Received revenue according to a new standard. Received revenue according to New Standard 18 International Financial Reporting Standards

The income is defined as an increase in economic benefits during the reporting period in the form of tributaries or an increase in assets or reduce obligations leading to an increase in capital not related to capital participants contributions. Income includes both the revenue of the enterprise and other income. Revenues are revenues from the usual activities of the enterprise, characterized, including as income from sales, payment services, interest, dividends and royalties. The purpose of this standard is to determine the procedure for accounting revenue arising from certain types of operations and events.

The main question when taking into account revenue is to determine the moment when it must be recognized. Revenue is recognized if there is a possibility that the enterprise will receive future economic benefits, and these benefits can be reliably evaluated. This standard defines the conditions under which these criteria are performed and, therefore, revenue is recognized. This standard also contains practical recommendations for the application of these criteria.

Scope of application

1 This standard is applied when taking into account revenue received from the following operations and events:

(a) sales of goods;

(b) provision of services;

(c) Use by other parties to the assets of an enterprise bringing interest, royalties and dividends.

2 This standard replaces IAS 18 "Receal Research", approved in 1982.

3 Under the goods implies products produced by the enterprise for sale, and goods purchased for further sale (for example, goods acquired by the retailer, land or other property intended for resale).

4 The provision of services usually implies the implementation by the enterprise agreed in the task agreement within a certain period of time. Services can be provided within one reporting period or more than one. Some contracts for the provision of services are directly related to construction contracts, for example, contracts for the provision of project managers and architects. Revenue arising from these contracts is not considered in this standard, but is reflected in accordance with the requirements for construction contracts, which are defined in IAS 11 "Construction Contracts".

5 The use of enterprise assets by other parties leads to the emergence of revenue in the form:

(a) interest - fees, which is charged for the use of cash and cash equivalents or with debt amounts to the enterprise;

(b) Royalty free stock fees for the use of long-term assets of the enterprise, for example, patents, trademarks, copyright and computer software;

(c) dividends - the distribution of profits between the owners of the share capital in proportion to their participation in the capital of a certain class.

6 This standard does not apply to revenue arising from:

(b) dividends from investments taken into account by the equity method (see IAS 28 "Investments in Associate and Joint Enterprises");

Change information:

(d) changes in the fair value of financial assets and financial obligations or their disposal (see IFRS 9 "Financial Instruments");

(e) changes in the value of other short-term assets;

(f) the initial recognition and changes in the fair value of biological assets associated with agricultural activities (see IAS 41 "Agriculture");

(h) mining mineral ores.

Definitions

7 This standard uses the following terms in the specified values:

Revenue - gross flow of economic benefits for a certain period during the usual activities of the enterprise, leading to an increase in capital not related to capital participants contributions.

fair value - This is the price that would be obtained when selling asset or paid when transferring an obligation during a voluntary basis between the market participants at the evaluation date (see IFRS 13 "Evaluation of fair value").

8 Under revenue, only gross revenues of the economic benefits obtained and to be obtained by an enterprise on his account are meant. The amounts received on behalf of the third party, such as sales tax, goods and sales taxes and value added tax, are not the economic benefits received by the enterprise and do not lead to an increase in capital. Therefore, they are excluded from revenue. Similarly, under agency relations, the gross influx of economic benefits includes the amounts collected on behalf of the Principal, which do not lead to an increase in the capital of the enterprise. Amounts collected on behalf of the Principal are not revenue. At the same time, the revenue is the amount of commission remuneration.

Evaluation of revenue

9 Revenues should be assessed at the fair value of the reimbursement obtained or to be obtained.

10 The amount of revenue arising from the operation is usually determined by the contract between the enterprise and the buyer or the user of the asset. It is estimated at the fair value of compensation obtained or to be obtained, taking into account the amount of any trading or wholesale discounts provided by the enterprise.

Change information:

11 In most cases, compensation is provided in the form of funds or cash equivalents, and the amount of revenue is obtained or payable amounts of money or cash equivalents. However, if the receipt of cash or cash equivalents is postponed, the fair value of compensation may be less than the amount obtained or to be obtained with the nominal amount of funds. For example, an enterprise can provide an interest-free loan to the buyer or take a bill from it to obtain with a percentage rate below the market as compensation when selling goods. When the contract actually represents the financing operation, the fair value of compensation is determined by the discounting of all future revenues using the imputed interest rate. The imputed interest rate is the most accurately determined value of the following:

(a) the prevailing rate for a similar financial instrument of the Issuer with a similar credit rating; or

(b) Interest rate, which discounts the nominal amount of financial instrument to current prices of goods or services during cash sales.

The difference between the fair value and the nominal amount of compensation is recognized by interest income in accordance with paragraphs 29-30 and in accordance with IFRS 9.

12 If goods or services exchange goods or services similar in nature and cost, the exchange is not considered as an operation that creates a revenue. This often happens with products such as oil or milk, when suppliers exchange reserves in various places for timely satisfaction of demand in a particular place. When selling goods or providing services in exchange for different goods or services, the exchange is considered as an operation that creates a revenue. Revenues are estimated at the fair value of the obtained goods or services adjusted for the amount of translated funds or their equivalents. If the fair value of the goods received or services cannot be reliably appreciated, the revenue is estimated at the fair value of the transmitted goods or services adjusted for the amount of translated funds or their equivalents.

Identification of the operation

13 Recognition criteria presented in this standard are usually applied separately to each operation. However, under certain circumstances, it is necessary to apply them to separately identifiable elements of an individual transaction in order to reflect its content. For example, if the selling price of goods includes the amount for subsequent maintenance, which can be determined, this value is postponed and recognized as a revenue for the period during which the maintenance is made. Conversely, the criteria for recognition can be used simultaneously to two or more operations, when they are associated in such a way that their commercial effect cannot be determined without considering a series of operations as a whole. For example, an enterprise can sell the goods and at the same time enter into a separate contract for the purchase of these goods in the future, thereby, in essence, reducing the effect of the operation. In such cases, both operations are considered together.

Sale of goods

14 Revenue from the sale of goods should be recognized if all the conditions listed below are satisfied:

(a) the company transferred significant risks and remuneration to the Buyer related to the right of ownership of goods;

(b) the company no longer participates in the management to the extent that is usually associated with the right of ownership, and does not control the goods sold;

(c) the amount of revenue can be reliably estimated;

(d) there is a possibility that the economic benefits associated with the operation will come to the enterprise;

(e) incurred or expected costs associated with the operation can be reliably evaluated.

15 Determining the moment when the company transmits to the Buyer significant risks and remuneration associated with the right of ownership requires the study of the conditions of operation. In most cases, the transfer of risks and remuneration associated with the right of ownership coincides with the transfer of legal ownership or ownership. This happens with most retail sales. In other cases, the transfer of risks and remuneration associated with the right of ownership occurs at a different moment than the transfer of legal ownership or transfer of ownership.

16 If an enterprise retains significant risks associated with the right of ownership, the operation is not sales and the revenue is not recognized. Under different circumstances, the company can maintain a significant risk associated with the right of ownership. The situation when the company has significant risks and remuneration associated with the right of ownership include the following circumstances:

(a) the company continues to be responsible for unsatisfactory work, not covered by standard warranty conditions;

(b) obtaining revenues from a particular sale depends on receiving revenue by the buyer as a result of the further sale of goods;

(c) the goods delivered are subject to installation, and the installation is a significant part of the contract, which the company has not yet fulfilled;

(d) The buyer has the right to terminate the purchase and sale transaction due to a certainty-selling contract, and the company has no confidence in receiving income.

