Business plan - clear program for investment. Investment Business Plan Enterprise: Step-by-step instruction drawing up a business plan and attraction of investments

You will certainly become rich if you have a good plan to which you follow.

R. Kiyosaki

Investment plan is a personal, almost intimate, purely individual business. Alisher Usmanov in an interview with Vedomosti:

"Companies that belong to me and my partners own 1.5% of Gazprom shares. I don't want to talk about other investments. Similar information - a signal to make someone bought or sold the shares of these companies. Its disclosure would be incorrectly in relation to my partners. "

If we talk about meaningful asset management, then you can select the following levels (states) of assets (right column) and put them in accordance with the status, position in the kiosaki quadrant of the corresponding person (left column).

Investor - Condition

Businessman - Capital

Employee, or a person of a free profession - savings

Wherein:

- savings - a relatively small amount of money (units - tens of thousands of dollars), which is important to save, save from the dangers and risks that we need to meet current and promising needs (education, incl. Children, Purchase of personal transport and real estate, treatment etc.); Investing part of your savings, you get a chance, free from slavery.

- capital is an average amount of money (hundreds of thousands - units of millions of dollars); This is money for making new money, in particular, by investing in a business.

- condition is a large amount of money (dozens, hundreds of millions of dollars), which is a tool for making new money, in particular by investing in businesses, as well as an object of inheritance, conservation, maintenance, management; As a rule, diversified in the assets of various kinds.

What is an individual investment plan?

As a rule, an investor, if this is not a professional financier does not have special skills and investment experience. It is difficult for him to independently choose the optimal risk ratio and profitability.

For help in this matter, you can contact the management company, for example, in some of them a technology has been developed that helps investors to express their intuitive attitude to risk in the form of quantitative characteristics and restrictions and consolidate it documented.

You can also solve this task as well as, but first it is necessary to get acquainted with several fundamental moments.

Amount of investment

We are moving to the side to gain a state, but each of us begins with your own place, so it is impossible to give common to all recommendations.

Each itself determines which part of its income, or savings, he is ready to invest and with what risk. When drawing up an investment plan, consider all the specifics of your own world? Children, parents, need to buy housing, in additional income, health condition, etc., etc.

In one of the management companies, they shared with me the following considerations on this subject:

"I would have identified the share of risky investors at 15-20% of the total number of government founders. The decision is made depending on what the proportion of its assets is ready to allocate for risky investments with a high potential yield (for example, 10% of insurance reserves is ready to allocate to invest with a potential yield of 35%). Someone is ready to risk 10-15% (for starters), someone who has already gained some experience of cooperation with managers, is ready to convey more. "

Where lies comfortable for you the amount of investment to determine only to you. Just remember that you define it never on always that it can always be revised.

Dates of investment

Here the answer for us is unequivocal - if we decided to become investors, then this is the rest of your life. However, the time of investment in one, or another tool, should be determined and revised with enviable regularity.

The terms of investment in each specific tool are highly dependent on your circumstances and the specifics of the instrument.

Comfortable measure risk

Risk is always back side yield. What part of savings risk is just your choice. What risk to invest is also your choice and your circumstances. One successful investor shared with me such thoughts:

"If you need profitability as bonds, it is better to carry money to the bank. And to come to the management company makes sense if you are ready to take risks, but potentially you can get the yield significantly above the market. From my point of view, it is definitely: a high risk is justified - high yield. Here everyone decides for themselves. I decided for myself - the maximum risk is the maximum yield. "

Another successful investor was less categorical, but close in spirit to the first:

"If some amount decided to give some amount, then you need at least something from average risk values \u200b\u200band higher to look for, and not with a minimum yield, because, at a minimum, I'd rather go to the bank "

Third, so generally stated that there are no investment risks. I exaggerate, of course, I really close his approach:

"There is a risk of loss, but in the long run, this risk is equal to risk of a serious change of political system, and all other risks in the long run are not significant. In short - yes. I went, I bought myself a portfolio with a number of businesses, something happened to them - any and your portfolio crawled. And if it is long-term to consider, then people will work, just so shares will not be cheaper, on the contrary - should increase their value. In the long term there is no such risk, unless the revolution happens, for example. But in this case, other activities will be questionable. "

The risk must be conscious

1. Measure of risk determines the yield.

Risk and yield - "Two sides of the same medal." The higher the level of expected profitability, the higher the risk measure. The higher the risks of investment, the higher the incidence will be required by investors from this investment.

Each investor seeks to get the maximum yield at a minimum risk level. However, in fact, the task of the investor comes down to define a comfortable risk ratio and profitability. The choice of this ratio determines the individual investment plan.

2. The optimal ratio "Risk-yield" can only determine yourself.

Comfortable ratio "Risk-yield" is an individual (personal) characteristic of each person. All people are distinguished by miscellaneous attitude To risk.

"One will be ready to risk five units to earn one, and the other is only three; This is determined by the individual tendency of a person to risk, and it may not coincide with the investor and the manager. "

Yes, and the relative value of money for each person is different. If your condition consists of two dollars, then risking one dollar, you risk a half state.

If you have a million dollars, then risking one dollar, you risks only 0.000001 of your condition.

"Take away the same dollar for different people means different risks. It may be that that is why sometimes the client gives the task to "manage as for itself." But the manager cannot know better than the investor, which relative value for the investor has been posted in the management of capital. "

The risk / return ratio you defines legally. For this, there is such a document as an investment declaration. It is not necessary to think that the investment declaration is a kind of document that will make up the managers for you if you decide to apply for help in investments to professionals. In fact, the investment declaration is your personal investment plan, without which swimming in the sea of \u200b\u200binvestment may be very risky and certainly unpredictable.

If you decide to invest independently, you will have to read not few books and understand the many economic issues. Sooner or later you will suit the need to somehow share assets as they are risks and profitability in order to be able to compare and choose. To solve this task, professionals are recommended to use their own, or developed by your management system of assets ranking.

To determine the risk measure, assets ranking.

