paypal history. Phenomenally successful business idea, or the history of PayPal. Transfer money to PayPal

164 million

Story

PayPal Inc. founded in March 2000 as a result of a merger of companies Confinity And x.com, in the very first months of its existence, the company began to serve electronic auctions, so, by April 2000, more than 1 million auctions on eBay offered payment through the PayPal payment system.

In October 2002, PayPal was taken over by eBay Corporation, since then more than 50% of eBay's auction transactions have been carried out using PayPal. Most of PayPal's main competitors are closed or sold.

For the beginning of 2012 PayPal works in 190 countries. For September, 2011 in PayPal 24 types of world currency were used.

PayPal Here

In March 2012, PayPal introduced a new device called PayPal Here, which will allow you to pay with a credit card through your mobile phone. While iPhone is supported , Android phones are planned to be supported in the future . PayPal Here is a card reader - a small blue triangle that connects to the phone through the headphone jack. The innovation is aimed primarily at small businesses and small retailers. The payment system will charge a fee of 2.7 percent of the payment amount. In addition, the company provides a debit card to which one percent of the transaction will be returned. Thus, the commission can be reduced to 1.7 percent. .

Bank status

In 2007, PayPal received a banking license in Luxembourg, which gave it the right to engage in banking activities throughout the European Union and the obligation to comply with the laws and regulations of the Financial Sector Supervisory Commission.

Usage

Payments are made through a secure connection after entering the e-mail and password specified after account confirmation. The account includes the address where purchases will be delivered. PayPal users can transfer money to each other.

Account verification involves debiting a small amount of money (usually a little less than two dollars $1.95 USD) from the user's card with a four-digit code in the payment details, which must be provided to PayPal. This confirms the identity of the cardholder who has access to the payment history of his card. After confirmation, the money is returned to the card.

Using PayPal is free of charge: registration in the system is free, and the sender is not charged a commission for sending money. The commission is charged from the payee. Its size depends on the country of origin of the payment and the country of the user receiving the payment, as well as his status. By default, PayPal also receives income from the difference in exchange rates when it converts money itself, and not through the issuing bank. This option can be disabled and always converted through the issuing bank.

In the case of payment for purchases subject to delivery, the money is not credited to the seller's account until the buyer confirms the fact of delivery, or the time for opening a dispute on the part of the buyer expires. Within 45 days from the moment of making the payment, the buyer has the opportunity to open a dispute if the delivered product differs from the ordered one, or the delivery did not take place. If the buyer and seller could not reach a mutual agreement, the dispute can be turned into a claim. The claim can be placed within 20 calendar days from the date of opening the dispute. If PayPal decides in favor of the buyer, they will be refunded the full purchase price, including shipping costs.

Commissions

Commission for transfer within Russia in dollars is 3.4% + $0.30 USD. Commission for accepting payments sent from most countries in Europe and North. America to Russia is 3.9% + $0.30 USD. But it is better to check for each country separately on the PayPal website in the Cross-border Fees section. The maximum commission for all other countries of the world when paying to Russia is 4.9% + $0.30 USD. The indicated commissions are deducted from the amount of the recipient in Russia. It is extremely important when selling on eBay, where the PayPal commission is added to the commission of the auction itself (fixed 9%). And from the price of the lot sold, and from the cost of shipping!

Notes

Links

Wikimedia Foundation. 2010 .

See what "PayPal" is in other dictionaries:

PayPal- PayPal Inc. Rechtsform Corporation Gründung 1998 Sitz … Deutsch Wikipedia

PayPal- PayPal Inc. Unternehmensform Corporation Gründung 1998 ... Deutsch Wikipedia

PayPal- Logo de PayPal Dates clés 1998 Siège social ... Wikipédia en Français

PayPal- Saltar a navegación, búsqueda PayPal Tipo Sociedad Anónima Fundación 1998 … Wikipedia Español

PayPal- - an international payment system with which you can pay for purchases on the Internet. To date, PayPal operates in almost all countries of the world, payments are made in 20 major world currencies. In Russia, the company services for ... ... Banking Encyclopedia

PayPal- es un negocio en Internet que permite la transferencia de dinero entre usuarios de email, evitando el traditional método en papel como los cheques. PayPal también procesa peticiones de pago en el comercio electrónico y otros servicios webs, por… … Enciclopedia Universal

