What reports does an individual entrepreneur submit to sleep. How to keep an individual entrepreneur's accounting department: step-by-step instructions. Accounting IP for beginners. SP on a patent

Any individual entrepreneur knows firsthand how important it is to make timely contributions to the tax service. At the same time, forgetting about the importance of tax reporting.

Despite the fact that this is an equally serious responsibility, many, more often out of inexperience, forget to submit documentation to the appropriate services on time.

As a result, they receive substantial fines.

To prevent such situations in the future, you should familiarize yourself in advance with the list of forms and the deadlines for their submission.

Reporting for individual entrepreneurs on the simplified tax system, UTII with an empty state in 2019

Those who are just starting their business are wondering about the choice of a tax payment system. The choice comes between two special modes: USN and UTII.

Each of them has a number of special characteristics that must be taken into account in order not to miscalculate and to reduce the payment of taxes to the maximum.

The most common tax payment regime created for small and medium-sized businesses is the STS.

When applying this system of paying taxes, it is necessary to independently pay advance payments without delay. The tax is paid at the end of the current year in accordance with Article 346.21 of the Tax Code.

Calendar of payments and submission of documents for the simplified tax system in 2019.

At the end of their activities, an individual entrepreneur, in any case, must provide the last declaration for the last month of work by the 25th day.

The assurance of the KUDiR in the tax authority was abolished, but this does not mean that it does not need to be maintained. It should be sewn and numbered by any individual entrepreneur.

The business owner has the opportunity to choose the object of taxation:

- Pay 6% of total income and reduce tax on insurance contributions;

- Pay 15% of the amount received when deducting expenses from income.

Choosing the simplified tax system and paying 6% of income with an empty state, an individual entrepreneur has the opportunity to significantly save on paying tax on insurance premiums. Moreover, in an amount reaching 100%.

then the right becomes available if insurance premiums are almost fully credited to the account of the Pension Fund of the Russian Federation.

When the taxable amount becomes the deduction of expenses from income, the fully paid insurance premiums cut the tax base.

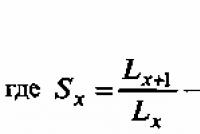

UTII is a tax payment regime in which the amount of payments is calculated on the potential income that can be obtained from permitted activities without taking into account the actually received monetary or material values. A feature of this method is the accounting of exclusively physical indicators, such as a retail space, parking area.

The larger they are, the greater the taxable income potential. When choosing UTII, the tax will have to be paid regardless of the profit received or the conduct of business, however, with an increase in income, the tax will remain fixed.

Reporting in this taxation regime has a number of special characteristics and its filing dates:

- KUDiR - is not needed, it can be omitted;

- tax return must be submitted by the 20th in all of the four quarters (20 Apr 2019, 20 Jul 2019, 20 Oct 2019, 20 Jan 2020).

Submission of reports is carried out at the tax service department at the actual place of business, and in the implementation of several types - at the place of residence:

- services for the movement of goods or transportation of passengers;

- trade related to the delivery or distribution of goods;

- advertising in vehicles.

It is necessary to keep records of physical indicators.

There are no strict rules in the legislation for this clause. For example, a lease or sublease document is provided for the metric “retail area”.

The total area of the occupied premises is prescribed, how much space is directly used for work, and how much is reserved for utility rooms.

List of tax reports required by individual entrepreneurs at OSNO 2019

The general tax regime is considered the most burdensome and complex. In order to understand the volume of tax reporting and the payment of taxes on OSNO, you often need to contact a specialist. However, this complexity hides significant benefits for some individual entrepreneurs.

There are no restrictions on activities, staff size or income received in this system. Individual entrepreneurs have the right to choose simultaneously with OSNO, UTII or.

The general taxation system is beneficial to apply in several cases:

- Partners and buyers also use OSNO and pay VAT. By paying VAT by suppliers and contractors, you can reduce personal value added tax.

- OSNO partners can also deduct input VAT, as a result of which the entrepreneur's competitiveness increases, based on the profitability of cooperation with him.

- When importing goods, paid VAT can be returned as a deduction.

Those who apply OSNO must provide the following reporting:

- Declaration in form 3-. It is provided once a year until Apr 30. 2019;

- Declaration of estimated income in the form of 4-NDFL.

Created to carry out calculations of advance payments of personal income tax.

This declaration is submitted within a period of up to five days after the expiration of the month in which some income was received.

All individual entrepreneurs, without exception, draw up this document: both those who just started their activities, and those who took a break from work and, accordingly, had no income, and then resumed their activities. An increase and decrease in annual income by more than 50% does not affect the provision of the document.

IE reporting required by the tax authorities in the presence of employee benefits

The emergence of a staff of workers obliges the individual entrepreneur to provide a number of new reporting forms.

Be sure to submit the data entered in the 2-NDFL form for the previous year by April 1.

For the FSS, it is necessary to provide the calculation of data in the 4-FSS form. By the 20th day of the month following the reporting period, it is necessary to submit information on paper.

For the FSS, it is necessary to provide the calculation of data in the 4-FSS form. By the 20th day of the month following the reporting period, it is necessary to submit information on paper.

The electronic version of the document is provided until the 25th day of the month after the reporting period.

For the PFR, there is its own form for submitting data - RSV-1 (Resolution of the Board of the PF RF dated 01.16.2014 No. 2p). The paper version of the document is provided by the 15th, the electronic - by the 20th day of the month following the reporting period.

January 20, 2019 is the last day to send information on the average headcount of the enterprise.

In 2019, entrepreneurs have a new reporting form related to information about insured persons. It is provided monthly to the Pension Fund in the SZV-M form.

Reporting on statistics in 2019 for individual entrepreneurs

The report to Rosstat contains information on the activities of an individual entrepreneur, the number of employees, salaries, and the level of financial and economic activities.

