Instruction 33n in autonomous institutions. We work correctly: all the instructions for budget accounting. Additional forms of budget reporting

When drawing up accounting reporting forms for 2017, health care institutions should take into account the provisions:– Order of the Ministry of Finance of the Russian Federation of 02.11.2017 No. 176n, which amended Instruction No. 191n (registered with the Ministry of Justice of the Russian Federation on 05.12.2017 No. 49101);

- Order of the Ministry of Finance of the Russian Federation of November 14, 2017 No. 189n, which amends Instruction No. 33n (registered with the Ministry of Justice of the Russian Federation on 12.12.2017 No. 49217).

Changes made by these orders to instructions No. 191n, No. 33n can be conditionally classified into the following groups:

New provisions in terms of general requirements for the preparation and submission of reporting forms to the executive authority acting as a founder;

correction of the rules for drawing up individual reporting forms (f. 0503130, 0503127, 0503128, 0503730, 0503737, 0503738, 0503721);

inclusion in the explanatory note (f. 0503760) of the table "Information on investments in real estate objects, on objects of unfinished construction of a budgetary (autonomous) institution" (f. 0503790, 0503190).

General provisions for the preparation of reporting forms

In terms of making changes to the general provisions of the procedure for drawing up and accounting (budget) forms, it should be noted that the provisions of orders No. 176n and No. 189n introduce similar norms. Let's consider which ones.

Note: accounting forms contain planned (forecast) and analytical (management) indicators.

If there are planned (forecast) and analytical (management) indicators, they are signed not only by the institution, but also by the head of the financial and economic service (if available in the institution's structure) and (or) a person for the formation of analytical (management) information.

The chief accountant signs these forms in terms of indicators formed on the basis of accounting data (new provisions included in clause 5 of Instruction No. 33n, clause 6 of Instruction No. 191n).

When drawing up accounting forms, there are cases when the institution does not have the numerical indicators necessary to fill out the reporting form. Clause 10 of Instruction No. 33n, clause 8 of Instruction No. 191n contain provisions stating that if all the indicators provided for by the financial reporting form, instructions No. 33n, No. 191n do not have a numerical value, this reporting form is not compiled as part of the financial statements for the reporting period is not presented. By orders No. 189n, No. 176n, the provisions of clause 10 of Instruction No. 33n, clause 8 of Instruction No. 191n were supplemented with the provisions that when generating and (or) submitting financial statements by means of automation software systems, accounting documents that do not have numerical values \u200b\u200bof indicators and do not contain explanations are generated and presented with an indication of the mark (status) "there are no indicators".

Note: information on the absence of forms in the financial statements for which the institution does not have numerical data shall be reflected in the textual part of the explanatory note (f. 0503760, 0503160) drawn up for the reporting period.

For healthcare institutions, recipients of budget funds , of interest are the new norms of clause 10 of Instruction No. 191n. This clause is supplemented by provisions stating that:

1) if an institution simultaneously performs several budgetary powers under the budgetary system of the Russian Federation (it is a recipient of budgetary funds, an administrator of budget revenues, an administrator of sources of financing the budget deficit), it generates a single set of budgetary reporting on the totality of its powers;

2) the code of the subject of budget reporting is indicated in the code zone after the variable "Date":

- PBS - the recipient of budget funds (administrator of budget revenues, administrator of sources of financing the budget deficit), the main manager (manager) of budget funds as a recipient of budget funds;

- AD - administrator of budget revenues (in the case of the formation of budget reporting in terms of the exercised powers of administrators of budget revenues, in relation to which the reporting entity does not exercise the powers of the recipient of budget funds);

- RBS - budget funds manager;

- GRBS - chief manager of budgetary funds, chief administrator of budget revenues, chief administrator of sources of financing the budget deficit;

- GLAD - the chief administrator of budget revenues (in the case of the formation of budget reporting in terms of the exercised powers of the chief administrator of budget revenues, in relation to which the reporting entity does not exercise the powers of the recipient of budget funds);

3) budget reporting containing corrections based on the results of a desk audit of budget reporting is submitted by the subject of budget reporting with a cover letter containing instructions on the changes made, in the manner prescribed by clauses 4, 6, 10 of Instruction No. 191n.

For budgetary and autonomous institutions health care are of interest to the new norms of clause 8.1 of Instruction No. 33n In the version of clause 8.1 of Instruction No. 33n that was in force before the entry into force of Order No. 189n of Instruction No. 33n, there was information setting the deadlines for submitting reports to the executive authority performing the functions and powers of the founder (hereinafter - the founder) in terms of information that does not contain state secrets:

no later than 15 working days preceding the deadline for the founder's submission of the annual budget reporting by the relevant chief administrator of the federal budget funds (founder) to the Federal Treasury;

no later than 7 working days preceding the deadline for the founder's submission of quarterly budget reports by the relevant chief administrator of federal budget funds to the Federal Treasury.

Order No. 189n reduced these terms, and instead of 15 days, 10 days were established, and instead of 7 days - 5 days.

The paragraph specifying that the institution must submit monthly financial statements to the founder no later than 6 business days preceding the deadline for submitting monthly statements by the founder has been declared invalid. This is due to the fact that budgetary and autonomous institutions, according to the norms of Instruction No. 33n, do not prepare monthly reports.

Balance (f. 0503130)

For health care institutions, in terms of drawing up a balance sheet (f. 0503130), the norm is that the reflection in columns 4, 7 of the sections "Non-financial assets", "Liabilities", "Financial result" of the balance sheet (f. 0503130) is carried out taking into account the specifics reflection on the corresponding accounts of the working chart of accounts of budget accounting of the subject of budget reporting of accounting objects by type of activity 3 - funds in temporary disposal established by the documents of the accounting entity of budget reporting in agreement with the financial authority.

Report (f. 0503127)

The procedure for filling out this reporting form was supplemented by a provision stating that in column 4 of the "Budget expenditures" section, the recipient of budget funds reflects the indicators of the approved budget allocations brought to him by the main manager (manager) of budget funds, for the reporting period, taking into account the changes: debit turnover on account 1 503 15,000 "Received budgetary allocations of the current financial year", containing in categories 15 - 17 the code of the type of expenditures related to subgroups 310 "Public normative social payments to citizens", 330 "Public normative payments to citizens of a non-social nature" (new provisions of clause 56 of Instruction No. 191n).

Read also

- New in accounting and reporting of institutions since 2017

- We take into account the explanations of the Ministry of Finance when drawing up financial statements for half a year

- Explanations on the preparation of monthly and quarterly budget reporting

- Analysis of errors and violations committed in the preparation of budget reporting

- Explanations of the Ministry of Finance on the preparation of accounting forms

Column 5 of the section "Budget expenditures" by the recipient of budget funds shall reflect the indicators of the limits of budgetary obligations brought to him by the main manager (manager) of budget funds for the reporting period, taking into account the changes: debit turnover on account 1 503 15 000 "Received budget allocations of the current financial year", containing in categories 15 - 17 the corresponding code of the type of expenses.

In addition, Order No. 176n introduced clarifications to the procedure for filling in column 6 of the report (f. 0503127). So, clause 57 of Instruction No. 191n was supplemented with new norms establishing that for lines that do not contain data in column 4, and (or) when performing above-planned indicators (in case of exceeding the indicator in column 8 over the indicator in column 4), column 9 is not filled. For the lines containing in column 4 indicators with a minus sign, the indicator of unfulfilled appointments (in terms of returns of income from the budget) is reflected in column 9 with a minus sign.

