Summer amendments to the tax code of the Russian Federation. The Tax Code has been changed: what to expect for taxpayers Changes in Tax Code from August 19

Federal Law of July 18, 2017 No. 163-FZ "On Amendments to Part One of the Tax Code Russian Federation"(valid from 19 August 2017).

Article 1.

Introduce into part one of the Tax Code of the Russian Federation (Collected Legislation of the Russian Federation, 1998, No. 31, Art. 3824; 1999, No. 28, Art. 3487; 2003, No. 22, Art. 2066; No. 23, Art. 2174; No. 27 , article 2700; 2004, No. 27, article 2711; No. 31, article 3231; No. 45, article 4377; 2005, No. 45, article 4585; 2006, No. 31, article 3436; 2007, No. 1 , p. 28; 2008, No. 48, p. 5500, 5519; 2009, No. 30, p. 3739; No. 52, p. 6450; 2010, No. 31, p. 4198; No. 48, p. 6247; No. 49 , Art. 6420; 2011, No. 1, Art. 16; No. 27, Art. 3873; No. 29, Art. 4291; No. 30, Art. 4575; No. 47, Art. 6611; No. 49, Art. 7014; 2012 , No. 27, Art. 3588; No. 31, Art. 4333; 2013, No. 9, Art. 872; No. 26, Art. 3207; No. 30, Art. 4081; No. 44, Art. 5645; No. 52, Art. 6985; 2014, No. 14, Art. 1544; No. 45, Art. 6157, 6158; No. 48, Art. 6660; 2015, No. 1, Art. 15; No. 10, Art. 1393; No. 18, Art. 2616; No. 24, Art. 3377; 2016, No. 7, Art. 920; No. 18, Art. 2486; No. 27, Art. 4173, 4176, 4177; No. 49, Art. 6844) the following changes:

1) supplement with Article 54 1 as follows:

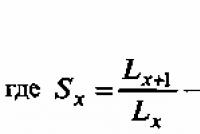

"Article 54 1. Limits on the exercise of calculating rights tax base and (or) the amount of tax, due, insurance premiums

1. The taxpayer is not allowed to reduce the tax base and (or) the amount of tax payable as a result of distortion of information about the facts of economic life (the totality of such facts), about taxation items subject to reflection in tax and (or) accounting, or tax reporting taxpayer.

2. In the absence of circumstances, under paragraph 1 of this article, for the transactions (operations) that have taken place, the taxpayer has the right to reduce the tax base and (or) the amount of tax payable in accordance with the rules of the relevant chapter of part two of this Code, provided that the following conditions are met simultaneously:

1) the main purpose of the transaction (operation) is not non-payment (incomplete payment) and (or) offset (refund) of the tax amount;

2) the obligation under the transaction (operation) has been fulfilled by a person who is a party to the agreement concluded with the taxpayer and (or) the person to whom the obligation to execute the transaction (operation) has been transferred under the agreement or law.

3. For the purposes of paragraphs 1 and 2 of this article, the signing of primary accounting documents by an unidentified or unauthorized person, violation of the taxpayer's counterparty of legislation on taxes and fees, the possibility of the taxpayer obtaining the same result economic activity when performing other transactions (operations) not prohibited by law, they cannot be considered as independent founding to recognize the reduction by the taxpayer of the tax base and (or) the amount of tax payable unlawful.

4. The provisions provided for in this article also apply to fees and insurance premiums and apply to payers of fees, payers of insurance premiums and tax agents. ";

2) Article 82 shall be supplemented with clause 5 as follows:

"5. Proof of the circumstances provided for by paragraph 1 of Article 54 1 of this Code, and (or) the fact of non-compliance with the conditions provided for by paragraph 2 of Article 54 1 of this Code, shall be carried out tax authority when holding events tax control in accordance with sections V, V 1, V 2 of this Code. ".

Article 2.