The study of statistics can be continuous or selective. The first is held every five years on the basis of Article 5 of Law No. 209-FZ. This statistical observation fell on 2019, therefore, by April 1, it is necessary to fill out the appropriate form (No. MP-sp, IP - form No. 1-entrepreneur) and send the data to Rosstat.

There are a lot of such forms, therefore it is important to clarify the correct one with the regional representative of the federal service. Selective - held every year for micro-enterprises, as well as every month or quarter for small and medium-sized enterprises selected by Rosstat.

If someone is not included in the list this year, then the check is expected next year.

The generated lists can be found on the regional sites of the state statistics service in the "Statistical reporting" section and the "List of reporting entities" tab.

According to the rules, Rosstat warns about the check by sending a letter to the mail, but in practice they do not always reach. In order not to receive fines and always keep abreast of the matter, it is recommended to view the data of the institution's Internet resource or to clarify the information with the employees of the federal service.

Dates for submission of reports to the tax service for individual entrepreneurs in 2019

The table contains all possible reports for both OSNO, STS, and UTII. It is necessary in order not to miss the deadline and not to forget what statements, to whom and when to submit.

The dates are identical for all systems.

| Document deadline | Name of the form for filling in the data |

|---|---|

| In the period up to 20 Jan. | KND-1110018. Contains information about the average number of state units UTII declaration. Form to be filled out if the entrepreneur conducts several types of activities |

| Electronic document - by Jan 25 | 4-FSS. It is a calculation of contributions to the Social Insurance Fund, which will be needed when an employee goes on maternity leave or in case of injury at work |

| In the period up to 25 January. | Declaration for value added tax |

| Electronic document - until Feb 22 Paper Document - By Feb 15 |

RSV-1. Data on contributions for pension and health insurance for employees reported to the FIU. Individual entrepreneurs who operate without employees do not pass this form |

| Until Apr 1 current year | 2-NDFL. A report in which the profit of individuals for the ended tax period is fixed. A separate document is drawn up for each employee Form MP-cn and form 1-Entrepreneur. In 2019, a continuous survey of individual entrepreneurs of small and medium-sized businesses is carried out according to last year's data. The forms of the forms must be clarified with the regional representatives of Rosstat. |

| No later than May 4th | 3-NDFL. Income tax declaration for individuals |

Find out the deadlines for payment and submission of reports by an individual entrepreneur for all taxes (checklist) from the video:

In contact with

The simplified taxation system is the simplest tax regime in which an entrepreneur does not need to transfer a large number of taxes and prepare complex documentation.

Dear Readers! The article talks about typical ways of solving legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and WITHOUT DAYS.

It's fast and IS FREE!

What are the required reports? What are the deadlines for submitting reports to individual entrepreneurs on the simplified tax system in 2020?

What you need to know

Consider what regulations regulate the use of the simplified tax system, including the deadlines for submitting reports.

What punishment awaits an entrepreneur for being late with the submission of documentation?

Appointment

Each individual entrepreneur must submit to the tax service reports on activities - on their profits or lack thereof.

For example, if the company had expenses / incomes from current accounts or cash during the tax period, then accompanying documents will have to be prepared.

If there was no economic activity, then the entrepreneur will have to submit zero reporting.

Normative base

If an individual entrepreneur is going to switch to a simplified taxation regime, then you need to study the following regulations:

- , which contains the basic rules for keeping records and filing reports by a small business entity.

- , approved on November 21, 1996 (accounting features).

- (features of filling out the current form).

Penalties

If the reports are not submitted in a timely manner, the entrepreneur will have to pay a fine in the amount of 5-30% of the tax amount, which is subject to transfer to the treasury.

The countdown is from the date when it was necessary to submit the report. It doesn't matter if the documentation was not submitted in the middle or at the beginning of the month.

For example, a representative of the tax authority charged a 10% fine for the company, which had to pay the tax of 55 thousand rubles.

Declaration filed by the firm on June 5th. The report had to be prepared by April 30th. This means that the amount of the fine will be calculated for 2 months.

Let's calculate:

55 thousand * 10% = 5.5 thousand rubles. per month.

5.5 thousand * 2 = 11 thousand rubles.

If the tax amount is not paid on time, the taxpayer is charged a 20 - 40% fine. Let's give an example.

The entrepreneur was supposed to transfer 5 thousand rubles on April 30, but he paid it on May 5. The tax authority determined a 25% fine. Late - 4 days.

5 thousand * 25% = 1.25 thousand rubles. in 1 day.

1.25K * 4 = 5K in 4 days.

If the company operates on the simplified tax system without employees, then the amount of the fine for late submission of reports will be:

Inspectors may block the settlement accounts of entrepreneurs, and it is also possible that you provoke representatives of the tax authority to visit more often with inspections.

When to submit reports to an individual entrepreneur under the simplified taxation system in 2020?

In order to timely submit all the necessary documents, it is worth focusing on the IE reporting calendar, which operates on a simplified taxation system.

Tax reports in hard copy or electronic form must be submitted to the Federal Tax Service annually. The individual entrepreneur maintains a book of income and expenses and prepares a declaration.

In the event that at least one employee is registered at the enterprise, the entrepreneur will have to submit the following annual reports:

Once a quarter, you need to cook:

- calculations of insurance contributions to the Pension Fund and the Mandatory Health Insurance Fund for. Rent every quarter.

- - no later than the last day of February.

Specificity of the object of taxation

What are the nuances worth knowing on a simplified IP? What documents should be submitted to companies that have chosen “income” or “income minus expenses” as the object of taxation?

Income

The simplified mode 6% is the simplest. Individual entrepreneurs do not need to understand numerous reports, as well as carry out complex calculations of tax amounts.

A simplified tax system with a 6% rate is ideal for small businesses if the costs do not exceed 60%. The peculiarity of such a system is that the tax is paid at a fixed rate.