Unfortunately, this approach is not applied in each management company, so when the manager is selected, it is worth asking how this particular manager is going to manage your risks.

"When developing the investment declaration of the company, all types of risks accompanying investing in the securities market and methods for their restrictions were analyzed. The investment declaration determines the objects of investment and requirements for the composition and structure of assets. The composition and structure of assets determine the risk of securities portfolio and are fixed in the investment declaration in the form of quantitative restrictions. "

Thin and rough risk measurement is carried out using restrictions - limits on different types valuable papers. The limit on the category of securities (stocks / bonds) is a tool of rough risk level setting.

"The presence of a managerial ranking system of securities is a guarantee for the investor. The ranking system of securities into groups allows you to carry out thin individual risk level setting by setting limits to each group of securities and limit on one issuer within each group. Requirements for the composition and structure of assets are fixed in the investment declaration. "

Quantitative criteria and ranking principles may be different. Managing from "Arsaggers" are optimal to believe that the ranking system of securities must establish quantitative criteria by which securities are ranked on homogeneous in their investment characteristics of the group, for example:

- for shares - liquidity (turnover) and capitalization (company size);

- for bond - liquidity (turnover) and credit quality (reliability).

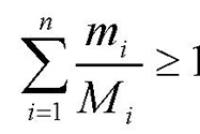

"Each group of securities should be assigned a quantitative assessment of the risk measure - the risk coefficient. The limits system installed in the investment declaration for each securities group allows you to calculate the risk coefficient for the entire portfolio formed with regard to the restrictions on each group. "

Thus, only with a competently compiled investment declaration, establishing limits on certain groups of securities, for example, only on blue chips and highly reliable bonds, you can be sure that the shares from the second and third echelon, as well as high-yielding ("trash" ) Bonds will not turn out to be in your portfolio.

How to choose investing tools

The choice of tools for investment, first of all, depends on the personal goals of the investor. It is worth considering:

- estimated amount of investment;

- the estimated investment period;

- the risk to which the investor is ready;

- income that expects an investor.

In fact, all these parameters must be considered in the complex. The easiest way to illustrate this is the example of such a tool as a mutual fund. For example, when investing for a long time, the investor can invest in a closed or interval mutation fund, the cost of entry into which can be high, but the potential profitability pleases.

However, here you have to be careful. On the one hand, these funds offer attachments into more promising from the point of view of the growth of their value of assets. On the other hand, these assets will be less liquid, and therefore more risky. For example, closed stock funds invest in shares of the second echelon, closed real estate funds in real estate.

If it is planned to invest small amounts, it is worth paying attention to funds with a low threshold of entry (minimum investment amount) and already among them choose a fund with an optimal risk-yield ratio for you.

To further narrow the possible options for choosing, you need to decide what level of profitability to count on and what risk to go. Venture funds and real estate funds offer the greatest profitability of all types of funds. But it is the prerogative of closed frills and risks appropriate.

From interval and open funds - the most high level profitability of stocks and index funds. Next are the funds of mixed investment, and then bond funds. For each group of funds, the ratio of profitability / risk will be different.

To diversify your risks, you can choose "exotic" mutages, such as funds foundations or index funds. They are still a bit. Index funds invest in securities in the proportion and in the composition in which they are presented in the index selected as a reference. As a reference, Russian index mutations chose the MICEX, RTS and RUX-CBonds index.

There is another option - fund funds. The yield of such funds is expected at the level of profitability of mixed investment funds.

A large number of information about management companies and funds can be learned on specialized sites. The most successful in this plan is the site of the national league of managers www.nly.ru, and the information agency InvestFunds.ru.

We will finish this conversation by the official opinion on this account of our native Russian government. Surprised? And then the opinion of the authorities?

Everything is very simple: our state is very closely following what is happening in the financial markets, our the legislative framework These issues are considered one of the best in the world. So here our authorities are ahead of the planet all.

Oleg Vyugin, head Federal Service According to the financial markets during the online conference organized by the Finance magazine about building a personal investment strategy, said the following:

"On issues of many it is clear that there is a real interest in the stock market. And, of course, this interest is associated with the possibility of receiving income. And in this regard, I want to say the following.

First, for a non-professional investor, income brings, as a rule, long-term investments.

Very often, attempts to make money on short-term operations for them are frustrated.

Secondly, the Russian stock market is the emerging market. And like all such markets, it carries at the same time and enormous growth potential, but also subject to unpredictable risks.

If you are haunting the goal of optimizing the risk-income ratio, then it is probably advisable to choose fund funds that invests your funds in the PAI of various mutual investment funds.

All other things being equal in the effectiveness of the investment in a mixed fund or separately to the stock fund and the Bond Foundation are the same.

If there is, what is called, "extra" money, then the risk can be justified. "

Oleg Vyugin shared even his own investment strategy:

"My investment strategy for natural reasons (there is no time to do this seriously) passive. Funds are distributed between the deposit in the bank and the bump of commercial real estate. "

Formation and reproduction of the portfolio

According to professional investors from all the same "Arsaggers", the formation of its investment portfolio is to produce on the basis of the criterion of maximum potential yield and taking into account the restrictions established by your risk. Potential yield is determined by the current value of the asset and the forecast of the future value.

Each of these parameters is subject to change: the current value changes as a result of fluctuations in securities quotes, and the forecast of the future value of assets is subject to constant revision on the basis of new information. As a result of changes in the current and forecast value of assets, their potential yield may vary.

"In this case, it may be necessary to reform the portfolio in such a way that there are again assets with maximum potential yield. The task of the manager trader is to constantly maintain the most profitable assets in the portfolio, taking into account the restrictions established by the investment declaration. "

As a rule, the potential yield in shares is higher than that of bonds, since the shares are an asset with a higher risk measure.

"And if in the investor's portfolio there is a limit on stocks, then most likely it will be fully filled. The managing trader will replace the shares by bonds only if the bonds have a greater potential yield, and this happens quite rarely. "

Very often in the market, current quotes are subject to oscillations. These momentous market moods do not always provide grounds for revising future prices of assets based on fundamental economic indicators Company activities.