1. This Federal Law shall enter into force upon the expiration of one month from the date of its official publication.

2. The provisions of clause 5 of article 82 of part one of the Tax Code of the Russian Federation (as amended by this Federal law) apply to cameral tax audits tax returns(calculations) submitted to the tax authority after the date of entry into force of this Federal Law, as well as field tax audits and audits of the completeness of calculation and payment of taxes in connection with transactions between related parties, decisions on the appointment of which were made by tax authorities after the date of entry into force of this Federal Law.

The president

Russian Federation

V. Putin

As a result of the changes, provisions on unjustified tax benefits were added to the Tax Code of the Russian Federation, which determine situations when a taxpayer is not entitled to receive a tax deduction and or expenses to be taken into account for tax purposes, even if there are "formally correct" primary documents.

The manifestation of an unjustified tax benefit in 2017 and earlier may be expressed

- in unfair competition in the tax area;

- cooperation with fly-by-night, offshore;

- erosion of the tax base;

- unjustified use of tax breaks, benefits, etc.

- According to the aforementioned resolution of the Plenum of the Supreme Arbitration Court of Russia dated October 12, 2006 No. 53 "On the assessment by arbitration courts of the justification for a taxpayer's tax benefit", an unjustified tax benefit arises when the tax liability is reduced by various actions, the composition of which is not exhaustive.

Obtaining an unjustified tax benefit in 2017 can be discussed if:

- The right to receive it is not documented.

- The tax authorities proved that the information in the submitted documents:

- incomplete;

- do not correspond to reality;

- contain contradictions.

That is, the generally accepted principle is valid: the tax benefit is justified until proven otherwise. In fact, the new rules are about combating aggressive methods of optimizing the tax burden, which lead to:

- non-fulfillment or incomplete fulfillment of obligations to pay taxes;

- obtaining the right to a tax refund - refund / offset.

What's new

Since 2017, the concept of "unjustified tax benefit" has been governed by the provisions of Article 54.1 of the Tax Code of the Russian Federation "Limits on the exercise of rights to calculate the tax base and (or) the amount of tax, due, insurance premiums". In particular:

- It is expressly prohibited to reduce the tax base and / or tax payable by distorting information:

- about the facts of economic life (a set of such facts);

- on objects of taxation subject to reflection in tax and / or accounting, tax reporting.

- In the absence of the facts listed above, for the transactions / operations that have taken place, the payer can reduce the tax base and / or the amount of tax in accordance with the provisions of the corresponding chapter of the Tax Code of the Russian Federation, provided that the following conditions are met simultaneously:

- 1) the main purpose of the transaction / operation is not non-payment / incomplete payment and / or offset / refund of tax;

- 2) the obligation under the transaction has been fulfilled by a party to the contract concluded with the taxpayer and / or the person to whom it was transferred by virtue of the contract or law.

- 3 By virtue of the above, the following cannot be considered as separate grounds and as illegal reduction by the payer of the tax base and / or the amount of tax payable:

- signing of the "primary organization" by an unknown or unauthorized person;

- violation of tax legislation by the counterparty;

- the ability of the payer to obtain the same economic result when performing other transactions and operations not prohibited by law.

- fees;

- contributions to extrabudgetary funds;

- payers of fees;

- payers of insurance premiums;

- tax agents.

The head of the State Duma Committee on Budget and Taxes Andrei Makarov, explaining the goals of the innovations, noted: "The time has come to include the legal position of the Supreme Arbitration Court of the Russian Federation in the Tax Code."

The deputy pointed out that Article 54.1 enshrines in tax legislation the priority of content over form, as the most important principle tax regulation... Legislators relied on the experience of judicial practice in order to establish in the article an exhaustive list of grounds on which the tax authority may prohibit a taxpayer from reducing tax payments.

The goals are good. But controversy over the formal grounds for applying tax deductions are still boiling (for example, on business trip). Will it be possible to consolidate the priority of content over form in such conditions? Or will Article 54.1 add grounds for litigation?

Paragraph 1 new article 54.1 does not allow "a decrease in the tax base and (or) the amount of tax as a result of distortion of information about the facts of economic life and objects of taxation in tax and (or) accounting or tax reporting."

The term "distortion of information" is not deciphered by the code. It is not clear if this definition covers counting errors. But at the same time, the provisions of Article 54.1 of the Tax Code of the Russian Federation are formulated in the form of a strict prohibition.