For example, if an enterprise has a profit of 200 thousand rubles, then the tax is 6% of the amount received, that is, 12 thousand rubles. In this case, the costs will not be taken into account in the calculations.

The tax base can be reduced by the funds of paid insurance premiums by 50 percent if there are employees, 100% if the individual entrepreneur does not have employees.

In this case, the taxpayer of the STS is also exempted from paying value added tax, as well as personal income tax.

Quarterly reporting on advances is submitted in the following terms:

- no later than April 25;

- July 25;

- the 25th of October.

- after the end of the tax period, the remaining amount is paid, but no later than April 30 of the year that follows the reporting year.

Insurance premiums that the individual entrepreneur must transfer to the simplified taxation system 6%:

An enterprise with disabled people can take advantage of benefits for the payment of personal income tax.

If the company has no employees, then only 3 reports will need to be prepared: a declaration, a book of income and expenses, and expenses do not need to be reflected in the document, and a certificate indicating the number of employees in the company.

Income minus expenses

If the company operates on the USN "income minus expenses", then it is worth knowing such nuances. In the event that costs exceed revenues, then the company receives losses. Then such amounts should be reflected in the declaration.

Since the tax inspectorate has the right to demand confirmation of the incurred loss, the individual entrepreneur should take care in advance of providing all written explanations explaining the reasons.

If there are losses, then the company must calculate the minimum tax that can be taken into account in the following tax periods, which will allow the amount of taxes to be adjusted.

The amount can be carried over for a maximum of 10 years after the occurrence of the loss. When calculating, income is taken into account on a cash basis, that is, after funds are received on current accounts or in the cash offices of enterprises.

If a refund is made for an advance payment for a product that was not delivered in full, the revenue is reduced by this amount. All transactions are reflected in the Book of Income and Expenses.

The costs incurred are checked by tax inspectors. Wherein:

- The costs should be attributed to the activities of the organization.

- The individual entrepreneur must have all the accompanying documentation that will confirm the fact that there are costs.

- Expenses must be reflected in accounting.

- A business case is needed.

- Payment of expenses must be transferred in full (100%).

All costs and advance payments made must be closely monitored by the entrepreneur.

Video: Individual entrepreneur did not pay taxes on the simplified tax system, did not submit reports. What to do?

The expenses are confirmed by documents, which are then transferred to the accounting department. Accountants record all costs in the Ledger of Income and Expenses.

The advance that was issued against future delivery is not taken into account in expenses, since it does not have documentary evidence.

When calculating the amount of tax that must be paid at the end of the tax period, advance quarterly payments are deducted. The balances should not be carried over to a new period.

How to keep records correctly

For reporting on the STS, you need to prepare:

- KUDiR;

- primary documentation;

- personnel documentation.

The documents that are needed for running an individual entrepreneur's business in a simplified mode are divided into 3 groups:

- Documentation required for tax accounting.

- Documents that contain information about working with clients.

- Documents related to hired personnel.

The main register by which all transfers and expenses are recorded is KUDiR.

In accordance with the new rules, the Book does not have to be certified by the tax authority, but the individual entrepreneur still undertakes to fill it out, because it may be needed when checking.

Such a document contains data:

- about the funds received;

- about expense transactions;

- about the correspondent account;

- about the recipient of the transfers;

- about the person who transfers funds to the cashier.

In the event that the book is kept in electronic format, the results of the work are printed daily. At the end of the tax period, all forms are stapled into a brochure.

To account for documentation and cash transactions, entrepreneurs use receipts and expenditure orders (and accordingly).

If cash payments are made, the entrepreneur must issue the buyer a cashier's receipt or strict reporting forms. It is this feature that distinguishes the STS from UTII.

Working with clients, an individual entrepreneur concludes a contract, draws up an act of work performed, prepares. If the company works with a legal entity, then it is worth invoicing for payment.

It is not necessary to exhibit, since an individual entrepreneur on the simplified system is not a value added tax payer.

Personnel documentation that may be of interest to the Tax Service when checking:

- an employee or his;

- working with personal information of personnel.

Frequently asked Questions

It is not always possible to find all the answers in the general provisions of the law. Often taxpayers have doubts about filing reports if the enterprise did not work for a certain time or was completely closed.

How to act in such situations? Should I prepare reports?

Do I need to submit zero accounting statements?

An entrepreneur must submit an activity report even if there was no profit or the activity was temporarily suspended. Zero accounting reports are submitted.

Filling out the declaration, the individual entrepreneur on the simplified tax system enters data about the entrepreneur, indicate the selected object of taxation, the OKATO code, tax rate, KBK. The rest of the items are dashes.

The deadline for submitting tax reports in the form of a zero report to the Pension Fund and the Social Insurance Fund is until the middle of the month, which follows the reporting quarter.

Zero reporting is not submitted for personal income tax. The employer presents a letter stating the reason why the wages were not calculated.

The inspector may additionally require an extract from the bank, which will prove that there is no movement in the accounts.

What to do when closing the IP

Provided that the enterprise ceases to operate due to the closure, the tax reporting of the individual entrepreneur must be filed (in the opinion of the tax authority) no later than the date on which the business was terminated.

Current accounts are closed after taxes are transferred (), if the individual entrepreneur does not have debts to a banking institution for servicing cash accounts.

The date when it is necessary to close the account is determined in accordance with the entries in the registration book for open accounts maintained by the bank.

A certificate stating that the account has been closed can be obtained from a representative of a banking institution. You need to inform about the closure of the IP:

An individual entrepreneur, as a person acting in the field of business, is obliged to systematically submit reports to the relevant authorities. It is recommended that the first step after registering a person as a business entity is to find out which reports and how often this need will arise. This systematicity directly depends on the type of taxation that is used by the entrepreneur, on the availability of employees, and, directly, on the very type of activity that the entrepreneur is engaged in.

