A sample of filling out the P14001 form when changing the legal address

There are plenty of articles on the internet on this subject. Our task is to minimize your time for reading and correct filling.

Main questions:

- About form p14001;

- correction of erroneous information about the organization in the register;

- in what situations the P14001 form is submitted;

- application form R14001;

- filling out an application;

- which pages in the P14001 form must be filled out in 2018;

- registration of changes.

Introduction

Form P14001 is filled out and submitted for registration with the IFTS in the following situations:

- When changing the director or head of the enterprise;

- Change of passport data of the General Director;

- Change of the legal address of the organization in the same locality without changing the charter;

- Removal or introduction of OKVED codes, without violating the content of the charter;

- The withdrawal of a participant from the company or the emergence of a new participant;

- Change in the distribution of shares in the authorized capital;

- Correction of errors made in the Unified State Register of Legal Entities by the applicant or the tax office.

Registration form P14001 is intended for entering information about the organization that is published in the Unified State Register of Legal Entities, but does not require changes to the Charter of the LLC. If the legal address is in the text of the Charter, then it will be necessary not only to correct the information in the Unified State Register of Legal Entities, but also in the Charter.

Requirements for filling out the form p14001

In the form P14001 of 2018, more than 50 pages are filled in only by those where changes are made to the Unified State Register of Legal Entities. Continuous numbering is mandatory, from the title page, then only completed pages are numbered. Blank pages will not be returned.

You can find a sample application p14001 for filling out the form in 2018 on the website of the federal tax service:

Instructions on how to correctly fill out the p14001 form when changing the legal address of an organization

- Changing the address of a legal entity is sheet B of the form;

- The form is filled out either by hand - only a black pen, printed letters or electronically. In the second case, in the Excel file, use the font Courier New, size 18. Only 1 character is entered in each cell;

- Double-sided printing of the application is not accepted;

- Sheet numbering starts from the title page: 001, 002, 003, etc.;

- Page 001 and sheet P are mandatory;

- On the title page, indicate the TIN, OGRN, the full name of the organization in capital letters. Spaces are indicated in the complex name of the enterprise, do not use hyphenation!

- On page 002, in paragraph 2, before the “reason for submitting the application”, indicate 1;

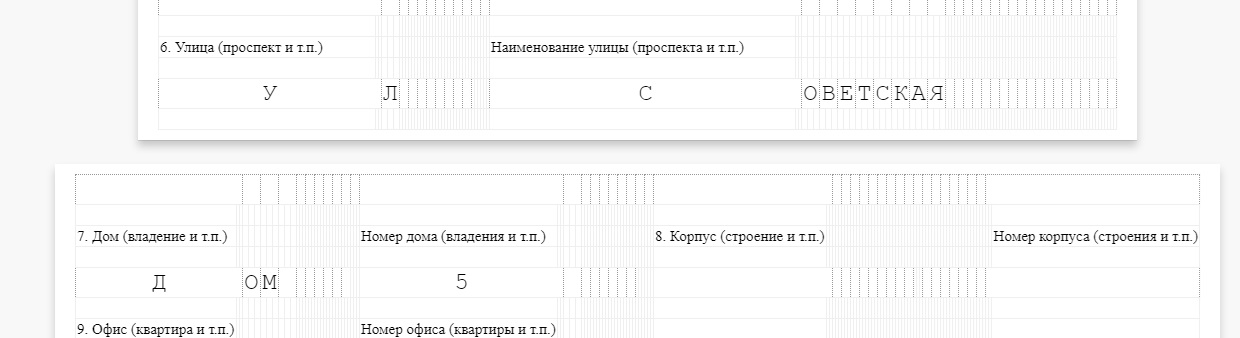

- On page 003, you fully indicate the new legal address with all the details and do not be confused by the filling format;

