How to buy gold using the example of Sberbank, which is more profitable - gold bars, coins or compulsory medical insurance, detailed instructions, calculations and safety rules. Investing in gold bars What are the pitfalls

Is it profitable to invest in gold? What are the ways to buy gold and what are their main differences? How and at what price to buy a gold bar from Sberbank? How can you save on taxes? This article answers this and many other questions.

Investing in gold is a reliable way to keep your savings. The price of this metal changes frequently. In the short term, investment in precious metals can be unprofitable. For example, in 2011 - 2013. the market fell. This can be seen in the figure (source: Central Bank statistical bulletin).

But in the long term, gold will rise in value. The amount of gold in nature is constant, and the amount of values \u200b\u200bproduced by people is increasing all the time (due to population growth, increased labor productivity, etc.). Therefore, for each gram of gold, there is an increasing number of created values \u200b\u200b(goods). As a result, commodities depreciate and gold rises in price.

The rise in gold prices is also determined by its properties:

- durability (gold does not rot, rust or oxidize);

- divisibility (intrinsic value is preserved when gold is divided into parts);

For example, if a diamond is divided into two parts, the cost of two new parts will be much less than a solid stone.

- homogeneity (in the absence of impurities, the internal composition of the metal of different gold bars and products has the same quality);

- convenience (great value is concentrated in a small volume);

- intrinsic value (associated with the limited amount of gold in nature: if gold were lying underfoot like pebbles, people would not appreciate it).

These properties make gold unique. Thanks to them, gold once served as money and is highly valued in modern world.

Gold is not afraid of crises. On the contrary, in times of crisis it grows faster in price. For other investment options, the risk increases. For example, if, during a crisis, you invest in an enterprise that cannot survive the crisis, you will be lost.

This will not happen with gold. It protects the owner's assets from depreciation.

The picture above shows gold prices since the beginning of 1998. This is a crisis year. At the beginning and middle of the year, the price of gold was 54 - 58 rubles. per gram. In the second half of the year, it grew almost 3.5 times to 186 rubles.

For the entire period from 1998 to 2018. prices increased 44 times, reaching 2393 rubles. per gram (March 1, 18). This means that if you bought 10 thousand rubles worth of gold in '98, now your capital would be 440,000 rubles.

Andrei: “I invest 10% of my income in physical gold, investments for 20 years or more. Fluctuations in the ruble price do not bother me even by 5-10%. I have three children and I want to give them something in the future. And besides physical gold, I don’t see any other reliable asset on such a long term ”.

What are the pitfalls?

The pitfalls of investing in gold:

1 The need to pay VAT 18% if you buy physical gold bullion;

Alternative options will allow you not to pay VAT: investment coins and compulsory medical insurance - about them a little below.

2 The accounting price of gold is set by the Central Bank and is a reference point for a commercial bank in setting its prices. At the same time, the bank's price differs from the official price of the Central Bank. Usually not in the investor's favor.

For example, on May 17, the official accounting price of gold at the Central Bank is 2587.5 rubles. In Sberbank that day, you would buy gold at a price of 2758 rubles. It is 6% more expensive.

3 The price at which the bank will buy gold from you will differ from the selling price. This difference is called.

For example, on the same date in Sberbank the purchase price is 2459, the sale price is 2758. The bank is a commercial enterprise and the spread gives it the opportunity to earn money. If on this day Sberbank buys 1 gr. gold and sell it to Masha, he will earn 299 rubles. And if it is 100 grams, then - 29,900 rubles.

For the investor, this difference can cause a loss in the short term.

For example, Anton bought 10 grams from Sberbank. gold on January 9 and sold it on May 17. The result of the transaction is shown in the table.

Although for 5 months prices increased: purchases by 7%, sales - by 9%., Anton lost 660 rubles. due to the fact that the bank buys gold cheaper than it sells.

4 You will have to pay 13% of the income if the gold will be owned for less than 3 years.

For example, when buying 1 gr. gold and its sale in a year, the income from the price difference will be 81 rubles. From this income you need to pay a tax of 13%, that is, 10.53 rubles.

Important: you pay the tax yourself. This involves filing tax return.

5 Purchased ingots must be stored somewhere. The storage location must be safe. For example, in a safe deposit box. You will have to pay for the rent of the cell. The annual cost of renting the smallest cell in Sberbank (up to 9 cm high) will cost the investor 6137 rubles. Naturally, this rule is not required. You can store ingots anywhere, even in a chest buried two meters deep in your backyard.

What are the ways to buy gold?

In our country, you can buy gold:

1 Through the opening of an impersonal metal account;

2 As a metal in the form:

- ingot;

- coins;

- jewelry.

The last option is special. The price of jewelry depends not only on the price of the metal, but also on other factors: the prestige of the brand, appearance and craftsmanship, etc.

A purchased piece of jewelry is difficult to sell at the same price. For example, a gold chain "Lines of Love" made of red gold of 585 assay value, weighing 1.58 grams. costs 4590 rubles. In terms of gram, this is 2905 rubles.

In a pawnshop, when registering a pledge, gold of such a test will be estimated at 1350 - 1500 rubles. per gram. Losses will be from 2580 to 2817 rubles. That is, more than half the cost of the product.

Therefore, when deciding the issue of investing money in gold in order to make money on it, this option is not considered. Let's dwell on the rest in more detail.

Gold bars

A gold bar is a piece of high-purity gold in the form of a brick with a mirrored surface with markings on the obverse.

Sberbank offers to buy:

- measured;

- standard ingots.

Measured have a weight of 1 g. up to 1 kg. They must comply with GOST R 51572-2000, which establishes the main characteristics of the ingot:

- weight: 1, 5, 10, 20, 50, 100, 250, 500, 1000 gr.;

- dimensions: length and width. Height (thickness) is not standardized. For example, for an ingot weighing 1 g. length can be from 12 to 15 mm., width from 7 to 9 mm .;

- chemical composition (sample): gold content not less than 99.99%;

-

- the inscription "Russia", framed in an oval;

- weight in grams (figure 1 in the figure);

- the name "Gold";

- sample (2);

- manufacturer's trademark (3);

- ingot number (4);

- packing each ingot in plastic wrap and all in a wooden box;

- availability of a certificate for each ingot, which indicates the date of issue, characteristics of the ingot and the signatures of the persons responsible for the quality of the ingot.

Standard ingots weigh from 11 to 13.3 kg. They must comply with GOST 28058-2015, which establishes the main characteristics of the ingot:

- shape: truncated pyramid;

- surface: without sagging, burrs, damage, grease stains and foreign inclusions. Places of stripping up to 1 mm deep and concavity due to metal shrinkage up to 5 mm deep are allowed.