"With the growth of the market, the potential profitability of shares is reduced, then you can increase the volume of bonds in the portfolio. When the market is reduced, the potential profitability of shares is growing and it is worth an increase in their share in the portfolio. "

The ratio of shares and bonds in your portfolio, as well as the presence of other investment objects in it (for example, gold, or real estate) depends on the strategy you chose - your personal investment plan.

Evolution Investor

Who are Russian investors? Agree that if we are going to start investing, it is worth a closer to get acquainted with future colleagues.

| Saving | Capital | condition | |

|---|---|---|---|

| Funds | 100% money | Shares in your business (stock packages) 60% | Business Shares (Shares Packages) 30 -50% |

| Real estate 20% | Shares in your business (stock packages) 30% | ||

| Business Shares (stock packages) | Real estate 10-30% | ||

| Money 10% | Money 10% | ||

| Instruments | "Bank", "Pillow", "stocking" | Own business | Own business |

| Investment tools | Investment tools | ||

| Measure risk: Who and how determines the measure of risk of investment | Investor on the eye | Investor on the eye, or with the help of experts | Investor Based on his own experience determines the comfortable measure of risk |

| Yield: Who and how determines the potential profitability of investment | The bank definitely sets through% of rates | Assistant on the eye | |

| Assistants | Banks | Real estate agency | Professional manager |

| Brokers | |||

| Manager | |||

| Costs: What are the assistants interested in | In the number of transactions. In the volume of invested funds | In gaining income by the owner of the state. After all, his remuneration is usually a percentage of profits received by the Founder of Management | |

| Partners | People. No professional partners | Professional investor | |

| What partners are interested in | Experiment | Experiment | Get profit for the client and reward -% of profits |

Business press, in particular "Vedomosti and Kommersant" write a lot about investors and investments. From their publications it follows that there were about 7 million potential private investors in Russia in 2006, in 2007, according to sociologists from the public opinion fund, at that time, no more than 850 thousand people venture out their funds. MICEVB CEO Alexei Rybnikov told "Vedomosti": "The growing stock market is increasingly attracting Russians - two thirds of the MICEX stock exchange transactions are private investors, the number of which reached 204,000."

They love Russians and mutual funds - for the first nine months of 2006, according to Investfunds.Ru, they bought a share for 36 billion rubles. Senior Advisor to the Center for Development of the Fund Market, Yuri Danilov, assesses the number of physicals working in the stock market independently or through mutual impacts, in 450-470 thousand people, or 0.7% of the economically active population of the country. According to FOM, 10% of Russians or their families have shares. According to sociologists from the Foundation "Public Opinion", for 2005-2006, only every second survey participant (57%) enjoyed banking services or invested somewhere; 26% - they took a loan in the bank or bought goods on credit, 15% - exchanged currency and only 2% - made transactions with shares. President Fom Alexander Oslon notes: "In this regard, the Russians urgently need a massive financial LikbezAfter all, be part of the survey participants a major amount of money, then 32% would prefer to put money in Sberbank, 20% - to open your own business. Only 9% of respondents would go to the stock market: 7% would be bought stocks of Russian companies, and 2% would be invested in mutual funds "

This is the emerging class of investors, the head of the Federal Service for Financial Markets (FSFR) Oleg Vyugin believes. He is pleased that people appear for whom investment is not a game, but a real business.

According to the general opinion of experts, the interest of the population to the stock market is obvious - in less than a year the number of investors on the MICEX doubled. Yury Mintsev, Vice-President of BrokercreditService, the largest Internet broker, believes that in five years there will be 4 million private investors. "This is a very optimistic forecast, if he is faithful, then we have enough work for a long time," says Mintsev. "Mostly people abandon the lack of knowledge and investment experience, as well as more important spending," it is divided by experience with potential customers.

There is hope that in the foreseeable future, funds will be invested in funds 10-20% of the population, as in Eastern Europe. This contributes to the fact that mutual investment funds (mutual mutual) successfully passed the first serious test. Despite the serious drop in the Russian stock market in May-June 2006, as a result of which the RTS index with the top of 1765 points collapsed to the mark of 1235 points, the shareholders were not rushed into a massive procedure from the funds of their investment investments either in the summer or early Autumn.

"Fixing profits arrived by shareholders after the RTS index rapidly lost the position achieved, turned out to be a less massive process than could be expected. The shareholders did not consider it appropriate to repay PAI after such a significant fall, waiting for improving the situation on the market, "said Sergey Mikhailov, Director General of the PSB Management Company in an interview with Kommersant. - As a result, the trend of the growth of the collective investment market has been preserved, although the influx of money in the funds, of course, slightly slowed down. "

As Vladimir Kirillov believes, the Director General of the Kit Finance Management Company, the increasing number of shareholders become not speculators, and investors, which is why there are no mass reactions to short-term fluctuations. "The preferences of shareholders change in response to a systematic change in the market in one direction or another, and takes this process usually for several months," says Mr. Kirillov.

"As such fixing the profits of shareholders in May-June - namely, during this period, the RTS lost more than 30% of the levels achieved - we did not observe, and Mr. Inkin notes from RTK-Invest.

True, as market participants recognize, the maturity of the collective investment market can only be said in spring next yearWhen most of the current shareholders receive the right without discounts to sell their pairs, purchased by them at the time of the rally on the market.

According to the "Kommersant" financiers, the main trend in the collective investment market is an increasing variety of various mutual funds. Almost every management company has a ruler of a dozen, or even more mutual investment funds with various investment declarations and strategies.

Moreover, as market participants noted, the potential customers of management companies have become much better than a year ago, to understand the specifics of the market, given not only possible returns, but also dangers. And even quietly perceive even serious fluctuations in the stock market.