PayPal™- UK US noun [U] TRADEMARK E COMMERCE, INTERNET a system that allows payments to be made using the internet: »a PayPal account/payment … Financial and business terms

PayPal- Infobox Dotcom company company name = PayPal Inc. company company type = Subsidiary of eBay genre = foundation = Palo Alto, California USA (1998) founder = location city = location country = location = flagicon|USA San Jose, California USA… … Wikipedia

PayPal- Logo de PayPal Dates clés 2000: Création 2002: Rachat par eBay ... Wikipédia en Français

PayPal- ▪ American company American e-commerce company formed in March 2000 that specializes in Internet money transfers. It was heavily used with and eventually purchased by the Internet auction company eBay. Paypal was the product of a merger… … Universalium

Books

- How it all began Apple PayPal Yahoo and 20 more stories of famous startups through the eyes of their founders, Livingston J.. How to start a business without money or experience, relying only on an idea? And where do you get this idea that will allow you to turn the world around? Founders of Apple, Yahoo!, Adobe and other global companies...

Now Max Levchin is known around the world as an American web developer and programmer, one of the creators of PayPal- the largest in the world electronic payment systems. Levchin is also Vice President of Engineering at the company. Google.

But his attempts to achieve success in the field of programming were not always successful, writes Peoples.ru.

Max was born on July 15, 1975 in Kyiv into a Jewish family. Maximilian was named after the poet Maximilian Voloshin, whose great admirer was Max's father - a well-known poet and prose writer in literary circles Rafael Zalmanovich Levchin. Mother Elvina Pinkhasovna Zeltsman is a multimedia artist, photographer, translator and programmer.

IN In 1991, the family emigrated to the United States, where they settled in Chicago, Illinois.

By the time he moved to the USA, Max already knew English quite well, and this helped him enter University of Illinois at Urbana-Champaign where he studied computer science. He graduated from the university in 1997 and then moved to Silicon Valley.

Before PayPal Levchin launched 3 startups that did not bring him success and profit. The first big money was earned in 2002, when eBay purchased a payment system PayPal for $1.5 billion. He, as one of the co-founders ( PayPal was founded in 1998 by Levchin, Peter Thiel and Elon Musk), then owned 2.3% of the company, and received about $34 million as a result of the takeover.

PayPal started its work at the end of 1999. The system now known was the sixth attempt, it was she who was invulnerable to hacker attacks that ruined some other electronic payment systems. The system owes this to the talent of the programmer and mathematician Max Levchin, one of the 6 people who stood at the origins of this project.

The project turned out to be more successful than its creators expected: in the very first months of its existence, the company Nokia invested $3.5 million in the project, Deutsche Bank— $1.5 million. Many other banks have invested in PayPal over $20 million in total. Thanks to the growth of the internet user community soon after launch PayPal already had about one and a half million customers in the database, and the daily turnover exceeded$2 million. It was then that the project decided to purchase eBay .

In 2004, Levchin launched his own startup Slide, the main development of which was a service for conveniently displaying a large number of photos for users of a social network myspace. Later Slide refocused on creating social services for MySpace and Facebook.

As a result, Levchin's photo hosting acquired Google, and Levchin himself became vice president of the company.

In 2009, Max Levchin ranked 25th in the list of the most successful businessmen under 40, according to the publication. Fortune.

Levchin, he says, is obsessed with cycling. He closely follows the various competitions.

When the entrepreneur first moved to Silicon Valley, he didn’t ride a bike at all, which was gathering dust in the garage. after sale PayPal Levchin gained excess weight and constantly complained to his girlfriend, and now wife Nelly, about boredom. Then the girl offered him a ride - according to her, this would help put his brain in order.

Levchin decided that he was ready to take up the bike only a few months later. Memories interfered with the entrepreneur - Max was used to the fact that cycling has always been what he is really good at. Levchin worried that due to his extra weight, he might not be able to drive fast or climb a high mountain.

Founder PayPal decided to “come back” by attending several group workouts. He found he could handle interval cycling fairly well—better than most who had taken classes—and didn't feel too breathless or tired. Then he realized that he could return to the road.