Column 9 is not filled in on line 010 "Budget revenues - total". The reasons for the deviation of the amount of unfulfilled appointments reflected in column 9 for the corresponding lines of the "Income" section, which form the final indicator for income, from the difference in the indicators of columns 4 and 8 for line 010 "Budget revenues - total" are disclosed as necessary in the text part of section. 3 "Analysis of the report on the execution of the budget by the subject of budget reporting" of the explanatory note (f. 0503160).

Also column 9 of the section "Sources of financing the budget deficit" not filled in:

according to the lines containing the indicators of the approved (reported) budgetary allocations for the financial year according to the grouping codes of the classification of expenses, sources of financing the budget deficit (column 4);

on the lines of the section that do not contain data in column 4, and (or) if the indicator in column 8 exceeds the indicator in column 4.

Report (f. 0503128)

The new version of clause 70 of Instruction No. 191n established that the completion of column 4 "Approved (brought up) for 20__ budgetary allocations" in terms of the budgetary allocations brought forward is carried out by the recipient of budgetary funds, the administrator of the sources of financing the budget deficit on the basis of debit turnover data in the amount of 1,503,15,000 "Received budgetary allocations of the current financial year", containing in categories 15 - 17 the code of the type of expenditures related to subgroups 310 "Public normative social payments to citizens", 330 "Public normative payments to citizens of a non-social nature."

In addition, Order No. 176n clarified the procedure for reflecting in column 11 of the report (f. 0503128) the amounts of accepted budgetary obligations of the current (reporting) financial year that were not fulfilled as of the reporting date: column 11 reflects an indicator with a minus sign, in the event of a monetary obligation, the costs of which are reimbursed by the FSS in the amount of payments made by the institution as the insured (new edition of clause 70 of Instruction No. 191n).

Also, by Order No. 176n, amendments were made to the procedure for filling in line 911 of the report (f. 0503128). Recall that earlier explanations for filling out this column of the form were contained in the Letter of the Ministry of Finance of the Russian Federation No. 02-07-07 / 21798, Federal Treasury No. 07-04-05 / 02-308 dated 07.04.2017. The provisions of this letter were partially transferred by Order No. 176n to the text of Instruction No. 191n. As a result, clause 72.1 of Instruction No. 191n has been supplemented with the following provisions regarding filling out line 911:

column 7 reflects the sum of indicators (balances) of the corresponding accounts of analytical accounting of account 1 502 99 000 "Deferred obligations" at the end of the reporting period. In this case, the indicators of columns 7 and 11 on line 911 must be identical;

in columns 3 - 6 and 8 - 10, 12 indicators are not filled in.

Report (f. 0503123)

Order No. 176n supplemented the report (f. 0503123) with a new section. 3.1 "Analytical information on the management of balances". It reflects detailed information on the management of the balances indicated in lines 463, 464 of Sec. 3 “Change in fund balances”. Also, Sec. 4 "Analytical information on disposal" of the report (form 0503123).

Report (f. 0503737)

The following additions were made to the completion of this report (new version of paragraphs 41 and 44 of Instruction No. 33n):

the indicator on line 500 of column 10 reflects the difference between the indicators of columns 4 "Approved planned appointments" and 9 "Completed planned appointments, total";

the indicator of line 730 "Change in the balances by the internal turnover of funds of the institution" in column 9 "Completed planned appointments, total" is zero.

Report (f. 0503738)

Changes have been made to the completion of this report aimed at regulating the procedure for filling in line 911 "Obligations of financial years following the current (reporting) financial year, in terms of deferred obligations" section. 3.

When filling out this line, the following ratio of indicators must be observed:

Indicators in columns 4 - 5, 7 - 9, 11 lines 911 are not filled in.

Column 6 on line 911 shall reflect the sum of indicators (balances) of the corresponding accounts of the analytical accounting of account 0 502 99 000 "Deferred obligations" at the end of the reporting period.

Report (f. 0503721)

Order of the Ministry of Finance of the Russian Federation No. 189n set out the provisions of clause 53 in a new edition, completely rewriting them. However, the provisions of this paragraph have not undergone significant changes. In the new edition of clause 53 of Instruction No. 33n, the features of filling in the following lines are of interest:

|

Line number |

Filling feature |

|

The amount of accrued income reflected on account 0 401 10 130 "Income from the provision of paid services" is reflected, minus VAT amounts accrued due to this income (on the debit of account 0 401 10 130). That is, the amounts of subsidies received by the institution under the type of activity code 4 are reflected in this line of the form |

|

|

Columns 5, 6 are not filled in, this line reflects the amount of accrued income on the credit of account 5 401 10 180 "Other income" (income received by the institution in the form of subsidies for other purposes) |

|

|

Columns 4, 5 are not filled in, and column 6 reflects the amount from the account 0 401 10 180 |

|

|

The sum of lines 160, 170, 190, 210, 230, 240, 260, 270 , 280 |

|

|

The difference between credit and debit turnovers on account 0 401 60 200 "Provisions for future expenses" formed during the reporting period is indicated |

In addition, column 5 on lines 030, 050, 060, 062, 063, 096, 101 , 102 , 103, 104 not filled.

Report (f. 0503723)

The provisions of clause 55.1 of Instruction No. 33n were supplemented by Order No. 189n with information stating that column 4 on lines 463, 464, 501, 502 reflects data taking into account the indicators on receipts (outflows) of funds reflected on off-balance accounts 17 “Receipt of funds "And 18" Disposals of funds ", opened to account 0 304 06 000" Settlements with other creditors ", in terms of operations to raise funds to cover the cash gap when fulfilling the obligation within the balance of funds on the personal account of the institution (borrowing funds between activities). Lines 165, 182, 234, 247, 253, 263, 302 - 304, 345, 352, 360 - 363 are not filled.

When filling out sect. 4 "Analytical information on disposal" of the report (form 0503723), it should be taken into account that (clause 55.3 of Instruction No. 33n as amended by Order of the Ministry of Finance of the Russian Federation No. 189n):

in column 5 it is necessary to indicate the corresponding codes of the section, subsection of budget expenditures, based on the functions (services) performed by the institutions;

column 6 reflects additional detailing by analytical codes of disposal in the structure approved by the financial authority of the relevant public law entity.

Explanatory note (f. 0503760)

Information about the conduct of inventories (table 6).

Clause 63 of Instruction No. 33n was supplemented with a provision stating that in the absence of discrepancies in the results of the inventory carried out in order to confirm the indicators of the annual financial statements, table 6 is not filled out. The fact of the annual inventory is reflected in the text part of Sec. 5 "Other activities of the institution" of the explanatory note to the balance sheet of the institution (form 0503760).

Information about the results of the institution's activities on the execution of the state (municipal) assignment (f. 0503762).

When filling out the table, it should be borne in mind that column 7 indicates the costs actually incurred by the institution (the cost of the service (work) for the fulfillment of the state (municipal) task as of the reporting date (in value terms)) (new version of clause 65.1 of Instruction No. 33n). On the line "Total" in columns 5, 7 the total values \u200b\u200bare indicated. Column 7 is not filled in if in column 5 the planned volumes of financial support for the fulfillment of the state (municipal) task for the corresponding type of service (work) in value terms are equal to zero.

Information on accounts receivable and payable of the institution (f. 0503769).

Order No. 189n, clause 69 of Instruction No. 33n supplemented a provision establishing that operations to clarify the codes of the budget classification of the current financial year in the table (f. 0503769) are reflected in column 5 with a minus sign for the specified code and with a plus sign for the revised code (in part of the expenses listed in the form of repayment of accounts payable).

Information about accepted and unfulfilled obligations (form 0503775).

Columns 7 and 8 of the table (f. 0503775) indicate the code and explain the reasons for non-fulfillment of obligations (monetary obligations). The provisions of clause 72.1 of Instruction No. 33n were supplemented by Order No. 189n with codes and their decoding, which should be reflected in these columns. Indicators columns 7 and 8 of Sec. 3 summary information (f. 0503775) are not filled in.

