Reinsurance agreement: Structure and types. Russian legislation on reinsurance insurance case under the reinsurance contract

Article 967 of the Civil Code of the Russian Federation so determines the reinsurance:

The risk of payment of insurance compensation or insurance amount adopted by the insurer under the insurance contract may be insured in whole or in part from another insurer (insurers) on a concluded with the latest contract of reinsurance.

The reinsurance contract applies the rules stipulated by this chapter to be applied to the insurance of entrepreneurial risk, if otherwise not provided for the reinsurance contract. At the same time, the insurer under the insurance contract (main agreement) concluded a reinsurance agreement, is considered in this last contract by the insured.

When reinsurance, the insurer under this agreement remains responsible for the policyholder under the main contract for the payment of insurance compensation or the sum insured.

A sequential conclusion of two or more reinsurance contracts is allowed.

Reinsurance in terms of its essence is nothing more than the same insurance, but a few other order. It is predetermined by the presence of a contract direct, original insurance and is based on it. There is no doubt that without insurance of reinsurance would not exist.

Thus, the simplest definition of reinsurance is "Insurance of insurers", from which it follows that:

- · An activity has been carried out that prevents insurance companies an offensive of too much damage that can significantly affect the implementation of insurance operations. Consequently, reinsurance is an effective tool for ensuring financial stability of insurance companies.

- · For an insurance company, it is possible to shift a part of the responsibility on the original risk to another insurer or professional reinsurer.

These two reinsurance functions - the level distribution of responsibility and ensuring the financial stability of the reinsurer are modified, acquire various features and new features, but were and remain fundamental and determine the appointment of reinsurance as a whole.

Law "On the organization of the insurance business in the Russian Federation", Art. 13 gives the following definition:

"The reinsurance is the insurance by one insurer (reinsurance) at a certain agreement of the risk of the execution of all or part of its obligations to the insured among another insurer (reinsurer).

If you compare these two definitions, it becomes obvious that the legislator gives different interpretations to the same process of transmission (distribution) of possible losses under the insurance contract between the insurer (reinsurance) and the reinsurer (-s).

The definition given in the law is closer to the truth, as many specialists, speaking about the "risk of payment", focus on not on the word "risk", but on the word "payment" and reduce understanding of reinsurance to the next: if under the insurance contract was Payment, then the insured case under the reinsurance agreement came, and, therefore, the reinsurer must pay insurance indemnity under the reinsurance contract.

Such an interpretation can lead to absolutely illegal conclusions, the most famous of which was made by the defendant's lawyers in the sensational trial between the "infosite" and the "military insurance company": if the payment of insurance indemnity under the insurance contract was made after the expiration of the reinsurance agreement, then the reinsurer It should not pay such a loss, even if it occurred during the term of insurance and reinsurance contracts.

I will explain that in the simplest case of the reinsurance agreement (the so-called optional proportional contract), according to the existing practice, the terms of insurance and reinsurance coincide.

Thus, if the loss under the insurance contract will occur in the last days of insurance and reinsurance contracts, the insurer will not have time to complete the insurance and reinsurance period to pay insurance compensation (since the investigation of the circumstances of the insurance event and the preparation of the necessary documents is required), and, consequently, In accordance with the logic indicated above, the reinsurer will not pay a loss.

This very interesting and completely unexpected conclusion for all reinsurers was made by the lawyers of the reinsurer, before which there was a task - to refuse to pay insurance indemnity under the reinsurance agreement in any way.

This conclusion clearly contradicts even the fact that the reinsure of the reinsurer received the reinsurement, in this simplest case of the reinsurance agreement, in proportion to the share of responsibility under the insurance contract adopted into reinsurance.

However, despite the instructional arguments against, there is already a real legal practice, the courts make decisions confirming this position of the reinsurer.

Thus, the thesis is confirmed that reinsurance as the institution of relationship is not sufficiently described in the legislation of the Russian Federation. However, if you turn to the continental European law, for example, to German law, we see that there are no legal reinsurance issues in legislation are not considered at all, but are related to the field of customs of business turnover and contractual law. For example, in paragraph 186 of the Law on the Insurance Treaty, the "LAW Conserving Insurance Contract" / VVG, directly indicated that "the terms of this Law are not applied to the maritime insurance and reinsurance."

Most Russian lawyers considers the reinsurance agreement by a type of insurance contract, while it is fundamentally incorrect.

Of course, reinsurance and insurance have a related nature, however, as already mentioned above, reinsurance simultaneously plays the role of a certain financial guarantee, and if we talk about the so-called financial reinsurance (which is not distributed in the Russian market), it is in some cases almost a banking service and Its connection with insurance is quite conditional.

Moreover, since reinsurance is inextricably linked with insurance, we can draw the following conclusion that there is a certain financial and economic institution, one part of which is insurance, and the other is reinsurance, and one cannot claim that one of them plays the dominant, and the second one - the subordinate role .

In confirmation of the foregoing, I will give the simplest example:

If any insurance company starts to insure multi-billion risk, then the first thing is to resolve the possibility of its reinsurance, and only then, after agreeing the conditions of the future contract of reinsurance with reinsurers, the company may enter into an insurance contract of this facility.

