The role of financial planning and forecasting in the implementation of the financial policy of the enterprise. How to prepare a cash flow statement (odds) Forecast of cash flows for the period of lending

The success of any enterprise, of course, ensures financial stability.

Financial stability, solvency of the company becomes independence from crises, adverse economic failures.

Such reliability helps to attract investments, therefore, guarantees profit growth.

The construction of the BDDS is becoming a priority factor in managing the activities of enterprises.

The economic stability of the company is directly related to the movement of funds, careful management of this flow.

As you know, the financial manager is engaged in the analysis of cash flow.

Definition of BDDS

To predict cash flows, prevent "cash gaps", manage the profitability of an enterprise, a financier needs the most important tool - a cash flow budget.

BDDS is understood as a cash flow plan of the cash desk of a given organization (possibly a structural unit).

It reflects almost all projected financial receipts, as well as cash withdrawals from the business operations of the company.

BDDS expresses all possible receipts of prepayment (for example, to a current account, to the cashier) for the supplied products.

The tool shows advance payments, also fixes financing delays for previously provided products.

If it is found that the financial balance in the initial budget period is not sufficient to cover the costs, additional financial sources will need to be found.

The construction of the BDDS is becoming a priority factor in managing the activities of enterprises. It is compiled at various intervals. The plan for the general budget period provides for monthly detailing.

The main thing to remember is that BDDS is a fairly flexible (that is, changeable) form.

Therefore, the most practical is the monthly plan, which has a breakdown by day. It is created, then approved monthly (at the end). Moreover, when compiling it, no doubt, all departments of the enterprise associated with planning, with the process of spending finances, participate.

Cash, having a high percentage of liquidity, gives the company freedom of choice in business activities.

Cash flow budget planning

For the effective operation of the organization, as you know, you need a positive financial balance. Professional, competent planning of BDDS will solve such a problem.

Not without reason, in the budgeting system, it is the BDDS that occupies the most important place.

Serious attention is paid, as a rule, to the study (forecast) of financial movement.

This is due to the irregularity of receipts (payments) in the course of the operation of the enterprise, as a result of any unforeseen circumstances.

It is precisely because of the lack of money that a crisis situation often arises.

The procedure for compiling a BDDS is best broken down into steps that are performed sequentially.

Stages of compiling BDDS:

- For investment costs, the required level of funds is determined.

- Finances are needed for making investments, acquiring fixed assets, building own facilities.

- Funds are formed, of course, at the expense of profits remaining after taxation.

- Determines the minimum financial balance per day for contingencies.

- The revenue part of the budget is determined. This includes the budget, taking into account the coverage of receivables, the sale of fixed assets, interest received, dividends.

- The expenditure part of the budget is determined.

Will the business have the necessary money on hand to carry out day-to-day operations? Are you ready to pay for your participation in the business?

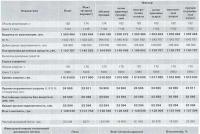

There are no magic crystals that predict your future cash flows, but it is necessary to make such a forecast. Reasoning about the inaccuracy of calculations, about future changes should not lead you to refuse to draw up such documents, since the cash flow forecast (analysis of future cash flows) is one of the most important elements of the financial section of the business plan. Table 7.3 provides an example of a cash flow forecast.

Table 7.3

Cash flow forecast as of April 1, 2001 (thousand rubles)

| Indicators | "Periods |

|||||

| 2 quarter | 3 quarter | 4 quarter |

||||

| plan | fact | plan | fact | plan | fact |

|

| Coming | | | | | | |

| Sale of goods, receipts on account of debt | 50 000 | | 60 000 | | 40 000 | |

| Sale of fixed assets | 5 000 | | | | | |

| Dividends/interest received | 1 000 | | 500 | | 2 000 | |

| Total: | 56 000 | | 60 500 | | 42 000 | |

| Consumption | | | | | | |

| materials | 30 000 | | 40 000 | | 41 000 | |

| Remuneration of staff | 10 000 | | 12 000 | | 12 000 | |

| Overheads | 5 000 | | b 500 | | 7 000 | |

| Purchase of fixed assets | 5 000 | | 10 000 | | 12 000 | |

| Total: | 49 000 | | 68 500 | | 72 000 | |

| Cash flow for the period | 7 000 | | 8 500 | | -30 000 | |

| cash balance at the beginning of the period | 2 000 | | 9 000 | | 1 000 | |

| Cash balance at the end of the period | 9 000 | | 1 000 | | 29 000 | |

Each element of the table is based on a forecast of the amount of cash involved in the business, remaining at the end of the period, and carried over to the next period. Thus, the cash flow forecast shows whether the business will have sufficient cash or will need financial assistance.

