The cost of fixed assets

Fixed assets transfer their value to the finished product gradually over a long period of time, covering several production and technological cycles. Therefore, the accounting of fixed assets and their reflection in the balance sheet are organized in such a way that at the same time it is possible to show the preservation of their original material form and the gradual loss of value.

should be distinguished initial,residual,restorative cost of fixed assets.

Initial cost reflects the actual costs of acquiring (creating) fixed assets. The original cost does not change. An exception is completion, radical reconstruction or partial liquidation.

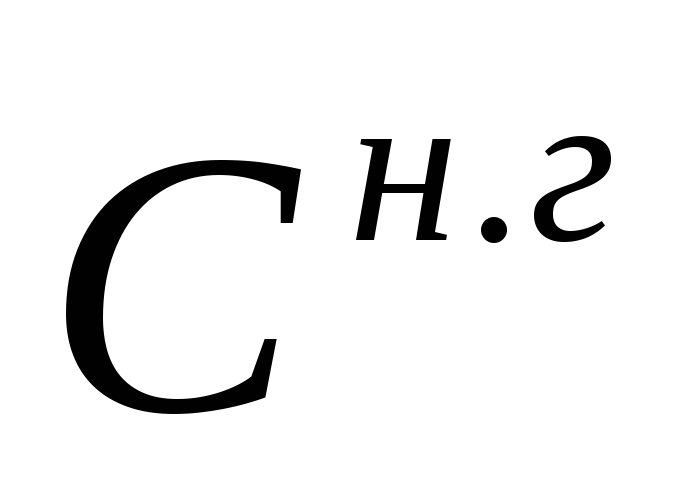

The initial cost of fixed assets,received at the expense of capital investments of enterprises, includes the costs of construction (construction) or acquisition of fixed assets, including the costs of delivery and installation, as well as other costs to bring this facility to a state of readiness for operation as intended. For a separate object, the initial cost is determined by the formula

Where: WITH about- the cost of the purchased equipment;

WITH mr- the cost of installation work;

W tr- transportation costs;

W tr- other costs.

made as a contribution to the authorized capital of the organization, their monetary value, agreed by the founders (participants) of the organization, is recognized.

The initial cost of fixed assets,received by the organization free of charge, their market value is recognized at the date of capitalization.

The initial cost of fixed assets,acquired in exchange for other property,other than cash the value of the exchanged property is recognized, at which it was reflected in the balance sheet.

Over time, the cost of reproduction of fixed assets changes, and the initial cost no longer reflects their true value.

replacement cost corresponds to the cost of creating or acquiring similar fixed assets in modern conditions. To determine the replacement cost of fixed assets, they are revalued by indexation or direct recalculation at documented market prices.

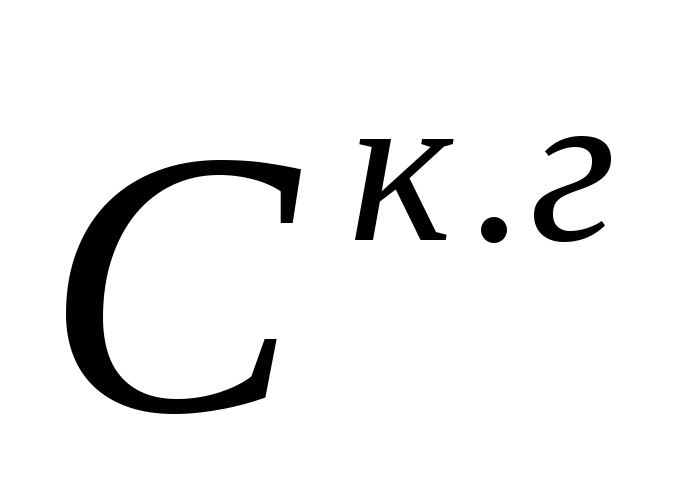

The gradual loss of value of property, plant and equipment is reflected in the valuation of property, plant and equipment at residual value. The residual value is the initial (replacement) cost, reduced by the depreciation amount:

Where: WITH first(restore)- the initial (replacement) cost of fixed assets;

AND- depreciation of fixed assets.

