In 1c, calculate the daily allowance for a business trip. Accounting info. Calculation of average earnings

In almost every organization, at least once, an accountant had to send an employee on a business trip. In this article, we will look at how to arrange a business trip in 1C 8.3 Accounting.

You will learn:

- is it possible to make an order for a business trip in 1C 8.3 Accounting;

- how to spend travel expenses in 1C 8.3;

- how to calculate daily allowance and travel allowances in 1C 8.3 Accounting.

First, let's look at the questions that most often arise before users:

- is it possible to make an order for a business trip in 1C 8.3?

- how to find a travel certificate form in 1C 8.3?

Unfortunately, there are no personnel documents, such as an order for a business trip or a travel certificate, in Accounting 3.0. But you can modify them yourself or with the help of a programmer.

Let's consider how to draw up travel transactions in 1C 8.3 Accounting, for example.

Constructor-designer P.A.Mikhailov was sent on a business trip from September 21 to 27. According to his work schedule, Saturday and Sunday are days off.

- railway ticket (Moscow-Samara) in the amount of 2 988 rubles. (including VAT 18% - 67.15 rubles);

- railway ticket (Samara-Moscow) in the amount of 2 240 rubles. (including VAT 18% - 67.15 rubles);

- receipt and invoice for hotel accommodation in the amount of 4,248 rubles. (including VAT 18%).

The daily allowance in the Organization in accordance with the Regulations on Business Trips is paid at the rate of 700 rubles per day. - 4 900 rubles.

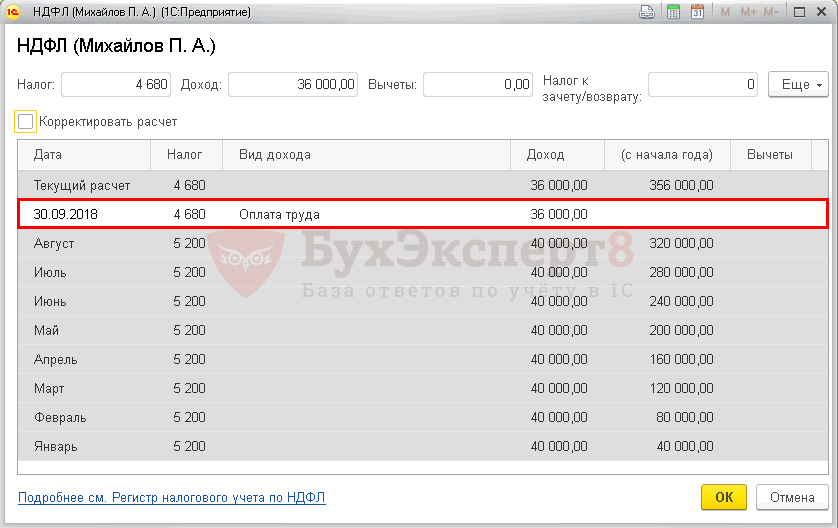

On September 30, the accountant calculated Mikhailov's salary for a month, including 5 working days of a business trip.

How to spend travel expenses in 1C 8.3

Travel expenses in 1C 8.3 Accounting, incl. Issue per diem on the basis of the employee's advance report on the business trip in the section Bank and cash desk - Cash desk - Advance reports.

In the header of the document, indicate:

- Accountable person - from the reference book Individuals select the employee who is accountable for the trip.

In the tab Prepaid expense by button Add to select documents for issuing an advance.

The accrual of daily allowances in 1C 8.3 Accounting reflect on the tab Other ... Show all other travel expenses (train tickets, accommodation, etc.) here.

Cost item choose with By type of consumption - Travel expenses.

Postings

Acceptance of VAT for deduction

So that the VAT allocated in tickets and invoices presented by counterparties can be accepted for deduction, in the columns:

- SF - check the box if SRF or SF is presented.

- BSO - check the box for SSO documents.

- Invoice details - enter the number and date of the Federation Council. SSO details will be filled in this column automatically from the column Document (expense) .

As a result of registration, SSO and SF will automatically be created:

- Invoice (strict reporting form) .

- Invoice received .

Documents can be found in the magazine Invoices received through section Purchases - Purchases-Invoices received or follow the links in the document Advance report .