Information about the cash balances of the institution (form 0503779).

The provisions of clause 74 of Instruction No. 33n were supplemented by Order No. 189n with the norms establishing that the formation of the table (form 0503779) is carried out according to the relevant types of financial support for activities (type of activity), for which the institution has data at the beginning and (or) the end of the reporting year about cash balances or for which there are open accounts at the reporting date with credit institutions (financial authority). In the case when during the reporting period there were no transactions with monetary funds for the relevant type of financial support of the activity, the table (f. 0503779) for this type of activity is not formed. The table (f. 0503779) discloses information on the availability of accounts opened by a budgetary (autonomous) institution, including provided that there are zero cash balances on them at the beginning and end of the reporting period.

Information on the execution of court decisions on the monetary obligations of the institution (f. 0503295).

Order No. 189n in a new edition sets out para. 15 p. 74.1 of Instruction No. 33n, which sets the rules for filling out the reference table. After the entry into force of this order, this paragraph will sound like this: the reference table for unfulfilled decisions of the courts of the judicial system of the Russian Federation discloses information about the unfulfilled monetary obligations as of the reporting date under the court decisions of the courts of the judicial system of the Russian Federation (court decisions of (international) courts), reflected in the column 8 information (f. 0503295), indicating:

kOSGU codes (column 1);

the total number of documents not executed by the institution on court decisions (column 2);

the total amount for unexecuted documents (column 3).

Information about investments in real estate objects, about objects of unfinished construction of a budget (autonomous) institution (f. 0503790).

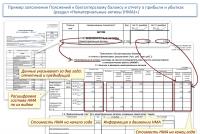

Order No. 189n included this form in the explanatory note (f. 0503790), which was previously contained in the Instructions and the procedure for compiling and submitting additional forms for annual and quarterly financial statements submitted by federal state budgetary and autonomous institutions, approved by Order of the Ministry of Finance of the Russian Federation dated 12.05.2016 No. 60n, and was called information about objects of construction in progress, investments in real estate objects of a budgetary (autonomous) institution (f. 0503790). In the wording of Order No. 189n, form 0503790 is called information about investments in real estate, about objects of unfinished construction of a budgetary (autonomous) institution (f. 0503790). Not only the name of the form has changed, but also the name of the lines, the graph of the form. Note that a similar form (only its number 0503190) is included in Instruction No. 191n by Order No. 176n. Previously, the form was approved by Instruction No. 15n.

Forms 0503790, 0503190 are compiled at the end of the year. They disclose information on capital investment objects, including data characterizing the investments made in real estate (the progress of capital investments (budget investments)), provided in order to form a table (f. 0503790, 0503190) by the structural divisions of the institution responsible for the implementation of capital investments in immovable property, and financial data generated on the corresponding objects of capital investments in the accounting of the institution on the corresponding accounts of analytical accounting of account 0 106 11 000 "Investments in fixed assets - real estate of the institution."

In conclusion, we note that in it we considered the most relevant changes for health care institutions in the procedure for drawing up accounting (budget) reporting forms. For clarifications regarding the reflection in the reporting forms of certain facts of financial and economic activity, we recommend that you refer to the letters of the Ministry of Finance and the Federal Treasury.

real estate explanatory note capital investment

Commentary to the Order of the Ministry of Finance of the Russian Federation of December 17, 2015 No. 199n.

By order of the Ministry of Finance of the Russian Federation of December 17, 2015 No. 199n (hereinafter - Order No. 199n, Amendments), amendments were made to Instruction No. 33n, which are used in the preparation of financial statements starting from 2016, with the exception of certain provisions for which the period of application is reporting for 2015 and 2017.

Changes applied in reporting 2015

Clause 2 of Order No. 199n establishes that clauses 1.1, 1.2, 2.1 - 2.6, 2.8, 2.9, 2.12, 2.16, 2.18, 2.19, 2.27, 3.2, 3.8, 3.10 of the Amendments are applied starting from the reporting of 2015. Here are the provisions of individual points.

For example, Instruction No. 33n was supplemented by clause 6 (clause 2.4 of the Amendments), which established that the financial statements are submitted by the institution to the state authority (state body), the local government body exercising the functions and powers of the founder in relation to the institution, or by decision of the financial of the public education authority, from the budget of which the institution is provided, to the specified financial authority on paper and (or) in the form of an electronic document, with the submission on electronic media or by transmission via telecommunication channels within the time frame established by the founder (financial body).

The founder, when determining the procedure for the provision of financial statements by an institution in the form of an electronic document on electronic media or by transmission via telecommunication channels, provides for mandatory requirements for the formats and methods of transferring financial statements in electronic form, corresponding to the mandatory requirements for formats and methods of transferring budget statements in electronic form, the approved financial authority of public education, from the budget of which the institution is provided with a subsidy (hereinafter referred to as the relevant financial authority), as well as provisions on the mandatory provision of information protection.

Clause 2.5 of the Amendments amended the provisions of clause 7 of Instruction No. 33n: the autonomous institution submits to the founder, another external user of the statements, in addition to the annual financial statements, information on its consideration by the supervisory board of the autonomous institution in accordance with the current legislation of the Russian Federation.

The group of columns "Not fulfilled" of the report on the obligations of the institution (f. 0503738) reflects the volume of the assumed obligations (monetary obligations) of the current (reporting) financial year (sections 1, 2 of the report) and financial years following the current (reporting) financial year (Section 3 of the report) (Clause 48 of Instruction No. 33n as amended by Clause 2.16 Amendments). The phrase “the execution of which is envisaged in the following reporting periods” (contained at the end of the sentence) is excluded from this paragraph.

The new version contains clause 51 of Instruction No. 33n (clause 2.18 of the Amendments), which establishes that the indicators of the statement of financial results of the institution's activities (f. 0503721) are reflected in the context of activities with earmarked funds (subsidies for other purposes and for the purpose of implementing capital investments) (column 4), activities at the expense of subsidies for the fulfillment of the state (municipal) task (column 5), income-generating activities (own income of the institution, compulsory health insurance funds, funds in temporary disposal) (column 6) and the final indicator (column 7, equal to the sum of indicators in columns 4, 5, 6).

Changes applied to the reporting for 2016

The composition of the financial statements compiled by autonomous institutions for 2016 was supplemented by a statement of the institution's cash flow (form 0503723). In addition, changes have been made to the tables of the explanatory note (f. 0503760), including:

- information on the results of the institution's activities in fulfilling the state (municipal) assignment (form 0503762);

- information on the implementation of measures within the framework of subsidies for other purposes and for the purpose of making capital investments (f. 0503766);

- information on the movement of non-financial assets of the institution (f. 0503768);

- information on the execution of court decisions on the monetary obligations of the institution (f. 0503295).

Below we will talk about the changes in relation to some forms in more detail.

Cash flow statement of the institution (form 0503723)

The report (f. 0503723) is formed by the institution as of April 1, July 1, October 1, January 1 of the year following the reporting year, and includes the following data (clause 55.1 of Instruction No. 33n as amended by clause 2.21 of Amendments):

- on the flow of funds in the accounts of institutions in rubles and foreign currency, opened in subdivisions of the Bank of Russia, in credit institutions, bodies that provide cash services for budget execution;

- cash flow at the cash desk of the institution, including funds in temporary disposal.