The cash flow forecast does not reflect the profit or loss made by the business, but only forecasts the amount of cash available in each period. The results of actual operations may differ from those planned, which requires changes to the cash flow forecast at the end of the period and adjustments to subsequent forecasts.

The cash flow forecast reflects a classic business problem - "fare". In the end, you can have the best possible goal - profit, and the bus can fully meet your requirements - have a body, four wheels and an appropriate engine - balance - but you also need to have a fare in your pocket in order to stay on the bus and go!

The cash flow forecast and income and expense estimates must be consistent with each other. For example, sales on credit that are reflected in the estimate will not be shown in the cash flow forecast until the customer or debtor has paid; the cost of materials reflected in the income estimate is the cost of materials used to manufacture goods sold during the period, and in the cash flow forecast, it is the amount paid to creditors for materials for the period.

So, we have explored three main sources of business valuation in the form of three financial documents:

The income and expense estimate evaluates the return on funds, which shows how the funds of the business have changed over the previous period.

The balance sheet evaluates the risk, which shows the state of the business funds presented and the sources of these funds.

The cash flow forecast assesses the sufficiency of cash receipts, i.e. the ability of the business to achieve financial goals; shows where the funds will be received from and how they will be spent in the future. The forecast allows you to show how much money the business will have at the end of each study period.

From these three sources flow all the financial information on which the success of every business depends.

More on the topic Development of financial information. Cash flow forecast:

- Cash and cash equivalents and presentation of information in the cash flow statement

- CHAPTER 5. CASH FLOW ANALYSIS FROM THE STATEMENT OF CASH FLOW

- 2.1.4. Cash flow statement and enterprise cash flow analysis

- 5.2. THE SIGNIFICANCE OF THE STATEMENT OF CASH FLOW IN EVALUATION OF THE EFFICIENCY OF CASH FLOW MANAGEMENT OF THE ORGANIZATION

- 2.1. Characteristics of the current financial condition of industries. Forecast of restrictions on the development of industries on the part of financial resources, taking into account the predicted dynamics of own resources and the possibility of attracting borrowed funds

Cash flow planning, analysis of deviations of actual results from planned ones, the formation of management decisions as a function of financial controlling today are of the highest relevance. However, in an environment where borrowed funds have risen sharply and the situation with payments has worsened, tools such as cash flow budgeting are becoming cumbersome and “sluggish”. It is advisable to use easier, but providing sufficient accuracy and reliability, planning methods and related information systems.

The functionality and quality of financial controlling, as well as general controlling, is determined by the quality of the tools used, that is, the methods and techniques, the state of planning and control mechanisms, as well as the quality of information systems that automate the planning process and build analytical reports.

If a company does not pay due attention to cash flows, then it is very difficult for it to predict cash gaps. This leads to the fact that at the end of the month she does not have money to pay suppliers' bills. Therefore, employees of various services are forced to make a promise to pay current bills next month from expected receipts. However, due to the lack of a cash flow management (CFM) system, there is no certainty that this situation will not happen again.

There is also a more unpleasant situation when a company constantly uses an overdraft, but due to non-compliance with the conditions for its use, the bank closes. As a result, the company cannot make payments. Suppliers, dissatisfied with payment problems, cancel discounts, which immediately affects the company's profitability.

So, insolvency occurs at the moment when the cash flow becomes negative. It is important that such a situation can arise even when the enterprise formally remains profitable. It is with this that the problems of profitable, but illiquid companies that are on the verge of bankruptcy are connected.

Most of these problems are the result of improperly organized payments or violations of their terms.

