How to open an individual entrepreneur online through the official website of the Federal Tax Service

Individual entrepreneurship is one of the most convenient and common ways of doing business. Modern technologies make it possible to open an individual entrepreneur online, and the official website will help in carrying out registration actions. In this article we will look in detail at how to register an individual entrepreneur through the official website of the Federal Tax Service.

To facilitate the registration procedure, it is possible to carry out transactions via the Internet. Documents can be submitted for registration electronically by uploading scans of them to a specialized website. It should be noted that this registration method has a number of inconveniences, one of which is the need to obtain a business organizer’s electronic signature key certificate from a specialized organization.

A new feature that significantly simplifies the procedure is the opportunity to register an individual entrepreneur online through the tax website. At the same time, filing an application for registration of entrepreneurial activity of an individual is carried out through registration via the Internet. At the same time, there is no need to even leave the house.

Online registration operation has more advantages than disadvantages. The benefits of the event include:

- automatic completion of the application after entering personal information into the service database

a one-time visit to the tax office in order to obtain already completed documents giving the right to work in the chosen direction, to receive income from which taxes should be paid in the amount according to the chosen system; - high speed of processing documentation, allowing you to receive it in finished form three days after sending the request;

- no expenses for notary services.

Note: The disadvantages of this method of conducting registration activities include the need to personally visit the tax office in order to pick up documents and sign in a special journal about their receipt.

To obtain a certificate, the tax authorities set a limited period of three days, during which you must appear at the establishment after receiving the invitation. It should be noted that invitations are sent by email, and information about the status of the application can be seen in your personal account on the website.

Required documents

Opening an individual entrepreneur online requires scanning documentation in color format in order to upload data in your personal account on the tax website. To do this, you need to prepare the following data:

- individual tax number;

- passports;

- OKVED codes.

The service is interested in information from the second and third pages of the passport, which indicate the place of issue of the document and registration of its owner. If there is no TIN, it will not be possible to carry out registration actions, since the program will not take the next step without the required data to be entered. An entrepreneur should approach the identification of OKVED codes responsibly, since the data is entered into a certificate, on the basis of which it will not be allowed to engage in activities not included in the document. In addition, some types of work require permits and licenses.

Stages of online registration of individual entrepreneurs

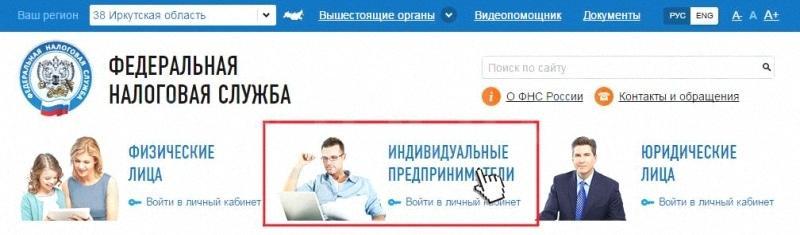

On the Federal Tax Service website, registering an individual entrepreneur online requires the following steps:

- visiting the Federal Tax Service;

- filling out an application;

- recording information about the application data, including its number and date of completion;

- downloading a receipt intended for payment of state duty;

- payment of 800 rubles in any convenient way, which can be using electronic

- payment systems or bank transfers.

The site interface is simple and clear; during the registration of an individual entrepreneur you will receive tips from the service

Application Form

In order to fill out an application for an individual entrepreneur online on the website of the Federal Tax Service, you should visit the official website of the Federal Tax Service and carry out the registration procedure in the service, after which your personal account becomes available. If the user has already registered on the site, then he must be authorized to log in.

The application should be submitted in the section intended for filling out a new document for registration actions regarding the functioning of individual entrepreneurship. An application on form P21001 is filled out on the website. To do this, you should step-by-step enter your personal information, including your individual tax number and passport details. For feedback, you should provide an email address to which all notifications will be sent. The service provides protection against hacking in the form of a captcha, which should be entered in a special window and click the “next” button. After completing the procedure, the application is assigned a number that should be remembered. In accordance with the number information of the application, you can subsequently track its status.

You should know that after a number is assigned, the application is considered registered, and it must be reviewed by tax specialists within 3 working days. During this period, the future individual entrepreneur must pay the state fee and fill out the remaining information in his personal account.

Note: If these requirements are not met within the specified period of time, the application will be rejected and cancelled.

Applying for an individual entrepreneur via the Internet eliminates the need to leave home, since everything can be done in a few clicks

In order to enter the already formed section of the application after paying the fee, you should go to your personal account of the service and indicate the document number in the small window located in the lower right corner. The TIN serves as confirmation for entry.

You should carefully check all the information provided, check the numerical and letter values of the document series. As additional information, you must provide your current mobile phone number and exact information about your place of residence, which must match your passport details. Registration of individual entrepreneurship at the place of temporary registration is prohibited. The exception is businessmen who have one in the city of Moscow.

OKVED codes are mandatory. They should be selected in a special directory in accordance with the planned activity. In this case, you need to familiarize yourself with the list of activities that require a license or other permitting documentation.

Payment information about the transfer of funds to the tax account as a state duty must be entered in a special field. After clicking the “complete” button, all completed information will be transferred to the tax service for review by specialists.

How to check the status of your application

Registration of individual entrepreneurs carried out on the Internet through the tax website requires constant checking of the status of the application. In order to check the stage of consideration of the registration issue, click on the “check status” button. If the registration is carried out correctly, the user will be provided with information that the application is being processed. If errors are detected in filling out the document with information, the service can automatically send the application for revision to enter the correct data.

Note: If the decision to register an individual entrepreneur is positive, a notification is sent to the specified email box about the need to pick up the certificate from the tax service.

The Federal Tax Service office must be visited only upon receipt of the certificate

To obtain a certificate from the tax service, you must appear at the establishment in person. To confirm your identity, you must use your passport and individual tax number. If your passport does not contain information about your place of residence, you should take a document confirming this fact. You should also take with you a copy of the receipt for payment of the state fee.

Thus, registering an individual entrepreneur online greatly simplifies this process for people who value time and would like to save hours on preparing documents and waiting in endless lines.