The report (f. 0503723) is compiled in the context of KOSGU codes, based on analytical data on the types of receipts and disposals reflected in off-balance sheet accounts 17 "Receipts of funds to the institution's accounts", 18 "Disposals of funds from the institution's accounts", opened:

- to account 0 201 11 000 "Funds of the institution on personal accounts with the treasury body";

- to account 0 201 23 000 "Institutional funds in a credit institution in transit";

- to account 0 201 26 000 “Funds of the institution on special accounts with a credit institution”;

- to account 0 201 27 000 “Funds of the institution in foreign currency on accounts with a credit institution”;

- to account 0 201 34 000 "Cashier";

- to account 0 210 03 000 "Settlements with the financial authority in cash".

The sections of the report (f. 0503723) as of the reporting date reflect:

1) in section 1 "Income" - receipts of funds for current, investment, financial transactions, taking into account returns;

2) in section 2 "Disposals" - outflow of funds for current, investment, financial transactions, taking into account returns;

3) in section 3 "Change in fund balances" - an increase and decrease in cash balances for current, investment, financial operations, taking into account returns, as well as the result of the conversion of funds in foreign currency into the currency of the Russian Federation, made for accounting purposes ().

Note that when completing this section, the following control ratios must be observed:

* Recall that the report (f. 0503737) is filled out separately for each type of activity of the institution. In turn, in the report (form 0503723) indicators are reflected at once for all types of activities of the institution. Therefore, in order to make control relationships between forms 0503737 and 0503723, you should summarize the indicators of lines 710 of the report (f. 0503737) for each type of activity (excluding non-cash transactions) and compare the result with the information reflected in line 501 of the report (f. 0503723) ... A similar procedure is applied when the ratio of the indicators of line 502 of the report (f. 0503723) and the sum of the indicators of lines 720 of the report (f. 0503737).

The indicator of line 503 of the report (f. 0503723) is the result of the translation of funds in foreign currency into the currency of the Russian Federation, made for accounting purposes (exchange rate difference). The positive exchange rate difference obtained as a result of recalculation of funds in foreign currency into the currency of the Russian Federation is reflected with a plus sign, and a negative exchange rate difference - with a minus sign.

The indicators of lines 421, 431, 441, 451, 461, 463, 501 are reflected in a negative value (with a minus sign).

Indicators of lines 422, 432, 442, 452, 462, 464, 502 are reflected in a positive value (with a plus sign);

4) in section 4 "Analytical information on disposal" reflects information regarding disposal of current operations and investment operations, detailed by analytical codes of budget classification.

Information on the results of the institution's activities on the execution of the state (municipal) task (form 0503762)

The table (f. 0503762) was included in the explanatory note by the Order of the Ministry of Finance of the Russian Federation dated December 29, 2014 No. 172n and was first compiled by the institution when generating reports for 2015. In it, in accordance with the provisions of clause 65.1 of Instruction No. 33n in the version valid until February 14, 2016, the data on the results of the activities of the state (municipal) institution on the execution of the state (municipal) task and on the achievement of the goals stipulated by the conditions for granting subsidies for other purposes and subsidies for the implementation of capital investments in the context of planned and actual indicators in physical and value terms. However, information on the implementation by the institution (separate subdivision) of measures, the financial support of which is made at the expense of subsidies for other purposes, including for the purpose of making capital investments, in fact, this information is reflected in the table (f. 0503766) (clause 66 of Instruction No. 33n) ... In order to eliminate the requirement to indicate the same information in two adjacent tables in clause 65.1 of Instruction No. 33n, amendments were made to exclude the reflection of such information in the table (f. 0503762) (clause 2.25 of Amendments). According to the new version of this clause (used in the preparation of financial statements starting from 2016), it reflects information on the results of the institution's activities in fulfilling the state (municipal) task. In addition, Order No. 199n added two columns to the form:

- column 8, which reflects the amount of actually not fulfilled quantitative indicators of the state (municipal) task (the indicator of column 8 is determined as the difference between the indicators of columns 4 and 6);

- column 9, which indicates the reason for the institution's failure to fulfill the indicators of the state (municipal) task.

Information on the execution of measures within the framework of subsidies for other purposes and for the purpose of making capital investments (form 0503766)

Clause 2.26 of the Amendments table (f. 0503766) was supplemented with a column, which reflects the volume of unfulfilled appointments (the indicator of column 6 is equal to the difference between the indicators of columns 4 and 5) (clause 66 of Instruction No. 33n).

Information on accounts receivable and payable of the institution (form 0503769)

Clause 2.28 Changes made the following changes to the table (f. 0503796):

1) in section 1 of the table "Information on receivables (payables)" new columns are included, which should reflect:

- an increase and decrease in the total amount of accounts receivable (payable) for monetary and non-monetary settlements (in columns 5 and 6 an increase in monetary, non-monetary settlements is indicated, in columns 7 and 8 - their decrease);

- data on debts (receivables, payables), formed at the end of the last financial reporting period (column 12 indicates the total amount of receivables (payables), recorded according to the corresponding accounting account number as at the end of the same reporting period of the last financial year, the amount of long-term debt reflected in column 13, overdue - in column 14);

2) the name of column 8 of section has been changed. 2 tables;

3) a new section is included. 4 "Analytical information on the movement of overdue receivables, payables"... It indicates:

- the total amount of overdue receivables (payables) (column 3);

- the amount of overdue receivables (payables) on accounts 0 205 00 000 "Settlements for income", 0 209 00 000 "Settlements for damage and other income"; 0 303 00 000 “Settlements on payments to budgets” (column 4);

- the amount of overdue receivables, payables on accounts 0 206 00 000 "Settlements on advances issued", 0 208 00 000 "Settlements with accountable persons", 0 302 00 000 "Settlements on obligations assumed", 0 303 000 00 "Settlements on payments to budgets ", 0 304 00 000" Other settlements with creditors (column 5).

Clause 69 of Instruction No. 33n was supplemented with the concepts of monetary and non-monetary settlements. In order to form a table (f. 0503769) under cash settlement means transactions on settlements in cash, reflected in correspondence with the corresponding accounts of analytical accounting of accounts 0 201 11 000, 0 201 21 000, 0 201 23 000, 0 201 26 000, 0 201 27 000, 0 201 34 000. In turn , under non-monetary Settlements mean settlement transactions in the form of offset (offset of overpayment of certain types of payments against other types of payments, advance payments, obligations, subsidies, subventions, other inter-budgetary transfers) reflected in correspondence with the corresponding accounts of analytical accounting of accounts 0 205 00 000, 0 206 00 000, 0 208 00 000, 0 209 00 000, 0 302 00 000, 0 303 00 000, 0 304 06 000.

When filling out the table (form 0503796), the following internal control ratios must be met:

Information on the execution of court decisions on the monetary obligations of the institution (f. 0503295)

Clause 2.31 of Amendments Instruction No. 33n was supplemented with clause 74.1, which established the procedure for filling out the table (f. 0503295). This table reflects the indicators formed by the institution in the reporting period by the amounts:

- subject to collection on unfulfilled monetary obligations at the beginning of the current financial year according to court decisions (judicial acts of foreign (international) courts), reflected in the corresponding accounts of budget accounting;

- monetary obligations arising from court decisions (judicial acts of foreign (international) courts) received from the beginning of the current financial year;

- monetary obligations arising from court decisions (judicial acts of foreign (international) courts) from the beginning of the current financial year, for which a decision was made to reduce them, including those related to the revision of court decisions;

- fulfilled monetary obligations under court decisions (judicial acts of foreign (international) courts);

- monetary obligations overvalued by a court decision;

- unfulfilled monetary obligations at the end of the reporting period.

The reference table on unfulfilled decisions of courts reflects information on unfulfilled monetary obligations as of the reporting date under enforcement documents (judicial acts of foreign (international) courts), reflected in column 8 information (f. 0503295), indicating the codes of KOSGU (column 1), the total number of court decisions unexecuted by the institution on the executive documents accepted for registration (column 2) and the total amount under the unexecuted executive documents (column 3).

