How to set up a write-off of overalls in 1s 8.3. Accounting info. Decommissioning of special equipment

How to take overalls into account in 1c? How to register overalls in 1s 8.3? Accounting for overalls and special equipment in 1C: Accounting 8.2 8.3 Part I

Receipt and transfer into operation of workwear and special equipment

We will devote today's article to the consideration of a question that also periodically arises among users of the 1C program. Namely: “How to write off overalls in 1s? How to take overalls into account in 1c 8.3? Accounting for overalls in 1C: Accounting 8.2 8.3 "

Such accounting does not differ in anything supernatural and special, nevertheless the question exists and takes place. How to reflect the receipt of overalls and special equipment, how to write off overalls from operation, on what account to take overalls into account, how to transfer overalls into operation, how to pay off the cost of overalls and special equipment in accounting and tax accounting - these are the questions to which we will also find answers in today's lesson ...

The topic of workwear is not new, it has been considered many times, and on the Internet you can find many different articles on this topic in 1C 7.7 or 1C 8.2. However, time passes and 1C changes. Today we will work with a relatively new 1C interface, namely the Taxi interface used in 1C version 8.3.

So let's get started.

In the first part of our lesson, we will consider the receipt of overalls and special equipment, as well as the transfer of overalls and special equipment into operation.

Part I.

To reflect receipts of workwear we use the document “Receipt of goods and services”. It is located along the following path - being on the main page, click on the item in the right menu "Purchases" and then select "Receipt of goods and services".

We draw up a new document with the "Goods" operation type. For the case when, simultaneously with the arrival of overalls, you need to register services, you need to use the operation type "Goods, services, commission". So, "Goods".

We fill in the header of the new document. We indicate the number and date, warehouse, counterparty and contract. In the absence of the necessary elements, create a new one. Then we add the rows of the tabular section.

We select the nomenclature from the folder "" or "Special equipment", respectively. If the groups are not organized, then we create them. This action is optional, but desirable for your own convenience. For example, in the case of preliminary organization and indication of such groups, accounting accounts will be substituted automatically from those entered earlier in the groups.

If the product card is not organized, then we also create it. We discussed how to work with the stock list reference book in the article ""

We indicate the data for the row of the tabular section - price and quantity. Overalls account 10.10, VAT 19.03.

At the end of the creation of the document, we indicate and register the invoice (if necessary).

We draw and close the document.

Further it is necessary transfer overalls or special equipment to production... For this, the document "Transfer of materials into operation" is used. We find it by going to the contents of the "Warehouse" tab. Create a new document.

Select a warehouse and organization and click the "Create" button.

The program will automatically fill in the necessary details of the cap, but we will only have to enter the location of the unit in which the MOL is located, to which the overalls are issued.

The next step is to enter data into the tabular section. Add the nomenclature needed for transfer.

We fill in the quantity and individual.

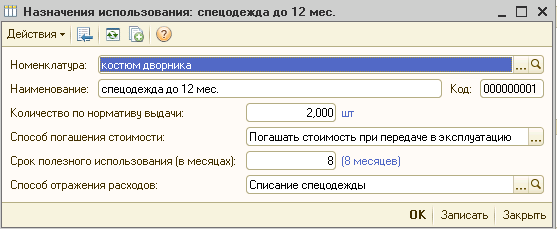

The next paragraph "Intended Use" will require some additional action from us. This data is used to reflect how the cost of workwear or special equipment is repaid for expenses. It is mandatory to fill it out.

Let's add the purpose of use by selecting the button built into the tabular section.

It should be noted that overalls, which amortize within 12 months. is accounted for as inventories and is written off simultaneously both in accounting and in tax accounting upon transfer to operation. If the useful life exceeds 12 months, then in the accounting records the overalls will be written off in a linear way, depending on the period of use. In tax accounting, overalls are written off to material costs also when they are put into operation. If the cost of workwear exceeds 40 thousand, then it is accounted for as a fixed asset.

Let's create a new one or select an existing use assignment.

We fill in the name, in which it is desirable to indicate the features that distinguish this type of purpose of use; we indicate the quantity according to the issuance standard. In our case, this is -1 pcs. Next, we introduce a linear cost recovery method for our example. We indicate the period in months and the method of reflecting expenses (20 or 25 accounts).

Swipe and close the document. When posting, the document will generate postings to accounts 10.10 and 10.11, as well as to the debit of material assets accounts.