One of the most important types of reporting is tax reporting. This process is carried out by submitting a certain package of documents to the appropriate tax authority. Depending on the type of taxation used by the individual entrepreneur, the type of reporting itself is established.

An individual entrepreneur, as a tax payer, is obliged to submit a declaration for a certain tax period. The form of the declaration directly depends on the type of taxation. For example, users of the unified agricultural tax submit the Unified Agricultural Tax Declaration annually, individual entrepreneurs who are in the general taxation system choose the type of Declaration, depending on the tax period. Individual entrepreneurs, payers of the single tax, submit reports once a month, once a quarter, or once a year.

The reporting of individual entrepreneurs on the simplified tax system also has its own characteristics. Most individual entrepreneurs when registering choose this particular taxation system, since it allows them not to pay other types of taxes (on the income of an individual, on property, etc.).

First of all, it should be noted that the reporting system under the simplified taxation system is carried out by submitting a declaration for one calendar year. That is, the tax period in this case is 12 months. It is necessary to submit a special Declaration on the simplified taxation system no later than April 30 of the year following the reporting period. If the individual entrepreneur did not manage to submit reports, then a fine is applied to him - 5% of the amount of unpaid tax for each month of such a delay. In this case, even if several days have passed, the fine will be considered as for a month. For example, an individual entrepreneur filed a Declaration with the tax authority on June 3. The amount of his tax is 60,000 rubles. Accordingly, we calculate the amount of the fine by multiplying the tax amount by 5%:

60,000 rubles * 5% = 3,000 rubles.

This is the amount of the penalty for one month. Since more than one month has passed since the last day of filing the declaration, although less than two, the amount of the fine will be calculated for 2 months, that is:

3,000 rubles * 2 = 6,000 rubles.

The reporting of individual entrepreneurs on UTII also has its own nuances. All users of the unified tax on imputed income are also required to submit to the tax authority at the place of their registration a special document of the state standard - the UNDV Declaration. Unlike the previous type of reporting, this one is submitted on a quarterly basis. The last line for filing a declaration for the UNDV expires on the 20th day of the month that follows the tax quarter. Well, for example, if an individual entrepreneur submits a declaration for January, February and March, then the last day of delivery will be April 20.

If an entrepreneur, due to any circumstances, has not submitted such a document to the tax authority, then a fine of 5% is applied to him, calculated from the amount of tax for a certain period. That is, the principle of calculating a fine is the same as in case of violation of reporting under the simplified tax system.

Individual entrepreneur financial statements

A very important point in the activities of an individual entrepreneur is financial reporting. This concept includes the recording of all financial transactions in physical and electronic media. This kind of reporting provides the fixation of all actions that were carried out by the entrepreneur, the movement of assets. First of all, if the financial statements are kept in the proper form, then this greatly simplifies the process of filling out tax returns and confirming the information contained in them.

The document that is kept to record all the operations carried out is called the Book of Income and Expenses. What is this book about. First of all, it is necessary to indicate that it does not matter in what form it is conducted. Each entrepreneur chooses the method of its design individually, based on his own convenience. For example, for those individual entrepreneurs who do not carry out a large number of business transactions, you can safely use a handwritten version. Individual entrepreneurs, who, on the contrary, have activities associated with a huge number of financial transactions, it is better to use the electronic option. This is due to the fact that it is easier to record actions and calculate the necessary indicators using computer programs that will greatly simplify this process.

Until 2013, such a book had to be registered at the place of tax accounting. Today, there is no need to carry out this action. There is an unclear moment associated with the need to maintain such a document. Although the Tax Code does not specify anything about the obligation to keep a ledger of income and expenses, there is an administrative fine for the absence of such a document in the amount of 200 rubles.

There are a few basic rules you need to know about keeping such a book. First of all, such a document is brought up for each tax period. It should consist of a title page, which indicates the name, name of the entrepreneur, tax period and signature. In most cases, the book is divided into two sections. The first is income. It denotes all operations related to profit. The second is expenses. Accordingly, it is designed to record activities that involve material costs.

All pages must be numbered and stitched together. To confirm each operation indicated in it, documents confirming its implementation (for example, checks) are supported.

An important issue is the accounting reports of individual entrepreneurs. Since 2011, a rule has been introduced that allows entrepreneurs not to submit such reports. If an individual entrepreneur keeps records of all income and expenses on his activities, but he does not have to submit accounting reports. It does not depend on the taxation system used by the entrepreneur. The presence of a completed book of expenses and income allows him not to submit accounting reports.

Reporting deadline

Depending on the taxation system, the lines for filing reporting documents varies. Do not confuse the reporting date and the tax payment date. For example, tax under the simplified system is paid in advance payments for quarters of the first nine months. The rest of the amount is paid no later than the end of March of the next year. For example, if an individual entrepreneur must pay 5,000 rubles of tax per quarter, then he makes the first three payments at the end of these periods, and he must pay the last 5,00 rubles by March 30 of the next year. If there were no advance payments, then the entire amount is paid at the end. The reporting is submitted, as we considered, before April 30 of the next year for 12 months of the previous year, which are the tax period.

Quarterly reporting is used for ENDV. Here, too, it is necessary to take into account that the tax itself is paid no later than the 25th day following the reporting quarter of the month, and reporting is drawn up before the 20th day of such a month. For example, an individual entrepreneur carries out calculations for the first quarter of 2015. His monthly tax is 8,000 rubles. Accordingly, by April 20, he must provide the tax authority with a declaration on payment of the simplified tax, and by April 25, he must pay the tax itself, in the amount of 24,000 rubles (8,000 rubles * 3 months).

IE reporting for employees

The package of documents that are required for reporting depends on the availability of a hired force - an employee. An individual entrepreneur without employees in this case is much easier, since the only thing that is required of him is to submit his tax return on time, depending on the type of taxation. To confirm all the information specified in the IP declaration, you must have a stitched and numbered book of income and expenses.

