Find out everything about the company. Counterparties cannot hide: how to find out the company's revenue by TIN and on the Internet? What information about the organization can be found by TIN

If there is no time to search on different sites, all information about the counterparty can be obtained in one place. Use the service "" (https://rnk.1cont.ru/), which was developed by the magazine "Russian Tax Courier".

Right now, you can check a counterparty by TIN for free in the "Counterparties" program (by demo access).

Check counterparty by TIN for free

Find out all about the counterparty

The Federal Tax Service can wrap up the deal and remove money from expenses if the simplified person did not show the so-called “ due diligence when choosing a counterparty". The partner must be "clean" according to the Unified State Register of Legal Entities, pay taxes on time and in the proper amount, and not be a one-day trip. Our service will give full information about your partner as the FTS sees it.

An additional advantage of the service - you will find out if the counterparty has cases in arbitration and whether bailiffs are digging for it. You can also trace the chain of links between the counterparty with other firms and check if they are fake.

State contracts and licenses of all companies are available in our card index. For example, if you buy alcohol, find out if the supplier has a license.

Another important option - you can find out if the company is being checked: tax, labor, etc.

Subscription cost

To use the service, subscribe. During the subscription period, it will be possible to check any number of counterparties.

Under the new law, counterparties must be checked every time before a deal. In order not to check every day of the statement, just find your partners and click the button " Track changes"- if the tax authorities suddenly suspect the company of unreliability, you will immediately receive a message in your personal account.

The FTS announced on its website that it had flagged 800,000 companies as unreliable, and it became dangerous to work with them. These tags are in our service. Therefore, you can check all partners and put them under control in one click.

The editorial staff of the Russian Tax Courier magazine made a service especially for accountants and managers. We have implemented the principle of traffic lights: the counterparty is highlighted red(you can't work) yellow(need to check) or green(safe to work with) color. And you do not have to be an advanced computer user or understand the intricacies of article 54.1 of the Tax Code of the Russian Federation for due diligence.

If there is no time to search on different sites, all information about the counterparty can be obtained in one place. Use the service "" (https://rnk.1cont.ru/), which was developed by the magazine "Russian Tax Courier".

Right now, you can check a counterparty by TIN for free in the "Counterparties" program (by demo access).

Check counterparty by TIN for free

Find out all about the counterparty

The Federal Tax Service can wrap up the deal and remove money from expenses if the simplified person did not show the so-called “ due diligence when choosing a counterparty". The partner must be "clean" according to the Unified State Register of Legal Entities, pay taxes on time and in the proper amount, and not be a one-day trip. Our service will give full information about your partner as the FTS sees it.

An additional advantage of the service - you will find out if the counterparty has cases in arbitration and whether bailiffs are digging for it. You can also trace the chain of links between the counterparty with other firms and check if they are fake.

State contracts and licenses of all companies are available in our card index. For example, if you buy alcohol, find out if the supplier has a license.

Another important option - you can find out if the company is being checked: tax, labor, etc.

Subscription cost

To use the service, subscribe. During the subscription period, it will be possible to check any number of counterparties.

Under the new law, counterparties must be checked every time before a deal. In order not to check every day of the statement, just find your partners and click the button " Track changes"- if the tax authorities suddenly suspect the company of unreliability, you will immediately receive a message in your personal account.

The FTS announced on its website that it had flagged 800,000 companies as unreliable, and it became dangerous to work with them. These tags are in our service. Therefore, you can check all partners and put them under control in one click.

The editorial staff of the Russian Tax Courier magazine made a service especially for accountants and managers. We have implemented the principle of traffic lights: the counterparty is highlighted red(you can't work) yellow(need to check) or green(safe to work with) color. And you do not have to be an advanced computer user or understand the intricacies of article 54.1 of the Tax Code of the Russian Federation for due diligence.

It is necessary to check the LLC - the counterparty in order to avoid additional taxes. This can be done via the Internet - there are several services. The article contains everything for verification, incl. free online forms.

Today there is only one online service for checking a company - a counterparty, which provides access to all information about its activities and forms a complete dossier on the company. This is the "Chief Accountant: Checking Contractors" service. Try it for free

Check counterparty online

Why is it important to check a counterparty company

If your counterparty violates tax laws and regulations, this fact alone will not result in a refusal to deduct VAT or charge expenses. Tax risks arise when there is a set of circumstances indicating that the counterparty firm is behaving in bad faith, and a detailed and thorough due diligence of the firm has not been carried out. In this case, additional taxation becomes a reality.