The requirements of the SAC Plenum, which are similar in meaning, are formulated not so categorically and in more detail. Clause 3 of the resolution of the Plenum states: A tax benefit may be recognized as unjustified if transactions are not accounted for in accordance with their actual economic meaning. Clause 7 of Resolution No. 53 specifies what to do in this case: the volume of tax payments must be recalculated based on the true economic content operations.

Fears from innovations are reinforced by paragraph 2 of Article 54.1 of the Tax Code of the Russian Federation, according to which the right to reduce the tax base, taxpayers receive in the absence of the circumstances provided for in paragraph 1 of Article 54.1 of the Tax Code of the Russian Federation. That is, literally, the only way to reduce the tax base is if a decrease in the base is not revealed as a result of "distortion of information" in accounting and reporting.

However, we believe that in practice, even after August 19, taxpayers will retain the right to recalculate tax liabilities based on the true economic meaning of transactions. That is, judges will continue to be guided by paragraph 7 of Resolution No. 53. In addition, the provisions of Articles 54 and 81 of the Tax Code of the Russian Federation, which establish the procedure for recalculating the tax base when errors (distortions) are detected, may acquire a new meaning.

Clause 2 of Article 54.1 of the Tax Code of the Russian Federation adds two more requirements for obtaining the right to reduce the tax base. As a result, in order to account for expenses or apply a deduction, you need to comply with three conditions simultaneously:

- Avoid distortions of accounting and reporting that reduce the tax base.

- The purpose of the transaction should not be non-payment and (or) offset (refund) of the tax amount.

- The transaction must be executed by the person with whom the contract has been concluded or by the person to whom the obligation has been transferred under the contract or law.

The prototype of the second and third of the above conditions can also be found in Resolution 53 of the Supreme Arbitration Court. But even in this case, the Plenum of the Supreme Arbitration Court is more universal, precise and understandable than the legislators.

Thus, paragraphs 4 and 9 of Resolution No. 53 state that a tax benefit cannot be recognized as justified if it is received outside of connection with real entrepreneurial activity. When determining such a connection and identifying a business purpose, the courts should evaluate evidence of the taxpayer's intentions to obtain an economic effect as a result of real entrepreneurial activity.

The tax benefit cannot be viewed as a business goal in its own right. Therefore, the court has the right not to recognize the tax benefit as justified if it establishes that there were no business purposes, and the taxpayer wanted to receive income solely from the tax benefit.

Clause 5 of Resolution No. 53 systematizes in some detail the signs that may indicate the unreasonableness of the tax benefit. In particular, these are:

- The impossibility of real implementation of operations, taking into account the time, place or amount of required material resources.

- Lack of managerial or technical personnel, fixed assets, production assets, storage facilities, vehicles necessary for operations.

- Operations with goods that were not produced or could not be produced in the declared volume.

Comparison of the strict but vague norms of Article 54.1 of the Tax Code of the Russian Federation with the specific and universal formulations of the Plenum of the Supreme Arbitration Court allows us to hope that the controllers will not be able to abandon Resolution 53. In practice, the conclusions of the 2006 SAC Plenum should now organically complement and clarify the new Article 54.1 of the Code.

Conclusion: if Resolution 53 does not retain its significance for the interpretation of the Tax Code, then we will face unnecessary tax disputes on new formal grounds.

That is, such disputes that the legislator would like to minimize by Article 54.1. But it cannot be ruled out that some inspectors may use new wording to infringe on the rights of taxpayers. It is obvious that Article 54.1 of the Tax Code of the Russian Federation provides new opportunities for clarifying a position in court.

And in this sense, it is not clear why legislators, trying to generalize judicial practice, abandoned the usual terminology. Apparently, understanding the risks, the head of the budget committee A. Makarov initially expressed concern that the interpretation of the norms of the new law in practice may differ from the concept of the legislators (MOSCOW, June 16. / TASS /).

Therefore, the deputies decided not to limit themselves to standard procedures. They will communicate the position of the legislator through the Federal Tax Service to the territorial tax authorities and organize monitoring of the application of the new rules.