An individual entrepreneur with employees has a more complex reporting system. In addition to reporting to the tax service, by submitting a declaration of the appropriate type of taxation, there are two more types of reporting.

To begin with, we will consider what special documents an individual entrepreneur must submit to the tax service, provided that he has hired workers in addition to the declaration. First of all, it is necessary to submit a Reporting Form for an individual entrepreneur on the average number of employees of an individual entrepreneur. This document indicates the name of the individual entrepreneur, his identification code, the number of employees who are in labor relations with the individual entrepreneur. The manager, represented by the individual entrepreneur, signs such a form, indicating the date, the state on which such a number of employees was calculated. This document must be submitted by January 20 of each year.

Together with the form, another document that is mandatory for submission to the pension fund is a certificate of the state sample 2-NDFL. Such a document is filled in for each employee who is in an employment relationship with an individual entrepreneur. it provides information about the name, citizenship, residential address, total income and taxes of the employee. Such an application must be submitted together with the register of information on the income of an individual. This document is a certificate from the tax office. The certificate and register must be submitted by April 1 of each year.

One of the types of reporting by an individual entrepreneur who has employees is the submission of documentation to the Pension Fund. By the 20th day of the second month of the quarter following the reporting quarter, it is necessary to submit to the pension service the state standard RSV-1 form. In it, the individual entrepreneur indicates all taxes paid for each employee to the pension insurance fund.

The next body to which the individual entrepreneur is obliged to submit reports is the Social Insurance Fund. By the 25th day of the next month after the end of the quarter, it is necessary to submit to the Social Insurance Fund the state standard form 4 - FSS. In it, the individual entrepreneur indicates all the amounts of contributions for the quarter paid for each employee to the insurance fund

SP on a patent

An individual entrepreneur, whose number of employees does not exceed 15, has the right to use the patent taxation system. The IP receives a patent for lines from 1 to 12 months of one calendar year.

The main feature of this patent is that the individual entrepreneur is completely exempted from the obligation to file a tax return. At the same time, it is enough for him to keep a book of income and expenses. The number of such books should correspond to the number of patents received. That is, for the period for which the individual entrepreneur received a patent, he does not report to the tax authorities by filing the usual declaration.

If an individual entrepreneur is also engaged in other activities for which he does not have a patent, then reporting must be submitted leaving the tax system for this activity.

Zero reporting for individual entrepreneurs

There are situations when it ceases to engage in its activities or suspends it due to the impossibility of paying taxes. In such cases, reporting for the tax period is zero.

At the same time, not all taxation systems allow you to submit zero reports. If an individual entrepreneur uses a simplified tax system, then if his activities are suspended, problems will not arise. In the absence of income and expenses for the tax period, the individual entrepreneur has the right to submit zero reporting.

But at the same time, users of the unified tax on imputed income do not have such an opportunity. The tax inspector does not have the right to accept an ENDV declaration from an individual entrepreneur, which will be an indicator of zero reporting. This is due to the fact that an individual entrepreneur under such a taxation system is obliged to withdraw from tax records within 5 days from the date of termination of activity.

Zero reporting must be submitted not only to the tax service, but also to social and pension insurance funds. It is submitted on the condition that for the entire tax period no taxes were paid legally (absence of employees) to these services.

To simplify the work, you can download a special free Business Pack program, it already contains all the samples of reporting forms.

Good afternoon, dear individual entrepreneurs!

A frequent question from newbies that comes up all the time. Well, let's take a closer look at this point and talk about the main reporting for individual entrepreneurs.

So, let us have an individual entrepreneur without employees on the simplified taxation system of 6%. What and where should he take in 2016?

They notify in advance about the required reporting and automatically generate it. And I repeat tirelessly that there is no need to save on this. The fact is that there is no universal (and unshakable) list of reports that will suit absolutely everyone. Moreover, this list is constantly changing, and the developers promptly update the reporting calendar and load new forms that need to be submitted to the IP.

So let's get started. Consider the basic reporting that you need to submit.

Tax reporting

Here it is minimal and consists only in the fact that an individual entrepreneur on the simplified taxation system of 6% needs to submit a tax return at the end of 2016.

An important point that is often forgotten. Even if an individual entrepreneur on the simplified tax system did not have income, he is still obliged to submit a tax return. The so-called "zero" declaration.

Reporting to the FIU

Since our individual entrepreneur does not have employees, there is no need to take anything to the Pension Fund, FSS, FFOMS. You just need to pay on time the quarterly contributions “for yourself” to the Pension Fund of the Russian Federation and FFOMS.

But here you need to understand that an individual entrepreneur without employees means that individual entrepreneur who did not hire employees for a year, did not register as an employer and did not work under the GPA (civil law contracts).

But I advise you to closely follow the news, as there will be a lot of changes in 2017, since the tax authorities (FTS) will already collect contributions.

Reporting to Rosstat

It depends on what kind of activity the individual entrepreneur is engaged in. Most individual entrepreneurs rarely come across reporting to Rosstat. As a rule, once every 5 years, when continuous observations are carried out. For example, the last continuous observation was at the beginning of 2016, at the end of 2015.

But nevertheless, I advise you to check yourself in the new service from Rosstat, in which you can find out which reports you need to submit. Read how to use this service here:

KUDIR

This is a ledger of income and expense, which must be kept continuously. It is clear that the majority maintains it electronically, in the same “1C. Businessman". You do not need to submit it to the tax office, but you need to provide it upon request. That is, it should always be up to date, with fresh data. All this is achieved by the fact that you need to regularly enter data into your accounting program for cash flows, accounts, acts, etc. etc. etc. etc ....

At the end of the calendar year, KUDIR is printed, attached and signed by the IP.

POS printer reporting

If you work with cash, then there must be appropriate reporting on cash register. That is, you need to comply with the requirements of cash discipline.