In this article, we will talk about the accounting of workwear in the 1C: Accounting program 8. I will tell you about how to reflect the receipt of workwear and on which account it should be taken into account, how to transfer it into operation and how to pay off the cost in accounting and tax accounting, as well as on how to write off overalls from service.

To reflect the operation of the receipt of overalls, the document "Receipt of goods and services", located on the "Purchases" tab, is used.

Create a new document with the "Goods" operation type (the "Goods, services, commission" operation type can also be used, but such a choice is justified when the document contains both goods and services).

In the form that opens, indicate the number and date of the invoice, select a warehouse, a counterparty and an agreement (if necessary, create new elements of directories). Then we add rows to the tabular section by selecting existing items from the Nomenclature directory or creating new ones (when creating new items, it is advisable to indicate that they are included in the Overalls group).

Accounting account for workwear in the tabular section - 10.10. It is also necessary to indicate the number and date of the invoice at the bottom of the form, if any, and click the "Register" button.

To register the fact of transferring overalls to an employee in the program, the document "Transfer of materials into operation" is intended, located on the "Warehouse" tab.

We create a new document, in the "Location" field, select the department to which the overalls are transferred, and indicate the warehouse to which the receipt was registered. In our example, we consider the accounting of overalls, so we will fill in the document tab with the appropriate name. In the event that you need to transfer special rigging or inventory into operation, then the procedure will be the same, only you will have to use other tabs.

Add a row to the tabular section, indicate the nomenclature, quantity and individual to whom the overalls are transferred.

To fill in the "Usage Assignments" column, we will add a new item to the appropriate directory. This guide contains information on how the cost of workwear will be repaid.

Overalls with a useful life of less than 12 months are accounted for in the MPZ. In this case, its cost is written off to costs in accounting and tax accounting at a time when it is put into operation.

In the event that the useful life of overalls is more than 12 months, and its cost is less than 40 thousand rubles, then it is also taken into account as part of the inventories, but at the same time in the accounting the cost is paid off linearly, and in the tax one at a time when it is put into operation.

Overalls worth over 40 thousand rubles are accounted for as fixed assets.

Create a new element of the "Purpose of Use" reference book and specify an arbitrary name. In our example, the useful life is 36 months, so we choose the linear way of repaying the cost.

In the field "Method of reflection of expenses" it is necessary to indicate to which accounts of expenses and subconto the cost of overalls will be written off.

As a result, in our case, the element of the reference book "Purpose of use" looks as follows.

When the document is posted, the following account movements will be generated (the cost of overalls is transferred to account 10.11.1, from which it will be repaid on a monthly basis, and the off-balance account MC.02 is also used, on which overalls will be taken into account until they are decommissioned).

In our case, the repayment of the cost of workwear will be carried out in a linear way within 36 months. This operation takes place during the close of the month.

In this case, the following invoice entry will be generated (in the event that the cost was paid off during the transfer into operation, a similar posting for the full cost of overalls would be formed by the document "Transfer of materials into operation"):

Upon expiration of the term of use or in other cases of disposal, the overalls are subject to write-off. In 1C: Enterprise Accounting 8, to register this fact, the document "Writing off materials from service" is intended, located on the "Warehouse" tab.

Create a new document and fill in the required tab, in our case it is "Overalls". This can be done manually or automatically by clicking the "Fill" button.

Since in our case the cost of the workwear has not yet been fully repaid, it will be written off to the costs of this document. On the "Write-off" tab, you must specify a cost account, or set the write-off method to match the intended use.

When the document is posted, the following account movements are generated.

In the event that the cost was repaid earlier, the composition of the transactions would be somewhat different:

If the cost was charged to costs at a time when transferring to operation, then only a posting is generated on the off-balance sheet account of the MC;

If the cost was repaid in a linear way, then a posting is also generated from account 10.11.1, but only in quantitative terms.

If you still have questions about accounting for workwear in 1C programs, you can ask them in the comments to the article.

And if you need more information about working in 1C: Enterprise Accounting 8, then you can get our book onlink.

Overalls and special equipment in 1C: UPP are a special type of inventory items (goods and materials), therefore, transfer to production and write-off occurs in a certain way.

Registration in the 1C: UPP program of workwear and special equipment takes place in the Nomenclature reference book.

