Mandatory audit criteria. When is an audit mandatory? Penalty for the lack of an audit report

Changes in statutory audit in 2018-2019

Regardless of the form of ownership, enterprises need to use audits to confirm the reliability of their reports. Experts licensed to carry out such analysis perform complex work. The specialists of the Group of Companies "Audit A" provide services for the mandatory audit. This year, organizations that meet one of the following parameters are subject to this procedure:

- the enterprise belongs to joint stock companies, credit institutions, NPF;

- the enterprise is classified as investment funds, insurance companies;

- the company's securities have access to exchange trading;

- business revenue over RUB 400 million (excluding VAT);

- consolidated financial statements are published.

Mandatory audit in 2018-2019 at enterprises in the form of LLC it is carried out if there is one more condition - the amount of balance sheet assets exceeds 60 million rubles. The analysis is carried out taking into account not only Russian, but also ISA standards. Evasion or refusal from this procedure will result in a fine. Therefore, it is necessary to promptly seek advice from the experts of the Group of Companies "Audit A". After analyzing the situation, specialists will be able to determine whether the company is subject to a statutory audit in the current year. If the answer is yes, the staff will offer the best option for cooperation.

Features of the statutory audit in relation to CJSC and LLC in 2018-2019

CJSC should place an order for a statutory audit in 2018-2019. before the publication of the reporting documentation for the year. For closed joint stock companies in mandatory such an analysis is provided if the type of their business falls under the Federal Law "On Auditing Activities". CJSCs with more than 25% state ownership are also subject to this procedure. Limited liability companies, which are one of the most common forms of business in Russia, order analysis when financial indicators are exceeded (with annual revenue of more than 400 million rubles).

An independent assessment of financial and accounting documentation during a mandatory audit is confirmed by an official opinion. The experts conducting the analysis provide it with detailed recommendations. They help eliminate shortcomings and irregularities that were found during the reporting study.

note

Group of Companies "Audit A" performs a statutory audit this year. Our experts carry out analysis, provide clients with detailed consultations, and help to timely eliminate identified errors. Auditing benefits companies regardless of ownership.

If your company does not meet the criteria for a statutory audit, you can order an initiative audit. In any case, please contact! Individual terms of cooperation and comprehensive support in the field of taxation, accounting guaranteed. Group of companies "Audit A" is at your service! Call for detailed information.

1) if the organization has the organizational and legal form of a joint stock company;

2) if the securities of the organization are admitted to organized trading;

(see text in previous edition)

3) if the organization is a credit institution, a credit bureau, an organization that is a professional participant in the securities market, an insurance organization, a clearing organization, a mutual insurance company, a trade organizer, a non-state pension or other fund, a joint-stock investment fund, a management company of a joint-stock investment fund, a mutual investment fund or a non-state pension fund (with the exception of state non-budgetary funds);

(see text in previous edition)

4) if the amount of proceeds from the sale of products (sale of goods, performance of work, provision of services) of the organization (with the exception of state authorities, local governments, state and municipal institutions, state and municipal unitary enterprises, agricultural cooperatives, unions of these cooperatives) for the previous the reporting year exceeds 400 million rubles or the amount of assets balance sheet as of the end of the previous reporting year exceeds 60 million rubles;

5) if the organization (with the exception of a public authority, local government, state extrabudgetary fund, as well as state and municipal institutions) presents and (or) discloses the annual consolidated (consolidated) accounting (financial) statements;

(see text in previous edition)

(see text in previous edition)

2. Mandatory audit is carried out annually.

3. Mandatory audit of the accounting (financial) statements of organizations whose securities are admitted to organized trading, other credit and insurance organizations, non-state pension funds, organizations in whose authorized (pooled) capital the share of state ownership is at least 25 percent, state corporations, state-owned companies, public companies, as well as accounting (financial) statements included in the securities prospectus, and consolidated financial statements carried out only by audit organizations.

(see text in previous edition)

4. Agreement for the conduct of a statutory audit of the accounting (financial) statements of an organization, in the authorized (pooled) capital of which the share of state ownership is at least 25 percent, as well as for the audit of the accounting (financial) statements of a state corporation, a state company, a public company , a state unitary enterprise or a municipal unitary enterprise is concluded based on the results of an open tender at least once every five years in the manner prescribed by law Russian Federation on the contract system in the field of procurement, goods, works, services to meet state and municipal needs, while the establishment of a requirement for securing applications for participation in a tender and (or) securing the execution of a contract is not mandatory.

(see text in previous edition)

5. In an open tender for the conclusion of a contract for the audit of the accounting (financial) statements of an organization, the volume of proceeds from the sale of products (sale of goods, performance of work, provision of services) of which for the previous reporting year does not exceed 1 billion rubles, the participation of audit organizations is mandatory, which are subjects of small and medium-sized businesses.

