A document confirming the fact of payment. What is required to confirm the fact of shipment? Proof of the transaction at the bank

The organization applies a general tax regime. Will the sales receipt without a cash register receipt attached to the advance report be a documentary confirmation of the expenses incurred by the organization? What documents should an organization have so that there are no problems with the tax office?

Having considered the issue, we came to the following conclusion:

In the situation under consideration, the documentary evidence of the costs incurred by the organization will be sales receipts if they are issued in accordance with Art. 9 of Law N 129-FZ, contain the details established by clause 2.1 of Art. 2 of Law N 54-FZ, and confirm the receipt of funds for the relevant product (work, service).

No other documents confirming expenses are required. In addition, the organization is not obliged to prove to anyone the fact of purchasing goods from UTII payers, and also has no right to demand from counterparties documents confirming the validity of the application of this taxation system.

Rationale for the conclusion:

In accordance with paragraph 1 of Art. 2 of the Federal Law of 22.05.2003 N 54-FZ "On the use of cash registers in the implementation of cash settlements and (or) settlements using payment cards" (hereinafter - Law 54-FZ) cash registers, included in the State Register, it is applied on the territory of the Russian Federation without fail by all organizations and individual entrepreneurs when they carry out cash payments and (or) settlements using payment cards in cases of sale of goods, performance of work or provision of services.

At the same time, the Federal Law of 17.07.2009 N 162-FZ (hereinafter referred to as Law 162-FZ) in Art. 2 of Law 54-FZ, amendments were made, in particular, this article was supplemented with clause 2.1.

In accordance with clause 2.1 of Art. 2 of Law 54-FZ, organizations and individual entrepreneurs who are payers of UTII for certain types of activities that are not subject to paragraph 2 and paragraph 3 of Art. 2 of Law 54-FZ, in the implementation of types of entrepreneurial activity established by paragraph 2 of Art. 346.26 of the Tax Code of the Russian Federation, they can carry out cash settlements and (or) settlements using payment cards without the use of CRE, provided that, at the request of the buyer (client), a document (sales receipt, receipt or other document confirming the receipt of funds for the relevant product (work, service)).

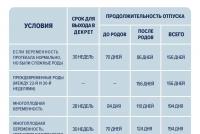

The specified document is issued at the time of payment for the goods (work, service) and must contain the following information:

Title of the document;

Serial number of the document, date of issue;

Name for the organization (surname, name, patronymic - for an individual entrepreneur);

Taxpayer identification number assigned to the organization (individual entrepreneur) that issued (issued) the document;

The name and number of paid goods purchased (work performed, services rendered);

The amount of payment made in cash and (or) using a payment card, in rubles;

Position, surname and initials of the person who issued the document, and his personal signature.

Thus, with the entry into force of this provision, UTII payers (with the exception of those mentioned in clauses 2 and 3 of article 2 of Law N 54-FZ) have the right to carry out cash payments without the use of CRE.

According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses, provided that they were made to carry out activities aimed at generating income.

Therefore, the cost of purchasing any goods and materials can be taken into account only if this type of expense is economically justified for the organization, aimed at generating income and documented.

At the same time, documented expenses are understood as expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or by documents drawn up in accordance with the customs of business turnover used in a foreign state in whose territory the corresponding expenses were incurred, and (or) documents, indirectly confirming the expenses incurred (including a customs declaration, a business trip order, travel documents, a report on the work performed in accordance with the contract) (paragraph 4, clause 1 of article 252 of the Tax Code of the Russian Federation).

In the case of acquiring goods and materials for the needs of the organization through the reporting person, the documents confirming the costs incurred will be the documents that the reporting person will attach to the advance report.

Note that in itself it cannot serve as documentary evidence of the costs incurred, it is the primary accounting document confirming the targeted spending of advance amounts by the accountable persons (clause 11 of the Procedure for conducting cash transactions in the Russian Federation (approved by the decision of the Board of Directors of the Central Bank of Russia on 09/22/1993 N 40).