- weight: any within 11 - 13.3 kg;

- possible deviation of weight: 0.03 - 0.1 g. (0.03 for the minimum weight ingot, 0.1 for the maximum weight);

- dimensions: length from 229 to 254 mm, width 59-88 mm, height 35 mm;

- deviation of dimensions: in length and width up to 5 mm., in height up to 8 mm.

- sample: not less than 99.9%;

- front side marking:

- symbol of the manufacturer's state;

- weight in grams;

- gold brand;

- try;

- manufacturer's trademark;

- ingot number;

- year of issue;

- packing each ingot in plastic wrap or wrapping paper and all in a wooden box.

The GOST notes that by agreement between the manufacturer and the consumer, the weight and shape may change.

The specifics of buying bullion are discussed in detail in the relevant sections.

Depersonalized metal account (OMS)

Depersonalized metal account is a way to invest money in precious metal without buying it in physical form. The metal will exist virtually as an entry in a bank account in the amount of grams of gold.

Since we are not talking about buying a specific bar with its marking and a unique number, the stored gold has no individual characteristics. Therefore, the account is called impersonal.

Important: Unlike buying an ingot, the opening of a compulsory medical insurance company exempts from paying VAT and from the risk of damage and loss of gold during storage.

They buy and sell gold at the quotes set by the bank. In this case, the bank, crediting funds to the account, will recalculate rubles into grams, and when returning it, vice versa: grams into rubles.

OMC in Sberbank opens free of charge for an indefinite period. That is, the account holder can at any time receive the cash equivalent of the stored gold at the current rate.

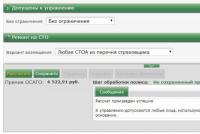

Sberbank offers to open OMC in the Sberbank Online system or during a personal visit to the office. Opening an account on the Internet is easier and faster. For this you need:

1 Log in to Sberbank Online.

2 Select the “Other” tab, then “Metal accounts” and “Opening an impersonal metal account”. On the same page you will see the rates for buying and selling precious metals. You will be able to buy gold at the selling rate.

Click to enlarge image

Click to enlarge image

4 Fill in the indicated fields: the account to be debited and the required deposit amount. The amount can be specified in rubles - then the cell “gold mass” will be filled in automatically according to the exchange rate. For example, if you deposit the amount of 7,000 rubles, this will be equivalent to the mass of 2.4 g of gold.

You can do the opposite: fill in the mass, for example, by indicating 3.5 g. Then the value of 10,045 rubles will appear in the amount field.

Important:

Click to enlarge image

The minimum amount of funds on the account is 0.1 g. gold. On May 10, this corresponds to the value of 252.5 rubles. (at the selling rate of 2525 rubles / gr.).

Sberbank does not charge interest on the account. You can only earn from the change in the cost of the metal over time.

Let's determine the income from compulsory medical insurance, subject to opening an account and buying gold for 10,000 rubles. in January 2016 and closing of the account in May 2018:

The result of the transaction depends on gold quotes and in a short period may be negative (loss).

In our example, the return for more than 2 years was 2.84%, in terms of the annual rate it is only 1.21%. This percentage is much lower than the rate on the Sberbank deposit (the minimum deposit rate is 3.4%). But in the long run, the result may be different.

For 10 years the amount is 10 thousand rubles. turned into 35 thousand with an average annual return of 24.61%. No bank deposit will provide the opportunity for such growth.

Investment coins

You can buy gold in Sberbank in the form of collectible and investment gold coins.

A bullion coin is a high-purity precious metal coin designed primarily for investing or holding savings.

Collectible Coin - a small edition of precious metal intended mainly for collecting. The issue of such a coin is usually timed to coincide with memorable dates, events known to people.

Collectible coin weighing 5 kg, issued for the 150th anniversary of the Bank of Russia. The front side shows the emblem of the Bank of Russia - a two-headed eagle, below the state symbols of the Russian Empire, the Provisional Government, the RSFSR and the USSR. On the reverse side there are portraits of Emperor Alexander II and the first leaders of the State Bank A.L. Stieglitz and E.I. Lamansky.

The main differences between these coins are shown in the table:

| Indicator | Investment coin | Collectible coin |

| Minting quality | common | high |

| Circulation | large | limited |

| Design | simplified | complicated |

| Artistic value | absent | there is |

| Presence of other precious metals and precious stones | not | possibly |

| Coin price and gold rate | approached | significantly differ |

| Coin issue | constant | on memorable dates or events |

| Numismatic value | not | there is |

| Profit | due to the rise in the price of gold | due to the increase in the price of metal and collection value |

| Bank redemption of coins | yes | not |

Important: Gold coins are not subject to VAT if they have legal tender status. This status has been established for all gold coins issued by the Central Bank since 1998. This status has been retained for a gold chervonets (10 rubles) containing 7.742 g of pure gold, issued in 1975-1982.

Legal tender status means that on the territory of Russia the coin must be accepted for payment at par. For example, the gold coin George the Victorious has the status of legal tender. Its face value is 50 rubles, and it is quite possible to buy a carton of milk with it. And if the seller refuses to accept it, you can sue him. True, there is hardly anyone willing to pay for goods worth 50 rubles. a coin sold in Sberbank for 27 thousand rubles.

At the moment, the following investment gold coins can be purchased at Sberbank:

To buy an investment coin of Sberbank, you need to have a passport with you. When paying for a coin, it is important to keep the receipt - it will be needed when selling a coin and for calculating income tax. The tax is determined in the same way as for bullion - this issue is discussed in the section "Answers to Questions".

You need to store investment coins in a bank package. Removing the packaging can damage the coin and this will significantly reduce its value.

In Sberbank, you can buy coins of excellent and satisfactory (with minor defects) quality. Sberbank neither sells nor buys coins of unsatisfactory condition.

Experts believe that buying investment coins is beneficial if the sale is planned not earlier than 10-15 years. In the short term, gains from a rise in the price of gold may turn into losses due to the spread.

A case from one's life

Matvey: “I tried to hand over to the bank a gold coin, which I had bought earlier in the same place (Sberbank) - the price I was offered was 2 times lower than the selling one !!! In short, I think that the bank is simply cashing in on numismatists ... "

Comparative table of the main ways to invest in gold

| Indicator | OMS | gold bar | Investment coin |

| Gold variant | virtual | real | real |

| Minimum size, gram | 0,1 | 1 | depends on the weight of the coin |

| Deposit insurance | not | ||

| VAT on purchase | not | yes | not if the coin is legal tender |

| Personal income tax | yes, if you own the metal for less than 3 years | ||

| Risk of damage and loss of gold | absent | there is | there is |

| The cost of renting a safe to reduce the risk of damage and loss | not | possible | possible |

| Bank selling price per gram as of 05/10/18, rub. | 2713 | RUB 3257 - RUB 3549 | 3372 - 3741 - excellent condition, 3022 - 3239 - satisfactory condition |

| Effect of spread on profit | In a short-term period, the spread (the difference between the buying and selling rates) “eats up” the profit due to price increases | ||

Investing in gold makes sense over the long term. An impersonal account is more economical than buying physical gold: when opening an account, the price of gold is lower, there is no risk of damage to gold and a decrease in its value, no need to spend money on storage.