17 If an enterprise retains only minor risks associated with the right of ownership, the operation is to sell and revenue is recognized. For example, the seller can leave the ownership legal right to ensure that the amount due to him is due. In this case, if the enterprise transferred significant risks and remuneration related to ownership, the operation is to sell and revenue is recognized. Another example when an enterprise retains only a slight risk associated with the right of ownership, can be retail trade in which the return of money is invited if the client is dissatisfied with the purchase. Revenue in such cases is recognized at the time of sale, provided that the seller can reliably estimate future returns and recognizes the obligation to return on previous experience and other relevant factors.

18 Revenues are recognized only if there is likelihood that the economic benefits associated with the operation will come to the enterprise. In some cases, this probability may not be absent until compensation is obtained or uncertainty is not eliminated. For example, it may be unknown whether the foreign government will allow the translation abroad received when selling compensation. After receiving the permission, the uncertainty is eliminated and, accordingly, revenue is recognized. However, in the case when uncertainty arises in relation to the possibility of obtaining the amount already included in the revenue, the resulting amount, or the amount, the probability of which became unlikely, is recognized as a consumption, and not as an adjustment of the amount of the initially recognized revenue.

19 Revenues and expenses related to the same operation or any event are recognized simultaneously; This process is usually called linking income and expenses. Expenditures, including guarantees and other costs arising from shipment of goods, can usually be reliably estimated when performing other conditions necessary to recognize revenue. However, revenue cannot be recognized when costs cannot be reliably appreciated. In such situations, any compensation is recognized as an obligation.

Provision of services

20 If the result of the operation involving the provision of services is a reliable estimate, the revenue from such an operation must be recognized in accordance with the completion stage of the operation at the end of the reporting period. The result of the operation can be reliably evaluated if all the following conditions are performed:

(a) the amount of revenue can be reliably estimated;

(b) there is a possibility that the economic benefits associated with the operation will come to the enterprise;

(c) the stage of completion of the operation at the end of the reporting period can be reliably estimated;

(d) Costs incurred when performing an operation and the costs needed to complete it can be reliably appreciated. ***

Recognition and evaluation

21 The definition of whether the enterprise acts as a principal or agent (amendment 2009).

Interest, royalties and dividends

29 Revenues arising from the use of other organizations of enterprise assets that bring interest, royalties and dividends should be recognized on the basis defined in paragraph 30 if:

(a) there is a possibility that the economic benefits associated with the operation will come to the enterprise;

(b) the amount of revenue can be reliably estimated;

30 Revenue must be recognized on the following basis:

(b) royalties are recognized on the principle of accrual in accordance with the content of the relevant contract;

(c) Dividends are recognized when the right of shareholders to receive payments is established.

31 [Removen]

32 When unpaid interest are calculated before the acquisition of an investment containing interest, the subsequent receipt of interest is distributed between the period before the acquisition and period after the acquisition; Only a part of percent for the period after the acquisition is recognized as a revenue.

33 royaltys.

34 Revenues are recognized only if there is likelihood that the economic benefits associated with the operation will come to the enterprise. However, in the case when uncertainty arises in relation to the possibility of obtaining the amount already included in the revenue, the resulting amount, or the amount, the probability of which became unlikely, is recognized as a consumption, and not as an adjustment of the amount of the initially recognized revenue.

Information disclosure

35 The company must disclose:

(a) accounting policies adopted to recognize revenue, including the methods used to determine the completion stage of operations related to the provision of services;

(b) the sum of each significant article revenue recognized during the period, including revenues arising from:

|

sales of goods; |

|

|

providing services; |

|

|

percent; |

|

|

dividends; |

(c) the amount of revenue arising from the exchange of goods or services included in each significant revenue article.

36 The company discloses data on any conditional obligations and conditional assets in accordance with IFRS 37 "Estimated reserves, conditional obligations and conditional assets." Conventional obligations and conditional assets may arise in such articles as costs of guarantees, claims, fines or possible losses.

Date of entry into force

37 This standard comes into force in relation to the financial statements covering periods beginning on January 1, 1995 or after this date.

38 Publication "Cost of investment in a subsidiary, jointly controlled enterprise or an associate enterprise" (amendments to IFRS 1 "First Application of International Financial Reporting Standards" and IFRS (IAS) 27 "Consolidated and Separate Financial Reporting") issued in May 2008 led to amending paragraph 32. The company should apply the specified amendment on a promising basis for annual periods beginning on January 1, 2009 or after this date. Early use is allowed. If the enterprise applies the appropriate amendments to paragraphs 4 and 38a of IAS (IAS) 27 in relation to an earlier period, then it must simultaneously apply the specified amendment in paragraph 32.

Change information:

International Financial Reporting Standard (IFRS) 11 "Joint Activities" This standard is supplemented with paragraph 41, issued in May 2011, amended the definition of fair value in

______________________________* "The concept of preparation and submission of financial statements" KMSFO was adopted by the Board of the CMSFO in 2001. In September 2010, the Board of the CMSFO replaced the "concept" on the "conceptual basis for the preparation of financial statements."

** See also PCR (SiC) 31

*** See also PCR (SIC) - 27 "Analysis of the essence of transactions with the legal shape of the lease" and PCR (SIC) - 31 "Revenue - barter operations including advertising services"

The International Financial Reporting Standard (IAS) 18 "Revenue" is given.

The standard is applied when taking into account revenue derived from the sale of goods, the provision of services, use by other parties to the assets of an enterprise bringing interest, royalties and dividends.

Under the goods implies products produced by the enterprise for sale, and goods purchased for further implementation.

The provision of services usually implies the implementation by the enterprise agreed in the task agreement within a certain period of time. Some such treaties are directly related to construction contracts (for example, contracts for the provision of project managers and architects). Revenue from these contracts in the standard is not considered. It is reflected in accordance with the requirements that are defined in IAS 11 "construction contracts".

Standard is not applied to revenue arising from lease agreements; dividends from investments taken into account by the method of equity participation; insurance contracts that are subject to the action of IFRS 4 "Insurance Contracts"; from changes in the fair value of financial assets and financial obligations or their disposal; changes in the value of other short-term assets; initial recognition and changes in the fair value of biological assets related to agricultural activities; from the initial recognition of agricultural products; mining of mineral ores.

The standard comes into force on the territory of Russia from the date of official publication in the magazine "Accounting". It replaces IAS 18 "Revenue Research", approved in 1982

The organizations make up, represent and publish consolidated financial statements since reporting for the year, following the one in which IFRS is recognized for use in our country.

International Financial Reporting Standard (IAS) 18 "Revenue"

The text of the International Financial Reporting Standard is published in the Annex to the Accounting Journal, 2011, N 12 (the date of signing the application in print - 12/15/2011)

Commissioned by order of the Ministry of Finance of the Russian Federation of November 25, 2011 N 160n

It comes into force on the territory of the Russian Federation from the date of official publication. Organizations are financial reporting (IFRS) 9 "Financial Instruments" (accounting of hedge and amendments to the International Financial Reporting Standard (IFRS) 9, International Financial Reporting Standard (IFRS) 7 and the International Financial Reporting Standard (IAS) 39), enacted by order Ministry of Finance of the Russian Federation of July 18, 2012 N 106n)

Changes take effect on official publication; For compulsory applications, with respect to annual periods beginning on January 1, 2013 or after this date

International Financial Reporting Standard (IFRS) 11 (commissioned by the Order of the Ministry of Finance of the Russian Federation of July 18, 2012 N 106n)

Changes come into force on the territory of the Russian Federation for voluntary use by organizations - from the date of their official publication; For compulsory applications by organizations - with respect to annual periods beginning on January 1, 2013 or after this date

Shared

Revenue recognition criteria are usually applied separately to each transaction. However, under certain circumstances, they must be applied to individual elements of the transaction in order to reliably reflect its content.