6. Information on the results of the statutory audit is subject to entry into the Unified Federal Register of information on the facts of activity legal entities by the audit customer indicating in the message of the audited entity identifying the audited entity data (taxpayer identification number, main state registration number for legal entities, insurance number of individual personal account, if any), name (surname, name, patronymic) of the auditor, identifying the data auditor ( taxpayer identification number, main state registration number for legal entities, insurance number of an individual personal account, if any), the list of accounting (financial) statements in respect of which the audit was conducted, the period for which it was drawn up, the date of the conclusion, the opinion of the auditing organization, individual the auditor on the reliability of the accounting (financial) statements of the audited entity, indicating the circumstances that have or may have a significant impact on the reliability of such statements, except for cases when subject to disclosure in accordance with this hour this information constitutes a state secret or a commercial secret, as well as in other cases established by federal law.

In 2019, many companies are required to conduct a statutory audit of financial statements. Read who exactly is subject to mandatory audit, what is the responsibility for failure and how to choose the right auditor.

For whom audit is mandatory

An audit is an event that allows a company to assess how correctly its financial statements are drawn up, taxes are calculated, etc. In addition, it allows management to assess the financial situation of his firm. In some cases, managers themselves appoint an internal or external review. For example, before the restructuring, sale, merger of a company, sometimes it may be a requirement of a credit institution). Often foreign firms require audits from their Russian divisions. But there are also organizations that are subject to statutory audits.

Statutory audit criteria in 2019

What firms cannot shirk the eye of auditors? According to Federal Law No. 307 of December 30, 2008, audit is mandatory for:

- Joint Stock Companies.

- Firms whose securities are traded.

- Credit, insurance organizations and investment funds (including pension funds) and their management companies.

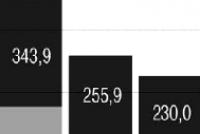

- Large companies (except for government agencies, etc.). These are firms whose revenue for the year before the reporting period exceeded 400 million rubles or whose assets at the end of the same period were more than 60 million rubles.

- Organizations (except for state or municipal authorities and other state institutions) that present (disclose) annual consolidated accounting or financial statements.

- Certain other organizations (as per other applicable laws).

Verification phase... At this stage, the auditor examines the statements themselves and other necessary documents, if necessary, requests explanations from the financial department / accounting department.

Preparation of the conclusion... The auditor draws up a conclusion, in which he points out the deficiencies found, gives recommendations to the management and the financial department of the company. Then the conclusion must be bound and certified with a signature and seal.

When conducting an audit and writing an opinion, it is necessary to be guided by International Standards on Auditing (IS, which can be read on the website of the Ministry of Finance (effective from January 1, 2017). In addition, the rules developed by a self-regulatory organization are also applied. It is important to remember that they should not contradict ISA and their observance is mandatory for all members of the organization.

An innovation that appeared in 2016: the customer must register the results of a mandatory check in the Unified Federal Register of information on the facts of the activities of legal entities.

Conclusion structure

The legislation describes in detail the mandatory components of the conclusion.

So, in the beginning comes the title "Auditor's Report". Then the addressee is indicated (these can be shareholders, members of the LLC, as well as other persons).

Information about the company must be provided: its name, state registration number, and location.

Information about the auditors themselves is also necessary: \u200b\u200bregistration data, the name of the self-regulatory organization of auditors, which includes the audit firm or auditor.

Next are the data on the audited accounting (financial) statements: its list, the period for which it was drawn up, the distribution of responsibility in its relation between the customer and the audit organization (or individual entrepreneur).

A mandatory part is the statement of the audit performed by auditors.

A very important part of the conclusion reflects the opinion of experts on the reliability of the reports they studied. In this case, circumstances are indicated that can significantly affect its reliability.

The conclusion can be unmodified or modified. The first option is drawn up if the specialist did not find any significant inconsistencies in reporting with the rules, that is, all data is reflected in it properly. The second option has three possibilities.

- Qualified opinion. This is possible only if the discovered (or possible, but not proven) discrepancies, although they are significant, do not affect the most significant elements of the reporting.

- Negative opinion. It is entered if the expert finds evidence that the misstatements, collectively or separately, significantly affect the reliability of the reporting.

- Disclaimer of Opinion. This option is possible if there is a lack of evidence from the auditor, allowing to come to any opinion regarding the reporting. At the same time, he may believe that possible misstatements may significantly adversely affect it.

From January 1, 2017, 48 International Standards on Auditing (ISA) are being introduced in the Russian Federation. They are introduced by two orders of the Ministry of Finance dated 10.24.2016 N 192n and dated 09.11.2016 No. 207n.