To minimize tax risks, it is necessary to check the counterparty company via the Internet and collect information about its actual activities.

For what questions to check the company on the Internet

In order for the audit of the company to be recognized as exhaustively complete, when accessing online services, you need to collect not only information about the counterparty itself, but also information about:

- the subject of the transaction;

- counterparty registrations;

- his financial position;

- its management and owners.

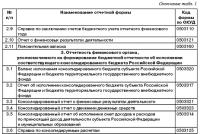

In other services, you can get additional information about the partner. For a list of information and online services where the required data is available, see Table 1.

| P / p No. | What to find out when checking a company | Where to get information |

| general information | ||

| 1. | Is the counterparty registered as a legal entity or individual entrepreneur | FTS service at egrul.nalog.ru |

| 2. | Is the information about him reliable in state registers | FTS database egrul.nalog.ru |

| Counterparty reliability | ||

| 3. | Financial condition according to annual financial statements |

Rosstat service at www.gks.ru/accounting_report Check accounting |

| 4. | Are there any outstanding tax debts? | FTS database service.nalog.ru/zd.do |

| 5. | How often does the counterparty sue? |

|

| 6. | Is enforcement proceeding under the counterparty's debts |

The base of the Federal Bailiff Service at fssprus.ru |

| 7. | Whether the counterparty is considered a dishonest supplier |

Service of the Federal Antimonopoly Office zakupki.gov.ru/epz/dishonestsupplier/quicksearch/search.html |

| 8. | Whether the counterparty is undergoing bankruptcy proceedings |

Unified federal database at bankrot.fedresurs.ru |

| Counterparty registration | ||

| 9. | Whether the counterparty is in the process of reorganization or liquidation |

Unified State Register se.fedresurs.ru/Companies |

| 10. | Does he face an exclusion from the Unified State Register of Legal Entities |

Unified State Register at se.fedresurs.ru/Companies |

| Director and owners of the counterparty | ||

| 11. | Real or "mass" leader |

Service of the Federal Tax Service for checking the "mass" of directors service.nalog.ru/mru.do |

| 12. | Does the director have the right to work in this position |

Online service of the Federal Tax Service for verifying the disqualification of managers at service.nalog.ru/disfind.do |

| 13. | Does the director of the counterparty have the right to sign documents |

FTS service service.nalog.ru/svl.do |

| 14. | Is the director's passport valid |

Database of invalid passports of Russian citizens on the website of the Migration Department of the Ministry of Internal Affairs at services.fms.gov.ru/info-service.htm?sid=2000 |

| Other information | ||

| 15. | Do foreign nationals have work permits or patents |

Base at services.guvm.mvd.rf /info-service.htm?sid=2060 |

| 16. | Are there any encumbrances on the acquired property (collateral, mortgage, etc.) |

|

When accessing the listed online services, in order to subsequently confirm that the company was checked, we recommend that you always make a screen from the screen on which you can see the results of the checks issued by the services.

Checking the legal entity by TIN on the FTS website

The following service allows you to check a company in terms of whether it is registered as a taxpayer:

It is not difficult to use the service, just follow the following algorithm.

Step 1. Select the search category - legal entity or entrepreneur / farm.

Step 2. Enter:

- either the name of the company, TIN or OGRN;

- or the full name of the entrepreneur / head of the farm, region, OGRNIP or TIN.

Step 3.

Step 4. Click the Find button.

How to understand the result of an online audit and in what cases there is a tax risk, read in Table 2.

Table 2. Legal entity verification by TIN

| P / p No. | Online check result | Risk explanation |

| 1. | No details found | The counterparty is not registered as a legal entity or individual entrepreneur |

| 2. | An extract was received with a mark in the section "Information about the founders (participants) of the legal entity" | Information about the owners of the counterparty is unreliable |

| 3. | An extract was received with a mark in the section "Address (location)" | Incorrect counterparty address specified |

Check the company for financial stability

The following free Rosstat service allows you to familiarize yourself with the accounting statements in order to check a legal entity:

To get the annual accounting of the counterparty, follow the following algorithm.

Step 1. Indicate for what period you want to receive reports, starting from 2012.

Step 2. Enter the TIN of the legal entity.