Comment

. The selling price of goods includes a certain amount for subsequent maintenance. This value is postponed and recognized as a revenue for the period during which the service is made.

Conversely, the criteria for recognition can be used simultaneously to two or more operations, when they are associated in such a way that their commercial effect cannot be defined without contacting a series of transactions in general.

Comment

. The company can sell goods and at the same time to conclude a separate contract for the purchase of goods in the future, thereby reducing the impact of the first transaction. In this case, two transactions are considered together.

Original IAS 18 Revenue Available in Publication ""

Below are examples for demonstrating the application of the provisions of IFRS (IAS) 18 for the most common in the practice of commercial situations.. Examples focus on specific aspects of the transaction and are not a comprehensive analysis of all significant factors that could affect recognition of revenue.

When using examples, it is assumed that:

The amount of revenue can be reliably appreciated;

? There is a high likelihood that future economic benefits will go to the company;

? Costs incurred or expected can be reliably appreciated.

1. Sale of goods

Legislation in different countries may establish criteria for recognizing revenues other than the criteria established in IAS 18. Therefore, examples in this section of the applications should be read in the context of the law on the sale of goods operating in the country in which the transaction is carried out.

1.1 Sales according to the scheme "Dispose and postpone"

Sometimes revenue can be recognized, despite the fact that formally the transfer of goods from the seller did not have been implemented. Delivery of goods can be postponed at the request of the buyer in view of some special circumstances, but it acquires ownership of these goods and signs the relevant documents.

Revenue recognized when acquiring the ownership by the Buyer, if:

Supply with a high probability will be carried out;

? The goods are available and ready to send to the buyer;

? The buyer confirms the condition for postponed delivery;

? Apply the usual terms of payment.

Example 1.

The buyer who regularly carries out the purchase of goods, addresses the seller of goods with a request to leave the goods for storage at home before it finds a suitable storage room, provided that the responsibility for risks lies on it. Revenue can be recognized immediately.

1.2 Shipment of goods with installation and testing

Revenue is usually recognized when the buyer accepts delivery after the installation and testing is completed.

Example 2.

The company supplies special equipment for industrial enterprises.

Access control, installation and testing of equipment are a prerequisite and take up to 30 days. Revenue can be recognized after testing and installing equipment.

However, revenue can be recognized immediately after the purchase by the Buyer, if:

? The installation process is not complicated by its nature (for example, the installation of a TV tested at the factory, which requires only unpacking and power connections and antenna);

? Testing is performed only for the final definition of prices under the contract (for example, the supply of iron ore, sugar or soybeans).

1.3 Sale with the right of the buyer to give up the goods when the buyer agreed a limited return right

If there is uncertainty about the probability of return, then the revenue is recognized when the shipment was formally adopted by the buyer or when the goods were delivered, and the period of time was the possible return of goods.

Example 3.

Publishing house sells books of retail stores. The contract provides the right to refund unrealized specimens within 6 o days.

The following three options for reflection revenue in conditions are possible when the seller is subject to return risks:

? If it is not possible to estimate the amount of returns, and also if this amount may be significant, the revenue is postponed until the expiration of the right to return, that is, the revenue can be recognized after 6 o days.

? If it is possible to reliably assess the amount of future returns from the experience of past years, then only part of the revenue is reflected - in the amount in which the seller is confident (or a reserve is created on the estimated amount of returns).

? If presumably the amount of returns will be an insignificant value, revenue and refund are reflected in fact, at the time of their occurrence. That is, the publishing house reflects the revenue as sales, but the return of books - as it exercises.

1.4 Sale under a consignment agreement

The recipient (buyer) undertakes to sell products from the facial supplier (seller).

Revenue recognized by the supplier after the sale of goods by the receiver to a third party.

Example 4.

In January, the company put the goods on a consignment contract to his consignment.

In February, this product was sold to third parties, and the means from the consignment entered the company only in March. Revenue must be recognized in February based on the notification of the consignment.

1.5 Sale with payment in cash upon receipt of goods

Revenue is recognized after delivery and receipt of money by the seller or its agent.

Example 5.

The toy manufacturer sells its products, including on the Internet. Customers usually pay orders upon receipt.

Revenue is recognized at the moment when the agent of the toy manufacturer received payment after their delivery to customers.

1.6 Deferred sale

Delivery of goods is carried out only when the buyer makes a final payment in a series of contributions.

Revenue from such sales is recognized after the delivery of goods. However, if experience shows that most such sales are completed successfully, the revenue can be recognized when a significant part of the deposit is obtained, provided that the goods are available, separated from other goods and are ready to ship by the buyer.

Usually this method of sales is characteristic of expensive goods.

1.7 Prepayment (for goods that are not yet available in stocks)

Revenue recognized only after the delivery of goods to the buyer.

The advances received are not revenue, since the main criteria for its recognition are not met. Advances are reflected as the obligation of the resulting parties to provide this amount for this amount or to provide a service.

1.8 Sales contracts with subsequent repurchase of previously sold goods

It is very important to determine the economic essence of the transaction, as the revenue is recognized or not recognized depending on the essence of the operation.

If, according to the terms of the agreement, the risks and benefits of ownership were transferred to the buyer, revenue should be recognized.

If, according to the terms of the agreement, the seller retains the risks and benefits of ownership (even despite the transfer of ownership), the goal of the transaction is to attract funding, and the revenue should not be recognized.

Example 6.

Johnny is a manufacturer of brandy, the production process of which requires three-agenic exposure. John sells brandy to distributors with 150% surcharge to the cost.

On January 1, 2012, John sold 150,000 liters of brandy with an exposure date of 1 year of the financial company of the Empire at cost, while John receives an option for redemption of brandy at any time over the next two years with allowance to the cost of 15% per year on a proportional basis. The empire also receives an option for the sale of Cognac Johnny over the next two years at a similar price.

Task: Explain how this transaction should be reflected in John's financial statements.

Solution: According to one of the principles of IFRS, the principle of priority content over the form, it is necessary to analyze all the terms of the transaction in order to determine its economic essence and reflect it in the reporting not only on the basis of legal form. In this case, John sold the financial company brandy in a state of semi-finished product at cost (although the sale is usually carried out on other conditions). In addition, the presence of the options for the return purchase / sale in both parties gives reason to believe that the redemption of the brandy sold is likely to happen. Johnny also pays for the use of money received as a borrower.

Conclusion: This transaction is not the usual purchase and sale, it is a deal to attract funding on the security of a unbended brandy. In this case, the recognition of revenues does not occur, the goods should not be written off from the financial statement. The transaction should be reflected as a loan attraction, with reflection of interest expenses in the statement of aggregate income.

1.9 Sale through intermediaries

Revenue from sales intermediaries (for example, distributors, dealers or other persons for the purpose of resale) is usually recognized when the risks and benefits of ownership are transmitted.

However, if the buyer acts as an agent, the sale is taken into account as a consignment.

1.10 Subscribe to printed publications and similar products

If during each period, the transaction facilities have the same cost, then the revenue is recognized on a uniform basis over the period during which data delivery of goods has been shipped.