"Every couple of years I promise myself to try racing - but getting back in shape took longer than I expected," admitted Levchin.

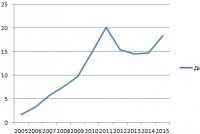

In the 21st century, it becomes one of the most promising ways of settlement between the seller and the buyer. Evidence of this is at least the fact that only in Russia in 2013 the volume of the electronic money market exceeded 2 trillion rubles. If we compare this figure with 2012, we can see that the e-commerce market has grown by 23%. According to these figures, it is easy to understand that electronic payment systems are gaining more and more popularity every year.

Consider one of the most common e-commerce systems in the world - PayPal.

Birth of the system

The history of PayPal dates back to March 2000, when it was invented (as a result of a merger of companies) by several students, one of whom was an immigrant from the Soviet Union (Max Levchin).

Immediately after its creation, the company began to serve electronic auctions, in particular, the world-famous eBay (in one month of existence, more than one million eBay auctions offered settlement with the PayPal payment system).

In 2002, the giant corporation eBay acquired PayPal, and from that moment on, 50% of purchases at auction occur through the latter.

In 2012, 190 countries could pay or trade using PayPal, the system's arsenal included 24 currencies around the world. Early 2015 marked the split between eBay and PayPal, and they are now two separate corporations.

Registration

So, PayPal. What it is and why it exists, we figured it out. To get started with PayPal, you need to go through the registration process. To start registration in the PayPal system, you need to go to the official website (it is the same for all countries, but for convenience, you can select the desired language on it), click on the "Register" button and in the next window select the "Personal account" tab, then click on the button "Continue".

After that, the browser is redirected to a page where you should specify the country of residence, e-mail, set a password to enter the system (it must consist of at least 8 characters, and it is better to enter both letters and numbers).

The next stage of registration is filling in personal information (first name, last name, date of birth, nationality, city, street, postal code, and phone number). All data should be entered correctly in order to avoid problems in the future, since the account (or PayPal wallet) will be opened exactly according to the specified data, which are then very difficult to change.

account activation

If all the fields are filled in correctly, you need to put a bird in the "User Agreement" column, and then click on the "I agree, create an account" button. Then you should check your mail and activate your account by clicking on the link in the letter.

Adding a bank card

Consider how to replenish PayPal. There is another important question. It sounds like this: "How on PayPal?" You must first link a bank card to the system. This is done in the user menu. You need to follow the link "Connect and confirm my debit or credit card" (top right on the site). After that, you will need to enter all valid card data, namely: last name, first name, card type (Visa, Master Card, etc.), number, expiration date and the so-called security code (3 digits that are located on the back of the card ), and then click on the "Continue" button.

In order for the card linking process to be successful and to be able to learn how to pay with PayPal, it is required that the card has an amount equivalent to $1.95. The system will remove this amount of money automatically to verify that the card really belongs to the owner. This money will not be lost, but will be returned to your account exactly in a day.

Withdrawal limits

For security purposes, PayPal sets certain withdrawal limits.

The minimum limit for CIS citizens is $50 or the equivalent in another world currency. The maximum withdrawal of funds per day (for residents of the Russian Federation) at the moment is 15,000 rubles, a month you can withdraw no more than 40,000 rubles. in Russia, whose user reviews inspire confidence, charges a minimum commission when withdrawing funds. This is a very advantageous moment.

How can I learn more about limits and how to fund PayPal? You need to go to the "My Account" tab in your account.

How to transfer money to PayPal

To transfer money in the system (for example, to another account), just go to the menu and click on the "Sending money" tab. In the window that appears, you will need to enter the data to whom the money will be sent (PayPal-purse of the recipient), the amount and currency. The default is the US dollar, but you can always choose the equivalent in another currency if necessary.

If there is a question about transferring to your card, which is tied to the system, then it is still easier here, since the system provides for transferring PayPal money to your personal account. This cannot but please users. PayPal - what is it? As you can see, this is a very convenient payment instrument.

To transfer funds, you need to select "My Wallet" in the menu and check the "Transfer to a bank card" item, indicate which card the transfer should be made to (since you can register not one, but several cards in the system at once), enter the amount and click " Translate". In this case, payment occurs almost instantly, and if everything is in order with the bank (there are no problems with the network, for example), then you can cash out money from the card in 2 minutes.