In this case, the data in column 3 of the reference table must correspond to the data in column 8 of the information (f. 0503295).

At the same time, the textual part of the explanatory note to the balance sheet of the institution (f. 0503760) discloses information about the debt under the executive documents and the legal basis for its occurrence.

Instructions on the procedure for drawing up, submitting annual, quarterly financial statements of state (municipal) budgetary and autonomous institutions, approved. By order of the Ministry of Finance of the Russian Federation of March 25, 2011 No. 33n.

Since the date of validity of the document is February 14, 2016, the autonomous institutions, when drawing up the reporting forms for 2015, applied the norms of this document, subject to the corresponding order of the founder.

Changes in instructions No. 191n, 33n. What should be considered when submitting a report?

– Order of the Ministry of Finance of the Russian Federation of 02.11.2017 No. 176n, which amended Instruction No. 191n (registered with the Ministry of Justice of the Russian Federation on 05.12.2017 No. 49101);

- Order of the Ministry of Finance of the Russian Federation of November 14, 2017 No. 189n, which amends Instruction No. 33n (registered with the Ministry of Justice of the Russian Federation on 12.12.2017 No. 49217).

Changes made by these orders to instructions No. 191n, No. 33n can be conditionally classified into the following groups:

New provisions in terms of general requirements for the preparation and submission of reporting forms to the executive authority acting as a founder;

correction of the rules for drawing up individual reporting forms (f. 0503130, 0503127, 0503128, 0503730, 0503737, 0503738, 0503721);

inclusion in the explanatory note (f. 0503760) of the table "Information on investments in real estate objects, on objects of unfinished construction of a budgetary (autonomous) institution" (f. 0503790, 0503190).

General provisions for the preparation of reporting forms

In terms of making changes to the general provisions of the procedure for drawing up and accounting (budget) forms, it should be noted that the provisions of orders No. 176n and No. 189n introduce similar norms. Let's consider which ones.

Note: accounting forms contain planned (forecast) and analytical (management) indicators.

If there are planned (forecast) and analytical (management) indicators, they are signed not only by the institution, but also by the head of the financial and economic service (if available in the institution's structure) and (or) a person for the formation of analytical (management) information.

The chief accountant signs these forms in terms of indicators formed on the basis of accounting data (new provisions included in clause 5 of Instruction No. 33n, clause 6 of Instruction No. 191n).

When drawing up accounting forms, there are cases when the institution does not have the numerical indicators necessary to fill out the reporting form. Clause 10 of Instruction No. 33n, clause 8 of Instruction No. 191n contain provisions stating that if all the indicators provided for by the financial reporting form, instructions No. 33n, No. 191n do not have a numerical value, this reporting form is not compiled as part of the financial statements for the reporting period is not presented. By orders No. 189n, No. 176n, the provisions of clause 10 of Instruction No. 33n, clause 8 of Instruction No. 191n were supplemented with the provisions that when generating and (or) submitting financial statements by means of automation software systems, accounting documents that do not have numerical values \u200b\u200bof indicators and do not contain explanations are generated and presented with an indication of the mark (status) "there are no indicators".

Note: information on the absence of forms in the financial statements for which the institution does not have numerical data shall be reflected in the textual part of the explanatory note (f. 0503760, 0503160) drawn up for the reporting period.

For healthcare institutions, recipients of budget funds , of interest are the new norms of clause 10 of Instruction No. 191n. This clause is supplemented by provisions stating that:

1) if an institution simultaneously performs several budgetary powers under the budgetary system of the Russian Federation (it is a recipient of budgetary funds, an administrator of budget revenues, an administrator of sources of financing the budget deficit), it generates a single set of budgetary reporting on the totality of its powers;

2) the code of the subject of budget reporting is indicated in the code zone after the variable "Date":

- PBS - the recipient of budget funds (administrator of budget revenues, administrator of sources of financing the budget deficit), the main manager (manager) of budget funds as a recipient of budget funds;

- AD - administrator of budget revenues (in the case of the formation of budget reporting in terms of the exercised powers of administrators of budget revenues, in relation to which the reporting entity does not exercise the powers of the recipient of budget funds);

- RBS - budget funds manager;

- GRBS - chief manager of budgetary funds, chief administrator of budget revenues, chief administrator of sources of financing the budget deficit;

- GLAD - the chief administrator of budget revenues (in the case of the formation of budget reporting in terms of the exercised powers of the chief administrator of budget revenues, in relation to which the reporting entity does not exercise the powers of the recipient of budget funds);

3) budget reporting containing corrections based on the results of a desk audit of budget reporting is submitted by the subject of budget reporting with a cover letter containing instructions on the changes made, in the manner prescribed by clauses 4, 6, 10 of Instruction No. 191n.

For budgetary and autonomous institutions health care are of interest to the new norms of clause 8.1 of Instruction No. 33n In the version of clause 8.1 of Instruction No. 33n that was in force before the entry into force of Order No. 189n of Instruction No. 33n, there was information setting the deadlines for submitting reports to the executive authority performing the functions and powers of the founder (hereinafter - the founder) in terms of information that does not contain state secrets:

no later than 15 working days preceding the deadline for the founder's submission of the annual budget reporting by the relevant chief administrator of the federal budget funds (founder) to the Federal Treasury;

no later than 7 working days preceding the deadline for the founder's submission of quarterly budget reports by the relevant chief administrator of federal budget funds to the Federal Treasury.

Order No. 189n reduced these terms, and instead of 15 days, 10 days were established, and instead of 7 days - 5 days.

The paragraph specifying that the institution must submit monthly financial statements to the founder no later than 6 business days preceding the deadline for submitting monthly statements by the founder has been declared invalid. This is due to the fact that budgetary and autonomous institutions, according to the norms of Instruction No. 33n, do not prepare monthly reports.

Balance (f. 0503130)

For health care institutions, in terms of drawing up a balance sheet (f. 0503130), the norm is that the reflection in columns 4, 7 of the sections "Non-financial assets", "Liabilities", "Financial result" of the balance sheet (f. 0503130) is carried out taking into account the specifics reflection on the corresponding accounts of the working chart of accounts of budget accounting of the subject of budget reporting of accounting objects by type of activity 3 - funds in temporary disposal established by the documents of the accounting entity of budget reporting in agreement with the financial authority.

Report (f. 0503127)

The procedure for filling out this reporting form was supplemented by a provision stating that in column 4 of the "Budget expenditures" section, the recipient of budget funds reflects the indicators of the approved budget allocations brought to him by the main manager (manager) of budget funds, for the reporting period, taking into account the changes: debit turnover on account 1 503 15,000 "Received budgetary allocations of the current financial year", containing in categories 15 - 17 the code of the type of expenditures related to subgroups 310 "Public normative social payments to citizens", 330 "Public normative payments to citizens of a non-social nature" (new provisions of clause 56 of Instruction No. 191n).

Read also

- New in accounting and reporting of institutions since 2017

- We take into account the explanations of the Ministry of Finance when drawing up financial statements for half a year

- Explanations on the preparation of monthly and quarterly budget reporting

- Analysis of errors and violations committed in the preparation of budget reporting

- Explanations of the Ministry of Finance on the preparation of accounting forms

Column 5 of the section "Budget expenditures" by the recipient of budget funds shall reflect the indicators of the limits of budgetary obligations brought to him by the main manager (manager) of budget funds for the reporting period, taking into account the changes: debit turnover on account 1 503 15 000 "Received budget allocations of the current financial year", containing in categories 15 - 17 the corresponding code of the type of expenses.