The specifics of the industry may imply some delay in the receipt of funds from customers. But the presence of significant accounts receivable and poor work with it can lead to a lack of funds to pay for the current activities of the enterprise. This problem can only be solved in a comprehensive manner at the stages of budgeting and operational management of payments.

The problem of violation of payment terms both by the company's clients and by the company itself is solved mainly at the stage of operational planning due to better work with clients to close receivables. If the company has a regulation for fixing planned cash receipts, then if these plans are violated, it becomes possible to quickly determine which counterparties violate the terms of payments.

Insufficient attention to planning and cash flow management leads to a lack of liquidity, violations in payment terms, deterioration of relationships with counterparties, unreasonable use of additional borrowed funds, etc. Even the presence of a full-fledged budgeting system cannot guarantee the absence of cash gaps. A system is needed to promptly make changes to plans and tools to regularly monitor their implementation and plan-to-fact deviations.

However, the crisis has shown that in a dynamically changing situation, a rigid plan slows down activity. The company is required to quickly respond to changing external conditions, and a rigid budgeting system prevents this. In large companies, coordination of actions takes too much time. Any decision requires a weighty justification, sometimes it is difficult to formulate it, especially if it is at the level of intuition. Past experience shows that both small and large companies require tools to quickly change plans.

The main stages of cash flow management

Cash flow management can be represented as a sequence of several stages (Scheme 1) with conditional names: planning for a certain period of time, operational planning, fact and analysis.

Scheme 1.

Main stages of cash flow management

When budgeting, based on the sales and purchase plan, cash flow plans are drawn up for a certain period of time - cash flow budgets (BDDS). Already here it is possible to identify potential cash gaps and take the necessary measures. The use of BDDS helps answer the questions: who, when, for what purposes and how much money can be spent.

The operational planning stage is designed to plan current needs and cash flows. Its ultimate goal is a payment calendar that allows you to identify cash gaps more accurately. Most often, the payment calendar is compiled on the basis of planned receipts and applications for spending funds.

Operational planning cannot be limited to reflecting applications and adjusting the payment calendar. Documents need to be reviewed and approved. It is important to conduct a preliminary selection of applications, which must be agreed with the responsible persons of the company. Moreover, the approval process should be fast enough. One of the important possibilities of approval is a request not to a specific user, but to a certain group of responsible persons. This makes it possible to quickly respond to the situation in the absence of one of the key employees.

The analysis of cash flow is, in fact, the determination of the moments and magnitudes of inflows and outflows of money. In many ways, the pace of development and financial stability of an enterprise is determined by how much the inflows and outflows of funds are synchronized with each other in time and in volume, since a high level of such synchronization allows you to use smaller loans and effectively use the available funds. For these purposes, the following tools are usually used:

and analysis of the execution of plans;

comparison of the long-term plan (budget), operational plan and fact;

determination of the main indicators of the movement of the DS;

in revealing regularities by numerical methods.

As you can see, the stages of cash management can be divided into the following horizons:

Operational tasks, which directly include the organization of payments, their coordination, operational controlling;

Medium-term tasks that solve the problems of synchronizing the volumes of incoming and outgoing payments, work with contracts and their conditions to ensure the company's solvency;

Strategic tasks that regulate the direction of the company's development.

Schematically, this distribution is shown in Scheme 2.

Scheme 2

Tasks of financial accounting solved by rolling planning

Approaches to budgeting DDS

Scheme 3.

Traditional budgeting and rolling planning

Traditionally, the budgeting process (Scheme 3) begins with the management of the company determining the directions of its development, growth rates, key indicators and takes a lot of time. As a rule, DDS budgets are prepared for a quarter or a year. Compiling a BDDS from scratch is a rather laborious process, since it requires processing a large amount of information about upcoming income and expenses. Work on next year's budget could begin as early as summer.

To facilitate this process, data from previous periods is often taken as a basis. However, in the first half of the year, the company has actual data on the implementation of the current budget for only a few months. It is clear that the budget formed on the basis of such data has inaccuracies, therefore it cannot serve as a guideline for the company throughout the next year. The way out of this situation is seen in the continuous revision of plans.