Moreover, often the conditions of such an insurance contract are determined by global standards developed by the largest reinsurers, and not vice versa.

Otherwise, the insurance company falls on the path leading to bankruptcy, since the insurance contract can be concluded anyone, but only a risk corresponding to global standards and situation in the reinsurance market can be reinsured.

So, the European legislator on the basis of more than a hundred-time experience came to the conclusion that the reinsurance institute is quite complex, multifaceted, moreover, is in constant development, therefore, for its description, it is necessary to have a sufficiently bulky and constantly updated and updated document, or as It was done, attributed it to the sphere regulated by the customs of the business turnover, and all the reinsurance proceedings transfer to the arbitration courts.

Oddly enough, a similar conclusion was made by the All-Russian Union of Insurers (hereinafter - the WCC), when a few years ago, a arbitration court was created to resolve possible insurance and reinsurance disputes.

This unanimous support of this arbitration court, designed to help in difficult situations and unload the arbitration courts, is overshadowed by only one fact: according to my information, none of the matter did not do it.

The fact that the largest reinsurance societies of the world are focused precisely in the continental part of Europe, in my opinion, proves that the basis of the foundation of the foundations is the unconditional fulfillment of the customs of business turnover, contractual conditions, and not the presence of detailed legislation on reinsurance.

The issues discussed in this article are one way or another are characteristic even for English and American law. Therefore, we can talk about global problems associated with the correct description and interpretation of reinsurance contracts.

I would like to once again note that there is a period of insurance (reinsurance) as a period of risk of risk (if the insurance event has arrived during this period, then insurance compensation under insurance and reinsurance contracts) is made) and there is a validity of the insurance contract (reinsurance), which usually begins Simultaneously with the term of insurance / reinsurance and continues until there are claimed or unresolved claims or any other consequences arising from these treaties.

At the same time, the reinsurance contracts are usually indicated only by a period of risk carrying (reinsurance period), therefore, a specialist who is not familiar with the specifics of this kind of contracts may arise: why the premium under the reinsurance contract (reinsurance premium) is paid after the expiration of insurance and / or reinsurance (specified, as a rule, as the term of the contract) or why damages are paid even after five or ten, and it happens more after the end of this term?

In the reinsurance contracts (and insurance, too), in accordance with the practice, the risk risk (period of insurance or reinsurance) is usually called a period (term) of the contract, however, as mentioned above, the end of it does not mean for the reinsurance and reinsurer (and for Insured and insurer with regard to the insurance contract too) liberation from their duties under the contract.

The term of insurance (reinsurance) means only the fact that the insurance event, from whose occurrence of the object, should occur during this period of time.

A characteristic example is a contract for the optional reinsurance of goods. The term of insurance and reinsurance, as a rule, begins and ends simultaneously with the beginning and end of transportation, which often can last several hours or days. It is clear that for such a period not only to resolve possible claims, but even pay the insurance premium (not to mention the premium under the reinsurance agreement) is extremely difficult.

Thus, the peculiarity of the reinsurance contracts (and insurance is also) is that the parties are obliged to fulfill their obligations (including payment for insurance and reinsurance premiums and losses), even if the period of reinsurance (insurance) has expired.

Another typical problem for the reinsurance contract is to determine the insured event.

There is no such determination in the legislation, and unfortunately, many experts go on a simple and formal path, if it is written in paragraph 1 of Art. 967 of the Civil Code of the Russian Federation: "The risk of payment ... may be insured", then this is an insured event under the reinsurance contract.

As a result, there was a wide walking in the following, absolutely not kept no criticism, the definition: "Insurance case under a reinsurance contract is the payment of the reinsurance of insurance compensation to the insured."

First of all, I ask you to pay attention to the fact that in the GC it is indicated: "The risk of payment ... may be insured ...", and not "payment of insurance compensation ... may be insured ...".

After all, it is obvious that these are different in the sense of the phrase: the first one speaks of the possibility of paying under the insurance contract, and therefore the principal possibility of insurance of this risk, from the second one we can conclude that the payment itself is, thereby the insurance event, which is concluded Reinsurance contract.

But you need to figure out what an insured event is. With the insured object, something happens, it is usually called an insurance event, which subsequently (after the investigation of the circumstances and the receipt of all necessary documents) can be qualified by the insurer as an "insurance" or "non-trap case".

But even if the event is recognized (in accordance with the terms of the insurance contract) by the insured event, this does not mean that the Insurer will pay insurance compensation, as there are oncoming obligations of the insured: to pay the insurance premium, inform reliable information about the object, etc. In addition, the insured event must occur during the risk of risk insurer (insurance period). At the same time, in the contract (rules) of insurance, as a rule, there are exceptions from insurance coverage, such as the occurrence of an insured event as a result of the impact of nuclear explosion, hostilities, etc. (Art. 964, paragraph 1 of the Civil Code of the Russian Federation). Insurance compensation payments may not be in the event that the size of the loss does not exceed the size of the franchise specified in the insurance contract (policy). Therefore, it is impossible to talk about the equivalence of the concepts of "insurance case" and "payment of insurance compensation". The presence of an insured event is the necessary, but insufficient condition for the payment of insurance compensation.