Industry reporting

It also depends on what the individual entrepreneur is doing. For example, some individual entrepreneurs submit reports to Rospotrebnadzor on environmental impact.

Here you will have to figure it out on your own by contacting the appropriate authorities.

EGAIS

Also, reports have recently appeared in RosAlkogolRegulation.

To be honest, I did not work with this system and here I am not a hint. But I know that many are already studying the so-called "alcohol declarations".

More recently, the labeling of fur products was introduced.

This happened quite recently, on August 12, 2016. I also haven't dealt with this issue yet, but for sure there will also be some cunning report.

P.S. And once again I will insistently repeat that there is no need to save on accounting programs for individual entrepreneurs. All this is displayed in the calendar of events, in the programs themselves.

What to use in order not to miss important reports?

Personally, I use 1C. Businessman". The program is simple and tailored for the management of the individual entrepreneur. It is regularly updated and automatically generates all the necessary reports.

But still popular are all kinds of "cloud" accounting, which will be optimal for beginners who do not want to regularly update "1C" and monitor its performance.

Don't forget to subscribe to new articles for IP!

And you will be the first to know about new laws and important changes:

I created this site for everyone who wants to start their own business as an individual entrepreneur, but do not know where to start. And I will try to tell you about complex things in the most simple and understandable language.

Alex

You can answer the following question to a potential buyer of one of your books.

What documents are needed in order to register a computer or laptop that will be at your workplace (store, stall, office)? I’m just wondering how inspectors will find out that this laptop is not stolen (for example, I brought it from home), if receipts and documents for the purchase of a laptop have been lost over the years.And one more question related to the 1C program. Does the license agreement violate the use of the Windows version of the 1C program on Linux? or 7 you can't buy now)?

And how critical is it to use an unlicensed version of Windows on a work computer? Can the regulatory authorities impose sanctions on you if they find any Zver DVD on your computer (provided that they have no complaints about other issues related to your business)?

I apologize for such a strange question, it's just that usually these moments are not considered on the resources related to small business, and there are no entrepreneurs from the acquaintances of IT specialists.

Best wishes, Alex.

Dmitry Robionek

Alex,

- I didn’t come across the first question, but it’s better to keep all receipts for equipment and software. But I don’t think that they will dig in this way without unnecessary grounds (about proof that the office equipment is yours, and not on the wanted list).

- for 1s - it's better to read on their website.

- it is definitely impossible to use unlicensed software on work computers. This applies not only to Windows, but in general to any unlicensed software. And you also need to keep receipts, etc.

On Habré, look at this information about responsibility. This topic was raised there quite often.

Alex

Thanks for the information. As for 1c, I have already been on their website, it seems that nothing has been said about Wine, which means it is possible, in any case it does not violate the license agreement.

Nastya

Hello! Tell me please. The situation is this, in August 2015 I opened a SP, switched to 6% sleep. I paid two or three times for myself (receipts came from the pension). Then I did not submit the declaration (I wanted to pass the zero one), because I was not in Russia. And it turns out after that the receipts for some reason stopped coming! Now I want to submit a declaration, pay the remaining debt into a pension and close the SP. But I'm in another city, how can you check all your debts in a pension? And why could they stop sending receipts abruptly ??? This may be due to the fact that the pensioner has already slapped a debt of 140 thousand to me for an unsubmitted declaration ?? Thank you very much in advance

Olga

Dmitry, did I understand correctly that if I am a sole proprietor without 6% STS employees, not yet conducting business, but paying mandatory taxes to the Pension Fund of the Russian Federation, FFOMS, then I DO NOT submit balance sheets to the tax office, but only a DECLARATION (zero).

And in the Pension Fund of the Russian Federation, FFOMS (without employees) I also do not submit reports, and I reflect payments made to these funds in my accounting department.

And do I need to pay contributions to the FSS?

Dmitry Robionek

Olga, Ip on the simplified taxation system 6% without income and employees only submits a declaration to the tax one at the end of the year (zero). You don't need to take anything to the Pension Fund and FFOMS, since there are no employees. But it is imperative that you pay your dues before the end of the year. KUDIR should also be available, but you do not need to take it.

In the FSS - this is optional, you can pay for yourself. I don’t pay them myself and I don’t know anyone who pays for themselves like that on a voluntary basis.What do you mean by "balance sheet"?

Olga

Dmitry, thanks! Sorry, typo, I mean "financial statements". By "accounting" I meant accounting and tax accounting in full with the obligatory maintenance of all journals - orders and general ledger, even if no activity was carried out, With quarterly financial statements (or already once a year, I don’t know), which includes such documents as: -the balance sheet, statements of financial results, cash flows ... etc. (and I do not need to keep all this even for myself, in case of verification). Only KUDIR is being conducted, but not surrendered.

Those. in the Federal Tax Service of the USN 6% submits only the declaration.

And with the introduction of the ESSS, the reporting procedure that is currently in force for the STS 6% without employees and so far without activity will not change?

Thanks!Nia

Good day! Here, let's say I SP asleep 6%. No staff. And I, for example, conclude an agency agreement with individuals (not individual entrepreneurs) And let's say my agent earned 10.00 rubles from sales in my affiliate program - it turns out I have to deduct 1,300 rubles from him and give personal income tax. - QUESTION: In addition to this, do I have to pay any fees FOR IT? And do you have to pay VAT for it?

Denis

Hello Dmitry again. Registered as an individual entrepreneur on 18.05.2012 according to the form of the USN - income, the main OKVED 92.13 - SHOWING FILMS. In the Pension Fund of the Russian Federation, he did not pay contributions and a fine has been imposed for 2014 in the amount of 135,000 rubles. ... I did not work on the IP. I called the Pension Fund of the Russian Federation and said that if I don’t submit reports to the tax authorities in the next few days, there will be a fine for 2015 as well. But the FIU needs a report only for 2014-2016. What to do? Submit reports to the tax office for all five years - zero and close the individual entrepreneur, or you can for 2014-2016. and close the SP. On the spot, a company with such an OKVED opened only last month and is unlikely to help in anything.

