradually.

- The borrower collects documents about income, family composition, employment, government subsidies, etc. In order to apply for a mortgage to the bank. It will be needed for this about a week.

- Contacts documents to the bank and makes an application. To study the client and its solvency, the bank takes 5-7 days

- After approval of the application, the buyer chooses real estate, harmonizing it with the bank and authorities (with their participation). It is also required to issue all documents for the purchased property, including its assessment in the evaluation company. At this stage, the preparation time is determined by the rapidity of the borrower itself, but it is not less than a week

- Registration and signing of the mortgage agreement on presented documents. The borrower has the right to learn the contract for five days. In the end, it may again get a week. At this stage, the depreciation of insurance contracts and the borrower is required. Rent a bank cell and placing money in it

- Mortgage registration in Rosreestra takes 4-7 days. After registration used by the state loan (subsidy, maternity capital, etc.) is sent to a partial repayment of debt

Features of programs

Welcome! Mortgage at first glance is a rather complicated process. In this post, we will tell you about the stages of the mortgage, so that you have formed a clear picture of the whole transaction. Step-by-step instructions for buying an apartment in a mortgage will help you understand what you need to do at each stage and what you need to pay special attention.

So, mortgage from scratch. Let's start to deal with this question.

Recently, more and more Russians make a decision to buy housing using a mortgage loan. This scheme has its advantages: no need to take money from relatives and acquaintances, you make an apartment immediately to the property, and you can pay on the loan in accordance with your needs.

Unlike consumer creditwhere the security is guaranteed individual or absent at all, in mortgage lending, the property is accomplished, which is bought by the Bank's client. This means that the apartment is superimposed on the apartment (without the consent of the bank - the creditor will not be able to sell, give, reorganize square meters), but you can live in it, make repairs, etc. After the obligations are repaid, the burden is removed.

Since in most cases, an individual has enough own funds, then mortgage loans are distinguished by a significant amount of lending (from 300,000 rubles to several million), long credit period (up to 30 years).

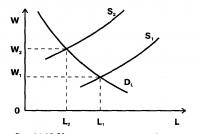

When making a mortgage loan, you can choose a debt repayment scheme: annuity payments or differentiated. In the first case, payments always have one size, percentages are distributed throughout the period of lending. With differentiated payments, the amounts are descended: first contributions are maximum, then gradually go down to decline, interest are accrued to the residue. What type of payments is more profitable? With differentiated payments, especially when maximum time, the overpayment amount will be less, but the income of the borrower (or family) should be higher.

More detailed about the housing you can learn from our past post.

Let's start to understand how the mortgage is drawn up by step.

Step-by-step instruction

Generalized can be allocated main stages of a mortgage transaction:

- search for a creditor (definition of the amount and conditions for issuing funds, approval of the application),

- selection of accommodation options, approval of the Bank's application,

- signing the Credit Treaty of the Purchase Treaty,

- registration of the transaction, accommodation of housing in property.

Mortgage design is a responsible question. If knowledge and time is not enough to independently analyze the mortgage lending market, you can use the services. For a certain amount, the specialist will select the most profitable option depending on your capabilities and wishes.

If the budget is so limited, it is worth considering bank's proposals to independently and choose a suitable offer. By visiting the branch of banks or the official websites of companies, you will familiarize yourself with current lending conditions and you can choose profitable.

Use our service "" to most quickly find a profitable offer on the market.

Upon desire to arrange a mortgage of the procedure for action:

- decide with the lending object (apartment in a new building, on secondary market, room, proportion, individual house, land, townhouse, etc.),

- find out whether there are special offers in the bank (young families, state support, etc.),

- determine the cost of real estate: Calculate the amount of the initial contribution and loan,

- request in the bureau credit stories his ki

- clarify the requirements for borrowers in terms of marital status, income, etc.

- decide on credit and payments depending on solvency.

Answer for yourself for each question should be gradually to avoid mistakes and unforeseen spending.