Example 7.

For sale annual subscription to a monthly magazine.

Each month after the release of the next number, 1/12 from the amount of revenue should be recognized.

When the cost of goods varies from the period by the period, then the revenue is recognized on the basis of the sales price of the delivered goods relative to the overall current sales price of all goods covered by the subscription.

1.11 Sale in installments

Under the sale in installments implies sales under contracts, refunds for which is paid in parts.

Revenue, attributable to the sales price without interest, recognized on the date of sale.

The selling price is equal to the discounted value of the expected payments on the suspended interest rate.

The percentage component is recognized as a revenue, taking into account the effective interest rates during the date of paying for the payment.

The same approach is also applied in the case of a postponement of a one-time amount of payment.

Example 8.

The company sells a car for $ 12,000, payment is made with a delay for a year. An acceptable interest rate is 10%.

At the time of sale recognized revenue in the amount of $ 10.909 (12,000 / 1.1 1) - this is a discounted amount of the future, established by the Treaty, payment. The difference in the amount of $ 1,091 is the percentage of the transaction (credit fee), which is recognized as a revenue on a monthly (or another acceptable) basis.

1.12 Property For Sale

Revenue is usually recognized in the transition of ownership of the buyer. However, the nature and moment of reflection of revenue is greatly influenced by the provisions of a particular contract and the current legislation in the state under consideration, so only if they are analyzed, it is possible to determine if the seller should fulfill any significant obligations to complete the sale transaction.

Example 9.

The company sells a house, while it assumes the obligation to repair it. Revenue must be recognized after repair.

Real estate can be sold with the preservation of the ownership of the seller until the full payment is as a guarantee of the non-payment of the buyer. In this case, the revenue is recognized only in the amount of the resulting monetary remuneration.

2. Provision of services

2.1 Installation fee

Installation fee is recognized as a revenue in the execution stages of work.

Example 10.

The company establishes a computer network for the customer in several separate buildings within the framework of one contract: in manufacturing, administrative, pilot experimental corps and in warehouse.

Revenue can be recognized as the work is completed in each case. However, if the installation is part of the sale of this product, it is recognized at the time of the sale of goods.

2.2 Remuneration for the service included in the price of goods

Recognized as a revenue over the period of the provision of the service.

Example 11.

The company sold cops for $ 8U, including the annual cost of maintenance. The fair value of maintenance work is $ 300, while the inspection of the xerox should be carried out quarterly.

In this case, $ 500 is recognized immediately as revenue from sales, and $ 75 ($ 300/4) - after each inspection as a revenue from the provision of services.

2.3 Commission compensation for advertising

Commission media is recognized when the relevant advertising or commercial transfer is shown to the public. Commission advertising manufacturers are recognized in accordance with the Project Completion Stage.

Example 12.

In June, the advertiser orders the publication of advertisements in the July and November issue of the journal.

Commission remuneration of an advertising agency is $ 500. Accounting recognizes revenue of $ 250 after each advertising release.

2.4 Insurance Company Commission

Recognizes at the time of the beginning or extension of the contract, unless the contract is required to provide additional services to the insured.

If such a requirement is reflected in the contract, the revenue is transferred and recognized throughout the term of the policy.

Example 13.

The client signs the policy, according to which the Insurance Company receives a commission of $ 250, and insurance payments will be carried out monthly during the year.

The insurance company also lies an obligation to collect insurance payments, and the Insurance Company Agent should ensure their collection of the client's place. Commission for each collection is $ 10. This amount is included in the cost of the initial remuneration of $ 250, since the client does not pay anything additionally.

In such a situation, an income of $ 130 is initially recognized (minus the cost of collecting services) and $ 10 after each payment collection.

2.5 Remuneration for Financial Services

Recognition of remuneration for financial services as a revenue depends on the purpose of the calculated remuneration and the basis of accounting for the relevant financial instrument.

The name of remuneration for financial services may not disclose the nature and content of the services provided.

Therefore, it is necessary to distinguish remuneration:

Who are an integral part of effective income on the financial instrument;

? earned as the services provided;

? Received after performing any significant action.

2.5.1 Remunerations that are an integral part of effective income on the financial instrument

Such remuneration is usually taken into account as amendment to effective real income.

For example, remuneration for the preparatory work received by the Company in connection with the creation or acquisition of a financial instrument, checking the creditworthiness of the borrower, negotiating, prepare and processing documents on the transaction and the completion of the transaction, is transferred to future periods and is recognized as an adjustment of effective real income.

Example 14.

The financial company provides a biennial loan in the amount of $ 25,000 under 10% per annum, subject to interest payments at the end of each year.

Remuneration for the preparatory work on loan, processing documents and other similar services related to the functioning of the loan is $ 400 and is paid in advance.

This amount is reflected as income of future periods; Subsequently, on a monthly basis, simultaneously with the accrual of interest income, it is recognized as a revenue of the current period - only $ 200 each year for two years.

The meaning of such recognition of revenues is a reflection of compensation for continuous participation. However, when the financial instrument shall be estimated at fair value through the report on the total income, the remuneration is recognized as a revenue at the initial recognition of this tool.

2.5.2 Remunerations obtained as the services provided

Remuneration accrued for debt maintenance (for example, for collecting customer funds, the maintenance of its subscriber boxes) is recognized as a revenue as the services provided - on an ongoing basis during the term of appeal (repayment) of debt.

2.5.3 Remunerations received after the implementation of meaningful

Remunerations are recognized as revenue after carrying out significant actions. For example, the remuneration for the distribution of client's shares is recognized as a revenue after the distribution of shares.

2.6 entrance fee

Revenue from artistic representations, banquets and other special events confess the after they occur.

When selling subscriptions for several events, the board is distributed to each of them based on the degree of execution of services as of each specific event.

2.7 Education fee

Revenue recognized during the training period.

2.8 Initial (introductory) and membership fees

Initial (introductory) contributions are recognized as a revenue in the absence of significant uncertainty regarding its receipt, if the board allows only membership, and all other services are paid separately.

If the contribution gives the right to member to use any services, it is recognized on the basis of the time, the nature and amount of the benefits provided.

Example 15.

In order to become a member of the professional lawyer guild, you need to pay an entry fee of $ 400 and an annual membership fee of $ 260.

The amount of $ 400 can be recognized as a revenue immediately after registering a new member, if it does not imply any service provision. Revenue must be postponed if a new guild member, paying an entrance fee, acquires the right to receive any services; Revenue will be recognized after providing relevant services or when it expires the right to receive them.

2.9 Revenue in franchise transactions

Commission remuneration for the provision of monopoly or preferential law may cover the provision of initial and subsequent services, fixed assets and other material assets, as well as know-how. Such a remuneration is recognized as a revenue depending on the purpose of remuneration.

2.9.1 Deliveries of fixed assets or other material assets

The amount based on the fair value of the sold assets is recognized as a revenue after the delivery of assets or transfer of ownership.

Example 16.

According to the franchise agreement, the enterprise of fast food should buy equipment for cooking equipment from the franchisor. Ownership goes after installing and checking equipment.

2.9.2 Provision of initial or subsequent services

The initial remuneration is recognized as a revenue after the provision of all initial services. Remuneration for the provision of permanent service is recognized as a revenue as the services provided. Recognition of part of the remuneration should be delayed in the amount sufficient to cover the costs of permanent service and ensuring reasonable profits for these services (in pursuance of this requirement, part of the initial remuneration is recognized as a delayed revenue).