Dmitry Robionek

No, you need to find a company not with your OKVED, but a company that provides accounting. support for individual entrepreneurs on closure. There are a lot of them in any city ... They will help you to draw up closing reports for little money.

You need to close if you do not plan to conduct an individual entrepreneur. Otherwise, everything will accumulate.Anastasia

Hello Dmitry! I have 2 questions for you:

1. Is there a law on changing the KUDiR for the simplified taxation system for 2017?

2. I subscribed to your mailing list (and for the third time), but nothing comes ((... Why? Confirmed from the email.Alexei

Hello Dmitry!

I am your subscriber and I want to ask a question.

During 2016, the individual entrepreneur received 3 payments for building materials, but after receiving the money, the buyer asked to return them, since this building material does not suit him according to the specification for the tender. And I sent this money back with the mark of an erroneous payment.

Question? Consider this money as income in the tax return for 2016 or not? After all, the tax authorities do not care what your expense on the simplified taxation system is 6%.

Thanks!Dmitry Robionek

Sergey, good afternoon.

In general:

-If there are no employees, and have not entered into civil law contracts with individuals, then you do not need to submit employee reports)

-In the FTS, only a declaration is submitted for individual entrepreneurs on the simplified taxation system 6% without employees.

-In the Pension Fund and FFOMS you do not need to take anything if there are no employees.

And other reporting depends on what you are doing. Therefore, it is better to buy an accounting program or an online service that, based on your data, will remind you of what exactly needs to be taken and when.

Sergey Vladimirovich

Thanks! There was information that the Federal Tax Service needs to take something even if there are no employees. Where can I find official documents on the composition of the reporting entity without employees on the STS 6%?

Thanks!

Dmitry Robionek

No, I haven't heard that. There are no warnings of this kind in my program either.

Most likely, you mean that you need to hand over to those individual entrepreneurs who are registered as employers, but they do not have employees (for example, everyone was fired). Then yes, they submit reports on employees in any case.You get tired of looking at official sites =) After all, everything is scattered over many sources in the form of orders, letters, recommendations…. There are reports to Rosstat if you get into the sample. If you hire employees, everything is constantly changing there ...

But in the Federal Tax Service, an individual entrepreneur without employees submits only a tax return according to the simplified tax system.

Buy an accounting program, do not suffer ... There is always all the freshest, a calendar of reporting, payments, recommendations.

I also recommend connecting to the personal account of the individual entrepreneur on the FTS website - there is also a lot of useful information there.Even at the stage of an idea for a business, a novice entrepreneur must determine for himself a number of important points regarding the practical implementation of his idea. Sources of funding, market niche and product characteristics should be looming in the mind of an entrepreneur as clearly as the employees he will or will not hire, the technology of promoting a product or service, and the way of keeping records.

Accounting for individual entrepreneurs for beginners can become a serious problem, since many businessmen simply do not want to bother with paperwork, believing that the practical side of business is much more important. Such an attitude can involve an individual entrepreneur in unforeseen losses and ultimately lead to the liquidation (legally - closure) of the business.

In economic theory, there are four types of accounting and reporting, respectively: tax, management, financial and accounting. In large companies and associations of companies, the functions for maintaining each of the types are divided between qualified employees, but an entrepreneur has such a luxury.

Often, an individual entrepreneur himself conducts the so-called accounting (all types of accounting together) and is very surprised if the tax or statistics refuse to accept reports due to minor inaccuracies and incorrect wording.

The accounting department of an individual entrepreneur, however, will not plunge into despair if the entrepreneur at the very beginning decides on some important points:

- what types of activities according to OKVED he will carry out in the first months of his economic activity;

- how much revenue is planned as a whole and separately for each type of activity;

- what tax regimes will be applied for certain types of activity or in general: PSN, OSNO, STS, UTII, ESHN, etc .;

- how many employees need to be attracted to achieve a given volume;

- what social categories these employees will be classified into, and what benefits an entrepreneur can receive for them;

- what social package, in addition to what is guaranteed by the state, the individual entrepreneur will be able to offer them now or after a lapse of time;

- in which territorial entities the economic activity will be carried out (whether a new cash register is needed, what is the regional percentage according to the simplified tax system);

- whether there will be a person among the employees to whom the individual entrepreneur will entrust the responsibilities for filling out and processing tax returns, reporting to statistics, or the employer will do this independently;

- whether the individual entrepreneur will employ employees of outsourcing organizations, including for accounting;

- what licensed program the individual entrepreneur intends to acquire / develop in the first months of work;

- whether the entrepreneur will use the online portals of public services / MFC and submit all the necessary reports via the Internet (for this it will be necessary to obtain a qualified electronic signature) or will he take everything on his own or through a trusted person.

This circle of questions is far from complete. However, by answering them to oneself before starting the procedure for registering individual entrepreneurship with the Federal Tax Service, a person will save time and money from mistakes in the chaotic accounting of individual entrepreneurs.

If an entrepreneur at the initial stage does not have the funds to hire his own or an incoming accountant who will manage several companies in parallel, he can purchase an accounting for beginner individual entrepreneurs a self-instruction manual, take a course of video tutorials, or simply get his hands on trading programs like 1C in different variations or Sail.

The least costly method in terms of money and the most time consuming is filling out reports, forms and a journal of cash transactions on your own. The employer and the employee in one person has the ability to control all stages of documentary production and track difficulties that arise. If an individual entrepreneur does not have employees and works on a simplified or imputed basis, this option is the most optimal for him.

When conducting accounting for an individual entrepreneur in the main mode or when combining tax regimes for different types of activities, difficulties may arise much more and it is better for a beginner individual entrepreneur to attract an external accountant. It is not necessary to take him to the state, it is enough to conclude an agreement for the provision of permanent services on a paid basis. Of course, there is a risk that a person may turn out to be a fraud, but few are immune from this.