Selection of special programs in the bank

- military mortgage (the state lists the funds to the individual account of the serviceman for the accumulation of the initial contribution, when making a loan - pays for debt),

- mortgage loans to young families (reduced percentages for spouses who have not reached the 35th anniversary),

- mortgage S. maternal capital (to support families with two or more children)

- mortgage loans for "salary" customers (for customers receiving salaries to a bank account, a reduced rate is offered).

What else to pay attention to when choosing a bank? On the need to pay additional commissions:

- commissions for maintaining or opening a settlement account (if available),

- insurance size (borrower insurance, title insurance, insurance of real estate object - depends on the tariffs of the insurance company with which the Bank cooperates),

- the cost of making a real estate market value report.

Apply for credit

When you decided on banking program And they made sure that you meet the requirements, you can safely apply for a loan. To purchase an apartment in a mortgage, such documents must be transferred to the bank:

- passport of a citizen of the Russian Federation of all participants in the transaction (borrower, coacher (spouse), guarantors, if any),

- marital status documents

- documents confirming income,

- certificates, graphs, documents on current liabilities (on the payment of alimony existing loans, etc.).

A package of documents may differ depending on the requirements of the bank. Snaps may also be required, insurance policy, subscription documents, driver's license, etc. When submitting documents, you need to fill out the questionnaire and application. It is advisable to specify the most accurate and true information, it will help to increase the chances of approving the application.

After 1-5 days, the credit inspector will report on the decision of the bank and will report the highest possible amount to the extradition, approved rate and payment schedule.

If the application is approved (the solution is really 2-6 months), it's time to start searching for a suitable apartment.

Select an object for mortgage loan

When buying real estate in the house under construction, it is worth considering options only in houses accredited in the bank. This simplifies the procedure for a mortgage transaction and will protect you from fraudsters. Money is listed directly to the settlement account of the developer or contractor, the right of the demand for the apartment will go to you.

Documents on an object for granting a bank:

- preliminary contract purchase agreement (an agreement on intent, investment contract, etc.), concluded with the developer,

- documents on the payment of the initial contribution (receipt, cash receipt) from the developer.

Thus, the packages of real estate documents are minimal, but at the same time purchase square meters The primary market is associated with risks - the bankruptcy of the developer, disruption of the deadlines, etc.

In the case of purchasing an apartment in the secondary housing market, the package of documents is significantly wider and in each specific situation may differ. So, you need to collect:

- expanding documents (certificate of state registration of property rights, purchase and sale agreement (or donation, on the division of property, etc.),

- copies of salary passports,

- copy of the personal account

- technical, cadastral passport,

- extract from the USRP.

Also requested:

- documents confirming the right- and the capacity of sellers (certificates from dispensaries),

- certificates about the absence of debts on utility payments, for property tax,

- other documents.

If the property is bought with a land plot, the list on the application is complemented by the documents on the ownership of land, about the boundaries of the land plot.

After prior approval, the application should order a report on market assessment, provide insurance policies.

Conclusion of the loan agreement and the issuance of the loan

When the bank issued a positive decision on the application for a mortgage, the most exciting and responsible point comes - the conclusion of the loan agreement and the issuance of credit funds.

Until now, in banking institutions there are two schemes of issuance: after state registration Transactions and using a bank cell. In the first case of algorithmcakers such: on the day of the conclusion of credit and security contracts, all buyers and sellers are visiting the purchase agreement - sales of real estate. On the same day, the borrower transfers the owner of the apartment an amount of the initial contribution of cash or by transferring to the seller's account, a receipt is made about recording.

Further, all documents are transmitted to the registration authority and within 5 working days there is a change of the owner of the apartment. For the final calculation, the certificate is transferred to the bank employee, on the basis of which the amount of credit funds is credited to the borrower's account, and then listed by the seller. Confirmation of the amount and final calculation is the second receipt.

How is the transaction on a mortgage using a bank cell

When renting a cell, credit funds are issued on the day of the signing of credit documentation. The sum of the initial contribution and credit funds in the presence of a credit inspector, borrowers and sellers is laid in the cell and is there until the state registration of the transaction. After granting a certificate for an apartment to the bank, the cell is opened in the same part, the money is transferred to the seller with writing receipts.