Form N AO-1 "Advance Report" approved by the Resolution of the State Statistics Committee of Russia dated 01.08.2001 N 55. Instructions for filling out the advance report provide that on the reverse side of the form the accountable person writes down a list of documents confirming the expenses incurred (travel certificate, receipts, transport documents, cash register receipts, sales receipts and other supporting documents), and the amount of expenses for them (columns 1-6). The documents attached to the advance report are numbered by the reporting person in the order they are recorded in the report.

According to Art. 9 of the Federal Law of 21.11.1996 N 129-FZ "On Accounting" (hereinafter referred to as Law N 129-FZ), all business transactions carried out by the organization must be formalized by supporting documents. These documents serve as primary accounting documents on the basis of which it is maintained. The same documents also serve as confirmation of tax accounting data (Article 313 of the Tax Code of the Russian Federation).

Thus, the current legislation of the Russian Federation does not contain the requirement that when purchasing inventory items (goods and materials) for cash, cash receipts are the documentary evidence of the organization's expenses. Moreover, according to some experts, cash register receipts are not primary documents at all and, accordingly, cannot serve as documentary evidence of costs.

This point of view is confirmed by judicial practice (see, for example, the resolution of the FAS of the East Siberian District of 06.07.2006 N A69-2609 / 05-2-6-FO2-3261 / 06-C1).

At the same time, the Ministry of Finance of Russia recognizes cash receipts for tax purposes as primary accounting documents confirming the actual implementation of expenses for the acquisition of goods (works, services) for cash (see, for example, letters of the Ministry of Finance of Russia dated 03.04.2007 N 03-03-06 / 1/209 and dated 05.01.2004 N 16-00-17 / 2).

They are supported by financiers and tax authorities (letter from the Federal Tax Service of Russia for Moscow dated 12.04.2006 N 20-12 / 29007).

However, when using these clarifications in the work, it should be borne in mind that they are all given in relation to situations when the organization did not have other documents (except for the check). In the situation under consideration, the organization has sales receipts, it is they who will serve as documentary evidence of the costs incurred. Therefore, even if we do not take into account the fact that the organization purchases goods and materials from UTII payers, the likelihood of disagreements with the tax authorities regarding the recognition of tax costs in the absence of a cash register receipt is small.

As for the acquisition of goods and materials specifically from UTII payers who do not use CKT, in this case, the buying organization cannot have a cash receipt in principle, and a sales receipt will be documentary evidence of costs, provided that its details meet the criteria specified in clause 2.1 of Art. ... 2 of Law N 54-FZ. This conclusion is also confirmed by the explanations of the Ministry of Finance of Russia, for example, see letters dated 01.19.2010 N 03-03-06 / 4/2, dated 11.11.2009 N 03-01-15 / 10-499, dated 06.11.2009 N 03-01 -15 / 10-492, dated 01.09.2009 N 03-01-15 / 9-436.

So, in the letter of the Ministry of Finance of Russia dated 11.02.2009 N 03-11-06 / 3/28, the letter of the Federal Tax Service of Russia for the Irkutsk Region dated 30.11.2009 N 16-25 / [email protected]"On the answers to the most frequently asked questions by taxpayers" the following is explained: "A sales receipt is one of the primary documents on the basis of which the buyer can confirm the fact of payment for goods purchased under a retail sale and purchase agreement (Article 493 of the Civil Code of the Russian Federation)."

We also draw your attention to the fact that the norms of the current legislation of the Russian Federation for organizations and individual entrepreneurs who are payers of UTII do not provide for the obligation to provide their counterparties with documents confirming the fact of the application of the taxation system in the form of UTII.

In addition, it is not responsible for the actions (inaction) of its counterparties, subject to its own good faith (see, for example, the definition of the Supreme Arbitration Court of the Russian Federation of 12.11.2009 N VAS-14714/09).

Prepared answer:

Expert of the Legal Consulting Service GARANT

Timukina Ekaterina

Quality control of the response:

Reviewer of the Legal Consulting Service GARANT

auditor Melnikova Elena

The material was prepared on the basis of an individual written consultation provided within the framework of the Legal Consulting service. For more information about the service, contact your manager.

Is a sales receipt without a sales receipt valid in 2019?

The sale of goods for cash is usually confirmed by the issuance of a sales receipt to the buyer. When using online cash registers, the mandatory details of the CCP check contain all the necessary information about the seller and about the goods sold (name, price, cost). Therefore, drawing up a sales receipt simultaneously with the cashier's check is not required. And if the cashier's check is not issued or is lost? Is a sales receipt valid without a sales receipt?