In the "Purpose of Use" reference book, all the write-off parameters are set: useful life in whole months, the method of repayment of the value in production, as well as the method of reflecting the cost of repayment of the value in the expenses of the organization.

When working with overalls in 1C: UPP, the following documents are used:

- "Transfer of materials into operation" (during the transfer of this type of inventory to production);

- "Moving materials in operation" (to register various changes in the parameters of operation, change of department, employee, etc.);

- "Return of materials from operation" (for registration of returns to the warehouse);

- "Redemption of the cost" (redemption of the cost of exploited overalls and special equipment);

- "Write-off of materials from service" (to register the disposal of this type of inventory in fact).

Let's consider several situations for a visual representation of the necessary actions and documents when repaying the cost of overalls.

Situation number 1

3) On March 20, we return the material from the employee to the firm. We repay the cost in a linear way (Documents "Return of materials from operation", "Repayment of the cost")

Situation number 2

1) We accept overalls for operation from January 11. We set the repayment of the cost in a linear way, the useful life is 12 months. (document "Transfer of materials into operation")

2) After operation for 2 months on April 20, we sell the material to an employee (Documents "Return of materials from operation" and "Sale of goods and services." We repay the cost in a linear way (Document "Repayment of the cost")

Situation number 3

1) We accept overalls for operation from January 11. We establish the repayment of the cost in a linear way (document "Transfer of materials into operation"), useful life 2 months

2) After 2 months. the material is completely cushioned.

Situation number 4

1) We accept overalls for operation from January 11. We establish the repayment of the cost in a linear way (document "Transfer of materials into operation"). We set the term of operation 10 months

2) After operation for 2 months, the material was not fully amortized.

3) We write off the material (Document "Write-off of materials from service"). We pay off the cost in a linear way. (Document "Repayment of the cost")

As a result, in all 4 cases, with the correct registration of workwear accounting documents in 1C: UPP, we see the correct closing of balances for employees who were issued with this workwear.

This can be illustrated in the 1C: UPP program by the report "Statement of the cost of materials in operation", generated in our case for the period from January 1, 2014 to April 30, 2014

Thanks!

Overalls or special clothing for personal protection are special clothing and its equipment intended for employees of the enterprise for personal protection when performing work duties from the harmful effects of the environment.

Overalls and special equipment are considered to be of little value and wearing out items (MBE), in other words, they can be called low value.

Under Russian law, enterprises are obliged to provide workers with overalls and special equipment. The employee's right to be provided with overalls and special equipment is enshrined in Art. 219 of the Labor Code of the Russian Federation.

Accounting for workwear and special equipment in 1C 8.3

Step 1. How to capitalize overalls in 1C 8.3

In 1C 8.3, on the section panel, select the Purchases section, then go to the Receipt subsection (acts, invoices):

In the appeared plate, click on the button Receipt and select the Goods (Invoice):

We check accounting entries:

- Dt 10.10 Kt 60.01 - receipt of workwear;

- Dt 19.03 Kt 60.01 - VAT charged:

Step 2. Transfer (issue) of overalls and special equipment for operation

Based on the Invoice for the receipt of goods, click on the button Create on the basis and from the menu that appears, select the document Transfer of materials into operation:

In the opened plate, fill in all the lines:

- Document number - autocomplete is provided;

- The location of the workwear;

- Warehouse - where you need to transfer overalls;

- Workwear name from the Nomenclature reference book (Add button):

Also in this document, through the Print button, you can generate the desired primary document:

- Issue accounting statement (MB-7);

- Invoice requirement (M-11):

If you need to transfer special rigging, then in the same document Transfer of materials into operation, select the Special rigging tab and enter all the necessary data in the same way.

Step 3. How to write off overalls in 1C 8.3

Since 2015, the taxpayer has the right to independently determine the procedure for repaying the cost of overalls, which must be specified in the accounting policy of the enterprise.

In 1C Accounting 8.3, the following methods of writing off workwear are used:

- Linear;

- Pay off the cost upon receipt of the workwear;

- The write-off method is proportional to the volume of products (works, services):

In accordance with the instructions of the Ministry of Finance of the Russian Federation dated 26.12.2002. No. 135н, the cost of workwear is debited when transferring to operation in a linear way.If the period of use of overalls is less than 12 months, then they can be written off immediately.