2.9.3 Fee for the permanent right to use benefits

Recognizes as a revenue as the services provided or the use of rights.

2.10 Special Software Development Fees

The fee for the development of special software is recognized as a revenue in accordance with the development stage of development, including the implementation of services for service support after the sale.

Example 17.

The company has a contract for the development of software for $ 30,000.

The contract provides that $ 5,000 of this amount relates to service support for software after the sale.

As a revenue, only $ 25,000 is recognized as a revenue at the completion of software development and accepting it.

The $ 5,000 service support is written off equal parts to the revenue during the provision of this support.

3. Interest, license payments and dividends

Remuneration and licensed payments (trademarks, patents, software, copyrights of musical works, art films) are usually recognized in accordance with the terms of the contract.

From a practical point of view, recognition can be carried out on a uniform basis throughout the term of the contract (for example, when the licensee has the right to use the technology throughout the set period of time).

If obtaining license payments or royalties depends on the events in the future, the revenue is recognized only if there is a possibility of obtaining these remuneration (which usually occurs when the specified event occurs).

Question 3. IFRS 18 "Revenue"

Revenues - the most important indicator of financial statements. The rules of their accounting on IFRS differ from the Russian rules. The most bright incompleteness is manifested in taking into account revenue from such activities as the provision of services, trade through an intermediary, barter transactions and some others.

In international standards, the procedure for assessing and recognizing the organization's income is regulated by IFRS 18 "Revenue". In Russian accounting analogue serves PBU 9/99 "Organization's revenues". Despite the apparent similarity, the rules of domestic accounting are in many ways different from international.

In IFRS, income includes both the company's revenue and other income, which, unlike PBU, are not divided into non-engineering, operational and emergency. Revenue is the receipt of funds from ordinary activities (sales, remuneration, interest, dividends and leasing payments). Both in international standards and in accounting attribution to income from conventional activities conditionally. Some and the same money receipts can be the main for one enterprise and other for the other.

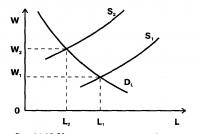

According to PBU 9/99, the organization's revenues are an increase in economic benefits as a result of the receipt of assets and repayment of obligations leading to an increase in capital (except for the contributions of participants). This definition is almost fully consistent with the concept of income under IFRS 18. However, there are some differences in the criteria for recognition of revenue. One of the main inconsistencies is that instead of the concept of "transfer of ownership" international standards use "translation to the buyer of significant risks and remuneration."

At the same time, PBU does not provide for an analysis of substantial risks associated with the property for goods. For example, under the terms of the contract of sale, a certain part of the goods can be returned to the Seller within a month from the moment the client is transferred. According to IFRS, the seller recognizes income from the sale or at the time of confirming that the goods will remain at the buyer, or after the expiration of the return period. In domestic accounting, income reflects immediately as soon as the contract has passed the right of ownership (most often after shipment). Then, with a partial return, shown reverse implementation. In essence, it is a separate delivery, where the income appears at the former buyer, who now acts as a seller. There are other differences (Table).

Table. Criteria for recognition of revenue in accordance with IFRS and RAS

|

Ownership (possession, use and orders) on the goods passed to the buyer or work adopted by the customer (the service was provided) |

The company supplier translated to the buyer significant risks and remuneration related to the goods on goods |

|

|

This condition is absent |

The company seller no longer controls the goods sold |

|

|

The amount of revenue can be determined |

The amount of revenue can be reliably appreciated. |

|

|

There is confidence that as a result of the operation there will be an increase in the economic benefits of the organization |

There is a possibility that the economic benefits associated with the transaction will go to the company |

|

|

The costs associated with the transaction (both incurred and future) can be determined. |

Incurred or expected costs associated with the transaction can be reliably appreciated |

|

|

The organization has the right to receive revenue arising from a specific contract or confirmed by another method. |

This condition is absent |

In addition, the differences arise when evaluating. According to international standards, revenue is assessed at the fair value of the obtained (or to be obtained) remuneration. Fair value is the amount to which the asset can be exchanged or repay the obligation when dealing between well-informed, interested and independent parties. Often the Agreement provides for either immediate payment, or a minimum deferment of payment (about one to three weeks). Such conditions provide fair value or a close amount to it. In case of large deferments to define fair value it is necessary to discount future cash receipts using a conditional interest rate.

Sale of goods

Consider the species of purchase and sale transactions in which the difference between the Rules of Russian Accounting and IFRS is most pronounced. Summary information regarding the torque recognition and evaluation is given in the table.

Table. Differences when taking into account revenue in Russian accounting and IFRS for some types of transactions.

|

Varieties of purchase and sale transactions |

||||

|

The moment of recognition of revenue |

Evaluation of revenue |

The moment of recognition of revenue |

Evaluation of revenue |

|

|

Barter transactions and exchange agreements |

Barter operations are always considered as sales. |

The amount of revenue for a barter agreement is calculated at the cost of that property that was obtained instead |

The sale of goods is recognized only when exchanging or standing in heterogeneous values. Exchange for similar in character and magnitude goods is not a realization |

When exchanging heterogeneous goods, revenue is measured at the fair value of the products obtained |

|

Sale of goods through an intermediary |

The Committee does not recognize the revenue if the goods on the report of the commissioner (agent) are not sold. Products shipped by an intermediary is taken into account on account 45 |

Revenue is estimated at a contractual value of goods sold |

The amounts reflected in the Account "Goods are shipped", they will be reclassified at the expense of the "Product" or recognize the revenue. The latter happens if the risks and advantages of ownership switched to the buyer and the price can be reliably defined |

Revenue is estimated at fair value, if the risks and advantages of possession of goods switched to the buyer |

|

Sale of goods in installments or with a delay of payment (providing a commercial loan) |

Revenue is recognized in full |

Revenue is reflected in accordance with the obligations of the Parties |

If installment or delay is provided for a period of more commonly adopted in business trafficking, then sales are treated as two operations: sales of goods and financial services (interest income) |

The assessment occurs at fair value. In addition, the income from receiving interest is reflected. Future arrivals are discounted |

Barter transactions

The Barter Agreement assumes that two organizations exchange property and each party acts as a seller and the buyer. In general, the ownership of the goods transferred to Barter is moving to the buyer only after the seller receives another property from him (Art. 570 of the Civil Code of the Russian Federation). Consequently, while the counter delivery is not received, the goods shipped by the counterparty is not considered to be sold and is taken into account in the account 45 "goods shipped".

After receiving the counterparty products in Russian accounting, it is necessary to show revenue. According to IFRS, it should be done only if the parties exchanged in heterogeneous values. In the case when a homogeneous and similar estimate was shipped and obtained and obtained, the transaction is not recognized by the implementation. There is difficulty here, since standards do not give the definition of goods similar in nature and magnitude. In practice, these are recognized value similar in their characteristics in the application and the same in value.

Committee's income

When the goods are shipped by the Comitant, the Obligor's ownership is not transferred to the Commissioner. This is the main feature of the mediation contract. In RAS, the Committee takes into account the goods on account 45 before shipment to the final buyer. Revenue is not charged until the report is received about the sale of a commission.

When transforming into IFRS reporting, the amount reflected in the account 45 must be either reclassified to account 41, or show revenue. The last option is used when the mediator crossed the risks and advantages of property ownership, the price of which can be reliably determined (as a rule, it is specified in the contract).