However, it does not become clear from what is not clear what an insured event under the reinsurance contract. I will give an example. The building was insured against the fire, and this agreement was transferred to reinsurance. A natural disaster occurred, and the building suffered as a result of floods, the insurer, nevertheless, based on advertising purposes, made the payment of insurance compensation. Is the insured case under the reinsurance contract? Obviously, there is no, although the payment by the reinsurance was produced.

If we consider the concept of an insured event under the reinsurance contract, it is clear that for the payment of the reinsurer of insurance indemnity under the reinsurance agreement, it is necessary to provide conditions that are required to recognize the insurer of the insurance event under the insurance claim by the Insurance Treaty.

Since, as we already know, the presence of an insured event under the insurance contract does not yet mean an automatic work by the insurer of the payment of insurance indemnity, the existence of an insured event under the reinsurance contract does not mean the automatic payment of insurance compensation on it.

If you follow the analogues with insurance, the insurer, in turn, is also obliged to fulfill its counterfeit obligations under the reinsurance contract, moreover, for the payment of insurance compensation, the reinsurer is necessary for the event that the event that happens to all the terms of the reinsurance contract (and these conditions do not have to be identical The conditions specified in the insurance contract).

Thus, on the basis of the fact that the reinsurance agreement cannot be considered as an absolutely independent contract, in no way associated with the insurance contract, I believe that for any reinsurance agreement by the insured event (insurance or insured risk) is the same event in the case of whose occurrence. According to the original insurance contract, the insurer undertakes to pay insurance compensation.

This statement can also be indirectly confirmed by the fact that in the property insurance agreements (to which the legislator traveled to the reinsurance contracts) the payment by the insured by a loss, as a rule, is not the insurer for the insurer.

The insurance case is considered an unfavorable event (for example, a fire, a natural disaster, etc.), indicated in the insurance and reinsurance contract, with the onset of which it comes to the obligation of the insurer and the reinsurer to pay insurance compensation.

At the same time, speaking of reinsurance, it is necessary to recognize that numerous existing types and types of reinsurance agreements make the definition of this concept extremely difficult.

The simplest example. The contract of optional proportional reinsurance is actually in nature, the conditions of action and even appearance are extremely close to the usual constructing contract. This is understandable, since in this contract the reinsurer participates in risk on the conditions that meet the conditions of the insurance contract. So, if he carries half of the risk (his share of 20 percent of the insurance amount under the insurance contract), then he must receive half of the general insurance premium (minus the reinsurance commission) and will pay half of any loss to pay under the insurance contract.

Of course, it is legally not a compacting contract. The insured cannot appeal to the reinsurer for the payment of insurance compensation, there are no legal relationship between him and the reinsurer. Moreover, the reinsurer cannot pay anything to the insurer while the reinsurance (he is the insurer) will not fulfill all his duties under the reinsurance agreement (pays for the award, reports a loss, will consider the claim, pays for a loss, will decide on the payment of insurance compensation and direct the reinsurer all the necessary documentation.

Another type of reinsurance agreement is an excessant agreement constitutes another extreme - this is actually some financial guarantee to the reinsurance from the reinsurer to compensate its losses if the unprofitability throughout the risk portfolio (for example, for agricultural insurance against hail) will exceed a certain amount (for example, percent) . However, in any case, this unprofitability of the reinsurance is associated with a certain event (s), in this case, with a hail, under an insurance contract, which (s), in my opinion, should be considered an insured event under the reinsurance contract.

It is clear that it is quite difficult to determine and describe the entire range of reinsurance contracts, but considering the insured event under the reinsurance contract without communication with the insurance case under the insurance contract seems to be unlawful.

Speaking of the need for the right interpretation of the GC, I will give another example. In h. 2 tbsp. 967 says:

"The rules stipulated by this chapter are applied to the reinsurance agreement to be applied regarding business risk insurance if otherwise provided by the reinsurance contract."

Some law enforcers understand this phrase as follows: the reinsurance agreement is an entrepreneurial risk insurance contract.

But it is not so! The legislator, understanding the obvious complexity of the description of reinsurance relations, indicated that the reinsurance agreements apply the rules to be applied to the insurance of entrepreneurial risk, and this means completely different.

Moreover, the parties under the reinsurance agreement have the right to negotiate about another. Thus, our legislation, following the principle of "Freedom of the Agreement", allows you to apply the most customs of business turnover and contractual conditions on which, as mentioned above, the entire system of continental and global reinsurance is maintained.

1. The risk of payment of insurance compensation or the sum insured, adopted by the insurer under the insurance contract, may be insured in whole or in part from another insurer (insurers) on a concluded with the latest contract of reinsurance.

2. The rules stipulated by this chapter shall be applied to the reinsurance agreement to be applied to the insurance of entrepreneurial risk, if the reinsurance contract is not provided otherwise. At the same time, the insurer under the insurance contract (main agreement) concluded a reinsurance agreement, is considered in this last contract by the insured.

3. When reinsurance in charge of the insured by the main insurance contract for the payment of insurance compensation or the sum insured, the insurer remains under this contract.