Step 3. Select the response format (display, generate Word file or Excel file).

Step 4. Enter the verification characters from the picture.

Checking a company for tax arrears

The following service allows you to check a company for free in terms of outstanding tax debts:

To get the information you want, follow a simple algorithm.

Step 1. Enter the verification characters from the picture.

Step 2. Enter the TIN of the legal entity or entrepreneur.

Step 3. Click the Search button.

If a counterparty is found, it means that either he has tax debts, or he has not submitted reports for more than a year. That is, there is a real risk of the counterparty's insolvency.

Inspection of a company for bankruptcy

To find out whether a bankruptcy procedure is underway against a counterparty, you can use the "advanced search" function for free in a single federal database:

The algorithm of actions is simple.

Step 1. In the "Search for debtors" menu, select the "advanced search" option.

Step 2. Fill in the fields "Name", "Address", "Region", "Category" and "Code". In the field "Code" you can enter OKPO, TIN or OGRN.

Step 3. Click the Search button.

How to check a legal entity in relation to its manager and owners

The free service of the Federal Tax Service will help to remove the risk of “mass” the director of the counterparty or its founders:

You can check the leader in four steps.

Step 1. Select a search category - manager or founder (member).

Step 2. Enter the TIN and full name of the person being checked.

Step 3. Enter the verification characters from the picture.

Step 4. Click the Find button.

The service will show whether the person being verified is a director or owner of several companies.

How to check an LLC using open data

From August 1, 2018, a new free service of the Federal Tax Service "Transparent Business", designed to check a company or an entrepreneur, has been operating. The volume of information issued will increase over time. Read about this in table 3.

Table 3. How to check a legal entity

| date | What information will be available |

| August 1, 2018 |

|

| October 1, 2018 |

|

| December 1, 2018 |

|

- Find out how to check IP >>

- Find out statistics codes online by TIN >>

- Find out how

According to the TIN or OGRN of the company, you can check for its participation in arbitration cases. Lawyers also find information on accounting reports, tax arrears and other important information for the transaction using the TIN.

When preparing materials, we use only information

Read in the article

Before concluding an agreement with the organization, check the future counterparty for the presence of arbitration processes on specialized sites - according to his TIN, the system will show:

- does this LLC or other legal entity have? person claims;

- in what status the enterprise participates in arbitration;

- at what stage of the proceedings did the arbitral tribunal stop.

How exactly to check the organization for arbitration depends on the specific site, but the principle is the same everywhere: after you enter the INN yul. person, information about the court cases and claims of this company will be available, on the basis of which you will be able to predict the behavior of the counterparty in the event of an arbitration dispute.

Why check a company by TIN

When an organization enters into a transaction, it takes on the legal and commercial risks. Company lawyers should anticipate and limit them if possible. To do this, they check the counterparty with whom they plan to sign an agreement. If lawyers discover dubious circumstances, the company's management may refuse an unreliable partnership. It is necessary to find out whether the counterparty is in a state of bankruptcy, whether it is dishonest, whether it belongs to one-day firms, etc. Lawyers should study information about the counterparty:

- find out the status of accounting statements;

- determine if there is tax debt;

- check the company for arbitration and identify cases of unfair performance of obligations;

- clarify if there is any enforcement proceedings against the company;

- determine if the company's management is included in the list of mass directors, and the legal address is not included in the list of mass addresses;

- confirm the authority of the representative to conclude a transaction, etc.

Legal Aids

How to check a company by TIN

Information about a company can be found on the Internet if its TIN or OGRN is known. You can check the company by TIN on some state resources, they provide the necessary information for free. The search option by INN or PSRN is present:

- on the website of the Federal Tax Service of Russia,

- in the file of arbitration cases,

- in the register of inspections of the General Prosecutor's Office,

- in the register of personal data operators,

- to the register of reliable partners of the RF CCI and some other resources.

For example, to check a company by TIN on the website of the Federal Tax Service of Russia nalog.ru, you need to enter the number in the search field in the section "Business risks: check yourself and the counterparty". On the website of the tax office you will find out:

- information about the company in the Unified State Register of Legal Entities,

- information on the address and manual,

- status of tax arrears, etc.

To check an enterprise on TIN for arbitration and to understand whether there are claims against it, go to the website of the arbitration case file. Here you can check the TIN company for free in the courts. To do this, enter the number immediately on the main page. The same field is intended for the registration number, if you want to check the company by OGRN.