When choosing between a bullion and a gold coin, pay attention to two nuances:

- By buying a coin, you save on VAT if the coin has legal tender status;

- Sberbank sells gold bullion cheaper.

Bullion price in Sberbank

The price of measured gold bars, current as of 05/10/2018, is shown in the table:

| Number of grams | Purchase price with satisfactory quality, rub. | Purchase price with excellent quality, rub. | Bar sales price, including VAT, rub. | |||

| ingot | in terms of gr. | ingot | in terms of gr. | ingot | in terms of gr. | |

| 1 | 2 459 | 2 459 | 2 479 | 2 479,00 | 3 549 | 3 549,00 |

| 5 | 12 295 | 2 459 | 12 335 | 2 467,00 | 16 685 | 3 337,00 |

| 10 | 24 590 | 2 459 | 24 660 | 2 466,00 | 33 134 | 3 313,40 |

| 20 | 49 180 | 2 459 | 49 280 | 2 464,00 | 65 915 | 3 295,75 |

| 50 | 122 950 | 2 459 | 123 070 | 2 461,40 | 163 902 | 3 278,04 |

| 100 | 245 900 | 2 459 | 246 050 | 2 460,50 | 326 742 | 3 267,42 |

| 250 | 614 750 | 2 459 | 614 950 | 2 459,80 | 815 144 | 3 260,58 |

| 500 | 1 229 500 | 2 459 | 1 229 870 | 2 459,74 | 1 629 226 | 3 258,45 |

| 1000 | 2 459 000 | 2 459 | 2 459 600 | 2 459,60 | 3 257 154 | 3 257,15 |

The price of an ingot depends on the size: the larger the size, the less it costs 1 gram. The exception is ingots of a satisfactory condition (we will describe in more detail how to determine the condition of an ingot below). Sberbank buys them out at a single price.

You can always find the current bullion prices on the Sberbank website.

Important: before deciding to buy a bullion, you should study the prices. You need to understand that the gold quotation and the price of an ingot in Sberbank are different indicators, and that the purchase and sale prices are different.

A case from one's life

Dmitry: “I went to the Sberbank website in the section“ precious metals ”, clicked on the quotes. The rate was 2636 rubles / gram. Then I called the operator and asked at what price I could buy gold that day. The operator specified the region and said the price was 2756.9 rubles / gram.

I scratched the back of my head and went to the bank. And there it turned out that the required ingot weighing 250 grams. I can buy at the price of 3190.68 rubles / gram. In my opinion this is a divorce. "

The process of buying a gold bar at Sberbank

1 Selection of an ingot, taking into account its price and weight. It is better to do this in advance.

2 Before visiting Sberbank, clarify in which of the nearest branches it is possible to make a transaction. Not all affiliates buy and sell gold.

3 Visiting Sberbank with a passport and agreeing on the transaction with a bank representative.

4 Deal. The customer must be present in person - online purchases are not allowed.

Usually, a trade takes about 10 minutes.

First, the ingot is examined and weighed in the presence of the client. The client must see the scale.

Important:0.01 gr. - an indicator of accuracy when weighing an ingot. But the unit for measuring the weight of the ingot is 0.1 g. For example, if the weight is determined during weighing 12845.27, then the mass of the ingot will be equal to 12845.2 (rounding down).

Then the payment and transfer of the bullion are carried out.

Important: gold is sealed in special packaging. You cannot violate its integrity, otherwise Sberbank will not accept the ingot back.

If the client so desires, for a fee, the ingot can be packed in a beautiful case with the Sberbank logo. This option is perfect for a gift.

The transfer of the ingot is formalized by the acceptance certificate. It must indicate: the name of the metal, fineness, weight, bar number, amount, date, full name of the buyer and the bank's representative.

The ingot is handed over to the client along with a certificate for it. The data indicated on the ingot and in the certificate must match.

Important: the certificate is made by the manufacturer. It contains the number and sample. The certificate must be kept together with the ingot. If the certificate is lost, the bank will not redeem the ingot and will not take it for storage. It will be possible to sell it at a pawnshop at a reduced cost.

The client is issued a cash order (check) confirming the purchase. He also needs to be saved.

You can store the ingot with your documents at home. But to ensure safety, it is better to rent a safe deposit box at a bank.

For the ingot to bring profit to the owner, the shelf life must be long: 10 - 20 years or more.

How to sell the purchased gold in the future?

First, you need to clarify in which of the nearest branches of Sberbank it is possible to make a deal.

To sell bullion, you need to come to the bank with an identity document.

Sberbank will buy a measured gold bar in excellent or satisfactory condition.

Excellent condition means a clean surface without scratches, burrs, abrasions, foreign inclusions. The bullion certificate must be clean and undamaged.

Satisfactory condition of the ingot means that the surface may have dirt spots, scratches and abrasions. But these features should not affect the weight of the ingot. An ingot without a single damage, but with a damaged certificate will also be considered satisfactory: a part is torn or torn off, in spots. But this damage should not affect the viewing of the text.

Important: if the bank suspects that the bullion is counterfeited, it has the right to withdraw it from the client and send it for examination. The client will be notified of the results.

The rules for buying bullion from the public are available on the Sberbank website.

Important: a gold bar purchased from Sberbank can be sold in another commercial Bank.

If the bank refused to buy your bullion, recognizing its condition as unsatisfactory, you can sell it:

- at the price of scrap to a jewelry workshop or gold buyers;

- hand over to a pawnshop.

1 gram gold bar in excellent condition. Sberbank will buy from you for 2,479 rubles, a satisfactory condition - for 2,459 rubles. (the price is valid as of May 10, 2018). A pawnshop will pay for an ingot from 1950 (your pawnshop) to 2285 rubles (pawnshop sunlight). Losses compared to the redemption of the bullion by Sberbank will amount to 11-21% of the value of gold.

Auris buys measured ingots at a scrap price - 2415 rubles. per gram. In this case, losses will amount to 2-3%.