In addition, Order No. 176n introduced clarifications to the procedure for filling in column 6 of the report (f. 0503127). So, clause 57 of Instruction No. 191n was supplemented with new norms establishing that for lines that do not contain data in column 4, and (or) when performing above-planned indicators (in case of exceeding the indicator in column 8 over the indicator in column 4), column 9 is not filled. For the lines containing in column 4 indicators with a minus sign, the indicator of unfulfilled appointments (in terms of returns of income from the budget) is reflected in column 9 with a minus sign.

Column 9 is not filled in on line 010 "Budget revenues - total". The reasons for the deviation of the amount of unfulfilled appointments reflected in column 9 for the corresponding lines of the "Income" section, which form the final indicator for income, from the difference in the indicators of columns 4 and 8 for line 010 "Budget revenues - total" are disclosed as necessary in the text part of section. 3 "Analysis of the report on the execution of the budget by the subject of budget reporting" of the explanatory note (f. 0503160).

Also column 9 of the section "Sources of financing the budget deficit" not filled in:

according to the lines containing the indicators of the approved (reported) budgetary allocations for the financial year according to the grouping codes of the classification of expenses, sources of financing the budget deficit (column 4);

on the lines of the section that do not contain data in column 4, and (or) if the indicator in column 8 exceeds the indicator in column 4.

Report (f. 0503128)

The new version of clause 70 of Instruction No. 191n established that the completion of column 4 "Approved (brought up) for 20__ budgetary allocations" in terms of the budgetary allocations brought forward is carried out by the recipient of budgetary funds, the administrator of the sources of financing the budget deficit on the basis of debit turnover data in the amount of 1,503,15,000 "Received budgetary allocations of the current financial year", containing in categories 15 - 17 the code of the type of expenditures related to subgroups 310 "Public normative social payments to citizens", 330 "Public normative payments to citizens of a non-social nature."

In addition, Order No. 176n clarified the procedure for reflecting in column 11 of the report (f. 0503128) the amounts of accepted budgetary obligations of the current (reporting) financial year that were not fulfilled as of the reporting date: column 11 reflects an indicator with a minus sign, in the event of a monetary obligation, the costs of which are reimbursed by the FSS in the amount of payments made by the institution as the insured (new edition of clause 70 of Instruction No. 191n).

Also, by Order No. 176n, amendments were made to the procedure for filling in line 911 of the report (f. 0503128). Recall that earlier explanations for filling out this column of the form were contained in the Letter of the Ministry of Finance of the Russian Federation No. 02-07-07 / 21798, Federal Treasury No. 07-04-05 / 02-308 dated 07.04.2017. The provisions of this letter were partially transferred by Order No. 176n to the text of Instruction No. 191n. As a result, clause 72.1 of Instruction No. 191n has been supplemented with the following provisions regarding filling out line 911:

column 7 reflects the sum of indicators (balances) of the corresponding accounts of analytical accounting of account 1 502 99 000 "Deferred obligations" at the end of the reporting period. In this case, the indicators of columns 7 and 11 on line 911 must be identical;

in columns 3 - 6 and 8 - 10, 12 indicators are not filled in.

Report (f. 0503123)

Order No. 176n supplemented the report (f. 0503123) with a new section. 3.1 "Analytical information on the management of balances". It reflects detailed information on the management of the balances indicated in lines 463, 464 of Sec. 3 “Change in fund balances”. Also, Sec. 4 "Analytical information on disposal" of the report (form 0503123).

Report (f. 0503737)

The following additions were made to the completion of this report (new version of paragraphs 41 and 44 of Instruction No. 33n):

the indicator on line 500 of column 10 reflects the difference between the indicators of columns 4 "Approved planned appointments" and 9 "Completed planned appointments, total";

the indicator of line 730 "Change in the balances by the internal turnover of funds of the institution" in column 9 "Completed planned appointments, total" is zero.

Report (f. 0503738)

Changes have been made to the completion of this report aimed at regulating the procedure for filling in line 911 "Obligations of financial years following the current (reporting) financial year, in terms of deferred obligations" section. 3.

When filling out this line, the following ratio of indicators must be observed:

Indicators in columns 4 - 5, 7 - 9, 11 lines 911 are not filled in.

Column 6 on line 911 shall reflect the sum of indicators (balances) of the corresponding accounts of the analytical accounting of account 0 502 99 000 "Deferred obligations" at the end of the reporting period.

Report (f. 0503721)

Order of the Ministry of Finance of the Russian Federation No. 189n set out the provisions of clause 53 in a new edition, completely rewriting them. However, the provisions of this paragraph have not undergone significant changes. In the new edition of clause 53 of Instruction No. 33n, the features of filling in the following lines are of interest:

|

Line number |

Filling feature |

|

The amount of accrued income reflected on account 0 401 10 130 "Income from the provision of paid services" is reflected, minus VAT amounts accrued due to this income (on the debit of account 0 401 10 130). That is, the amounts of subsidies received by the institution under the type of activity code 4 are reflected in this line of the form |

|

|

Columns 5, 6 are not filled in, this line reflects the amount of accrued income on the credit of account 5 401 10 180 "Other income" (income received by the institution in the form of subsidies for other purposes) |

|

|

Columns 4, 5 are not filled in, and column 6 reflects the amount from the account 0 401 10 180 |

|

|

The sum of lines 160, 170, 190, 210, 230, 240, 260, 270 , 280 |

|

|

The difference between credit and debit turnovers on account 0 401 60 200 "Provisions for future expenses" formed during the reporting period is indicated |

In addition, column 5 on lines 030, 050, 060, 062, 063, 096, 101 , 102 , 103, 104 not filled.

Report (f. 0503723)

The provisions of clause 55.1 of Instruction No. 33n were supplemented by Order No. 189n with information stating that column 4 on lines 463, 464, 501, 502 reflects data taking into account the indicators on receipts (outflows) of funds reflected on off-balance accounts 17 “Receipt of funds "And 18" Disposals of funds ", opened to account 0 304 06 000" Settlements with other creditors ", in terms of operations to raise funds to cover the cash gap when fulfilling the obligation within the balance of funds on the personal account of the institution (borrowing funds between activities). Lines 165, 182, 234, 247, 253, 263, 302 - 304, 345, 352, 360 - 363 are not filled.

When filling out sect. 4 "Analytical information on disposal" of the report (form 0503723), it should be taken into account that (clause 55.3 of Instruction No. 33n as amended by Order of the Ministry of Finance of the Russian Federation No. 189n):

in column 5 it is necessary to indicate the corresponding codes of the section, subsection of budget expenditures, based on the functions (services) performed by the institutions;

column 6 reflects additional detailing by analytical codes of disposal in the structure approved by the financial authority of the relevant public law entity.

Explanatory note (f. 0503760)

Information about the conduct of inventories (table 6).

Clause 63 of Instruction No. 33n was supplemented with a provision stating that in the absence of discrepancies in the results of the inventory carried out in order to confirm the indicators of the annual financial statements, table 6 is not filled out. The fact of the annual inventory is reflected in the text part of Sec. 5 "Other activities of the institution" of the explanatory note to the balance sheet of the institution (form 0503760).

Information about the results of the institution's activities on the execution of the state (municipal) assignment (f. 0503762).

When filling out the table, it should be borne in mind that column 7 indicates the costs actually incurred by the institution (the cost of the service (work) for the fulfillment of the state (municipal) task as of the reporting date (in value terms)) (new version of clause 65.1 of Instruction No. 33n). On the line "Total" in columns 5, 7 the total values \u200b\u200bare indicated. Column 7 is not filled in if in column 5 the planned volumes of financial support for the fulfillment of the state (municipal) task for the corresponding type of service (work) in value terms are equal to zero.

Information on accounts receivable and payable of the institution (f. 0503769).