A detailed check of the counterparty is necessary, but it has a significant disadvantage: it takes a lot of time to collect and analyze information from different sources. You need to contact each resource, and also confirm that you checked the counterparty with it - you will need to request documents, etc. The websites of government organizations will provide data on the company for free, but working with them requires a lot of time and attention.

How to check the company for arbitration cases using the TIN in the service "Lawyer of the company Counterparties"

The presence of some tabs depends on the availability of information on this section in the database. So, if there is no information about the participation of the organization in arbitration cases, such a tab will not appear after searching by TIN. If there is information, it will be available.

After entering the TIN and loading the page in the "Arbitration" section, you can:

- check in what cases and in what status the company is involved in disputes;

- find out its index of judicial activity, this helps to predict the behavior of the counterparty in the arbitration court.

By clicking on the "Arbitration" section, a page of judicial statistics on this company appears. It has two tabs: "Arbitration cases" and "Index of judicial activity".

The judicial activity index shows:

- how often the company appears in disputes and in what capacity,

- whether the process is delaying,

- is he actively behaving,

- how well her lawyers are preparing for the proceedings,

- the total amount of all claims and the average amount in dispute,

- the average duration of each process,

- statistics on current affairs.

The results for this company are being compared with judicial statistics for its region. In addition to data on the counterparty, you will receive:

- information about the period of the greatest judicial burden;

- an expert's recommendation on what to expect from this opponent in the arbitration court.

This information can be used, among other things, in preparation for the process.

TIN Search Shows Arbitration Data

Filters are available on the "Arbitration cases" tab in the left column:

- by the role of the counterparty in the dispute (plaintiff, defendant, third party);

- by types of cases (rent, purchase and sale, provision of services, contract, taxes, bankruptcy, etc.);

- by years - if the company is large, has existed for a long time and judicial activity is high, an archive may accumulate over several years.

The right column displays a list of to-do items according to the specified filter. To view the progress of a specific case, click the "Details" button. Judicial acts are available for download in PDF format.

If the search for arbitration cases by TIN or other data of the future counterparty showed that he is often sued, this is a sign of risk. There is a good chance that such a company is not fulfilling its obligations.

Doing business is inextricably linked with the constant risk of working with unreliable companies.

In the worst case, this can lead to large material losses.

The Federal Tax Service will help you avoid such consequences.

Every resident of our country, every natural or legal person, has one common identification identifier - TIN.

An individual taxpayer number allows you to calculate taxes, and can also be used to search for the necessary data.

Therefore, the knowledge of how check the company by TIN, can be useful to every entrepreneur.

What is TIN?

TIN - individual taxpayer number.

A unique combination of 12 digits that defines the registration number of all state taxpayers in the register of individuals (legal entities).

It is possible only at the age of 14 by writing an application to the regional tax office.

What should an entrepreneur know about a TIN?

It is important that each organization registered in the register of the Federal Tax Service has its own TIN code.

Using the TIN, you can determine the publicly available information about the company:

- title;

- place of physical and legal registration;

- the presence of debts to the state;

- the size of the company's assets;

- business profitability;

- debts to other counterparties;

- the presence of court proceedings, in which the audited company is a participant.

The list is impressive - isn't it?

But, as in any other legal process, there are subtleties here, which you will learn by reading the article to the end.

Situations requiring verification of the organization by TIN

Inexperienced entrepreneurs often make a very gross mistake, considering checking a potential partner an unnecessary operation.Often, most bankrupt enterprises fell to this level due to illogical and inappropriate managerial behavior.

The basis of entrepreneurial activity is interaction with partners on favorable terms.

But can you be completely sure of the status of your counterparty when making a deal?

The obvious answer is no.

Situations requiring firm verification:

- Carrying out financial transactions between enterprises.

- Drafting cooperation agreements.

- Providing legal assistance to the organization.

There are several dozen other special cases that require verification. But all of them can be combined under the wording "financial transactions".

How to check a company by TIN using online services?

In the twenty-first century - the century of technical breakthrough - there is no need to even get out of your chair when you need to check.You only need two things: a computer and internet access.

The reader might be thinking, “How can I trust online services? What if there is inaccurate data? "

In order not to raise such questions, the Federal Tax Service has created its own state resource - https://www.nalog.ru.