According to the new requirements of International Standards, instead of the usual form of the auditor's report on several sheets of standard text, for all new contracts for the statutory audit of the organization, concluded from January 1, 2017, a more information-rich opinion is drawn up in accordance with ISA. New form the auditor's report will contain not only an assessment of the company's financial statements, but also draw the attention of users to the most important points in the activities of the audited entity, including what attracted the most attention of the auditor, to what the auditor sees the most significant risks for the organization. For comparison, in the auditor's report issued in accordance with the Federal Auditing Standards, the auditor expresses only his opinion on the reliability of the accounting of the audited entity, while he does not assess the financial statements of the company, does not describe special moments in the activities of the audited entity. All this information is reflected in the auditor's working documents and is not available to a wide range of users. After the introduction of International Standards on Auditing, almost all information obtained by the auditor in the course of the audit should be reflected in the auditor's report.

The new form of the auditor's report should contain extended information not only for the accounting department, but also for external and internal interested users: shareholders, the board of directors, etc., that is, a wider circle of people who make decisions about the business development strategy.

Thus, from January 1, 2017, the new requirements of the ISA will affect both auditors and audited companies. The amount of data required to analyze the activities of audited organizations is significantly increasing, and the degree of publicity of audit results also increases.

THE AUDITOR'S OPINION WILL BECOME MORE INFORMATIVE AND PUBLIC

Let us recall that from October 1, 2016, legally significant information about the facts of the activities of legal entities, including information about a mandatory audit, is entered into the Unified Federal Register. At the same time, the audit client is obliged to disclose the circumstances that have a significant impact on the reliability of the statements listed in the auditor's report. Information in the Register must be entered within three working days from the date of occurrence of the relevant fact (paragraph 2, clause 9, article 7.1 of Law No. 129-FZ). If this term is violated, the organization's officials may be brought to administrative responsibility, up to and including disqualification.

CONSEQUENCES FOR BUSINESS

Disclosure of additional data in the auditor's report will allow investors and contractors of companies to make more balanced business decisions. However, for the audited company, financial risks increase, since an increase in the level of transparency of the company's activities and the reflection in the audit report of all identified business risks will automatically lead to an increase in the cost of bank loans for companies if the auditor expresses concerns about the activities of the audited organization or sees increased financial risks in the audit report. ...

The new rules for disclosing information in the auditor's report under ISA have additional business implications. It is assumed that from 2018 the IFTS will be able to require auditors to disclose audit secrets. Such innovations are set out in the draft Federal Law on Amendments to Articles 82 and 93.1 of Part One of the Tax Code of the Russian Federation. When conducting tax control, it will be allowed to collect, store, use and disseminate information about the taxpayer received from audit organizations and individual auditors. Executive tax authority will have the right to demand from auditors the documents received by them during audits and the provision of other audit services that serve as the basis for calculating and paying tax by the organization, if they are not submitted in the prescribed manner by the taxpayer.

Mandatory audit criteria for 2016

A statutory audit of an organization's financial statements is carried out by legal entities that have:

Revenue over 400 million rubles. or the balance sheet assets exceed 60 million rubles. by the end of 2015;

- organizational and legal form of joint stock company,

- the organization (with the exception of the state authority, local government, state non-budgetary fund, as well as state and municipal institutions) submits and (or) publishes summary (consolidated) accounting (financial) statements;

-organizations whose securities are admitted to organized trading, credit and insurance organizations, non-state pension funds.

Mandatory audit of organizations in whose authorized capital the share of state ownership is at least 25 percent, state corporations, state-owned companies, as well as accounting (financial) statements included in the securities prospectus, and consolidated financial statements are carried out only by audit organizations. (Part 3 as amended by Federal Law dated 01.12.2014 N 403-FZ).

An agreement for conducting a statutory audit of the accounting (financial) statements of an organization in whose authorized (pooled) capital the share of state ownership is at least 25 percent, as well as for auditing the accounting (financial) statements of a state corporation, state company, state unitary enterprise or municipal unitary the enterprise is concluded with an auditing organization or an individual auditor, determined by holding an open tender at least once every five years in the manner prescribed by the legislation of the Russian Federation on the contract system in the field of procurement, goods, work, services to meet state and municipal needs, while the establishment of a requirement for securing applications for participation in a tender and (or) securing the execution of a contract is not mandatory. (as amended by Federal Laws of 28.12.2013 N 396-FZ, of 01.12.2014 N 403-FZ)

On a note . In an open tender for the conclusion of a contract for an audit of the accounting (financial) statements of an organization, the volume of proceeds from the sale of products (sale of goods, performance of work, provision of services) of which for the previous reporting year does not exceed 1 billion rubles, the participation of audit organizations, which are subjects small and medium-sized businesses. (Part 5 is introduced by Federal Law dated 01.12.2014 N 403-FZ)

Why it is necessary to conduct a mandatory audit of an enterprise at the end of 2016

The experience of the audit firm "Yurinform-audit" allows us to assert that the organizations that conducted the audit had the opportunity to timely identify the main mistakes in accounting and correct them in a timely manner. Therefore, statutory audit has its own advantages and undoubted benefits.