Rolling planning is a technology that, after a certain period of time, changes plans for the future, moving the border by the amount of the passed stage. For example, a weekly plan is drawn up for the next 12 weeks. At the same time, the detail of plans decreases in proportion to the “remoteness” of the corresponding period from the planning point. So, a daily plan for the first week, a weekly breakdown for the next month, and an enlarged monthly plan for subsequent periods. Methodologically, rolling planning solves all operational tasks and partially medium-term ones that have become relevant at the present time.

This planning technology has a number of advantages over traditional budgeting. If traditional budgeting is sometimes compared to wall-to-wall planning, that is, the company does not see its future beyond the boundaries of the budget, then in rolling planning the horizon required for daily work is increased and detailed.

Rolling planning allows you to take into account the actual cash flow and promises of payment counterparties. It becomes possible to quickly make adjustments to payment schedules.

Technological processes are carried out in mass production continuously, and planning occurs discretely. Therefore, rolling planning brings the planning process closer to the pace of the rest of the company's processes. This improves the quality and reliability of the information on the basis of which the rolling plan is formed. The responsiveness is also increased, as all responsible employees regularly make adjustments to their part of the plan.

Transition to rolling planning

The main questions that need to be answered first of all when switching to rolling planning are what are the frequency and planning horizon?

Since the processes in the company run continuously, the planning intervals should be as small as possible. However, very fine crushing is not always convenient. Therefore, planning intervals must be chosen based on the characteristics of the work of the trade, production and financial departments. For example, if the maximum payment delay is 1 month, and the maximum order lead time is 2 weeks, then it makes no sense to strive for a detailed income plan for six months in advance.

When maintaining rolling planning, you can use different detail for different dates. For example, for the next week, have a detailed plan by day, a month ahead - by week, and for a couple of months ahead, draw up a general plan.

Despite some laboriousness of regularly reviewing the current situation and changing plans, rolling planning has a number of advantages over traditional budgeting. Since the receipts (according to information from customers and the terms of contracts) of funds and planned expenses are known (with an accuracy of up to the day), it is possible to promptly:

keep track of the planned cash balances and, in case of their shortage, also promptly make adjustments to expenses;

control discrepancies between plan and fact and adjust the plan for receipts if the next payment is not received on time or use additional receipts more efficiently;

manage accounts receivable.

The main advantage of rolling planning is that when the end of the period approaches, it is clear and clear what to do next.

The involvement of employees in the process of conducting rolling planning improves its quality. However, even specialists interested in rolling planning have to master a new section of accounting for themselves and abandon old habits, rebuild established business processes.

The so-called "preliminary applications" allow to reduce the tension of introducing a new technology. They indicate only the most common details of payments: subdivision, item, amount. But this data is quite enough for rolling cash flow planning.

In the first cycle of using rolling scheduling, you need to create a regular weekly plan. In the future, the weekly plan will be mainly compiled according to completed applications. Cash receipts, about which there is information about the exact date of the transaction, are left as is. The same receipts, for which there is no such information, are evenly distributed over a certain time interval, usually a week or a month.

Do the same with expenses. But since the company manages the expenses itself, they can almost always be tied to a more accurate period (day / week) compared to receipts. Expenses that cannot be tied to specific weeks are broken down evenly throughout the month.

With the help of department heads (sales, purchases, production) and additional information from them about sales, receipts, payments, the weekly plan is adjusted, evenly distributing payments over the planning interval.

At the end of the next planning period (week / month), the next updated plan for the near future is drawn up. That is, the plan is consistently adjusted to a certain depth, due to which greater reliability is achieved compared to traditional planning.

The data sources for rolling planning are:

Contracts. For example, payment schedules, terms of deferred payment agreements, etc.;

Arrangements. A common mistake is that only one person, a maximum of his leader, has information about planned receipts. This information must be recorded, for example, reflecting the deviation in the payment schedule.

Seasonality, other recurring fluctuations. There are many examples, the main thing is that these unevenness must be taken into account. One of the tools that helps predict such irregularities is

One of the tools that helps to identify, analyze and predict such cyclical fluctuations is statistical and data mining.

Forecasting with intelligent methods

The better the cash flow forecast needs to be built, the more resources and time are required. Moreover, highly qualified specialists are needed for these purposes. You can reduce costs by automating the forecasting process.