After 2005, many people had the feeling that mutual impacts were always big profitability, agrees with the assessment of the colleague director for the development of the Criminal Code "AVK" Palace Square "" Alexey Lestovkin. "However, this is not always the case, and many, unfortunately, were convinced of this in May-June 2006, he noted. - And then, you should not forget: mutual funds are a long-term investment tool. The greatest efficiency is achieved with investments for three to five or more years. Help to avoid dependence on market fluctuations can also regularly replenish investments at different price levels. "

Meanwhile, in Russia, everything is rapidly developing alternative to mutual investment funds, ways to transfer to management of funds. Both in Moscow, and in St. Petersburg, private trusts began to grow - confidential office funds, in which private clients are offered both individual and joint investment in a special fund under the management of a financial company. The rules of such a fund, in contrast to the FIF, are not registered. Depending on whether a fund is being created under a particular investor or several, this scheme is either an integral part of individual trust management, or by an intermediate link between the effect and individual confidence-management.

Investors in a private trust investment opportunities are much wider, since less restrictions imposed by government regulatory bodies for collective investments. For example, the maximum proportion of one issuer in the structure of the mutual fund according to russian legislation should not exceed 15%. While the investor in a private trust can invest all its funds into one-single paper. In the Shares Foundation, the minimum share of shares in the portfolio should not be less than 50%, with classical trust management or in a private trust there are no such restrictions. In many respects, due to the absence of these restrictions, the yield within the framework of individual confidence management is higher than that that demonstrate the most successful mutual impacts.

However, confidential control is not available to everyone. Managing companies promoting this service establish a very high minimum bar for the amount of funds received in a private trust. As a rule, this is the amount of 100-200 thousand dollars. But the remuneration of the manager, as a rule, is tied to the result, whereas in most mutual impacts, the remuneration is a certain percentage of the feed volume regardless of the result.

An analogue of a private trust can be called a closed mutual investment fund (ZPIF), Mr. Kirillov adds from Kit Finance. True, the creation of such a fund for the management of assets of specific customers is justified if their volume is no longer measured by millions, but dozens of millions of dollars. Only in this case, the creation of a shell in the form of a ZPIFA, the structuring of assets and the cost of paying remuneration become justified.

Personal investment plan in examples

I will give a few examples of investment plans, which investors shared with me.

Example 1. Caution-student

Oleg is a novice investor, the savings of which were extremely limited, the investment experience was absent, but there was an extraordinary caution and a tendency to low risk, amounted to the following plan.

The purpose of investment: get the experience of investing, choose for yourself the optimal risk / return ratio (find a way to sleep quietly) and find a suitable managing company personally.

Timing of investment: Sufficient for testing period Oleg considered one year.

The amount of investment: Oleg decided to invest 10% of his monthly salary, as well as invest all the premiums received on various "Halturki", as well as those who have fallen from the sky, found and other "light" money if they are.

The meaning of investment (why do I need it?): In order to make a long-term investment plan on the basis of the experience gained a long-term investment plan and make money on investments enough money for a comfortable old-age retirement.

Ways to solve the problem: as a literate person, Oleg came up with three ways to solve the problem.

- 1 Path: Based on general recommendations and own intuitive assumptions, choose a management company and a suitable fund and invest a small amount. Dumping PAI into small amounts during periods of recession on the market, as recommended by experienced investors, and after a year to look at the results.

- 2 way: Select multiple management companies and insert in several funds. Regularly (monthly) track their results and shift funds into the most effective funds. Results to rate at the end of the year.

- 3 way: "Other ways". Oleg decided to regularly read a specialized press, follow the news on specialized sites, communicate on investing with all his friends, so as not to miss any other, while he is not known, but a possible way.

Result: A year later, Oleg wanted to obtain results expressed in monetary equivalent in all three ways to have data for comparing and building a long-term plan.

Implementation on the first way

Oleg chose the management company X and bought one Pai for 1000 rubles, which form the stock shares of this company. A month when the Foundation has formed and paid government agencies and various infrastructure companies all required platesBut it has not started to work yet, the taxation fell up to 900 rubles.

Just at this time, Oleg received an award at work and, remember that it was better to buy the cost of the share, another 10 feud bought for 9,000 rubles. After a month, 10,000 people invened to them poured into 11 feud.

In the next five months of the Foundation, the cost of one share has grown to 1200 rubles. For half a year, 10,000 invested Oleg rubles turned into 13,200 rubles. Then the market was corrected on the market, and the cost of the solder fell to 1100 rubles. Oleg, acting clearly in his plan, opened the converter, which folded 10% of the salary intended for investment.

In the envelope, 11,500 rubles were discovered, which Oleg bought 10 more feud and paid for the remuneration of the management company for the entrance to the Fund in the amount of 2%. As a result, he has already accumulated 21 PAI of this Fund.

The next half of the year, the market hesitated little, slightly adjusted, a little bit, fell, but not so drastically to prevent funds. By the end of the year, the fee was 1350 rubles.

Oleg Terdrates on this path amounted to: three visits to the company.

Expenditures amounted to 400 rubles for two conflicting funds to the Fund.

Revenues: By the end of the year, 21,000 rubles, invested by Oleg turned into 28350 rubles. The yield was 35% per annum.

Realization on the second path

Oleg opened the rating of managers on profitability over the past year and chose three first on the company's list from it. In each of these companies, he chose one at the very profitable foundation last year. In two companies, the threshold of entry into the foundation was 3000 rubles, in the third 10,000 rubles.

Acting strictly according to its strategy, to the company Foundation and Oleg invested 3,000 rubles at the cost of the share of 1500 rubles. And he received 2 solders, the company's fund in the same way 3000 rubles and received a little more than one paradise at the cost of the share at 2500 rubles., In the company with Oleg received 5 feud at the cost of each share in 2000 rubles. Additional costs for this operation amounted to 160 rubles - the remuneration of managers 1% of the amount of investment for entry into the funds.