In 1C 8.3, the write-off of the cost of overalls is made out through the document Transfer of materials to operation by clicking the Create button based on:

In 1C 8.3, all data is loaded automatically, we enter only the amount of overalls that needs to be written off:

Immediately in the same document, you need to print the Decommissioning Act (MB-8):

Step 4. Returning workwear (special equipment) from service

If during operation the overalls (special equipment) have become unusable or are returned to storage, upon dismissal, business trip, sick leave, and so on, then from the document Transfer of materials to operation an accounting document is created Return of materials from service:

We check the formed postings:

Step 5. Redeeming the cost of workwear

At the end of each month, the 1C 8.3 program calculates the repayment of the cost of overalls (special equipment). To do this, select the Operations tab on the panel, then Close the month:

We execute the command Execute closing of the month:

and check the accounting entries:

For example, the organization received dressing gowns on 03/31/2016. in the amount of 100 pieces at a price of 250 rubles. for one robe. To check the amount of repayment of the cost of robes in our example, we will compose a calculation:

According to the calculation given in the table, we get: 50 rubles * 100 pieces \u003d 5,000 rubles, which means that the 1C 8.3 program correctly calculated the amount of repayment of the cost of the dressing gowns.

Step 6. Reports on the analysis of special equipment and workwear

We will check the accounting of overalls in the 1C 8.3 program through the analysis of the WWS for account 10.11.1:

To open OSV in more detail, place the cursor on any amount of the table turnover, double-click on the "mouse". As a result, an Account Card is opened with all accounting operations:

You can also generate a report Subconto card or a card for accounting of overalls in 1C 8.3:

Or via Subconto Analysis:

How to correctly draw up operations for the transfer of workwear into operation in 1C 8.3, incl. with features of BU and NU; how to carry out an operation to transfer household equipment into operation, so that off-balance accounting of such MCs is also organized, as required by the BU methodology - all this is considered on our

Special clothing is designed for the personal protection of workers, for example, when working in hazardous industries or to protect against pollution, let us analyze how the accounting of work clothes is kept in 1c Accounting 8, rev. 2.

Accounting for overalls in 1c depends on the period of its operation and cost. So overalls with a useful life of less than 12 months will be taken into account in the composition of material costs in accounting and tax accounting. Overalls with a service life of more than 12 months and a cost of less than 40,000 rubles are accounted for differently in accounting and tax accounting. In accounting, it is accounted for as part of the inventories, but its cost is redeemed on a straight-line basis, depending on the useful life. In tax accounting, such overalls are written off immediately to material costs. In this case, there is a temporary difference. And overalls with a service life of more than 12 months and a cost of more than 40,000 rubles are accounted for as fixed assets, and in tax accounting as depreciable property.

Accounting for overalls in 1s Accounting 8

Let's consider how to account for overalls with a period of use less than 12 months in 1c Accounting 8, rev. 2.

For example, LLC "Veda" purchased a janitor's suit 2 pcs. at the price of 2,000 rubles. (VAT above 18%). Then the janitor's suit was put into operation in the amount of 2 pieces.

The first document is the document “Receipt of goods and services”, which can be found on the “Purchase” tab. Operation type "Purchase, commission". In the new document, we indicate the counterparty, contract and warehouse. At the bottom of the document, add or select the name of the workwear, in our example "janitor's suit". We have this new element, so to add it to the "Nomenclature" directory, go to the "Overalls" folder. Account 10.10 "Special equipment and special clothing in the warehouse" is "tied" to this folder. Next, we indicate the quantity, price, VAT rate and post the document. If the supplier has provided an invoice, indicate its number and date.

According to the document, postings were generated:

Dt 10.10 Kt 60.01 received a janitor's suit without VAT

Dt 19.03 Kt 60.01 VAT

When the overalls are put into operation, on the basis of the document "Receipt of goods and services", you can form a document "Transfer of materials into operation".

Here you need to indicate the department where the overalls are transferred, an individual, the purpose of use and the quantity.

In our example, the service life of overalls is 8 months, therefore, in the purpose of use, we indicate the name "Overalls for up to 12 months", the method of repayment of the cost - Redeem the cost upon transfer into operation, the useful life is 8 months. and the method of reflecting expenses - writing off to account 20.

We post the document and look at the postings:

Dt 10.11.1 Kt 10.10 overalls were handed over for operation

Dt 20.01 Kt 10.11.1 the cost of workwear is repaid