Registration of the transaction

In order for the transaction to be conducted in the registering authority (justice, Rosrester, etc.), it is necessary to apply to the sellers and customers with the indication of personal data. The application must be applied to the guidelines, copies of passports, receipt of the payment of state duty. If the seller property is jointly acquired by property, it will also be necessary to compile the consent of the spouse to alienate housing in the notary.

To register transactions with encumbrance, it will take 5 business days, while ordinary real estate purchase transactions are registered within 30 days.

Features of mortgage programs

- Buying property in the secondary housing market

Since this segment is most in demand, the chance to face fraudsters is the most large - the apartment can be pledged, be illegally alienated, etc. If you doubt the legality of sellers, we recommend issuing the title insurance - it will save you from loss of housing in case Recognition of the transaction is invalid.

In addition, ready accommodation must comply with the requirements of the Bank. For example, it will not be possible to buy an apartment on the 1st floor with a balcony attached on Earth - such redevelopment is very difficult to legalize. The same applies to other redevelopments - displacement of wet dots, demolition of supporting structures, etc. As a result, the bank will not miss such a loan application.

There are other requirements for the object of the pledge (each bank they have their own): housing should not be verth, be in emergency condition, should not have wooden floors (in high-rise buildings), remoteness from the city is no more than 30-50 km and others.

- Buying property in new building

The acquisition of real estate in the house under construction is certainly conjugate with risk, as often the borrower becomes the owner of square meters even before they are built. This promises the possibility of poor-quality construction of walls, ceiling, gender, as well as poor repair and finishing.

In addition, as mentioned above, there is a risk of bankruptcy of the developer, which will lead to the fact that at home will not be erected at all. To protect yourself from the illiquid property of banks require a guarantee of 1- 2 individuals.

It is also worth noting that for the entire period of construction, the borrower owns the right demand, the ownership of it only after the house is transferred and recognized by residential.

- Acquisition of Shares, Rooms

Buying a share or a separate room in the apartment is possible using a mortgage loan only if after issuing a loan all properties will belong to the borrower (in other words - there must be redemption of the last share). As the mortgage is drawn up on the room and we have previously told the share.

- Purchase of the House and Land

Individual house on land plot, Townhouse is considered less liquid housing, therefore banks reluctantly issue loans - the rate in such a lending direction is higher. About Tom, told in a separate post.

We hope you have no questions left. If they are, please ask them in the comments. We will be grateful for a positive assessment of the article and repost in social networks.

Last updated: 02.02.2019

Buying an apartment through a mortgage is a responsible and important solution in the life of every person. Therefore, a potential borrower first need to evaluate its own financial capabilities. It should be considered:

- The rank size of monthly payments (as a rule, it is not more than half of the income received);

- The cost of the apartment;

- The sum of the initial contribution (usually 30 and more% of the cost of housing);

- View of the apartment and the estimated area of \u200b\u200bits location.

Instructions for buying an apartment in a mortgage involves the implementation of the following procedures.

Choice of the Bank and Mortgage Program

Before you take a mortgage to buy an apartment, it is necessary to analyze the conditions and proposals in various banks. Determining indicators when choosing the optimal option are:

- The sum of the mortgage loan;

- Interest rate, as a rule, it vary from 11 to 15% per annum, and depends on the bank and the desired amount;

- Encumbrances (terms of issuance and maintenance);

- Loan currency;

- Collateral conditions (including guarantee requirements);

- Payment timing;

- Insurance conditions (including mortgage objects);

- The presence of penalties for early repayment.

Choosing several suitable banks and mortgage programsIt is necessary to carefully examine the subtleties of the mortgage product based on consultations obtained as a result of a ringing or visiting.