One of the most convenient options is to conduct bookkeeping online: on a smartphone, laptop, etc.

In order to systematically submit reports and use free public services, it is necessary to take two important steps in the process of registering a business:

- Purchase a qualified electronic signature and install a program for its introduction into electronic documents (JavaScript, etc.).

- Open a bank account as an individual entrepreneur and gain access to your personal account.

The legislation does not oblige individual entrepreneurs to do either the first or the second, however, these steps can greatly facilitate the entrepreneur's life in further economic activities.

Actually, federal law No. 402-FZ does not require private business to conduct accounting for individual entrepreneurs in the broadest sense of the word, however, an entrepreneur must still submit reports to the tax, MHIF and FSS in the same way as regularly pay taxes and insurance premiums for himself and for employees.

Regardless of the chosen tax regime, each individual entrepreneur is obliged to keep the Book of Records of Income and Expenses (KUDiR), enter the appropriate deadlines into it and keep it for a possible, but optional, inspection by the regulatory authorities.

You can conduct KUDiR both by hand with black paste in a lined journal or a regular notebook, and on a computer in an Excel spreadsheet, and then at the end of the reporting period, print and staple into a notebook. The sheets should be numbered and the total number of sheets should be indicated on the last page. It is necessary to store the document for at least five years, even if during this period there was not a single check.

The list of the rest of the documentation is determined based on the number of employees and the selected tax regime.

If the entrepreneur, simultaneously with the registration of the individual entrepreneur, did not submit an application for the transition to another regime, he will automatically be assigned the main one (OSNO). This regime involves payments for personal income (personal income tax), deductions for value added (VAT report) and property.

In addition to filling out the book of income and expenses, the entrepreneur will have to fill out during the calendar year:

- sales book;

- shopping book;

- depreciation charges (AMO) for fixed assets.

The plus is that it is possible to significantly reduce income tax due to amortization, the minus is that it is not always enough to be a talented businessman to fill out the documentation correctly. You need a well-trained eye of a business executive and experience in communicating with supervisory services. In other words, it is necessary to involve a permanent or incoming accountant.

Simplified accounting is much easier. The report is based on the calculation of 6% of income with the subsystem "Income" and 15% with the subsystem "Income minus expenses". The first subsystem of taxation does not even require special skills in mathematics - everyone can calculate six percent of the total income.

The second subsystem "Income minus costs" is a little more complicated than the first, since it assumes that the entrepreneur will keep a systematic record of income and expenses, and also classify expenses in two categories: those due to which it is possible to reduce the tax, and those due to which this can not be done.

Entrepreneurs on a single imputed income and a patent must also account for income. The main difference between these systems of taxation from others is that for each type of activity the individual entrepreneur must calculate the tax separately.

A number of difficulties may arise if some types of activities are accounted for according to the PSN, and others according to the STS. In this case, it is better to seek help from a professional accountant or for advice on the online portal.

To answer the question of how to keep the accounting department of an individual entrepreneur on your own, step-by-step instructions 2019 will be given below.

Step 1. The decision to register an individual entrepreneur must be final and irrevocable. If a person at first decided that business is good and received an extract from USRIP, and then worked for a month and a half and abandoned everything, the regulatory authorities will not be happy about this. Even if there is no economic activity, a registered individual entrepreneur is obliged to draw up blank reports and pay mandatory insurance premiums for himself.

Step 2. It is necessary to draw up an initial business plan or at least an indicative plan of expenses and income.

Step 3. It is necessary to choose a taxation system and switch to it either immediately upon registration (if the FTS permits), or within 30 working days after the date of registration with the tax office. If the tax authorities did not receive and did not accept the application for changing the tax regime, the individual entrepreneur by default will be considered a payer under the OSNO.

Step 4. At the very beginning, you need to decide who will be responsible for maintaining business accounting and how much the entrepreneur is on average willing to spend on it. If funds are limited, but accounting for an individual entrepreneur looks like a Chinese letter, it is better to involve an external accountant or use online services.

If the salary of a full-time accountant is not equal to half of the budget, and accounting is carried out for several types of activities and tax systems, it is still better to hire one.

Step 5. Combining the main work activity and entrepreneurship does not leave the entrepreneur free time. The choice in favor of the services of an accountant is obvious.

Step 6. For timely submission of reports and making advance and basic payments, it is necessary to create a payment calendar in paper or electronic form and regularly check the dates with those specified in the current tax and pension legislation.

Step 7. It is best to download the reporting forms that are submitted to the regulatory authorities on the public services portal. Errors, blots, misprints and misprints must not be allowed. The information must be reliable and supported by primary documents (BKO, checks, acts, TTK, etc.).

Step 8. The capitalization of the goods must be documented. It is necessary to keep records of cash transactions, since in 2019 almost all individual entrepreneurs were obliged to supply a cash register with a network connection and the ability to transfer information to the tax office online.

Step 9. It is necessary to store all electronic and printed documents (checks, payments, receipts), inspection reports, etc., even if this is not required by law. All agreements and transactions with counterparties (suppliers, buyers, banks, non-financial organizations, associations, services, etc.) must be made in writing.

Step 10. SP does not hurt from time to time to reconcile their payments and debts in the tax and insurance services. No matter how ideally the entrepreneur draws up the reports and regularly pays, the debt may appear due to the human factor or purely for technical reasons.

The diagram for a beginner entrepreneur is given. If you follow all the points step by step and methodically, no problems with accounting should arise. You should not take the refusal of the Federal Tax Service and the Federal Medical Insurance Fund to accept certain reports as a personal offense. Employees of these services act in accordance with the letter of the law and simply do their job, just like an entrepreneur does his own, wishing to achieve the set goals.