Commercial credit

Often, according to the sales contract, the seller provides installments of payment, which is called a commercial loan. Usually under these conditions, the buyer lists not only the cost of the goods itself, but also interest for late payment. In domestic accounting, revenue increases by the amount of interest.

International standards also take into account the interest specified in the contract. In addition, a conditional calculation of interest is required if the contract indicates the rate is significantly lower than the market. In this case, to comply with the general rule of recognition of revenue at fair value, the percentage recorded in the Agreement must be adjusted to real value in the market. To do this, analyze the conditions on which enterprises (most often banks) provide deferred payment.

In addition, if the delay period exceeds usually used in business trafficking (for example, more than three months), the sale is considered as two operations: the sale of goods and the provision of financial services.

Service

The reflection of services for the provision of services just as well as transactions of sale, differs in Russian accounting and IFRS. According to international standards, when recognizing revenues for services provided (performed works), we must be guided by the general criteria (we told about them above). Additionally, it is necessary to apply the criterion for determining the completion stage of work as of the reporting date. At the same time, income is recognized by the method "as ready". Its essence is that the revenue needs to be reflected according to the results of each reporting period, even if the work is not yet completed. But it is not the full amount of remuneration, but a percentage of it if an intermediate result can be reliably evaluated. The last condition is performed when there is a reliable assessment or degree of services for the last day of the period, or costs that are incurred during the work and will be returned by the Client. Please note that the presence or absence of primary documents does not affect the recognition of income.

According to the rules of domestic accounting, the organization can show the implementation or at the end of all works, or after the implementation of individual stages. And in that and in another case, the revenue is reflected on the basis of the act.

Task number 1

In the recently open hairdresser during the first month of work, the following events are registered:

- 1. August 1, 20XHG. The owner introduced 2000 p. at the expense of the hairdresser;

- 2. On August 2, consumables are purchased for 600 p.;

- 3. August 3, 500 p. rental fee;

- 4. On August 5, the installation of furniture purchased on a loan for 1,200 p., Moreover, this amount must be returned to three equal shares during August, September and October;

- 5. The hairdresser opened on August 10 and in the first week, which ended on August 16, cash receipts amounted to 855 p.;

- 6. On 17 August, payments to the assistant amounted to 125 p.;

- 7. Incoming money from the provision of services in the next 2 weeks, ending on August 31, amounted to 1900 p.;

- 8. On August 31, the first part of the furniture debt was paid;

- 9. On August 31, seizures were made in the amount of 900 p.

It is required to prepare:

- · balance sheet;

- · gains and losses report;

- · Report on capital changes;

- · Cash movement report.

Accounting balance, r.

Profit and loss statement, r.

Report on Capital Change, R.

Report on cash flow, r.

|

Hairdresser ABC. Report on cash flow for August 20xx |

|

|

Operating activities |

|

|

Receipts from customers |

|

|

Lease payments |

|

|

Payments payments |

|

|

Acquisition of consumables |

|

|

Receipts from operating activities |

|

|

Investment activities |

|

|

Financial activities |

|

|

Deposits of owners |

|

|

Payments to owners |

|

|

Repayment of a debt |

|

|

Receipts from financial activities |

|

|

Cash growth |

|

MAGAZIN "IFRS IN PRACTICE"

The revenue reflection standard is one of the most important and most used. Therefore, every novice specialist is important to clearly understand the approaches to its accounting. Consider at the examples, which is the difference in the evaluation and recognition of revenues depending on situations: shipment of goods, provision of services, receiving interest, royalty, dividends.

The updated conceptual foundations of financial statements recognize the relevance and truthful submission of the fundamental characteristics of financial information.

Relevant is the information that affects decision-making, and truthfully presented - information on real economic facts (and not legal forms).

In real life, many factors can create conditions for potential decoration of financial performance (Window Dressing - Financial Voyage, Bearing, Balance Tinning in order to create high liquidity visibility). In order to exclude the influence of such phenomena, as well as to comply with the principle of the truthful submission, IAS 18 "Revenue" was developed.

Below is a typical example of the application of the Truthful Presentation principle.

EXAMPLE

Caucasian brandy company (CCC) produces a 15-year exposure brandy. A year after spilling around the barrels, brandy sells the entire supply of a commercial bank at cost of 1,000,000 rubles. With the right reverse ransom for five years with a payment of 15 percent per annum.

Strictly in form is a sale, and the CCC should reflect the implementation with the recognition of revenues:

Dt "Calculations with buyers" 1,000,000 rubles;

CT "Revenue" 1,000,000 rubles;

DT "Cost" 1,000,000 rubles;

CT "Reserves" 1,000,000 rubles.

Economic content is credit financing of 1,000,000 rubles. For five years under 15 percent per annum. Approval is confirmed by circumstances:

- the product did not pass all the stages of recycling and the bank will not be able to implement it;

- the bank does not have technologies and specialists necessary to complete the production cycle;

- the contract contains an option in which the CCC has the right to buy out, and the Bank is obliged to sell on the first request;

- cognac is sold at cost, no extra charge.

DT "Cash" 1,000,000 rubles;

CT "Credits and loans" 1,000,000 rubles;

Next, interest is accrued annually in the amount of 150,000 rubles;

DT "Borrowing costs" 150,000 rubles;

CT "Debt percentage" 150,000 rubles.

There are no operations for implementation and recognition of the cost.

It is noteworthy that, unlike other IFRS standards (IAS) 18, it contains not principles, but the specific rules for recognizing revenue in different situations.

The purpose of the Standard is to determine the moment of recognition of revenue, namely when there is a possibility that the company will receive future benefits subject to reliable evaluation.

Revenue assessment. Revenue is estimated at the fair value of obtained or subject to reimbursement, taking into account the amount of any trading or wholesale discounts provided by the company (paragraph 10 of IFR (IAS) 18). In the case of providing a delay to pay, the fair value of compensation is discounted at the imputed interest rate defined as (paragraph 11 of IAS 18):

- the prevailing rate for a similar financial instrument of the issuer with a similar credit rating;

- interest rate that discounts the nominal amount of financial instrument to current prices of goods or services when selling cash.

The difference between the fair value and the nominal amount of compensation is recognized by interest income in accordance with the Standard Paragraphs and in accordance with IFRS 9 "Financial Instruments".

EXAMPLE

The company AD sells equipment for 920,000 rubles. With the provision of postponement for payment in one year. Cost of equipment - 500,000 rubles. The cost of the company's capital (weighted average interest rate on all sources of company financing) - 15 percent per annum.

Revenue is 800,000 rubles. (920,000 rubles / (1 + 15%) 1). Income in the amount of 120,000 rubles.

(920,000 - 800 000) is recognized evenly during the year of 10,000 rubles. per month.

Accounts receivable is recognized at fair value.

At the time of sale of equipment:

DT "Calculations with buyers" 800,000 rubles;

CT "Revenue" 800,000 rubles.

Percentage income is charged monthly:

DT "Calculations with buyers" 10 000 rubles;

CT "Percentage revenues" 10 000 rubles.

Identification of the contract. Revenue recognition criteria should be applied to individual elements of the contract to show its content.

EXAMPLE

NPM sells manufacturing equipment requiring maintenance every six months, for 700,000 rubles, including two-year maintenance. Usually semi-annual service for two years costs 200,000 rubles. Thus, two elements can be distinguished in the contract: the sale of equipment and its subsequent maintenance that is subject to separate recognition. At the time of sale of equipment, revenues are recognized in the amount of 500,000 rubles. (700 000 - 200,000) at the same time, and 50,000 rubles. (200 000 rubles / 4) are taken into account every six months during the two-year period as maintenance is carried out.