4. A sequential conclusion of two or more reinsurance contracts is allowed.

Comment to Art. 967 of the Civil Code of the Russian Federation

1. Considering the content of paragraph 1 of the commented article, it should also be recalled that by virtue of paragraph 1 of Art. The 13 Insurance Insurance Act is understood as the protection of the property interests of another insurer (reinsurance) associated with the Insurance Treaty adopted by one insurer (reinsurance) associated with the continuation of the insurance fee (main agreement) of the insurance contract.

The basis of the occurrence of reinsurance obligation is a reinsurance agreement.

The parties to the reinsurance contract are the reinsurer and reinsurance.

Reinsurance is secondary insurance. Following the letter of the law (paragraph 1 of the commented article; paragraph 1 of Art. 13 of the Insurance Act), in time it is preceded by a certain insurance contract (the main contract). In order to ensure the interests of the insurer on this (main) contract, and the reinsurance is concluded. In the reinsurance contract, this subject, which is an insurer in the main contract, acts as a reinsurance (insurer) in the reinsurance contract. If he has a duty to produce insurance payments on the main contract (an insured case comes), then the insured event occurs under the reinsurance agreement. The property area of \u200b\u200bsuch a person (insurer under the main contract, the reinsurance (insured) under the reinsurance contract) is restored in whole or in terms of the reinsurer (insurer in the reinsurance contract).

———————————

ConsultantPlus: Note.

The question of which event has the meaning of the insured event to reinsurance, refers to the number of discussion. In addition to the outlined position, the opinion is often expressed, in accordance with which the insurance case for reinsurance is the payment of the insurer in the main agreement of the sum insured. For example, see, for example: Braginsky M.I., Vitryansky V.V. Contract law. 2nd ed., Ched. M.: Statute, 2001. The third book: contracts on the performance of work and the provision of services. P. 598 - 600.

Both sides of the contract must have a license (see Art. 938 GK and comment on it).

2. With the first approximation, the content of paragraph 2 of the commented article creates the impression that the reinsurance agreement is an entrepreneurial risk insurance contract (see Art. Art. 933, 947, 949 - 952, 955, and the corresponding comment). The impression is wrong. The reinsurance contract only applies the rules on the insurance of entrepreneurial risk. Moreover (and this is the main thing) they are applied if the reinsurance contract is not provided otherwise. Thus, at the head of the corner are the terms of the contract, but not the rules on the insurance of entrepreneurial risk. These rules may be completely "crossed" by the contract: it can be provided that the rules for the insurance of entrepreneurial risk in the appropriate case are not applied at all. In the contract on this account there may be direct indication; The conclusion about this may follow from the content of the contract.

At the same time, the noted does not mean arbitrariness in the formulation of the conditions of reinsurance contract. This contract is a kind of insurance contract. And therefore, essentially, should be an insurance contract (reflecting the essence of relevant economic relations). From the point of view of the formal legal, the reinsurance agreement should not be contrary to the imperative norms on the insurance contract.

In this regard, an insolvent extremely widespread point of view is presented, in accordance with which reinsurance is a kind of cessia.

———————————

ConsultantPlus: Note.

Monograph M.I. Braginsky, V.V. Vitryansky "Negotiated Law. Contracts for the performance of work and the provision of services "(Book 3) included in the information bank according to publication - Statute, 2002.

For example, see, for example: Braginsky M.I., Vitryansky V.V. Decree. cit. P. 592 - 594.

3. It is hardly possible to agree with the fact that during the reinsurance, the distribution (redistribution) of risks occurs. From the point of view of economic, probably, this is true, but from the point of view of the legal relationship of insurance and reinsurance relationships are independent. Although, of course, being an insurance relationship affects the dynamics of reinsurance relationship. Thus, the reinsurance ratio may arise, provided that there is an insurance ratio (the main contract). The offensive of the insured event in the main contract means the offensive of the insured event under the reinsurance agreement.

4. It is allowed that the reinsurer, in turn, also concluded a reinsurance agreement. After all, the reinsurance agreement is a kind of insurance contract. Such reinsurance contracts concluded consistently (vertically) may be several. There is also possible the existence of several reinsurance contracts in parallel when the insurer for the main contract concludes several reinsurance contracts.

5. By virtue of paragraph 2, 3 of Art. 13 of the insurance law is not subject to reinsurance of the risk of insurance payments under the life insurance contract in terms of harvesting the insured person until a certain age or the deadline or the occurrence of a different event. Insurers who have licenses for life insurance are not entitled to reinsurance of property insurance risks assumed by insurers.

Definition. Insurance case under the reinsurance contract. The sequence of concluding reinsurance contracts. Risks not subject to reinsurance.

1. The risk of payment of insurance compensation or insurance amount adopted by the insurer under the insurance contract may be insured in whole or in part from another insurer (insurers) on prisoner with the latest reinsurance contract (clause 1 of Art. 967).

The reinsurance agreement is a variety of property insurance contract.

(K.Yu. Bubnova)

From the history of civilistics

This contract does not differ from ordinary insurance, and therefore those legislation are performed completely correctly, which subordinate the reinsurance of the general insurance rules.