Procens: Every month, Oleg chose the new best managers, made money from one fund, made it to another. Oleg worriedly worried, each time feared for the correctness of the choice. It would seem that the fascinating process of finding a better place under the sun was worth him of large nerves, but he continued the work began, strictly following his plan.

Costs: This process cost him 3% of the investment amount (input fee) every month.

Revenues: By the end of the year, 16,000 rubles, invested in this way, turned into 22,500 rubles, the final yield was 41%.

Implementation on the third way

Nothing particularly interesting on the third path of Oleg was turned up, but his level of investment literacy due to actions on the third way significantly increased that Oleg considered an excellent result.

As a result, Oleg decided for himself that running on the manager was not for him, even despite the greatest yield on the annual window, took for himself the first way for the main - strategic and began to develop a new long-term investment plan.

Example 2. Risky-rejuvenating

Marina and Sergey - Young parents and people already held in a professional plan, having an apartment in Norilsk, prestigious and highly paid job, decent savings, but at all who do not have time to the child and each other amounted to the following plan.

The purpose of investment: grow a child to school age in healthy conditions. Have enough time to communicate with each other and with a child. Have enough funds for current expenses. Throwing to live in St. Petersburg by the time the child will need to be given to school.

Dates of investment: 6 years.

The amount of investment: the guys decided to risk everyone with their assets, including intangible (their work).

The meaning of investment (why should I need it?): To enjoy family life, grow a healthy child, to learn it in the "right" place for this place.

Ways to solve the problem: consulting with their subconscious, as is done in detail described in the book "Tell me the money" yes "!" The guys stopped on one way - to invest all and chose several tools for this.

Result: in six years to buy an apartment in St. Petersburg, send a child to a good school, find your business, your business or a good job for yourself and a certain amount to continue investment.

Implementation: Marina and Sergey quit from work, sold an apartment, cars, gathered all their savings received a round sum of $ 100,000 and started calculations.

The house with all the amenities in the Pskov province cost $ 10,000. The amount required monthly on costs for accommodation in the village was not more than 500 dollars. Male found a bank in which interest rate On the deposit was 12% per annum and there was a possibility of monthly receipt of interest (hereby all the calculations are extremely simplified and are given only for a general understanding of the scheme). The necessary guys 500 dollars per month are 1% of $ 50,000. It was decided to put this amount into a bank on a deposit and thus obtain money for current expenses.

Money in the bank and the cost of the house in the village make up $ 60,000, which, according to the calculations of the guys to buy an apartment in St. Petersburg and current expenses, first of time after the move, they will need 100-120 thousand dollars - that is, all that they have now and even more. Therefore, they needed some kind of investment tool that will help increase their funds and will allow you to buy an apartment in 6 years and will leave a certain "financial pillow" for future investment and to finance current expenses (for the period of repair, moving and searching for work).

Of the remaining guys, $ 30,000 decided was 50%, or 20,000 to invest in the fund of the property under construction for 5 years, the rest equal shames In open funds of mixed investments, stocks and in the interval shares.

Implementation: Marina and Sergey for three years already live in their village and really happy with each other. Before the end of the investment period for another 3 years, therefore the results to bring early. I will just say about the interim results that are currently available, and a little adjusted the overall investment plan of the guys.

In the last year, just a boom in the real estate market was observed, prices grew by 10% per month and the real estate fund, which invested part of the funds Marina and Sergey, only at the end of the last year rose more than 100%. Investigated 20 thousand already now amount to 70 thousand.

Guys interspersed in securities also grown in three years percent of fifty. Marina and Sergey decided to reconsider their investment plan somewhat.

The amount in the Real Estate Fund is already percent of 80 from the cost of an apartment that the guys plan to purchase at the initial stage, and in the most pessimistic forecasts will grow percentage of 20 per year. Therefore, the guys decided to withdraw a part of the money from open funds and pay the first contribution for the apartment in the house under construction in St. Petersburg. The contract with the builders concluded in such a way that the remaining amount is paid at the end of construction - in two years. Just at this time they will be able to get back their money from the real estate fund.

After three years, the guys have an already under construction, which will be handed over, taking into account the eternal delays of construction terms just by the time they need to move to St. Petersburg. Funds required for paying the last contribution for this apartment. Small amount Money in open funds and a little more than 10,000 dollars in a risky interval stock fund.

During his studies, Konstantin tried to earn money, the question was gradually the question, where to keep money and as, the easiest answer, - in the bank on the deposit. In 2003, in the spring, our hero decided to debut in the investment market and chose the fund, based on the ability to invest. minimum amount in rubles. Stopped at the interval pip "Bond Fund" (minimum investment of 600 rubles).

Invested 2000 rubles. When in December 2003 found out that there was no profit, took his money - 1996 rubles. It was a good lesson, Konstantin began attentively to the history of fund returns, the specifics of investments, and decided that the Interval Fund was often a risky investment.

"Ideally, for me it should be a fund of the FIF with low costs and minimal risks of management, in all over the world such funds are index funds. Therefore, when I saw in the Internet that in November 2004, the KIT company opens the index fund, the choice was made. "

It should be noted that index funds gradually conquer their admirers around the world. The basis for the success of the funds of steel: minimum management costs, minimal operating costs, low risks of investments compared to conventional investments in stocks. Konstantin believes that it is possible to lose money in the index foundation only when the entire market is crashes immediately, in the usual foundation it all depends on the competence of the manager.

True, in the index investment there are also its cons: the need to follow the index changes (because only you decide when you enter or leave the fund, in fact, you manage the profitability of your investments that analysts do in conventional funds, although in The framework of the investment declaration of the Index Fund is trying to maximize profits), minimal awareness in economic processes and in Russia and in the world (this determines the current and future index quotes to a greater extent than quotes separately taken shares), willingness to loss (as stated, all We are not gods and can be wrong and if in the usual stock stock there is a ghost hope for the head of the manager in the index fund remains only to pray).