A case from one's life

Lena: “Two bars of gold were kept at my house. When I took them out to hand over to the bank and receive money, rust was found on one ingot. The bank did not accept the ingot. I was able to hand it over to the jeweler at the price of scrap !!! The jeweler said that this is rather the result of a violation of technology during manufacture. The stain is easy to remove, but the ingot will be damaged. "

The most scandalous case of rusty gold is associated with the gold coins "St. George the Victorious", issued in 2006-2009 at the St. Petersburg Mint. The defect is associated with the ingress of iron microparticles on the surface of the coin, which oxidized when exposed to a humid environment.

If your bullion or coin is covered in rust stains, collect the paperwork and sell it to the bank. If you fail to sell, contact a jeweler for stain removal. And then you can try again to sell the coin to the bank. Or a jeweler.

Rust is the most harmless of the defects encountered. The main problem is that rust does not appear immediately, but after several years.

Blackheads are considered a more serious defect. This is a crumb of slag that got into the gold melt - it cannot be cleaned. Therefore, when buying, you should carefully examine the ingot or coin.

Rust spots on the St. George the Victorious coin of the St. Petersburg Mint

An example of calculating income from the purchase and sale of a gold bar

Let's make a calculation for gold bars of 50 and 100 grams. for a shelf life of 5-7 years, provided that the gold is stored in a safe deposit box.

| Indicator | The result when buying a gold bar weighing 50 grams. 10/01/2011 | The result when buying a gold bar weighing 50 grams. | The result when buying a gold bar weighing 100 grams. |

| The price of an ingot weighing 50 grams. at the date of purchase, RUB | 86018,08 | 106840,87 | 213540,00 |

| Selling price per gram on the date of purchase, rub. | 1720,36 | 2136,82 | 2135,40 |

| The price of an ingot weighing 50 grams. on the date of sale to the bank, rub. | 123070,00 | 123070,00 | 246050,00 |

| Sberbank purchase price per gram as of 05/10/2018, RUB | 2461,40 | 2461,40 | 2460,50 |

| Transaction result (price difference), rub. | 37051,92 | 16229,13 | 32510,00 |

| Result after tax, RUB | 37051,92 | 16229,13 | 32510,00 |

| Cell rental price, rub. | 32016,92 | 25131,63 | 25131,63 |

| Profit (loss) from the transaction | 5035,00 | -8902,50 | 7378,37 |

Ownership of an ingot under 3 years was not considered, because it is unprofitable because of the spread.

Ingots weighing less than 50 grams were not taken into account. they do not cover the cost of renting a cell.

Ownership of a 50 g bar. becomes profitable starting from a seven-year term. But an ingot weighing 100 grams. makes a profit in 5 years.

Important: an alternative to a safe deposit box will be the execution of a storage agreement with Sberbank. The cost of storing 1 ingot is 50 rubles. per day. This will amount to 18,250 rubles per year. For 5 years - 91 thousand rubles, for 7 years - 128 thousand rubles. This is significantly more expensive than the cell. In addition, the storage of each ingot is paid separately.

Safety rules when buying gold bullion

1 It is safe to buy gold bullion from the bank. The bank must be reliable - Sberbank fully meets this requirement. Sberbank bullion will be redeemed by any bank that has the right to this operation. Problems may arise with the sale of bullion from another bank - not all banks buy “someone else's gold”.

2 You cannot buy gold bars from your hands. This is against the law. Moreover, there is a risk of buying counterfeit bullion.

Investments in measured and standard bars of bank gold are unattractive for investors from countries where an irrational form of taxation of this type of transactions is established at the legislative level.

Investment in gold bars

An ingot of bank gold can be a good gift, an adornment of some personal collection, and an excellent investment vehicle.

Investing in gold bars in Russia is one of the simplest ways to meet investment needs in the domestic precious metals market. Many banks specialize in buying and selling gold bars. Prices, the specifics of the transaction, its volume, as well as the possibility of the subsequent repurchase of the bullion by the bank, are regulated in each individual bank in a special way.

You can invest in Russia in two types of gold bars:

- dimensional.

Standard ingots are manufactured and labeled by the plant in accordance with industry production standards. The weight of standard gold bars varies from eleven to thirteen point three kilograms, which is identical, respectively, three hundred and fifty and four hundred and thirty troy ounces.

Measured gold bars are produced by specialized Russian refineries. Their weight is often barely one kilogram. The percentage of pure gold in such bars is 99.99%. The weight denomination of such ingots:

- one gram;

- five grams;

- ten grams;

- twenty grams;

- one hundred grams;

- two hundred and fifty grams;

- five hundred grams;

- one kilogram.

The cost of one gram of gold contained in an ingot depends on the weight denomination of such an ingot. As a rule, the larger it is, the lower the cost of one gram of gold contained in it.

An important aspect of investing in gold bars in Russia is the need to pay an eighteen percent value added tax.

It is important! VAT is charged to the buyer of the bullion only if he wishes to receive the bullion in his hands. There is an alternative to such a transaction, thanks to which the need to pay VAT disappears - to leave the bullion for safekeeping at the bank. This service is also paid. Its cost is different in each individual bank.

Gold Bull Investment Video

Prices

According to the instructions of the Central Bank of the Russian Federation "On the procedure for determining the mass of precious metals and precious stones and calculating their value in the Bank of Russia and credit institutions»The cost of precious metals (including bullions of precious metals) is calculated by multiplying the quantitative indicator of the precious metal by the indicator of its price per one gram, established in Russian rubles.

Throughout January 2015, the accounting prices of the Central Bank of the Russian Federation for gold changed as follows:

| the date | Price, Russian rubles for one gram of gold |

| 01.01.2015 | 2168,34 |

| 13.01.2015 | 2464,8 |

| 14.01.2015 | 2582,98 |

| 15.01.2015 | 2611,23 |

| 16.01.2015 | 2574,82 |

| 17.01.2015 | 2636,52 |

| 20.01.2015 | 2664,44 |

| 21.01.2015 | 2699,97 |

| 22.01.2015 | 2735,75 |

| 23.01.2015 | 2706,12 |

| 24.01.2015 | 2636,32 |

| 27.01.2015 | 2705,17 |

| 28.01.2015 | 2788,62 |

The graph of the dynamics of accounting prices for gold in the Central Bank of the Russian Federation for January 2015 is presented below:

Sberbank of Russia is one of the financial institutions Of the Russian Federation, which offers its customers to purchase refined gold bars by concluding an appropriate agreement with a bank.

Among the variety of services provided by Sberbank of Russia in the sale of banking gold bars, it should be noted, in particular, the possibility of purchasing refined gold bars in gift wrapping.

In general, Sberbank of Russia offers its customers today to purchase measured gold bars in the following mass:

- one gram;

- five grams;

- ten grams;

- twenty grams;

- fifty grams;

- one hundred grams;

- two hundred and fifty grams;

- five hundred grams;

- one kilogram.