(P. Schenevich)

2. According to the above definitions, the insured event under the reinsurance contract is the payment of insurance compensation to the insured.

Reinsurance should be considered not as insurance of the risk of payment of insurance compensation and not as insurance of the fulfillment of the obligation under the insurance contract. Reinsurance should be defined as insurance of the risk of the onset of the obligation to pay insurance compensation or insurance amount.

(A.V. Kohnsky)

Arbitrage practice

Abz 20 Resolution of the FAS of the Moscow District of 28.05.2003 N kg-A40 / 2529-03-p.

3. For one original insurance contract, it is possible to conclude several reinsurance contracts.

In the practice of reinsurance, the terms "Risk transfer", "Transfer of responsibility" are sufficiently sustainable. The parties to the contract call themselves "Cedent" and "Cession", consecutive reinsurance contracts are called "retrocession", thereby stressing that when reinsuranceing from the reinsurer to the reinsurer something is transmitted. This is completely incorrect. When reinsurance, no turnover of civil rights objects (Article 128 of the Civil Code) does not occur and no one transfers anything to anyone.

(Yu.B. Fogelson)

4. Reinsurance of some insurance risks is prohibited by law. In particular, the risk of insurance payments under the contract of life insurance in a part of the progress of the insured person to a certain age or the occurrence of a different event is not reinsured.

Literature

Abramov V.Yu., Dedikov S.V. Forensic-practical commentary on insurance legislation. M.: Volkers Clever, 2004.

Braginsky M.I. Insurance contract. M.: Statute, 2000.

Bubnova K.Yu. On the subject of the legal nature of the reinsurance agreement // Actual civil law problems: a collection of articles. Vol. 6 / Ed. O.Yu. Shilohvost. M.: Norm, 2003.

Emelyanov A. On the concept of mandatory insurance // Household and law. 1997. N 12.

Zhuk A.V. Delicious liability insurance problems: Author. diss. ... Cand. jurid science St. Petersburg., 2001.

Igoshin N.A. Insurance law: Lecture Abstract. SPb.: IVESEP; Knowledge, 2008.

Kosyenko N.N. Legal support of public interests in the field of insurance: monograph. M.: Volters Clever, 2010.

Kosyenko N.N. Modern Insurance Law. M.: Economics, 2009.

Kosyenko N.N. Insurance law: course of lectures. M.: Flint; MPSI, 2008.

Mamedov A.A. Insurance law is a comprehensive branch of legislation // Legislation and economics. 2004. N 7.

Morgunova E.L. Implementation of state interests in insurance: constitutional legal framework: author. diss. ... Cand. jurid science M., 2006.

Silver V.I. Selected works on hereditary and insurance law. M.: Statute, 1997. (Classics of Russian civilistics.)

Smirnova M.B. Insurance law: studies. Location. M.: Justicinform, 2007.

Insurance law of Russia: studies. Location. / VS White, I.V. Krivosheev, I.A. Mithrike; Ot. ed. V.S. White. 3rd ed. M.: Norm, 2009.

Insurance services are becoming increasingly popular every day. The load on insurers is growing increasingly - that is why legislation reforms are held, allowing to make it possible to slightly facilitate financial responsibility. One of the most effective measures is to use the reinsurance contract.

Dear readers! The article tells about the typical ways to solve legal issues, but each case is individual. If you want to know how solve your problem - Contact a consultant:

Applications and calls are accepted around the clock and seven days a week..

It's fast i. IS FREE!

What it is

A phenomenon as reinsurance is a risk redistribution system between several insurance companies.

They can be divided into two categories:

- direct insurer;

- other participants in the reinsurance contract.

If an insured event occurred in the contract occurs, the direct insurer is initially the entire financial burden.

Subsequently, it is evenly or otherwise distributed between other participants in the Type of Treaty - direct insurer is reimbursed by reinsurance.

To understand the essence of this phenomenon, it is necessary to familiarize themselves with the following terms that appear in the treaties under consideration:

- wrapping;

- reinsurance;

- reinsurer.

CONSTRUCTION - a form of responsibility at which there is no direct insurer. Upon the occurrence of the insured event, the financial load will immediately be distributed among all the participants in the Type of Treaty.

The reinsurance is called SC, which betrayed another company part or even all responsibility on how much risk.

The reinsurer - the company that makes responsibility from the reinsurer as a result of the occurrence of the case agreed in the contract.

The development of reinsurance relationships between various companies led to several types of standard contracts.

Most often today are used by the following varieties:

- optional - optional;

- mandatory - bonds;

- optional - bonds.

The use of any kind of contract depends on the specific situation and a large number of various factors.

Basic principles

All reinsurance contracts are drawn up taking into account the basic principles formulated by the insurers themselves in the process of obtaining experience with various insured events. They are not enshrined at the legislative level, but most of the companies keep them.

To these principles, first of all, the following should be attributed:

- principle of retribution;

- principle of goodwill;

- principle of following fate;

- principle of confidence.

The principle of retribution implies the obligatory payment of the reinsurer to the reinsurance (cedent) in full compliance with its share of participation, as well as various other conditions of the contract in question. But this payment is possible only if the reinsurance fully complies with all the terms of the contract.