If the first two paragraphs of Article 54.1 of the Tax Code of the Russian Federation add uncertainty, then paragraph 3 of Article 54.1 is definitely a positive phenomenon, which will reduce the number of tax disputes. The law now explicitly prohibits inspectors from withdrawing expenses or denying the right to deduction simply because:

- the primary document was signed by an unidentified or unauthorized person;

- the taxpayer's counterparty violated tax laws;

- a taxpayer could have obtained the same result of economic activity in a different way (in the course of other transactions (operations).

Now the tax authorities will not be able to automatically deny the right to deduction on invoices from unscrupulous suppliers.

And this happened all the time, as soon as the controllers established that the counterparty did not submit reports or was not located at the address indicated in the invoice. Now the main thing is that the deal is real and that the counterparty with whom the company has entered into an agreement will execute it.

August 2017

Prepared by experts from Pravovest Audit

Still have questions?

We invite you to the round tables on the practice of law enforcement - sign up for

The words “business purpose”, “unjustified tax benefit”, “due diligence”, “honesty” have become so tightly embedded in the life of an ordinary Russian entrepreneur that, perhaps, he will explain their meaning as well as any tax inspector. And following the results of attending the next tax seminar, instead of planning a new production line, he will begin to draw in his imagination a weighty justification (with numbers, graphs, convincing testimonies) for the need to attract a new counterparty.

Almost not a single act of a tax audit, not a single court decision is complete without mentioning the very unjustified tax benefit that caused damage to the budget. And this concept was introduced more than 10 years ago - by the Resolution of the Supreme Arbitration Court No. 53 of 12.10.2006. Higher Arbitration court since then has sunk into oblivion, merging with The Supreme Court, and the concept he developed is still alive.

But, either it is undignified to refer to a court decision (after all, we do not have England with its case-law), or vague concepts of good faith are outdated, it was decided to be in accordance with the provisions of Tax Code RF. On July 18, 2017, verified amendments to the code were signed by the President. A new article 54.1 was born. The new rules will begin to apply to inspections scheduled after August 19, 2017.

This means that all transactions for the period 2014 - 2016 and subsequent years can be evaluated taking into account the new criteria.

Let's say right away that there was no revolution. In a laconic form, devoid of emotional coloring, provisions have been introduced into the law that reflect the meaning of the already familiar search for a "business goal", proving the validity of tax benefits, in order to exclude a value-based approach to judgments about the behavior of a taxpayer. Suppose the courts gradually move from citing Decree No. 53 to citing the law. Time will show how this will affect the statistics of tax dispute resolution.

So, firstly, instead of the presumption of good faith of the taxpayer and the presumption of reliability of information in the accounting and tax reporting, the law states:

"It is not allowed by the taxpayer to reduce the tax base and (or) the amount of tax payable as a result of distortion of information about the facts of economic life, about objects of taxation" in tax and / or accounting.

The code does not use the familiar notion “tax benefit”. However, speaking of the inadmissibility of distorting information to reduce the tax base and / or the amount of tax, the legislator has in mind what was previously considered an unjustified tax benefit.

Secondly, if all the information in the reporting is taken into account correctly, the next test for the taxpayer will be to check whether two conditions are met simultaneously (clause 2 of article 54.1):

- reducing the size of tax liabilities is not the only purpose of the transaction;

- the obligation under the transaction was fulfilled by the very person who is declared by the party to the contract, or by the person to whom the obligation has passed by law or contract (for example, under an assignment contract, by way of succession, etc.).

The first condition is nothing more than the "business purpose" of the transaction, which should not be exclusively related to the reduction of tax liabilities.

Sometimes one hears this answer to the question about the advisability of creating two sales companies using the simplified tax system: "If all turnovers are in one company, it will not be able to apply the simplified tax system because of the turnover, and the business will become unprofitable." Remember: this is an example of a sincere recognition for the tax authority - a purpose other than complying with the conditions for the application of a special tax regime, the entrepreneur does not.