It is also necessary to remember that many banking institutions impose requirements and restrictions on alleged borrowers, namely:

- Constant registration in the territory determined by the bank;

- A certain experience at the present place of work (the total employment experience is at least 1 year, last place Over 4-6 months);

- Positive credit history;

- No criminal record;

- Lack of other parallel loans;

- Legal capacity;

- Age qualifications (min. Age 21 years, the maximum is determined by the moment of repayment of the loan, by this year the borrower must be no more than 65-75 years)

- If cooked cars are involved, then no more than 3 people, the degree of kinship - spouses, brothers, parents, 3rds;

- If a borrower is a man under 27 years without a military ticket - he will refuse him in the loan. That is, the military-ridden, who has not passed the service that has a delay (for example, in connection with the study), and there may be no borrower (the elimination of military personnel, in stock).

Submitting an application at the same time in several banks, You can find out the specific mortgage conditions and the order of buying an apartment in each of them. After approval of the application, it is necessary to start choosing a suitable apartment. To carry out this procedure usually assigned 2-3 months.

Information on preliminary conditions on mortgage lending is presented on the official websites of banks.

The deadline for approval of the mortgage application is from 5 to 10 business days. In the meantime, all the documents provided are carefully checked, so you need to start looking for housing only after the firm consent of the credit institution.

Important: the bank may refuse to issue a loan and concluding a contract, only if the presented documents show that the potential borrower is unable to return the loan and interest on the basis of its financial capabilities. The remaining motives of failure are illegal and they can be appealed to the court.

Selection of real estate

When choosing a property, the bank's requirements should be taken into account to the mortgage object. Usually:

The apartment in the secondary market should:

Residential house or cottage should:

- Located in the zone defined by the mortgage program;

- Have a year-round driveway;

- To be suitable for year-round accommodation:

- Comply with plumbing standards (have heating, sewage and water supply systems);

- Complete cadastral records.

To select real estate in new buildings, bank institutions, as a rule, offer objects from the developer bases that have passed official accreditation. For this, special programs are provided, including state-in support for mortgage lending for the primary housing market.

Example: Bank "Deltacredit" offers loans under the program "Mortgage with state support" under 12% per annum. Customers can take advantage of the facilities under the conditions approved by the Government of the Russian Federation.

If the borrower independently chooses an apartment on the primary market, banks usually make the following requirements to developers:

- Term on the market housing construction - more than five years;

- Compliance with appraisal standards financial Sustainability According to the Federal Law 214-FZ;

- Lack of delays (more than a year) in the completion of construction and delivery of objects during previous years;

- The presence of point and mass development objects (two or more), commissioned;

- Lack of initiation of bankruptcy procedure or decision on liquidation;

- Other requirements.

For professional assistance in choosing real estate and confidence in the legal purity of transactions, banks offer to use the services of real estate agencies that are their partners. To do this, they provide customers with the corresponding partner bases.

Property valuation

For the timely execution of obligations under the contract, mortgage conditions determine the provision of liquid collateral, which most often also serves the acquired property of real estate. The market value of the collateral is the starting point for determining the amount of the mortgage loan, in connection with which the assessment of the collateral is an important indicator in the lending process.

Most banks, to carry out a reliable assessment of the loan, offer to use the services of appraisal organizations from among their partners. At the same time, they do not limit borrowers in the selection, however, if the evaluation report is provided by an organization that has negative experience with the bank, the latter has the right to initiate an additional check.

Also, if the unreliability of the estimates provided or violation of the requirements of the Evaluation Legislation, the banking institutions have the right to send motivated complaints to regulatory organizations (SROO). Therefore, experts recommend using partner appraisers services.

The assessment certificate is provided to the bank-lender.

List of documents and submission of the Bank's application

In most banks provided by documents for the purchase of a mortgage apartment are:

- Application application on a mortgage loan, you can arrange it online on the bank's website;

- By customer, Photocopies of the following documents:

- Photocopy of passport;

- Certificate of income in the form of a specific banking institution or 2-NDFL;

- Certified copy of the employment record;

- SNILS - Insurance certificate of state pension insurance

- Military ticket for male assignments;

- Formations on education (certificates, diplomas, etc.);

- Marriage / divorce certificate and marriage contract (if available);

- Certificates of the birth of children;

- Certificate of registration in tax authority individual at the place of residence in the territory of the Russian Federation (about the assignment of the taxpayer identification number (INN);

- Documents on the Customer Debt Comments (or previously executed);

- On real estate:

- Guide documents (agreements, acts, etc.);

- Technocamentation (cadastral passport or technical transport);

- Photocopy of passports of real estate sellers.