Sales receipt instead of sales receipt

In general, when selling goods using cash or electronic means of payment, a cashier's receipt is issued (Article 1.2 of the Federal Law of 22.05.2003 No. 54-FZ).

Sellers (individual entrepreneurs, organizations) engaged in retail trade and applying the PSN or UTII, until 07/01/2018, had the right not to use the CCP. Until 07/01/2019, organizations and individual entrepreneurs may not apply on the PSN and UTII providing certain services, as well as individual entrepreneurs on the PSN and UTII, operating in the field of retail trade or catering, if such entrepreneurs do not have employees (part 7.1 of article 7 Federal Law dated 03.07.2016 No. 290-FZ). Instead of a sales receipt, they give customers sales receipts.

In this case, both the cashier's check and the sales receipt generally confirm the conclusion of a retail sale and purchase agreement and payment for the goods (Article 493 of the Civil Code of the Russian Federation).

Do you need a cashier's receipt to a sales receipt?

Regardless of whether the cashier's receipt was lost or the seller did not issue it because he was exempted from the use of CCP, the sales receipt can confirm the expenses for the purchase of goods, if such a receipt contains all the required details.

Mandatory details of a sales receipt without a cash register

A sales receipt is valid without a sales receipt if it contains the following information (Letters of the Ministry of Finance dated 16.08.2017 No. 03-01-15 / 52653, dated 06.05.2015 No. 03-11-06 / 2/26028):

- sales receipt number and date;

- the name of the seller;

- TIN of the seller;

- Name of product;

- quantity of goods;

- payment amount;

- position, full name and the signature of the person who issued the sales receipt.

The presence of the above details in the sales receipt is important for recognizing the value of the purchased goods in tax expenses.

However, there are no requirements for a sales receipt to confirm the fact of a purchase in consumer protection cases. There may even be no sales or sales receipts at all. In this case, the fact of purchase can be confirmed by testimony (clause 5 of article 18, clause 1 of article 25 of the RF Law of 07.02.1992 No. 2300-1).

Cash and sales receipts for an advance statement

We answered above whether it is possible to report a sales receipt without a cash register. For an advance report, a sales receipt without a sales receipt will confirm expenses if the sales receipt contains the above required details. Well, a sales receipt from an LLC without a cash register can be taken into account. Is the reverse situation possible: a cashier's receipt without a sales receipt? If this is a modern online cash register receipt, then the name of the product is indicated in it, and therefore it will be possible to do without a sales receipt. But if the name of the product is not on the cashier's receipt, then it will not work to confirm the purchase without a sales receipt or invoice (

What is a sales receipt? The difference between a sales receipt and a cash register. Sales receipt functions. Is a sales receipt without a cash register valid in 2020?

Dear Readers! The article talks about typical ways of solving legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

It's fast and IS FREE!

Today, more and more organizations, when concluding a sale-purchase transaction or providing any services, use cash registers on which the corresponding receipts are printed.

But a number of LLC organizations still prefer issuing a sales receipt. This document has an important role for individual entrepreneurs as well. The reasons for this can be varied.

As a rule, this is most often associated with the presence of an outdated cash register model at the enterprise or its absence.

According to the legislation of the Russian Federation, the seller is obliged to issue a check when carrying out a trade operation.

But many people have a question: "Is a sales receipt valid in the absence of a cash register?" You can find the answer in this article.

General aspects

Before moving on to the question of the validity of checks, it is worth deciding what they are, how they differ and what they are used for.

The concept of "check" has been heard for several centuries, but today it has received several meanings. What they have in common is that a check is a document that indicates a certain amount of money.

However, there are several types of checks. Everybody has known a payment check for a long time. It is a form, sewn into a check book and intended for the issuance of funds to the bearer from the account of the person who wrote the check.

Today, checks are more familiar to every user. They represent a list of goods purchased or received, their cost and amount to be paid. Depending on the design, cash and sales receipts are distinguished.

Necessary terms

What are its functions

The sales receipt is issued at the time of the transaction. It has two main functions.