Many traders use mathematical methods to predict stock prices and exchange rates. Their essence lies in the fact that the computer, analyzing the previous values of the time series, builds a model (usually in the form of a formula) and uses it to predict future values. Perhaps, for very short periods of time, when it is required to make a decision in a matter of seconds, such methods are the only way to build a forecast.

The simplest methods, for example, linear approximation, when trying to describe the previous values of indicators with a simple line, are used in business. Although this method is quite simple, its accuracy is not great. To improve the accuracy of the forecast, you can use more complex functions: exponents, logarithms, power functions, etc. Usually, these functions are used in Excel to build beautiful smooth graphs. Statistical data processing methods are also implemented in the SPSS package. Intelligent forecasting methods using neural networks, genetic algorithms, etc., as well as the corresponding tools are also used in business: Matlab, Statistica Neural Networks, Polyanalyst, etc.

However, all of them require a large amount of historical data (at least 30 previous values). In reality, taking into account the constantly changing market situation and, accordingly, the changing model, it is not possible to accumulate such an amount of data.

One of the promising methods is "Caterpillar" or "singular spectrum analysis". It is interesting because it tries not just to create a time series model, but first to decompose this time series into the simplest components and does not require a large amount of previous data. Typically, a time series is presented as a trend, periodic fluctuations (for example, seasonal) and noise components. The decomposition into such components occurs automatically, the user only needs to specify which components should be taken into account when building a forecast, and which should not.

The "caterpillar" can be used not only for forecasting, but also for the analysis of complex time series.

However, no intelligent methods can completely replace the knowledge and experience of an analyst, but only help controllers form proposals for decision making.

Variance Analysis

With rolling planning, the analysis of plan variances is somewhat different from the analysis in traditional budgeting.

In rolling planning, the plan generally consists of two parts - specific requests and a forecast made using certain tools or based on the experience of the budgeting staff.

It is relatively easy to make decisions on a specific application for payment or on a planned receipt of funds. This is more of an organizational issue. All that is needed is to obtain information from the initiator or responsible for a specific amount. The planned movement will either be postponed to one of the future periods or cancelled.

But the predicted part of the plan requires a different approach. Depending on the specifics of the company's activities, internal processes and the detail of the forecast, two options for solving this problem can be proposed.

You can ignore variances and not carry them over to subsequent periods. For example, if the limits on current expenses (stationery, current repairs, etc.) have not yet been fully used.

But there are cases when a specific application has not been submitted (documents from the supplier were not received on time, etc.), and the spending limit has been allocated. Then it must be carried over to the next period. In such situations, it is useful to use the so-called "periodic applications", the validity of which is limited to a certain period, for example, the duration of the contract. Based on them, regular (weekly, monthly) requests for spending funds are formed. The adoption of this or that decision can be partially automated by classifying articles into those for which the balance of the budget of the closed period is distributed over the following periods, and for those for which the plan is “overwritten” by the fact.

Elements of the methodology of planning and accounting of funds described above are implemented in the product "RG-Soft: Cash Flow Management".

Cash flow management is an important factor in accelerating the capital turnover of an enterprise. This is due to a reduction in the duration of the operating cycle, more economical use of own funds and, as a result, a decrease in the need for borrowed funds. Therefore, the efficiency of the enterprise largely depends on the organization of the cash flow management system.

Cash flow forecasting plays an important role in ensuring the normal operation of the enterprise. The need for this often arises when lending at a bank, when the bank, wanting to insure against non-payments, wants to see whether the company will be able to repay its obligations on a specific date. However, this far does not include all the important points that pose the task of forecasting cash flows for the financial manager.

This issue is reduced to the calculation of possible sources of income and direction of outflow of funds. Since most indicators are rather difficult to predict with great accuracy, cash flow forecasting is often reduced to building cash budgets in the planning period, taking into account only the main components of the flow: sales volume, the share of cash proceeds, accounts payable forecast, etc. The forecast is carried out for some then the period in the context of sub-periods: year by quarter, year by month, quarter by month, etc.

In any case, the procedures of the forecasting methodology are performed in the following sequence: forecasting cash receipts for sub-periods; cash outflow forecasting for sub-periods; calculation of net cash flow (surplus / shortage) for sub-periods; determination of the total need for short-term financing in the context of sub-periods.