In gift wrapping you can buy gold bars in the following weight:

- one gram;

- five grams;

- ten grams;

- twenty grams;

- fifty grams;

- one hundred grams.

One of the additional services provided by Sberbank of Russia to its customers is the safe storage of precious metals. The advantages of this service are as follows:

- Safe and structured storage. Banking gold bars are stored here separately from bars of other precious metals, and are differentiated among themselves by weight, fineness, manufacturing method (cast, stamped, etc.) and other features.

- Efficiency of services. Bars are placed very quickly, and if necessary, they are also promptly returned to the client.

- Professionalism. The employees of the bank are competent each in their field, which allows ensuring the high quality of the services provided by the bank.

In general, prices and investment opportunities for gold bars are acceptable in Russia. It should be noted that, on average, an investor can calculate the cost of a particular bar of bank gold independently. To do this, it is enough to have information about where you are going to purchase an ingot, and determine the mass of the purchased ingot.

Opportunities in Russia

In Russia, it is associated primarily with the state taxation system, since the eighteen percent value added tax that has existed for a long time, which is levied on the buyer of a bar of bank gold, is really disproportionate to the prospects for this method of investment.

Nevertheless, along with the official market, which, in particular, is represented by such banking institutions as Sberbank of Russia, VTB 24, Nikoil, Nomos-Bank, there is also a black market for precious metals, on which, among others gold bars are also sold. The absence of taxation often attracts investors to this market. But do not forget about the undeniable disadvantages of such a market. Among them, it is perhaps worth highlighting the following:

- Uncertainty about the actual conclusion of the transaction. Market brokers often "throw" their clients, charging them an advance payment for the goods, which are subsequently not provided.

- Lack of any quality assurance. An investor purchasing a gold bar through the "black market" cannot be sure that it meets the stated requirements.

Alternatively, which will be discussed later.

Video on the growth in demand for gold bars in Russia

Opportunities in Europe

If we compare investments in gold bars in the Russian Federation and in Europe, then we can draw up a similar comparative table:

| Criterion | Russia | European Union countries |

| Availability of taxation | There is an eighteen percent value added tax. | VAT and other taxes are absent. |

| Subjects of realization of the right to sell | Banks licensed to carry out operations with precious metals. | Banks, refineries and others. |

| Who can buy bullion | Physical and legal entities, which are registered with the Assay Office. | All individuals and legal entities, without exception, various financial institutions, pension funds. |

| Quality standard | GOST R 51572-2000 for measured ingots up to 1 kg. GOST 28058-89 for ingots from 11 kg to 13.3 kg. | Good Delivery Rules. |

| Calculation of the cost of one gram of gold | Depends on discount price for gold set by the Central Bank of the Russian Federation | It is calculated taking into account the London fixing indicators (per one troy ounce of gold). |

| Calculation of the cost of one gram of gold depending on the mass of the ingot | The smaller the bar, the more expensive one gram of gold it contains. | The price does not change with the increase / decrease in the mass of the ingot. |

| Storage services | Bullions are stored in a bank depository, which can lead to the emergence of storage risks associated with restricted access to the vault, or bank instability. | Bullions are stored: in bank depositories; in independent non-bank depositories in Belgium, Austria, Switzerland, Great Britain. |

| Redemption | The service of redemption of bank gold bars is not provided by all banking institutions in the country. As a rule, the buyback cost is an order of magnitude higher than the price at which the bullion is sold. | Availability of buyback guarantee at market prices. |

It is important! Thus, it should be noted that it is certainly more profitable to invest in bank gold bars in the member states of the European Union than in the Russian Federation.

Video about swapping gold bars in a Ukrainian bank

Alternatives

There are several alternative investment options for a Russian investor:

- on the territory of the countries of the European Union. In this case, it is worth studying in detail legislative framework, which regulates this industry in the country of the Eurozone chosen by the investor.

- Choose another one in Russia. It is worth highlighting here, perhaps, investments in unallocated metal accounts. Although, each investor, depending on his capabilities and needs, can choose any other form for investing in gold.

Today, gold in our daily life appears in the form of jewelry, dental crowns, gold coins and ingots. And the last form is the most popular when it comes to large savings or exchange trading. It is an ingot of gold, the price of which depends on the value of one gram or an ounce, that becomes the main means for replenishing the gold and foreign exchange reserves of different countries. With the help of this ageless currency, settlements between states are often carried out. This form of storage of precious metal is a kind of universal, which is described by various international and national standards.

Varieties of gold bars

In this area, there are world standards that determine the requirements for the so-called measured ingots, described by the following positions:

- The presence of industrial brands, which are put by the manufacturer. This marking includes the name of the country, weight in grams, indication of the type of precious metal, samples, brand of the manufacturer.

- Permissible deviations in length and width, inadmissibility of serious deformations

In Russia, the standardization of 999.9-sample ingots weighing up to 1000 grams is carried out using the provisions of GOST R 51572-2000. Each ingot has an individual registration number, which allows you to identify a specific dimensional object. Scratches, chips, dirty spots, strong deformations are not allowed. The maximum surface flaw in depth should not exceed 5 mm.

By the method of production, gold bars are classified as follows:

- stamped

- cast

- powder

The most expensive stamped ingot will cost about 10-12% more than a powder one. In all cases, a certificate is attached to the officially purchased ingot.

Where to buy a gold bar

In Russia, citizens can purchase bullion from almost all major banks in the country, including Sberbank, VTB and Gazprombank. These assets, like any currency, have a sale and purchase price. The difference between buying and selling is quite large, so gold bars are rarely purchased by individuals for quick speculation. Usually this product is bought for a gift or long-term private investment. The perceptible difference between buying and selling arises from the value added tax (18%).

When buying a gold bar, you must keep all receipts and certificates that accompany such a purchase. The most active seller in this market is Sberbank, which offers the population gold bars weighing from 1 gram. For such a purchase, you will need a valid passport of a citizen of the Russian Federation. By selling and buying gold bars, Sberbank guarantees the highest quality of goods, which is confirmed by a certificate from the manufacturer. You can follow the course of precious metals from personal account... Purchases are classified into two categories - satisfactory and excellent quality.

For storing gold bars, you can get a term

Article 191 of the Criminal Code of the Russian Federation defines criminal liability for illegal trafficking in precious metals and precious stones for up to five years and various large fines. Of course, if you bought a gold bar from Sberbank and have all the supporting documents on hand, no one will make any claims against you. But if a gold bar, nugget or sand fell into your hands directly from the bowels or from clandestine production, in this case you should think hard about the consequences. The punishment will depend on the amount of damage, which is considered large, starting from 1,500 thousand rubles.