First of all, confirmation of the fact of making a purchase allows, if necessary, to return the goods to the seller in the manner prescribed.

To perform this function, the sales receipt must be filled out correctly and have all the necessary details.

The main ones are the date of the purchase, the name of the product and the signature of the person in charge. In addition, the sales receipt allows you to confirm the fact of the targeted use of funds.

This document function is performed in the following cases:

- when calculating;

- when making a sale and purchase transaction between two enterprises of consumables and stocks;

- etc.

In this case, the sales receipt is attached to the documents on the basis of which the reporting is prepared. Its number is entered in the documentation, and the receipt itself is stored until the expiration of the required period.

Legal regulation

Issuing and receiving a sales receipt is a stage in a trade relationship between a seller and a buyer, and therefore they have their own legal and regulatory framework governing this process.

A sales receipt is used in financial statements, on the basis of which calculations are made with the tax office.

Therefore, in this matter, one should not forget about, namely:

- clause 1 of Art. 252 of the Tax Code of the Russian Federation.

In the case of using a sales receipt as a primary document, when confirming the use of funds by the accountable person, the following acts are used:

How to fill out a sales receipt form without a cash register

A sales receipt must be issued at the request of the client if it is not possible to issue a cash register.

It is important that it is correctly drawn up, since a violation in the preparation of documentation entails an administrative and criminal one. Sales and cash receipts are completely independent documents.

If necessary, they can be supplemented and issued in aggregate, since a cashier's check is necessary for tax reporting. However, they can coexist and function separately.

Mandatory requirements (details)

The sales receipt does not have a standard form approved by law. Therefore, sellers can create their own templates.

For this purpose, you can contact any printing house. The most important thing is that the sales receipt has the following details:

- document's name;

- serial number;

- date and time of receipt of goods or services;

- Name of the organization;

- list of goods or services;

- the number of units received;

- total amount;

- Full name of the seller (cashier);

- seller's signature.

You can see what the sales receipt form without a cash register 2020 looks like below.

For comparison, consider what information is indicated on the sales receipt.

KCH is produced using a special cash register on thermal paper, which ensures a long shelf life.

The following details should be displayed on it:

- Company name;

- location (actual address where the purchase was made);

- cash register number;

- Document Number;

- date of purchase;

- list of goods;

- number;

- unit price;

- price for all units of a given category of goods;

- the amount of discounts (if any);

- amount to pay.

- KKP - document authentication code.

Everyone has seen an example of a sales receipt today, but we still suggest that you consider it again.

Of course, the sales receipt contains more detailed information about the location of the seller and the conditions of the purchase.

As mentioned above, it is a fiscal document, since, among other things, it contains information about payment.

But this does not exclude the validity and functionality of the sales receipt. The main feature of a cash register receipt is the availability of information on the payment of VAT.

In some cases, if there are facts confirming that the acquisition is necessary for the direct activities of the organization, it is entitled to a tax refund.

Correct paperwork

Having examined the details and the form of the sales receipt presented above, you have already got acquainted with what information should be contained in it.

Most of the letterhead is printed on the check while still in the printing house, if it is made to order. And the information about the purchase is entered by the seller himself.

If the entrepreneur has purchased standard forms, then you must carefully fill in all the fields.

Due to the fact that the document is filled in manually, the question arises about the color of the ink with which this is done.

This norm is not established by law, but it is still best to stick to the standard colors - blue and black.

The most important thing when filling out a check is a truthful and accurate display of information about the purchase: product, quantity, price and amount.

It is imperative to register the date of purchase. As a rule, the fact of sale is recorded in the seller's documentation.

Therefore, in the case of a buyer with claims regarding a purchase, the fact of sale can be viewed using these records. It is also important to pay attention to whether the receipt should be stamped.

According to the law, the stamp on the sales receipt is not required. But still, we recommend that sellers do not abandon this item, as this gives an additional opportunity to check the check for authenticity in the event of a conflict.

To fill out the document correctly, we suggest that you consider a sample sales receipt without a cash register.

Is the sales receipt proof of payment

Many buyers, when they receive a sales receipt, do not even pay attention to it. The only problem is that, as a rule, such forms are rather plain. Often they are used by individual entrepreneurs.