If we are talking about geographically separate sales departments, different target categories of clients, different management teams and even competing with each other in performance, then the effect of applying a reduced tax rate is no longer paramount.

The second condition says that the transaction must be executed by the very person indicated in the documents. Or others, to which the obligation to execute the transaction has passed by law or contract. That is, not by some unidentified third party.

This condition is extremely important, since it can reverse the tendency, which has developed in the interests of the taxpayer, of "establishing the actual size of the tax benefit" when it comes to income tax. As a reminder, back in 2012, the Supreme Arbitration Court ruled:

The actual amount of the estimated tax benefit and costs incurred by the taxpayer in calculating income tax is subject to determination based on market prices used for similar transactions.

A different legal approach entails a distortion of the real size of tax liabilities for income tax ...

Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation No. A71-13079 / 2010-A17 dated 03.07.2012

This led to the fact that the tax authority ceased to challenge the taxpayer's accounting of costs when it could not prove that the cost was overstated. For example, a house is built - it means there were bricks; food products have been released and their composition can be checked only after an expensive examination - costs for meat, flour, other ingredients are accepted, etc. Let us emphasize that it was only about income tax, but at least in this part the taxpayer could be calm.

After the amendments come into force, if the tax authority questions the possibility of executing the transaction, for example, for the delivery of a specific raw material by a specific counterparty, the costs may be excluded from the calculation of income tax. Only the practice of applying the new provisions will show whether the taxpayer can still refer to the fact that raw materials (materials, components) were really and really used in the production, construction or provision of services, despite the lack of proven relationship with a specific supplier. Compliance with the above principles will allow the taxpayer to emerge victorious from the tax dispute.

To make this easier than it seems, the law provides for circumstances that by themselves cannot confirm that the taxpayer is wrong (clause 4 of article 54.1 of the Tax Code of the Russian Federation):

- signing of primary documents by an unidentified or unauthorized person.

A similar approach was reflected in the letter of the Federal Tax Service of Russia dated 03.23.2017 No. ED-5-9-547, which mentioned the urgent problem of the tax authorities' formal collection of evidence for the purpose of confirming the receipt by the taxpayer of an unjustified tax benefit. Very often, the tax authorities do not dispute the reality of transactions with counterparties, but simply limit themselves to arguments about the unreliability of the primary documents, based on interrogations of the heads of the counterparties, who stated that they were not involved in the activities of the companies, and handwriting examinations. In this regard, the Federal Tax Service of Russia stated that the fact that the interrogated persons denied signing documents on behalf of counterparties or that they have the authority of a manager is not an unconditional and sufficient basis for the conclusion that the taxpayer has received an unjustified tax benefit. - violation of tax legislation by the counterparty of the taxpayer. If the documents were drawn up by the supplier ideally, the goods were delivered (services were provided), and there was no doubt about their need for real economic activity, but suddenly it turned out that the counterparty stopped paying taxes, the taxpayer being audited cannot be held responsible for this. Undoubtedly, the consolidation of this rule in the law will benefit taxpayers;

- the possibility for a taxpayer to obtain the same result of economic activity when performing other transactions (operations) not prohibited by law. It is also a long-established rule that entrepreneurial activity is carried out at your own risk, and retroactively indicate that the transaction turned out to be unprofitable, useless and that other suppliers were on the market, tax inspector not entitled.

Thus, the lawmakers have done a multi-stage work, in which they looked for different options for fixing what has developed in practice in the code. They started with attempts to find a universal definition of "abuse of law", and came to extremely laconic formulations, devoid of scope for assessment and subjectivity.

However, the gains of conscientious taxpayers were not ignored. If there is a business purpose, confirmed the feasibility of the concluded transactions and their actual execution, additional taxes will be insolvent.

On August 19, 2017, a new version of the Tax Code of the Russian Federation comes into force. Legislators have defined the limits for taxpayers to exercise their rights to calculate the tax base and the amount of taxes, fees or insurance premiums. In addition, the specifics of determining tax periods for newly created individual entrepreneurs have been established.

The revision of part one of the Tax Code of the Russian Federation was changed at once by two new laws, which come into force on August 19, 2017:

Federal Law of 18.07.2017 N 163-FZ;

Federal Law of 18.07.2017 N 173-FZ.