Account types

And we figured out how to use it. Now it's time to tell you what accounts are in the system.

Globally, PayPal accounts can be divided into 4 types (types):

- personal;

- premium;

- student;

- business.

The most common type of account is personal (or personal). They are free to both transfer PayPal money and accept currency. At the same time, contacts with various kinds of payers are provided. In order for the money to be delivered to the address, you only need to have a PayPal wallet and an email address. This is all limited. The user cannot send or receive money from any type of card, only transfers within the system are allowed.

Premium accounts have added specialized features that are not available to other users. If you are interested in the question of how to transfer money to PayPal from a card, then this type of personal account will help you answer it. It is in the premium account that you can freely withdraw money to the cards of other participants or receive funds on your card through the system.

A student account is an innovation in the electronic payment system. With it, you can easily answer the question of how to transfer money to a child's PayPal account if he is studying or living abroad. A person must be at least 13 years old in order to be able to open an account without any problems. One parent has the right to have up to 4 such accounts. In this case, a real account is not opened, but a system for replenishing a student account from a parent one takes place.

The business cabinet allows the user to use the service to the maximum. You can accept payments as a business, there is no limit on currency turnover per day, and, most importantly, you can accept money into your account from any other bank or e-wallet (not PayPal). Unfortunately, there is no such possibility in the types of accounts discussed above.

User verification

To begin with, let's define the phrase "PayPal user verification", what it is, we'll also consider it. Let's explain the word "verification" in simple words. It means confirmation (in a literal translation), and in our case - confirmation of the veracity of the completed information about the user who is registered in the system. That is, the system requires certain actions on the part of the user in order to make sure that the information that he submitted is 100% true (for example, you can register as Vasya Pupkin, but in fact not be).

Until the user is verified, payments can be made, but with certain restrictions. To withdraw the latter, you need to send a scanned copy of your passport (with a residence permit) electronically or by mail and confirm your mobile phone number. This data is confidential, you can be sure that it will not fall into the wrong hands through PayPal.

Verification Benefits:

- sending and receiving any amount of money at any time of the day;

- trust in a verified user is many times greater than in an unverified one;

- lightning-fast sending of payments from a bank account without delays and other minor annoyances;

- the availability of exclusive services (among them - the protection of the seller)

Why PayPal?

Among all kinds of electronic on the Internet, PayPal takes 1st place. And this is no accident. For the PayPal system - what is it, if not the safest place to store personal savings? Advanced technology and detect fraud of any kind. Getting to your personal funds is almost impossible, even if the robber is an experienced hacker. The account is tied to a physical key generated by the system. This key can be stored not on the network, but, say, on a flash drive. Without access to the key, no one will ever be able to steal any amount of money from the account.

A little about commission

How to transfer money to PayPal and not spend money on a commission? Actually, not at all. The system charges a commission, but only on completed transactions. You do not have to pay for opening an account and its maintenance.

To withdraw funds to a check (a real one that can be cashed in any bank), you need to give the system 1.5 dollars.

The fee depends on the country in which (or to which) the transfer will be made, on how PayPal money is transferred (bank or wire transfer), and on the transfer currency.

For example: if you withdraw money from a personal account to your account in the USA, you do not need to pay anything, while in Bulgaria you will need to pay 2.5 dollars for such a transfer.

The system also provides for a return commission. If for some reason you need to return the funds back (how to transfer money to PayPal, described above), then a certain amount will also be deducted for this.

As for the commission within the system, it also exists, and depends on the country and other factors. In the system itself, 0.5-2% of the total amount of the transaction or transfer will need to be shared. Again, a definite figure cannot be given, since everything depends on many factors.

Conclusion

From the foregoing, it became clear what PayPal is and how to use it. The choice in any case will always be yours. The system has proven itself and proved its right to exist by the fact that it is trusted by millions of people around the world - it has existed for more than 15 years. If the question is about transfers within the Russian Federation, then you can find an alternative, but if the receipts are from different countries, then, of course, you should choose PayPal.

To survive and leave offspring, you do not need to be the best:

it is enough to be a little better than a neighbor in the savannah.

.