How to calculate travel allowances in 1C 8.3 Accounting

Settings in 1C for calculating payment for a business trip

To calculate the average earnings during a business trip, create the accrual type of the same name in the reference book Accruals which can be opened from the section Salary and personnel - Reference books and settings - Salary settings - Payroll calculation - Accruals.

Pay attention to filling in the fields:

Section Personal income tax :

- switch taxed ;

- income code - 2000 - remuneration for the performance of labor or other duties; pay and other taxable payments to military personnel and those equated to them;

- Income category - Salary.

Section Insurance premiums :

- Income type - Wholly taxable income.

Section Income tax, type of expense under Art. 255 Tax Code :

- switch taken into account in labor costs under the item : nn. 6, Art. 255 Tax Code - the amount of average earnings accrued to employees, retained for the time they perform their state and (or) public duties and in other cases provided for by the legislation of the Russian Federation on labor;

- flag Included in the basic charges for calculating charges "Regional coefficient" and "Northern markup" do not need to be installed for Accruals Payment for time on a business trip, because for calculating the payment, these charges have already been taken into account.

Section Reflection in accounting :

- Reflection method - not installed.

In 1C, the accrued amount will be reflected on the payroll account with the BU and NU settings specified in the reference book Employees in field Cost accounting .

Calculation of payment for time on a business trip

Accrual of travel allowances in 1C 8.3 Accounting does not have a special standard document. Therefore, the accrual of average earnings during a business trip is calculated manually and documented Payroll In chapter Salary and HR - Salary - All accruals - Create button - Payroll.

Specify in the document:

- Salary for- the month for which the employee's salary is calculated;

- from - the last day of the month.

By button Add toselect the employee to be paid for the time on the business trip. By button Accrueselect:

- Accrual Salary payment - indicate the number of days worked at the workplace, minus days on a business trip (calculate manually). The program will automatically calculate the amount.

- Accrual Payment for time on a business trip- fill in.

Check all the amounts charged to the employee and, if necessary, correct them in the form following the link Assessed .

- count Personal income tax - the amount of calculated personal income tax.

How to arrange a business trip and pay travel allowances in the 1C 8.3 Accounting program?

Sending an employee of an enterprise on a business trip begins with an order from the director. The employee is notified of this, and if an agreement is reached, the order is forwarded to the accounting department (the order of operations at different enterprises may be different).

In the accounting department, a travel certificate is issued (based on the order of the director). These documents in a typical configuration 1C 8.3 "Enterprise Accounting 3.0" are not drawn up.

In the 1C program, the design of a business trip begins with the issuance of money.

Issuance of travel allowances in 1C 8.3

As a rule, money is issued from the cashier. In this case, the issue is drawn up by a “cash outflow order”. Although, especially recently, funds can be transferred by bank payment to the employee's card. This creates a document "Write-off from the current account".

The amount is initially calculated approximately based on the estimated costs:

- travel

- residence

- per diem

- other

To receive funds, an employee must write a statement indicating the amount and purpose of the expenses. In our case, these are travel expenses.

Let's consider how to issue an advance payment using the example of an “Expense cash order”.

Immediately you need to establish the type of issue (type of operation) "Reporting person". Then we fill in the details:

- organization (if there are several of them in the database)

- recipient

- sum

- in the decoding of the details of the printed form, indicate the number of the employee's statement

In the comment, you can indicate that this is an advance payment for a business trip:

Now you can post the document and view the transactions for issuing travel allowances, which 1C Accounting 8.3 will generate:

The employee has a debt for which he must account.

Employee travel expense report

Upon returning from a business trip, the employee is obliged to account for the money spent. For this in 1C 8.3 is the document "Advance Report".

The "Advance report" is created in the same section as "Cash documents".

In the form of a list, press the button "Create". A new document form will open.

First of all, we choose an accountant. Then, on the "Advances" tab, click the "Add" button and in the "Advance document" column, select the expense slip that was issued earlier (a window will open first where you need to select what type of document we need):

Then go to the "Other" tab and fill in the lines where the employee's expenses went. If the funds went to purchase goods, these operations should be reflected on the "Goods" tab.

An example of filling in the "Other" tab:

If we pass the document and look at the transactions, we will see that the company's debt to the employee has decreased by 2,000 rubles:

Since the expenses have already been paid, they immediately fall into the Book of Income and Expenses of the STS:

Based on materials: programmist1s.ru

In the economic activity of the organization, the preparation of advance reports is one of the most common actions of an accountant. Most cash settlements are processed advance reports: this and travel expenses, and various household purchases.