The first of them introduced the so-called presumption of good faith for taxpayers, setting the limits for the exercise of their rights to calculate the tax base and the amount of taxes, fees or insurance premiums. The second law establishes features for determining tax periods for newly registered individual entrepreneurs.

New responsibilities of taxpayers and regulatory authorities

A new one was added to the Tax Code, which determined the limits of the exercise of rights to calculate the tax base and (or) the amount of tax, due, insurance premiums. According to its rules, taxpayers cannot reduce the tax base and (or) the amount of tax payable as a result of distortion of information about the facts of economic life (a set of such facts), about objects of taxation to be reflected in the tax and (or) accounting or tax reporting of the taxpayer. Such a decrease is possible only in accordance with the rules of the corresponding chapter of the second part of the Tax Code of the Russian Federation, while observing the following conditions:

- the main purpose of the transaction (operation) is not non-payment (incomplete payment) and (or) offset (refund) of the tax amount;

- the obligation under the transaction (operation) is fulfilled by a person who is a party to the agreement concluded with the taxpayer and (or) the person to whom the obligation to execute the transaction (operation) has been transferred under the agreement or the law.

Clause 3 of the same article of the Tax Code of the Russian Federation determines that if the primary accounting documents signed by an unidentified or unauthorized person, the taxpayer's counterparty violated the requirements of the legislation on taxes and fees, and the taxpayer could have obtained the same result of economic activity when performing other transactions (operations) not prohibited by law, the Federal Tax Service cannot consider this as an independent basis for recognizing a decrease The taxpayer of the tax base or the amount of tax payable is unlawful.

Supplemented with clause 5 as follows:

The proof of the circumstances provided for in paragraph 1 of Article 54.1 of the Tax Code of the Russian Federation, and (or) the fact of non-compliance with the conditions provided for in paragraph 2 of Article 54.1 of the Tax Code of the Russian Federation, is carried out by the tax authority when carrying out tax control measures in accordance with Sections V, V.1, V.2 of this Code ...

Taxable period

Legislators have made significant changes in it, several new items appeared at once, regulating the specifics of determining tax periods for new individual entrepreneurs and organizations. In particular, it was determined that if the state registration of an individual as individual entrepreneur was carried out in the period from January 1 to November 30 of one calendar year, then the first tax period for such an individual entrepreneur is the time period from the day state registration an individual as an individual entrepreneur until December 31 of this calendar year. If the individual entrepreneur was registered in the period from December 1 to December 31 of one calendar year, then the first tax period for him will be the period from the date of state registration to December 31 of the calendar year following the year of creation of the individual entrepreneur.

In addition, legislators have established that upon termination of natural person activity as an individual entrepreneur, the last tax period for him is the period from January 1 of the calendar year, in which the state registration of an individual as an individual entrepreneur became invalid until the day of state registration of this event. But if the state registration of an individual as an individual entrepreneur was carried out and became invalid during a calendar year, then the tax period for him is the period from the date of state registration until the state registration of an individual as an individual entrepreneur becomes invalid.

Also, a new clause 3.1 has been added to the article with the following content:

If, in accordance with part two of this Code, the tax period for the relevant tax is a quarter, the dates of the beginning and end of the tax period are determined taking into account the provisions established by this paragraph and paragraph 3.2 of Article 55 of the Tax Code of the Russian Federation.

Another new clause 3.2 of this article, in particular, says that when an organization is terminated by liquidation or reorganization, or an individual ceases to act as an individual entrepreneur, the last tax period for such an organization (such individual entrepreneur) is the period from the beginning of the quarter in which the organization was terminated or the state registration of the individual entrepreneur became invalid, before the day of state registration of the corresponding event.

Now the Tax Code of the Russian Federation has legalized the long-used jurisprudence on tax disputes the principle of the right to deductions (expenses) for real business transactions.