Illegal trafficking means storage, transportation, purchase and sale of precious metals. And there is one important nuance here. If a piece of gold has signs of jewelry (scrap), then no questions arise to the owner. It's another matter if such signs are difficult to detect. Then you will have to prove for a long time that this fragment came to you in a legal way. So, if you take and melt a ring at home, then the resulting ingot under unfavorable circumstances can send you to the bunk.

Gold bars continue to be the most demanded physical asset of our time. Despite the ups and downs in value, this precious metal successfully fulfills the function of the global financial and economic equivalent and regulator.

Historically, gold has been one of the most popular investment vehicles. Investors account for 30–40% of the total volume of gold purchases, and jewelers - 40–50%. In times of crisis, investors, hedging risks, increase their investments in gold, while in moments of stability the demand for jewelry grows, which prompts jewelers to increase their output. The combination of these factors makes the demand for gold stable and resilient, which enhances the precious metal's role as a capital preservation tool. At the same time, the variety of formats for investing in gold makes the choice not very easy. Let's try to figure it out.

Text: Ayrat Khalikov

The instruments for investing in gold can be divided into two groups: the direct purchase of bullion or alloy products and the purchase of derivatives based on the price of gold.

Gold bullion

Buying gold bars is the most traditional way of investing in gold to save money. About one thousand tons of gold bars are purchased annually in the world, which is 60% of the total investment in gold.

In Russia, individuals can purchase bullion from precious metals only within the banking system. Upon purchase, VAT is added to the value of the ingot at the rate of 18%, and upon sale back to the bank, VAT is not refunded to an individual. Payment of VAT can be avoided by leaving the bullion in safe custody at the bank. In Russia, such a service is provided by a limited number of banks, since it requires special premises, expensive equipment, and trained and certified personnel. In addition, the ingot that is in safe custody at the bank will eventually have to be sold to this particular bank, since if the ingot is removed from the bank, VAT will have to be paid.

In Russia, measured ingots weighing 1–1000 g, stamped in accordance with Russian GOST, and so-called standard ingots, cast in accordance with the international standard LBMA Good Delivery bars weighing 11–13.3 kg, are in circulation.

The margin set by banks for bullion of precious metals depends on their weight. When selling ingots weighing 1 kg, the premium is 1.5–2%, while for ingots weighing 1 g, banks' mark-up can be up to 14–33%. As a rule, the tariffs for storage of ingots in banks depend on the duration of storage and the number of ingots and fluctuate in the range of $ 30-200 per ingot per year, regardless of its weight.

Russian citizens can also use the service of buying / storing bullion abroad, since there are no restrictions on such operations in the legislation. The most convenient way to buy bullion is through the London Bullion Market Association (LBMA) system - bullion prices are determined as a result of exchange trading, and a small commission is charged for transactions. When buying a bullion abroad, it is best to leave it in a special depository included in the LBMA delivery list, or in a depository of a member of this association. This saves a lot of money as there will be no additional costs associated with verifying the identity and origin of the bullion when reselling. The commission for purchasing a gold bar through LBMA ranges from 1% to 1.5% (for a 400 oz / 12 kg bar) and up to 3% (for a 32 oz / 1 kg bar). The cost of storing the ingot in storage is 0.3–0.5% of its value per year.

The key advantage of specialized bullion vaults over banks is that they do not carry out financial transactions that can lead to bankruptcy and insure the full value of bullion. Placing bullion in vaults provides additional convenience to entrepreneurs, since it allows them to be used as collateral for lending to related organizations.

The main advantage of buying gold bullion is that this investment does not carry any banking or financial risks and is the cheapest investment instrument in physical metal.

The downside of buying ingots abroad is that in case of importing ingots into Russia, the owner is obliged to pay VAT in the amount of 18% and duty in the amount of 20% (if the customs decides that the ingots are imported for commercial purposes).

It should be noted that at present in Russia the commissions for the purchase and storage of gold bars are lower than in the LBMA system.

Investment coins

Acquisition of coins made of precious metals is the second most popular investment method - annually about 300 tons of gold go to the production of investment coins, which is 20% of all investments in physical gold.

The Central Bank of Russia mints coins from precious and semi-precious metals, which can also be used as an investment tool. In this context, the most interesting are coins with the status of "investment", because when they are acquired individual does not pay VAT. At the moment in russian banks coins made of gold, silver, platinum and palladium are available for purchase. The most popular is the "St. George the Victorious" coin with a gold content of 7.78 g.

Unfortunately, in Russia investment coins are sold with a significant mark-up: the supply price of the Central Bank is 7% higher than the price of gold in a coin, and the banks' mark-ups are 8-24% to the Central Bank price. For example, Sberbank, which sells half of the investment coins in Russia, sells the St. George the Victorious coin with a 33% premium to the price of gold in the coin, which reduces the investment attractiveness of such purchases. Such a high premium is due to the fact that the volume of demand for coins significantly exceeds the volume of their production. We believe that in the long term, with an increase in coin turnover, banks' commissions will decline to the world level. The advantage of investing in coins is that they can be stored anywhere and sold to any bank, provided that the integrity of the coin packaging is preserved.

In world practice, at the moment, the most popular investment gold coin Krugerrand, which is issued in a very large circulation (46 million coins weighing 1 ounce), due to which its spot price is only 2% higher than the cost of gold in metal. At the same time, the price of a coin in European banks is only 5–6% higher than the price of a coin manufacturer. This makes the coin an attractive tool for small investments. When importing foreign investment coins into Russia, the owner will also have to pay VAT (18%) and, possibly, import duty (20%) - by analogy with the import of bullion. A small number of coins can be brought in as a souvenir without paying taxes.

Some coins also have collectible and historical value. The pricing of such coins is less dependent on the economic environment and is determined by the numismatic value.

Exchange Traded Fund (ETF)

Gold-linked certificates, such as ETFs, are traded on most stock exchanges as freely as stocks. Usually one or 1/10 ounce of gold is tied to the ETF certificate, placed in a special vault. Each year, the funds charge a commission for storage, insurance of gold and various administrative expenses, which is 0.25 - 0.4%. The payment of the commission is expressed in a decrease in the amount of metal associated with the certificate. Funds' assets are backed by real gold, which is in vaults, which determines a high correlation between the fund's share price and gold prices. ETFs, reflecting the growing demand for this instrument, buy 180-380 tons of gold every year.

The main advantage of buying ETF certificates, rather than bullion or coins, is that the buyer does not have to bear the costs associated with storing gold, and the high liquidity of the instrument ensures low purchase costs - usually the transaction costs do not exceed brokerage fees in the stock market. ETF certificates are highly liquid instruments. For example, the average daily volume of transactions under the certificates of the largest ETF SPDR (ticker GLD US) is $ 146 million (for comparison: the daily volume of transactions in shares on the Moscow Exchange is $ 850 million).