Under the principle of goodwill, the responsibility of the reinsurance (cents) is meant to provide the reinsurer all information about the possible risk transmitted for insurance (cited).

The reinsurer in turn assumes all the responsibility of this risk. There is one important nuance - the risk of insurance payments under the contract is not subject to reinsurance.

Since most insurers are not profitable to work with such cases. The probability of financial losses in this case is quite large. The most relevant is the principle of following fate.

His essence lies in the fact that the reinsurer fulfills all its obligations fully according to the current contract.

But in the event of a violation of its duties, the reinsurance contract is unilaterally eliminated. The basis for this can serve a rough error or other action, which is accomplished deliberately and leading to violation of the provisions of the concluded agreement.

The principle of trust in the contract itself is not reflected. It implies conscientious business and fulfilling all obligations assumed.

What it provides

In the insurance contract, a variety of risks may appear. There is also a large number of other nuances. When using bond reinsurance, the Agreement may be concluded both for a certain period and for an unlimited period.

The contract of this type provides for the following:

- the reinsurer undertakes to transfer all agreed risks present in the text of the document;

- the reinsurer, in turn, is obliged to accept them (accept).

The main advantage of this method of reinsurance is fully automatic transmission of all risks for reinsurance. That is why all obligations are usually carried out with a high guarantee.

Agreement of optional reinsurance actually represent a single transaction. With optional reinsurance, the subject of the contract is any specific risk or a group of such risks.

The following points are very important:

- the reinsurance holds the right to independently choose the reinsurer;

- the reinsurer decides independently - whether the risk in the reinsurance agreement is included.

The reinsurance contract of this type has its advantages and disadvantages. The latter should include:

- laboriousness of the design (in the text of the document sometimes there is a very large number of different risks);

- conditions can be chosen individually for any, regardless of the value, object.

When concluding optional-bond insurance, it is always possible to decide on the transfer of risk yourself.

That is, if necessary, you can not contact the insurance company for compensation upon the occurrence of the insured event.

The bonmon-optional insurance provides for the possibility of transferring the risk by a direct insurer to reinsurance. But at the same time the reinsurer has the right to take this risk to insurance, and not accept it.

What is responsible for the reinsurer

The reinsurer is responsible for the risks marked in the contract, and pays monetary compensation on them.

But perhaps this is only if the reinsurer decides to appeal to the SC in the event of an insured event, as well as, if it is provided for by the terms of the concluded agreement between all parties to the contract.

As a risk in which direct insurers and reinsurers are responsible may be the following:

- accidents on nuclear reactors;

- emergency situations in nuclear power plants;

- damage from terrorist acts and all kinds of sabotage actions;

- pharmaceutical risks, agricultural and other character.

The above risks today are the most dangerous, and the emergence of them leads to the consequences, which sometimes require quite serious financial costs.

That is why the responsibility for such situations, the cedent is trying to shift on the third person - the insurer, the reinsurer.

The obligations of the subject in the reinsurance contract are determined in the amount of the insurance premium, mandatory for payment. In addition to insurance risks, the reinsurer is responsible for respecting all its duties.

If they are not fulfilled for some reason, the company can suffer quite serious losses - often one of the terms of the contract under consideration is the payment of a penalty.

What is a reinsurance agreement on the basis of an extrudental loss

The special type of the contract under consideration is an agreement on the basis of an extrudent of the loss. As an object of reinsurance, a loss is indicated, the magnitude of which significantly exceeds the priority.

For the reinsurer, the limit is mandatory, within which it is responsible.

If an insured event occurs, the company is obliged to compensate all losses, but strictly within the limit designated in the text.

Expandment reinsurance agreement loss may include:

- damage from one risk;

- damage from a group of different risks.

Moreover, when the risk occurs, the payment under the reinsurance contract is carried out simultaneously with the payment of an ordinary insurance contract - if these agreements are concluded at the same time.

Usually, if any insured event occurs, followed by a liability limit on it decreases to the amount paid.

It happens that the entire limit is exhausted even before the term of the insurance contract is completed. To avoid the emergence of this kind of situation, many standard agreements provide for automatic responsibility.

But for the accuracy of this kind of action, it is necessary to make the payment of the insurance premium in favor of the reinsurer.

Compression in contracts

In the reinsurance contracts, very often appears such a concept as compression. Most often it is present in the agreements designed for an excessive loss type.

Under this term themselves is understood as the fact of increasing the cash limit on payments in the event of a certain, previously agreed, conditions.

These include:

- long insurance period;

- the absence of the emergence of insurance risks.

Often, many insurance companies engaged in reinsurance go towards their customers and increase the limit of responsibility, not charged for this fees.

The basis for this is usually a very long period of cooperation, during which the reinsurance did not violate his duties. Compression may be present in any contracts, regardless of the number of risks stipulated in them.

Reinsurance - The system of redistribution of the risk between insurers, at which the first (direct) frameman accepts the entire risk of its own responsibility from the policyholder, and further redesses each other and other insurers. Upon the occurrence of the insured event, the damage is reimbursed by the first (direct) stamp, after which the remaining insurers reimburse him (direct insurer) damage in accordance with the terms of the reinsurance contract.