And as you know, this category has no prerequisites to increase its own costs also for the production of individual check forms.

But such an attitude to a payment check is wrong, because it is a full-fledged document.

Often, a check is perceived as a document confirming the fact of purchasing a product. But does he confirm the fact of payment?

This question usually concerns transactions between entrepreneurs, since in case of confusion with the documents, the seller can present debt obligations to the buyer.

In this case, it is necessary to use the available documents confirming the payment.

As a rule, these include cashier's checks, but organizations such as individual entrepreneurs and LLCs are legally allowed to conduct business without using a cash register. Therefore, it is advisable that they write sales receipts by hand.

Video: when you can not use the cash register in activities

Having all the necessary details, a sales receipt is a document that is guaranteed to confirm the fact of payment of funds for services, works and goods.

Therefore, it can be easily used in the event of conflicts in order to protect the rights of the buyer.

If for an expense report

As mentioned above, the sales receipt is the primary document when making purchases by the accountable person.

After payment is made, it is drawn up with a detailed description of all the purchases made and their amounts.

On the reverse side of the report, all documents confirming the targeted spending of money are recorded. Based on this document, the amount is included in the costs.

Many, paying attention to the type of sales receipt, doubt that the sales document can be attributed to supporting documents. However, it should be noted that it does not lose its legal force.

Quite the opposite. Most specialists give preference to a sales receipt, since it has all the necessary details and a personal signature of the person in charge who made the sale, namely a signature and, if necessary, a seal.

According to the legislation of the Russian Federation, the seller is obliged to issue a check with the goods.

Most businesses prefer to use cashier's checks, which are issued using a special machine on the paper intended for this.

But since such equipment is not cheap, not all organizations can afford to purchase and install them.

In this regard, an exception was made for individual entrepreneurs and LLCs by amending the legislation, which allows them to work without using cash register equipment.

But the obligation to issue a check to customers still remains with them, so they can use the forms to issue a sales receipt.

Nevertheless, buyers often have a question: "Is this form valid and can it be used without a sales receipt?"

From the article, we can conclude that, despite the fact that cash and sales receipts contain similar information, they perform different functions.

A cashier's check is a fiscal document that is used in tax reporting, while a sales receipt is the primary document confirming the fact of payment.

They can be used as independent documents or attached to each other. In this case, both checks are valid and can be used to fill out reports or exchange and return goods.

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and WITHOUT DAYS.

A transactional operation at a bank or FTS is impossible without a document confirming payment. A check or statement, as well as a certificate of absence of debt - any of these documents is proof of the payment made. But the appearance of receipts in each organization may differ from the recognized pattern, as well as the requirements for depositing funds.

Why is payment confirmation required?

When depositing money for a loan or annual tax repayment, citizens are advised to keep the checks issued by the operator (or terminal). They are proof of the transaction in the event of a dispute.

For example, the tenant received a notification about the presence of debt at the Federal Tax Service. The presence of a document in hand, issued after the transaction, will be proof of payment of taxes.

The absence of checks makes it much more difficult to prove the reality of a payment. Despite the transition to the electronic payment mode, in 50% of cases, government agencies accept claims for consideration only if there is a "paper" copy of the certificates.

What is the proof of payment?

According to article 861 of the Civil Code of the Russian Federation, there are 2 payment methods in Russia: using real money and non-cash. Payments between legal entities must be 100% non-cash. The legislation of the Russian Federation does not apply strict requirements to individuals.

As proof of payment, in accordance with Article 220 of the Tax Code of the Russian Federation, it is allowed to use:

- cash receipt order;

- check, commodity or cash;

- extract;

- the act on the transfer of funds;

- other certificates drawn up and certified properly.

Proof of the transaction at the bank

Financial institutions that issue loans oblige customers to timely deposit funds to the lender's account. Delays lead to the accrual of penalties and penalties.

In rare cases, for example, in the event of a technical failure in the system, the payment may be delayed or not received. To save himself from the need to re-deposit funds, the payer must prove the fact of the account replenishment.

Confirmation of payment in "Sberbank" and other credit institutions can be an order, check or account statement.