The meaning of the first stage is to calculate the amount of possible cash receipts. A certain difficulty in such a calculation may arise if the company applies the methodology for determining revenue as goods are shipped. The main source of cash receipts is the sale of goods, which is divided into the sale of goods for cash and on credit. In practice, most businesses keep track of the average time it takes customers to pay bills. Based on this, it is possible to calculate which part of the proceeds for sold products will come in the same sub-period, and which in the next. Further, using the balance method, cash receipts and changes in receivables are calculated in a chain way.

A more accurate calculation involves the classification of receivables by maturity. Such a classification can be performed by accumulating statistics and analyzing actual data on the repayment of receivables for previous periods. The analysis is recommended to be done monthly. Thus, it is possible to establish the average share of accounts receivable with a maturity of up to 30 days, up to 60 days, up to 90 days, etc. If there are other significant sources of cash receipts (other sales), their predictive assessment is performed using the direct account method; the amount received is added to the amount of cash receipts from sales for the given sub-period.

The second step is to calculate the cash outflow. An integral element is the repayment of accounts payable. The business is considered to pay its bills on time, although it may delay payment to some extent. The process of late payment is called accounts payable “stretching”; deferred accounts payable in this case acts as an additional source of short-term financing. In countries with developed market economies, there are various systems of payment for goods, in particular, the amount of payment is differentiated depending on the period during which the payment is made. Under such a system, deferred accounts payable become quite a costly source of funding, as part of the discount provided by the supplier is lost. Other areas of use of funds include staff salaries, administrative and other fixed and variable expenses, as well as capital investments, payment of taxes, interest, dividends.

The third stage is a logical continuation of the two previous ones by comparing the projected cash receipts and payments, the net cash flow is calculated.

At the fourth stage, the total need for short-term financing is calculated. The meaning of the stage is to determine the size of a short-term bank loan for each sub-period, necessary to ensure the projected cash flow. When calculating, it is recommended to take into account the desired minimum of funds in the account, which is advisable to have as an insurance reserve, as well as for possible unpredictable profitable investments in advance.

Cash flow planning involves the ability to manage the company's liquidity. Providing liquidity during a crisis is the first clear indicator of the success of an enterprise.

Operational cash flow planning for a certain reporting period is carried out by compiling a payment calendar within the framework of the cash flow budget based on the current state of payments, concluded contracts, signed agreements and actual obligations. From a budgeting point of view, a payment calendar is a system for reserving funds from a plan.

The payment calendar, being in fact a planned "schedule" of the company's cash flow, allows you to predict cash gaps, which means it makes it possible to take measures in advance to eliminate the situation of the need to make a payment in the absence of sufficient funds in the company's account. Following the principle of "forewarned is forearmed" - you can quickly change the plans for spending money, thereby preventing a cash gap.

Thus, if the company is experiencing a shortage of free cash, it is possible to plan expenses for the upcoming receipts of money.

Having touched on such an aspect of cash management as “planning”, it should be said that in a situation of a shortage of “live” money, the clear work of the enterprise to coordinate the payment plan at all levels of management and competent, thoughtful prioritization are of particular importance.

Of course, determining the priority of certain payments is a purely personal matter for each enterprise. But most likely, the determining factor of priority will be the provision of the main activity of the enterprise: payment for raw materials and materials for the production of products for customer orders will remain more important, for example, the next purchase of new furniture for office workers. Without the latter, the work of the enterprise will not stop, but if production is not provided with the necessary resources, the consequences are predictable.

In this regard, an analysis of the so-called “permanent” payments will be very useful: often, enterprises have a certain class of expenses that are carried out only because it has always been like this, they are used to them and do not question the need for such expenses.

Drawing up a cash flow plan only makes sense when you can be sure that all necessary payments are taken into account. The plan is drawn up in order to eliminate the need for "sudden" financing of any important, urgent, etc. projects. This means that it is necessary to think over the directions of spending money in advance, which means that in a crisis situation, it is appropriate to introduce more stringent deadlines for agreeing on a payment plan at all levels of enterprise management.