It happens differently when the criteria for recognition should be applied to several contracts, since the complex effect cannot be determined without analyzing the Group of Contracts in general. For this situation, an example may be the above-described situation with the sale of reserves of brandy, when it is required to take into account the aggregate and contract of sale on the transfer of brandy Bank, and a potential contract for the purchase of brandy in the bank, confirmed by an option, and possibly the practice of business turnover. For various operations, in the course of the implementation of which revenue arises (selling goods, provision of services, obtaining dividends, interest, royalties), there are features of recognition of revenue. Consider them.

Sale of goods

Proceeds from the sale of goods are recognized when all the conditions given in paragraph 14 (IAS) are performed in paragraph 14 of IFRS:

- the buyer has translated significant risks and benefits from the ownership of the goods;

- the company does not participate in the management to the extent that is associated with the right of ownership and does not control the transmitted goods;

- the amount of revenue is subject to reliable evaluation;

- there is confidence in obtaining economic benefits as a result of the fulfillment of the contract;

- incurred or expected costs associated with the contract can be reliably measured.

In other words, the transition is not included in IFRS, and the risks and advantages of ownership. For example, in the case of supplying equipment with the transition of ownership of the right after full payment and calculations in a year from the date of delivery, the revenue is recognized at the time of delivery, if all the risks and benefits of ownership have changed already at the time of delivery. Although in most cases the transition of risks and advantages of ownership coincides with the moment of transition of ownership.

Ordinary credit risks are not the reason for deferring recognition of revenues. For example, when delivering equipment with the transition of ownership at the time of delivery and payment a year after delivery, the revenue is recognized at the time of delivery. But sometimes the seller can save the risks and advantages of ownership, despite the shipment of goods produced, and then recognition of revenues is postponed:

- the seller remains responsible for the quality of goods, not covered by standard warranty obligations. Let's say, the company for Gosakazaz develops and produces air defense tools, and a series of tests occurs after delivery. In this case, the revenue is subject to confession if the tests are successful;

- sale with attracting agent. Receiving revenue from a particular sale depends on receiving revenue by an agent as a result of its sale. For example, the Svt company put equipment for the scene on the terms of consignation in January. In December, the store must return the goods or make a payment. In July, the store sold equipment. SVT should reflect the recognition of revenues in July, despite the fact that payment can be produced until December;

- sale with a significant installation. Submitted goods are subject to installation, and the installation takes a significant part of the contract, which is not yet fulfilled by the supplier. For example, in the manufacture of built-in furniture to order 50 percent of its value, the furniture itself is actually furnished, and 50 percent is the work on its installation and fit at the customer. Furniture companies should recognize revenue only after installing furniture at the customer;

- the possibility of termination of the contract. The buyer has the right to terminate the contract of sale due to the contract defined in the contract, and the company has no confidence in making a profit. For example, a company engaged in the distribution of powerful expensive vacuum cleaners, offers clients with a vacuum cleaner with the right of return without explaining the reasons during the year from the date of receipt and return 90 percent of its cost. Returns level is 50 percent. Revenue should be recognized after the termination of the right to return the vacuum cleaner;

- uncertainty in obtaining economic benefits (restrictive measures). If at the time of recognition of revenue there is uncertainty in obtaining economic benefits, the recognition of revenues is postponed before they obtain or eliminate

- defities. However, if such circumstances arose after the recognition of revenue, the resulting amount or the amount, the production of which became unlikely, is recognized as a consumption, and not as an adjustment of the amount of the initially recognized revenue.

For example, in 2014, the CAC company, which carries out a supporting role in transshipment of fuel in the seaport, cannot receive a fee for its services rendered by the American oil company in connection with the sanctions. Despite the legal and political difficulties, the services still turn out to be and both parties confirm the intention to continue cooperation. CAC companies should recognize revenue, however, as sanctions tightening, it is necessary to form a reserve of dubious debt.

Revenue recognition is not postponed in the following situations:

- preservation of minor risk of possession. The seller retains only a slight risk of possession. For example, a retail store guarantees a refund if the client is not satisfied with the purchase, within the framework of the Consumer Rights Protection Act. In this case, the revenue is recognized as the seller can reliably assess future returns, using the experience of past years, and make an obligation to return funds. A reserve is charged for the predicted amount of return.

- warranty service. The presence of standard warranty obligations for free service is not the basis for delaying revenue recognition or its adjustment. The buyer of the coffee machines of the famous German brand provides a guarantee of three years from the date of sale. The costs associated with warranty service are immediately recognized as a consumption in the form of a reserve, but do not reduce the revenue.

Exchange of goods. When exchanged similar to the nature and cost of goods, such as milk or oil (when suppliers exchange reserves in various places for timely satisfaction of demand in a particular place), the revenue is not recognized.

According to distinguished goods / services, revenues are recognized in the amount of the value of the obtained goods / services adjusted for the amount of translated funds. And if only this cost can not be reliably appreciated, the revenue is determined by the cost of the transferred goods / services adjusted to the amount of translated funds (clause 12 of IFRS (IAS) 18).

EXAMPLE

The company in the topics of the nuclear industry makes the exchange of fuel cells with another KRS market player on the gas centrifuge. The usual cost of fuel cells is 200,000 rubles, surcharge in cash for the centrifuge - 100,000 rubles., While the cost of centrifuges is 250,000 rubles. Revenue at the same defined as 150,000 rubles. (250 000 - 100 000). Accounting for the implementation of fuel elements will be as follows:

DT "Receivables" 150,000 rubles;

CT "Revenue" 150 000 rubles.

Acquisition of the centrifuge:

DT "Fundamentals" 250,000 rubles;

CT "Accounts Credit" 250,000 rubles.

Calculations and offset of mutual requirements:

DT "Credit Debt" 250 000 rub.;

CT "Cash" 100,000 rubles;

CT "Receivables" 150 000 rubles.

PROVISION OF SERVICES

If the result of the contract for the provision of services can be reliably measured, then the revenue under the contract should be recognized by indicating the completion of the transaction for the reporting date, taking into account the following conditions (paragraph 20 of IAS 18):

- . Revenue Cum may be reliably estimated;

- There is a possibility of obtaining economic benefits;

- The completion stage can be reliably appreciated;

- The costs of the transaction and the cost required to complete the contract

- could be reliably appreciated.

- reports on the work performed;

- services provided at the date of reporting, as a percentage of the total volume of services;

- the proportional ratio of costs incurred at the moment to the estimated value of the total cost of the transaction.

In costs incurred at the date of the report, only those that reflect the services provided to this date are included. Only costs reflecting provided or subject to the provision of services are included in the estimated total transaction costs.

To comply with these terms, it is necessary to have an effective financial planning and reporting system. As the contract of evaluation of revenues and costs under the contract are checked and revised.

EXAMPLE

On July 1, 2014, AK concluded a contract with the customer - group O.O.O. On the provision of compiling services of consolidated reporting in accordance with IFRS and compliance with IFRS 1 "First use of IFRS". For the first time publish reporting is planned for 2014, and the date of the transition to IFRS is January 1, 2013. The service life is one year. Contract amount - 5,000,000 rubles. Direct contract costs - 3,000,000 rubles. By the end of 2014, the compiler prepared data on the implementation of the conditions for the first application of IFRS, developed a statement of reporting, and also produced a compilation of data for 2013. The customer confirmed the acceptance of work on the first application of IFRS and compiling data for 2013, the costs of 1,500,000 rubles. The customer was not provided to the customer, since the contract provides for the submission of only the final version of the reporting. Prooform costs are 250,000 rubles.