Order No. 189n, clause 69 of Instruction No. 33n supplemented a provision establishing that operations to clarify the codes of the budget classification of the current financial year in the table (f. 0503769) are reflected in column 5 with a minus sign for the specified code and with a plus sign for the revised code (in part of the expenses listed in the form of repayment of accounts payable).

Information about accepted and unfulfilled obligations (form 0503775).

Columns 7 and 8 of the table (f. 0503775) indicate the code and explain the reasons for non-fulfillment of obligations (monetary obligations). The provisions of clause 72.1 of Instruction No. 33n were supplemented by Order No. 189n with codes and their decoding, which should be reflected in these columns. Indicators columns 7 and 8 of Sec. 3 summary information (f. 0503775) are not filled in.

Information about the cash balances of the institution (form 0503779).

The provisions of clause 74 of Instruction No. 33n were supplemented by Order No. 189n with the norms establishing that the formation of the table (form 0503779) is carried out according to the relevant types of financial support for activities (type of activity), for which the institution has data at the beginning and (or) the end of the reporting year about cash balances or for which there are open accounts at the reporting date with credit institutions (financial authority). In the case when during the reporting period there were no transactions with monetary funds for the relevant type of financial support of the activity, the table (f. 0503779) for this type of activity is not formed. The table (f. 0503779) discloses information on the availability of accounts opened by a budgetary (autonomous) institution, including provided that there are zero cash balances on them at the beginning and end of the reporting period.

Information on the execution of court decisions on the monetary obligations of the institution (f. 0503295).

Order No. 189n in a new edition sets out para. 15 p. 74.1 of Instruction No. 33n, which sets the rules for filling out the reference table. After the entry into force of this order, this paragraph will sound like this: the reference table for unfulfilled decisions of the courts of the judicial system of the Russian Federation discloses information about the unfulfilled monetary obligations as of the reporting date under the court decisions of the courts of the judicial system of the Russian Federation (court decisions of (international) courts), reflected in the column 8 information (f. 0503295), indicating:

kOSGU codes (column 1);

the total number of documents not executed by the institution on court decisions (column 2);

the total amount for unexecuted documents (column 3).

Information about investments in real estate objects, about objects of unfinished construction of a budget (autonomous) institution (f. 0503790).

Order No. 189n included this form in the explanatory note (f. 0503790), which was previously contained in the Instructions and the procedure for compiling and submitting additional forms for annual and quarterly financial statements submitted by federal state budgetary and autonomous institutions, approved by Order of the Ministry of Finance of the Russian Federation dated 12.05.2016 No. 60n, and was called information about objects of construction in progress, investments in real estate objects of a budgetary (autonomous) institution (f. 0503790). In the wording of Order No. 189n, form 0503790 is called information about investments in real estate, about objects of unfinished construction of a budgetary (autonomous) institution (f. 0503790). Not only the name of the form has changed, but also the name of the lines, the graph of the form. Note that a similar form (only its number 0503190) is included in Instruction No. 191n by Order No. 176n. Previously, the form was approved by Instruction No. 15n.

Forms 0503790, 0503190 are compiled at the end of the year. They disclose information on capital investment objects, including data characterizing the investments made in real estate (the progress of capital investments (budget investments)), provided in order to form a table (f. 0503790, 0503190) by the structural divisions of the institution responsible for the implementation of capital investments in immovable property, and financial data generated on the corresponding objects of capital investments in the accounting of the institution on the corresponding accounts of analytical accounting of account 0 106 11 000 "Investments in fixed assets - real estate of the institution."

In conclusion, we note that in it we considered the most relevant changes for health care institutions in the procedure for drawing up accounting (budget) reporting forms. For clarifications regarding the reflection in the reporting forms of certain facts of financial and economic activity, we recommend that you refer to the letters of the Ministry of Finance and the Federal Treasury.

real estate explanatory note capital investment

Based on article 165 of the Budget Code of the Russian Federation (Collected Legislation of the Russian Federation, 1998, No. 31, Art. 3823; 2005, No. 1, Art. 8; 2006, No. 1, Art. 8; 2007, No. 18, Art. 2117; 45, Art. 5424; 2010, N 19, Art. 2291), paragraphs 4 and 5 of the Resolution of the Government of the Russian Federation of April 7, 2004 N 185 "Questions of the Ministry of Finance of the Russian Federation" (Collected Legislation of the Russian Federation, 2004, N 15 , Art. 1478; N 49, Art. 4908; 2007, N 45, Art. 5491; 2008, N 5, Art. 411), Federal Law of November 21, 1996 N 129-FZ "On Accounting" (Collection legislation of the Russian Federation, 1996, N 48, Art.5369; 1998, N 30, Art.3619; 2002, N 13, Art.1179; 2006, N 45, Art.4635; 2009, N 48, Art.5711; 2010 , N 19, Article 2291) and in order to establish a unified procedure for drawing up, submission by state (municipal) autonomous institutions and state (municipal) budgetary institutions, I order:

2. This Order does not apply to state (municipal) budgetary institutions, autonomous institutions in terms of operations for the exercise by them in accordance with the legislation of the Russian Federation of powers to fulfill public obligations to an individual subject to execution in monetary form, powers of a state (municipal) customer the conclusion and execution on behalf of the relevant public law entity of state (municipal) contracts on behalf of state authorities (state bodies), state non-budget funds management bodies, local self-government bodies that are state (municipal) customers, when making budget investments in state ( municipal) property, and receiving budgetary investments in capital construction objects of state (municipal) property and (or) for the acquisition of real estate objects of state (m municipal) property in the manner prescribed for recipients of budget funds, as well as in the implementation of the most significant institutions of science, education, culture and health, specified in the departmental structure of budget expenditures, in terms of operations to exercise their powers of the main manager of budget funds.

Instructions

on the procedure for drawing up, submitting annual, quarterly financial statements of state (municipal) budgetary and autonomous institutions

(approved by order of the Ministry of Finance of the Russian Federation of March 25, 2011 N 33n)

1. State (municipal) autonomous institutions, state (municipal) budgetary institutions (hereinafter for the purposes of this Instruction - institutions) draw up and submit annual, quarterly financial statements in the forms according to this Instruction (hereinafter for the purposes of this Instruction - financial statements).

2. Financial statements are prepared by institutions for the following dates: quarterly - as of April 1, July 1 and October 1 of the current year, annual - as of January 1 of the year following the reporting year.

For newly created institutions, the first reporting year is the period from the date of their registration in accordance with the procedure established by the legislation of the Russian Federation until December 31 of the year of their creation.

For a state (municipal) budgetary, autonomous institution created during a financial year by changing the type of state (municipal) government institution, the first reporting year for which financial statements are generated in accordance with this Instruction is the period from the moment of the type change to December 31 year of its creation.

For a state (municipal) budgetary, autonomous institution, in respect of which a decision was made during the financial year to change its type in order to create a state (municipal) government institution, the reporting year for which financial statements are generated in accordance with this Instruction is the period from the beginning of the financial year in which the said decision is made (from the date of registration in accordance with the procedure established by the legislation of the Russian Federation when creating a state (municipal) budgetary, autonomous institution; from the moment of creating a state (municipal) budgetary, autonomous institution by changing its type) and until the moment of change type of state (municipal) budgetary, autonomous institution for a state institution.

5. The financial statements should include indicators of the activities of all divisions of an economic entity, including its branches and representative offices, regardless of their location.

The financial statements are signed by the head and chief accountant of the institution. Financial reporting forms containing planned (forecast) and analytical indicators are also signed by the head of the financial and economic service (if available in the structure of the institution) and (or) the person responsible for the formation of analytical information.