A cash receipt order is issued by the operator when funds are deposited into the client's personal account. It must indicate the full name of the contributor, the date of the transaction and the amount, account, name of the financial organization. At the bottom of the order, the signatures of the participants in the operation are affixed: the client, the manager and the cashier, and, if provided, the seal of the bank.

A statement is a list of bank transactions on a client's account. It displays 1 or more transactions for a specified period of time (for example, the current month), the name of the owner, the name and account number of the organization, the date of the statement and the data of the authorized person. It is allowed to print an electronic document when making a payment in remote service channels (UCO): online banking, terminals, mobile version of the site.

A check is issued when the debt is repaid to the account of a legal entity. It contains (partially or completely) the details of the recipient of funds, the name of the company, data about the payer, amount, date and purpose. The check printed after the operation at the UCO is also a confirmation of the payment of the invoice.

Receiving a duplicate when a document is lost

The bank provides for the restoration of the client's checks in case of their absence to confirm the payment of the invoice. If the transaction was performed by the payer himself in terminals or online banking, the employee can re-print the account statement or issue a copy of the check.

In case of loss of paper documents, the recovery period can be up to 30 days. To speed up the search for a transaction, the client must know the date, approximate time, payment amount and recipient's details. Lack of information may serve as a refusal to provide a duplicate document.

Payments made more than six months ago are usually ordered through the bank's archive. The term for the provision of the service is from 3 days. For the restoration of some certificates, a commission may be charged.

How to prove payment of taxes?

Payments to the Federal Tax Service are the responsibility of every citizen of the Russian Federation. Every year, Russians pay off debts for land, property, and a car. Failure to confirm payment not only entails the accrual of fines in the form of penalties, but can also serve as a reason for the ban on travel abroad.

The Federal Tax Service is a state body and is obliged by law to accept the following types of documents as proof of payment:

- Cashier's check.

- Account statement signed and stamped by an authorized person.

- Receipt order.

- Another document confirming the fact of depositing funds.

As another certificate, a check or a form in the form of a financial institution is issued, which confirms the repayment of the taxpayer's debt.

Can a financial institution refuse to issue a check?

When paying bills at a bank, FTS or other organizations, the client must necessarily require a supporting document. The issuance of checks is proof of a successful transaction.

Refusal to issue a payment document may be the depositor's desire to receive several copies at the same time. According to the Tax Code of the Russian Federation, financial institutions are authorized to issue only originals of certificates. Issuance of a duplicate is possible only after a written application from the payer about the loss of the primary document.

The managers of the company have the right to refuse to receive a certificate for third parties without the presence of confirmed powers of the representative, for example, a notarized power of attorney, which contains permission to issue documents in the name of the depositor.

Payment confirmation is not issued in the event of an uncompleted transaction or its cancellation in the process. Some types of transactions made in remote service channels do not provide an opportunity to reprint the receipt. For example, transferring funds from a plastic card account using the SMS-informing service. The client receives a payment confirmation code on the phone, he enters the data, the money goes to the sender's account. In this case, the proof of the payment is not a check, but an SMS about sending and carrying out a transaction, or an extract from a bank card account.

How to prove payment for services in court?

When filing a statement of claim or complaint with Rospotrebnadzor, the payer must provide evidence of the transaction. The judicial authorities require a documented fact of the transaction indicating the full name of the citizen, details, date and amount of payment.

If the transaction took place at the office of a financial institution, it is recommended that you submit the original receipt or order. Additionally, the bank can issue a transaction confirmation certificate with the seal of the branch and the signature of an authorized person.

When paying online, it is recommended to print receipts and certify documents at the office where the account is held. Despite the presence of an electronic seal on the letterhead, in 15% of cases, law enforcement agencies refuse to accept certificates without the organization's stamp and signatures of the company's employees.

In banks and other financial institutions, customer orders are archived for 5 years. Housing and communal services have the right to demand from subscribers proof of depositing funds to a personal account within 3 years from the date of the transaction. According to the legislation, the storage period for documents confirming payment is 5 years from the date of receipt.

The advantage of online payment is the ability to print receipts for 10 years or more from the date of the transaction. If the client could not find the document on his own, he can contact the financial organization for a request. Documents for more than 3 years are issued from the archive.

Not all transactions can be printed after 6 months or more. In the absence of technical capabilities or updating the database, financial institutions may refuse to issue a certificate.