Documents on other regular income and a marital status can also be requested.

Example: The married couple appealed to the bank to receive a mortgage for 2,500,000 rubles, both (total monthly income of 50 thousand rubles), no children, age 30 years. They received a refusal to the bank, since the income did not allow to arrange a loan - living wage Each is 15,000 rubles. Exit: To take a smaller amount - 1,500,000, or look for an additional coacher, not retirement age, with wages not less than 25,000 per month.

If in the object of collateral, registered capable adult persons who are not borrowers, banks are asked to additionally provide signed and certified notarized statements about their awareness in that:

- The apartment in which they live is transferred to the mortgage;

- In the event of the failure to fulfill the obligations prescribed in the mortgage agreement, the apartment will be drawn to the apartment, up to the eviction of the applicants.

If the object of collateral is registered persons who are not close relatives of the pledger, banks additionally require explanations about the need to register the specified persons in this facility and documentary confirmation of the property in these people where they can be registered.

Important: As a rule, banks are not acceptable to ensure that there are minors and / or incapable faces among the property owners of the property transmitted as collateral.

Conclusion of a loan agreement

Before signing a loan contract purchase agreement requires his careful study. You should pay close attention to all encumbrances and potential expenses, especially on the subject of hidden interest, for which it is recommended to translate them into numbers.

As a rule, hidden interest consist of various commissions (for cashing, account maintenance, etc.) and mandatory deposits defined in the percentage ratio from the sum of the mortgage loan.

Example: When obtaining a mortgage loan of 1 million rubles at a rate of 10% per annum, annual payments without hidden interest will amount to 100 thousand rubles (1 million * 10%). Challengement of one commission for cashing in the amount of 2.8% will lead to an increase in interest rates up to 12.8% and additional payments in the amount of 28 thousand rubles (1 million * 2.8%).

Important: By the decision of the Presidium of the Court of Justice of the Russian Federation No. 8274/09 of 11/17/2009, banks are forbidden to charge a commission for opening and maintaining a loan account.

If the bank imposes commissions, making them mandatory to obtain a loan, then it must indicate these burdensions in the contract and with the disclosure of an effective interest rate. Passing the stages of purchase, when signing the contract, it is necessary to require the disclosure of associated costs from the bank in order to determine the real value of the mortgage.

It should also be paid to the conditions for resizing percentage. Many banks provide such an opportunity unilaterally without the consent of the borrower. It is fraught with the fact that under certain economic situations the bank can increase the percentage and credit for the client will become unbearable. Therefore, conditions should be made to the loan agreement providing for a change in interest or loan returns only by mutual agreement of the parties.

Another important condition is the opportunity to pay off the loan ahead of time. This is provided for by law. However, banks go to cunning and determine this right with additional payments.

For instance, in the loan agreement it may be provided for that in the case of early repayment of the loan, the borrower pays the Bank one-time payment in the amount of 1% of the return amount over the early returned loan.

Registration of a transaction with the seller and transfer of money

The next step of the purchase procedure, after the conclusion of the loan agreement, will receive money and acquiring selected real estate. The transfer of money is key Moment Transactions. As soon as the money turns out to be in the hands of the buyer, you can deal with the design of an apartment purchase contract *. Relations between the parties are reflected in the contract of sale, which is an important condition of which is the cost of property and payment procedure. Payment procedure can be carried out:

- In cash (in hand);

- Non-cash payment (transfer to the seller's account);

- Through a bank cell.

Often, banks issue a loan on the conditions of initial registration of the purchase and sale of real estate and mortgages, and only after that issue borrowed funds. In such cases, the acquisition of real estate is carried out at the following steps:

- buyer to inform the seller about the concluded loan agreement and negotiate the transaction with the condition of delaying payment

- pays an advance to the seller from own funds

- registration of transactions and mortgages

- the Bank provides evidence of a concluded transaction and registration of the mortgage, on the basis of which money is issued.