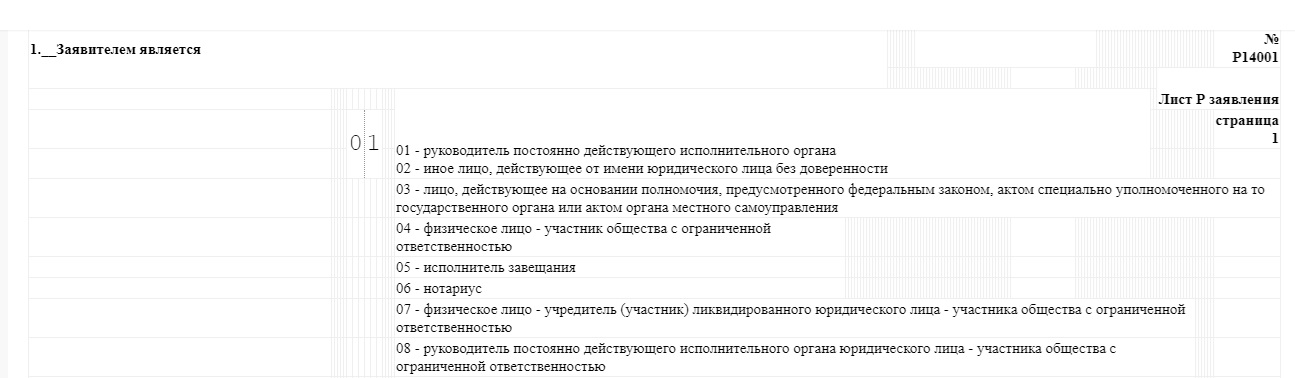

- On page 004, indicate the applicant's code (serial number). The applicant (person filing P14001) can be:

- director or owner of the enterprise;

- notary;

- a member of the society, but which can be issued a notarized power of attorney.

And so on, there are 16 possible applicants;

- If the company is an affiliated structure, then information about the managing organization is filled in. In other cases, the page is not filled;

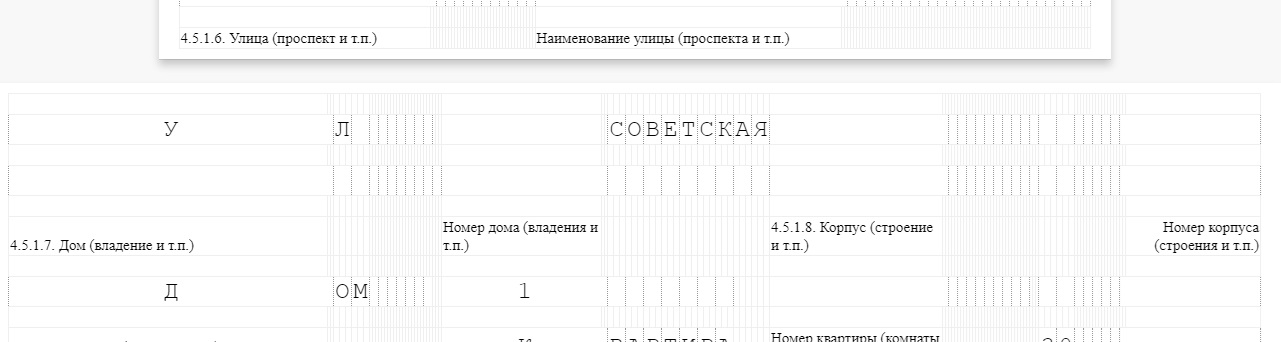

- Page 005 - information about the applicant and the document proving his identity;

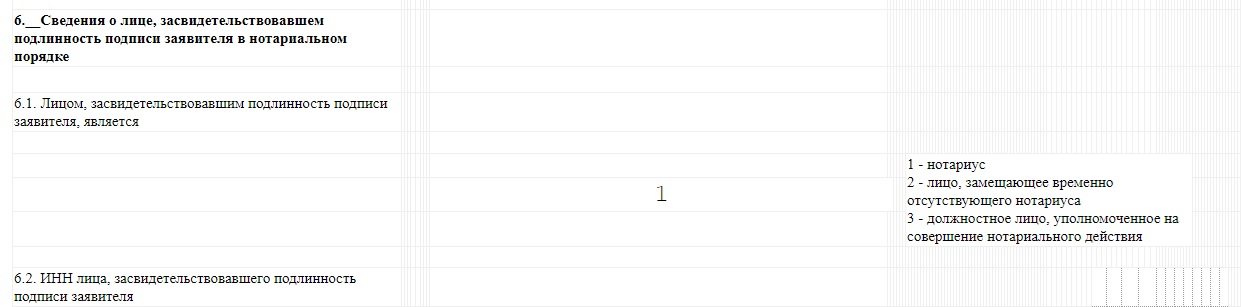

- Page 006 - confirmation of the accuracy of the information provided, an indication of the person to whom the documents confirming the fact of making changes to the Unified State Register of Legal Entities and information about the person testifying to the authenticity of the applicant's signature should be transferred.

Form P14001 is submitted to the registration authority within 3 days after the changes are made. In addition to the form, it is necessary to provide documents to the new legal address and a receipt for payment of the state duty.