But now every second grader knows perfectly well that there are colossal fortunes on the Web and hundreds of billions of dollars are spinning. Today it is the Internet - a global propaganda machine that has jokingly outdone television, newspapers and radio. It is easy to believe in the World Wide Web, when it is already clear: it is here that humanity has finally migrated in the 21st century.

And you try to imagine yourself in the place of the pioneers who came to the Network at the dawn of her youth. Then, when they did not even imagine that one day the Internet would blow up the well-being of this world and reshape all the rules of the game. The pioneers of the Webway knew nothing for sure, took huge risks, and were often the butt of ridicule. And yet it is on their optimism and faith that the current Internet is built. That's PayPal, now thundering all over the world, at one time was just a dream, which was lucky enough to take shape as a leader and a billionaire.

About some unknown whim PayPal stories in Runet is known only to a small number of people. We will talk about this below. But this fact does not make the role of PayPal less significant for the global Internet. That is why this text is here.

How did PayPal get started?

You don't have to think that PayPal history is a story of easy success studded with roses. Rather, it can be called an example of a successful symbiosis, when two companies that alone would have remained in the settlements of fame, together managed to create a sought-after tandem.

And so, it all started with the fact that there were two companies, but until some point they fought their way to fame one by one. So, the first participant in a successful symbiosis was called simply and unpretentiously - xcom. Founded the company at the end of the twentieth century Elon Musk, which immediately sent her to the financial rails. In fact, he wanted to create some kind of intermediary platform that would send payments through the Network for a small percentage. This person had a lot of experience, a lot of ideas, but serious problems with ensuring the security of encryption.

It was from here that he needed the help of a former Kiev resident Max Levchin("skill" - programming and cryptography) and Peter Thiel("skill" - finance), who in 1998 organized a company Confinity. Don't be put off by the unfamiliar name of the company, fortunately, the site on which the main application worked is known to almost everyone. Yes, yes, it was paypal.com. Of course, the principles of operation of that service were quite different from those of , but still, it was at that time that the main algorithms had already begun to run.

I will not go into the details of the merger, I will only say that due to some technical issues, the existence of these companies separately was possible, but unproductive. And, conversely, when merging, each of the parties complemented each other. It turned out to be a powerful online tool that could already boldly butt heads for leadership in the vastness of the Web.

From today they say, they say, PayPal was good, because they had no competitors, and therefore it was only necessary to catch the wave and set it up. Nonsense! Just at the turn of the 20th and 21st centuries, the Web was full of more or less similar services that could intercept the palm. Two very strong arguments played in favor of PayPal:

- A). they were not greedy and took a small percentage of transactions;

- b). they immediately put the protection of their service at such a high level that competitors only blushed with anger and cursed.

PayPal: growth by leaps and bounds

As the chronicle of the Network says, the merger of the companies took place in 2000, and it was decided to leave the name of the main service - PayPal as a common name. By the way, in translation it is something like “pay friends” or “pay, friend”. And immediately a great success: PayPal began to be offered as an alternative means of payment on the already popular one.

In addition, the payment system was noticed by other companies. The popularity of the service grew, and in 2002 PayPal put its shares up for auction. And luck again: the shares attracted about $ 1 billion in investments, which is fantastic for a company with a two-year history. Serious work has begun on the global conquest of the Web.

I don’t know how PayPal’s story would have developed further if, in the same 2002, the already mentioned Ebay hadn’t bought the system for 1.5 billion dollars. I don’t even know if this amount can be trusted, because in some places I have seen figures of $2 billion and even $2.5 billion. In principle, this is not so important for us, any of the amounts looks damn impressive. Then the following happened: he took PayPal under his wing, making it the main payment system on his site.

And again, I have to praise the foresight of the auctioneers, because they not only got themselves a pocket payment system, they also did everything to ensure that it had its own name. Over the following years, PayPal serviced millions of payments from Ebay without fail, but it didn't forget about the growth. So, just a couple of years after the redemption, this payment system became the most authoritative in the dollar zone. All its competitors by that time either successfully closed, or lagged behind the leader by a whole building.

When the PayPal management realized that you can’t get enough with one dollar, the introduction of a mass of new payment currencies began: the yen, yuan, euro, Canadian dollar, Czech crown, etc. At the same time, multi-platformity was introduced: the service was translated into more and more new languages. Soon the triumph of PayPal became obvious to everyone. Except…

PayPal in Russia

You, but in our homeland, PayPal has not become a truly popular payment system. There are two main reasons for this.