- ultimate calculation with the seller

As a rule, sellers go to such conditions, since after registration of the mortgage, the Bank issues credit funds in the coming working days. And the commission of sale without payment guarantees the seller a deposit by virtue of the law. So the seller has no risks.

The purchase and design of the apartment is carried out in Federal Service State registration, cadastre and cartography (Rosreestre). With its conclusion, it is important to achieve an agreement on all important conditions that will not allow this transaction not to take place.

Insurance and transfer to the mortgage

To conclude a mortgage agreement, you need to go through the procedure mandatory insurance Login real Estate From the risks of damage and loss. This procedure is provided for by the Mortgage Law.

Often, banks require the life insurance of a borrower or other risks. The decision to sign an agreement with additional types of insurance is the solution of the borrower, because it leads to an increase in loan payments (hidden percentage).

This is followed by the process of issuing a mortgage agreement and mortgage. The mortgage agreement is registered in Rosreestre, which will not allow the borrower to make any actions with the object of real estate without the consent of the bank, the holder of the collateral. The mortgage remains at the banking institution and allows him to resell the right of claim under the contract of collateral.

Methods to challenge overdue debt on loans

Overdue loans negatively affect the activities of any financial organization, Up to its vitality. In this regard, banks will improve the process of working with problem loans.

Work with debtors comes through a constructive dialogue. If it is determined that the financial difficulties of the borrower are urgent, banks go to the loan restructuring by:

- Changes in payment schedule;

- Loan prolongation;

- Changes% bet.

Eah, underwriting loan revealed problems in terms of the solvency of the borrower, the Bank sends him notifications with the requirements of debt repayment, negotiates with him. During the negotiations, the consequences of non-payment of debt are explained, up to the possibility of transferring a case to court instances (to the recovery of debt forcibly).

It is worth noting that evasion from paying debt is a criminal act. Therefore, it is necessary to use all the possibilities for paying debt on credit Treaty, and better in voluntary.

What to do if there is no money further paying a mortgage loan

All sorts of nuances should be taken into account, for example, the loss of work, deterioration of health, etc. If you delay the payment, banking workers start calling the debtor and remind of debt payment. If the answer to this did not follow the bank sends a postal notice of the urgent payment of existing debt within 10 days. If nothing followed by this reaction, the mortgager has the right to apply to the court, where the decision will be made about the early recovery of the entire remaining loan amount and interest, and the sale of the apartment at the auction auction.

The apartment at the auction is sold on a collateral value, which is usually less than the market. Therefore, when concluding a mortgage agreement, attention should be paid to the amount of collateral value and try to bring it to the market level.

In this case, after the sale of the apartment, the debtor will receive only the amount paid by them on the main loan for a minus%, also for a minus fine imposed by the bank and then, provided that the sale of the apartment will remain money.

Example: The client issued a loan to buy an apartment in the amount of 3,000,000 rubles. For 2 years, the bank returned with interest of 500,000 rubles. At the time of recovery, the debt before the bank is at the court of 2,700,000 rubles. (credit balance + interest due). The deposit value of the apartment was 2,300,000 rubles, and in fact at the auction sold for 2000,000 rubles. As a result, the borrower should have 700,000 rubles to the bank (this residue is covered by the sum insured).

That is, the debtor remains in the minus - loses the apartment and the amount of paid%, pays the penalty to the bank, which is impressive amounts. The remaining funds go on the repayment of judicial and other costs, and the bank (in account of the repayment of the loan issued earlier).

But since the process of appealing for the apartment is quite long enough, during which time it is advisable to find a job and repay debts:

- In case the debtor to court or even in the process court session will find a job, etc. and will pay off current debt, perhaps a peaceful settlement of disagreement, since banks are also not profitable to contact the sale of apartments.

- If it comes to court - the debtor can be struggling to reduce the amount of the penalty (under certain conditions it can be reduced).

If you have questions about the topic of the article, please feel free to ask them in the comments. We will definitely answer all your questions for several days.

87 comments