In the event that the head of the institution, in accordance with the legislation of the Russian Federation, transfers the accounting and compiles reports on its basis under an agreement (agreement) to another state (municipal) institution, organization (hereinafter referred to as centralized accounting), accounting statements are drawn up and submitted by centralized accounting on behalf of the institution to in the manner prescribed by this Instruction. The financial statements compiled by the centralized accounting department are signed by the head of the institution that transferred the accounting, the head and the accountant-specialist of the centralized accounting department, carrying out the accounting.

Submission by the centralized accounting department of the financial statements of the institution in respect of which the centralized accounting conducts accounting, to the users of the accounting statements is carried out in agreement with the head of the said institution.

6. The financial statements are submitted by the institution to the state authority (state body), the local self-government body exercising the functions and powers of the founder (hereinafter referred to as the founder) in relation to the institution, or by decision of the financial body of public law formation, from the budget of which the institution is provided with a subsidy, to the specified financial body on paper and (or) in the form of an electronic document, with submission on electronic media or by transmission via telecommunication channels within the time frame established by the founder (financial body).

The founder, when determining the procedure for the provision of financial statements by an institution in the form of an electronic document on electronic media or by transmission via telecommunication channels, provides for mandatory requirements for the formats and methods of transferring financial statements in electronic form, corresponding to the mandatory requirements for formats and methods of transferring budget statements in electronic form, the approved financial authority of public education, from the budget of which the institution is provided with a subsidy (hereinafter referred to as the relevant financial authority), as well as provisions on the mandatory provision of information protection.

Financial statements on paper are submitted on behalf of the institution by the chief accountant of the institution or by the person responsible in the institution (in the centralized accounting department) for accounting, preparation and presentation of financial statements, in a bound and numbered form with a table of contents and a cover letter.

The founder, another user of the financial statements does not have the right to refuse the institution to accept its financial statements and, at the request of the representative of the institution, on the cover letter provided for in this paragraph, as well as in the upper left corner of the title page of the Balance sheet of the state (municipal) institution (Separation (liquidation) balance sheet of the state ( municipal) institution) puts a mark on the receipt of the financial statements of the institution, containing the date of receipt, position, signature (with decoding) of the responsible executor of the founder. If the institution submits financial statements via telecommunication channels, a notification of the receipt of financial statements is sent to the institution in the form of an electronic document.

The date of submission of financial statements is considered the date of its sending via telecommunications channels or the date of the actual transfer of ownership.

If the date of submission of the financial statements of the institution, established by the founder, coincides with a holiday (day off), the financial statements are submitted by the institution no later than the first business day following the established day of submission.

7. An autonomous institution submits to the founder, another external user of the reporting, in addition to the annual financial statements, information on its consideration by the supervisory board of the autonomous institution in accordance with the current legislation of the Russian Federation.

8. The relevant financial body, the founder has the right to establish additional forms and the procedure for their preparation and presentation for submission as part of quarterly, annual financial statements.

9. Financial statements are drawn up on the basis of data and other accounting registers established by the legislation of the Russian Federation for institutions, with the obligatory reconciliation of turnovers and balances in analytical registers with turnovers and balances in synthetic accounting registers.

The data reflected in the annual financial statements of the institution must be confirmed by the results of the inventory of assets and liabilities carried out by the institution in the manner established by it as part of the formation of the accounting policy.

Instruction No. 33n was amended by Order of the Ministry of Finance dated 07.03.2018 No. 42n. Download Instruction 33n on budget accounting in 2018 in the latest edition, and you can also find out all the changes in our article.

Instruction 33n on budget accounting in 2018 with the latest changes

The latest changes to Instruction 33n were made by Order of the Ministry of Finance dated 07.03.2018 No. 42n:

Download Instruction 33n in the latest edition of 2018 with all approved changes.

Useful material in the article

33n Instruction on the procedure for drawing up and submitting annual reports

33n Instruction on the procedure for drawing up and submitting annual reports

Prior to that, the Ministry of Finance amended the Budgetary Accounting Instruction No. 33n dated March 25, 2011 by Order No. 189n dated November 14, 2017 (entered into force on December 24, 2017):

- Reduced the terms of reporting that institutions submit through the GIS "Electronic Budget". For annual reporting from 15 to 10 working days, for quarterly - from 7 to 5 working days. The paragraph about the terms of monthly reporting was declared invalid.

- Introduced a new form of Information on objects of construction in progress, investments in real estate objects of a budgetary (autonomous) institution (f. 0503790) and the procedure for filling it out.

- It was clarified that in the Statement of Financial Results (f. 0503721) the subsidy for the state order must be reflected on line 040 and KOSGU 130.

- We added that in section 3 of the cash flow statement of the institution (f. 0503723) borrowing of funds on account 304.06 will have to be reflected in turnover on 17 and 18 off-balance sheet accounts on lines of changes in balances 463, 464, 501 and 502.

- electronic formats;

- methods of electronic transmission of such reports.

- as of January 1, 2018;

- on an accrual basis from January 1, 2017;

- in rubles with an accuracy of two decimal places after the decimal point.

- to its founder;

- to the financial authority of a public legal entity, from the budget of which the institution is provided with a subsidy (hereinafter - the financial authority), if the said authority makes such a decision);

- tax office at the location of the institution (head institution).

- founder (financial authority);

- tax legislation (no later than three months after the end of the reporting year).

Special issue of the journal "Salary in the institution". Available for download!

Find out now:

☑ When is it more profitable to go on vacation in 2018

☑ How to reduce the fine for SZV-M without trial

☑ How to include bonuses in vacation pay

The procedure for presenting financial statements in 2018

Financial statements are submitted by state (municipal) budgetary and autonomous institutions in paper or electronic form. Submitted to a government body (government body), a local government body exercising the functions and powers of the founder in relation to the institution.

The annual financial statements for 2017 are submitted by April 2, 2018, because March 31st is a day off.

Quarterly financial statements are prepared as of April 1, July 1 and October 1 on an accrual basis from the beginning of the current financial year. If the date for submitting reports set by the founder falls on a weekend or a holiday, the deadline is postponed to the next first business day.

The reporting should include indicators of the activities of all divisions of the entity, including branches and representative offices. The documents are signed by the head and chief accountant of the institution.

If the indicators of the form do not have a numerical value, such a form shall not be drawn up or submitted. But it is necessary to describe this in the textual part of the Explanatory Note to the Balance of the institution (f. 0503760).

If you file reports using electronic programs, empty forms are generated and provided with the mark “indicators are missing”. For more information on how to do this, read the article in the journal Institutional Accounting.

The founder can establish additional forms and the procedure for their preparation in the reporting.

Accounting and budgetary reporting figures must be disclosed. To do this, regularly publish information in electronic form on the Internet - on your website or other resource.

Composition of financial statements for the 1st quarter of 2018

Please note that forms 0503738 and 0503769 for 1 quarter are not submitted. This follows from the Order of the Ministry of Finance dated 03/07/2018 No. 42n and the letter of the Ministry of Finance and the Federal Treasury dated 03.19.2018 No. 02-06-07 / 16938, 07-04-05 / 02-4382.

Information (f. 0503295);

other information specified by the founder.

Additional reporting forms:

Composition of financial statements for the 2nd quarter of 2018 (half-year)

Information (f. 0503769): the order of filling is given in paragraph 69 of Instruction 33n;

Information (f. 0503779);

Electronic reporting according to Instruction No. 33n

Until now, institutions form financial statements in order to personally provide them to recipients on paper. If, nevertheless, the accountant unloads the reporting in the form of an electronic document, then he still goes to report in person, with the presentation of such a document on electronic media.

An electronic document does not have to be loaded onto a USB flash drive or, even worse, onto a floppy disk.