Question: An individual entrepreneur carries out retail trade in hand-held power tools and accessories, for which he leases a retail space of 30 sq. m. 1. What documents for cashless payments with buyers for the purpose of applying UTII confirm both payment and the conclusion of a retail sale and purchase agreement? Is it required to conclude a contract in writing stating that the goods will not be used by the buyer for commercial purposes? 2. What forms of cashless payments can be used in the implementation of this activity?

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

The Department of Tax and Customs Tariff Policy considered the letter on the application of the provisions of Ch. 26.3 "The taxation system in the form of a single tax on imputed income for certain types of activities" of the Tax Code of the Russian Federation (hereinafter - the Code) in relation to retail trade and informs the following.

1. According to Art. 346.27 of the Code, retail trade includes activities related to the sale of goods under retail purchase and sale agreements (including for cash and using payment cards).

At the same time, for the purpose of applying the unified tax on imputed income, retail trade is the sale of goods to both legal entities and individuals under retail sales contracts for non-cash and cash payments for purposes not related to entrepreneurial activity (for example, not for subsequent resale, etc.) .NS.).

Please note that retail sales do not include sales in accordance with delivery contracts.

So, based on the content of Art. 506 of the Civil Code of the Russian Federation (hereinafter - the Civil Code of the Russian Federation), the purpose of delivery is the use by the buyer of goods for use in the business sphere or for other purposes not related to personal, family, home and other similar use.

Consequently, if the goods are sold under supply contracts (Article 506 of the Civil Code of the Russian Federation) and under other similar contracts, then such activities are not transferred to the payment of a single tax on imputed income.

According to paragraph 1 of Art. 492 of the Civil Code of the Russian Federation under a retail sale and purchase agreement, a seller selling goods at retail undertakes to transfer to the buyer goods intended for personal, family, home or other use not related to entrepreneurial activity. Moreover, in accordance with paragraph 2 of Art. 492 of the Civil Code of the Russian Federation, the retail sale and purchase agreement is a public agreement.

At the same time, it must be borne in mind that, based on Art. 493 of the Civil Code of the Russian Federation, unless otherwise provided by law or agreement, a retail sale and purchase agreement is considered concluded from the moment the seller issues a cash or sales receipt or other similar document confirming payment for the goods to the buyer.

Thus, the sales and cash receipts serve as documents confirming the fact of the conclusion of a retail sale and purchase agreement for goods.

Other documents confirming payment for the goods, for example, may include operational documentation for the goods, warranty documentation, in which a mark of payment is made.

Therefore, instead of a sales receipt or a cash register receipt, other documents may be submitted to confirm the conclusion of a purchase and sale agreement, confirming the fact of payment for the goods.

In some cases, laws, other legal acts, in particular the rules for the sale of certain types of goods, approved by the Government of the Russian Federation, may provide for other documents that the seller must issue to the consumer when selling goods.

2. In accordance with the Regulations on the Procedure for Making Non-Cash Payments by Individuals in the Russian Federation, approved by the Central Bank of the Russian Federation on 01.04.2003 N 222-P, payment for purchased goods can be made by individuals in a non-cash manner by payment orders, letters of credit, checks and collection orders ...

At the same time, for the purposes of this Regulation, individuals are understood as citizens whose non-cash payments are not related to the implementation of entrepreneurial activities.

Thus, retail trade includes the sale of goods to individuals with their payment in cash and by bank transfer. This entrepreneurial activity can be transferred to the payment of a single tax on imputed income, subject to the above conditions.

Under the supply agreement, the buyer pays for the supplied goods in compliance with the procedure and form of settlements provided for in the agreement. If by agreement of the parties the procedure and form of settlements are not determined, then settlements are made by payment orders (Article 516 of the Civil Code of the Russian Federation).

In accordance with the Regulation on Cashless Payments in the Russian Federation, approved by the Central Bank of the Russian Federation on 03.10.2002 N 2-P, payment for purchased goods by legal entities and individual entrepreneurs is carried out in a non-cash manner by payment orders, letters of credit, checks and collection orders.

Deputy Director

Department of Tax

and customs and tariff policy

S.V. RAZGULIN