CONSTRUCTION - The system of redistribution of risk between insurers, in which the whole risk is immediately redistributed to several insurers. Upon the occurrence of the insured event, each insurer immediately participates in the compensation of damage in accordance with the shame of responsibility.

Reinsurance - Insurer who transmits to another insurer (reinsurer) part of responsibility or all responsibility but risk adopted by him either from the insured or from another insurer.

Reinsurer - Insurer hosting another insurer (reinsurance) part of responsibility or all responsibility at risk.

Insurance relations systems

The following systems of insurance relations are distinguished: coordination, reinsurance ,.

Corporation It is used as a method for the distribution of large property risks by separating the risk between insurers. Thus, the object of insurance may be insured by one agreement together with several insurers. At the same time, the contract must contain conditions that determine the rights and obligations of each insurer. If the rights and obligations of each of the insurers are not identified in such a contract, they jointly respond to the insured (beneficiary) for the payment of insurance compensation under the property insurance contract or the sum insured under the personal insurance contract.

At the principle of cooching, the activities of insurance pools are based - the association of insurers for joint insurance of certain categories of risks (aviation insurance, environmental insurance, etc.). Insurers together insure large risks, sharing the responsibility among themselves.

Corporation is one of the methods for the distribution of large property risks, but is rarely used when insuring responsibility. The method of implementing this method is simple and suitable for most cases. Although there are problems. First, in the case of large losses, all Sosduchists will send individual checks. It may be burdensome if large amounts of insurers are involved in the composure. Secondly, the mediator when placing a large risk will have to contact a large number of different Sosparachists, each of which is ready to provide a coating on only part of the risk in accordance with its container.

Reinsurance- An integral element. Reinsurance ensures financial sustainability of insurance operations of any insurance society.

The Law of the Russian Federation "On the Organization of Insurance In the Russian Federation" gives the following definition definition: "Reinsurance is an insurance with one insurer (reinsurance) at the contractual risk of the execution of all or part of its obligations to the Insured for another insurer (reinsurer).

Reinsurance There are secondary insurance of previously insured risk to ensure the solvency of the insurer. At the same time, the insurer concluded a reinsurance agreement with the reinsurer remains responsible for the insured in full in accordance with the insurance contract.

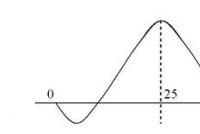

Reinsurance is a very specific area of \u200b\u200binsurance relationships. This is reflected in its terminology. So, the process associated with the transfer of everything or part of the risk is called reinsurance risk, or reinsurance Cessia (Fig. 1). In this case, the reinsurer who gives the risk is called cedent, and the reinsurer who takes the risk - cessionaria. The risk taken by the reinsurer from the reinsurer ( cessionarius from Cedenta), in turn, is often subjected to subsequent transmission fully or partially the following insurance society. Such a subsequent transfer of the reinsured risk is called retrocession. Insurance society that transmits the risk to the reinsurance of the third participant is called retroceedent, and insurance society that takes this risk - Retrocessiona.

Transferring risks to reinsurance, the reinsurer receives the right to bonus, that is, the commission from the profits, which the reinsurer can obtain when implementing the contract.

Thus, reinsurance is the secondary insurance of emergency risk insurers exceeding the solvency of the insurance organization. This is the essence and the main function of reinsurance.

The object of the reinsurance relations of the subject and the cessionary is the property interests of the Insurance Company. The reinsurance is based on a contract, according to which one side of the Cedent - transmits the other party to the reinsurer (Cessionaria), which in turn assumes the obligation to reimburse the provision of the corresponding part of the paid insurance indemnity. The transfer process is called testing Risk, or reinsurance zason.

Fig. 1. Reinsurance process- primary insurance;

- reinsurance (cession);

- retrocession

The reinsurance agreement corresponds to the principle of retribution, which is that the reinsurer is obliged to pay the provider (reinsurance) insurance amount, or insurance compensation, in proportion to the share of participation and only if the reinsurer paid the insurance amount due to the insurance amount (insurance indemnity) to the insured. At the same time, the reinsurance is obliged to provide the reinsurer full and reliable information about the cited risk. This condition is called the principle of goodwill.

The object of reinsurance relations is the property situation of this insurance company, which advocates as a subject. The reinsurer does not have any rights and obligations arising from the insurance contracts concluded by the reinsurer. In turn, the insured has nothing to do with the reinsurance agreements concluded by the reinsurance relative to the transfer of risks. The insurer is not obliged to inform the policyholder about the intention to transfer risks into reinsurance.

Active and passive reinsurance differ. Active reinsurance is the transfer of risk, passive - in his reception.

Types of reinsurance contracts

The long-term development of reinsurance relations has formed a number of types of reinsurance contracts. In the form of mutually taken obligations, the reinsurance contracts are divided into:

- optional (optional);

- bonds (mandatory);

- optional and bonds.