The growing popularity of investing in the gold market by buying ETFs has been a major driver of investment demand for gold since the early 2000s. The largest ETFs such as SPDR, iShares COMEX Gold Trust and ETFS Physical Swiss Gold Shares undergo financial audits by the world leaders from Big 4 two or more times a year, and Inspectorate International Limited auditor completely recounts the amount of gold in vaults twice a year ... The funds only keep cash in their accounts to cover administrative costs and do not contain any derivatives. In this context, we can safely say that investing in ETFs is no more risky than investing in physical gold, while being cheaper than investing in coins and bars.

Depersonalized metal accounts (OMS)

The key advantage of OMC is that they allow the investor to avoid the risks and costs associated with the transportation and storage of precious metal bullions. OMS accounts take into account the amount of precious metal in grams, while some banks offer urgent compulsory medical insurance accounts, on which interest is charged in grams of metal - usually in the range of 0.1–2.5% per annum. Since banks do not purchase gold, they do not incur the costs associated with the purchase and storage of the precious metal, which makes this instrument cheaper. The main motivation of banks to participate in cHI programs due to the fact that they attract money at rates 2–4 times lower than on deposits.

The key risk for the investor is that the deposit insurance system does not apply to OMI: in the event of a bank bankruptcy, the depositor will have to wait for the delivery of metal or compensation for its value in money at the exchange rate on the day of bankruptcy in the general queue of creditors. The volume of liabilities on compulsory medical insurance accounts can be an order of magnitude higher than the collateral with physical gold. In the event of improper hedging of price risks, the bank may incur significant losses, which jeopardize the ability to fulfill obligations to customers.

Commissions for opening an account in Russian banks differ insignificantly and are in the range of 1–2.4% to gold prices in the Central Bank.

Investors in OMC benefit from taxation: income tax of 13% is paid only on the accrued interest, and not on the difference between the purchase and sale prices, as is the case with bullion and coins. Also, the depositor can withdraw funds from his account in the form of bars of precious metal by paying VAT and bank commission for the service.

Western banks also offer CHI with similar conditions. Their advantage is that they allow you to translate compulsory medical insurance funds from one bank to another without intermediate conversion to currency. And although Russian legislation also allows transfers between CHI accounts, in fact, Russian banks do not provide such a service.

In the context of investments in compulsory medical insurance, the main task of an investor is to select a reliable bank with low spreads to precious metals prices.

Derivatives (gold futures)

Investing in the gold market through futures contracts (options and futures) is a relatively inexpensive but high-risk instrument. To make such investments, you just need to open an account on FORTS (a division of the Moscow Exchange) with any domestic broker.

The exchange trades settlement contracts that do not imply the delivery of the metal itself to the buyer. This determines the low cost of this instrument and the narrow spread between buy / sell quotes. The low level of collateral allows transactions with a large "leverage" (up to 20 times the amount of funds on the account), which allows you to receive income with a small investment level.

The costs of purchasing futures are made up of the brokerage commission (1–2 rubles per contract), the spread between the purchase and sale price (0.01–0.05%) and contango (0.5–1.15% premium to the price of the underlying asset charged by the seller for deferring settlement of the transaction).

The disadvantage of a futures contract as a tool for investing in precious metals is short term until maturity. The average range of investments in precious metals for conservative investors is 3 years, which means that an investor in futures will have to perform a rollover 11 times during this period (it is necessary to reinvest funds in a futures contract on the Moscow Exchange every quarter). As a result, the annual cost of investing in the gold market through futures can reach 5-6% per year.

Another disadvantage is the need to track collateral for contracts in near real time. The low volume of the gold futures market on the Moscow Exchange (the volume of collateral on the market for an instrument does not exceed $ 10 million) makes the instrument unsuitable for a large investor.

According to analysts, gold futures are more suitable for speculation and hedging price risks than for maintaining value.

Gold mining stocks

From time to time in the media there is a thesis that buying shares in gold mining companies can be a good bet on the gold market. However, upon closer examination, this statement looks too superficial.

The fact is that investing in stocks brings investors additional risks associated with the operating activities of companies. Various emergencies regularly occur at gold mines: mines are flooded, drilling equipment fails, and contractors delay the delivery of equipment. The largest gold miners in Russia (Polyus Gold, Polymetal, Petropavlovsk) have repeatedly violated their production plans, which negatively affected their stock prices. At the same time, investments in indices of shares of gold mining companies suffer less from operational problems of individual issuers.

The general mood of investors in the financial markets also has a very strong influence on the dynamics of shares. When economic expectations deteriorate, investors are shifting to government bonds and gold, thereby reducing their risks. As the market situation improves, interest in shares increases, which leads to an increase in their quotes. Thus, the shares of gold mining companies are simultaneously influenced by two oppositely directed vectors, which leads to the fact that the correlation between the prices of shares of gold mining companies and the prices of gold is low. This makes gold miners' shares a bad bet on the gold market.

Jewelry

The myth of buying jewelry to save value is very popular in developing countries. On closer examination, it becomes obvious that this idea is utopian. This is due to the fact that the price of a piece of jewelry is usually higher than the price of a precious metal in a piece, since the final price is added to the cost of labor of jewelers (up to 50% of the final cost), store commissions and premiums for the brand. However, the resale does not take into account the artistic value - pawnshops buy jewelry as scrap at a significant discount to the original price, taking into account only the mass of the precious metal. In this context, it should be noted that the purchase of jewelry is justified only for its intended use - as a decoration.

It is also worth addressing the issue of investing in items of artistic and antique value. These investments are not, in fact, investments in precious metals, as their value is largely determined by the history associated with the subject.

Thus, summarizing what has been said, we can conclude that, within the framework of long-term investments in precious metals, the most interesting and cheap option is to invest in the compulsory medical insurance of Russian banks, and in international markets - in ETF certificates. Investors who prefer to minimize risks are advised to purchase gold bars and place them in specialized storage facilities both in Russia and in the LBMA system.

Gold is considered one of the most reliable assets among investors. That is why, on the eve of crises, it is actively growing in price. One of the most obvious ways to make money off gold is to buy bullion. But, as practice shows, this method is far from the most convenient and profitable. Let's figure out how else you can invest in gold and which option is the most acceptable for a private investor.

The most obvious way to invest in gold is to simply buy it. The precious metal is sold in the form of ingots in banks, jewelry shops and some pawnshops. But the bulk of bullion gold is sold through bank branches. The price of a bar depends on the weight, current gold prices and bank margins. For example, Sberbank sells bars weighing from 1 gram to 1 kilogram at a price of 4192 to 3,894,360 rubles, and Rosselkhozbank - from 4,270 to 3,872,890 rubles.