"And further. I like what John K. Bogl said about the index feeds, - the man headed the second largest to the US FIF in the USA, a person, thanks to which index PIF exist today: "Despite the fact that some investors can make profits on the market Shares in the short term, in the long run, these overestimated profits will evaporate, as profitability inevitably decreases to the weighted average. The story has shown that only a few managers can be able to exceed the level of the market and is actually not possible in advance to predict who it will be. " I posted a little more than 1000 dollars, since a smaller amount simply would not give any effect. My strategy was to keep money in two funds. The first fund, the basic, where money is accumulated, and the fund in which money is growing or reduced. "

Konstantin knew that it was possible to achieve maximum profitability if you exchange all the shares at the peak of the index quotes and buy on all the money of the PAI at the minimum level of quotations. However, personally for him this strategy seems too risky, as he believes that he does not own full information about the market and can only assume the upcoming changes.

"I would like to note that the unsuccessful placement of funds in a coupe with their unsuccessful conclusion can make the yield of your investments or lower than the feed or negative indicators, therefore, index mutual impacts in themselves and new opportunities and new risks. I would include this tool, as less risky compared to direct attachment in stock, but more risky compared to conventional piffs. This fund fully satisfies my ideas about investing your own funds, and is a unique investment product on the russian market With enormous growth potential. "

Workshop: My investment plan

Currently, we with you have all the necessary data and knowledge in order to compile your own investment plan. Moreover. Workshop to the previous chapters allowed us to make a good half of this plan.

My investment plan for _______________________ years

Modern technology development paces and globalization determine the need for a rapid and qualitative organization of their own business. Most often it is impossible to develop a specific project without relevant investments, and in such cases investments come to the aid. IN modern world Investment projects are a peculiar guarantor of a significant increase in the competitiveness of the enterprise and its ultimate market value.

Investment projects and business plan: Main features

The investment project is a set of all documentation that characterizes a certain project from the very beginning (ideas) to the final implementation (achievement of business performance indicators). As a rule, such a project covers several stages of implementation - pre-investment, directly investment, exploitation and liquidation.

Most often, investment projects are such that they provide for the need for capital investments with the subsequent income from the business. Projects differ depending on the specified object, the speed of execution of the task and the size of the investment. This can be attributed to the creation of new legal entities and their divisions, and the involvement of the necessary technical means, and the release of new goods and services, and the reconstruction of the business.

At the level of certain production, innovative projects are most often performed, which are a complex of innovations necessary for continuous improvement. economic System. With the help of investment projects, you can implement strategic problems of production. Note that most of these projects differ in duration and high risk.

A detailed technical and economic substantiation of the need for investment is set out in the relevant plan. Business plan investment project It has such a characteristic as the formation and submission of investors of the idea that is carefully developed and justifies in the plan, and in practice it is implemented through the necessary investment.

What is a business plan for an investment project?

The business plan for the investor is an economic and technical substantiation of the need for investment. IN obligatory An analysis of the effectiveness of the activities under consideration, assessing the reality and need for investment and resolving problems that appear with the immediate implementation and use of the idea.

In other words, the investment project business plan is a logical and structured substantiation of the need and feasibility of infringement of the investor's funds into a certain case.

The business plan is created to motivate the following positions:

- The degree of stability and economic liquidity of the project.

- The possibility of obtaining funds in the event of the project is liquidated - their return.

- Proposals for organizing joint industries.

- The need for a complex of measures provided in the framework of support from state bodies.

- Orientation in the further development of the project being implemented.

A business plan is the most important package of documents for both potential lenders and a businessman himself. From the compilation of the plan directly depends on the possibility of implementing the idea and its further economic viability.

How to make an investment business plan?

The development of the business plan of the investment project provides for an exact, complete, competent and structured presentation of the entire material, which comprehensively characterizes the business model offered investors. The text must be as easy as possible and containable and reliable information for depositors.

An important condition is the logical structure of the entire plan.

When drawing up a plan, it is necessary to be guided by the following principles:

- Accuracy and accuracy of information.

- Avoiding incorrect wording, as well as expressions that carry a two-way, controversial understanding of the situation.

- Using a sufficient number of digits, facts and information for the logical justification of all actions at every step of the project.

- The use of short and exceptionally necessary data.

- The avoidance of information data that is overly emphasized the benefits and misses existing shortcomings of the project.

Note that only a concise and reasonable position, enshrined in the created project, can attract potential depositors. If the business plan is unnecessary details, an array of technical terminology or obviously untruth information, the entrepreneur will not be able to receive funds from investors.

Note that only a concise and reasonable position, enshrined in the created project, can attract potential depositors. If the business plan is unnecessary details, an array of technical terminology or obviously untruth information, the entrepreneur will not be able to receive funds from investors.

The structure of the business plan of the investment project includes two parts: entry (a brief summary of the entire business plan, with which investors will first get acquainted) and the main part. In turn, the main part involves the following structure:

- The overall characteristics of the enterprise and the estimated strategy of its development.

- Description of goods or services. Also, this clause is called "Industry Characteristics". IN this case It is considered the overall position of the entire industry in the market and the position of the enterprise (implemented goods and services) in particular. At this stage, the proposed product or service is being considered, which is compared with the product or service offered after investment.

- Marketing strategy, consideration of potential marketing markets. Treated in detail key pointsaimed at achieving high sales and optimal ways to bring goods and services for the consumer;

- Production and organizational plan (may be in separate sections). An existing technical base is considered, which allows producing products, as well as the existing organizational orderliness in the enterprise.

- Plan of technical and economic implementation of the project. Before the debate of the depositors, a plan is brought with the ability to implement the declared amount of products based on the existing material base.

- Investment plan.

- Forecasts regarding further financial and economic activities.

- Ronated indicators of potential efficiency. In this case, the entrepreneur justifies the effectiveness of his own idea that requires depositors. In other words, the entrepreneur must convince potential investors in that his ideas are really able to profit.

- Risk assessments. The main problems with which the enterprise may face at any stage of production and sales of products or services.

- Legal plan.

- Data on the face that has developed the project.