In 2014, the following postings will be made in 2014:

DT "Incomplete Production" 1 750 000 rub. (1,500,000 + 250,000);

CT "Salary Debt" 1,750,000 rubles.

Acceptance of work in 2014 by the customer:

DT "Cost" 1,500,000 rubles;

CT "Incomplete production" 1,500,000 rubles;

DT "Receivables" 2 500 000 rub.;

CT "Revenue" 2,500,000 rubles. (5,000,000 (1,500,000 / 3 000 000).

Linear method for recognizing revenue from services. When services are provided with an indefinite number of times during a certain period of time, the revenue is recognized as a regular basis (if any other method does not reflect the better stage of completion) (paragraph 25 of IFR (IAS) 18).

EXAMPLE

Sport + manages fitness clubs and sells annual unlimited subscriptions (client maps) for one year to 30,000 rubles. Revenue is subject to admission monthly in the amount of 2500 rubles. (30 000 rubles / 12 months) during the period of the subscription. Delayed revenue assessment. If the revenue from the provision of services cannot be estimated immediately, the revenue is recognized only by the value of recognized reimbursable costs (paragraph 26 of IFRS (IAS) 18).

EXAMPLE

The Skolkovo resident company (PC) concluded a state contract for the development of equipment for Roscosmos. The contract was agreed by reimbursement of expenses for research and development in the amount of up to 2,000,000 rubles, in the case of successful test results, equipment is planned to be taken for 3,000,000 rubles. In the first year of work, costs were carried out in the amount of 500,000 rubles (including pay for 300,000 rubles, written off materials for 200,000 rubles).

Following the cost and revenue:

DT "Cost" 500,000 rubles;

CT "Incomplete production" 500,000 rubles;

CT "Revenue" 500,000 rubles.

Revenues are recognized in the amount of costs incurred, since there is only confidence that these costs will be reimbursed, but there is no reason to believe that development will be carried out successfully. Operation at a loss. If there is a high probability that expenses will not be reimbursed, then the revenue is not recognized, and costs are recognized as expenses immediately (paragraph 28 of IFR (IAS) 18).

EXAMPLE

The Skolkovo resident company (PC) concluded a state contract for the development of equipment for Roscosmos. In the case of successful test results, equipment is planned to be taken for 3,000,000 rubles., But under negative results, no reimbursement is provided. In the first year of work, costs of 500,000 rubles were carried out.

In 2014, the following wiring will be made in 2014:

DT "Incomplete Production" 500,000 rubles;

CT "Salary Debt" 300,000 rubles;

CT "Materials" 200,000 rubles.

At the end of the year, expenses refer to the financial result:

DT "Other expenses" 500,000 rubles;

CT "Incomplete Production" 500,000 rubles.

Thus, depending on how precisely the financial result can be defined, the revenue is allowed to be recognized as products or in the amount of recoverable costs or to refuse its recognition with the attribution of all costs incurred.

Interest, license payments and dividends

Revenue from the use of enterprise assets by third parties should be recognized if it can be reliably appreciated and there is a high probability of obtaining economic benefits. At the same time (paragraph 30 of IFRS (IAS) 18):

- interest is recognized by the effective interest rate method;

- royalties are recognized on the principle of accrual under the contract;

- dividends are recognized when the right of shareholders has been established for paying.

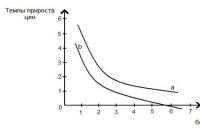

- a risk interest rate that arises on the basis of demand and suggestions for borrowed funds and other objective market factors in the loan sector, that is, on the market of loans and bonds

- risk allowance - due to the degree of risk of non-return and depends on the reliability of the borrower, the availability of pledge, guarantees and guarantees of third parties;

- inflationary premium is due to the inflation rate and the level of inflation expectations of the lender.

Revenue from interest is determined taking into account the requirements of the relevant standards for financial instruments and includes depreciation of the discount, award or another difference between the initial balance sheet

the amount of debt security and its sum at the time of repayment.

EXAMPLE

GPB Bank issues a loan in the amount of 1,000,000 rubles. Under 24 percent of HP annual companies for one year. This corresponds to the average loan rate. In addition, the Bank charges the Commission for issuing a loan in the amount of 1.2 percent

At the time of issue. The following wiring will be made in accounting of the bank:

DT "Funds placed in loans" 988 000 rub.;

CT "Cash" 1,000,000 rubles;

Dt "Cash" 12,000 rubles.

The income is admitted monthly:

DT "Interest to getting" 21 000 rubles;

CT "Percentage revenues" 21 000 rubles.

The effective loan rate is 25.5 percent, calculated by the formula of Chiutlich. In accordance with IAS 39, "Financial Instruments: Recognition and Evaluation" Such a category of financial assets such as loans and receivables should initially recognize at fair value, and subsequently on amortized with the use of an effective interest rate. Therefore, in compiling reports, in accordance with IFRS, it is necessary to reduce the received loan for the amount of the received commission, and then accrual a part of the income relating to the reporting period as interest income. In other words, to prepare for the calculation of amortized cost, counter cash flows should be removed on the issuance of a loan and receipt of the Commission.

If interest is not paid, but are charged before the acquisition of a financial instrument (accumulated income), their subsequent receipt is distributed for two periods: before purchasing and after purchase, and only the second part is recognized as a revenue (p. 32 IAS 18) .

EXAMPLE

June 30, 2014 for 210,000 rubles. The company acquired a bond with a nominal value of 200,000 rubles. At the end of each year it pays income of 10 percent.

At the time of purchase, the company will make the following wiring:

DT "Financial Instrument" 210,000 rubles;

CT "Cash" 210,000 rubles.

At the time of payment of income, the company makes wiring:

Dt "Cash" 20,000 rubles;

CT "Financial Tool" 10 000 rub.;

CT "Income in the form of a percent" 10,000 rubles.

Dividends. Dividends are recognized when the shareholder has the right to receive them. If dividends on equity securities are declared before purchasing, but not paid, they are deducted from the initial value of the securities in the same way described above.

Royalties. This royalty (licensed payments) is accumulated and recognized by the method of accrual in accordance with the content of the contract, if there is no other, more appropriate systematic rational basis (clause 33 of IFRS (IAS) 18).

EXAMPLE

The company "A-Records", which owns the rights to the popular O-LA melody, provided the right to mobile operators to install this melody as a Good'OK service worth 0.1 rubles. For each connection of this melody. During the first month, 5,000,000 connections were set, during the second month - 15,000,000. Accordingly, on the basis of data of billing systems and reports of operators, the Company recognizes revenue:

In the first month:

DT "Receivables" 500,000 rubles;

CT "ROYALTY PROCESS" 500 000 RUB. (5 000 000 connections. 0.1 rubles).

For the second month:

DT "Receivables" 1,500,000 rubles;

CT "ROYALTY PROCESS" 1 500 000 RUB. (15 000 000 connections. 0.1 rubles).

INFORMATION DISCLOSURE

According to the standard, the company must disclose (clause 35 IFRS (IAS) 18):

- accounting policies adopted to recognize revenue, including the methods used to determine the completion stage of operations related to the provision of services;

- the sum of each significant article revenue recognized during the period, including revenues arising from:

- sales of goods;

- providing services;

- percent;

- royalties;

- dividends;

- the amount of revenue arising from the exchange of goods or services included in each significant revenue article.

purpose