On account of the employee of the organization, cash is issued from the cash desk (or cash documents, for example, air tickets). This is drawn up by an expense cash order or the document "Issuance of cash documents".

After spending the expenses, the employee reports, providing the accounting department with documents confirming the expenses incurred, and fills out an advance report for final calculations.

Consider the order of entering the document “ Advance report" For example 1C Accounting 8.2 revision 3.0.

If you are working in the program 1C Enterprise Accounting revision 2.0, then it's okay - the document "Advance Report" in these editions is almost identical. There is some difference in, but you can find the document in the program menu.

You can open the list of documents "Advance reports" in the accounting section "Bank and cash desk", subsection "Cash desk" in the navigation panel, item "Advance reports".

Using the "Create" button, enter a new document.  In the header (top) of the document, you must specify the main details:

In the header (top) of the document, you must specify the main details:

- organization (if the default organization is specified in the user's personal settings, that when new documents are entered, it is selected automatically);

- the warehouse where the purchased accountable person material values;

- an individual is an employee of an organization who is accountable for the funds issued to him under the report (this requisite is required to be filled in).

Form of the document "Advance report" has five tabs.

On the “Advances” tab, the document to which the accountable funds were issued is selected. There are three types of documents to choose from:

- issuance of cash documents;

- account cash warrant;

- write-off from the current account.

If the accountable person was given money, then you must select the document that reflects the issue.

In the list of documents that opens, select an already created one or create a new document.

When you enter an expense cash order from the “Advance Report” document, the transaction type “Issue to the reporting person” is automatically substituted into the cash register, the recipient - the reporting person selected in the advance report, and the accounting account. It remains for us to select an item of cash flows and indicate the amount of the advance.

After the document is posted, we select it, and in the tabular section "Advances" of the document "Advance report" the amount and currency of the advance payment will be automatically entered.

Stationery was purchased for the advance payment. Their purchase must be reflected on the "Products" tab. This tab contains information about the purchased goods and materials.

On the "Container" tab, information on returnable containers received by the accountable person from suppliers (for example, bottles for drinking water) is filled in.

The "Payment" tab contains information about the amounts in cash paid to suppliers for the purchased values \u200b\u200bor issued in advance for future delivery.

The "Other" tab is designed to display information about travel expenses. This can be per diem, tickets, gasoline costs. The name, number, date of the document (or expense), the amount of expense are entered on it.

Goods, services and other expenses are selected from the directory ““. In the corresponding tabular sections of the document, the requisites "Accounting account" and "VAT account" are provided, which are filled in automatically if the system has set up item accounting accounts (an article on how to set them up -).

If an invoice is attached to the expense report, then you need to check the "Invoice submitted" checkbox, indicate the date and invoice number in the corresponding line details, and when conducting an advance report, the system will automatically generate the Invoice Received document. The same mechanism for generating the received invoice is provided for on the "Goods" tab.

After posting, the document will generate transactions:

From the document, you can generate and print the form AO-1 "Advance report":

Thus in the program 1C Accounting 8.2 introduced expense reports.

Video tutorial:

Enterprises sending their employees on a business trip must pay them travel expenses. The sums of payments for the days of being on a business trip are calculated based on the average daily earnings, calculated according to the data for the previous 12 months of work of this employee.

If your company uses 1C Accounting 8.3 for accounting, then in this article you will find a description of how to set up the calculation of travel allowances using 1C: Accounting.

To accrue travel allowances, you need to enter a new charge in the directory of types of charges. To do this, you need to go along the path / Salary and personnel / - / Reference books and settings / - / Salary settings / - / Accruals /. In the list that opens, you need to add a new type of charges with the "Create" button.

In the field "Name" you need to enter the phrase "Travel payments" (or name it as it is convenient for you). In the "Code" field you need to enter a unique encoding (it can be both letters and numbers).

In the "Personal Income Tax" field, you need to set a "dot" in the "Taxed" field and indicate the income code for personal income tax. In our case it will be 2000 “Remuneration for the performance of labor or other duties; pay and other taxable payments to military personnel and those equated to them. "

There is no need to set the setting that this income is paid in kind (not in money).

When setting up the calculation of insurance premiums, you need to specify that this is "Income fully taxable by insurance premiums." Since in article 420 of the Tax Code (paragraph 1) it is stated that travel allowances are fully taxed with insurance premiums.