Elimination of typical errors.

Timely identification and elimination of inconsistencies in tax and accounting is possible thanks to a timely independent audit following the results of the reporting financial year. Correction of such errors for the reporting financial year, both in accounting and tax accounting will avoid penalties from tax inspectors.

During the course, the auditors of the company "Yurinform-audit" check not only the correctness of the accounting statements, but also the correctness of the formation tax returns and their reliability based on the results of the reporting 2016.

The relevance of correct accounting is especially important in view of the strengthening of administrative responsibility for violations in the field of accounting legislation and the submission of inaccurate financial statements. For gross violations in accounting, fines are increased. New fines were approved on March 30, 2016. The President signed Federal Law No. 77-FZ on amendments to the Administrative Code of the Russian Federation. Penalties for officials are set in the range from 5,000 to 10,000 rubles (it was from 2 to 3 thousand rubles). For a repeated violation within a calendar year, the fine will increase and amount from 10,000 to 20,000 rubles or disqualification for a period of one to two years (previously, the penalty for a repeated violation was not provided).

Below are violations that are classified as gross:

- understatement of the amounts of accrued taxes and fees by at least 10% due to distortion of accounting data;

- distortion of any indicator of accounting (financial) statements, expressed in monetary terms, by at least 10%;

- registration of a non-existent fact of economic life, an imaginary, feigned accounting object in the accounting registers;

- maintaining accounting accounts outside the applicable accounting registers;

- preparation of accounting (financial) statements not based on data from accounting registers;

- the economic entity does not have primary accounting documents and (or) accounting registers and (or) accounting (financial) statements and (or) an auditor's report on accounting (financial) statements during the established storage periods for such documents.

The limitation period for bringing to responsibility for violation of accounting legislation is established by article 4.5 of the Administrative Code and is limited to two years from the date of the offense (previously this period was 3 months).

Penalty for the lack of an audit report.

If the organization, for some reason, did not conduct a statutory audit, it will not be punished for this, the current legislation does not provide for liability for failure to conduct a statutory audit, but administrative liability is established for the absence (failure to submit, non-publication) of an audit report.

In particular, the absence of an audit report on the accounting (financial) statements of the Joint Stock Company entails the imposition of an administrative fine on officials in the amount of five thousand to ten thousand rubles in accordance with Part 1 of Art. 15.11 of the RF Code of Administrative Offenses.

Failure to submit or untimely submission to the state statistics bodies of the annual accounting (financial) statements, which must include an auditor's report, will result in an administrative fine under Art. 19.7 of the Administrative Offenses Code of the Russian Federation in the amount of three hundred to five hundred rubles for officials and from three thousand to five thousand rubles for legal entities.

Non-publication by the joint stock company on the Internet page of the audit report in fixed time, in accordance with Part 2 of Art. 15.19 of the Administrative Code of the Russian Federation, may entail the imposition of an administrative fine on officials in the amount of thirty to fifty thousand rubles or disqualification for a period of one to two years; for legal entities - from seven hundred thousand to one million rubles.

Awara is a Russian accoutning company that offers a full range of bookkeeping and financial administration services for foreign companies who start business in Russia. Although we a local accounting firm we follow the best international practices to provide you with the best client support. Make your accounting safe, sound, and efficient with Awara.

Legal Services

We are a Russian legal company working under international standards. We offer services that cover most possible matter that companies may face while doing business in Russia. We state that the function of the commercial lawyer is not to “tell what the law says,” but to deliver winning arguments and real solutions.

IT Solutions

Awara IT Solutions is proud to provide its clients with IT-services meeting the requirements of Russian law without changing clients' existing processes. This unique combination of a strong background in system integration, law and taxation makes us a reliable and efficient partner for new-comers onto the Russian market. Our team has implemented multiple projects with Microsoft Dynamics NAV, Microsoft Dynamics AX, CRM and 1C.

Audit Services

We focus on providing audit services resulting in a clear understanding of financial records, accurate risk assessment and recommendations for areas of improvement and tightening of internal controls. Our services include Russian statutory audit, tax audit, internal audit and audit in accordance with international standards (IFRS, US GAAP).

Direct Search & Recruitment

As an internet and social media based recruitment leader, we really offer a competitive edge in finding the best and most motivated people in Russia and the CIS. We provide headhunting and recruitment services with 19% success fee only and no retainers. If no candidate is hired, no fee applies.

Corporate Trainings and Seminars

We understand that every business and organization is different and pre-packaged training programs don’t work for everyone. Our client-focused approach allows us to design training programs that are customized to deliver the results you need. At our hands-on practical training sessions professionals in fields such as business, sales, marketing, HR, finance and law improve their skills and abilities to solve the problems of tomorrow.