- Firstly, the opportunity to withdraw your money to a Russian bank account appeared only at the end of 2013. Prior to that, it was necessary to go for too murky frauds, such as withdrawing through local “hucksters” or not entirely transparent payments through shim banks.

- Secondly, PayPal came too late: when it became legal to withdraw your money from the system, the market was already heavily staked by local "authorities" like Yandex.Money. Finally, the contingent of PayPal turned out to be too specific: in Russia, this payment system is used mainly by buyers of Ebay and Western stores, or those who work directly with the West.

Be that as it may, PayPal remains the main payment system in the West and, who knows, the company may soon significantly increase its presence in Russia. Wait and see.

Appeared on the world market just when the Internet was just gaining popularity. This payment system was able to quickly gain leadership positions and today it works with almost 3 dozen currencies and has over 150 million registered users. The path of development of this payment system was winding, but interesting and impressive, because it was not in vain that the creators were able to bypass dozens of competitors and maintain leadership positions in the electronic payment market almost from the first months of work.

How it all began?

PayPal's success story is multifaceted and not as simple as it may seem to users of the service now, when the company operates in more than 190 countries and is known in wide circles. The beginning of the path of this payment system took place at the time of the merger of two companies - Confinity and X.com.

The creator of X.com was Elon Musk, who was one of the first to recreate in reality the idea of a platform for transferring payments over the Web for a small percentage. The project was successfully implemented, but it lacked strong data encryption to ensure the security of money transfers. Therefore, joining forces with Confinity was most welcome, because its founders were Max Levchin, a cryptographer and talented programmer, and Peter Thiel, who was well versed in the field of finance.

Despite the fact that even in those years PayPal had enough competitors, they were able to gradually gain huge popularity among users, as they charged a small percentage for transfers and offered a really high level of security.

How PayPal became a leader: the main stages of the development of the payment system

In the first months of its work, PayPal already served Internet auctions, by 1998, about 1 million auctions on eBay offered to pay using this payment system. In 2002, PayPal put up for auction its shares in order to receive more investment for further development. As a result, about $ 1 billion was received, which was a huge success. Attempts to step even further in the conquest of the global network did not stop there, and in the same year, PayPal was absorbed by eBay for $ 1.5 billion. But the payment system did not become exclusively a “personal functionality” of an online auction, and continued to conquer the market.

Within a few years, PayPal became such a success that many of the system's competitors were shut down or sold. There are very few working payment systems left in the dollar sector, but they were noticeably behind the clear leader in the face of PayPal.

PayPal's development continued in different directions:

- It became possible to work with new currencies, such as euro, yen and yuan, Canadian dollars, etc.

- The interface was translated into other languages, which made it easier for residents of other countries to work with the functionality.

- New features were constantly introduced, PayPal was working with almost all popular platforms.

Company status in different countries of the world

In the US, PayPal is officially licensed, and although the system is not a bank, it is registered as a financial institution that deals with money transfers. The company must comply with all laws created for financial institutions.

In 2007, PayPal also received a banking license in Luxembourg, after which the system was able to operate throughout the European Union, subject to all the rules of the Financial Sector Supervisory Commission. A year earlier, the company received a license for savings and loans in Australia, so it is officially subject to the banking legislation of this country.

In the CIS countries, PayPal has not yet managed to gain great popularity. The payment system entered the post-Soviet space when Yandex.Money and WebMoney were already actively used in it. In addition, until 2013 it was impossible to withdraw money to a card, so in the CIS countries PayPal was used mainly to pay for purchases in online stores. In Russia, PayPal received a license to operate as a non-banking credit institution only in 2013.

Features of using PayPal today

PayPal is hugely popular today for the same reasons that made it a leader on the web in its early years: ease of use, globality, and security. A resident of any country can transfer payments for purchases in online stores in the USA, China, etc. in a matter of seconds, without even entering their card details. All you need to enter is your personal user ID. Thanks to the most powerful encryption tools, you can be sure that your funds and personal account are safe. And dozens of currencies used and more than 190 countries that support PayPal make it possible to make international payments.