Then you should fill in paragraph of article 255 of the Tax Code of the Russian Federation when attributing these costs to expenses for calculating income tax. It is necessary to set the setting that this payment is "taken into account in labor costs" and select subparagraph 6, article 255 of the Tax Code of the Russian Federation (these are travel allowances).

In the field "Reflection in accounting" you need to select the way these payments are reflected in the accounts. If this list does not contain the desired type of reflection, it should be created in it.

In the event that your business uses one cost account for calculating payroll costs, then the option "Reflecting accruals by default" is most likely suitable for you, which will indicate the standard transaction for payroll in your company.

If you use several expense accounts, for example 26 "General business expenses", 44 "Commercial expenses" or 20 "Main production", then you need to select the appropriate from this list. However, it should be noted here that the name of this type of charges should be clarified. For example, if travel allowances will be accrued to administrative and managerial personnel, then you need to choose the way of reflecting Dt 26 - Kt 70 and formulate the name as follows: "Travel payments to AUP".

In the event that a business trip will be paid to production employees, then the wiring should be Dt 20 - Kt 70. And the name must be formulated as follows: "Travel payments to production workers."

Then, when everything is already set up in this card of the type of accruals, you need to check that the checkbox "Included in the base charges for the regional coefficient and the northern allowance" is unchecked, since when calculating the average daily earnings, the employee's income for the previous 12 months is used, taking into account these allowances ... And therefore, the average daily earnings indicator is obtained taking into account these allowances.

The payment is configured and it should be added when calculating the salary to the corresponding employee on the "Accruals" tab, indicating the appropriate amount.

/ "Accounting encyclopedia" Profirosta "

@2017

24.07.2017

Information on the page is searched for by queries: Courses of accountants in Krasnoyarsk, Accounting courses in Krasnoyarsk, Courses of accountants for beginners, Courses 1C: Accounting, Distance learning, Training of accountants, Training courses Salary and personnel, Advanced training of accountants, Accounting for beginners

Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistical reporting, Pension fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support , Provision of accounting services, Help for an accountant, Reporting via the Internet, Drawing up declarations, I need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Taxes of individual entrepreneurs, 3-NDFL, Organization of accounting

In one of the previous articles, I already wrote about the registration of a business trip in 1c Accounting 8 edition 2.0 for an enterprise on a simplified taxation system, today I wanted to tell you how the same operation is processed in the new edition 3.0.

The basis for sending an employee on a business trip is an order signed by the director of the enterprise, then a travel certificate is issued for it. In the program 1C Accounting 8 edition 3.0, these documents are not generated.

Making a business trip in 1s begins with the issuance of money to the account. A cash advance can be issued from the cash desk (document "Cash outflow order") or from the current account (document "Write-off from the current account").

Within three working days after returning from a business trip, the employee must draw up an advance report with all documents confirming the expenses (hotel invoices, checks, travel tickets, etc.). These expenses will be recognized at the date of approval of the expense report if the condition of their payment is met. In the event that travel expenses are exceeded the amount of the advance payment, they can be recognized only after the employee has been reimbursed for the amount of the overrun.

Business trip registration in 1s Accounting 8 edition 3.0

For example, LLC "Plyushka" sends an employee to S.S. Sakharov. on a business trip to Kazan for 3 days. She is given an advance payment from the cash desk in the amount of 8,000 rubles. The basis is the statement No. 3. Upon his return, the employee submits an advance report with the following documents attached: hotel invoice RUB 3,000. (Not subject to VAT), train tickets 2 360 rubles. including VAT 18%. The daily allowance for the enterprise is 600 rubles per day.

The issuance of an advance payment from the cash register to the employee must be formalized with the document "Expense cash order". To do this, go to the "Bank and cash desk" tab and select the required document in the "Cash desk" section. Do not forget to correctly set the type of operation "Issue to an accountable person". We fill out the document, in the appendix we indicate the number of the application, since since 2012 the funds are issued on the basis of the application.

Then we draw up an advance report. It is located on the same tab and in the same section. In the document, fill in the "Advances" tab, where we indicate the cash settlement facilities to which the money was issued. Next, go to the "Other" tab. Here we indicate three types of employee travel expenses. All expenses will be taken into account under the simplified taxation system.

After posting the document, we look at the transactions and the income and expenses book. All travel expenses will go to the KUDiR, as they were paid.