The most early form of contracts were contracts optional reinsurance. This Agreement is an individual transaction concerning one risk. His distinguishing feature lies in the fact that both the reinsurer and the reinsurer provided the possibility of an individual risk assessment: to the subject - in solving the issue, how much should be left in our own risk (own retention), and the censionary - in solving risk issues in one way or another . The negative side of optional reinsurance - the cedent must convey part of the risk before the conclusion of the contract with the insured. Because of this, the cessionary has a small period of time for a detailed analysis of the received risk.

Treaty bond reinsurance obliges the cable to convey certain stakes in all risks adopted for insurance if their overall insurance amount exceeds a certain in advance of its own participation (guarantee) of the insurer. At the same time, this agreement imposes a commitment to the reinsurer to adopt the shares of these risks offered to him. Such a type of contract is most profitable for the cedentis, since all predetermined risks automatically receive insurance provision at the reinsurer.

Service of bond reinsurance is cheaper for both parties compared to fault reinsurance service. Therefore, in the practice of an international reinsurance market, bond reinsurance contracts are most often found.

Optional and bonds (transitional) The form of the contract gives the subject to the freedom of decision-making, with respect to what risks and in what size should be transferred to cessionary. In turn, the cessionary is obliged to adopt the pricing shares of risks on pre-agreed conditions. The reinsurer This form of the contract may be disadvantageous and unsafe, since the reinsurer, having analyzed risks in the insurance portfolio, can transfer the most dangerous risks to reinsurance.

Therefore, the "Open Coverage" contracts are concluded only with reinsurance workers who enjoy complete confidence of reinsurers.

With bonne-optional reinsurance, the obligation is assumed for the reinsurance, and the optionality is for the reinsurer.

In general, reinsurance contracts are divided into two main groups:

- proportional reinsurance;

- disproportionate reinsurance.

The main forms of contracts proportional reinsurance are:

- quota, or equity;

- excedutent, or limit;

- quota-excendent, or mixed.

In addition, the modifications of these forms are sometimes used, which are used depending on the goals set.

Quad, or equity, contract is the most simple form of proportional reinsurance. Under the terms of this agreement, the reinsurer transfers to reinsurance in a fraction agreed with the reinsurer, all without exceptions adopted for insurance risks on a certain type of insurance or group of adjacent insurance. In the same share, the reinsurer is transmitted to the insurance premium due to him, and it reimburses the reinsurance in the same proportion all the insurance losses paid to them upon the occurrence of the insured event, i.e., with a quota agreement, the censionary fully divides the losses of the cedentis in a certain proportion.

Transferring risks to reinsurance, the reinsurance holder has the right to commission in its favor, which, depending on the type of insurance, can range from 20 to 40% of the gross premium, as well as on a certain participation of the reinsurer obtained by the risk adopted by him i.e. the reinsurer has the right to bonus.

The main disadvantage of the quotient contract lies in the need to reinsurance in a large proportion of small and, therefore, which are not serious danger of risks, which under other circumstances the transmitting company could keep in their own liability, while maintaining large amounts of award.

The defining factor in reinsurance on the excendent agreement is the so-called "own retention", which is a certain level of deduction of the sum insured, within which the reinsurer leaves on its responsibility only a certain part (limit) of risks, and the rest transmits the reinsurer.

Self-liability limit The insurer, as a rule, establishes in a certain amount in each risk group, but in one type of insurance (for example, vessels, cargo, space objects, etc.). So, if the maximum of its own participation of the reinsurance (excessant) is 100 thousand rubles, then all risks adopted for insurance within this amount are transferred to the reinsurer.

At the conclusion of the contract excedutent The reinsurance is excluded all risks, the insurance amount of which is less or equal to the number of shares of the insurer's own participation established for this portfolio.

Conversely, risks, the insurance amount of which exceeds their own liability of the insurer, are considered reinsured. The percentage of reinsurance is the ratio of the participation of the reinsurer to the insurance amount of this risk. It is the basis for mutual settlements between the reinsurance and the reinsurer, both on reinsurance payments and insurance payments.

Exceduent reinsurance agreements are more profitable for the reinsurance than quota reinsurance agreements. The advantage is expressed in the fact that the maximum alignment of the insurance portfolio is ensured. In addition, under the extent reinsurance agreement, the lower amount of insurance payments is transferred to the reinsurer (the cedent holds the entire set of small insurance risks on its own insurance liability).

Quotary Excedutent The reinsurance agreement is a combination of the two types of reinsurance contracts listed above. The portfolio of this type of insurance is reinsured by quota, and exceeding the amount of risk insurance over the established quota (norm) is subject to reinsurance on the principles of the extent.

Disproportionate reinsurance, unlike proportional, where the main thing is the equity distribution of responsibility for risks (the share of the insurance sum, premium, losses) is based on the division of liability of the parties to the loss.

In case of disproportionate reinsurance, the fee for the damage provided is a certain part of the insurance premium, but this part is determined in accordance not with the share of the participation of the reinsurer in the contract, but with a loss share. The appointment of such reinsurance is to ensure the guarantee of the solvency of the insurer at risks with a major loss.

Disproportionate reinsurance is also applied in all types of insurance, where there is no liability limit of the insurer (for example, with personal insurance). Its essence is that the reinsurance itself pays for all losses to the size consistent in the contract, and the excess of this size is subject to payment by the reinsurer, for which certain responsibility is also established.