The stages of the implementation of the investment project within the framework of the specified structure are also considered. In other words, the business plan contains not only a description of the business idea on the sections, but also the possibility of step-by-step realization, ranging from the development and ending with the actual implementation of ideas in practice.

The business plan of the investment project is official documentation and is performed according to the requirements that are presented by investors.

How do investors assess a business plan?

Evaluation of the effectiveness of the plan is characterized by a set of indicators that represent the ratio of investment on the results obtained. Taking into account the existing types of investors, consider three types of indicators:

- Financial performance indicators, including actual financial consequences For investors.

- Efficiency indicators for the existing budget, in the case of capital investments on the part of the budgets within the city, region or state.

- Efficiency indicators for economic factors, including all kinds of costs (such that are not direct interests of investors).

In addition to the above indicators, environmental and social indicators efficiency. Enterprises that only plan to enter the market and further consolidate on it, the main indicator is financial efficiency.

In addition to the above indicators, environmental and social indicators efficiency. Enterprises that only plan to enter the market and further consolidate on it, the main indicator is financial efficiency.

Note that the investment project business plan is estimated in the following indicators:

- Payback rate.

- Business profitability index.

- Clean revenues from doing business.

- Internal rates of profitability.

The expediency of a certain amount of investment is determined by the ratio of the received net profit and the amount of capital, which is invested in the organization of the enterprise.

Based on the calculations carried out, investors decide whether to invest in the business the amount of money that the entrepreneur requires.

We have considered an example of a business plan of the investment project for the main points that are necessary for the successful implementation of the idea in practice. It should be noted that the entrepreneur should strictly adhere to the entire business plan, starting with the consideration of the industry and the current position of the enterprise in the market (if there is any) before assessing the maximum profit, which investors will receive after investments. It must be remembered that investors are people who are interested in your business only in terms of profitability. That is why all the actions discussed in the business plan should be aimed at solving this paramount task. The correct implementation of the plan will ensure the actual success for the business.

Can I invest money? Stop! Investing begins not with the search for management companies and not with the selection of tools for working with money, but with the preparation Plan.

Do not repeat my mistakes. When I started to invest, I lost a lot. First of all, my losses were due to the fact that I began to try not and not thinking about diversification. My investments were chaotic and not considered. Life does not forgive this. So we will learn to compile plans to conquer investment vertices.

First of all, make sure that you are not afraid to lose money you want to invest. If you at least somehow count on this money, it is better not to start. With this configuration from your money, nothing will remain. So first learn to lead your own.

When you reached the investment step and you have free money, you can go to plan your investment.

Make an investment plan?

- this is your strategy, in accordance with which you will distribute your own cash between financial instruments, and extract profits from them.

This investment plan scheme is not exhaustive and can change in each particular case. However, it illustrates the main idea - before investing the money can be solved by the following questions:

- What are your income, expenses, assets, liabilities? It is necessary to paint and take into account all the financial and material tools you have.

- How much can you invest monthly? Based on your family, you need to define the part that you can invest, while feeling comfortable.

- Where and how much to invest money? Explore various investment tools, determine their profitability and riskiness, initially diversify your investment portfolio.

- How much are you ready to lose?Investments should be divided into conservative (minor, but reliable), there must be 50% of your capital. On average profitable (more risky, but bringing significant income). They should have 30% of your capital. And on high-yielding (and therefore risky). They should invest no more than 20% of your capital.

- What do you want to achieve? You need to decide on your goals. Investments are in business, finance, securities, in real estate. All these are various tools that require various knowledge and skills. In which direction do you want to develop?

- How do you protect your money? Need to think about. This is important, because the Internet is full of intruders.

Do not invest all the money in one source or even in one industry. For example, if you work with the Forex market, think about other investment directions, such as real estate, precious metals, securities, etc. Try to expand your investment portfolio and do not be lazy to learn the companies in which you want to invest.

The possibilities provided by investment business plans are used by companies that, for example, are interested in a significant increase in the production of their products. To implement such a task, funds, production facilities, equipment are required. To achieve the planned results of the company are looking for new partners with which you can conclude agreements to attract the required financial resources. Here will be needed an investment plan, which can be demonstrated by investors, partners, credit institutions. Among the main tasks that he decides can be noted:

- providing detailed study information;

- evidence of the effectiveness of planned projects;

- calculation of income and profits that will be obtained as a result of activities;

- disclosure of details and evidence of benefits for third-party investors.

Investment business plan - a document that must contain a brief and reliable information. It is issued in accordance with generally accepted rules. The documentation of this species is actively used to implement the planned medium and long-term projects. Russian companies began to use investment business plans not so long ago. Domestic enterprises have a need for such documentation to convince investors, including foreign ones, in the benefits of joint cooperation.

The investment business plan is usually used by organizations that have already achieved a certain market situation. Such enterprises seek to win new niches, and this requires careful analysis, finding reliable partners, risks to minimal values. Each consistently functioning company needs to increase production volumes, modernization, reducing the cost of its goods. To solve these problems, also draw up a business plan.

Features of compilation

There are no strict requirements that operate in the preparation of an investment business plan. This analytical document is issued in arbitrary form. Its content and structure depends on the characteristics of the project. The only condition is necessarily taken into account who will use the document for whom it is intended (investors, lenders, top management of the company, etc.). General rules Compilation of investment business plans are as follows:

- information about the company is revealed - the project initiator;

- calculation of expenses, future revenue, profitability;

- sources of attracting financial resources are indicated;

- risk assessment was performed a brief description of Industries.

This is only part of the sections that should be located in the investment business plan. In this document, it is necessary to pay attention to marketing, the structure of the organization, financial issues. All data must be outlined concisely and briefly. During the presentation of the document, the attention of investors on the positive components should be concentrated. This is usually helped graphics, tables, schemes. Therefore, they should also be included in the investment business plan.