Gold bullion sales quotes at Rosselkhozbank

The main disadvantage of bullion gold is large overhead costs associated with its storage and implementation.Gold, especially of high purity, is a very soft metal. Since any scratch or chip instantly leads to the loss of 30-40% of the value of the ingot, it must be stored either in a safe or in a safe deposit box. Both are expensive.

Another disadvantage: when buying bullion gold, you must pay 20% VAT. That's a lot. For many years there have been talks about the abolition of the tax on the purchase of precious metals, but the law has not yet been adopted.

But let's also note the pluses of bullion gold:

- easy to sell - even to a bank, even to a jeweler;

- there are no difficulties with inheritance and donation;

- if stored correctly (in a safe and in a vacuum case), then gold can retain its properties for centuries.

Thus, bullion gold is convenient investment instrument, but only in certain cases. A beginner investor with little capital is better off choosing other ways to invest in gold.

Depersonalized metal accounts

The closest alternative to buying bullion gold is opening an impersonal metal account (hereinafter - OMC). In fact, the OMS is a savings account, the main unit of account of which is the equivalent of real gold in grams. For example, if you buy 100 grams of gold on the OMS for 285 thousand rubles, then when the price of 1 gram changes from 2850 to 3100 rubles, the total amount for the compulsory medical insurance will also change to 310,000 rubles.

You can watch the current OMS quotes on the banks' websites. For example, such prices are set in Sberbank.

OMS quotes in Sberbank

OMS quotes in Sberbank "Paper" gold is an excellent alternative to bullion. The main advantages of compulsory medical insurance:

- Low entry threshold (from several thousand rubles), no need to bear the cost of storing gold;

- not subject to VAT;

- relatively low spreads (the difference between the purchase price and the sale of gold by the bank);

- you can open an unlimited number of OMC;

- you can buy additional gold to your account as free funds become available.

But impersonal metal accounts have their drawbacks:

- limited liquidity: “paper” gold can be sold only in the bank where the metal account was opened, and only at the rate that is offered by the bank itself;

- oMI does not accrue interest as on deposits. The profit depends on the dynamics of the gold rate;

- OMS are not insured by the DIA.If the bank's license is revoked, the money will most likely not be returned.

OMC are beneficial if you are confident that the value of gold will rise in the near future. Sometimes investors have to wait several years before the price of a precious metal reaches the desired value.

Investment coins

Another way to invest in gold is to buy precious metal coins. They fall into two categories:

- Investment... Almost complete analogue of bullion, produced in large circulation, their value is mainly determined by the price of gold;

- Commemorative (collectible).They are issued in different editions, mostly small (literally up to hundreds of pieces up to 20-25 thousand), the cost of coins depends not so much on the price of the metal, but on the collection value.

The selection of both types of coins on the Russian market is quite large. Coins are sold by:

- banks - the largest collections from Sberbank, VTB, Rosselkhozbank;

- collectors clubs;

- specialized organizations, for example, the Golden Mint, Derzhava, Troy Standard;

- auction houses - the largest Findcoins, Conros, Raritetus.

In addition, coins can always be bought from hands - at the same "Avito" or even in a pawnshop.

Gold investment coins

Gold investment coins The value of investment coins grows by an average of 8-10% per year. But with a successful combination of circumstances, the coin can be resold with a yield of tens or even hundreds of percent per annum.

The main disadvantages of investing in gold coins are the unpredictability of income, difficult storage conditions (chips, scratches or traces of rust lead to a fall in value), and low liquidity.

Gold mining stocks

It is not necessary to invest in gold directly by purchasing it physically. You can invest in the extraction of the precious metal by purchasing shares in gold mining companies. So you can make money not only on the growth of stock quotes (which are sensitive to changes in prices for precious metals), but also on dividends. For example, the current dividend yield of Polyus is 6.9% per annum.

The largest gold mining companies in the world are Kinross Gold, Barrick Gold, Centerra Gold, Newmont Mining Corp, AngloGold Ashanti, Goldcorp. There are more than two dozen industry companies in the world. In Russia, you can buy securities of the aforementioned Polyus, as well as Polymetal, Petropavlovsk Group, Lenzoloto. Shares of all companies, except for Petropavlovsk, are traded on the Moscow Stock Exchange and can be bought by opening an account with any domestic broker. Petropavlovsk went public on the London Stock Exchange, and a broker is needed to provide access to it.

Mutual funds and ETFs for gold

Buying bullion or coins requires some preparation from the investor, as does stock picking. If you don’t want to do all this, you can earn income by increasing the price of gold in an alternative way: buy shares of a fund or ETF in gold.

There are currently 13 mutual funds in Russia from 12 management companies that invest in gold. Return on investment - from 16% to 32% over the last year.

Mutual funds investing in gold

Mutual funds investing in gold The investor makes money on the growth in the value of the share. He needs to study the UIF's earnings strategy, its profitability in recent years, the composition of assets. Pay attention to the commission: too much remuneration for the manager can negate all the potential income. It is recommended to invest in "gold" mutual funds for a period of 3 years or more. With such a duration of holding shares, there is no need to pay personal income tax when they are sold, and this significantly increases the return on investment.

There is only one ETF for gold on the Russian stock market - FXGD from FinEx. The Fund tracks the LBMA Gold Price AM Index by copying it. Commission - 0.45% per year.

Dynamics of ETF FXGD quotes

Dynamics of ETF FXGD quotes You can buy units of mutual funds through management company... The entry threshold depends on the Criminal Code and varies from 1,000 to 50,000 rubles. You can buy ETFs for gold through any broker on the Moscow Exchange.

Alternative ways to invest in gold

There are other ways to invest in gold, but they are more speculative and intended for professional market participants.We are talking about options, gold futures, and CFDs (Contracts for Difference). The derivatives market instruments - options and futures / forward contracts - are used by large investors and funds to hedge their risks.

Gold futures

Gold futures To put it simply, if an investor is counting on an increase in the gold rate, but fears that at a certain point in time the estimated price of an asset will be less than the required value, he can buy either an option or a gold futures. If the price reaches the desired value, then he will make money on the growth, if the price falls, he will realize the option and receive his insurance premium.

CFD is a speculative instrument used in the forex market. The trader determines which direction the gold price will go and then either buys the asset or sells it. If the price moves in the right direction, then the trade is closed with a profit. If not, you have to fix the loss.

The advantage of derivatives and CFDs is that you can make money both on the rise in gold and on its fall.

Which way to invest in gold to choose depends on the investor and his strategy. For simple savings, you can use the purchase of bullion, investment coins or an impersonal metal account. To increase funds and make active money, it is best to buy shares of gold mining companies, "gold" mutual funds and ETFs. Active traders will love the derivatives market instruments and CFDs.