Literature. Butynets F.F., Mnikh E.V., Oliynik O.V. Economic analysis: Workshop: Navch. posib. For university students. - Zhytomyr: FITI, 2000. - 465 p. Kovalev V.V. Financial analysis: methods and procedures. - M.: Finance and statistics, 2001. - 471 p. Financial statements // Bulletin of the accountant and auditor of Ukraine, 2002., - No. 3.

Forecasting in the economy is essential. At all times, soothsayers, from court astrologers to councils of economic advisers to presidents, have been charged with advising on financial planning. At present, a powerful mathematical and computer support for forecasting methods in the economy has been developed.

There are many groups inside and outside the firm that are interested in predicting the future financial condition of the firm. For example, within a firm, the finance manager typically reviews project documents to estimate the amount of additional funding the firm may need in the coming year. On the other hand, potential sources of financing - banks - will certainly want to know the needs of the firm and its ability to repay these debts.

In order to determine whether a company can carry on with current activities, repay debts to its creditors and finance planned investments, in addition to the income statement, it is necessary to have additional information.

This information is obtained from the cash flow forecast, which gives an overview of all expected income and expenses, grouped at the time of the actual cash inflow or outflow. The basic principle of constructing a report (forecast) in cash flow is the following rule: the actual movement of money is reflected when they are spent or should be spent.

The principle of making a cash flow forecast

A cash flow forecast starts with determining the company's bank balance at the beginning of a certain period. A list of all cash inflows and outflows for that period is then compiled. Putting them together gives us net cash flow, which can be positive, zero, or negative.

The sum of the bank balance at the beginning of the period and the net cash flow will give the bank balance at the end of the period. The bank balance at the end of the period is the opening balance of the next period. As a result, the cash flow forecast will show the distribution of funds by maturity and the amount of their excess or deficit (Table 7.3).

Table7 .3. Cash flow forecast

The cash flow statement (forecast) includes the following elements (Table 7.4).

Table

7

.four. Cash flow statement

Report element |

Information |

|

Cash flow data |

Information about the receipt of money for a month, regardless of the source of funding. Possible sources: Revenue from sales of products, including VAT Subsidies Loans Equity |

|

Cash outflow data |

Information about spending. Reflected in the month of payment, not the month of purchase. Paid expenses are shown inclusive of VAT. Depreciation is not taken into account. |

|

Excess / Deficit |

It is the difference between inflow and outflow, calculated monthly. |

|

Opening bank account balance |

Reflects the balance of funds in the bank account at the beginning of each month. If the enterprise was active, then this figure is the closing balance of the bank account from the previous month. |

|

Bank account ending balance |

Obtained by adding the amount of excess or deficit to the opening balance of a bank account. This figure is the opening bank account balance for the next month. |

An analysis of cash flow should show that the enterprise has funds in the amount necessary to pay the existing debt (to workers on wages, the budget, creditors, etc.), and ultimately determine the most profitable options for allocating all the free cash of the enterprise.

Measures aimed at correcting the situation in the event of a monetary deficit:

Maximization of cash receipts (reduction of the credit period provided to debtors);

Cost reduction (deferred payments / capital investments);

Search for additional sources of funding.

Based on the available funds at the end of the year, the company is obliged to outline forecasts for their further use for the short, medium and long term. Such a forecast is part of the financial plan of the enterprise.

Relationship between profitability and cash flow

Profitability and cash flow are different and not interchangeable concepts: an unprofitable enterprise may have cash in the bank and at the same time a profitable enterprise may have difficulty paying bills.

To calculate profitability, a profit and loss statement must be drawn up. To determine the bank balance of an enterprise, a cash flow statement must be prepared.

The reason for the difference between cash and profit lies in the method of accounting for profit. Measuring profit is much more difficult than measuring cash. Profit is calculated "periodically". Business operations are carried out daily, and there simply cannot be such a moment when they all suddenly stop and then resume again.

Expenses related to the current activities of the enterprise in this reporting period may not be paid in this period, but must be included in the income statement. For example, there may be prepaid expenses for insurance, rent. In the cash flow statement, these amounts will be taken into account in the month of actual payment, and in the profit and loss statement they will be evenly distributed over the entire time period to which the payment relates.