From August 19, 2017, a new article 54.1 of the Tax Code comes into force (takes effect). Obviously, these additions to the code became the reason for the appearance of a well-known letter from the Federal Tax Service, which the public perceived as a "prohibition" for inspections to withdraw VAT deductions and income tax expenses during tax audits. (In our opinion, the opposite is true.)

The new article of the code quite specifically limits the discretion of tax authorities when assessing the validity of obtaining tax benefits in cases of a "defective" primary - signing by an unauthorized or unknown person, removes from the hands of tax authorities the possibility of assessing the feasibility of business transactions, specifies the distribution of the burden of proof, which should undoubtedly be welcomed.

At the same time, taxpayers should not be mistaken about a significant improvement in their situation: part 1 of the new article of the code contains the term "distortion" in relation to accounting and reporting and tax accounting and reporting, what it means, the code does not disclose.

Obviously, tax administration is being modernized, both methodologically and technologically, which means the removal of deductions and expenses during tax audits should now be formalized much more motivated. In any case, this is exactly how the FTS explained to the inspections their functions and powers.

THE RUSSIAN FEDERATION

THE FEDERAL LAW

ABOUT CHANGES

IN PART ONE OF THE TAX CODE OF THE RUSSIAN FEDERATION

Article 1.

Introduce into part one of the Tax Code of the Russian Federation (Collected Legislation of the Russian Federation, 1998, N 31, Art. 3824; 1999, N 28, Art. 3487; 2003, N 22, Art. 2066; N 23, Art. 2174; N 27 , Art.2700; 2004, N 27, Art.2711; N 31, Art. 3231; N 45, Art. 4377; 2005, N 45, Art. 4585; 2006, N 31, Art. 3436; 2007, N 1 , art. 28; 2008, N 48, art. 5500, 5519; 2009, N 30, art. 3739; N 52, art. 6450; 2010, N 31, art. 4198; N 48, art. 6247; N 49 , art. 6420; 2011, N 1, art. 16; N 27, Art. 3873; N 29, Art. 4291; N 30, Art. 4575; N 47, Art. 6611; N 49, Art. 7014; 2012 , N 27, Art. 3588; N 31, Art. 4333; 2013, N 9, Art. 872; N 26, Art. 3207; N 30, Art. 4081; N 44, Art. 5645; N 52, Art. 6985; 2014, N 14, Art. 1544; N 45, Art. 6157, 6158; N 48, Art. 6660; 2015, N 1, Art. 15; N 10, Art. 1393; N 18, Art. 2616; 24, Art. 3377; 2016, N 7, Art. 920; N 18, Art. 2486; N 27, Art. 4173, 4176, 4177; N 49, Art. 6844) the following changes:

1) supplement with article 54.1 as follows:

"Article 54.1. The limits of exercising the rights to calculate the tax base and (or) the amount of tax, due, insurance premiums

1. A taxpayer is not allowed to reduce the tax base and (or) the amount of tax payable as a result of distortion of information about the facts of economic life (a set of such facts), about taxation objects to be reflected in the tax and (or) accounting or tax reporting of the taxpayer.

2. In the absence of the circumstances provided for in paragraph 1 of this article, for the transactions (operations) that have taken place, the taxpayer has the right to reduce the tax base and (or) the amount of tax payable in accordance with the rules of the relevant chapter of part two of this Code, provided that the following conditions are met simultaneously:

1) the main purpose of the transaction (operation) is not non-payment (incomplete payment) and (or) offset (refund) of the tax amount;

2) the obligation under the transaction (operation) has been fulfilled by a person who is a party to the agreement concluded with the taxpayer and (or) the person to whom the obligation to execute the transaction (operation) has been transferred under the agreement or law.

3. For the purposes of clauses 1 and 2 of this article, the signing of primary accounting documents by an unidentified or unauthorized person, violation of the taxpayer's counterparty of legislation on taxes and fees, the possibility of a taxpayer receiving the same result of economic activity when performing other transactions (operations) not prohibited by law cannot be considered as an independent basis for recognizing a reduction by a taxpayer of the tax base and (or) the amount of tax payable unlawful.

4. The provisions provided for in this article also apply to fees and insurance premiums and apply to payers of fees, payers of insurance premiums and tax agents. ”;