Evaluation of fixed assets at residual value is necessary in order to know their qualitative condition and to draw up a balance sheet.

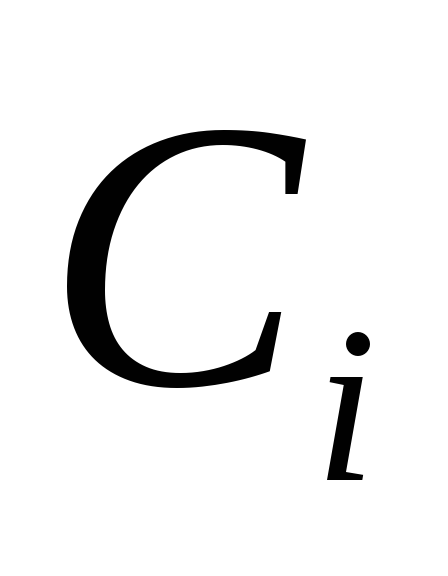

Since the physical volume of fixed assets changes during the year (an enterprise, for example, may purchase several units of new equipment and write off part of the existing one), the initial cost of fixed assets at the end of the year will differ from the initial cost at the beginning of the year. The initial cost at the end of the year is calculated as follows:

Where - initial cost at the beginning of the year;

- the cost of fixed assets introduced during the year;

- the value of fixed assets retired during the year.

Since the cost of fixed assets at the beginning and at the end of the year can differ significantly from each other, the average annual cost indicator is used in economic calculations. The average annual cost of fixed assets can be determined in various ways.

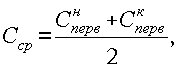

With a simplified method, the average annual cost is determined as half the sum of balances at the beginning and end of the period:

where - the initial cost of fixed assets at the beginning of the year;

- initial value at the end of the year.

But the input - output of fixed assets during the year is uneven, so the method proposed above gives an approximate result. For a more accurate determination of the average annual cost of fixed assets, a formula is used that takes into account the month of input and output:

where M1 and M2 are the number of full months, respectively, from the moment of commissioning (disposal) of an object (group of objects) of fixed assets;

WITH input - the cost of fixed assets introduced during the year;

WITH select- the value of fixed assets retired during the year.

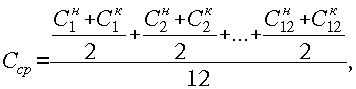

However, the most accurate way to determine the average annual cost of fixed assets is to calculate using the chronological average formula:

Where WITH n- the cost of fixed assets at the beginning of the month;

WITH To- the value of fixed assets at the end of the month.

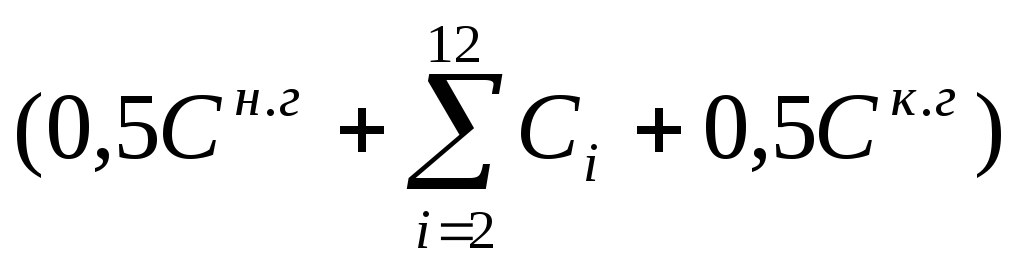

Or  =

= /12,

/12,

Where  - the cost of fixed assets at the beginning of the year;

- the cost of fixed assets at the beginning of the year;

– cost of fixed assets at the end of the year;

– cost of fixed assets at the end of the year;

– cost of fixed assets by months.

– cost of fixed assets by months.

After a certain period of time from the moment of purchase or creation, fixed assets lose part of their value. In economics, this phenomenon is called wear and tear.