Benefits use

Justify your investment proposal, using a special business plan. This document is "bridge" between business and potential investors, authorities, credit institutions, commercial structures. It is he who can convince them in profitability and profitability of the project. The value of the investment business plan should not be understood. If you deal with the advantages that this document gives, it will be used not only large companies, but also small firms in size seeking to develop and achieve success.

Perfectly when the entrepreneur has enough funds necessary for doing business. But it happens not always. In 9 cases out of 10, the entrepreneur is forced to seek third-party resources for investing in their business. To do this, thoroughly consider and planful ways to search for financial injections and maximize themselves.

Consider the options for attracting additional finances. We analyze who can act as an investor. We will try to provide practical assistance to an entrepreneur in need of financing, making a step-by-step guide to find an investor.

The purpose of attracting an investor

Investment - This is a bitter infusion. financial means In a certain project, a program, a long-term start-up, designed for the deferred profit.

Why do entrepreneurs may need extraneous funds, because then will you have to share profit? The goal with which a businessman can invite others financially to participate in his "brainchild" may be one of the following:

- growth and development of current activities;

- attracting additional or missing resources;

- an increase in major assets;

- technology mastering;

- entry into new areas of business.

Types of investment infusion

According to the degree of participation in the project, investments may be:

- portfolio- funds are invested in a group of projects, and immediately in several business spheres or in different organizations;

- real - Capital is designed to finance a specific project in order to obtain real profits.

According to the features of the investment, investments can be divided into:

- state;

- private;

- foreign.

In the nuances of the project funded, investments are allocated:

- intellectual;

- production.

If possible, the investor controls its investments:

- controlled;

- uncontrollable.

Options for attracting investments at different stages of the project

To get money to your project, he must show his worth. And in order for the project to work, you need money. How to get out of this closed circle? For each stage of the project functioning, it will be more expedient to attract investments from different sources.

- Planning stage. If the entrepreneur has an interesting business idea, perhaps a model or sample finished productsBut the management and processes have not yet started to improve, then the means makes sense to ask for such sponsors:

- middle Circle (relatives, friends, like-minded people);

- public investment (there are special programs to support some innovations);

- venture investments (they are intended just for risky startups).

- Getting started project. The business plan is designed, the team is formed, the process "went", but there is no profit yet. In this case, the money for further promotion can give:

- venture funds;

- private investors;

- foreign sponsors.

- Successful start. The organization took a certain place on the market, the project began to profit, let it be too big. To expand activities, the funds can provide:

- direct investment funds;

- venture depositors;

- banks (in this project stage, when the first results are already visible, credit organizations can already risk their own means).

- Growth and development. When the profit is already obvious and stable, find investors will not be difficult. In such a company, they will enjoy funds:

- venture funds;

- foreign capitalists;

- state funds;

- banking institutions.

- Excellently established business. When the growth and prospects of affairs do not doubt, the company ranks in the market one of the leading places, investors may even "fight" for the right to invest in a clearly profitable company. In this case, you can no longer just take sponsorship investments, but publicly sell your shares. In addition, you can take into investors:

- private entrepreneurs;

- banks;

- pension Fund.

Main sources of investment

In addition to private investments, the entrepreneur can invest banks or the state.

Public investment "Sharpened" for specific programs. Their rules are very strict and not subject to adjustment. For the most part, these programs are designed for production companies, therefore, not every entrepreneur can take advantage of the state's support. As a rule, state money is intended for the purchase of equipment, materials, transportation costs. Funds for labor, advertising and other expenses will need to look for an independently.

Bank investment, i.e. loans "for business" will not give anyone who wants. In order to take money to a specific case, it must have already begun either borrower must have another stable income. This is due to the need to pay bank interest.

Private investment - The most promising sponsors for a novice entrepreneur. Among the numerous types of companies and funds, ready to provide financial assistance at any stage of the project, any businessman can find the right one.

One of the convenient forms of investment for novice businessmen is business incubators - organizations that specialize in financing and supporting entrepreneurs at the beginning of their business path.

As part of the Incubator, a businessman can lease the room on preferential conditionsHe will be helped with accounting and legal support, will provide consulting services.

Investor Search: Step-by-Step Guide

If the entrepreneur put himself a goal to attract investment CapitalBefore it begins a difficult path that he will have to go through step by step.

- Choosing a reliable capital savingiver. The investor will become a strategic partner, so it is necessary to approach his choice very responsibly. To do this, it is necessary to clearly imagine what type of money owner may be interested in your project. The choice depends on:

- project functioning stages;

- own cash and resources;

- the presence of additional investment attractive factors (unique assets, liquid collateral, original and viable business idea, etc.).

- Formation of a sentence. Outside the range of alleged investors, you need to convey to them the information that they can benefit from investing their funds into your project. To do this, you need to competently "package" information about the project:

- allocate advantages;

- justify profitability;

- provide a realistic business plan;

- specify the circle of future consumers, that is, the potential market for sales.

- Drawing up an investment summary. The entire attractiveness of the project for investors needs to be made as excit as possible and briefly. A correctly compiled investment offer - "Advertising" of your project - can be more effective for a personal meeting with future depositors. If a businessman does not feel in the power to do this, the preparation of proposals can be assigned by one of the consulting companies.

- Mailing of investment supply and summary. An optimal number of potential "sponsors" should be determined, which should be made. One or two appeals may not give results, and a large number of recipients will question the seriousness of your intentions. Practice shows the greatest efficiency when accessing 10-20 potential investors: the response percentage will be quite sufficient.

- Conversation. If your appeal is interested, you will need a personal meeting, which will solve the issue of investment opportunities. To negotiations, it is necessary to carefully prepare: create a short, bright, convincing presentation in which you need to highlight key questions regarding the project. It is advisable to use illustrative and handouts. The potential investor will certainly ask many questions.

- Documentation. Personal agreements are recorded in the formal document, a kind of contract. In the practice of investing, such paper is called a "letter of obligations" or "registration of the terms of the transaction". It has no legal force, but is preliminary in relation to future official cooperation, which will begin after signing the contract. Only after that the company can get fedes.