There is no point in doubting its reliability, all site content is carefully checked by the tax authorities themselves.

The purpose of creating such a service is to bring the entrepreneur closer to the Federal Tax Service.

You can check the structure you are interested in only after registering on the portal, after which you should follow the link - https://www.nalog.ru/rn77/related_activities/registries/, where you will see the following picture:

The arrows indicate the zone for determining the search parameters, in simple language - the menu items.

The user can select the data he needs from an extensive database of tax authorities.

We must not forget about one small, but very important detail: data on financial transactions cannot be instantly updated in the FTS database.

If you re-check a counterparty with whom you interact, and the updates did not appear during the day, you should not immediately accuse him of cheating.

To get started, contact the portal support center and report a problem situation.

Other resources for checking a company by TIN

To determine information on TIN, you can use other Internet resources, such as:

The accuracy of the data when checked on the indicated sites cannot be 100% guaranteed.

On the other hand, such resources do not have any benefit from deceiving ordinary users, since clients provide them with income.

A huge plus of checking a company by TIN using online services is the amount of information received.

Using paid systems, you can learn literally everything about the company.

Starting with outstanding debts, ending with the composition of the family and the smallest nuances of doing business.

For “old school” entrepreneurs, there are other ways to check enterprises using the TIN.

How to check a company by TIN in a representative office of the Federal Tax Service?

In order to find out information about the counterparty, you can simply visit the regional office of the Federal Tax Service, taking your passport with you as an identity card.For greater convenience, it is necessary to schedule an appointment in advance by discussing this issue by phone with representatives of the tax service.

First of all, an entrepreneur may be interested in the place of registration of a legal entity, the reliability of the documentation, and the financial reliability of the company.

The TIN by itself does not represent information about the company. Federal Tax Service officials use it as an identifier for the database.

That is, according to the numbers that make up the TIN, you will not be able to disclose all information about the company's debt to its counterparties and other details.

To determine the status of an organization, it is found in the register of the Unified State Register of Legal Entities or the Unified State Register of Legal Entities, the necessary information is selected, and search queries are made in the databases of the State Pension Fund and banking structures.

The presence of cases in arbitration courts is another factor that may interest counterparties. It can be easily determined by analyzing court claims by TIN (this procedure is also carried out using the methods described above).

If you contact the Federal Tax Service in person, the chances of an error in compiling a search query are clearly reduced.

If you are not completely confident in your abilities, you should contact the regional tax office.

This solution will eliminate the problems of counterparty identification.

Data protection for entrepreneurs

Every entrepreneur reading this article might have some concerns about the excessive openness of data to others.It is necessary to note a very important point: without the consent of the management structure of the counterparty enterprise, it is simply impossible to find out the entire list of data you are interested in.

Without the permission of the director of the audited organization, you will be able to find out only a few facts about his activities, namely the following:

- Does the person conduct business?

- Name and location of the legal entity.

- The presence of claims related to an enterprise or an individual.

To access other information, you must notify the counterparty and request permission.

In the event of a refusal, it is worth considering: is there any point in doing business with such an entrepreneur?

The video shows how to find out the TIN of an enterprise through the FTS website:

TIN search analysis

In the article, you learned two ways to find information about a company using the TIN code of the company.By the way, the TIN itself can be found on the same services presented above.

To do this, it is enough to enter the name, and in some cases - additional information about the company.

Which of the following search methods is the best? You can draw conclusions for yourself by studying the comparison table:

| Criterion | Online services | Visit to the department of the Federal Tax Service |

|---|---|---|

| Comfort | Very comfortable, does not require much time and effort. | Loses to a competitor, since the method will require spending time and effort on a visit to the Federal Tax Service. |

| Informativeness | Used correctly, online services are a great source of information. | Informational content at the highest level, employees will provide a complete data package. |

| Credibility | Only the official services of the Federal Tax Service are 100% reliable. | Data reliability at the highest level. |

| Price | There are paid online services, the cost can range from 500 to 3,000 - 4,000 rubles. | Completely free service. |

After reading the article, you should not have a question left, how to check a company by TIN.

All available paths and services are reviewed.

The choice of the most suitable is yours.

One general conclusion can be drawn: do not regret and take an hour or two to thoroughly check your partner.

This step will never be superfluous + can save you from unpleasant surprises and financial losses.

Helpful article? Don't miss new ones!

Enter your e-mail and receive new articles by mail